EX-99.1

Published on June 17, 2024

Overview of Athene’s Corporate Structure June 2024 Update

Disclaimer 2 This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security of Athene Holding Ltd. (“Athene”). This presentation is not intended to constitute a solicitation of any insurance policy or contract or application therefor. Unless the context requires otherwise, references in this presentation to “Apollo," "AGM" and "AGM HoldCo" refer to Apollo Global Management, Inc., together with its subsidiaries, and references in this presentation to “AAM” refer to Apollo Asset Management, Inc., a subsidiary of Apollo Global Management, Inc. This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks, uncertainties and assumptions that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, benefits to be derived from Athene's capital allocation decisions; the anticipated performance of Athene's portfolio in certain stress or recessionary environments; the performance of Athene's business; general economic conditions; expected future operating results; Athene's liquidity and capital resources; and other non-historical statements. Although Athene management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. For a discussion of other risks and uncertainties related to Athene's forward-looking statements, see its annual report on Form 10-K for the year ended December 31, 2023 and its quarterly report on Form 10-Q for the quarter ended March 31, 2024 which can be found at the SEC’s website at www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Information contained herein may include information respecting prior performance of Athene. Information respecting prior performance, while a useful tool, is not necessarily indicative of actual results to be achieved in the future, which is dependent upon many factors, many of which are beyond Athene's control. The information contained herein is not a guarantee of future performance by Athene, and actual outcomes and results may differ materially from any historic, pro forma or projected financial results indicated herein. Certain of the financial information contained herein is unaudited or based on the application of non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. Furthermore, certain financial information is based on estimates of management. These estimates, which are based on the reasonable expectations of management, are subject to change and there can be no assurance that they will prove to be correct. The information contained herein does not purport to be all-inclusive or contain all information that an evaluator may require in order to properly evaluate the business, prospects or value of Athene. Athene does not have any obligation to update this presentation and the information may change at any time without notice. Models that may be contained herein (the “Models”) are being provided for illustrative and discussion purposes only and are not intended to forecast or predict future events. Information provided in the Models may not reflect the most current data and is subject to change. The Models are based on estimates and assumptions that are also subject to change and may be subject to significant business, economic and competitive uncertainties, including numerous uncontrollable market and event driven situations. There is no guarantee that the information presented in the Models is accurate. Actual results may differ materially from those reflected and contemplated in such hypothetical, forward-looking information. Undue reliance should not be placed on such information and investors should not use the Models to make investment decisions. Athene has no duty to update the Models in the future. Certain of the information used in preparing this presentation was obtained from third parties or public sources. No representation or warranty, express or implied, is made or given by or on behalf of Athene or any other person as to the accuracy, completeness or fairness of such information, and no responsibility or liability is accepted for any such information. The contents of any website referenced in this presentation are not incorporated by reference. This document is not intended to be, nor should it be construed or used as, financial, legal, tax, insurance or investment advice. There can be no assurance that Athene will achieve its objectives. Past performance is not indicative of future success. All information is as of the dates indicated herein.

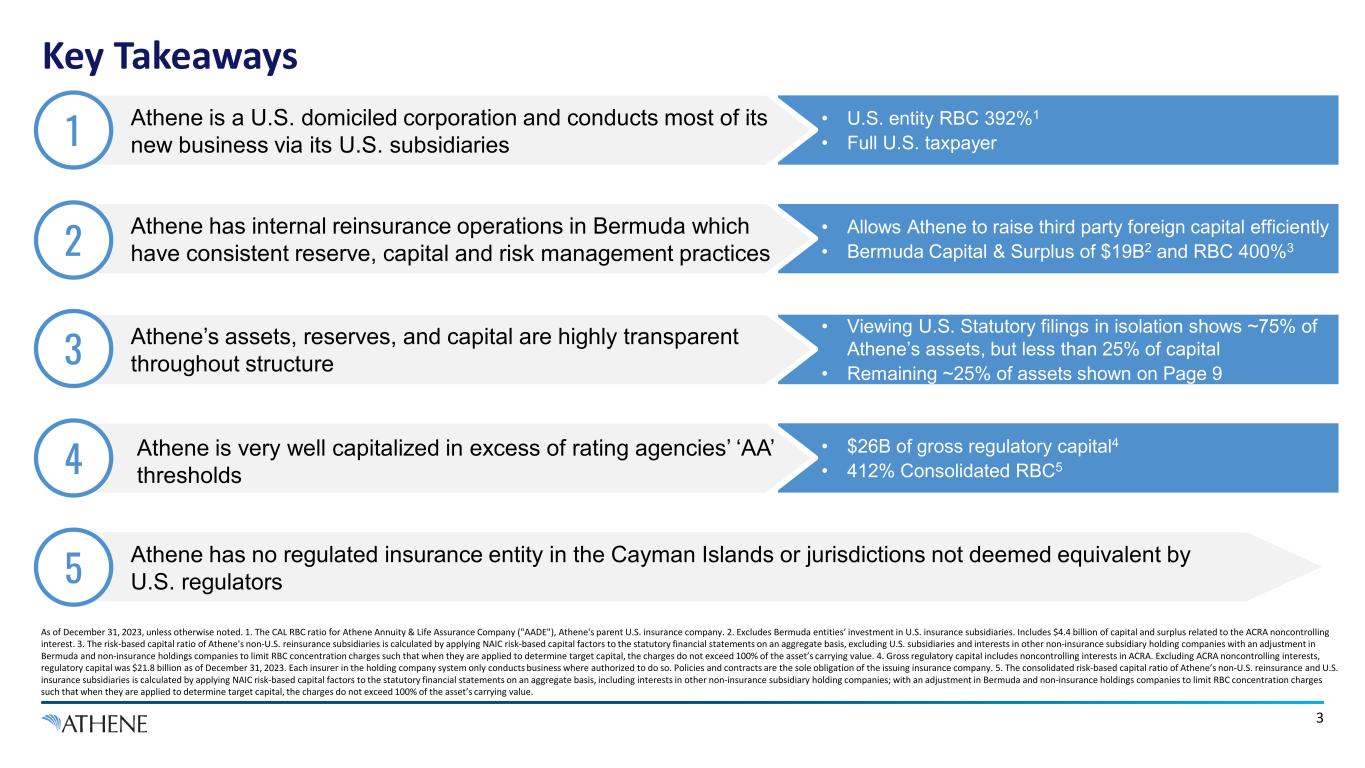

Key Takeaways 3 As of December 31, 2023, unless otherwise noted. 1. The CAL RBC ratio for Athene Annuity & Life Assurance Company ("AADE"), Athene's parent U.S. insurance company. 2. Excludes Bermuda entities’ investment in U.S. insurance subsidiaries. Includes $4.4 billion of capital and surplus related to the ACRA noncontrolling interest. 3. The risk-based capital ratio of Athene's non-U.S. reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding U.S. subsidiaries and interests in other non-insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 4. Gross regulatory capital includes noncontrolling interests in ACRA. Excluding ACRA noncontrolling interests, regulatory capital was $21.8 billion as of December 31, 2023. Each insurer in the holding company system only conducts business where authorized to do so. Policies and contracts are the sole obligation of the issuing insurance company. 5. The consolidated risk-based capital ratio of Athene’s non-U.S. reinsurance and U.S. insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 5 Athene has no regulated insurance entity in the Cayman Islands or jurisdictions not deemed equivalent by U.S. regulators • $26B of gross regulatory capital4 • 412% Consolidated RBC54 Athene is very well capitalized in excess of rating agencies’ ‘AA’ thresholds • Viewing U.S. Statutory filings in isolation shows ~75% of Athene’s assets, but less than 25% of capital • Remaining ~25% of assets shown on Page 9 3 Athene’s assets, reserves, and capital are highly transparent throughout structure • Allows Athene to raise third party foreign capital efficiently • Bermuda Capital & Surplus of $19B2 and RBC 400%32 Athene has internal reinsurance operations in Bermuda which have consistent reserve, capital and risk management practices • U.S. entity RBC 392%1 • Full U.S. taxpayer1 Athene is a U.S. domiciled corporation and conducts most of its new business via its U.S. subsidiaries

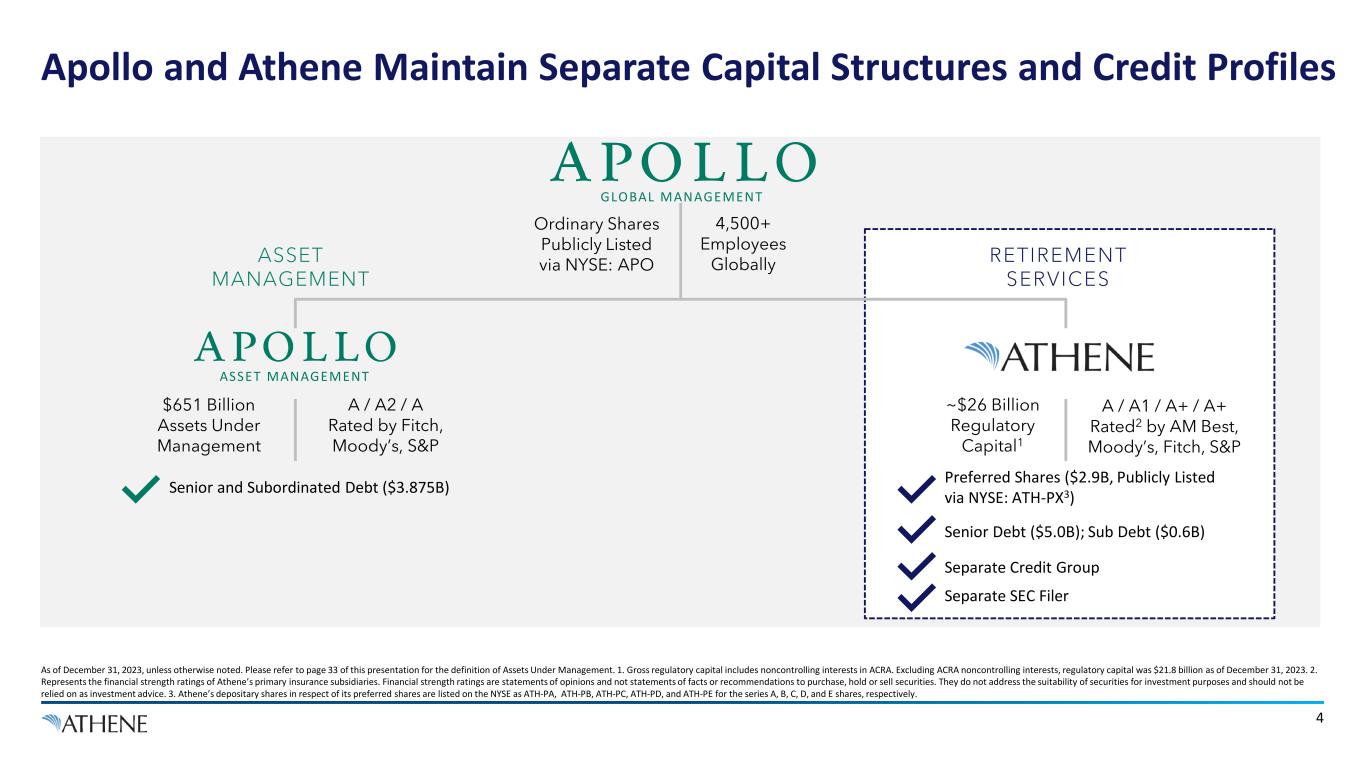

4 Apollo and Athene Maintain Separate Capital Structures and Credit Profiles As of December 31, 2023, unless otherwise noted. Please refer to page 33 of this presentation for the definition of Assets Under Management. 1. Gross regulatory capital includes noncontrolling interests in ACRA. Excluding ACRA noncontrolling interests, regulatory capital was $21.8 billion as of December 31, 2023. 2. Represents the financial strength ratings of Athene’s primary insurance subsidiaries. Financial strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 3. Athene’s depositary shares in respect of its preferred shares are listed on the NYSE as ATH-PA, ATH-PB, ATH-PC, ATH-PD, and ATH-PE for the series A, B, C, D, and E shares, respectively. $651 Billion Assets Under Management ~$26 Billion Regulatory Capital1 A / A1 / A+ / A+ Rated2 by AM Best, Moody’s, Fitch, S&P ASSET MANAGEMENT RETIREMENT SERVICES Ordinary Shares Publicly Listed via NYSE: APO 4,500+ Employees Globally ASSET MANAGEMENT GLOBAL MANAGEMENT A / A2 / A Rated by Fitch, Moody’s, S&P Senior Debt ($5.0B); Sub Debt ($0.6B) Preferred Shares ($2.9B, Publicly Listed via NYSE: ATH-PX3) Separate Credit Group Separate SEC Filer Senior and Subordinated Debt ($3.875B)

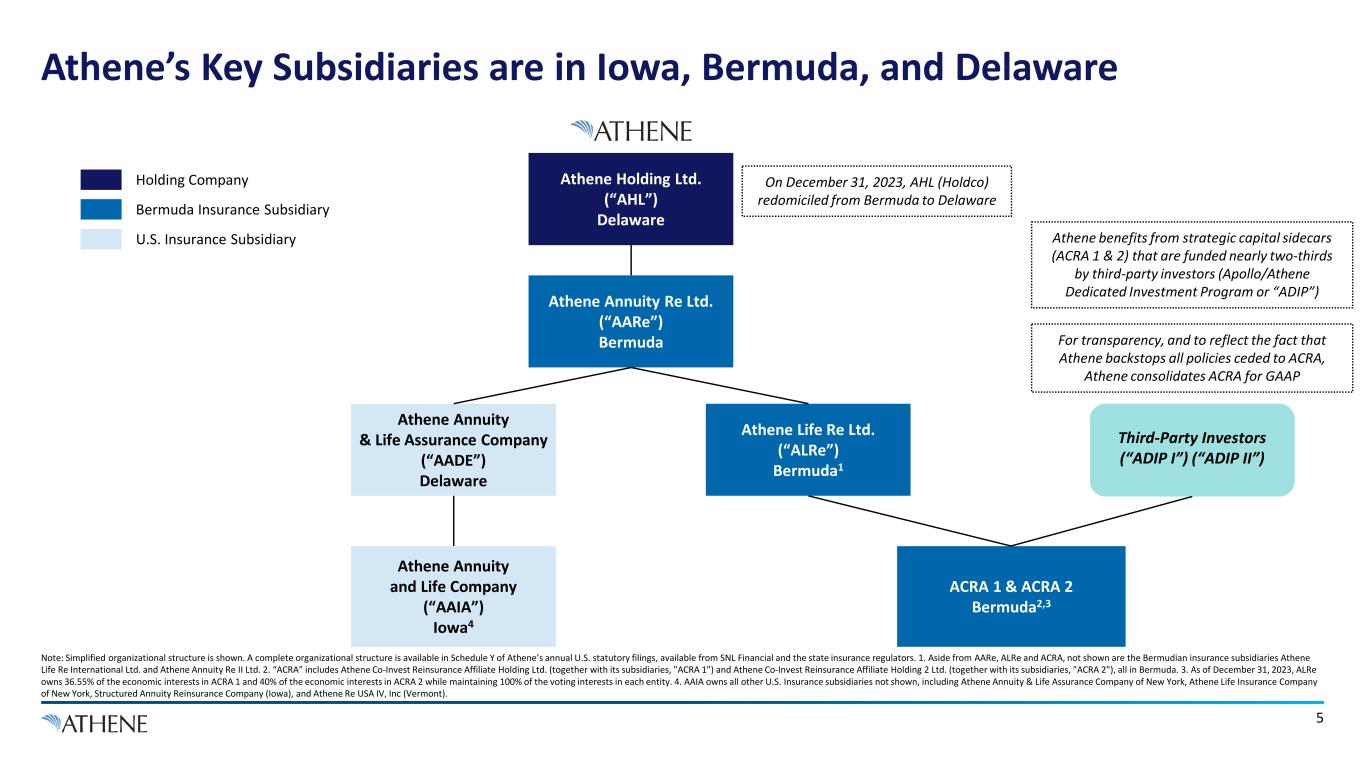

Third-Party Investors (“ADIP I”) (“ADIP II”) 5 Athene’s Key Subsidiaries are in Iowa, Bermuda, and Delaware Note: Simplified organizational structure is shown. A complete organizational structure is available in Schedule Y of Athene’s annual U.S. statutory filings, available from SNL Financial and the state insurance regulators. 1. Aside from AARe, ALRe and ACRA, not shown are the Bermudian insurance subsidiaries Athene Life Re International Ltd. and Athene Annuity Re II Ltd. 2. “ACRA” includes Athene Co-Invest Reinsurance Affiliate Holding Ltd. (together with its subsidiaries, "ACRA 1") and Athene Co-Invest Reinsurance Affiliate Holding 2 Ltd. (together with its subsidiaries, "ACRA 2"), all in Bermuda. 3. As of December 31, 2023, ALRe owns 36.55% of the economic interests in ACRA 1 and 40% of the economic interests in ACRA 2 while maintaining 100% of the voting interests in each entity. 4. AAIA owns all other U.S. Insurance subsidiaries not shown, including Athene Annuity & Life Assurance Company of New York, Athene Life Insurance Company of New York, Structured Annuity Reinsurance Company (Iowa), and Athene Re USA IV, Inc (Vermont). Athene Annuity & Life Assurance Company (“AADE”) Delaware Athene Annuity Re Ltd. (“AARe”) Bermuda Athene Holding Ltd. (“AHL”) Delaware ACRA 1 & ACRA 2 Bermuda2,3 Athene Annuity and Life Company (“AAIA”) Iowa4 For transparency, and to reflect the fact that Athene backstops all policies ceded to ACRA, Athene consolidates ACRA for GAAP Holding Company Bermuda Insurance Subsidiary U.S. Insurance Subsidiary Athene Life Re Ltd. (“ALRe”) Bermuda1 Athene benefits from strategic capital sidecars (ACRA 1 & 2) that are funded nearly two-thirds by third-party investors (Apollo/Athene Dedicated Investment Program or “ADIP”) On December 31, 2023, AHL (Holdco) redomiciled from Bermuda to Delaware

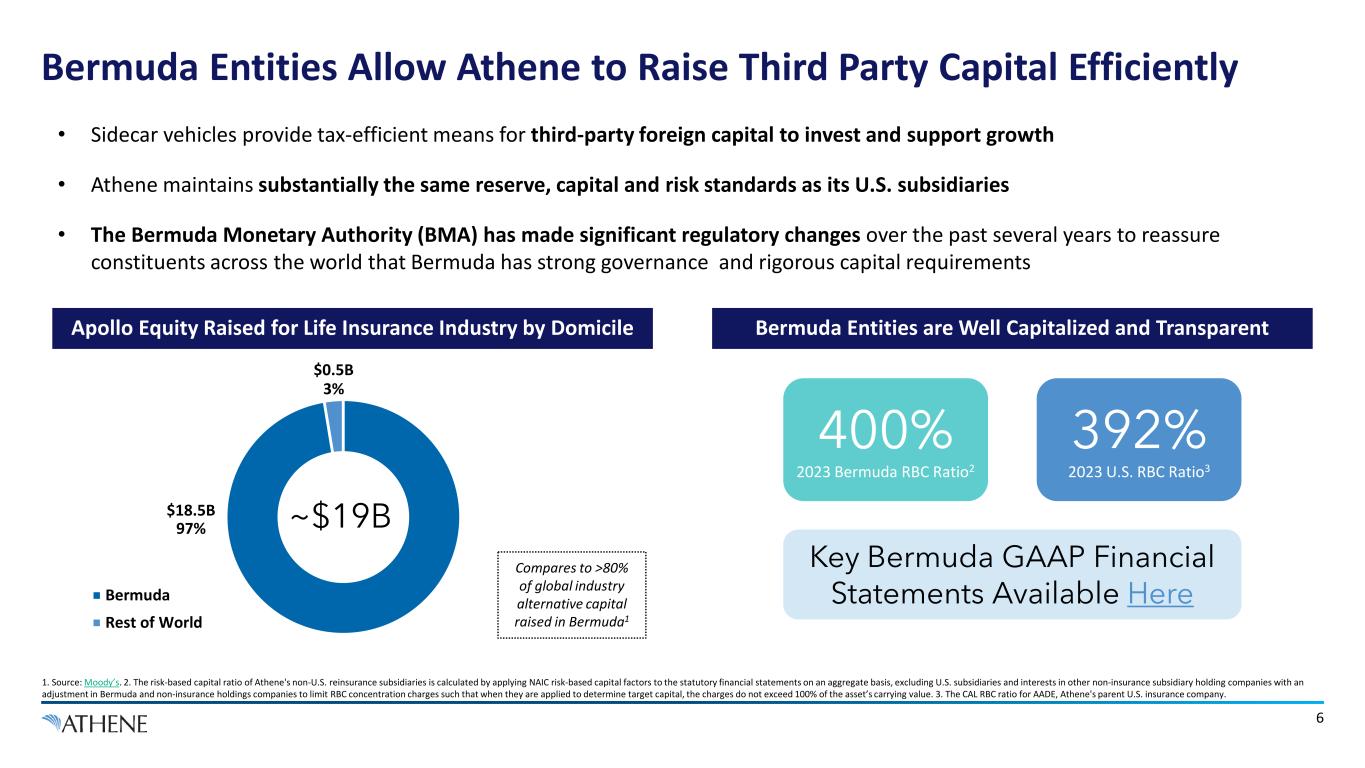

6 Bermuda Entities Allow Athene to Raise Third Party Capital Efficiently Apollo Equity Raised for Life Insurance Industry by Domicile Bermuda Entities are Well Capitalized and Transparent Bermuda Rest of World ~$19B 3% 97% Compares to >80% of global industry alternative capital raised in Bermuda1 400% 2023 Bermuda RBC Ratio2 392% 2023 U.S. RBC Ratio3 1. Source: Moody’s. 2. The risk-based capital ratio of Athene's non-U.S. reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding U.S. subsidiaries and interests in other non-insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 3. The CAL RBC ratio for AADE, Athene's parent U.S. insurance company. Key Bermuda GAAP Financial Statements Available Here $18.5B $0.5B • Sidecar vehicles provide tax-efficient means for third-party foreign capital to invest and support growth • Athene maintains substantially the same reserve, capital and risk standards as its U.S. subsidiaries • The Bermuda Monetary Authority (BMA) has made significant regulatory changes over the past several years to reassure constituents across the world that Bermuda has strong governance and rigorous capital requirements

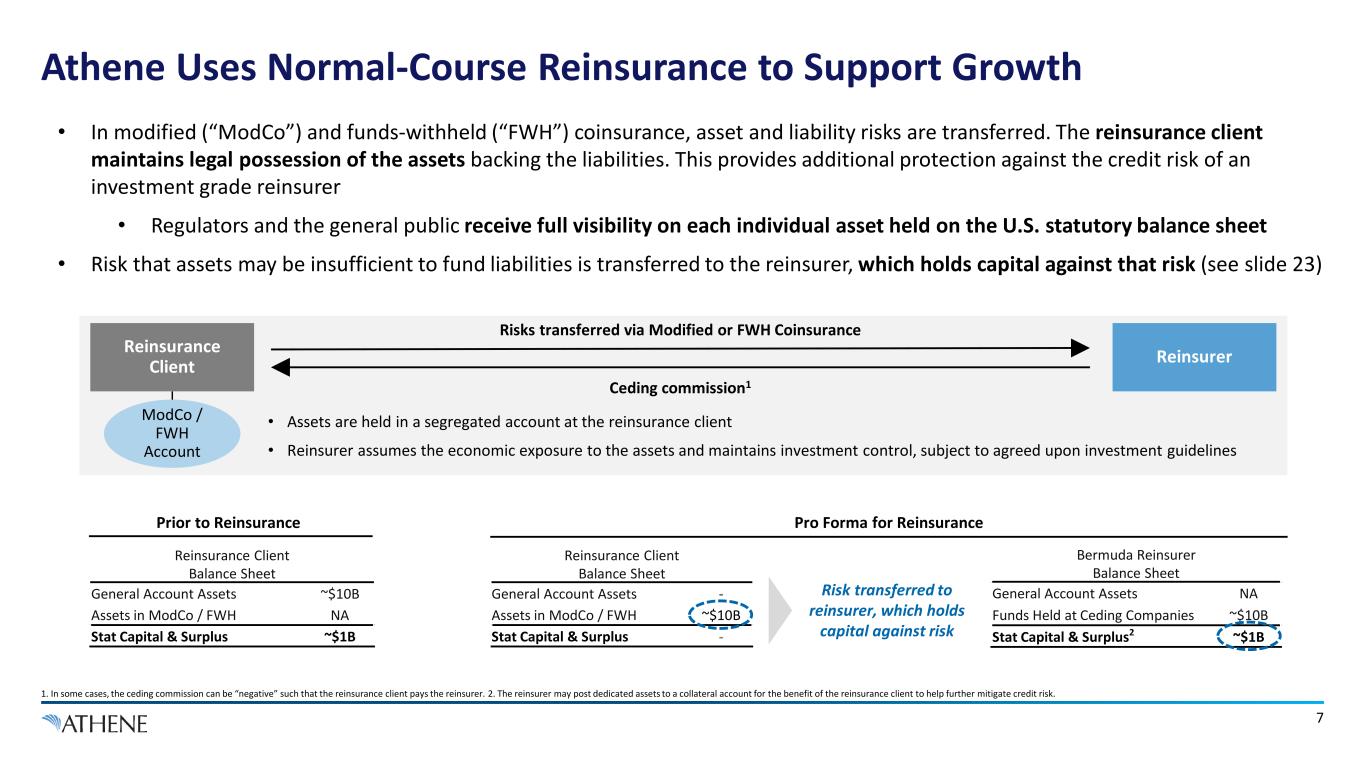

7 Athene Uses Normal-Course Reinsurance to Support Growth 1. In some cases, the ceding commission can be “negative” such that the reinsurance client pays the reinsurer. 2. The reinsurer may post dedicated assets to a collateral account for the benefit of the reinsurance client to help further mitigate credit risk. Reinsurance Client Balance Sheet General Account Assets - Assets in ModCo / FWH ~$10B Stat Capital & Surplus - Reinsurance Client Balance Sheet General Account Assets ~$10B Assets in ModCo / FWH NA Stat Capital & Surplus ~$1B Bermuda Reinsurer Balance Sheet General Account Assets NA Funds Held at Ceding Companies ~$10B Stat Capital & Surplus2 ~$1B Reinsurer Risks transferred via Modified or FWH Coinsurance Reinsurance Client Ceding commission1 • Assets are held in a segregated account at the reinsurance client • Reinsurer assumes the economic exposure to the assets and maintains investment control, subject to agreed upon investment guidelines ModCo / FWH Account Risk transferred to reinsurer, which holds capital against risk Prior to Reinsurance Pro Forma for Reinsurance • In modified (“ModCo”) and funds-withheld (“FWH”) coinsurance, asset and liability risks are transferred. The reinsurance client maintains legal possession of the assets backing the liabilities. This provides additional protection against the credit risk of an investment grade reinsurer • Regulators and the general public receive full visibility on each individual asset held on the U.S. statutory balance sheet • Risk that assets may be insufficient to fund liabilities is transferred to the reinsurer, which holds capital against that risk (see slide 23)

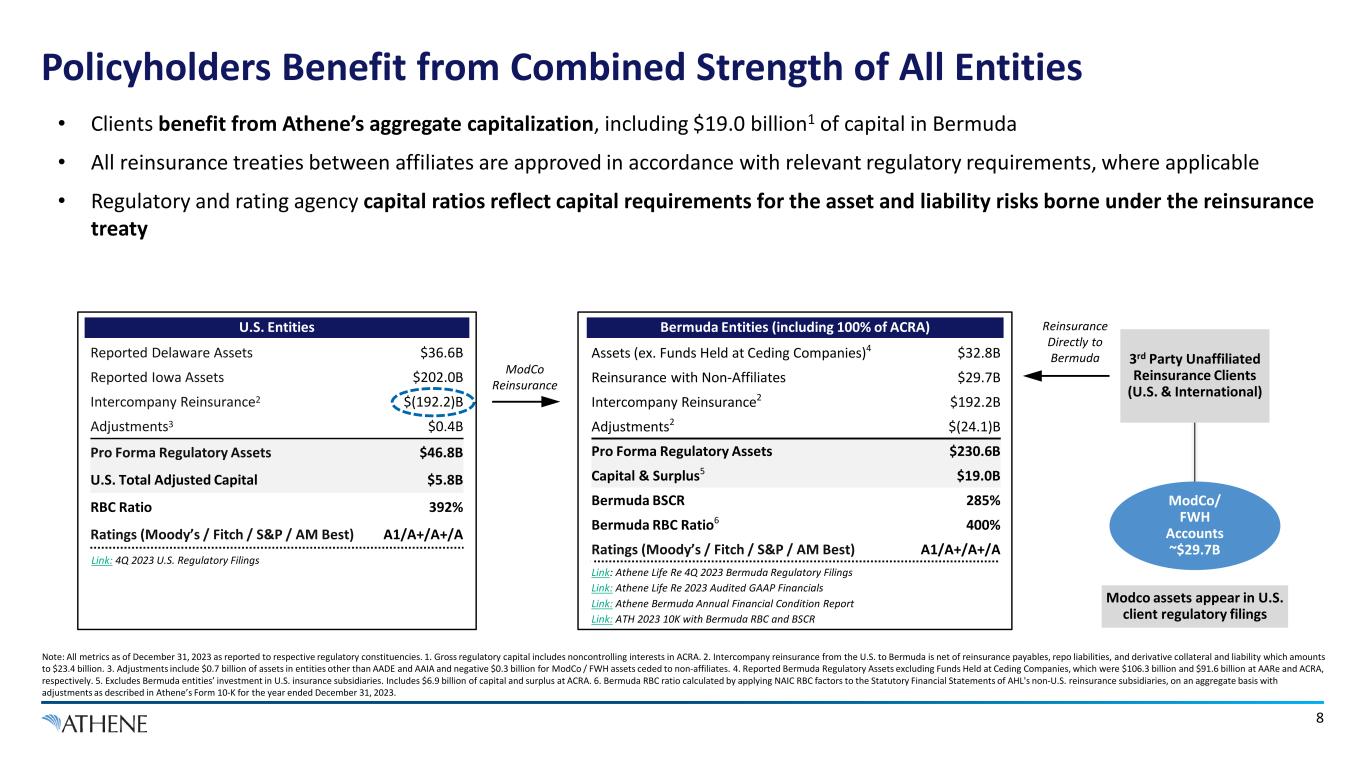

8 Policyholders Benefit from Combined Strength of All Entities Note: All metrics as of December 31, 2023 as reported to respective regulatory constituencies. 1. Gross regulatory capital includes noncontrolling interests in ACRA. 2. Intercompany reinsurance from the U.S. to Bermuda is net of reinsurance payables, repo liabilities, and derivative collateral and liability which amounts to $23.4 billion. 3. Adjustments include $0.7 billion of assets in entities other than AADE and AAIA and negative $0.3 billion for ModCo / FWH assets ceded to non-affiliates. 4. Reported Bermuda Regulatory Assets excluding Funds Held at Ceding Companies, which were $106.3 billion and $91.6 billion at AARe and ACRA, respectively. 5. Excludes Bermuda entities’ investment in U.S. insurance subsidiaries. Includes $6.9 billion of capital and surplus at ACRA. 6. Bermuda RBC ratio calculated by applying NAIC RBC factors to the Statutory Financial Statements of AHL's non-U.S. reinsurance subsidiaries, on an aggregate basis with adjustments as described in Athene’s Form 10-K for the year ended December 31, 2023. Reported Delaware Assets $36.6B Reported Iowa Assets $202.0B Intercompany Reinsurance2 $(192.2)B Adjustments3 $0.4B Pro Forma Regulatory Assets $46.8B U.S. Total Adjusted Capital $5.8B RBC Ratio 392% Ratings (Moody’s / Fitch / S&P / AM Best) A1/A+/A+/A Link: 4Q 2023 U.S. Regulatory Filings ModCo Reinsurance Reinsurance Directly to Bermuda Assets (ex. Funds Held at Ceding Companies)4 $32.8B Reinsurance with Non-Affiliates $29.7B Intercompany Reinsurance2 $192.2B Adjustments2 $(24.1)B Pro Forma Regulatory Assets $230.6B Capital & Surplus5 $19.0B Bermuda BSCR 285% Bermuda RBC Ratio6 400% Ratings (Moody’s / Fitch / S&P / AM Best) A1/A+/A+/A Link: Athene Life Re 4Q 2023 Bermuda Regulatory Filings Link: Athene Life Re 2023 Audited GAAP Financials Link: Athene Bermuda Annual Financial Condition Report Link: ATH 2023 10K with Bermuda RBC and BSCR 3rd Party Unaffiliated Reinsurance Clients (U.S. & International) ModCo/ FWH Accounts ~$29.7B U.S. Entities Bermuda Entities (including 100% of ACRA) • Clients benefit from Athene’s aggregate capitalization, including $19.0 billion1 of capital in Bermuda • All reinsurance treaties between affiliates are approved in accordance with relevant regulatory requirements, where applicable • Regulatory and rating agency capital ratios reflect capital requirements for the asset and liability risks borne under the reinsurance treaty Modco assets appear in U.S. client regulatory filings

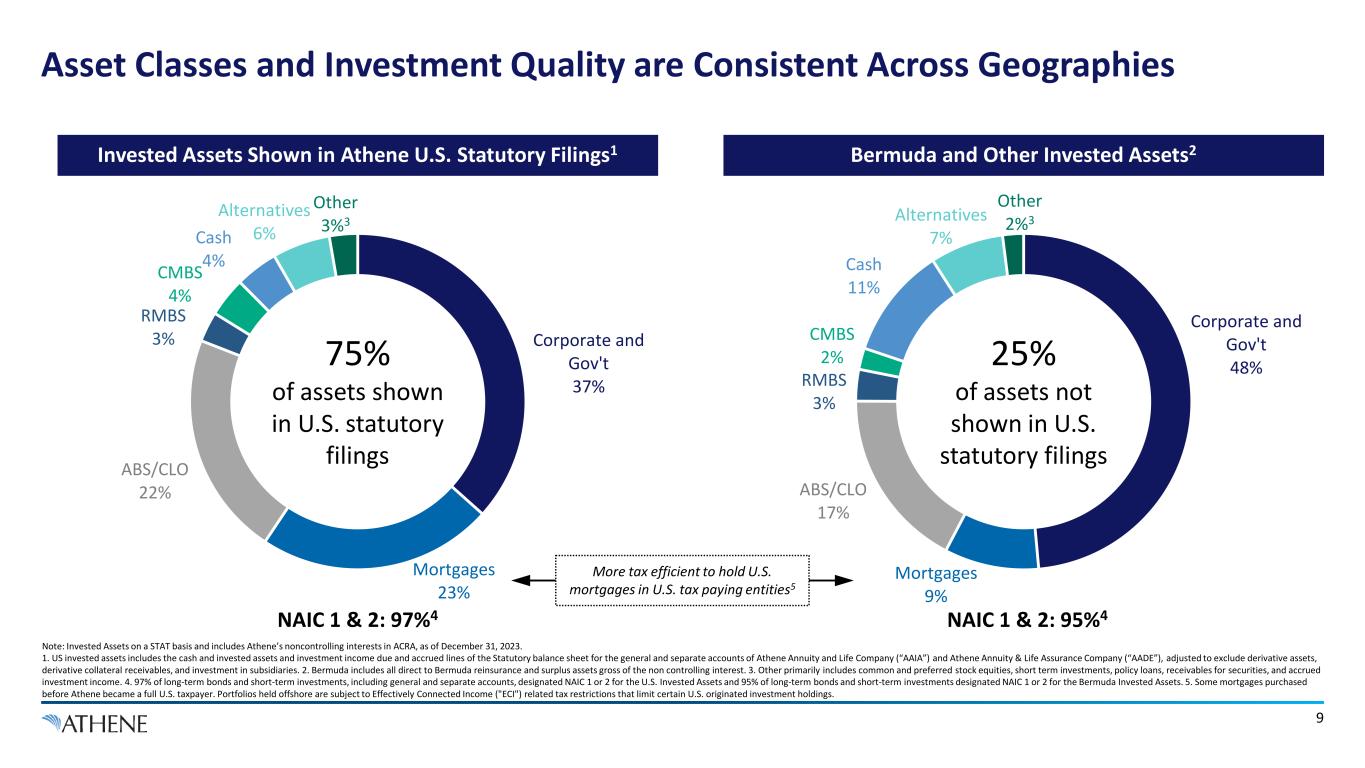

Corporate and Gov't 37% Mortgages 23% ABS/CLO 22% RMBS 3% CMBS 4% Cash 4% Alternatives 6% Other 3%3 75% of assets shown in U.S. statutory filings Corporate and Gov't 48% Mortgages 9% ABS/CLO 17% RMBS 3% CMBS 2% Cash 11% Alternatives 7% Other 2%3 25% of assets not shown in U.S. statutory filings Asset Classes and Investment Quality are Consistent Across Geographies Note: Invested Assets on a STAT basis and includes Athene’s noncontrolling interests in ACRA, as of December 31, 2023. 1. US invested assets includes the cash and invested assets and investment income due and accrued lines of the Statutory balance sheet for the general and separate accounts of Athene Annuity and Life Company (“AAIA”) and Athene Annuity & Life Assurance Company (“AADE”), adjusted to exclude derivative assets, derivative collateral receivables, and investment in subsidiaries. 2. Bermuda includes all direct to Bermuda reinsurance and surplus assets gross of the non controlling interest. 3. Other primarily includes common and preferred stock equities, short term investments, policy loans, receivables for securities, and accrued investment income. 4. 97% of long-term bonds and short-term investments, including general and separate accounts, designated NAIC 1 or 2 for the U.S. Invested Assets and 95% of long-term bonds and short-term investments designated NAIC 1 or 2 for the Bermuda Invested Assets. 5. Some mortgages purchased before Athene became a full U.S. taxpayer. Portfolios held offshore are subject to Effectively Connected Income ("ECI") related tax restrictions that limit certain U.S. originated investment holdings. Invested Assets Shown in Athene U.S. Statutory Filings1 Bermuda and Other Invested Assets2 9 NAIC 1 & 2: 97%4 NAIC 1 & 2: 95%4 More tax efficient to hold U.S. mortgages in U.S. tax paying entities5

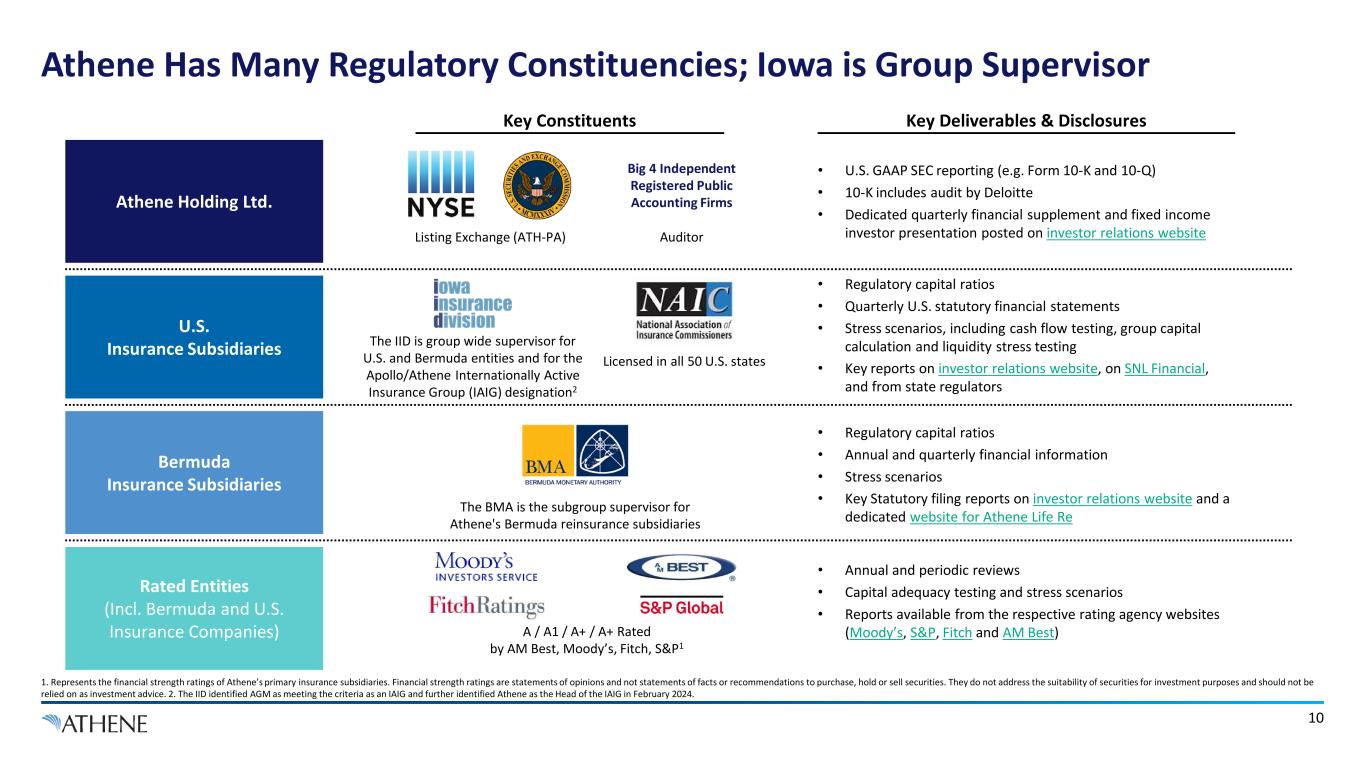

10 Athene Has Many Regulatory Constituencies; Iowa is Group Supervisor 1. Represents the financial strength ratings of Athene’s primary insurance subsidiaries. Financial strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 2. The IID identified AGM as meeting the criteria as an IAIG and further identified Athene as the Head of the IAIG in February 2024. • U.S. GAAP SEC reporting (e.g. Form 10-K and 10-Q) • 10-K includes audit by Deloitte • Dedicated quarterly financial supplement and fixed income investor presentation posted on investor relations website Bermuda Insurance Subsidiaries U.S. Insurance Subsidiaries Athene Holding Ltd. Key Constituents Key Deliverables & Disclosures The BMA is the subgroup supervisor for Athene's Bermuda reinsurance subsidiaries Rated Entities (Incl. Bermuda and U.S. Insurance Companies) • Regulatory capital ratios • Annual and quarterly financial information • Stress scenarios • Key Statutory filing reports on investor relations website and a dedicated website for Athene Life Re • Regulatory capital ratios • Quarterly U.S. statutory financial statements • Stress scenarios, including cash flow testing, group capital calculation and liquidity stress testing • Key reports on investor relations website, on SNL Financial, and from state regulators • Annual and periodic reviews • Capital adequacy testing and stress scenarios • Reports available from the respective rating agency websites (Moody’s, S&P, Fitch and AM Best)A / A1 / A+ / A+ Rated by AM Best, Moody’s, Fitch, S&P1 Licensed in all 50 U.S. states The IID is group wide supervisor for U.S. and Bermuda entities and for the Apollo/Athene Internationally Active Insurance Group (IAIG) designation2 Listing Exchange (ATH-PA) Auditor Big 4 Independent Registered Public Accounting Firms

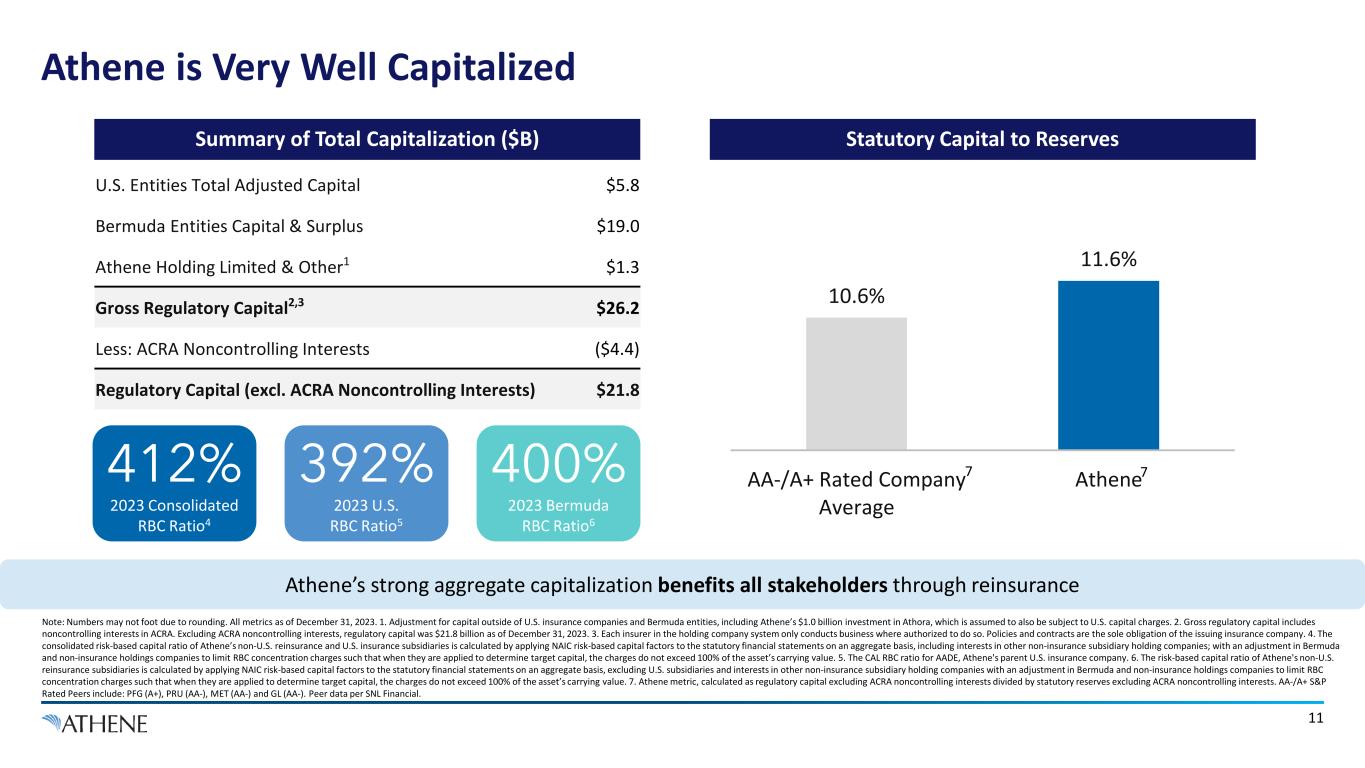

11 Athene is Very Well Capitalized Note: Numbers may not foot due to rounding. All metrics as of December 31, 2023. 1. Adjustment for capital outside of U.S. insurance companies and Bermuda entities, including Athene’s $1.0 billion investment in Athora, which is assumed to also be subject to U.S. capital charges. 2. Gross regulatory capital includes noncontrolling interests in ACRA. Excluding ACRA noncontrolling interests, regulatory capital was $21.8 billion as of December 31, 2023. 3. Each insurer in the holding company system only conducts business where authorized to do so. Policies and contracts are the sole obligation of the issuing insurance company. 4. The consolidated risk-based capital ratio of Athene’s non-U.S. reinsurance and U.S. insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 5. The CAL RBC ratio for AADE, Athene's parent U.S. insurance company. 6. The risk-based capital ratio of Athene's non-U.S. reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding U.S. subsidiaries and interests in other non-insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 7. Athene metric, calculated as regulatory capital excluding ACRA noncontrolling interests divided by statutory reserves excluding ACRA noncontrolling interests. AA-/A+ S&P Rated Peers include: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). Peer data per SNL Financial. 10.6% 11.6% AA-/A+ Rated Company Average Athene Statutory Capital to Reserves 7 Summary of Total Capitalization ($B) U.S. Entities Total Adjusted Capital $5.8 Bermuda Entities Capital & Surplus $19.0 Athene Holding Limited & Other1 $1.3 Gross Regulatory Capital2,3 $26.2 Less: ACRA Noncontrolling Interests ($4.4) Regulatory Capital (excl. ACRA Noncontrolling Interests) $21.8 Athene’s strong aggregate capitalization benefits all stakeholders through reinsurance 400% 2023 Bermuda RBC Ratio6 392% 2023 U.S. RBC Ratio5 412% 2023 Consolidated RBC Ratio4 7

Corporate Structure FAQs

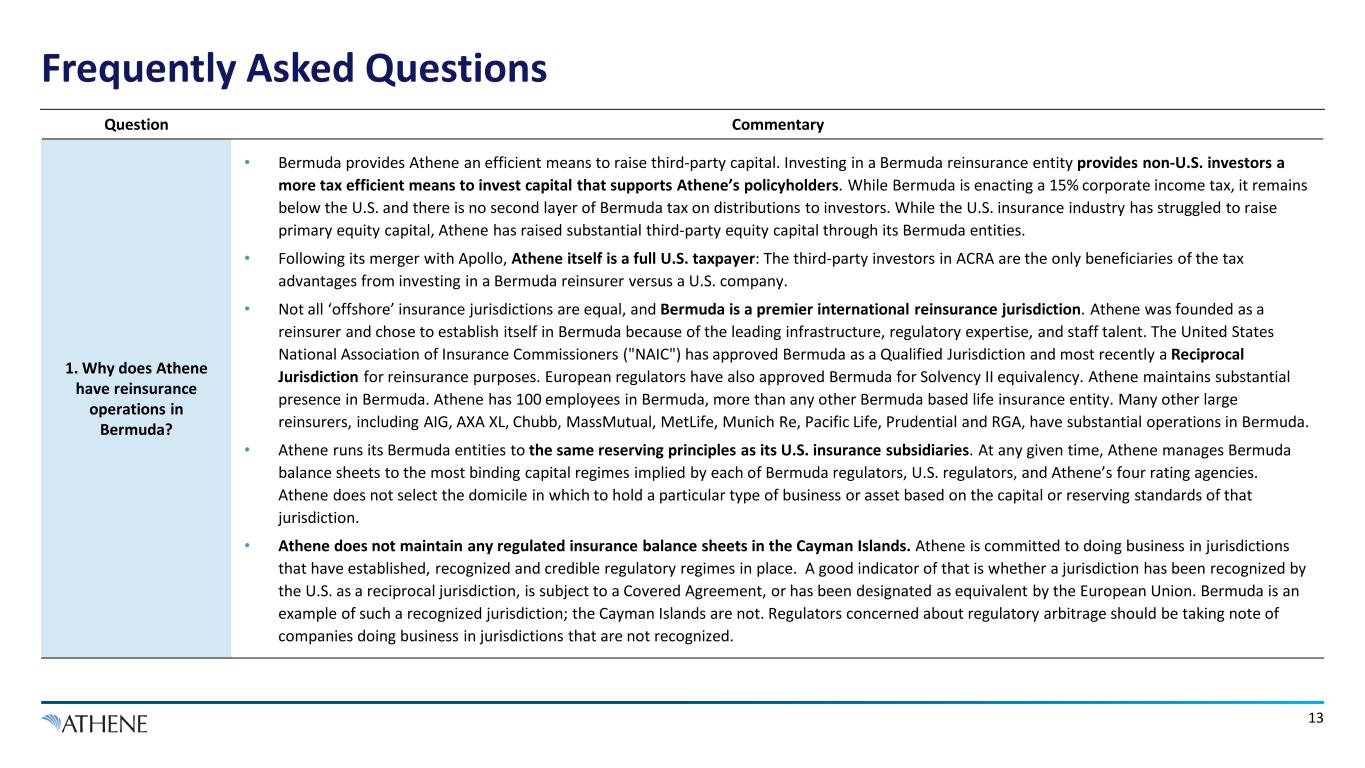

Frequently Asked Questions Question Commentary 1. Why does Athene have reinsurance operations in Bermuda? • Bermuda provides Athene an efficient means to raise third-party capital. Investing in a Bermuda reinsurance entity provides non-U.S. investors a more tax efficient means to invest capital that supports Athene’s policyholders. While Bermuda is enacting a 15% corporate income tax, it remains below the U.S. and there is no second layer of Bermuda tax on distributions to investors. While the U.S. insurance industry has struggled to raise primary equity capital, Athene has raised substantial third-party equity capital through its Bermuda entities. • Following its merger with Apollo, Athene itself is a full U.S. taxpayer: The third-party investors in ACRA are the only beneficiaries of the tax advantages from investing in a Bermuda reinsurer versus a U.S. company. • Not all ‘offshore’ insurance jurisdictions are equal, and Bermuda is a premier international reinsurance jurisdiction. Athene was founded as a reinsurer and chose to establish itself in Bermuda because of the leading infrastructure, regulatory expertise, and staff talent. The United States National Association of Insurance Commissioners ("NAIC") has approved Bermuda as a Qualified Jurisdiction and most recently a Reciprocal Jurisdiction for reinsurance purposes. European regulators have also approved Bermuda for Solvency II equivalency. Athene maintains substantial presence in Bermuda. Athene has 100 employees in Bermuda, more than any other Bermuda based life insurance entity. Many other large reinsurers, including AIG, AXA XL, Chubb, MassMutual, MetLife, Munich Re, Pacific Life, Prudential and RGA, have substantial operations in Bermuda. • Athene runs its Bermuda entities to the same reserving principles as its U.S. insurance subsidiaries. At any given time, Athene manages Bermuda balance sheets to the most binding capital regimes implied by each of Bermuda regulators, U.S. regulators, and Athene’s four rating agencies. Athene does not select the domicile in which to hold a particular type of business or asset based on the capital or reserving standards of that jurisdiction. • Athene does not maintain any regulated insurance balance sheets in the Cayman Islands. Athene is committed to doing business in jurisdictions that have established, recognized and credible regulatory regimes in place. A good indicator of that is whether a jurisdiction has been recognized by the U.S. as a reciprocal jurisdiction, is subject to a Covered Agreement, or has been designated as equivalent by the European Union. Bermuda is an example of such a recognized jurisdiction; the Cayman Islands are not. Regulators concerned about regulatory arbitrage should be taking note of companies doing business in jurisdictions that are not recognized. 13

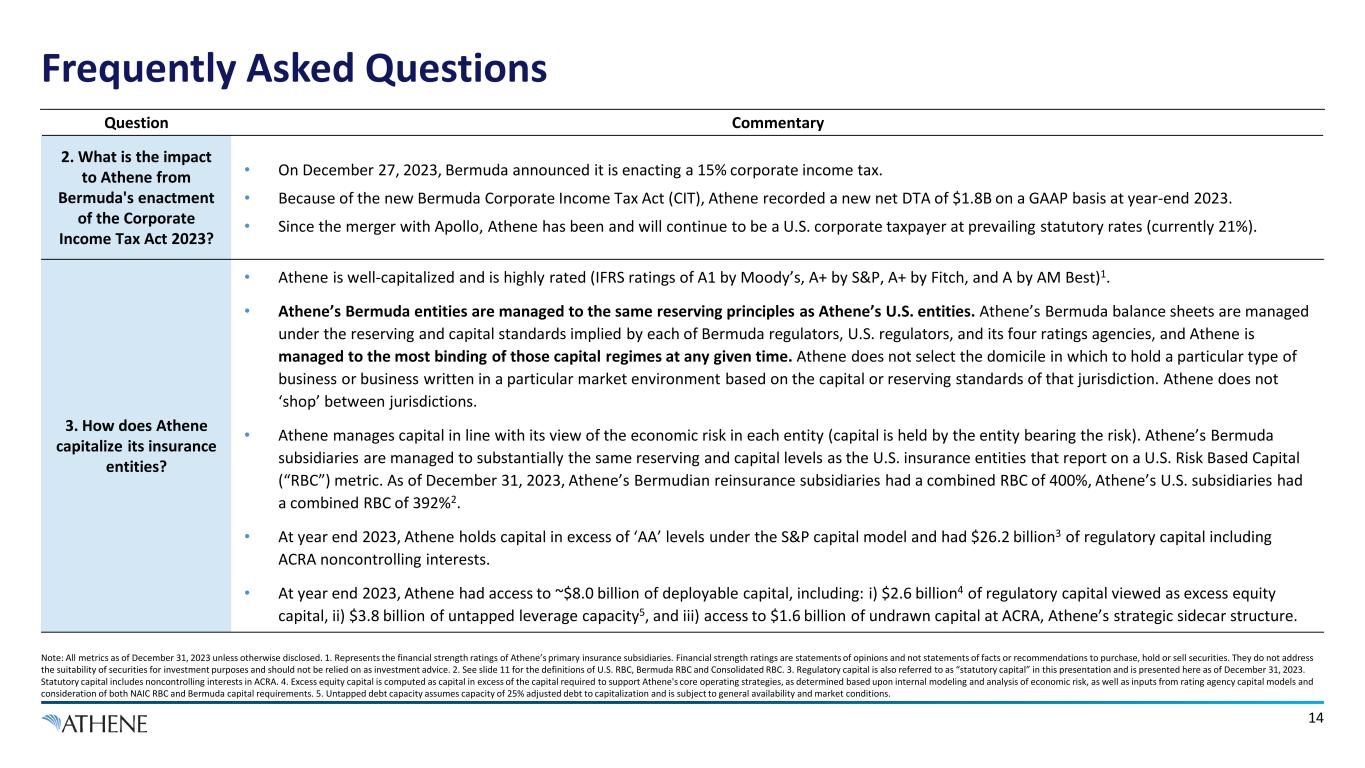

Frequently Asked Questions Note: All metrics as of December 31, 2023 unless otherwise disclosed. 1. Represents the financial strength ratings of Athene’s primary insurance subsidiaries. Financial strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 2. See slide 11 for the definitions of U.S. RBC, Bermuda RBC and Consolidated RBC. 3. Regulatory capital is also referred to as “statutory capital” in this presentation and is presented here as of December 31, 2023. Statutory capital includes noncontrolling interests in ACRA. 4. Excess equity capital is computed as capital in excess of the capital required to support Athene's core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 5. Untapped debt capacity assumes capacity of 25% adjusted debt to capitalization and is subject to general availability and market conditions. Question Commentary 2. What is the impact to Athene from Bermuda's enactment of the Corporate Income Tax Act 2023? • On December 27, 2023, Bermuda announced it is enacting a 15% corporate income tax. • Because of the new Bermuda Corporate Income Tax Act (CIT), Athene recorded a new net DTA of $1.8B on a GAAP basis at year-end 2023. • Since the merger with Apollo, Athene has been and will continue to be a U.S. corporate taxpayer at prevailing statutory rates (currently 21%). 3. How does Athene capitalize its insurance entities? • Athene is well-capitalized and is highly rated (IFRS ratings of A1 by Moody’s, A+ by S&P, A+ by Fitch, and A by AM Best)1. • Athene’s Bermuda entities are managed to the same reserving principles as Athene’s U.S. entities. Athene’s Bermuda balance sheets are managed under the reserving and capital standards implied by each of Bermuda regulators, U.S. regulators, and its four ratings agencies, and Athene is managed to the most binding of those capital regimes at any given time. Athene does not select the domicile in which to hold a particular type of business or business written in a particular market environment based on the capital or reserving standards of that jurisdiction. Athene does not ‘shop’ between jurisdictions. • Athene manages capital in line with its view of the economic risk in each entity (capital is held by the entity bearing the risk). Athene’s Bermuda subsidiaries are managed to substantially the same reserving and capital levels as the U.S. insurance entities that report on a U.S. Risk Based Capital (“RBC”) metric. As of December 31, 2023, Athene’s Bermudian reinsurance subsidiaries had a combined RBC of 400%, Athene’s U.S. subsidiaries had a combined RBC of 392%2. • At year end 2023, Athene holds capital in excess of ‘AA’ levels under the S&P capital model and had $26.2 billion3 of regulatory capital including ACRA noncontrolling interests. • At year end 2023, Athene had access to ~$8.0 billion of deployable capital, including: i) $2.6 billion4 of regulatory capital viewed as excess equity capital, ii) $3.8 billion of untapped leverage capacity5, and iii) access to $1.6 billion of undrawn capital at ACRA, Athene’s strategic sidecar structure. 14

Frequently Asked Questions Commentary 4. Did Athene Holding Company redomicile in the U.S.? • Effective December 31, 2023, Athene's parent company, Athene Holding Ltd., redomiciled from Bermuda to the state of Delaware. As a result, Athene Holding Ltd. is a U.S. corporation. • Athene Holdco redomiciled to simplify its corporate structure following the merger with Apollo in 2022; the regulated Bermuda insurance entities remain. Athene has been subject to U.S. corporate taxes at a 21% statutory corporate rate since the merger with Apollo. • There are no changes to regulatory requirements. Iowa remains group supervisor. • The 8-K Filing announcing the redomicile to Delaware can be found here. 5. Are there capital maintenance obligations to Athene’s insurance subsidiaries? • A capital maintenance agreement requires a parent company to provide capital, or cause capital to be provided, to its insurance subsidiary to the extent the subsidiary’s capital falls below an agreed upon amount. • We have several capital maintenance agreements in place, including from Athene Holding Ltd. (AHL) (capital provider) to Athene Annuity & Life Assurance Company (our Delaware domiciled insurer) and Athene Annuity and Life Company (AAIA) (our Iowa domiciled insurer) and from AAIA (capital provider) to Athene Annuity & Life Assurance Company of New York (AANY) (our New York domiciled insurer). • Each agreement (i) requires the capital provider to maintain the RBC ratio of the relevant insurer to a certain level and (ii) is perpetual until terminated with the consent of the relevant state insurance regulator (e.g., the New York Department of Financial Services in the case of the AAIA – AANY agreement). • Through these capital maintenance agreements, clients benefit from Athene’s aggregate capitalization. 15

Frequently Asked Questions Note: All metrics as of December 31, 2023 unless otherwise disclosed. 1. Gross regulatory capital includes noncontrolling interests in ACRA. 2. Including the non controlling interests. Question Commentary 6. Why does Athene use intercompany reinsurance? • Intercompany reinsurance is a common practice in the insurance industry. Intercompany reinsurance allows insurance companies to pool risk into and diversify risks within particular entities. It strengthens the creditworthiness of the entire group by making the capital in all entities available to support risks assumed by any one particular entity. It is on this consolidated basis that rating agencies, clients, and shareholders look at Athene’s capital levels. • When reinsurance clients choose to face Athene’s U.S. entities for their reinsurance needs or when those U.S. entities offer policies directly to U.S. consumers, Athene typically utilizes internal reinsurance to transfer the majority of the liabilities to its Bermuda subsidiaries. This allows all policyholders to benefit from Athene’s aggregate capitalization, including $19.0 billion1 of gross regulatory capital in its Bermuda subsidiaries, and access to third-party capital raised to support its insurance business. • Like Athene’s reinsurance transactions with third parties, Athene’s intercompany reinsurance transactions are executed in accordance with appropriate insurance regulation. • Athene’s primary purpose for intercompany reinsurance is to utilize on demand capital from third party investors in their ACRA sidecars 7. How do Athene’s reinsurance agreements impact the statutory financials of Athene’s respective entities? • Under modified and funds-withheld coinsurance agreements, the ceding insurer maintains possession of the assets in a dedicated account in order to provide further protection against the credit risk of a reinsurer. Accordingly, the assets backing the liabilities reinsured to Athene’s Bermudian reinsurers remain on the balance sheets of the U.S. reinsurance clients. The risk, and the capital backing that risk, sits with Bermudian reinsurers as documented in the reinsurance treaties. • All the intercompany liabilities reinsured to Athene’s Bermuda subsidiaries under Athene’s structure, like those of its third-party clients, benefit from the substantial $19.0 billion1 gross regulatory capital base in the Bermuda entities. • As a result, Athene’s U.S. statutory financials show ~75%2 of its assets, but less than 25% of its capital. 16

Frequently Asked Questions Note: All metrics as of December 31, 2023 unless otherwise disclosed. 1. The risk-based capital ratio of Athene's non-U.S. reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding U.S. subsidiaries and interests in other non- insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 2. The CAL RBC ratio for AADE, Athene's parent U.S. insurance company. Question Commentary 8. Would NAIC changes to asset adequacy / cash flow testing on reinsurance impact Athene? • The analysis is in the early stages and subject to robust deliberation by the NAIC. • Athene conducts quarterly cash flow testing on a legal entity basis, including all Bermuda entities, as well as on a consolidated basis. • All balance sheets are managed to the most binding capital regimes of US, Bermuda, and the four rating agencies. • Similar reserve, capital and risk management practices between the U.S. and Bermuda (Bermuda RBC of 400%1; $1B of reserves in the U.S. = $1B of reserves in Bermuda) 9. Where can I find additional disclosure on Athene’s Bermuda entities? • Athene makes financial statements of several of its insurance operating subsidiaries, including its Bermudian reinsurance entity Athene Life Re Ltd. ("Athene Life Re"), available on its website: https://ir.athene.com/FinancialDocs. The latest key financial disclosures provided to the Bermuda Monetary Authority, are available at the following link. • Athene Life Re also has a dedicated website on which it publishes Athene Life Re’s annual audited GAAP financials and its Financial Condition Report, a report on the business operations of a Bermuda-based insurance company including its risk management, governance and capital position. A link to Athene Life Re’s website is here: https://www.athenelifere.bm/about/financials/. • In addition to disclosure under Bermuda regulation, Athene voluntarily discloses the capitalization of its Bermuda entities under the alternative U.S. Risk Based Capital framework. On an annual basis, Athene discloses the RBC of both Bermudian 400%1 and U.S. 392%2 reinsurance subsidiaries in its Form 10-K. See a link to the latest Form 10-K at https://ir.athene.com/Docs. • While Athene makes all this disclosure available on an entity level, the company’s structure means that stakeholders are supported by the aggregate capital across each of Athene’s entities. Athene’s consolidated financials provide a combined view across all its entities, and it is on this basis that rating agencies, clients, and shareholders look at Athene’s capital levels. Athene’s consolidated financials are available here: https://ir.athene.com/QuarterlyResults and https://ir.athene.com/Docs. 17

18 Frequently Asked Questions 1. Absent failure to pay by the U.S. reinsurance client. 2. Once a judgement against an Athene Bermuda reinsurer is obtained in a U.S. court, an Athene U.S. insurer would enforce the judgment in Bermuda. Question Commentary 10. How would Athene’s U.S. entities legally ensure support from their Bermuda affiliates? • The reinsurance treaties between Athene’s U.S. insurance entities and their affiliated Bermuda reinsurers are generally similar to other modified and funds withheld coinsurance reinsurance treaties used between third-parties in the industry. Such reinsurance requires that collateral is fully funded, as tested quarterly. In the event the collateral is in deficit, the reinsurer is required to contribute to fully fund the collateral requirement. • Athene’s Bermuda entities have no legal right to terminate their obligations under the reinsurance treaties without the consent of their affiliated U.S. reinsurance clients. 1 Performance by Athene’s Bermuda reinsurers is further assured as a result of those entities being under common control with the U.S. entities and the fact that it is on the consolidated basis that rating agencies, clients, and shareholders look at Athene. • In the unlikely event that Athene’s Bermuda entities do materially breach a reinsurance contract, including failure to pay, the Athene U.S. entity may terminate that reinsurance treaty following a cure period. Such termination would result in a recapture of the insurance policies and a release of the insurance reserve assets held at the Athene U.S. insurer with respect to the policies. Upon termination, the Athene Bermuda reinsurer would also be required to pay any final settlement of claims under the reinsurance treaty. In addition, it is helpful that the underlying assets have remained on the U.S. entity’s balance sheet, so there would be no need to ‘claw’ them back. • Any breach of contract due to failure to pay amounts under the treaty, including a termination payment (if any), would be subject to U.S. law (generally the state of the relevant Athene insurer) and any disputes as to payments would be subject to arbitration in the U.S.2

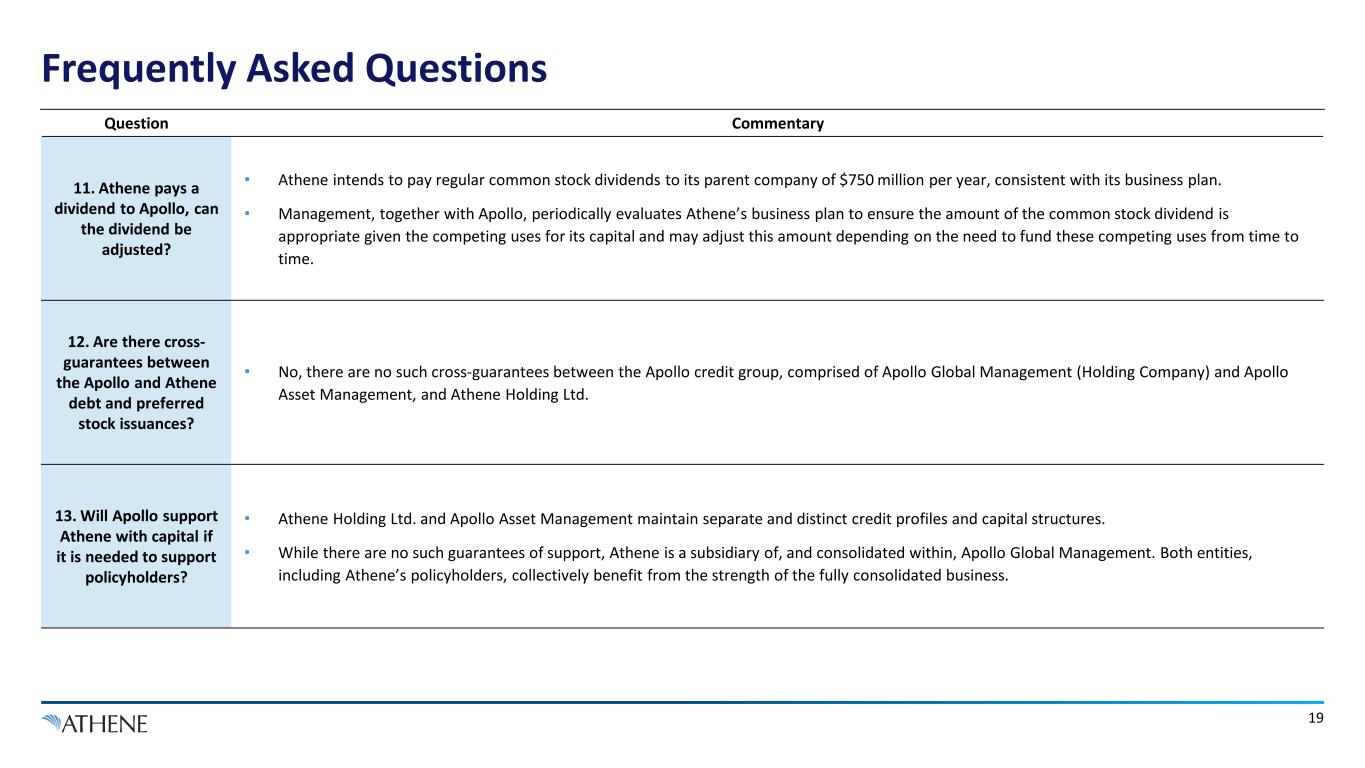

Frequently Asked Questions Question Commentary 11. Athene pays a dividend to Apollo, can the dividend be adjusted? • Athene intends to pay regular common stock dividends to its parent company of $750 million per year, consistent with its business plan. • Management, together with Apollo, periodically evaluates Athene’s business plan to ensure the amount of the common stock dividend is appropriate given the competing uses for its capital and may adjust this amount depending on the need to fund these competing uses from time to time. 12. Are there cross- guarantees between the Apollo and Athene debt and preferred stock issuances? • No, there are no such cross-guarantees between the Apollo credit group, comprised of Apollo Global Management (Holding Company) and Apollo Asset Management, and Athene Holding Ltd. 13. Will Apollo support Athene with capital if it is needed to support policyholders? • Athene Holding Ltd. and Apollo Asset Management maintain separate and distinct credit profiles and capital structures. • While there are no such guarantees of support, Athene is a subsidiary of, and consolidated within, Apollo Global Management. Both entities, including Athene’s policyholders, collectively benefit from the strength of the fully consolidated business. 19

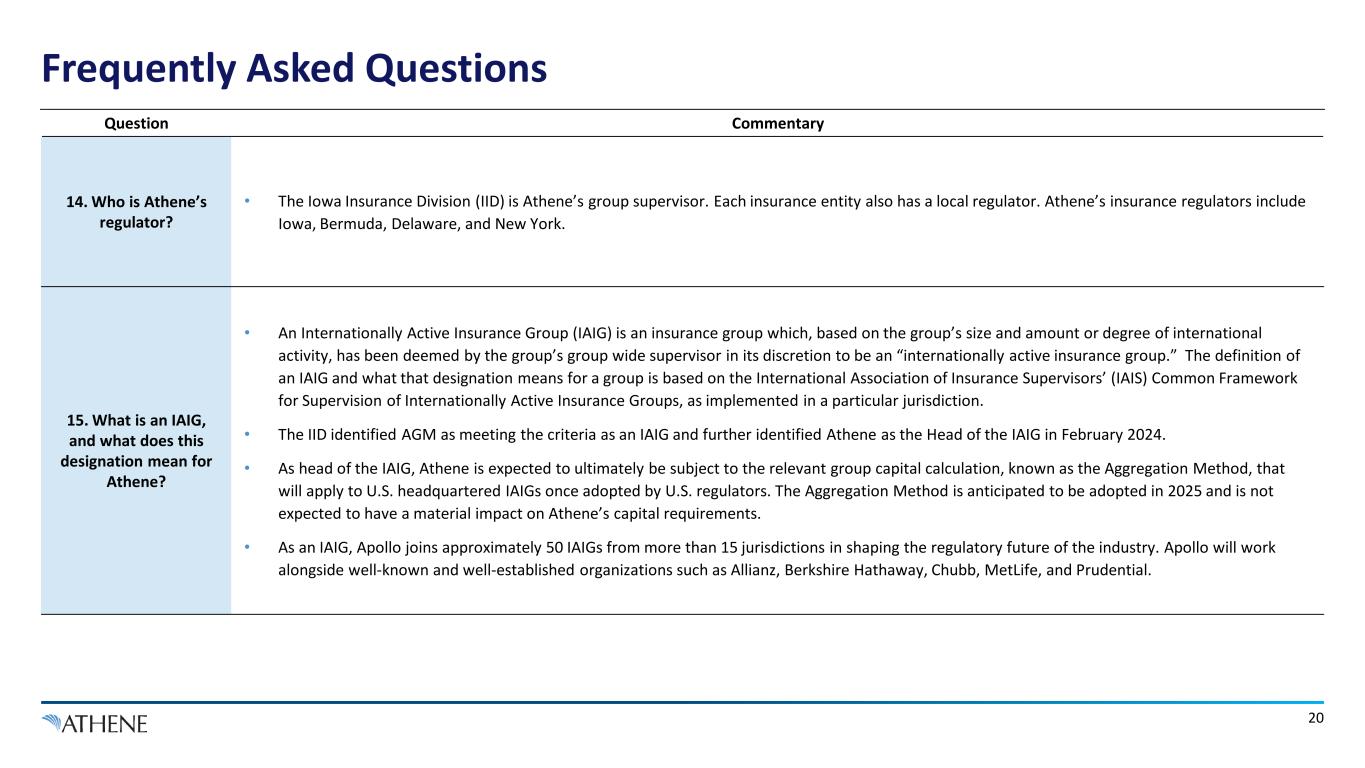

Frequently Asked Questions Question Commentary 14. Who is Athene’s regulator? • The Iowa Insurance Division (IID) is Athene’s group supervisor. Each insurance entity also has a local regulator. Athene’s insurance regulators include Iowa, Bermuda, Delaware, and New York. 15. What is an IAIG, and what does this designation mean for Athene? • An Internationally Active Insurance Group (IAIG) is an insurance group which, based on the group’s size and amount or degree of international activity, has been deemed by the group’s group wide supervisor in its discretion to be an “internationally active insurance group.” The definition of an IAIG and what that designation means for a group is based on the International Association of Insurance Supervisors’ (IAIS) Common Framework for Supervision of Internationally Active Insurance Groups, as implemented in a particular jurisdiction. • The IID identified AGM as meeting the criteria as an IAIG and further identified Athene as the Head of the IAIG in February 2024. • As head of the IAIG, Athene is expected to ultimately be subject to the relevant group capital calculation, known as the Aggregation Method, that will apply to U.S. headquartered IAIGs once adopted by U.S. regulators. The Aggregation Method is anticipated to be adopted in 2025 and is not expected to have a material impact on Athene’s capital requirements. • As an IAIG, Apollo joins approximately 50 IAIGs from more than 15 jurisdictions in shaping the regulatory future of the industry. Apollo will work alongside well-known and well-established organizations such as Allianz, Berkshire Hathaway, Chubb, MetLife, and Prudential. 20

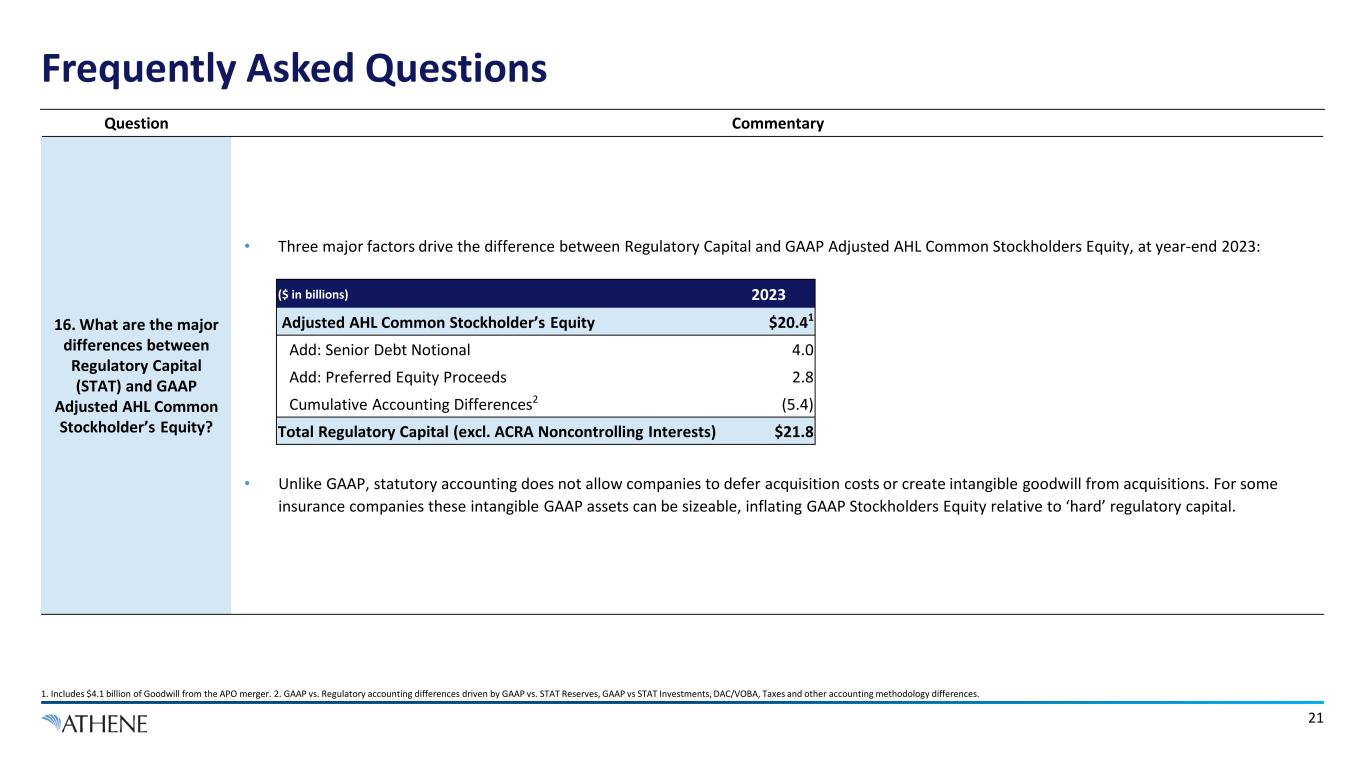

Frequently Asked Questions 1. Includes $4.1 billion of Goodwill from the APO merger. 2. GAAP vs. Regulatory accounting differences driven by GAAP vs. STAT Reserves, GAAP vs STAT Investments, DAC/VOBA, Taxes and other accounting methodology differences. Question Commentary 16. What are the major differences between Regulatory Capital (STAT) and GAAP Adjusted AHL Common Stockholder’s Equity? • Three major factors drive the difference between Regulatory Capital and GAAP Adjusted AHL Common Stockholders Equity, at year-end 2023: • Unlike GAAP, statutory accounting does not allow companies to defer acquisition costs or create intangible goodwill from acquisitions. For some insurance companies these intangible GAAP assets can be sizeable, inflating GAAP Stockholders Equity relative to ‘hard’ regulatory capital. ($ in billions) 2023 Adjusted AHL Common Stockholder’s Equity $20.41 Add: Senior Debt Notional 4.0 Add: Preferred Equity Proceeds 2.8 Cumulative Accounting Differences2 (5.4) Total Regulatory Capital (excl. ACRA Noncontrolling Interests) $21.8 21

Appendix

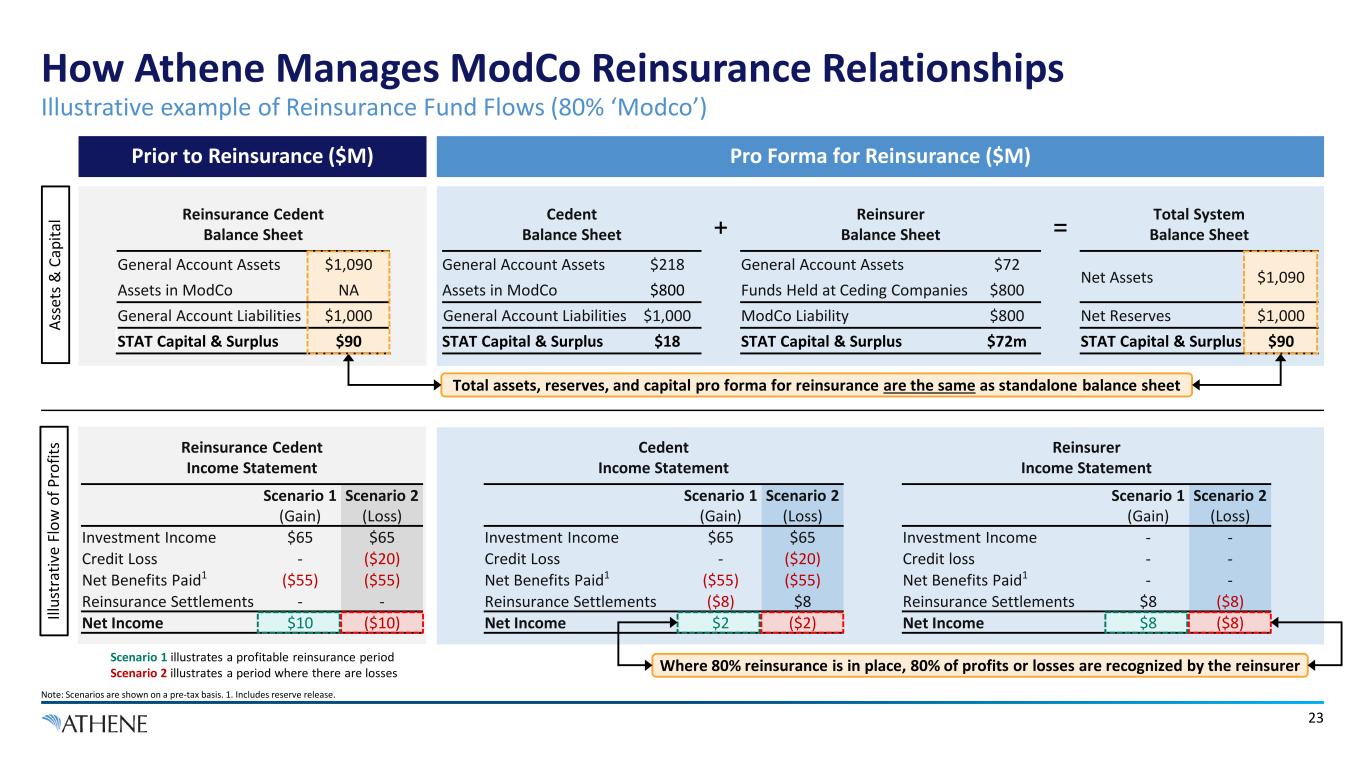

How Athene Manages ModCo Reinsurance Relationships Note: Scenarios are shown on a pre-tax basis. 1. Includes reserve release. 23 Cedent Balance Sheet General Account Assets $218 Assets in ModCo $800 General Account Liabilities $1,000 STAT Capital & Surplus $18 Reinsurance Cedent Balance Sheet General Account Assets $1,090 Assets in ModCo NA General Account Liabilities $1,000 STAT Capital & Surplus $90 Reinsurer Balance Sheet General Account Assets $72 Funds Held at Ceding Companies $800 ModCo Liability $800 STAT Capital & Surplus $72m Reinsurance Cedent Income Statement Scenario 1 (Gain) Scenario 2 (Loss) Investment Income $65 $65 Credit Loss - ($20) Net Benefits Paid1 ($55) ($55) Reinsurance Settlements - - Net Income $10 ($10) Where 80% reinsurance is in place, 80% of profits or losses are recognized by the reinsurer Total System Balance Sheet Net Assets $1,090 Net Reserves $1,000 STAT Capital & Surplus $90 + = Cedent Income Statement Scenario 1 (Gain) Scenario 2 (Loss) Investment Income $65 $65 Credit Loss - ($20) Net Benefits Paid1 ($55) ($55) Reinsurance Settlements ($8) $8 Net Income $2 ($2) Reinsurer Income Statement Scenario 1 (Gain) Scenario 2 (Loss) Investment Income - - Credit loss - - Net Benefits Paid1 - - Reinsurance Settlements $8 ($8) Net Income $8 ($8) As se ts & C ap ita l Prior to Reinsurance ($M) Total assets, reserves, and capital pro forma for reinsurance are the same as standalone balance sheet Scenario 1 illustrates a profitable reinsurance period Scenario 2 illustrates a period where there are losses Pro Forma for Reinsurance ($M) Ill us tr at iv e Fl ow o f P ro fit s Illustrative example of Reinsurance Fund Flows (80% ‘Modco’)

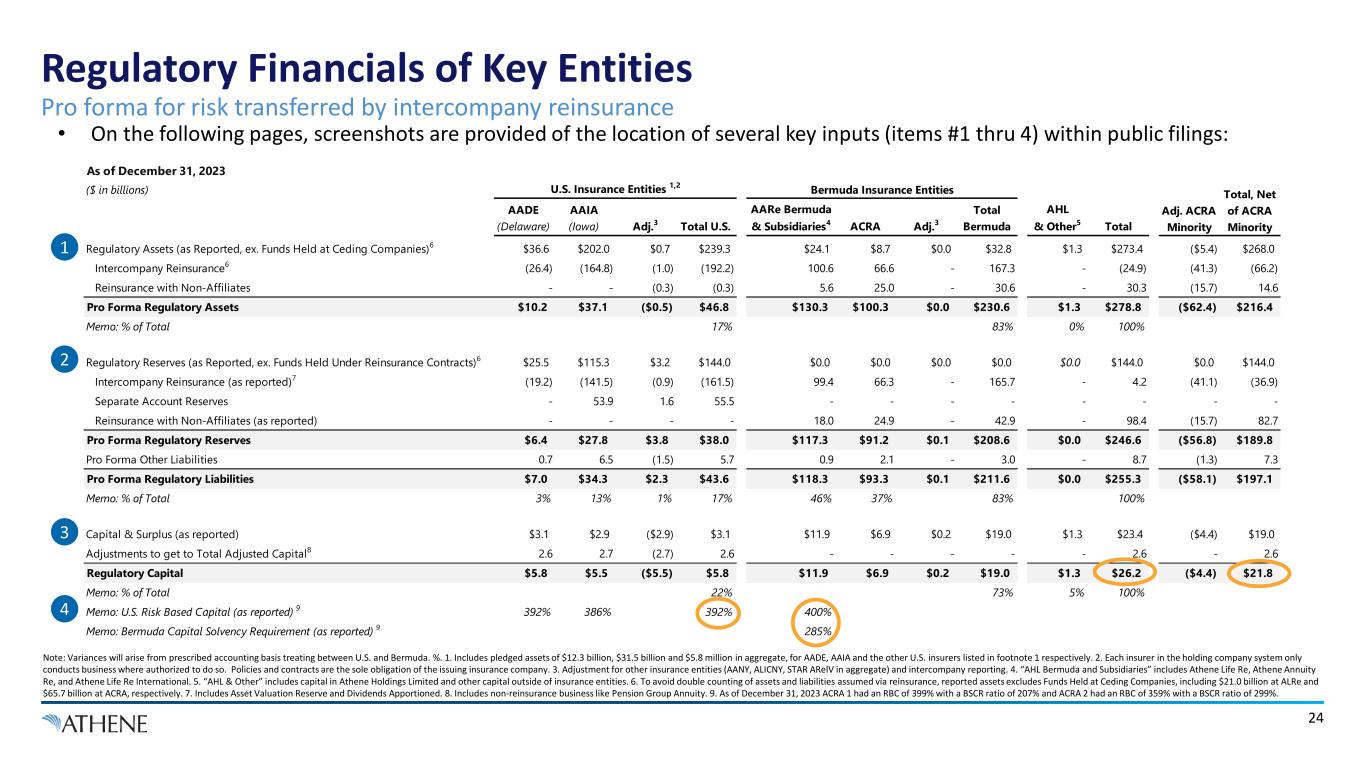

As of December 31, 2023 ($ in billions) U.S. Insurance Entities 1,2 Bermuda Insurance Entities AADE (Delaware) AAIA (Iowa) Adj.3 Total U.S. AARe Bermuda & Subsidiaries4 ACRA Adj.3 Total Bermuda AHL & Other5 Total Regulatory Assets (as Reported, ex. Funds Held at Ceding Companies)6 $36.6 $202.0 $0.7 $239.3 $24.1 $8.7 $0.0 $32.8 $1.3 $273.4 ($5.4) $268.0 Intercompany Reinsurance6 (26.4) (164.8) (1.0) (192.2) 100.6 66.6 - 167.3 - (24.9) (41.3) (66.2) Reinsurance with Non-Affiliates - - (0.3) (0.3) 5.6 25.0 - 30.6 - 30.3 (15.7) 14.6 Pro Forma Regulatory Assets $10.2 $37.1 ($0.5) $46.8 $130.3 $100.3 $0.0 $230.6 $1.3 $278.8 ($62.4) $216.4 Memo: % of Total 17% 83% 0% 100% Regulatory Reserves (as Reported, ex. Funds Held Under Reinsurance Contracts)6 $25.5 $115.3 $3.2 $144.0 $0.0 $0.0 $0.0 $0.0 $0.0 $144.0 $0.0 $144.0 Intercompany Reinsurance (as reported)7 (19.2) (141.5) (0.9) (161.5) 99.4 66.3 - 165.7 - 4.2 (41.1) (36.9) Separate Account Reserves - 53.9 1.6 55.5 - - - - - - - - Reinsurance with Non-Affiliates (as reported) - - - - 18.0 24.9 - 42.9 - 98.4 (15.7) 82.7 Pro Forma Regulatory Reserves $6.4 $27.8 $3.8 $38.0 $117.3 $91.2 $0.1 $208.6 $0.0 $246.6 ($56.8) $189.8 Pro Forma Other Liabilities 0.7 6.5 (1.5) 5.7 0.9 2.1 - 3.0 - 8.7 (1.3) 7.3 Pro Forma Regulatory Liabilities $7.0 $34.3 $2.3 $43.6 $118.3 $93.3 $0.1 $211.6 $0.0 $255.3 ($58.1) $197.1 Memo: % of Total 3% 13% 1% 17% 46% 37% 83% 100% Capital & Surplus (as reported) $3.1 $2.9 ($2.9) $3.1 $11.9 $6.9 $0.2 $19.0 $1.3 $23.4 ($4.4) $19.0 Adjustments to get to Total Adjusted Capital8 2.6 2.7 (2.7) 2.6 - - - - - 2.6 - 2.6 Regulatory Capital $5.8 $5.5 ($5.5) $5.8 $11.9 $6.9 $0.2 $19.0 $1.3 $26.2 ($4.4) $21.8 Memo: % of Total 22% 73% 5% 100% Memo: U.S. Risk Based Capital (as reported) 9 392% 386% 392% 400% Memo: Bermuda Capital Solvency Requirement (as reported) 9 285% Total, Net of ACRA Minority Adj. ACRA Minority 24 Regulatory Financials of Key Entities Note: Variances will arise from prescribed accounting basis treating between U.S. and Bermuda. %. 1. Includes pledged assets of $12.3 billion, $31.5 billion and $5.8 million in aggregate, for AADE, AAIA and the other U.S. insurers listed in footnote 1 respectively. 2. Each insurer in the holding company system only conducts business where authorized to do so. Policies and contracts are the sole obligation of the issuing insurance company. 3. Adjustment for other insurance entities (AANY, ALICNY, STAR ARelV in aggregate) and intercompany reporting. 4. “AHL Bermuda and Subsidiaries” includes Athene Life Re, Athene Annuity Re, and Athene Life Re International. 5. “AHL & Other” includes capital in Athene Holdings Limited and other capital outside of insurance entities. 6. To avoid double counting of assets and liabilities assumed via reinsurance, reported assets excludes Funds Held at Ceding Companies, including $21.0 billion at ALRe and $65.7 billion at ACRA, respectively. 7. Includes Asset Valuation Reserve and Dividends Apportioned. 8. Includes non-reinsurance business like Pension Group Annuity. 9. As of December 31, 2023 ACRA 1 had an RBC of 399% with a BSCR ratio of 207% and ACRA 2 had an RBC of 359% with a BSCR ratio of 299%. Pro forma for risk transferred by intercompany reinsurance • On the following pages, screenshots are provided of the location of several key inputs (items #1 thru 4) within public filings: 1 2 3 4

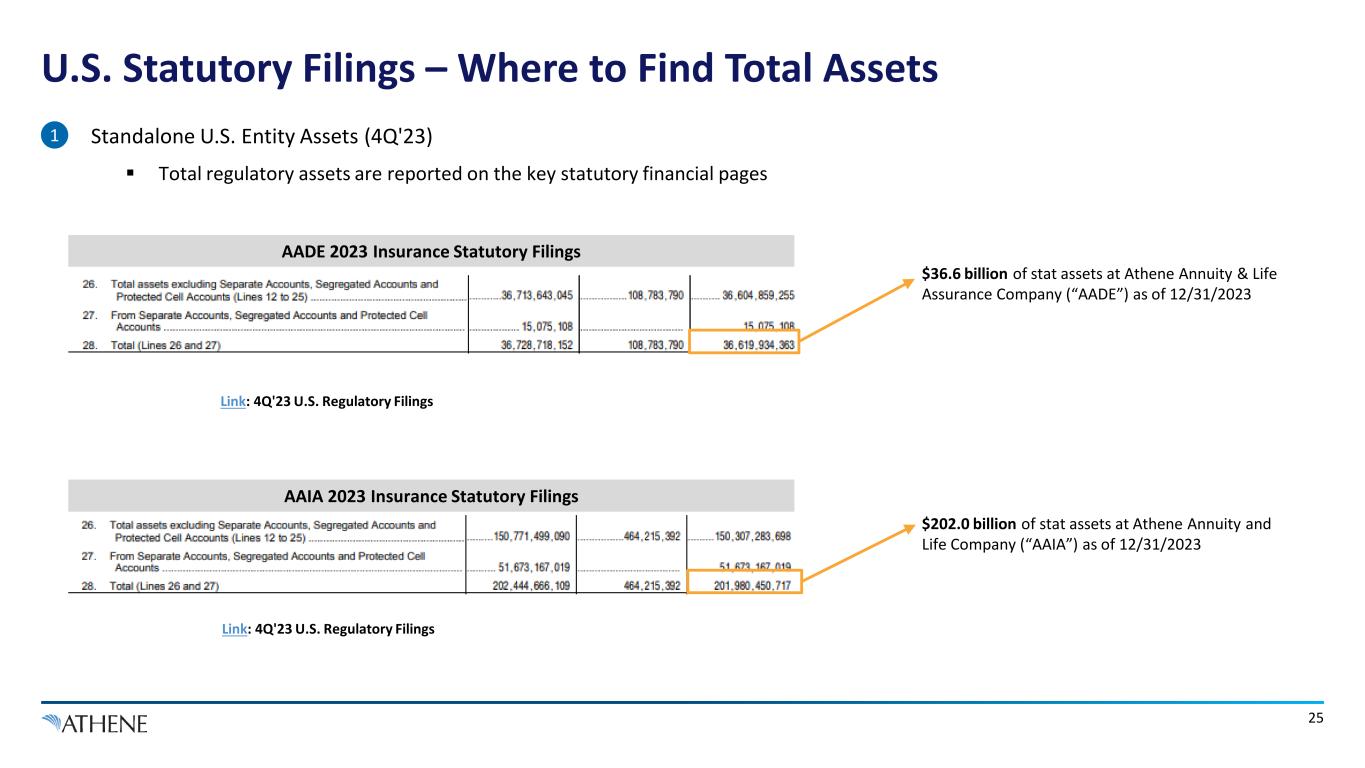

• Standalone U.S. Entity Assets (4Q'23) Total regulatory assets are reported on the key statutory financial pages 25 U.S. Statutory Filings – Where to Find Total Assets AAIA 2023 Insurance Statutory Filings AADE 2023 Insurance Statutory Filings Link: 4Q'23 U.S. Regulatory Filings Link: 4Q'23 U.S. Regulatory Filings $202.0 billion of stat assets at Athene Annuity and Life Company (“AAIA”) as of 12/31/2023 $36.6 billion of stat assets at Athene Annuity & Life Assurance Company (“AADE”) as of 12/31/2023 1

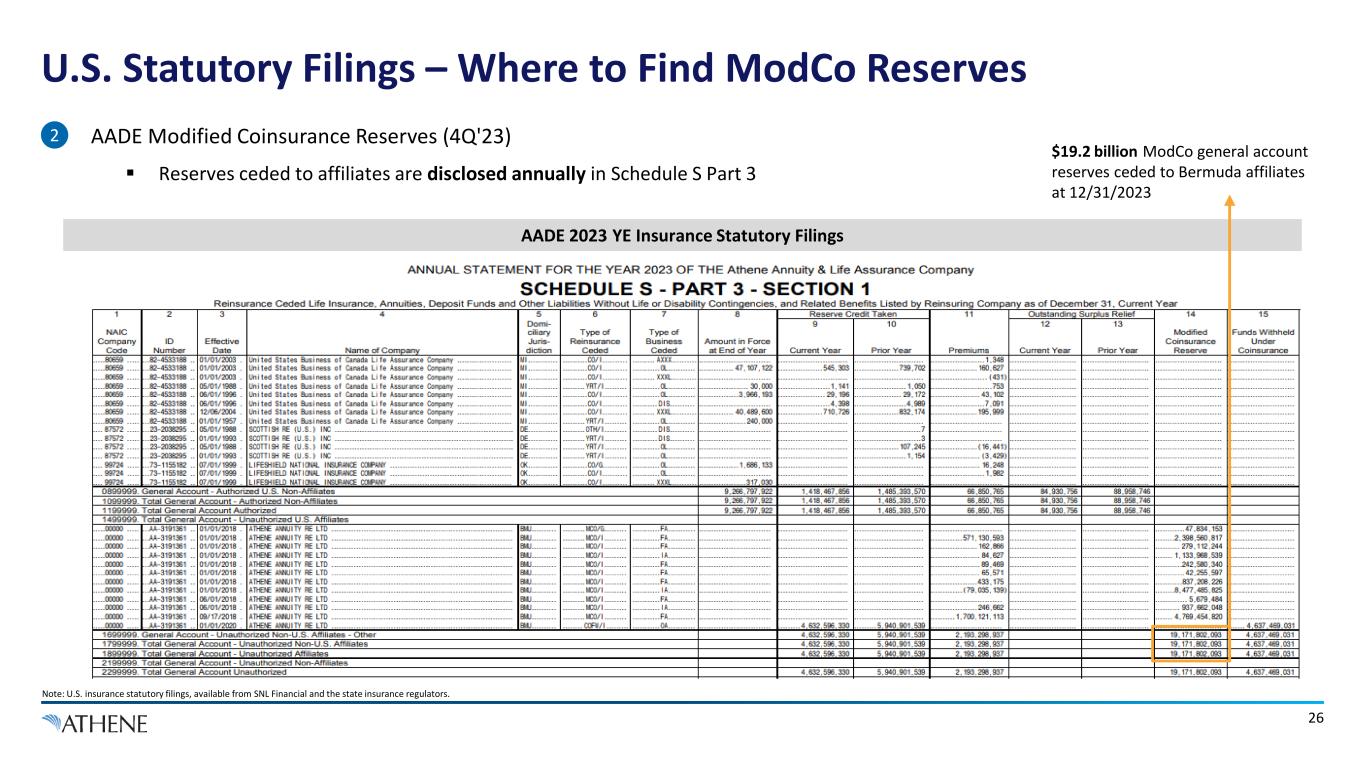

AADE 2023 YE Insurance Statutory Filings 26 U.S. Statutory Filings – Where to Find ModCo Reserves Note: U.S. insurance statutory filings, available from SNL Financial and the state insurance regulators. $19.2 billion ModCo general account reserves ceded to Bermuda affiliates at 12/31/2023 • AADE Modified Coinsurance Reserves (4Q'23) Reserves ceded to affiliates are disclosed annually in Schedule S Part 3 2

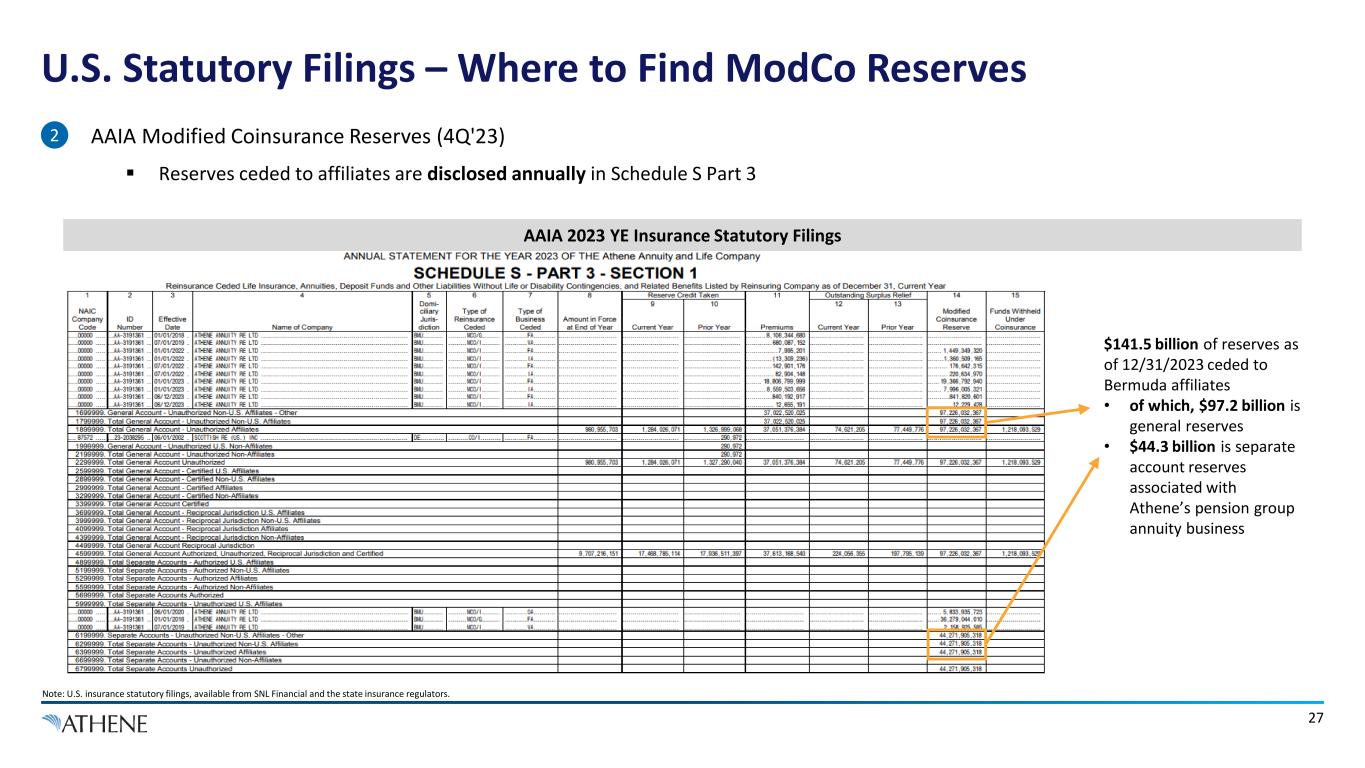

27 U.S. Statutory Filings – Where to Find ModCo Reserves Note: U.S. insurance statutory filings, available from SNL Financial and the state insurance regulators. • AAIA Modified Coinsurance Reserves (4Q'23) Reserves ceded to affiliates are disclosed annually in Schedule S Part 3 2 $141.5 billion of reserves as of 12/31/2023 ceded to Bermuda affiliates • of which, $97.2 billion is general reserves • $44.3 billion is separate account reserves associated with Athene’s pension group annuity business AAIA 2023 YE Insurance Statutory Filings

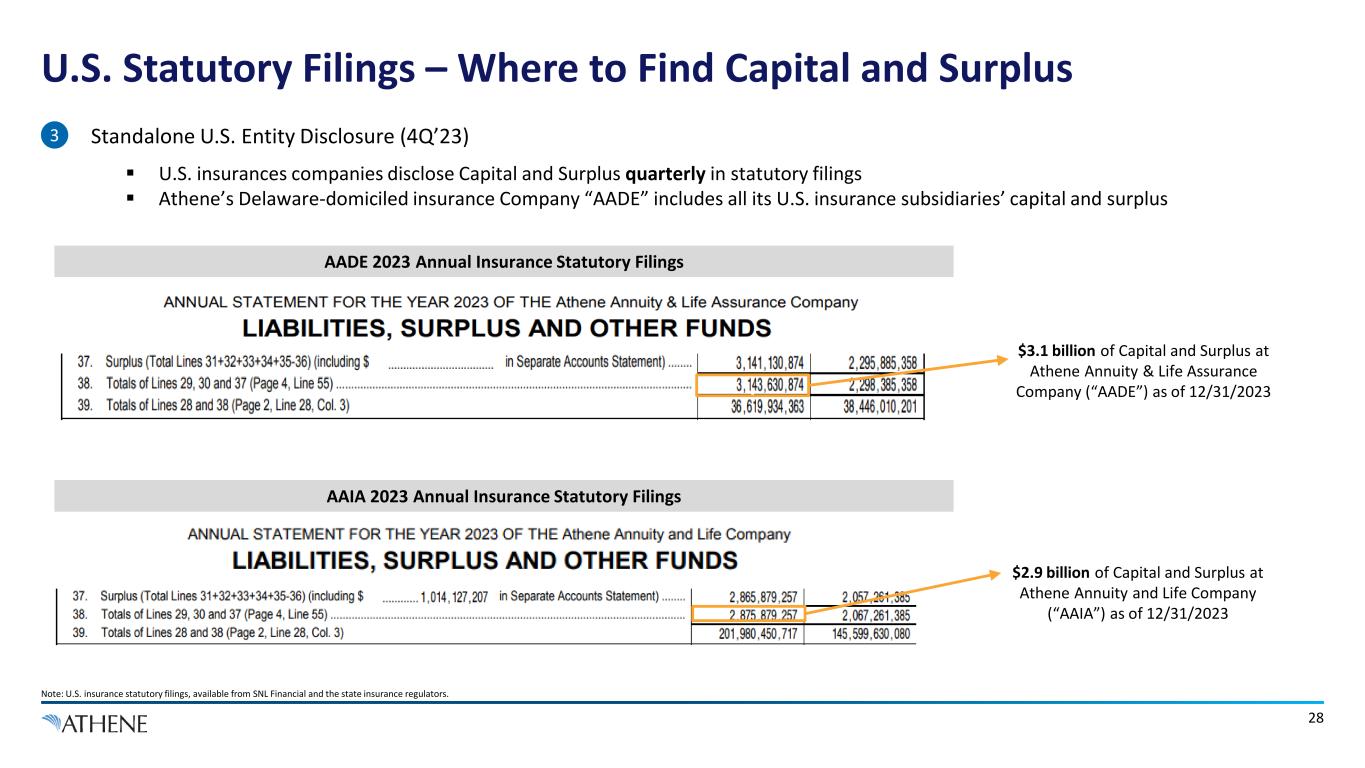

28 U.S. Statutory Filings – Where to Find Capital and Surplus Note: U.S. insurance statutory filings, available from SNL Financial and the state insurance regulators. AAIA 2023 Annual Insurance Statutory Filings AADE 2023 Annual Insurance Statutory Filings $3.1 billion of Capital and Surplus at Athene Annuity & Life Assurance Company (“AADE”) as of 12/31/2023 $2.9 billion of Capital and Surplus at Athene Annuity and Life Company (“AAIA”) as of 12/31/2023 . • Standalone U.S. Entity Disclosure (4Q’23) U.S. insurances companies disclose Capital and Surplus quarterly in statutory filings Athene’s Delaware-domiciled insurance Company “AADE” includes all its U.S. insurance subsidiaries’ capital and surplus 3

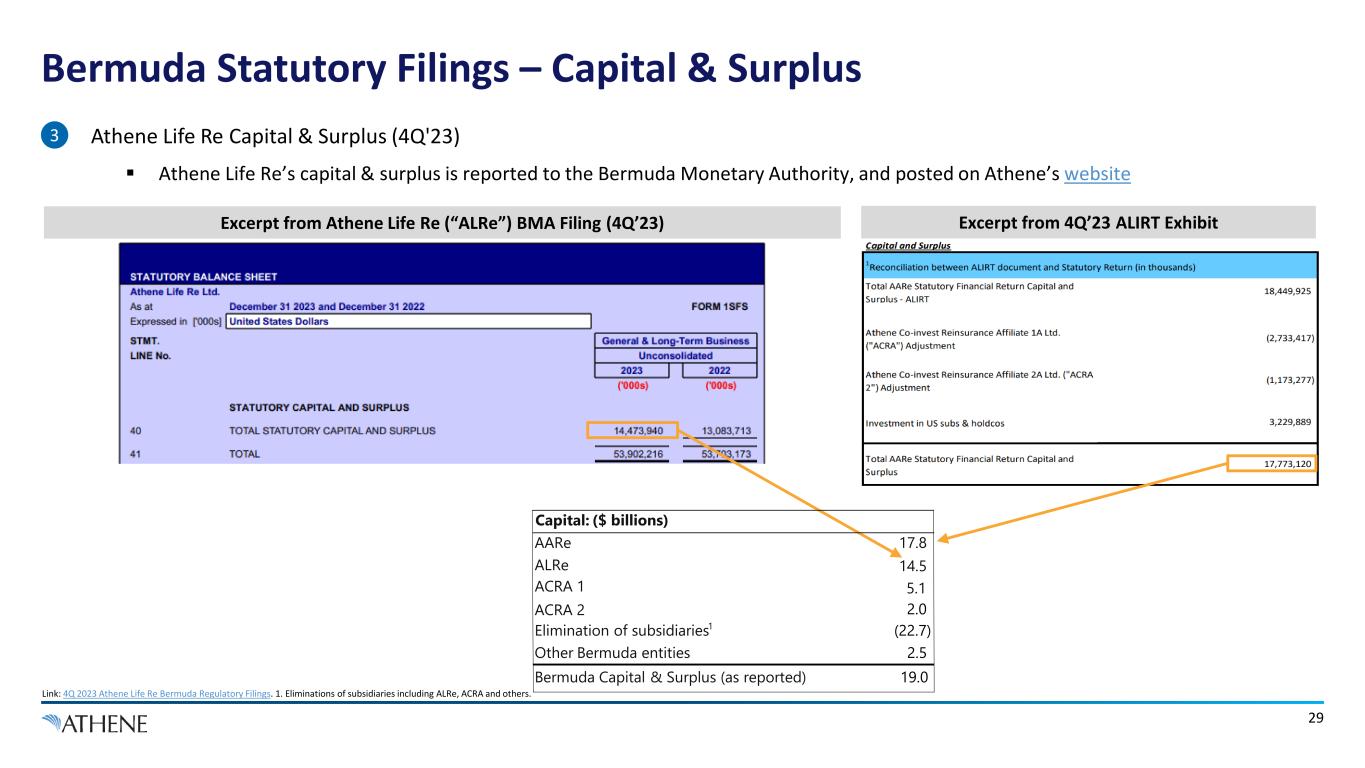

29 Bermuda Statutory Filings – Capital & Surplus Link: 4Q 2023 Athene Life Re Bermuda Regulatory Filings. 1. Eliminations of subsidiaries including ALRe, ACRA and others. • Athene Life Re Capital & Surplus (4Q'23) Athene Life Re’s capital & surplus is reported to the Bermuda Monetary Authority, and posted on Athene’s website 3 Excerpt from Athene Life Re (“ALRe”) BMA Filing (4Q’23) Excerpt from 4Q’23 ALIRT Exhibit Capital: AARe 17.8 ALRe 14.5 ACRA 2 2.0 Elimination of subsidiaries1 (22.7) Other Bermuda entities 2.5 Bermuda Capital & Surplus (as reported) 19.0 ACRA 1 5.1 ($ billions)

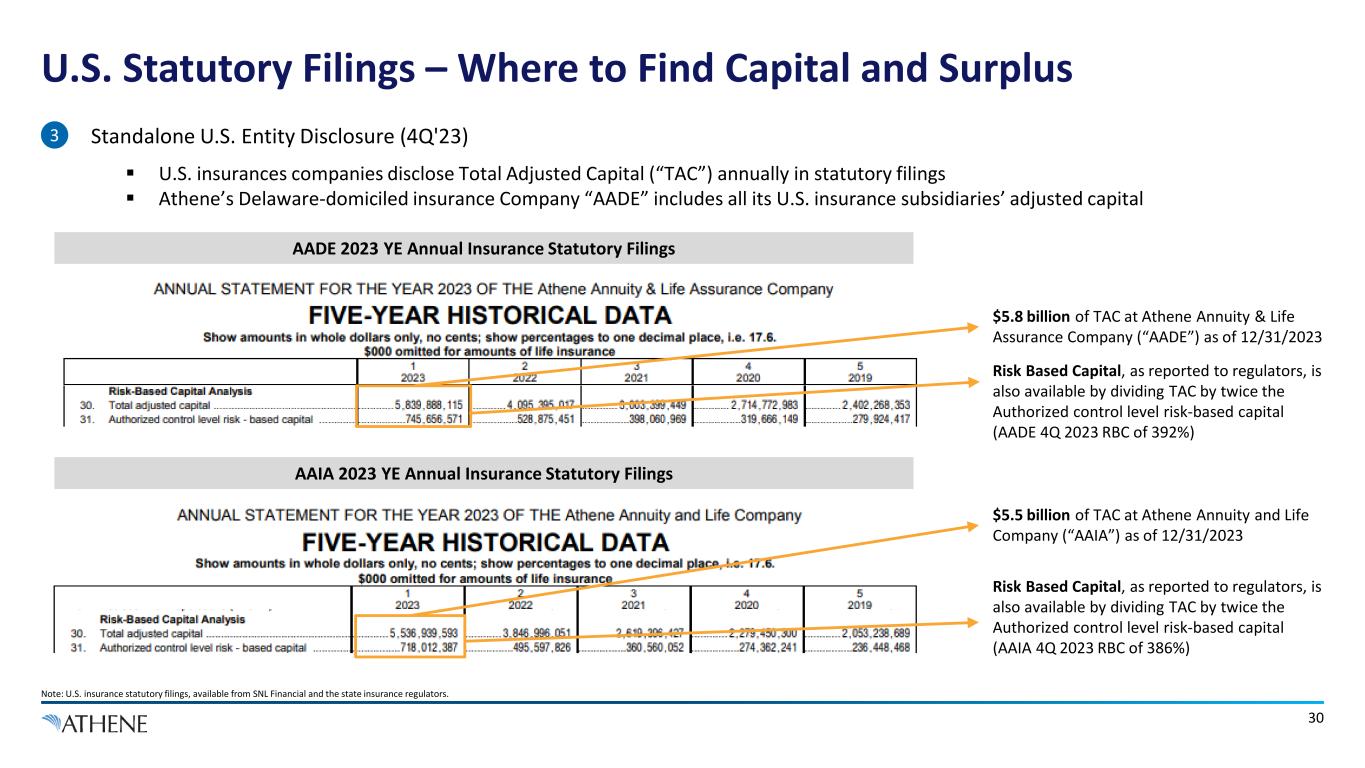

30 U.S. Statutory Filings – Where to Find Capital and Surplus • Standalone U.S. Entity Disclosure (4Q'23) U.S. insurances companies disclose Total Adjusted Capital (“TAC”) annually in statutory filings Athene’s Delaware-domiciled insurance Company “AADE” includes all its U.S. insurance subsidiaries’ adjusted capital 3 AAIA 2023 YE Annual Insurance Statutory Filings AADE 2023 YE Annual Insurance Statutory Filings Risk Based Capital, as reported to regulators, is also available by dividing TAC by twice the Authorized control level risk-based capital (AAIA 4Q 2023 RBC of 386%) $5.8 billion of TAC at Athene Annuity & Life Assurance Company (“AADE”) as of 12/31/2023 $5.5 billion of TAC at Athene Annuity and Life Company (“AAIA”) as of 12/31/2023 Note: U.S. insurance statutory filings, available from SNL Financial and the state insurance regulators. Risk Based Capital, as reported to regulators, is also available by dividing TAC by twice the Authorized control level risk-based capital (AADE 4Q 2023 RBC of 392%)

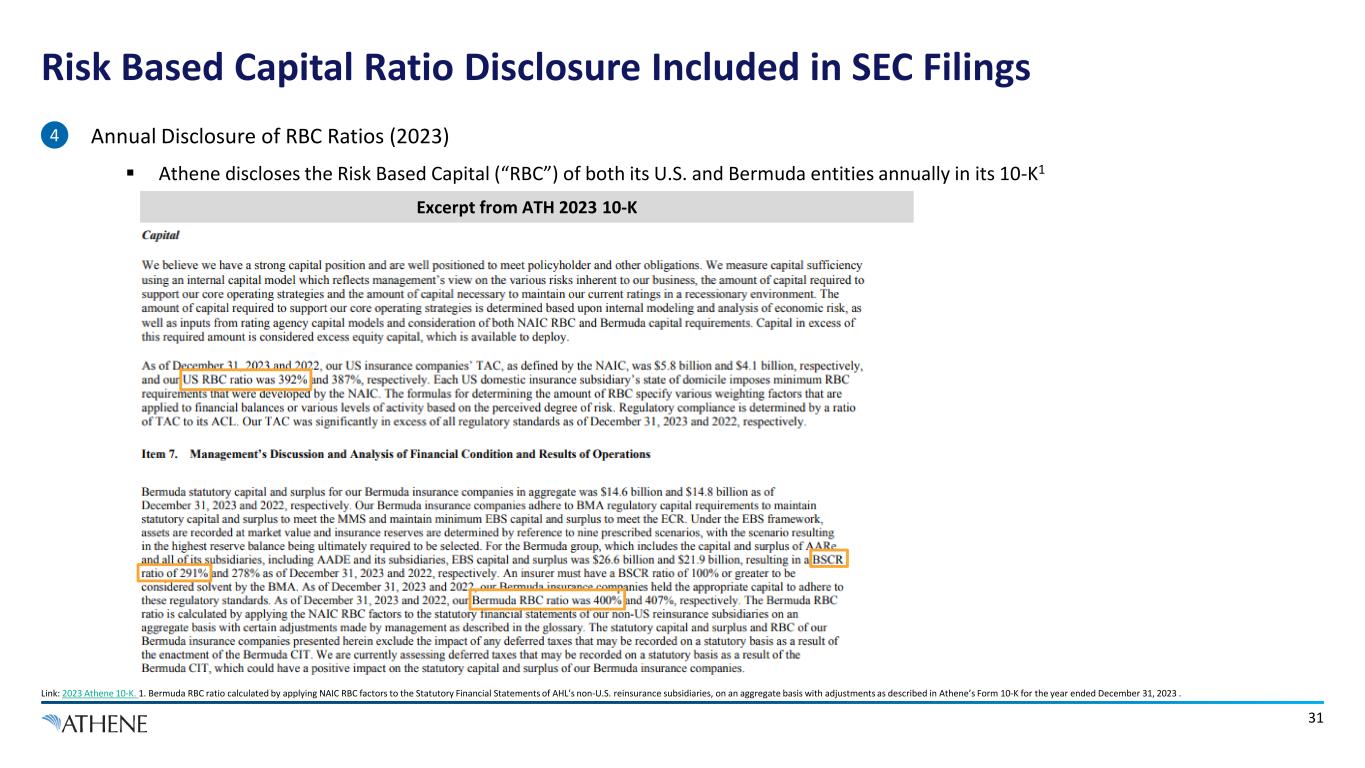

31 Risk Based Capital Ratio Disclosure Included in SEC Filings • Annual Disclosure of RBC Ratios (2023) Athene discloses the Risk Based Capital (“RBC”) of both its U.S. and Bermuda entities annually in its 10-K1 4 Link: 2023 Athene 10-K. 1. Bermuda RBC ratio calculated by applying NAIC RBC factors to the Statutory Financial Statements of AHL's non-U.S. reinsurance subsidiaries, on an aggregate basis with adjustments as described in Athene’s Form 10-K for the year ended December 31, 2023 . Excerpt from ATH 2023 10-K

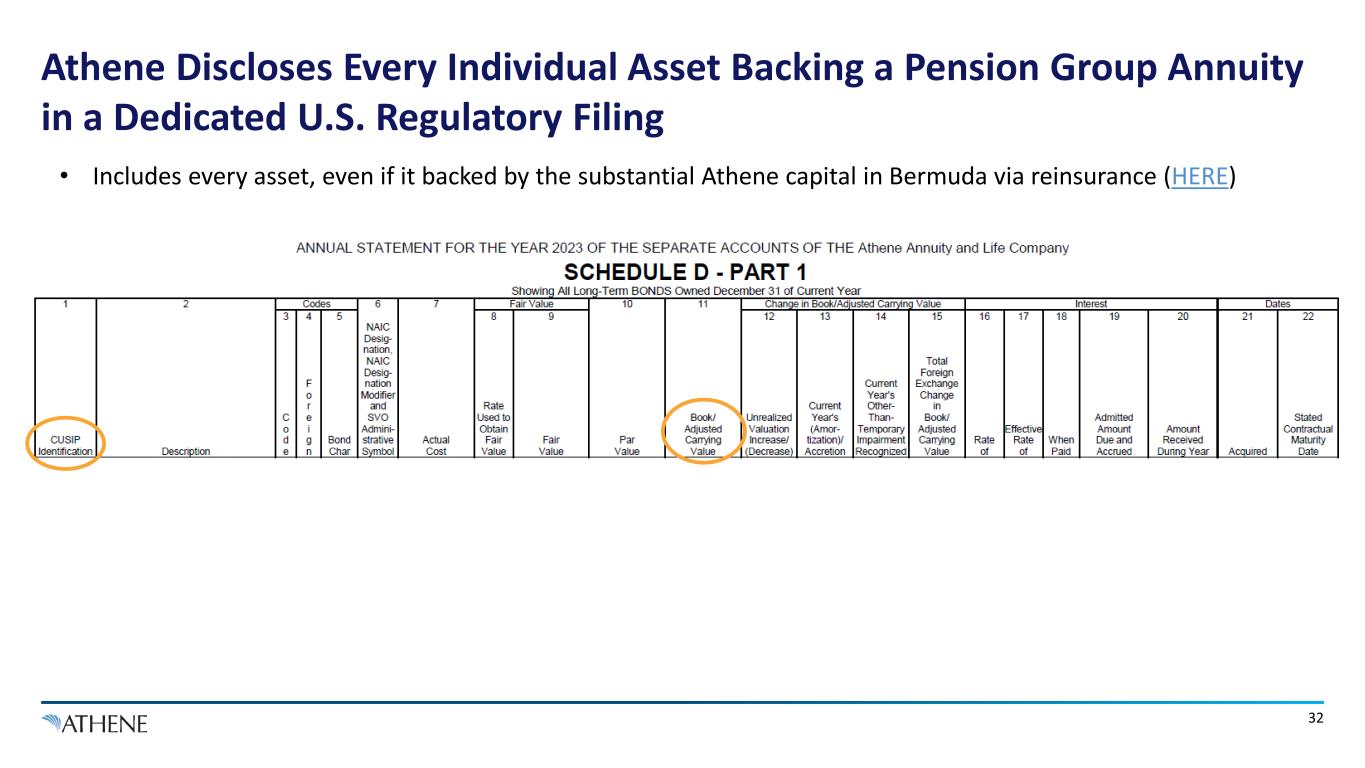

Athene Discloses Every Individual Asset Backing a Pension Group Annuity in a Dedicated U.S. Regulatory Filing • Includes every asset, even if it backed by the substantial Athene capital in Bermuda via reinsurance (HERE) 32

Non-GAAP Measures & Definitions 33 Assets Under Management “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. the net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of equity and certain hybrid funds, partnerships and accounts Apollo manages or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any Apollo Fund management agreements. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in its funds; and (3) the AUM measures that Apollo uses internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM as a performance measurement of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs.