EX-99.1

Published on February 22, 2023

Athene Fixed Income Investor Presentation February 2023

Disclaimer This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security of Athene Holding Ltd. (“Athene”). Unless the context requires otherwise, references in this presentation to “Apollo," "AGM" and "AGM HoldCo" refer to Apollo Global Management, Inc., together with its subsidiaries, and references in this presentation to “AAM” refer to Apollo Asset Management, Inc., a subsidiary of Apollo Global Management, Inc. This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks, uncertainties and assumptions that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, benefits to be derived from Athene's capital allocation decisions; the anticipated performance of Athene's portfolio in certain stress or recessionary environments; the performance of Athene's business; general economic conditions; the failure to realize economic benefits from the merger with Apollo; expected future operating results; Athene's liquidity and capital resources; and other non-historical statements. Although Athene management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. For a discussion of other risks and uncertainties related to Athene's forward-looking statements, see its annual report on Form 10-K for the year ended December 31, 2021 and quarterly report on Form 10-Q filed for the period ended September 30, 2022, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Information contained herein may include information respecting prior performance of Athene. Information respecting prior performance, while a useful tool, is not necessarily indicative of actual results to be achieved in the future, which is dependent upon many factors, many of which are beyond Athene's control. The information contained herein is not a guarantee of future performance by Athene, and actual outcomes and results may differ materially from any historic, pro forma or projected financial results indicated herein. Certain of the financial information contained herein is unaudited or based on the application of non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. Furthermore, certain financial information is based on estimates of management. These estimates, which are based on the reasonable expectations of management, are subject to change and there can be no assurance that they will prove to be correct. The information contained herein does not purport to be all-inclusive or contain all information that an evaluator may require in order to properly evaluate the business, prospects or value of Athene. Athene does not have any obligation to update this presentation and the information may change at any time without notice. Models that may be contained herein (the “Models”) are being provided for illustrative and discussion purposes only and are not intended to forecast or predict future events. Information provided in the Models may not reflect the most current data and is subject to change. The Models are based on estimates and assumptions that are also subject to change and may be subject to significant business, economic and competitive uncertainties, including numerous uncontrollable market and event driven situations. There is no guarantee that the information presented in the Models is accurate. Actual results may differ materially from those reflected and contemplated in such hypothetical, forward-looking information. Undue reliance should not be placed on such information and investors should not use the Models to make investment decisions. Athene has no duty to update the Models in the future. Certain of the information used in preparing this presentation was obtained from third parties or public sources. No representation or warranty, express or implied, is made or given by or on behalf of Athene or any other person as to the accuracy, completeness or fairness of such information, and no responsibility or liability is accepted for any such information. The contents of any website referenced in this presentation are not incorporated by reference. This document is not intended to be, nor should it be construed or used as, financial, legal, tax, insurance or investment advice. There can be no assurance that Athene will achieve its objectives. Past performance is not indicative of future success. All information is as of the dates indicated herein. 2

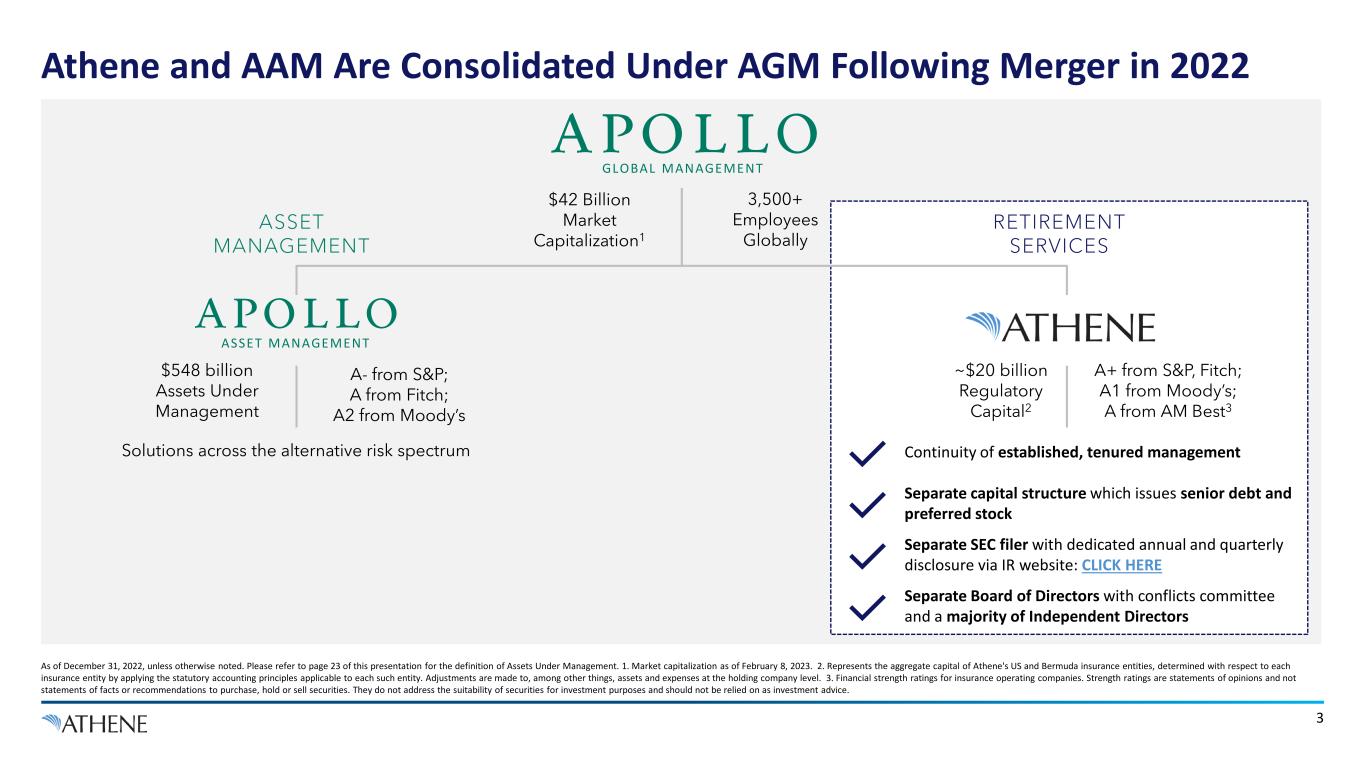

3 Athene and AAM Are Consolidated Under AGM Following Merger in 2022 As of December 31, 2022, unless otherwise noted. Please refer to page 23 of this presentation for the definition of Assets Under Management. 1. Market capitalization as of February 8, 2023. 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. 3. Financial strength ratings for insurance operating companies. Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. $548 billion Assets Under Management ~$20 billion Regulatory Capital2 A+ from S&P, Fitch; A1 from Moody’s; A from AM Best3 ASSET MANAGEMENT RETIREMENT SERVICES $42 Billion Market Capitalization1 3,500+ Employees Globally ASSET MANAGEMENT GLOBAL MANAGEMENT Solutions across the alternative risk spectrum Separate capital structure which issues senior debt and preferred stock Separate SEC filer with dedicated annual and quarterly disclosure via IR website: CLICK HERE Separate Board of Directors with conflicts committee and a majority of Independent Directors Continuity of established, tenured management A- from S&P; A from Fitch; A2 from Moody’s

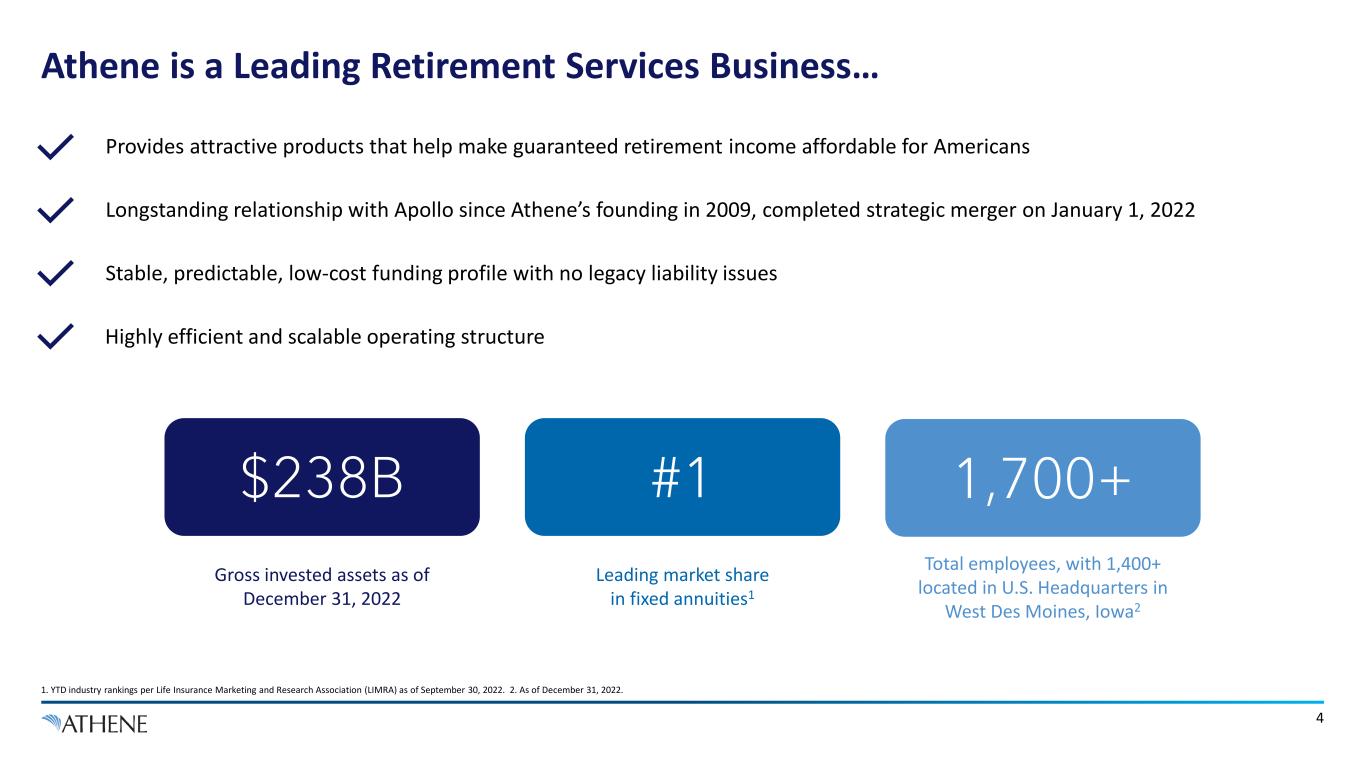

4 Athene is a Leading Retirement Services Business… 1. YTD industry rankings per Life Insurance Marketing and Research Association (LIMRA) as of September 30, 2022. 2. As of December 31, 2022. Provides attractive products that help make guaranteed retirement income affordable for Americans Stable, predictable, low-cost funding profile with no legacy liability issues Longstanding relationship with Apollo since Athene’s founding in 2009, completed strategic merger on January 1, 2022 Highly efficient and scalable operating structure Total employees, with 1,400+ located in U.S. Headquarters in West Des Moines, Iowa2 1,700+ Leading market share in fixed annuities1 #1 Gross invested assets as of December 31, 2022 $238B

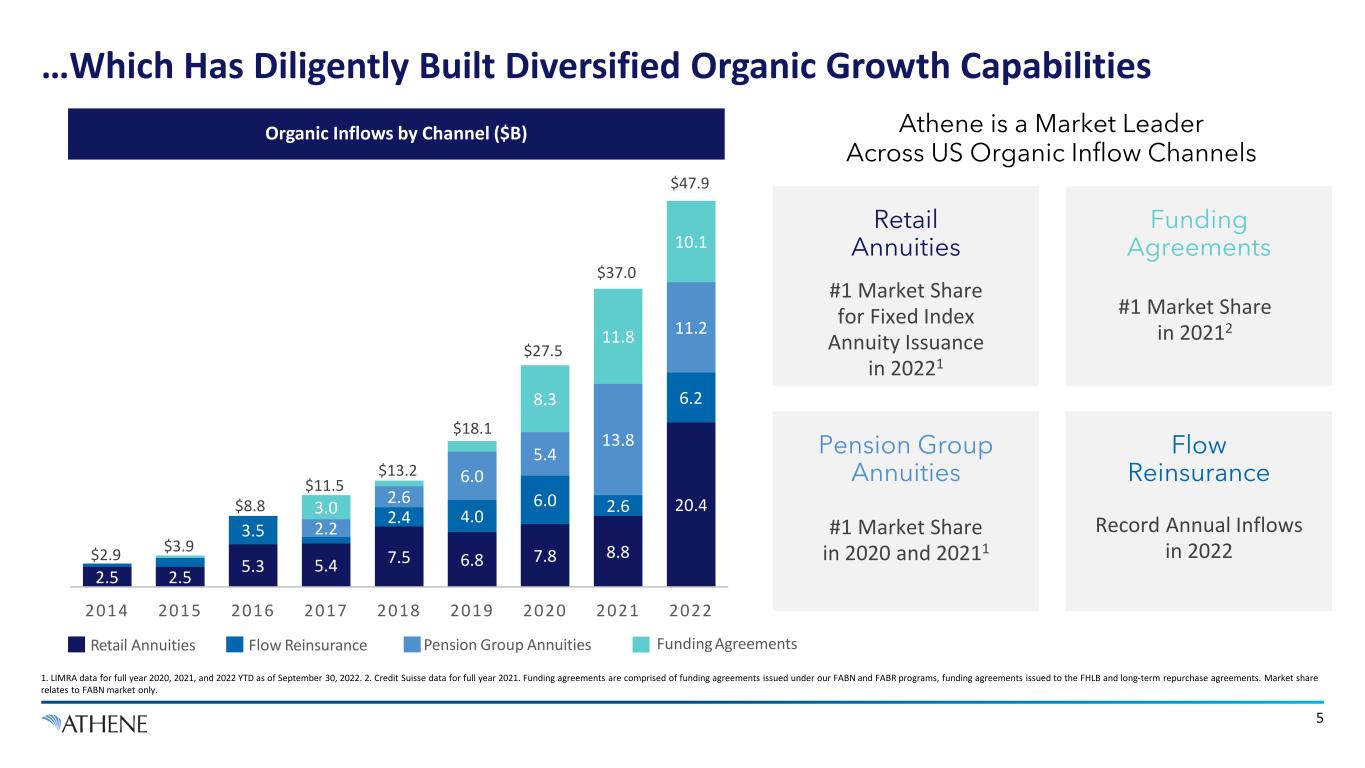

5 …Which Has Diligently Built Diversified Organic Growth Capabilities 1. LIMRA data for full year 2020, 2021, and 2022 YTD as of September 30, 2022. 2. Credit Suisse data for full year 2021. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding agreements issued to the FHLB and long-term repurchase agreements. Market share relates to FABN market only. 2.5 2.5 5.3 5.4 7.5 6.8 7.8 8.8 20.4 3.5 2.4 4.0 6.0 2.6 6.2 2.2 2.6 6.0 5.4 13.8 11.2 3.0 8.3 11.8 10.1 2014 2015 2016 2017 2018 2019 2020 2021 2022 $2.9 $3.9 $8.8 $11.5 $13.2 $18.1 $27.5 $37.0 Funding AgreementsRetail Annuities Flow Reinsurance Pension Group Annuities $47.9 Athene is a Market Leader Across US Organic Inflow Channels Pension Group Annuities #1 Market Share in 2020 and 20211 Funding Agreements #1 Market Share in 20212 Retail Annuities #1 Market Share for Fixed Index Annuity Issuance in 20221 Flow Reinsurance Record Annual Inflows in 2022 Organic Inflows by Channel ($B)

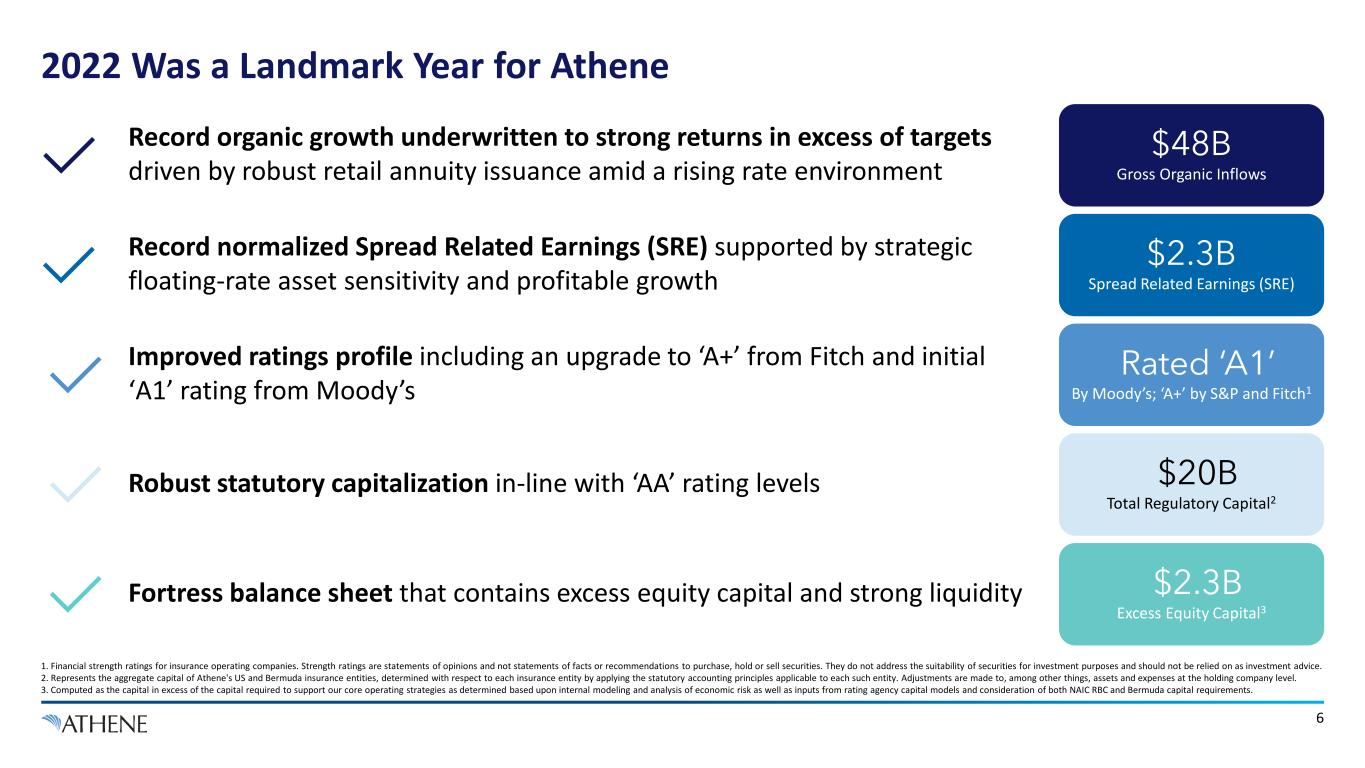

6 2022 Was a Landmark Year for Athene 1. Financial strength ratings for insurance operating companies. Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. 3. Computed as the capital in excess of the capital required to support our core operating strategies as determined based upon internal modeling and analysis of economic risk as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. $48B Gross Organic Inflows Record organic growth underwritten to strong returns in excess of targets driven by robust retail annuity issuance amid a rising rate environment Record normalized Spread Related Earnings (SRE) supported by strategic floating-rate asset sensitivity and profitable growth $2.3B Spread Related Earnings (SRE) Rated ‘A1’ By Moody’s; ‘A+’ by S&P and Fitch1 Improved ratings profile including an upgrade to ‘A+’ from Fitch and initial ‘A1’ rating from Moody’s $20B Total Regulatory Capital2 Robust statutory capitalization in-line with ‘AA’ rating levels Fortress balance sheet that contains excess equity capital and strong liquidity $2.3B Excess Equity Capital3

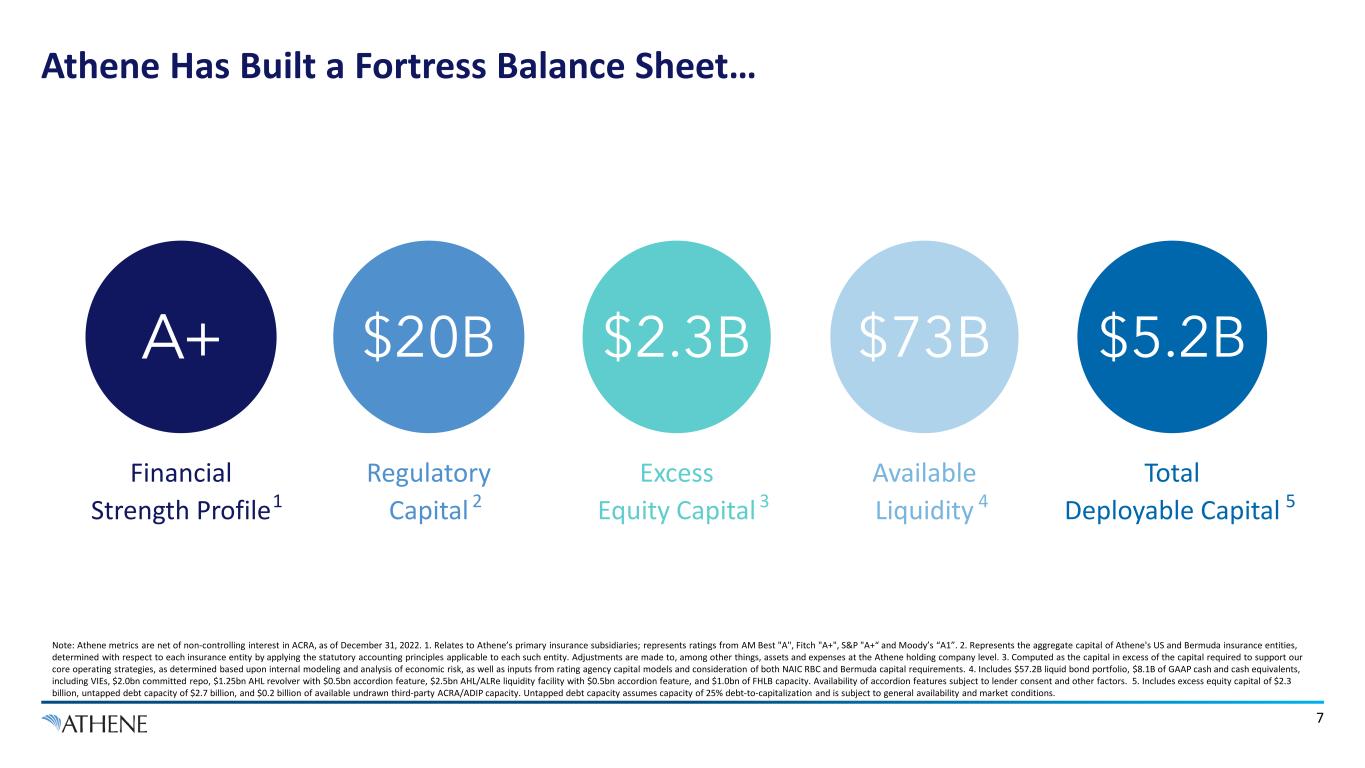

7 Note: Athene metrics are net of non-controlling interest in ACRA, as of December 31, 2022. 1. Relates to Athene’s primary insurance subsidiaries; represents ratings from AM Best "A", Fitch "A+", S&P "A+“ and Moody’s “A1”. 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. 3. Computed as the capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 4. Includes $57.2B liquid bond portfolio, $8.1B of GAAP cash and cash equivalents, including VIEs, $2.0bn committed repo, $1.25bn AHL revolver with $0.5bn accordion feature, $2.5bn AHL/ALRe liquidity facility with $0.5bn accordion feature, and $1.0bn of FHLB capacity. Availability of accordion features subject to lender consent and other factors. 5. Includes excess equity capital of $2.3 billion, untapped debt capacity of $2.7 billion, and $0.2 billion of available undrawn third-party ACRA/ADIP capacity. Untapped debt capacity assumes capacity of 25% debt-to-capitalization and is subject to general availability and market conditions. Athene Has Built a Fortress Balance Sheet… Financial Strength Profile A+ $2.3B Excess Equity Capital 3 $20B Regulatory Capital 2 $5.2B Total Deployable Capital 5 Available Liquidity $73B 41

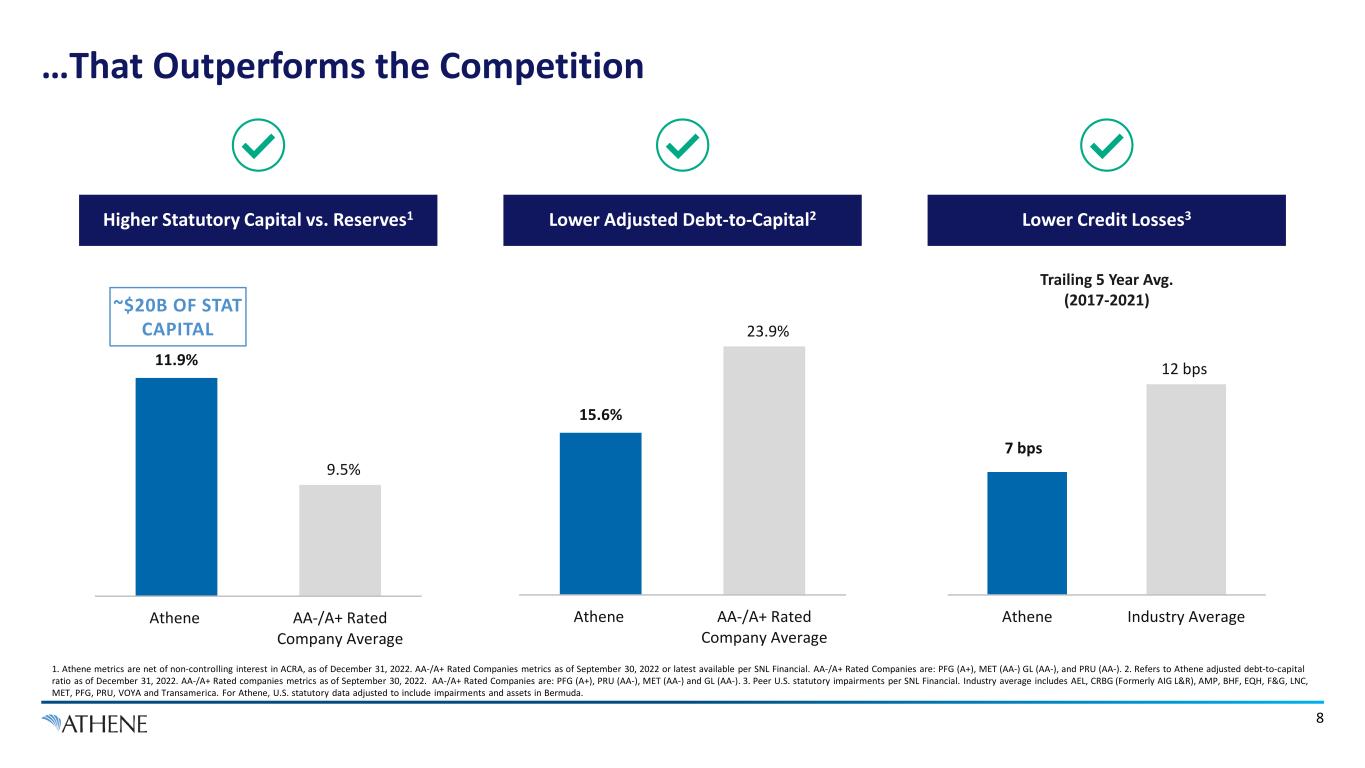

8 1. Athene metrics are net of non-controlling interest in ACRA, as of December 31, 2022. AA-/A+ Rated Companies metrics as of September 30, 2022 or latest available per SNL Financial. AA-/A+ Rated Companies are: PFG (A+), MET (AA-) GL (AA-), and PRU (AA-). 2. Refers to Athene adjusted debt-to-capital ratio as of December 31, 2022. AA-/A+ Rated companies metrics as of September 30, 2022. AA-/A+ Rated Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). 3. Peer U.S. statutory impairments per SNL Financial. Industry average includes AEL, CRBG (Formerly AIG L&R), AMP, BHF, EQH, F&G, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. …That Outperforms the Competition ~$20B OF STAT CAPITAL 7 bps 12 bps Athene Industry Average Trailing 5 Year Avg. (2017-2021) Higher Statutory Capital vs. Reserves1 Lower Adjusted Debt-to-Capital2 Lower Credit Losses3 15.6% 23.9% Athene AA-/A+ Rated Company Average 11.9% 9.5% Athene AA-/A+ Rated Company Average

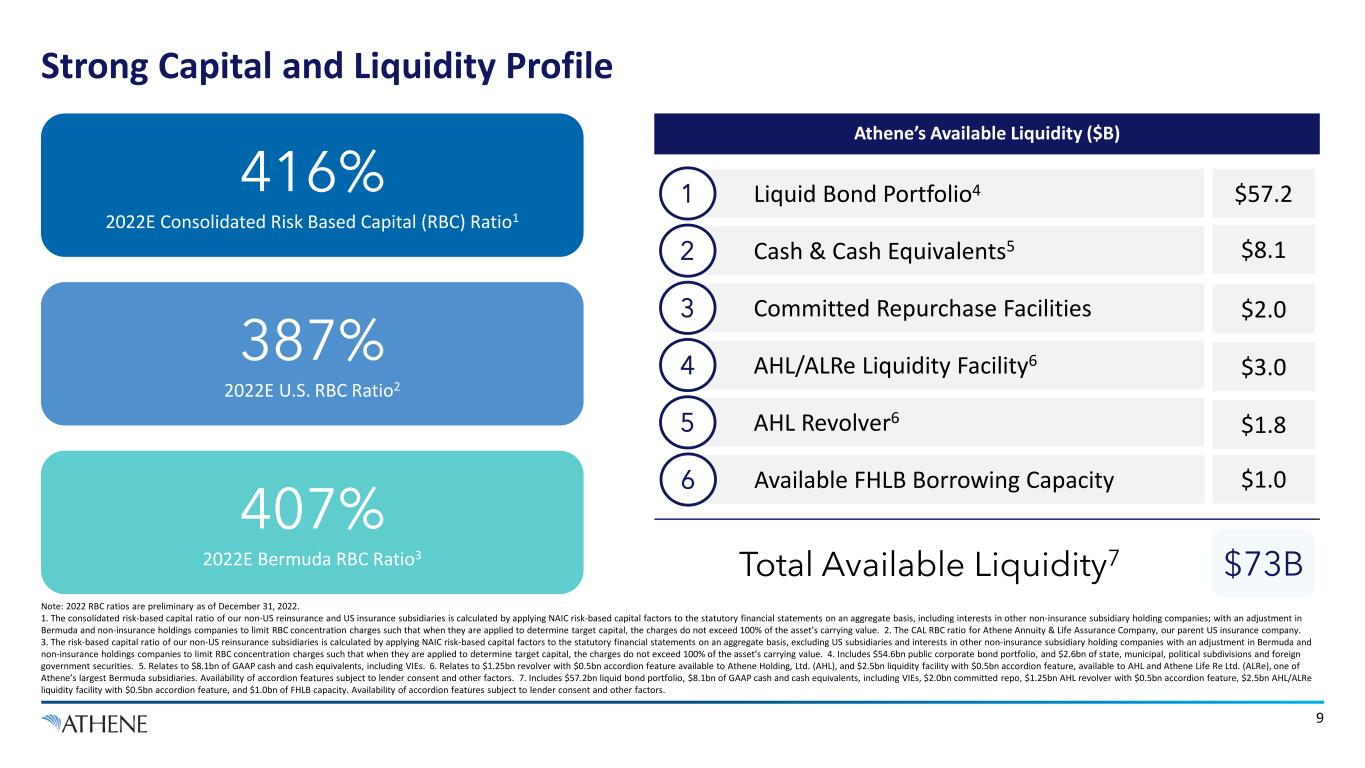

9 Strong Capital and Liquidity Profile Note: 2022 RBC ratios are preliminary as of December 31, 2022. 1. The consolidated risk-based capital ratio of our non-US reinsurance and US insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 2. The CAL RBC ratio for Athene Annuity & Life Assurance Company, our parent US insurance company. 3. The risk-based capital ratio of our non-US reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding US subsidiaries and interests in other non-insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holdings companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 4. Includes $54.6bn public corporate bond portfolio, and $2.6bn of state, municipal, political subdivisions and foreign government securities. 5. Relates to $8.1bn of GAAP cash and cash equivalents, including VIEs. 6. Relates to $1.25bn revolver with $0.5bn accordion feature available to Athene Holding, Ltd. (AHL), and $2.5bn liquidity facility with $0.5bn accordion feature, available to AHL and Athene Life Re Ltd. (ALRe), one of Athene’s largest Bermuda subsidiaries. Availability of accordion features subject to lender consent and other factors. 7. Includes $57.2bn liquid bond portfolio, $8.1bn of GAAP cash and cash equivalents, including VIEs, $2.0bn committed repo, $1.25bn AHL revolver with $0.5bn accordion feature, $2.5bn AHL/ALRe liquidity facility with $0.5bn accordion feature, and $1.0bn of FHLB capacity. Availability of accordion features subject to lender consent and other factors. 416% 2022E Consolidated Risk Based Capital (RBC) Ratio1 387% 2022E U.S. RBC Ratio2 407% 2022E Bermuda RBC Ratio3 Athene’s Available Liquidity ($B) Liquid Bond Portfolio41 Cash & Cash Equivalents52 Committed Repurchase Facilities3 AHL/ALRe Liquidity Facility64 AHL Revolver65 Available FHLB Borrowing Capacity6 $73B $57.2 $8.1 $2.0 $3.0 $1.8 $1.0 Total Available Liquidity7

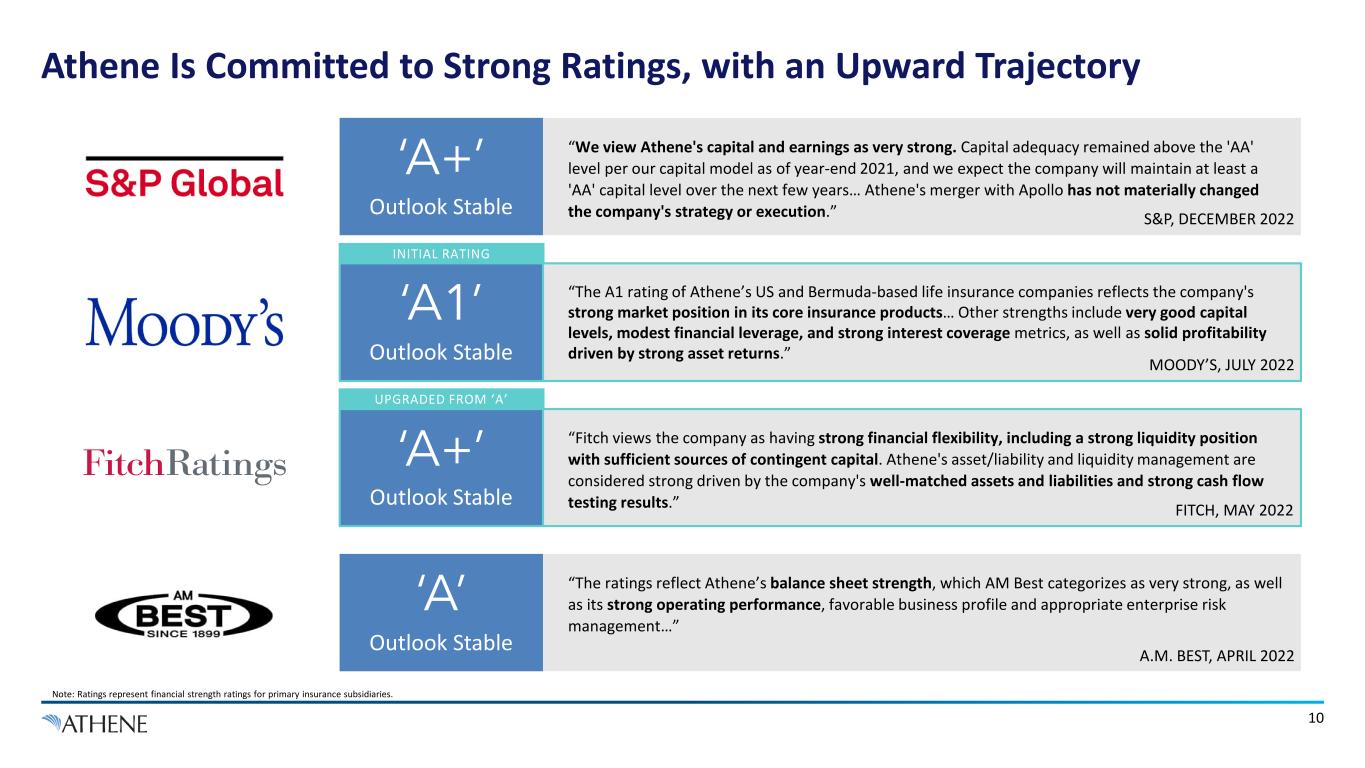

“The A1 rating of Athene’s US and Bermuda-based life insurance companies reflects the company's strong market position in its core insurance products… Other strengths include very good capital levels, modest financial leverage, and strong interest coverage metrics, as well as solid profitability driven by strong asset returns.” ‘A1’ Outlook Stable 10 “Fitch views the company as having strong financial flexibility, including a strong liquidity position with sufficient sources of contingent capital. Athene's asset/liability and liquidity management are considered strong driven by the company's well-matched assets and liabilities and strong cash flow testing results.” ‘A+’ Outlook Stable “We view Athene's capital and earnings as very strong. Capital adequacy remained above the 'AA' level per our capital model as of year-end 2021, and we expect the company will maintain at least a 'AA' capital level over the next few years… Athene's merger with Apollo has not materially changed the company's strategy or execution.” ‘A+’ Outlook Stable “The ratings reflect Athene’s balance sheet strength, which AM Best categorizes as very strong, as well as its strong operating performance, favorable business profile and appropriate enterprise risk management…” ‘A’ Outlook Stable S&P, DECEMBER 2022 FITCH, MAY 2022 A.M. BEST, APRIL 2022 MOODY’S, JULY 2022 Note: Ratings represent financial strength ratings for primary insurance subsidiaries. UPGRADED FROM ‘A’ INITIAL RATING Athene Is Committed to Strong Ratings, with an Upward Trajectory

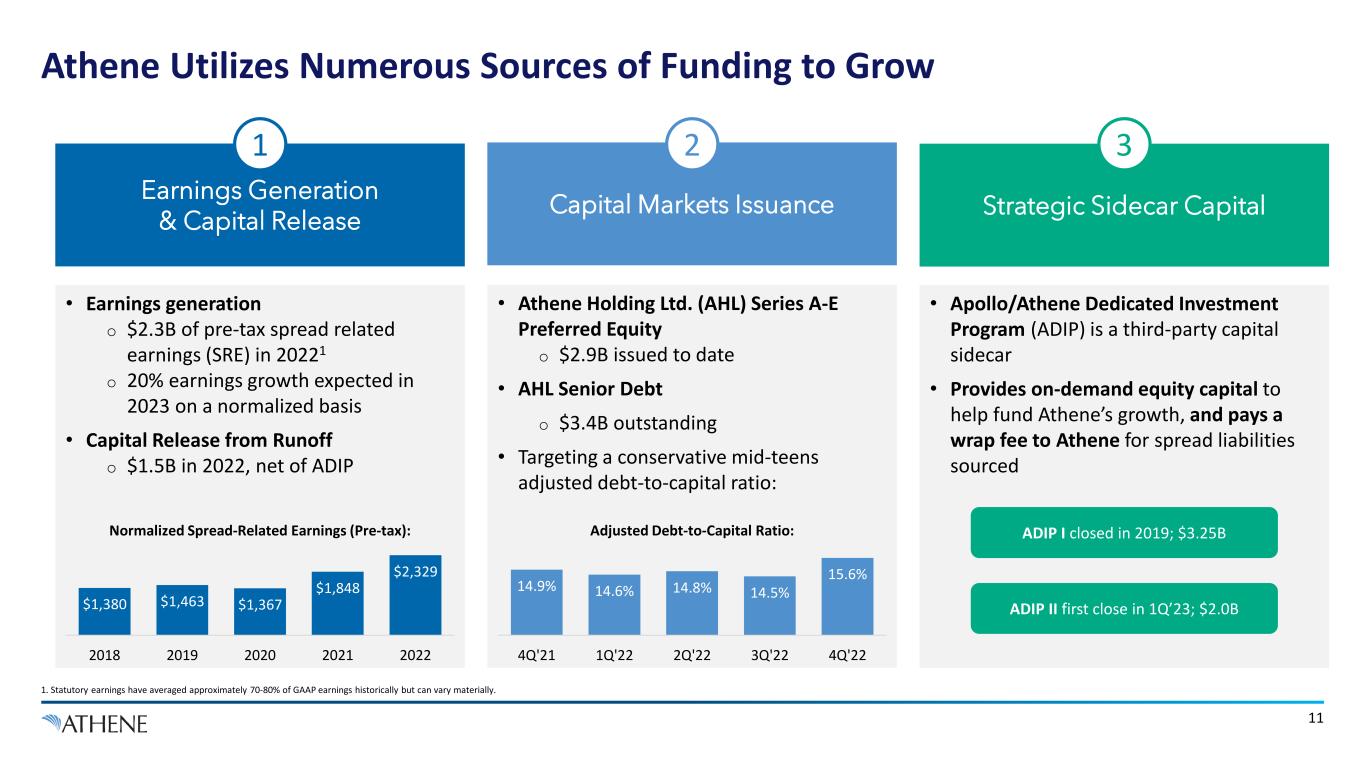

11 Athene Utilizes Numerous Sources of Funding to Grow 1. Statutory earnings have averaged approximately 70-80% of GAAP earnings historically but can vary materially. • Earnings generation o $2.3B of pre-tax spread related earnings (SRE) in 20221 o 20% earnings growth expected in 2023 on a normalized basis • Capital Release from Runoff o $1.5B in 2022, net of ADIP Earnings Generation & Capital Release 1 • Athene Holding Ltd. (AHL) Series A-E Preferred Equity o $2.9B issued to date • AHL Senior Debt o $3.4B outstanding • Targeting a conservative mid-teens adjusted debt-to-capital ratio: Capital Markets Issuance 14.9% 14.6% 14.8% 14.5% 15.6% 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 2 • Apollo/Athene Dedicated Investment Program (ADIP) is a third-party capital sidecar • Provides on-demand equity capital to help fund Athene’s growth, and pays a wrap fee to Athene for spread liabilities sourced Strategic Sidecar Capital 3 $1,380 $1,463 $1,367 $1,848 $2,329 2018 2019 2020 2021 2022 Adjusted Debt-to-Capital Ratio:Normalized Spread-Related Earnings (Pre-tax): ADIP I closed in 2019; $3.25B ADIP II first close in 1Q’23; $2.0B

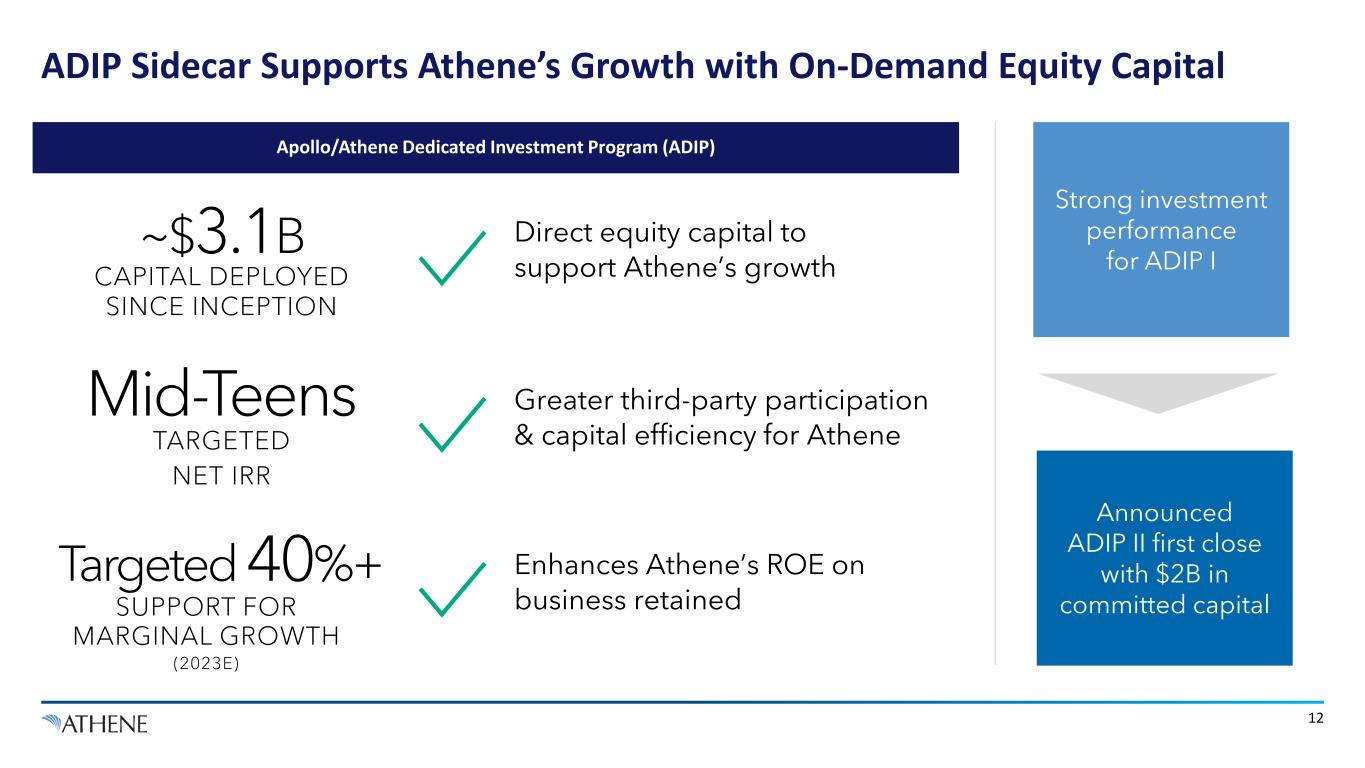

12 ADIP Sidecar Supports Athene’s Growth with On-Demand Equity Capital Apollo/Athene Dedicated Investment Program (ADIP) CAPITAL DEPLOYED SINCE INCEPTION ~$3.1B Direct equity capital to support Athene’s growth TARGETED NET IRR Mid-Teens Greater third-party participation & capital efficiency for Athene Strong investment performance for ADIP I Announced ADIP II first close with $2B in committed capital Enhances Athene’s ROE on business retainedSUPPORT FOR MARGINAL GROWTH (2023E) Targeted 40%+

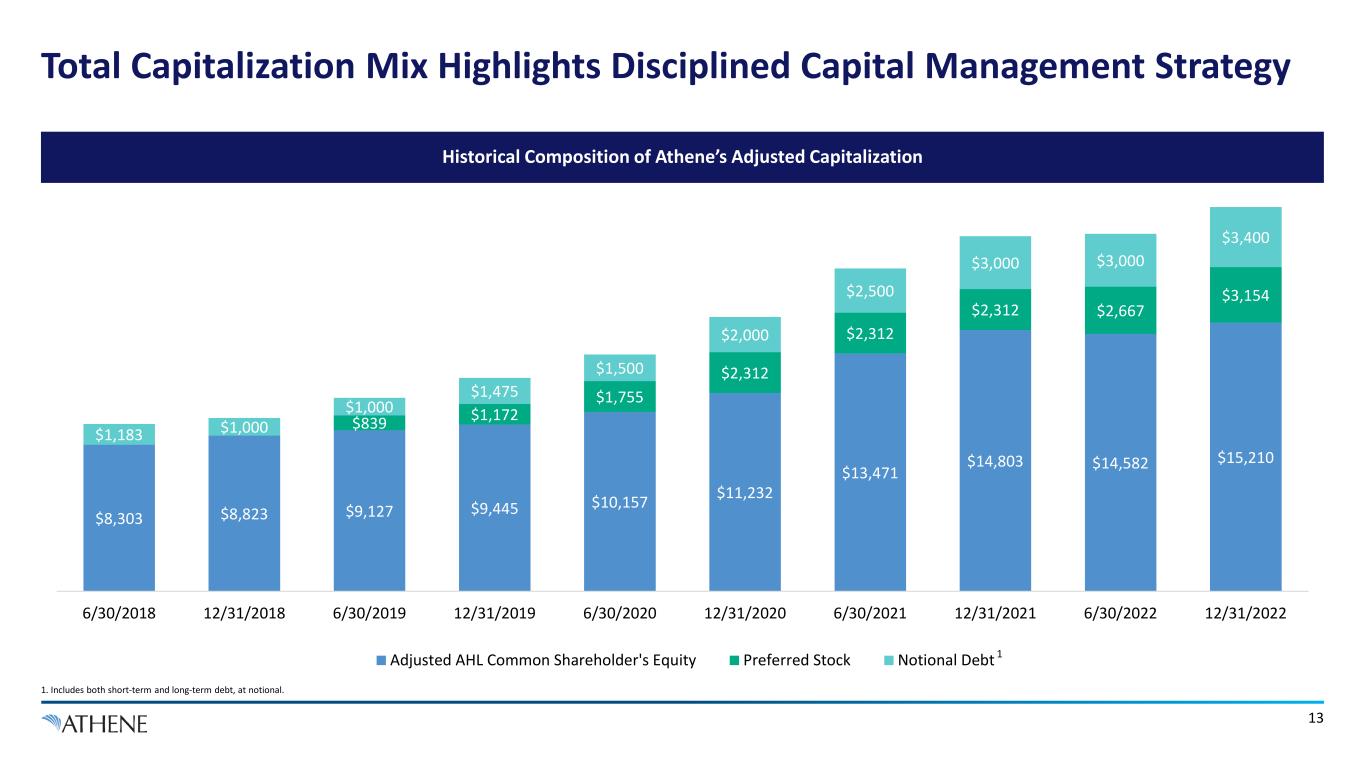

13 Total Capitalization Mix Highlights Disciplined Capital Management Strategy 1. Includes both short-term and long-term debt, at notional. $8,303 $8,823 $9,127 $9,445 $10,157 $11,232 $13,471 $14,803 $14,582 $15,210 $839 $1,172 $1,755 $2,312 $2,312 $2,312 $2,667 $3,154 $1,183 $1,000 $1,000 $1,475 $1,500 $2,000 $2,500 $3,000 $3,000 $3,400 6/30/2018 12/31/2018 6/30/2019 12/31/2019 6/30/2020 12/31/2020 6/30/2021 12/31/2021 6/30/2022 12/31/2022 Adjusted AHL Common Shareholder's Equity Preferred Stock Notional Debt 1 Historical Composition of Athene’s Adjusted Capitalization

14 Capital Allocation Priorities Balance sheet strength determines the capital available to pursue profitable growth opportunities Support Profitable Growth Preserve excess capital at ‘AA’ levels with a mid-teens adjusted debt-to- capital ratio and strong liquidity Maintain Fortress Balance Sheet Athene Allocates Capital to Support its Fortress Balance Sheet, Which Enables the Pursuit of Profitable Growth Successful profitable growth supports the budgeted $750 million annual dividend to AGM HoldCo Facilitate Capital Return

15 Athene’s Investment Management Philosophy Target higher and sustainable risk- adjusted returns by capturing illiquidity premia to drive consistent yield outperformance Focus on downside protection given long- dated liability profile and low cost of funding Dynamic asset allocation to take advantage of market dislocations Differentiation driven by proprietary asset origination and greater asset expertise 30 – 40 bps Targeted Incremental Yield Without Incremental Credit Risk

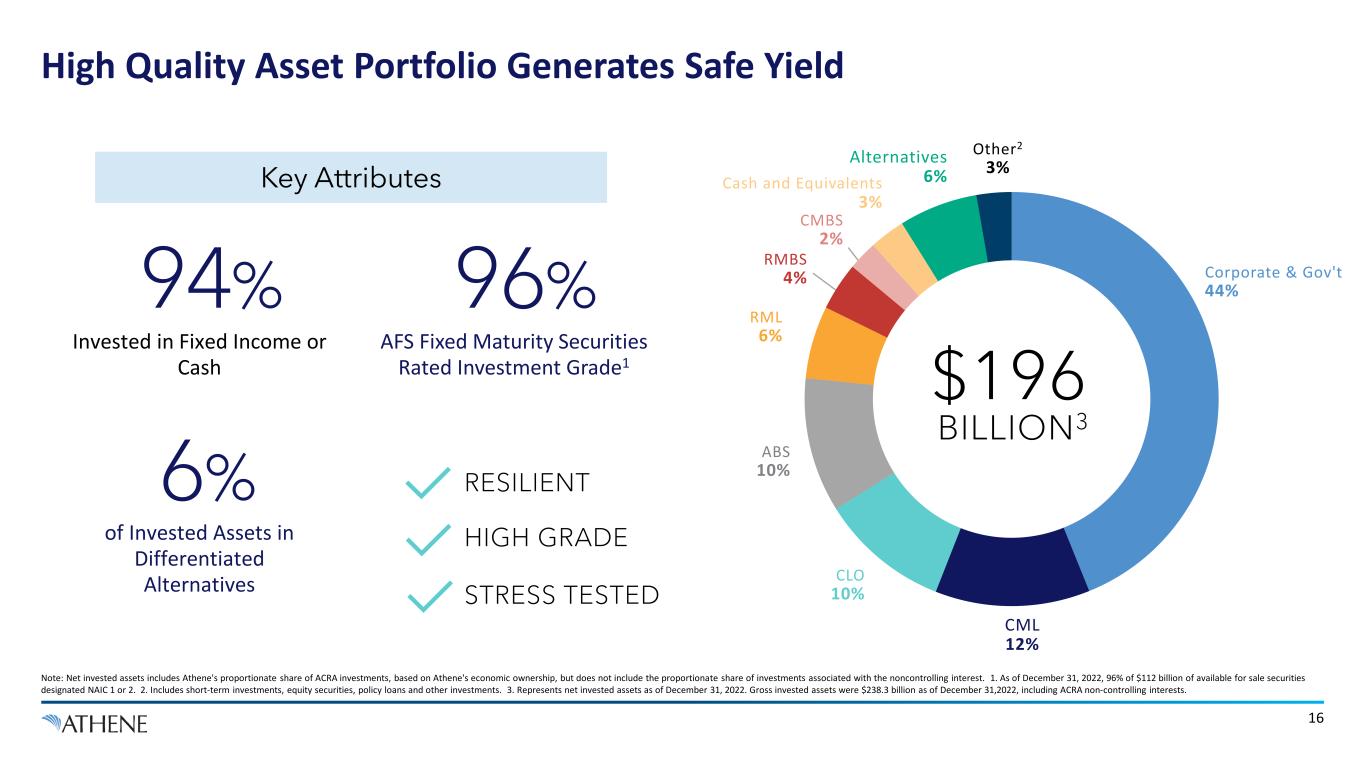

High Quality Asset Portfolio Generates Safe Yield Note: Net invested assets includes Athene's proportionate share of ACRA investments, based on Athene's economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. 1. As of December 31, 2022, 96% of $112 billion of available for sale securities designated NAIC 1 or 2. 2. Includes short-term investments, equity securities, policy loans and other investments. 3. Represents net invested assets as of December 31, 2022. Gross invested assets were $238.3 billion as of December 31,2022, including ACRA non-controlling interests. AFS Fixed Maturity Securities Rated Investment Grade1 RESILIENT HIGH GRADE STRESS TESTED 96% Invested in Fixed Income or Cash 94% of Invested Assets in Differentiated Alternatives 6% 16 Key Attributes Corporate & Gov't 44% CML 12% CLO 10% ABS 10% RML 6% RMBS 4% CMBS 2% Cash and Equivalents 3% Alternatives 6% Other2 3% $196 BILLION3

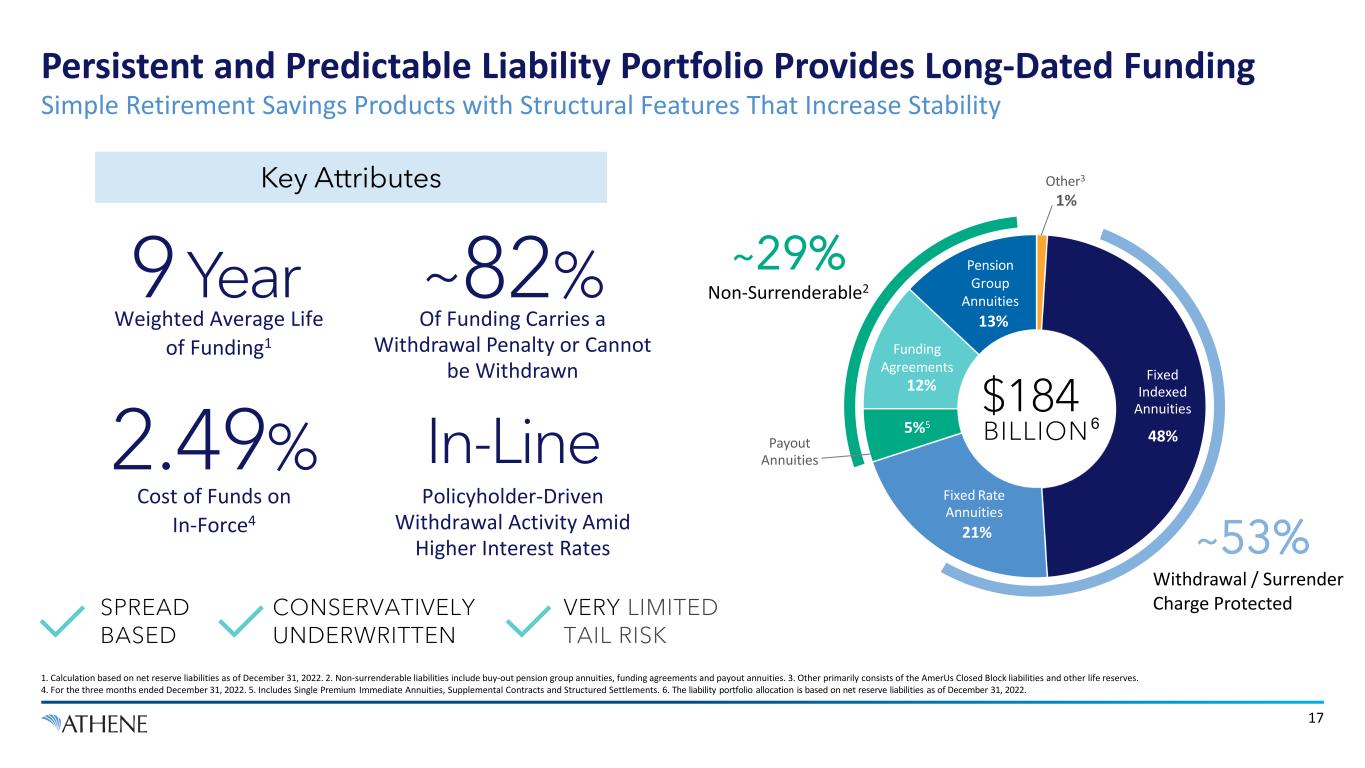

Persistent and Predictable Liability Portfolio Provides Long-Dated Funding 1. Calculation based on net reserve liabilities as of December 31, 2022. 2. Non-surrenderable liabilities include buy-out pension group annuities, funding agreements and payout annuities. 3. Other primarily consists of the AmerUs Closed Block liabilities and other life reserves. 4. For the three months ended December 31, 2022. 5. Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements. 6. The liability portfolio allocation is based on net reserve liabilities as of December 31, 2022. 1% 48% 21% 5%5 12% 13% Fixed Rate Annuities Pension Group Annuities Payout Annuities Fixed Indexed Annuities$184 BILLION 6 ~29% Non-Surrenderable2 Simple Retirement Savings Products with Structural Features That Increase Stability Of Funding Carries a Withdrawal Penalty or Cannot be Withdrawn ~82% SPREAD BASED Weighted Average Life of Funding1 9Year Cost of Funds on In-Force4 2.49% CONSERVATIVELY UNDERWRITTEN VERY LIMITED TAIL RISK Policyholder-Driven Withdrawal Activity Amid Higher Interest Rates 17 ~53% Withdrawal / Surrender Charge Protected Funding Agreements In-Line Key Attributes Other3

18 Robust risk management framework and procedures underpin focus on protecting capital and aligning risks with stakeholder expectations Risk strategy, investment, credit, asset-liability management (“ALM”) and liquidity risk policies, amongst others, at the board and management levels Stress testing plays a key role in defining risk appetite, with tests performed on both sides of the balance sheet Risk Management is Embedded in Everything We Do Managing Risk Such That Athene Can Grow Profitably Across Market Environments CLICK HERE TO VIEW ATHENE’S ASSET STRESS TEST ANALYSIS Duration-Matched Portfolio with Quarterly Cash Flow Monitoring & Stress Testing

Athene Financial Supplement will continue to be published quarterly Athene Holding Ltd. (AHL) will continue to publish 10-K’s and 10-Q’s as a ’34 Act SEC filer Parent company, Apollo Global Management, Inc. (AGM) publishes 10-K’s and 10-Q’s as a ’34 Act SEC filer Statutory filings for main Athene operating subsidiaries, including Bermuda, available via IR website 19 Athene is Committed to Transparency and Ongoing Disclosure Supplemental Disclosure Items Provide Additional Perspective on Athene’s Strategy and Performance CLICK HERE CLICK HERE 1 2 3 4 Asset Stress Test Analysis February 2023 CLICK HERE Structured Credit Whitepaper December 2022 Retirement Services Business Update June 2022 Committed to publishing asset stress test results on an annual basis5

20 Key Credit Highlights Indicate Winning Strategy Remains the Same ASSET PORTFOLIO IS HIGH QUALITY AND GENERATES SAFE INVESTMENT GRADE YIELD Athene has consistently delivered strong net spread generation with lower credit losses versus peers 3 ATHENE HAS BUILT A FORTRESS BALANCE SHEET Highly-rated and conservatively managed balance sheet with ample liquidity and no legacy liability issues2 GOVERNANCE AND RISK CONTROLS ARE UNCHANGED POST-MERGER Athene provides industry-leading disclosure around its balance sheet, investment, and risk management philosophies 5 ATHENE IS A MARKET LEADER IN RETIREMENT SERVICES Demonstrated ability to source stable, low-cost, long-dated funding across multiple organic business channels 1 FULL ALIGNMENT WITH APOLLO PROVIDES DIFFERENTIATED ACCESS TO THIRD-PARTY CAPITAL Successful ADIP sidecar strategy provides on-demand equity capital to help fund growth 4

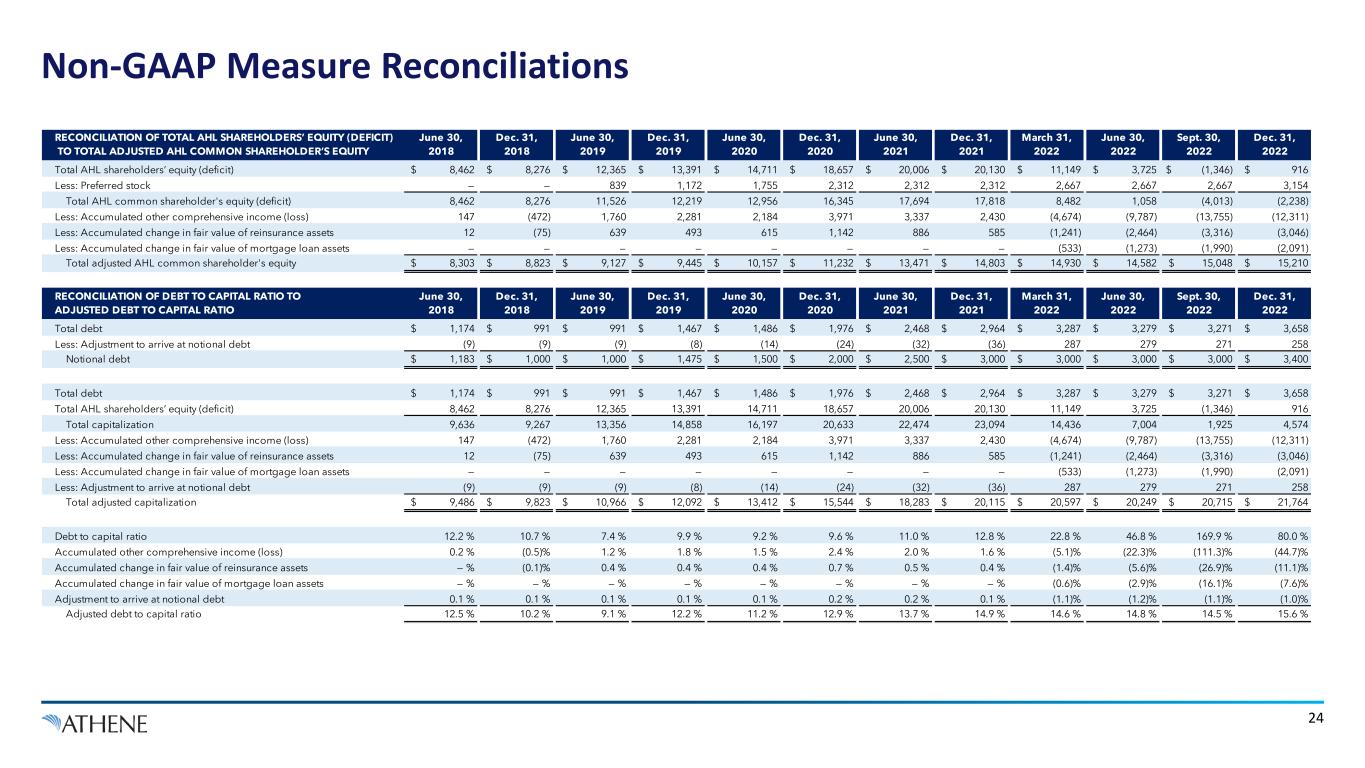

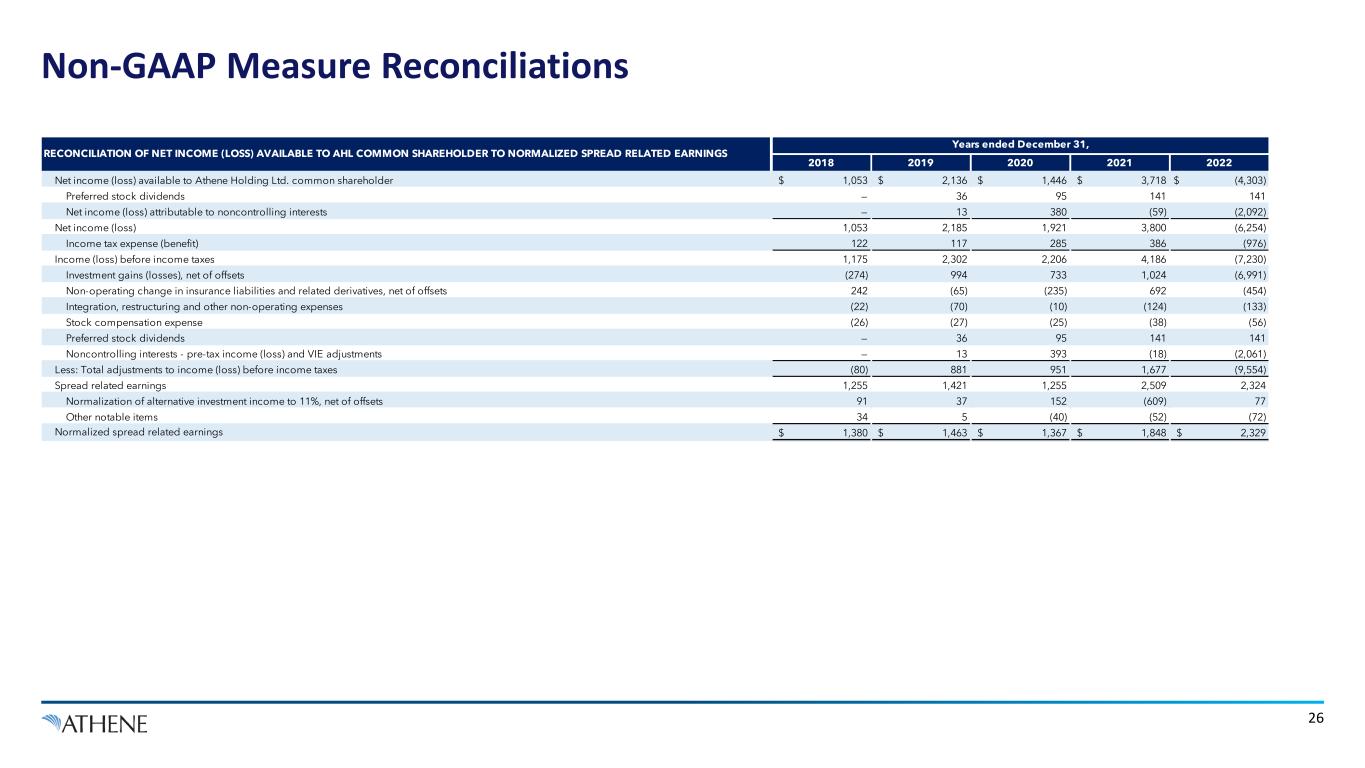

Non-GAAP Measures & Definitions 21 Non-GAAP Definitions In addition to our results presented in accordance with GAAP, we present certain financial information that includes non-GAAP measures. Management believes the use of these non-GAAP measures, together with the relevant GAAP measures, provides information that may enhance an investor’s understanding of our results of operations and the underlying profitability drivers of our business. The majority of these non-GAAP measures are intended to remove from the results of operations the impact of market volatility (other than with respect to alternative investments) as well as integration, restructuring and certain other expenses which are not part of our underlying profitability drivers, as such items fluctuate from period to period in a manner inconsistent with these drivers. These measures should be considered supplementary to our results in accordance with GAAP and should not be viewed as a substitute for the corresponding GAAP measures. Spread Related Earnings (SRE) Spread related earnings is a pre-tax non-GAAP measure used to evaluate our financial performance excluding market volatility and expenses related to integration, restructuring, stock compensation and other expenses. Our spread related earnings equals net income (loss) available to AHL common shareholder adjusted to eliminate the impact of the following: (a) investment gains (losses), net of offsets, (b) non-operating change in insurance liabilities and related derivatives, net of offsets, (c) integration, restructuring, and other non-operating expenses, (d) stock compensation expense and (e) income tax (expense) benefit. We consider these adjustments to be meaningful adjustments to net income (loss) available to AHL common shareholder. Accordingly, we believe using a measure which excludes the impact of these items is useful in analyzing our business performance and the trends in our results of operations. Together with net income (loss) available to AHL common shareholder, we believe spread related earnings provides a meaningful financial metric that helps investors understand our underlying results and profitability. Spread related earnings should not be used as a substitute for net income (loss) available to AHL common shareholder. Adjusted Debt to Capital Ratio Adjusted debt to capital ratio is a non-GAAP measure used to evaluate our capital structure excluding the impacts of AOCI and the cumulative changes in fair value of funds withheld and modco reinsurance assets as well as mortgage loan assets, net of DAC, DSI, rider reserve and tax offsets. Adjusted debt to capital ratio is calculated as total debt at notional value divided by adjusted capitalization. Adjusted capitalization includes our adjusted AHL common shareholder’s equity, preferred stock and the notional value of our debt. Adjusted AHL common shareholder’s equity is calculated as the ending AHL shareholders’ equity excluding AOCI, the cumulative changes in fair value of funds withheld and modco reinsurance assets and mortgage loan assets as well as preferred stock. These adjustments fluctuate period to period in a manner inconsistent with our underlying profitability drivers as the majority of such fluctuation is related to the market volatility of the unrealized gains and losses associated with our AFS securities. Except with respect to reinvestment activity relating to acquired blocks of businesses, we typically buy and hold AFS investments to maturity throughout the duration of market fluctuations, therefore, the period-over-period impacts in unrealized gains and losses are not necessarily indicative of current operating fundamentals or future performance. Adjusted debt to capital ratio should not be used as a substitute for the debt to capital ratio. However, we believe the adjustments to shareholders’ equity are significant to gaining an understanding of our capitalization, debt utilization and debt capacity.

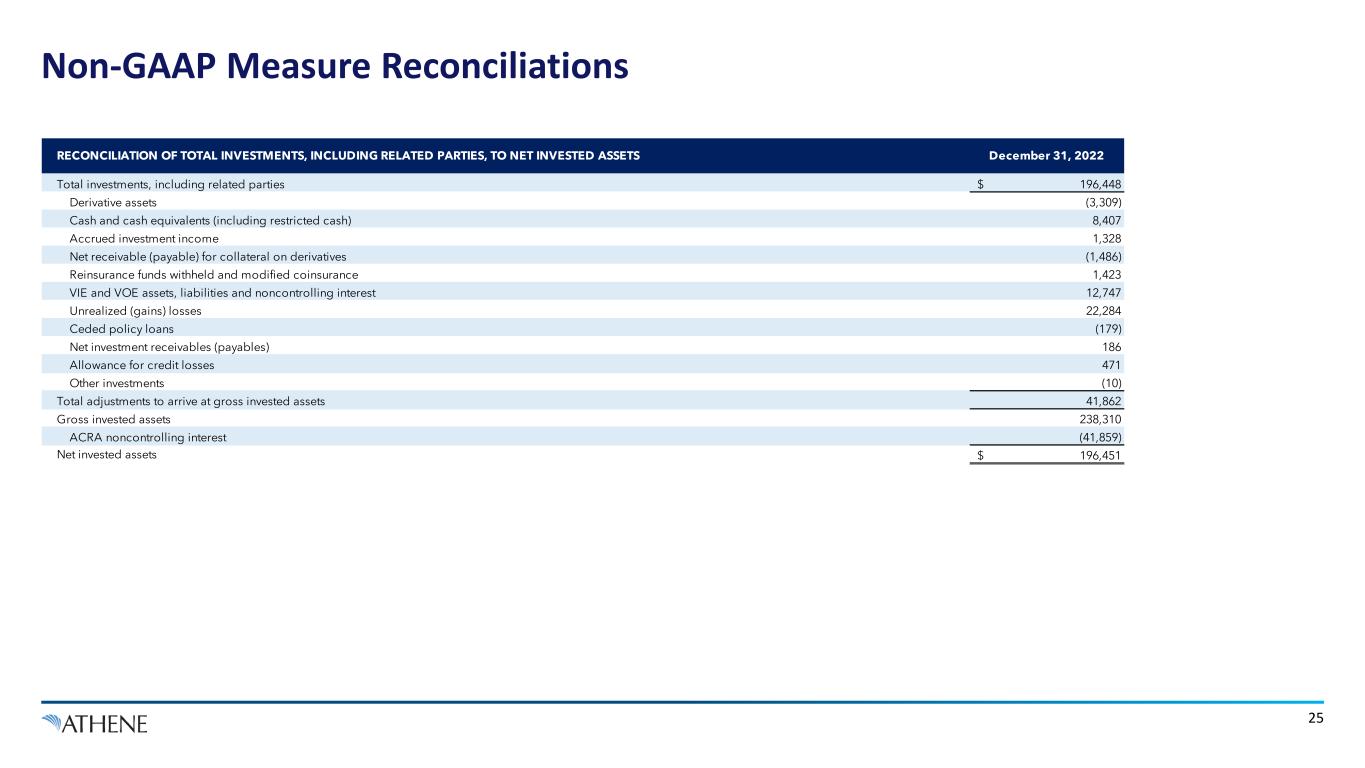

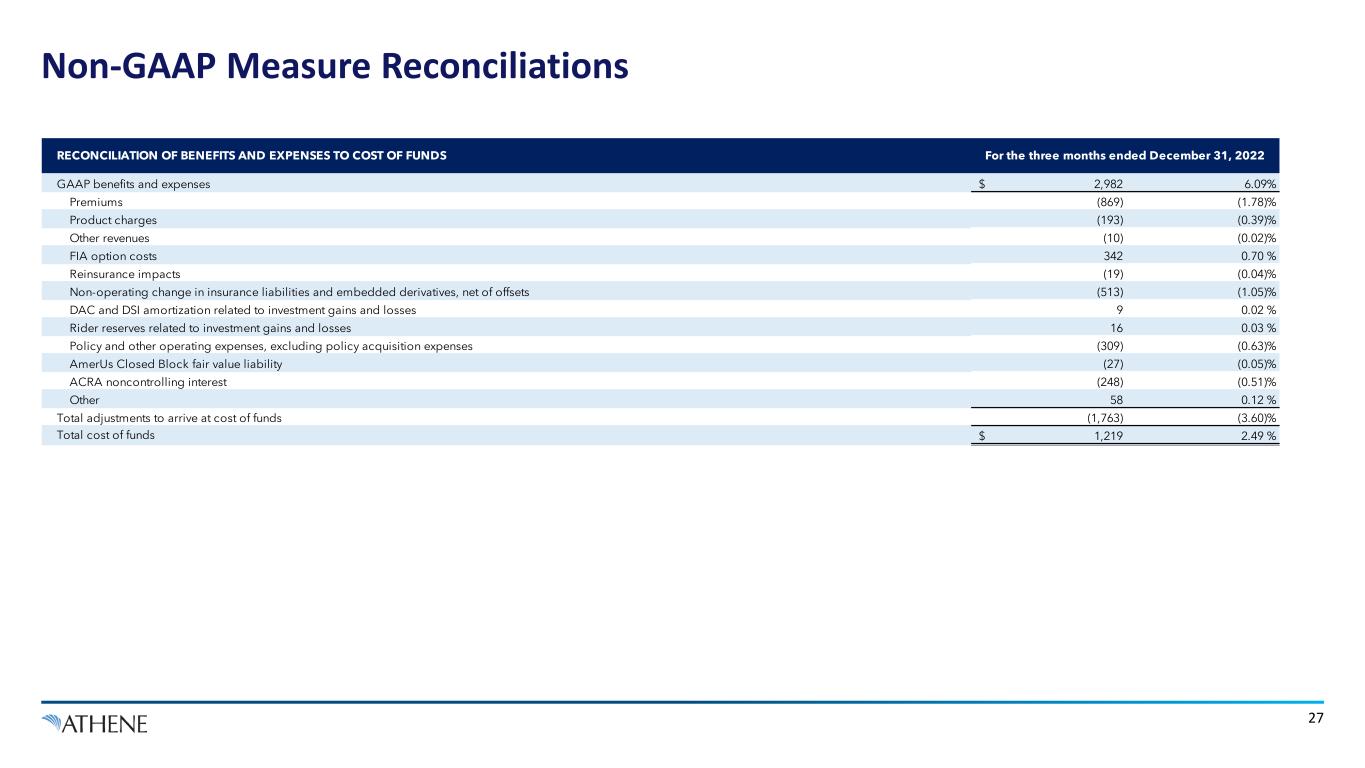

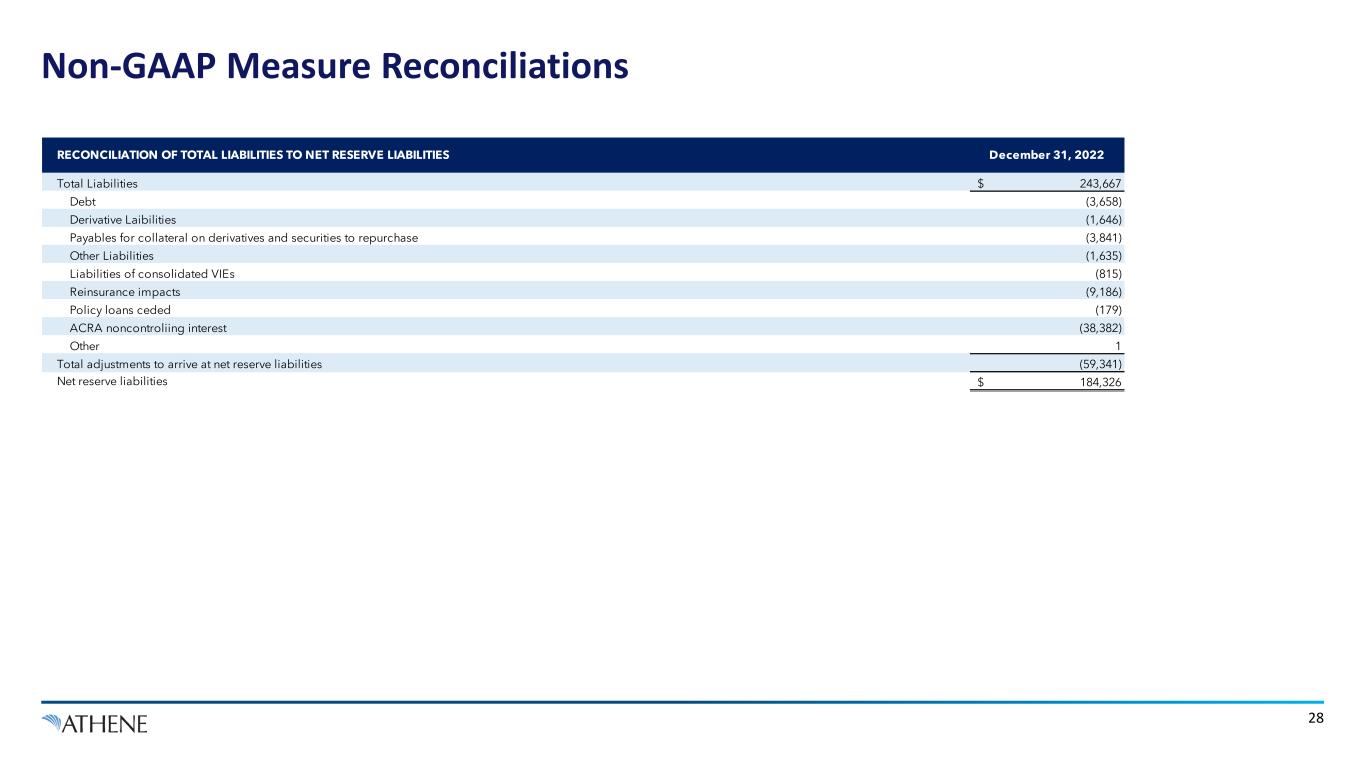

Non-GAAP Measures & Definitions 22 Cost of Funds Cost of funds includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the noncontrolling interest. Cost of crediting on deferred annuities is the interest credited to the policyholders on our fixed strategies as well as the option costs on the indexed annuity strategies. With respect to FIAs, the cost of providing index credits includes the expenses incurred to fund the annual index credits, and where applicable, minimum guaranteed interest credited. Cost of crediting on institutional products is comprised of (1) pension group annuity costs, including interest credited, benefit payments and other reserve changes, net of premiums received when issued, and (2) funding agreement costs, including the interest payments and other reserve changes. Other liability costs include DAC, DSI and VOBA amortization, change in rider reserves, the cost of liabilities on products other than deferred annuities and institutional products, premiums, product charges and other revenues. We exclude the costs related to business that we have exited through ceded reinsurance transactions. Cost of funds is computed as the total liability costs divided by the average net invested assets, for the relevant period. To enhance the ability to analyze these measures across periods, interim periods are annualized. We believe a measure like cost of funds is useful in analyzing the trends of our core business operations and profitability. While we believe cost of funds is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total benefits and expenses presented under GAAP. Cost of funds is a non-GAAP measure we use to evaluate the profitability of our business. We believe this metric is useful in analyzing the trends of our business operations, profitability and pricing discipline. While we believe this metric is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total benefits and expenses presented under GAAP.Net Invested Net Invested Assets In managing our business, we analyze net invested assets, which does not correspond to total investments, including investments in related parties, as disclosed in our consolidated financial statements and notes thereto. Net invested assets represent the investments that directly back our net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which allows us to analyze the profitability of our investment portfolio. Net invested assets includes (a) total investments on the consolidated balance sheet with AFS securities at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE and VOE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets also excludes assets associated with funds withheld liabilities related to business exited through reinsurance agreements and derivative collateral (offsetting the related cash positions). We include the underlying investments supporting our assumed funds withheld and modco agreements in our net invested assets calculation in order to match the assets with the income received. We believe the adjustments for reinsurance provide a view of the assets for which we have economic exposure. Net invested assets includes our proportionate share of ACRA investments, based on our economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. Net invested assets also includes our investment in Apollo for prior periods. Our net invested assets are averaged over the number of quarters in the relevant period to compute our net investment earned rate for such period. While we believe net invested assets is a meaningful financial metric and enhances our understanding of the underlying drivers of our investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under GAAP. Net Reserve Liabilities In managing our business, we also analyze net reserve liabilities, which does not correspond to total liabilities as disclosed in our consolidated financial statements and notes thereto. Net reserve liabilities represent our policyholder liability obligations net of reinsurance and is used to analyze the costs of our liabilities. Net reserve liabilities include (a) interest sensitive contract liabilities, (b) future policy benefits, (c) long-term repurchase obligations, (d) dividends payable to policyholders and (e) other policy claims and benefits, offset by reinsurance recoverable, excluding policy loans ceded. Net reserve liabilities include our proportionate share of ACRA reserve liabilities, based on our economic ownership, but do not include the proportionate share of reserve liabilities associated with the noncontrolling interest. Net reserve liabilities is net of the ceded liabilities to third-party reinsurers as the costs of the liabilities are passed to such reinsurers and, therefore, we have no net economic exposure to such liabilities, assuming our reinsurance counterparties perform under our agreements. The majority of our ceded reinsurance is a result of reinsuring large blocks of life business following acquisitions. For such transactions, GAAP requires the ceded liabilities and related reinsurance recoverables to continue to be recorded in our consolidated financial statements despite the transfer of economic risk to the counterparty in connection with the reinsurance transaction. While we believe net reserve liabilities is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total liabilities presented under GAAP.

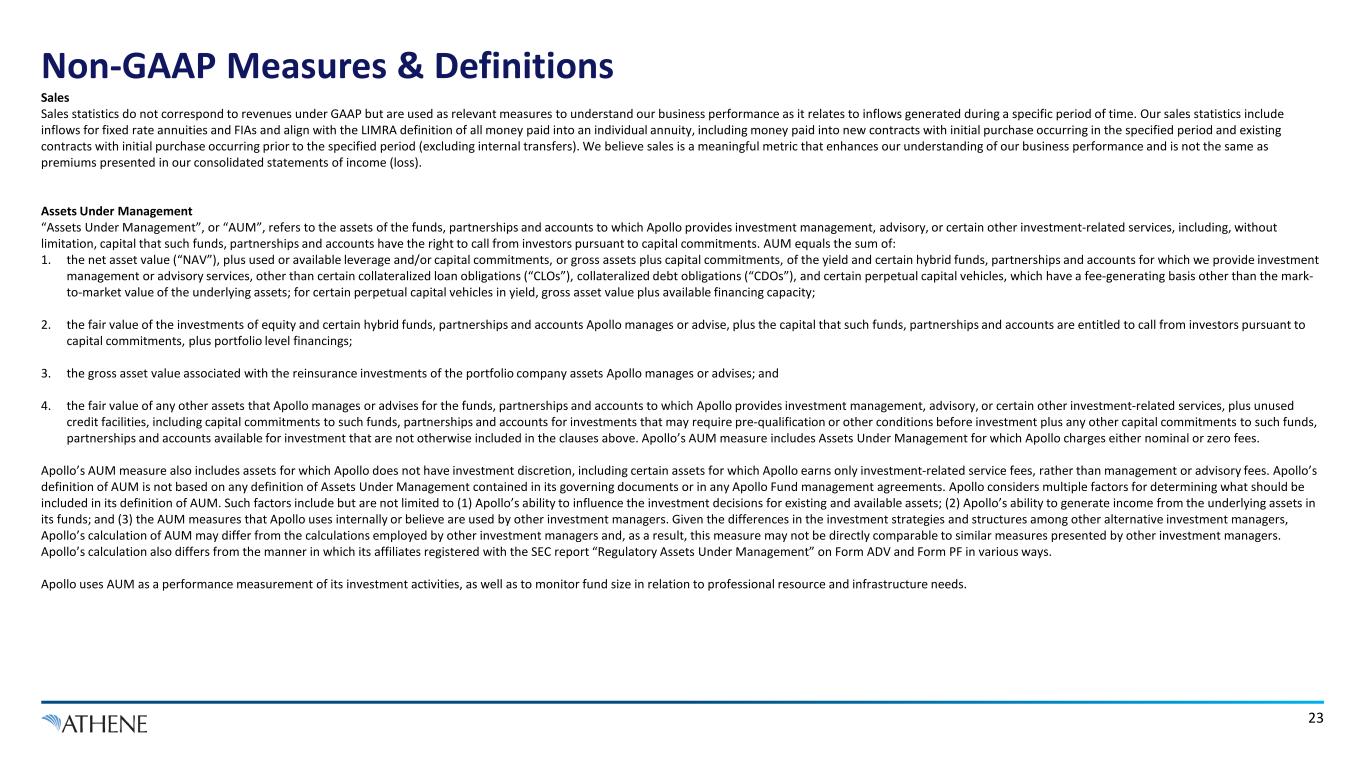

Non-GAAP Measures & Definitions 23 Sales Sales statistics do not correspond to revenues under GAAP but are used as relevant measures to understand our business performance as it relates to inflows generated during a specific period of time. Our sales statistics include inflows for fixed rate annuities and FIAs and align with the LIMRA definition of all money paid into an individual annuity, including money paid into new contracts with initial purchase occurring in the specified period and existing contracts with initial purchase occurring prior to the specified period (excluding internal transfers). We believe sales is a meaningful metric that enhances our understanding of our business performance and is not the same as premiums presented in our consolidated statements of income (loss). Assets Under Management “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. the net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain perpetual capital vehicles, which have a fee-generating basis other than the mark- to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of equity and certain hybrid funds, partnerships and accounts Apollo manages or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any Apollo Fund management agreements. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in its funds; and (3) the AUM measures that Apollo uses internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM as a performance measurement of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs.

Non-GAAP Measure Reconciliations 24 Total AHL shareholders’ equity (deficit) $ 8,462 $ 8,276 $ 12,365 $ 13,391 $ 14,711 $ 18,657 $ 20,006 $ 20,130 $ 11,149 $ 3,725 $ (1,346) $ 916 Less: Preferred stock — — 839 1,172 1,755 2,312 2,312 2,312 2,667 2,667 2,667 3,154 Total AHL common shareholder's equity (deficit) 8,462 8,276 11,526 12,219 12,956 16,345 17,694 17,818 8,482 1,058 (4,013) (2,238) Less: Accumulated other comprehensive income (loss) 147 (472) 1,760 2,281 2,184 3,971 3,337 2,430 (4,674) (9,787) (13,755) (12,311) Less: Accumulated change in fair value of reinsurance assets 12 (75) 639 493 615 1,142 886 585 (1,241) (2,464) (3,316) (3,046) Less: Accumulated change in fair value of mortgage loan assets — — — — — — — — (533) (1,273) (1,990) (2,091) Total adjusted AHL common shareholder's equity $ 8,303 $ 8,823 $ 9,127 $ 9,445 $ 10,157 $ 11,232 $ 13,471 $ 14,803 $ 14,930 $ 14,582 $ 15,048 $ 15,210 Total debt $ 1,174 $ 991 $ 991 $ 1,467 $ 1,486 $ 1,976 $ 2,468 $ 2,964 $ 3,287 $ 3,279 $ 3,271 $ 3,658 Less: Adjustment to arrive at notional debt (9) (9) (9) (8) (14) (24) (32) (36) 287 279 271 258 Notional debt $ 1,183 $ 1,000 $ 1,000 $ 1,475 $ 1,500 $ 2,000 $ 2,500 $ 3,000 $ 3,000 $ 3,000 $ 3,000 $ 3,400 Total debt $ 1,174 $ 991 $ 991 $ 1,467 $ 1,486 $ 1,976 $ 2,468 $ 2,964 $ 3,287 $ 3,279 $ 3,271 $ 3,658 Total AHL shareholders’ equity (deficit) 8,462 8,276 12,365 13,391 14,711 18,657 20,006 20,130 11,149 3,725 (1,346) 916 Total capitalization 9,636 9,267 13,356 14,858 16,197 20,633 22,474 23,094 14,436 7,004 1,925 4,574 Less: Accumulated other comprehensive income (loss) 147 (472) 1,760 2,281 2,184 3,971 3,337 2,430 (4,674) (9,787) (13,755) (12,311) Less: Accumulated change in fair value of reinsurance assets 12 (75) 639 493 615 1,142 886 585 (1,241) (2,464) (3,316) (3,046) Less: Accumulated change in fair value of mortgage loan assets — — — — — — — — (533) (1,273) (1,990) (2,091) Less: Adjustment to arrive at notional debt (9) (9) (9) (8) (14) (24) (32) (36) 287 279 271 258 Total adjusted capitalization $ 9,486 $ 9,823 $ 10,966 $ 12,092 $ 13,412 $ 15,544 $ 18,283 $ 20,115 $ 20,597 $ 20,249 $ 20,715 $ 21,764 Debt to capital ratio 12.2 % 10.7 % 7.4 % 9.9 % 9.2 % 9.6 % 11.0 % 12.8 % 22.8 % 46.8 % 169.9 % 80.0 % Accumulated other comprehensive income (loss) 0.2 % (0.5)% 1.2 % 1.8 % 1.5 % 2.4 % 2.0 % 1.6 % (5.1)% (22.3)% (111.3)% (44.7)% Accumulated change in fair value of reinsurance assets — % (0.1)% 0.4 % 0.4 % 0.4 % 0.7 % 0.5 % 0.4 % (1.4)% (5.6)% (26.9)% (11.1)% Accumulated change in fair value of mortgage loan assets — % — % — % — % — % — % — % — % (0.6)% (2.9)% (16.1)% (7.6)% Adjustment to arrive at notional debt 0.1 % 0.1 % 0.1 % 0.1 % 0.1 % 0.2 % 0.2 % 0.1 % (1.1)% (1.2)% (1.1)% (1.0)% Adjusted debt to capital ratio 12.5 % 10.2 % 9.1 % 12.2 % 11.2 % 12.9 % 13.7 % 14.9 % 14.6 % 14.8 % 14.5 % 15.6 % June 30, 2020 June 30, 2018 Dec. 31, 2018 June 30, 2019 Dec. 31, 2019 June 30, 2020 Dec. 31, 2022 RECONCILIATION OF TOTAL AHL SHAREHOLDERS’ EQUITY (DEFICIT) TO TOTAL ADJUSTED AHL COMMON SHAREHOLDER’S EQUITY Dec. 31, 2020 June 30, 2021 March 31, 2022 Dec. 31, 2022 June 30, 2018 Dec. 31, 2018 RECONCILIATION OF DEBT TO CAPITAL RATIO TO ADJUSTED DEBT TO CAPITAL RATIO Dec. 31, 2020 June 30, 2021 March 31, 2022 June 30, 2019 Dec. 31, 2019 Sept. 30, 2022 Sept. 30, 2022 June 30, 2022 June 30, 2022 Dec. 31, 2021 Dec. 31, 2021

Non-GAAP Measure Reconciliations 25 Total investments, including related parties Derivative assets Cash and cash equivalents (including restricted cash) Accrued investment income Net receivable (payable) for collateral on derivatives Reinsurance funds withheld and modified coinsurance VIE and VOE assets, liabilities and noncontrolling interest Unrealized (gains) losses Ceded policy loans Net investment receivables (payables) Allowance for credit losses Other investments Total adjustments to arrive at gross invested assets Gross invested assets ACRA noncontrolling interest Net invested assets RECONCILIATION OF TOTAL INVESTMENTS, INCLUDING RELATED PARTIES, TO NET INVESTED ASSETS December 31, 2022 (1,486) 1,423 8,407 1,328 $ 196,448 (3,309) 471 41,862 (179) 186 12,747 22,284 $ 196,451 (10) 238,310 (41,859)

Non-GAAP Measure Reconciliations 26 Net income (loss) available to Athene Holding Ltd. common shareholder Preferred stock dividends Net income (loss) attributable to noncontrolling interests Net income (loss) Income tax expense (benefit) Income (loss) before income taxes Investment gains (losses), net of offsets Non-operating change in insurance liabilities and related derivatives, net of offsets Integration, restructuring and other non-operating expenses Stock compensation expense Preferred stock dividends Noncontrolling interests - pre-tax income (loss) and VIE adjustments Less: Total adjustments to income (loss) before income taxes Spread related earnings Normalization of alternative investment income to 11%, net of offsets Other notable items Normalized spread related earnings RECONCILIATION OF NET INCOME (LOSS) AVAILABLE TO AHL COMMON SHAREHOLDER TO NORMALIZED SPREAD RELATED EARNINGS $ (4,303) $ 2,329 77 (72) (2,092) (6,254) (976) (7,230) (9,554) 2,324 (6,991) (454) 141 (2,061) (133) (56) (26) — $ 1,053 — — 1,053 122 1,175 141 $ 3,718 141 (59) 3,800 386 4,186 $ 1,380 $ 2,136 36 13 2,185 117 2,302 994 (65) (70) (27) — (80) 1,255 91 34 (274) 242 (22) 5 $ 1,463 $ 1,446 95 380 1,921 285 2,206 733 (235) (10) 36 13 881 1,421 37 152 (40) $ 1,367 Years ended December 31, 2018 2019 2020 2021 2022 (609) (52) $ 1,848 (124) (38) 141 (18) 1,677 1,024 692 (25) 95 393 951 1,255 2,509

Non-GAAP Measure Reconciliations 27 GAAP benefits and expenses Premiums Product charges Other revenues FIA option costs Reinsurance impacts Non-operating change in insurance liabilities and embedded derivatives, net of offsets DAC and DSI amortization related to investment gains and losses Rider reserves related to investment gains and losses Policy and other operating expenses, excluding policy acquisition expenses AmerUs Closed Block fair value liability ACRA noncontrolling interest Other Total adjustments to arrive at cost of funds Total cost of funds 2.49 % (0.63)% (0.05)% (0.51)% 0.12 % (3.60)% 0.70 % (0.04)% (1.05)% 0.02 % 0.03 % (248) $ 1,219 16 (309) (27) 58 (1,763) 9 RECONCILIATION OF BENEFITS AND EXPENSES TO COST OF FUNDS $ 2,982 (869) (193) (10) 342 (19) (513) For the three months ended December 31, 2022 6.09% (1.78)% (0.39)% (0.02)%

Non-GAAP Measure Reconciliations 28 Total Liabilities Debt Derivative Laibilities Payables for collateral on derivatives and securities to repurchase Other Liabilities Liabilities of consolidated VIEs Reinsurance impacts Policy loans ceded ACRA noncontroliing interest Other Total adjustments to arrive at net reserve liabilities Net reserve liabilities $ 184,326 (38,382) 1 (59,341) (179) RECONCILIATION OF TOTAL LIABILITIES TO NET RESERVE LIABILITIES December 31, 2022 $ 243,667 (3,658) (1,646) (3,841) (1,635) (815) (9,186)