EX-99.1

Published on June 13, 2022

June 13, 2022 Exhibit 99.1

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Forward-Looking Statements and Important Disclosures 2 This presentation has been prepared by Apollo Global Management, Inc., a Delaware corporation. (“HoldCo” and together with its subsidiaries, “Apollo,” “we,” “us,” “our” and the “Company”), solely for informational purposes for its public stockholders in connection with evaluating the business, operations and financial results of Apollo, including Athene Holding Ltd., a Bermuda exempted company (together with its subsidiaries, “Athene”). Information contained herein is as of March 31, 2022 unless otherwise noted, including information and data labeled “2022”, “Current”, “Today” and similar labeled content. This presentation is not complete and the information contained herein may change at any time without notice. Apollo Safe Harbor for Forward-Looking Statements This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, liquidity and capital resources and the other non-historical statements. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “target,” “goal,” “outlook” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to the impact of COVID-19, the impact of energy market dislocation, market conditions and interest rate fluctuations generally, our ability to manage our growth, our ability to operate in highly competitive environments, the performance of the funds we manage, our ability to raise new funds, the variability of our revenues, earnings and cash flow, our dependence on certain key personnel, the accuracy of management’s assumptions and estimates, our use of leverage to finance our businesses and investments by the funds we manage, Athene’s ability to maintain or improve financial strength ratings, the impact of Athene’s reinsurers failing to meet their assumed obligations, Athene’s ability to manage its business in a highly regulated industry, changes in our regulatory environment and tax status, litigation risks and our ability to recognize the benefits expected to be derived from the merger of Apollo with Athene, among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company's Quarterly Report on Form 10-Q filed with the United States Securities and Exchange Commission (“SEC”) on May 10, 2022, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law. Athene Safe Harbor for Forward-Looking Statements This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks, uncertainties and assumptions that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, benefits to be derived from Athene's capital allocation decisions; the anticipated performance of Athene's portfolio in certain recessionary environments; the performance of Athene's business; the magnitude of potential future growth in invested assets; general economic conditions; the failure to realize economic benefits from the merger with Apollo; expected future operating results; Athene's liquidity and capital resources; and other non-historical statements. Although the Athene management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. For a discussion of other risks and uncertainties related to Athene's forward-looking statements, see its annual report on Form 10-K for the year ended December 31, 2021 and quarterly report on Form 10-Q filed for the period ended March 31, 2022, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The contents of any website referenced in this presentation are not incorporated by reference. This presentation contains information regarding Apollo's and Athene’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States ("non-GAAP measures"). Refer to slides at the end of this presentation for the definitions of Adjusted Segment Income (“ASI”), Adjusted Net Income (“ANI”), Fee Related Earnings (“FRE”), Spread Related Earnings (“SRE”), Principal Investing Income (“PII”), and other non- GAAP measures presented herein, and reconciliations of GAAP financial measures to the applicable non-GAAP measures. This presentation is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities, products or services, including interests in the funds, vehicles or accounts sponsored or managed by Apollo (each, an “Apollo Fund”), any capital markets services offered by Apollo, or any security of Athene, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Forward-Looking Statements and Important Disclosures 3 Apollo makes no representation or warranty, express or implied, as to the fairness, accuracy, reasonableness or completeness of the information contained herein, including, but not limited to, information obtained from third parties. Unless otherwise specified, information included herein is sourced from and reflects the views and opinions of Apollo Analysts. Certain information contained in these materials has been obtained from sources other than Apollo. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and Apollo does not take any responsibility for such information. This presentation may contain trade names, trademarks and service marks of companies which (i) neither Apollo nor Apollo Funds own or (ii) are investments of Apollo or one or more Apollo Funds. We do not intend our use or display of these companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, such companies. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Past performance is not necessarily indicative of future results and there can be no assurance that Apollo, Athene or any Apollo Fund or strategy will achieve comparable results, or that any investments made by Apollo in the future will be profitable. Actual realized value of currently unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the current unrealized valuations are based. Accordingly, the actual realized values of unrealized investments may differ materially from the values indicated herein. Information contained herein may include information with respect to prior investment performance of one or more Apollo funds or investments, including gross and/or net internal rates of return (“IRR”). Information with respect to prior performance, while a useful tool in evaluating investment activities, is not necessarily indicative of actual results that may be achieved for unrealized investments. The realization of such performance is dependent upon many factors, many of which are beyond the control of Apollo. Aggregated return information is not reflective of an investable product, and as such does not reflect the returns of any Apollo Fund. Please refer to the slides at the end of this presentation for additional important information.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 TIME TOPIC PRESENTER ROLE 9:00AM-10:25AM Welcome Remarks Noah Gunn Apollo Global Head of Investor Relations Business Overview & Investment Philosophy Jim Belardi Athene Chairman, Chief Executive Officer, & Chief Investment Officer Growth Engine Grant Kvalheim Athene President & Athene USA Chief Executive Officer Liability Underwriting & Risk Profile Mike Downing Athene Chief Operating Officer & Chief Actuary Asset Risk Framework & Stress Results Doug Niemann Athene Chief Risk Officer 5 MINUTE BREAK 10:30AM-12:15PM Asset Class Spotlight: Structured Credit Bret Leas Apollo Partner, Structured Credit Asset Class Spotlight: Commercial Real Estate Scott Weiner Apollo Partner, Commercial Real Estate Financial Overview & Capital Management Marty Klein Athene Chief Financial Officer Apollo’s Winning Model Martin Kelly Apollo Chief Financial Officer Q&A Marc Rowan and Presenters Apollo Chief Executive Officer and Management Team Retirement Services Business Update – Agenda 4

Welcome Remarks NOAH GUNN Global Head of Investor Relations, Apollo

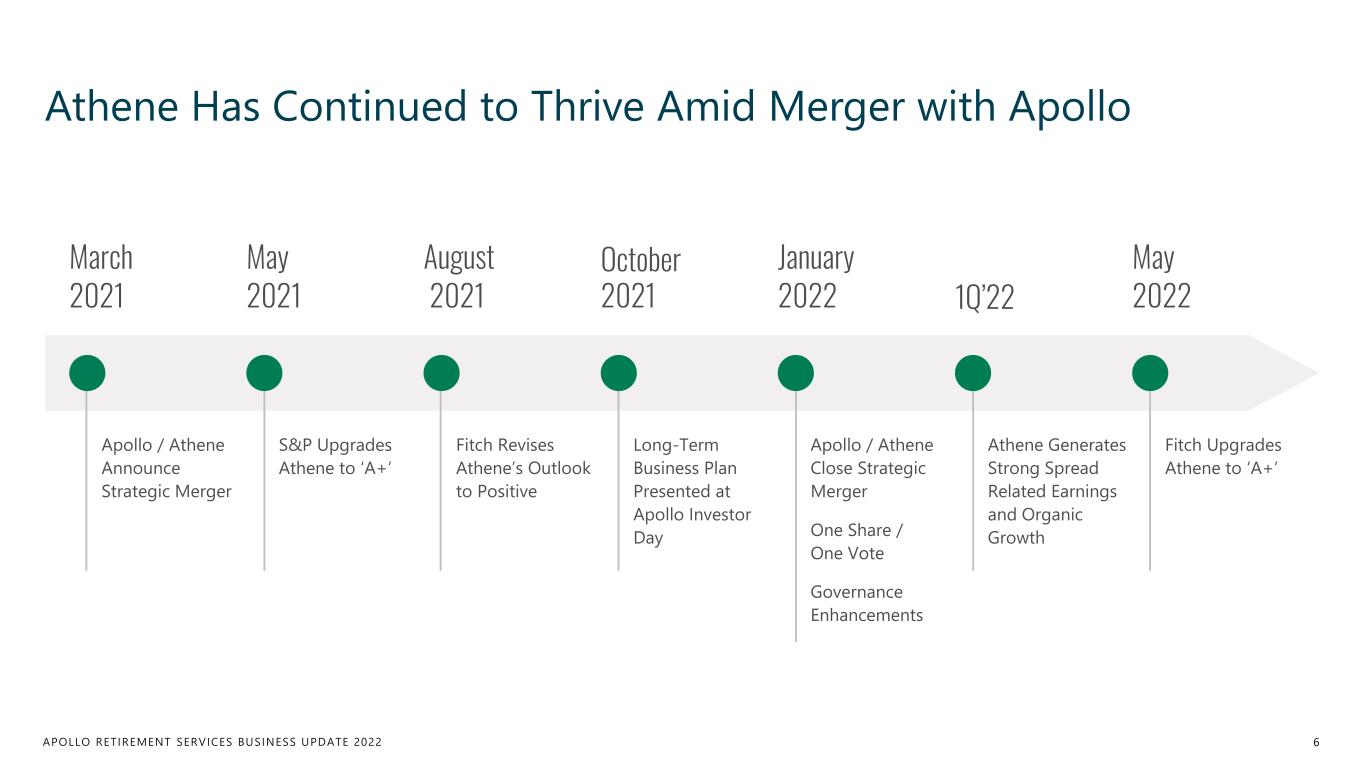

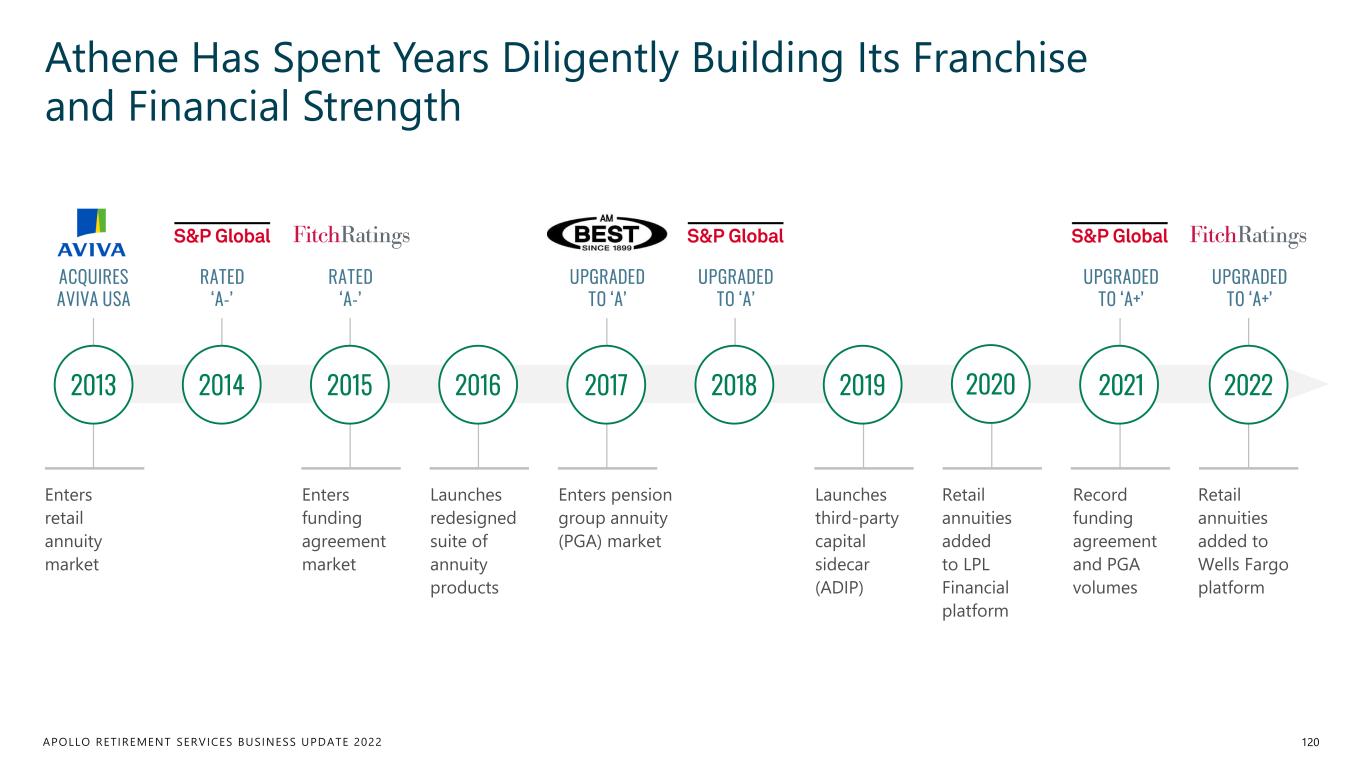

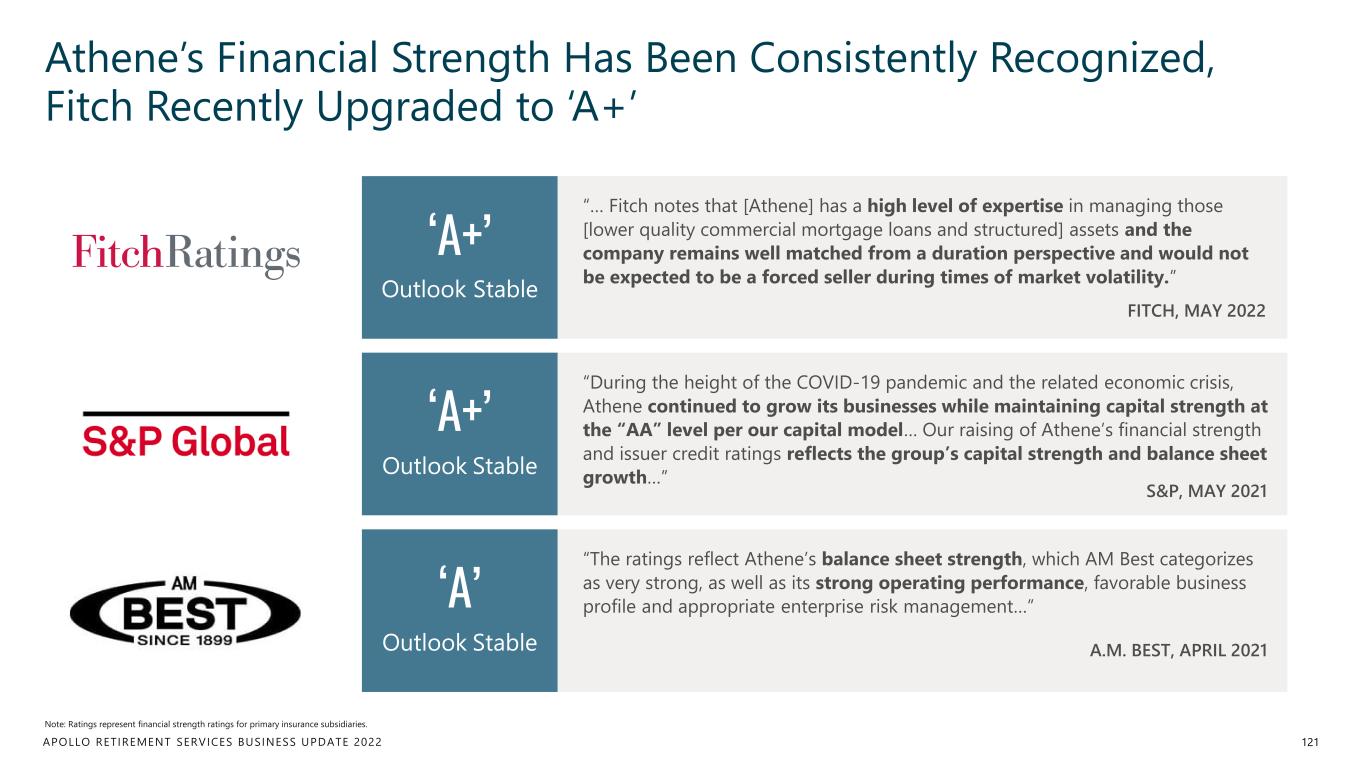

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene Has Continued to Thrive Amid Merger with Apollo 6 March 2021 October 2021 January 2022 1Q’22 Apollo / Athene Announce Strategic Merger Long-Term Business Plan Presented at Apollo Investor Day Apollo / Athene Close Strategic Merger Athene Generates Strong Spread Related Earnings and Organic GrowthOne Share / One Vote May 2022 Fitch Upgrades Athene to ‘A+’ May 2021 S&P Upgrades Athene to ‘A+’ Governance Enhancements August 2021 Fitch Revises Athene’s Outlook to Positive

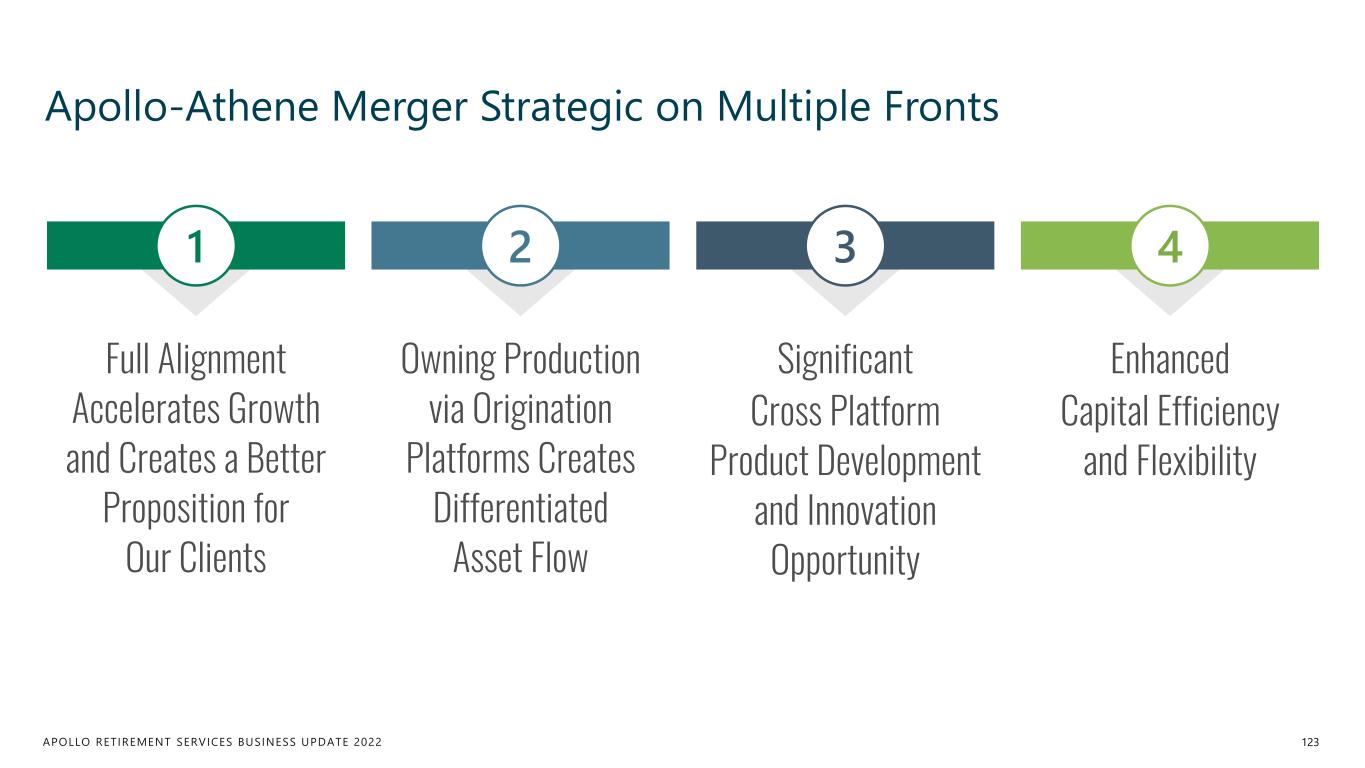

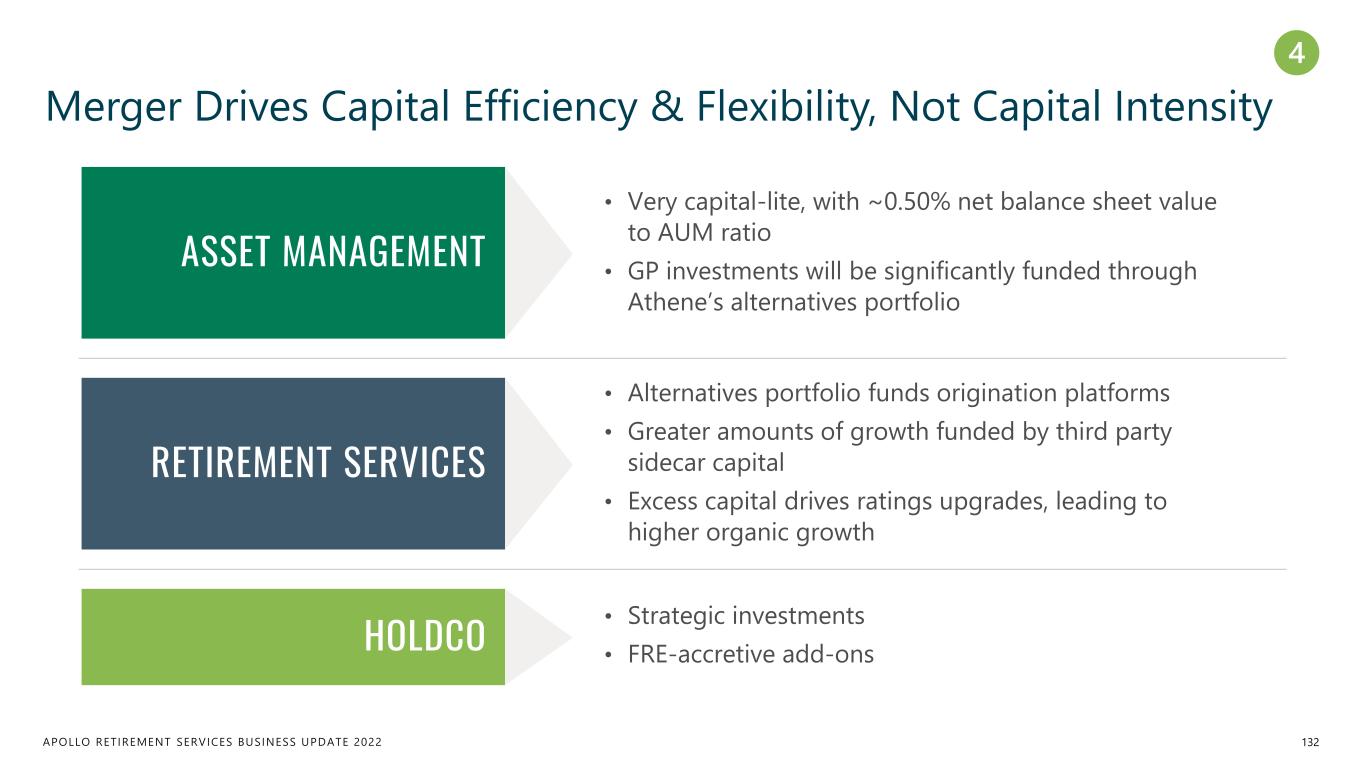

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Merger Benefits Are Even Clearer and More Tangible 7 Full Alignment Drives Shareholder Value Creation Growth Accelerant Owning Asset Origination Better Client Proposition New Product Opportunities Increased Internal Collaboration Enhanced Capital Efficiency & Flexibility

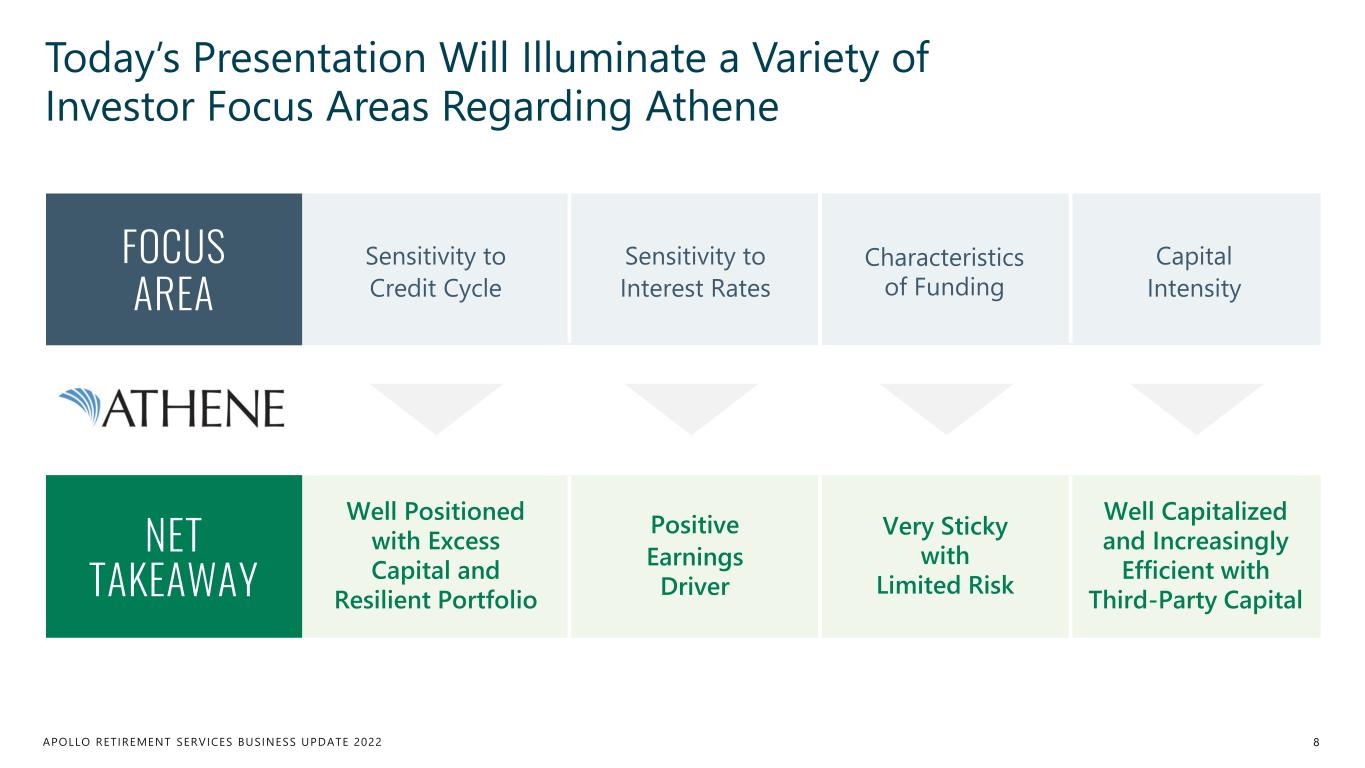

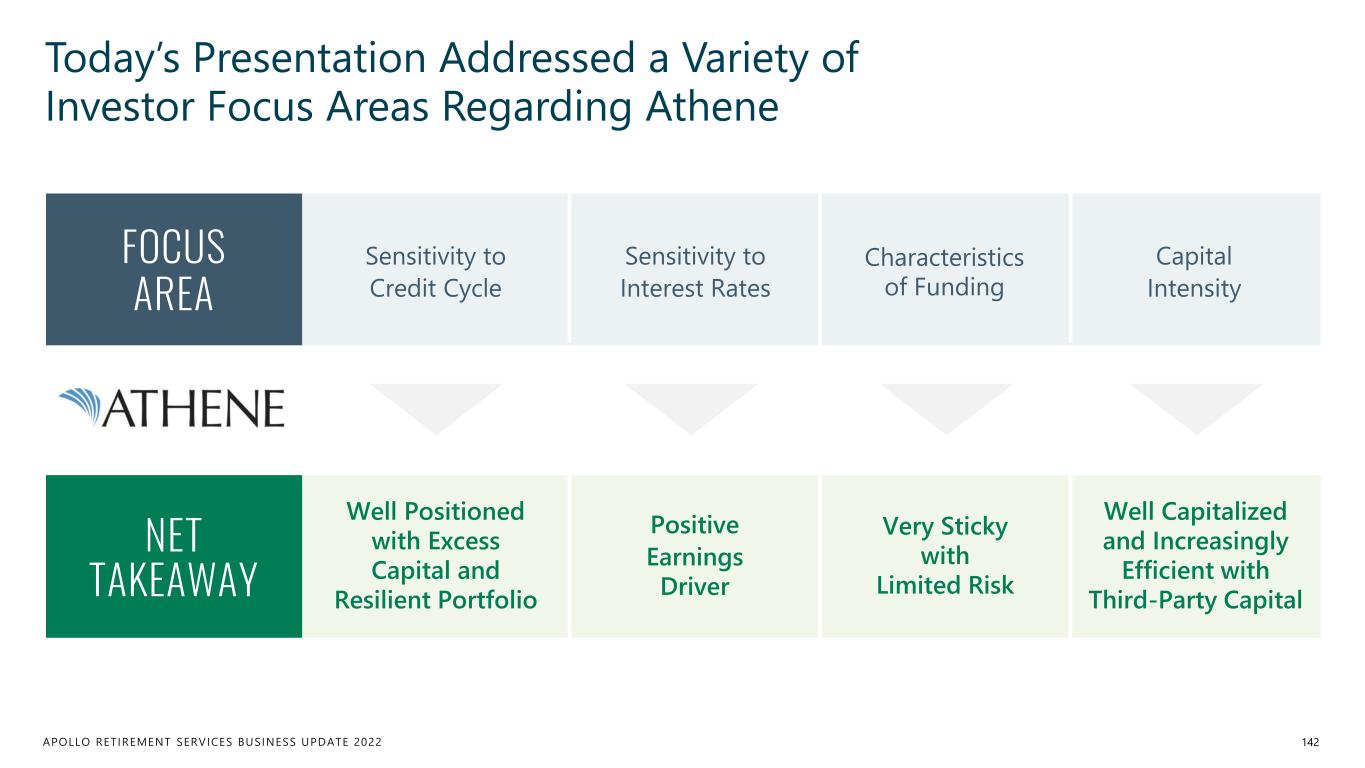

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Today’s Presentation Will Illuminate a Variety of Investor Focus Areas Regarding Athene 8 FOCUS AREA Sensitivity to Credit Cycle Sensitivity to Interest Rates Characteristics of Funding Capital Intensity NET TAKEAWAY Well Positioned with Excess Capital and Resilient Portfolio Positive Earnings Driver Very Sticky with Limited Risk Well Capitalized and Increasingly Efficient with Third-Party Capital

Business Overview & Investment Philosophy JIM BELARDI Chairman, Chief Executive Officer, & Chief Investment Officer, Athene

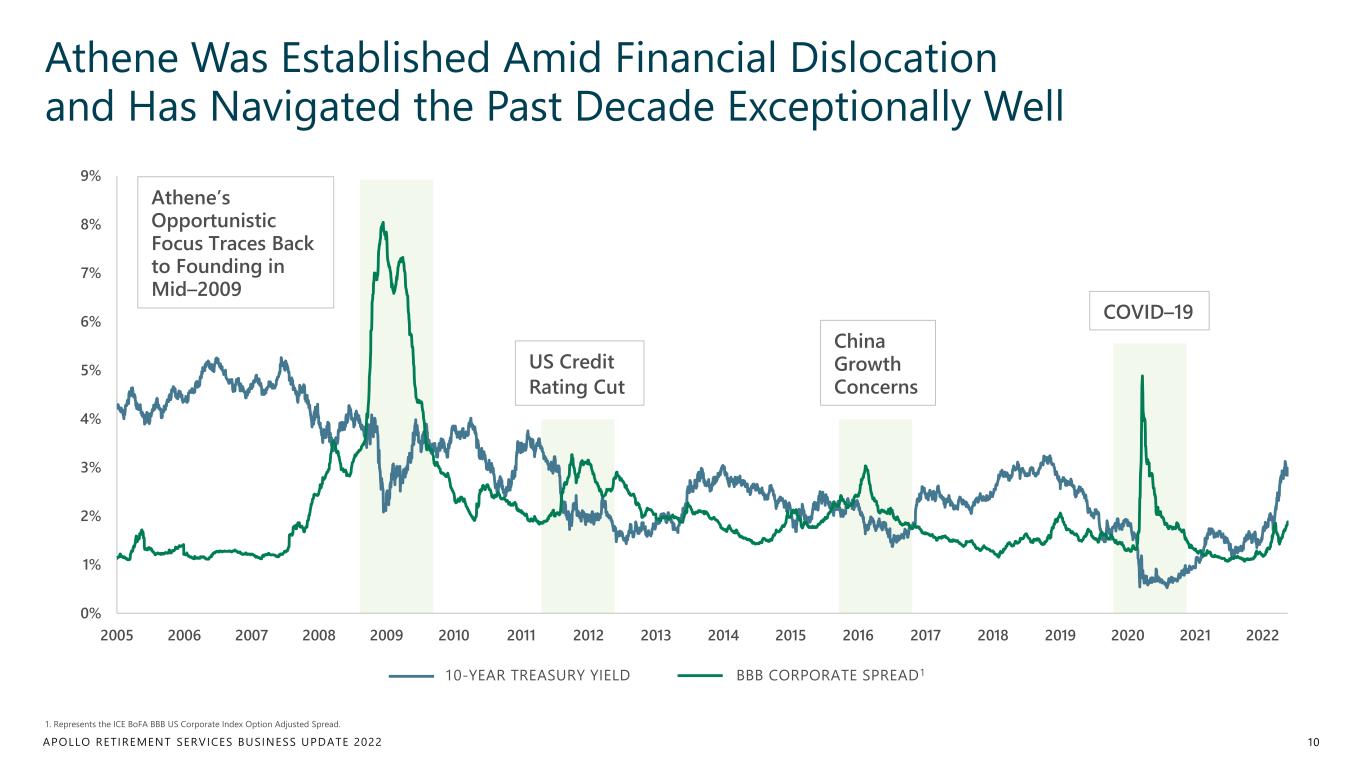

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Athene Was Established Amid Financial Dislocation and Has Navigated the Past Decade Exceptionally Well 10 Athene’s Opportunistic Focus Traces Back to Founding in Mid–2009 COVID–19 China Growth Concerns US Credit Rating Cut 10-YEAR TREASURY YIELD BBB CORPORATE SPREAD1 1. Represents the ICE BoFA BBB US Corporate Index Option Adjusted Spread.

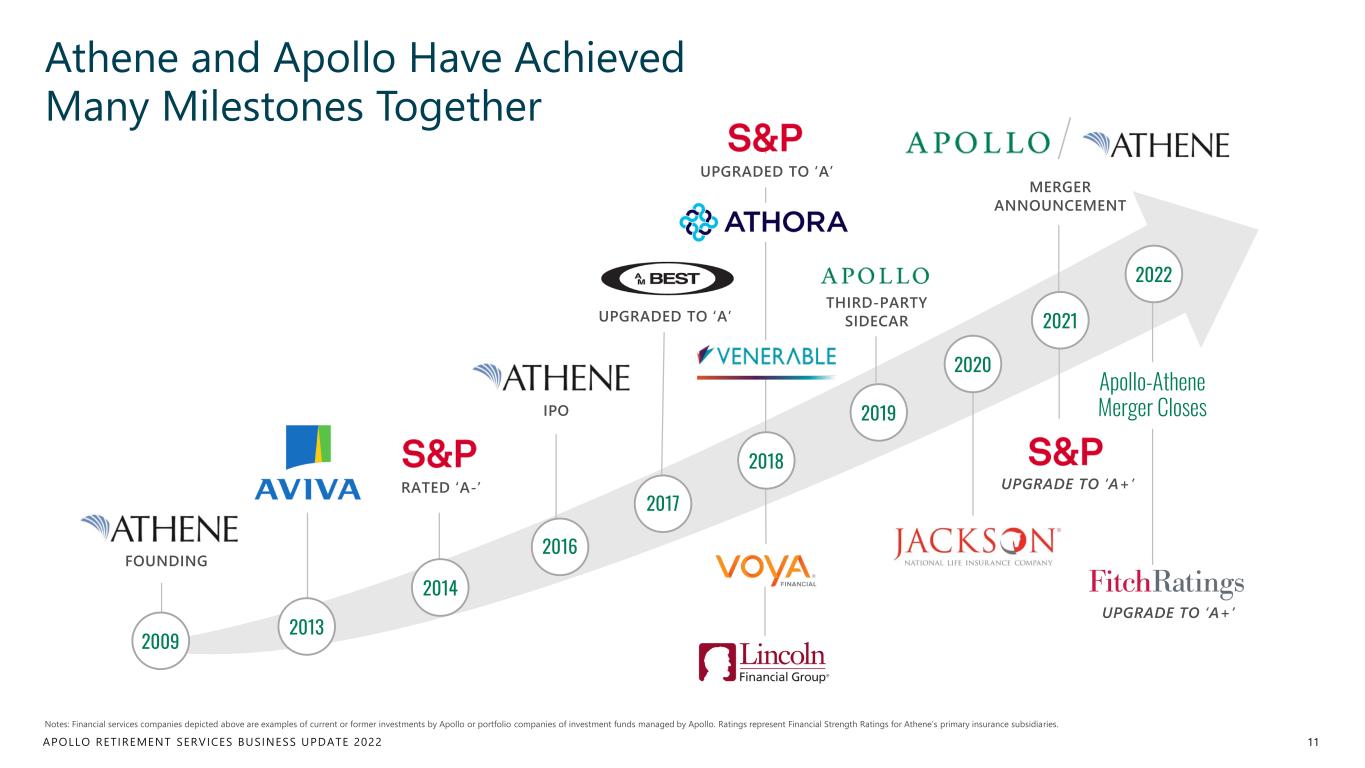

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene and Apollo Have Achieved Many Milestones Together 11 Notes: Financial services companies depicted above are examples of current or former investments by Apollo or portfolio companies of investment funds managed by Apollo. Ratings represent Financial Strength Ratings for Athene’s primary insurance subsidiaries. THIRD-PARTY SIDECAR FOUNDING IPO MERGER ANNOUNCEMENT UPGRADE TO ‘A+’RATED ‘A-’ UPGRADE TO ‘A+’ 2009 2013 2014 2016 2019 2020 UPGRADED TO ‘A’ 2021 2018 2022 Apollo-Athene Merger Closes 2017 UPGRADED TO ‘A’

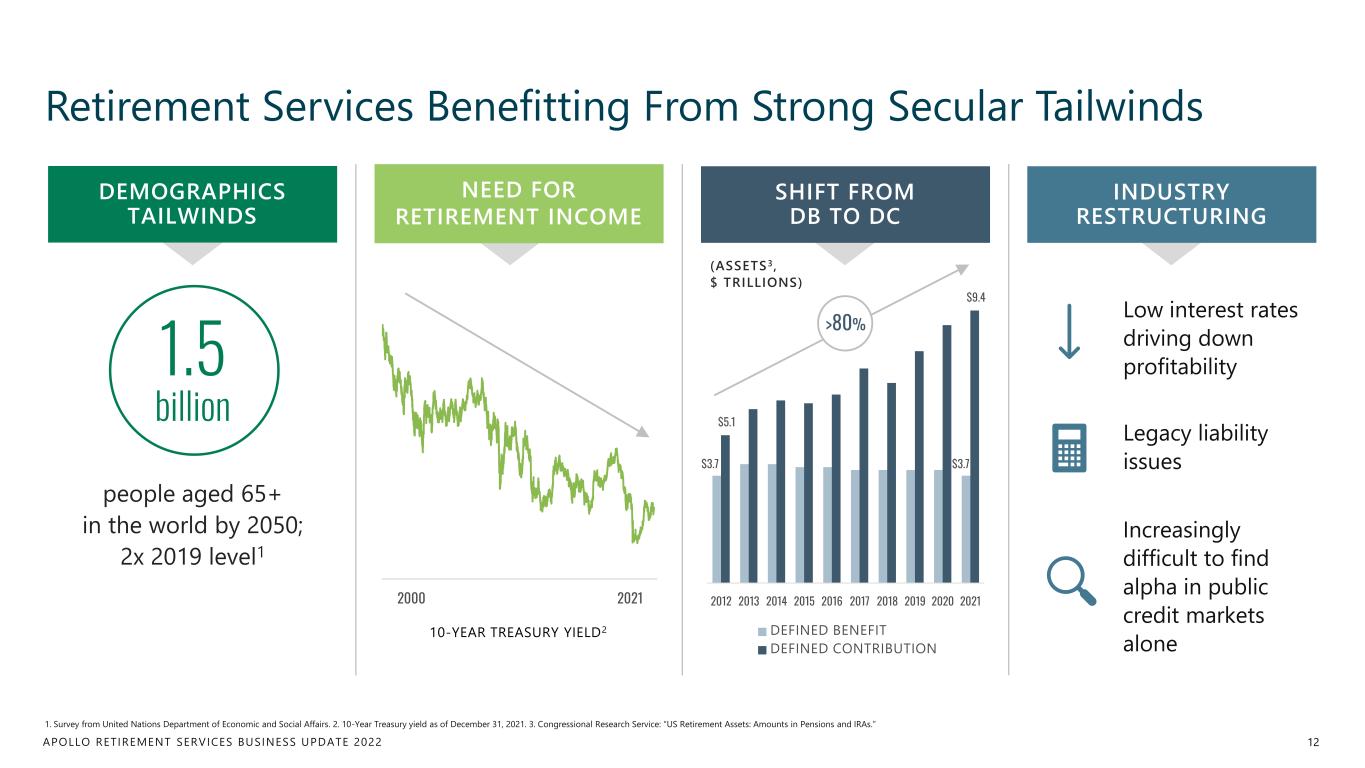

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Retirement Services Benefitting From Strong Secular Tailwinds 12 1. Survey from United Nations Department of Economic and Social Affairs. 2. 10-Year Treasury yield as of December 31, 2021. 3. Congressional Research Service: “US Retirement Assets: Amounts in Pensions and IRAs.” 1.5 billion Low interest rates driving down profitability Legacy liability issues Increasingly difficult to find alpha in public credit markets alone 10-YEAR TREASURY YIELD2 INDUSTRY RESTRUCTURING SHIFT FROM DB TO DC NEED FOR RETIREMENT INCOME DEMOGRAPHICS TAILWINDS people aged 65+ in the world by 2050; 2x 2019 level1 2000 2021 $3.7 $3.7 $5.1 $9.4 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 DEFINED BENEFIT DEFINED CONTRIBUTION (ASSETS3, $ TRILLIONS) >80%

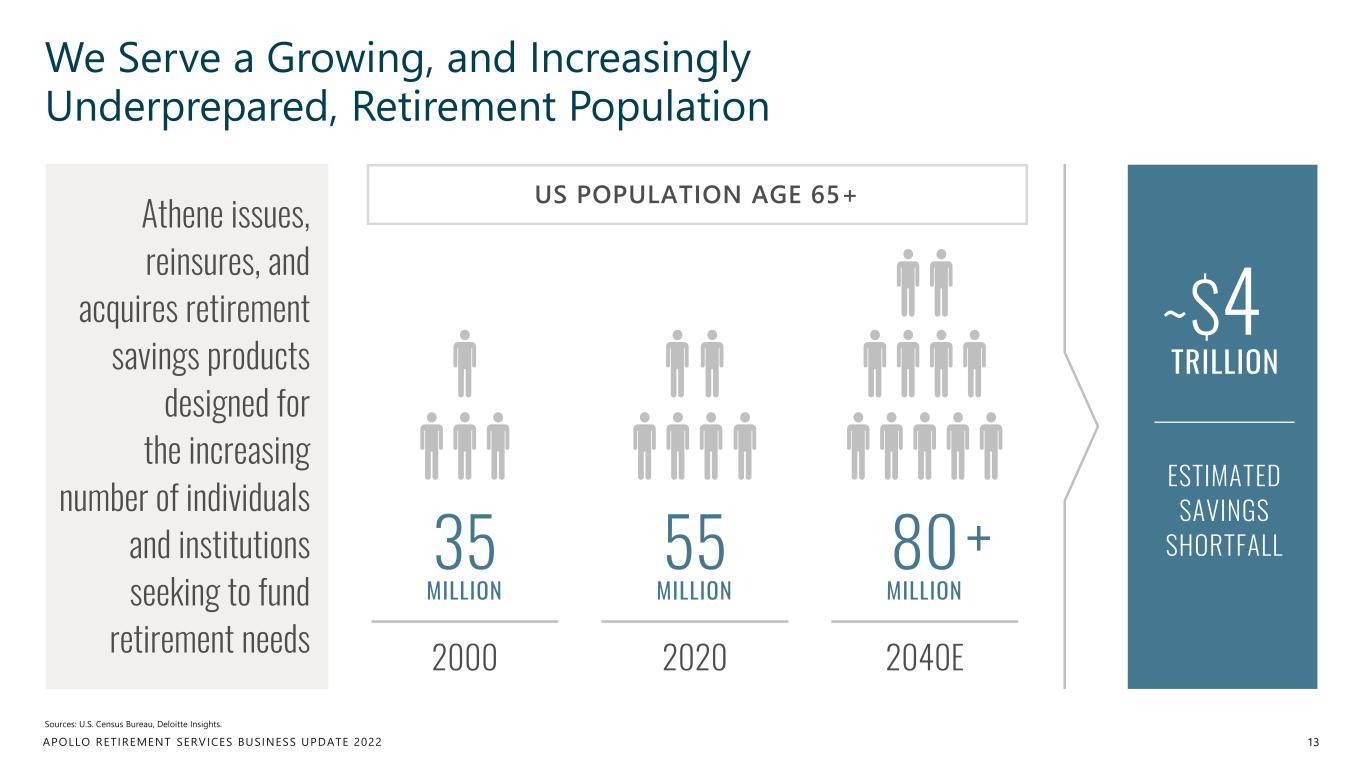

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 We Serve a Growing, and Increasingly Underprepared, Retirement Population 13 Sources: U.S. Census Bureau, Deloitte Insights. Athene issues, reinsures, and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs 35 MILLION 2000 55 MILLION 2020 +80 MILLION 2040E US POPULATION AGE 65+ $4 TRILLION ~ ESTIMATED SAVINGS SHORTFALL

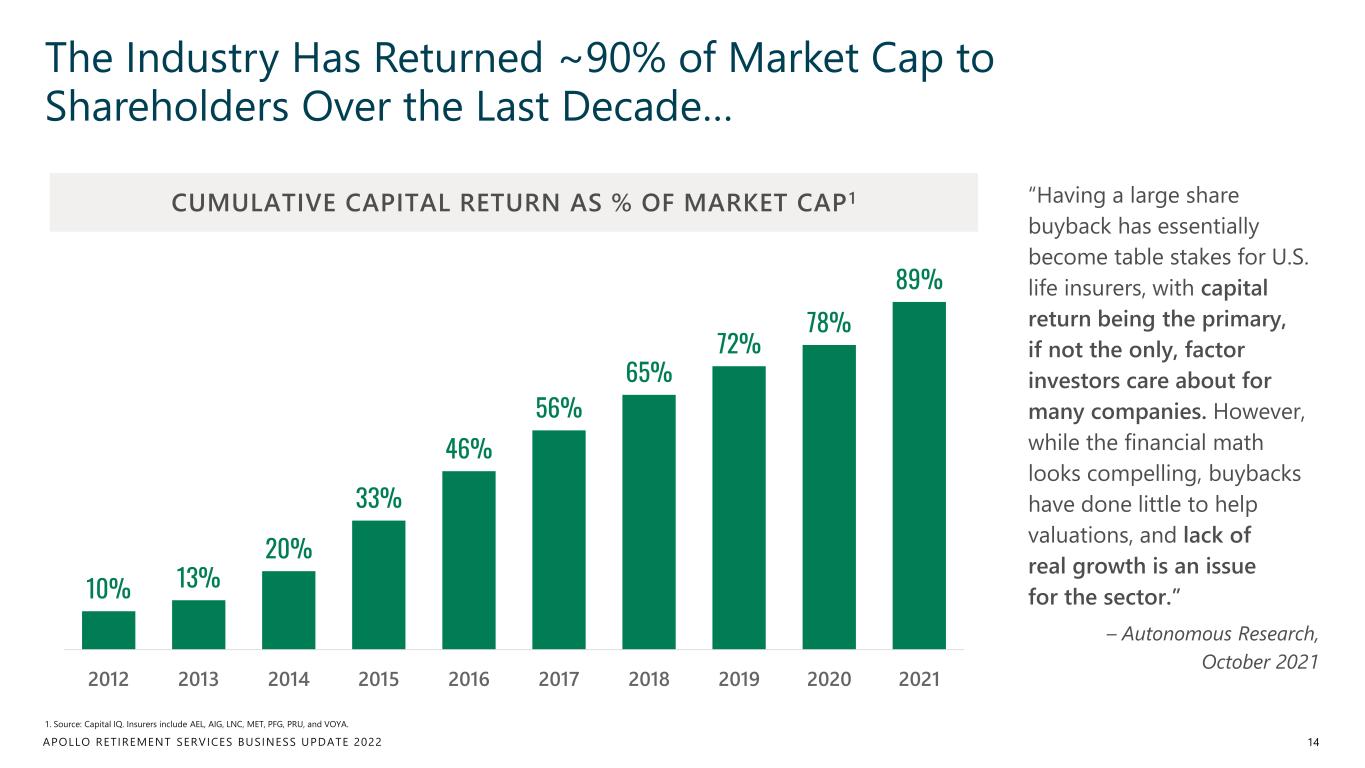

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 The Industry Has Returned ~90% of Market Cap to Shareholders Over the Last Decade… 14 1. Source: Capital IQ. Insurers include AEL, AIG, LNC, MET, PFG, PRU, and VOYA. CUMULATIVE CAPITAL RETURN AS % OF MARKET CAP 1 “Having a large share buyback has essentially become table stakes for U.S. life insurers, with capital return being the primary, if not the only, factor investors care about for many companies. However, while the financial math looks compelling, buybacks have done little to help valuations, and lack of real growth is an issue for the sector.” – Autonomous Research, October 2021 10% 13% 20% 33% 46% 56% 65% 72% 78% 89% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

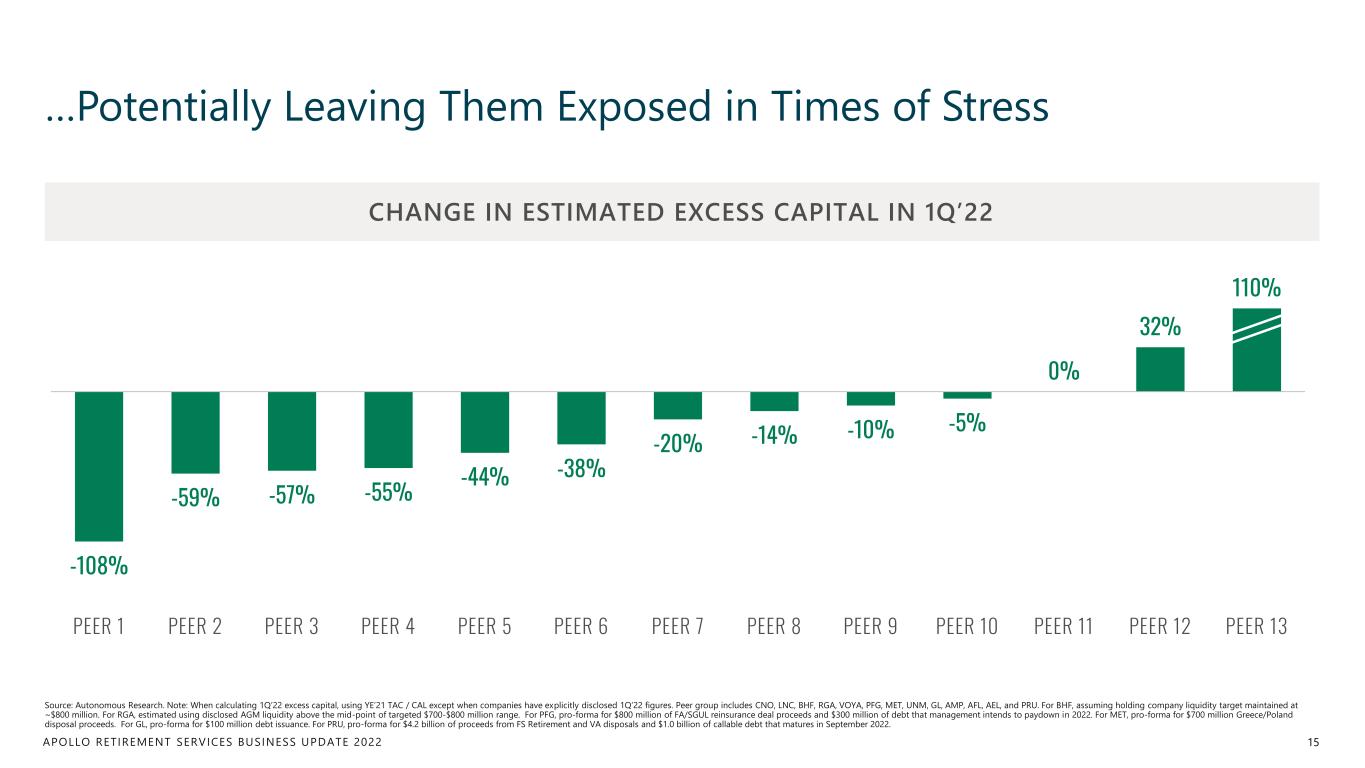

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 …Potentially Leaving Them Exposed in Times of Stress 15 Source: Autonomous Research. Note: When calculating 1Q’22 excess capital, using YE’21 TAC / CAL except when companies have explicitly disclosed 1Q’22 figures. Peer group includes CNO, LNC, BHF, RGA, VOYA, PFG, MET, UNM, GL, AMP, AFL, AEL, and PRU. For BHF, assuming holding company liquidity target maintained at ~$800 million. For RGA, estimated using disclosed AGM liquidity above the mid-point of targeted $700-$800 million range. For PFG, pro-forma for $800 million of FA/SGUL reinsurance deal proceeds and $300 million of debt that management intends to paydown in 2022. For MET, pro-forma for $700 million Greece/Poland disposal proceeds. For GL, pro-forma for $100 million debt issuance. For PRU, pro-forma for $4.2 billion of proceeds from FS Retirement and VA disposals and $1.0 billion of callable debt that matures in September 2022. CHANGE IN ESTIMATED EXCESS CAPITAL IN 1Q’22 -108% -59% -57% -55% -44% -38% -20% -14% -10% -5% 0% 32% 110% PEER 1 PEER 2 PEER 3 PEER 4 PEER 5 PEER 6 PEER 7 PEER 8 PEER 9 PEER 10 PEER 11 PEER 12 PEER 13

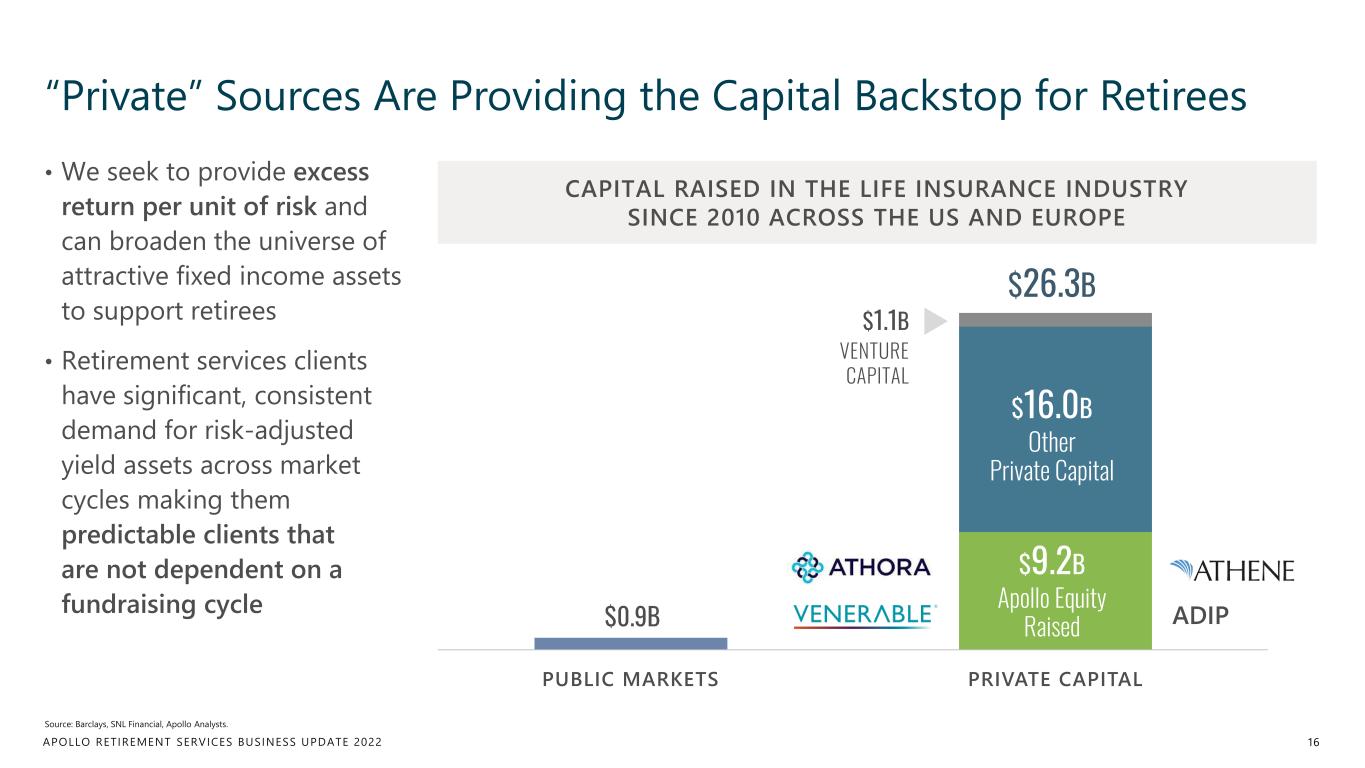

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 “Private” Sources Are Providing the Capital Backstop for Retirees 16 Source: Barclays, SNL Financial, Apollo Analysts. CAPITAL RAISED IN THE LIFE INSURANCE INDUSTRY SINCE 2010 ACROSS THE US AND EUROPE $0.9B PUBLIC MARKETS PRIVATE CAPITAL • We seek to provide excess return per unit of risk and can broaden the universe of attractive fixed income assets to support retirees • Retirement services clients have significant, consistent demand for risk-adjusted yield assets across market cycles making them predictable clients that are not dependent on a fundraising cycle ADIP $9.2B Apollo Equity Raised $16.0B Other Private Capital $1.1B VENTURE CAPITAL $26.3B

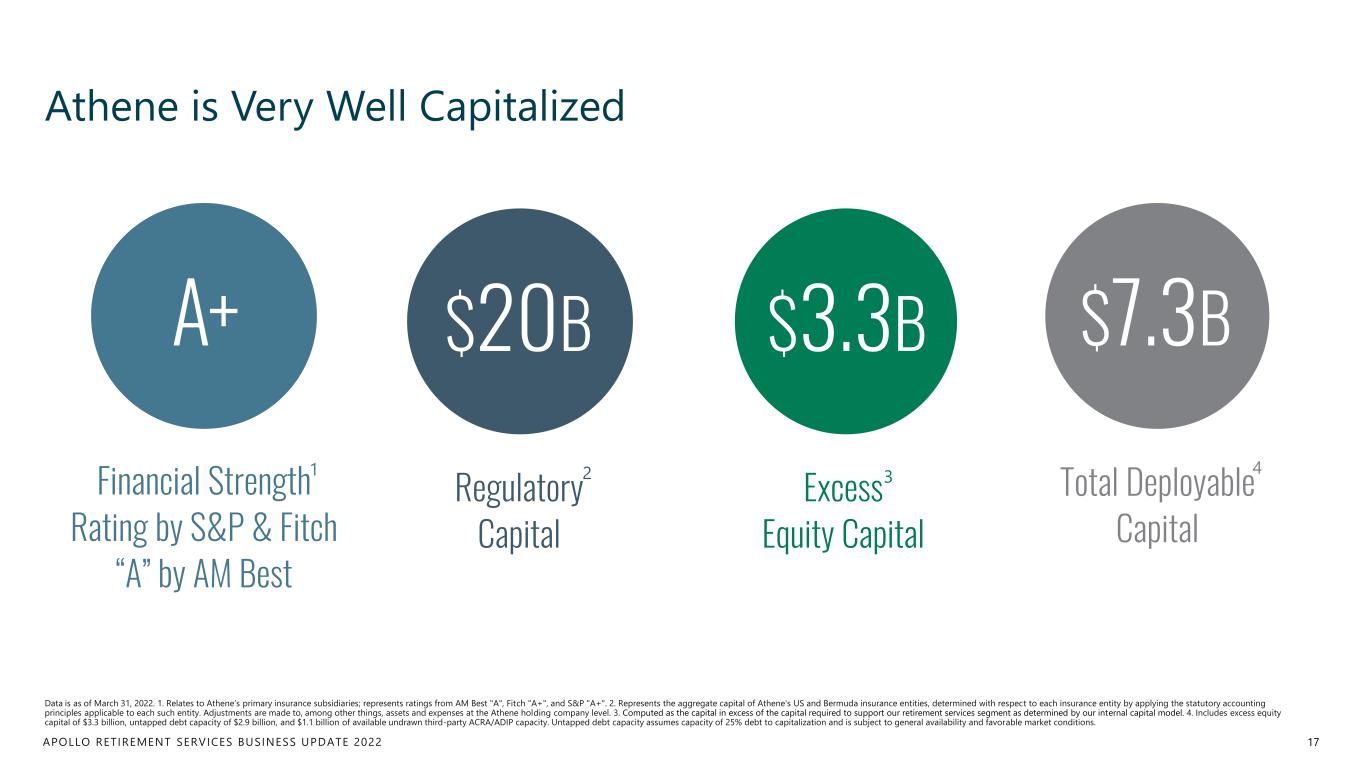

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene is Very Well Capitalized 17 Financial Strength Rating by S&P & Fitch “A” by AM Best Total Deployable Capital A+ $7.3B Data is as of March 31, 2022. 1. Relates to Athene’s primary insurance subsidiaries; represents ratings from AM Best "A", Fitch "A+", and S&P "A+". 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. 3. Computed as the capital in excess of the capital required to support our retirement services segment as determined by our internal capital model. 4. Includes excess equity capital of $3.3 billion, untapped debt capacity of $2.9 billion, and $1.1 billion of available undrawn third-party ACRA/ADIP capacity. Untapped debt capacity assumes capacity of 25% debt to capitalization and is subject to general availability and favorable market conditions. 1 Excess Equity Capital $3.3B 3Regulatory Capital $20B 2 4

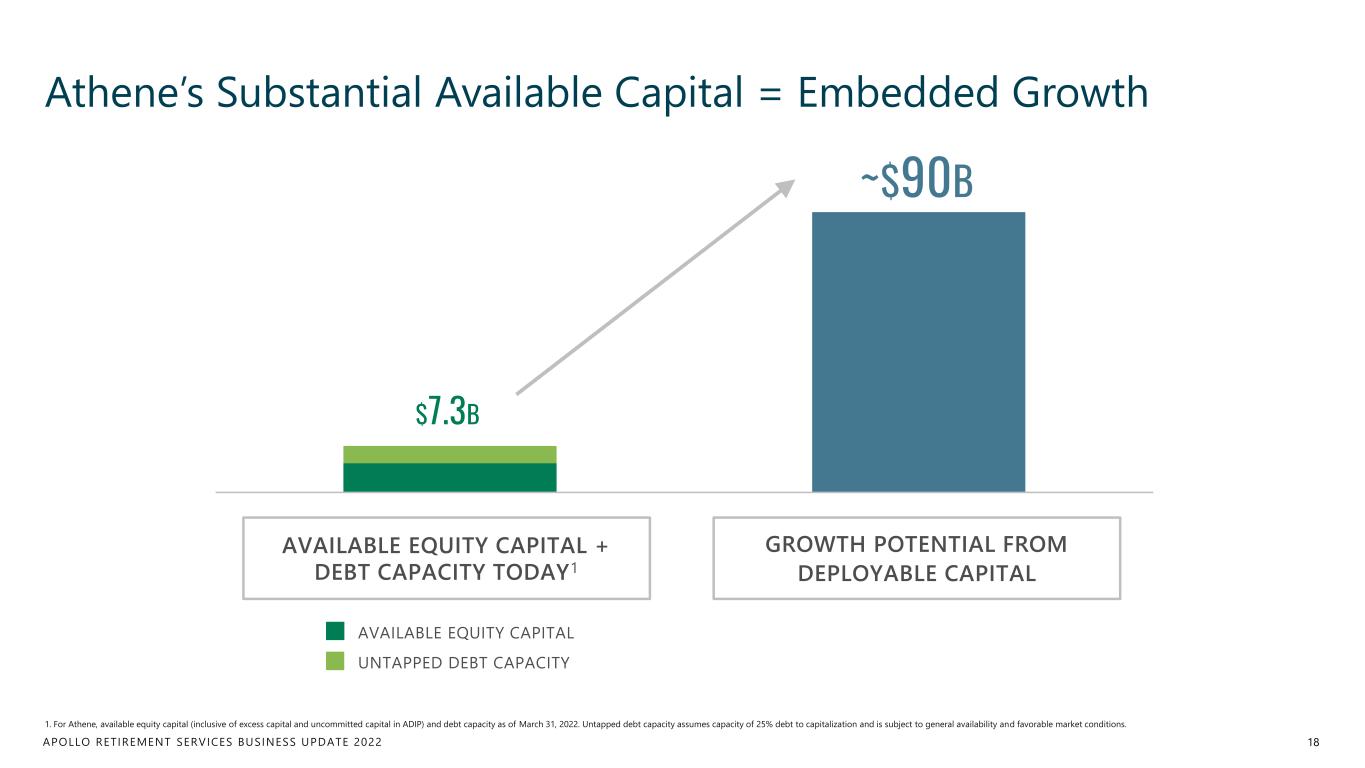

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Substantial Available Capital = Embedded Growth 18 1. For Athene, available equity capital (inclusive of excess capital and uncommitted capital in ADIP) and debt capacity as of March 31, 2022. Untapped debt capacity assumes capacity of 25% debt to capitalization and is subject to general availability and favorable market conditions. $7.3B ~$90B AVAILABLE EQUITY CAPITAL UNTAPPED DEBT CAPACITY GROWTH POTENTIAL FROM DEPLOYABLE CAPITAL AVAILABLE EQUITY CAPITAL + DEBT CAPACITY TODAY1

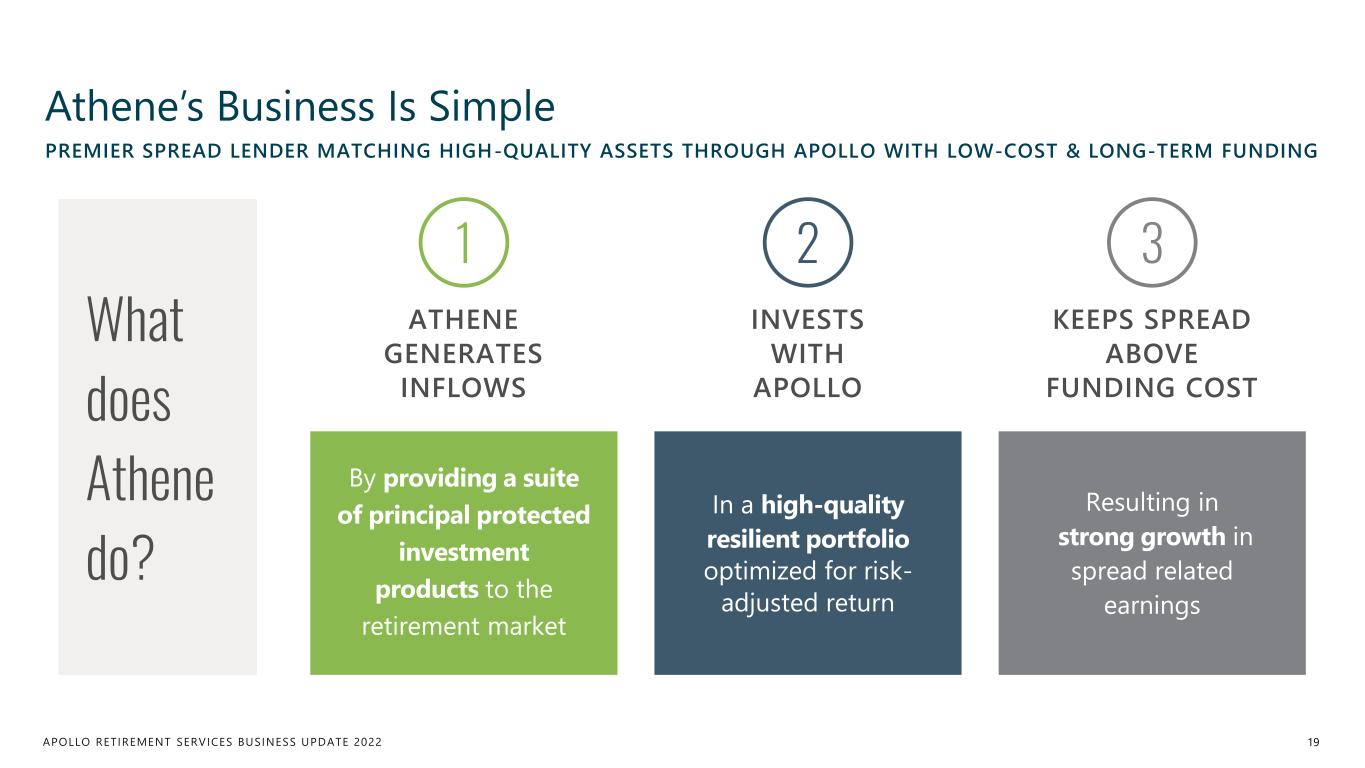

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Business Is Simple 19 By providing a suite of principal protected investment products to the retirement market ATHENE GENERATES INFLOWS 1 What does Athene do? INVESTS WITH APOLLO 2 In a high-quality resilient portfolio optimized for risk- adjusted return KEEPS SPREAD ABOVE FUNDING COST 3 Resulting in strong growth in spread related earnings PREMIER SPREAD LENDER MATCHING HIGH-QUALITY ASSETS THROUGH APOLLO WITH LOW-COST & LONG-TERM FUNDING

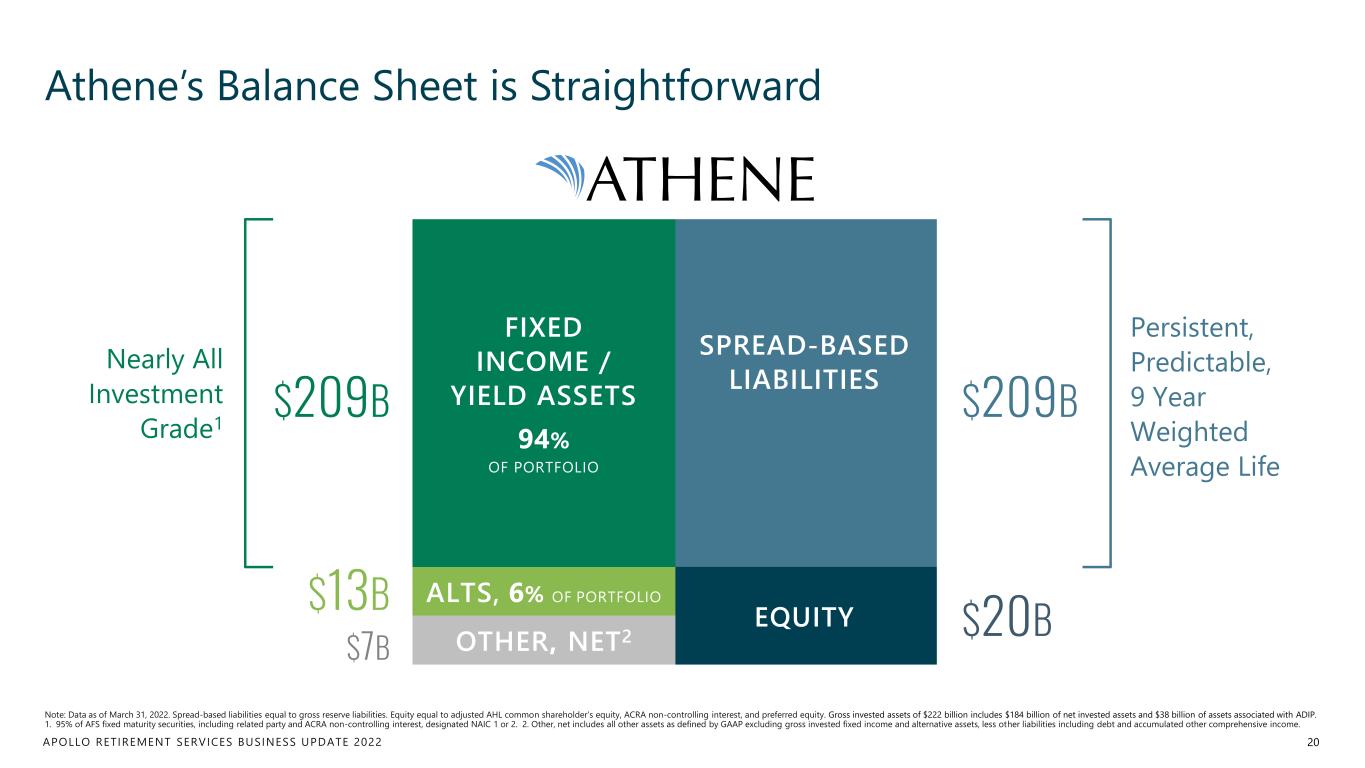

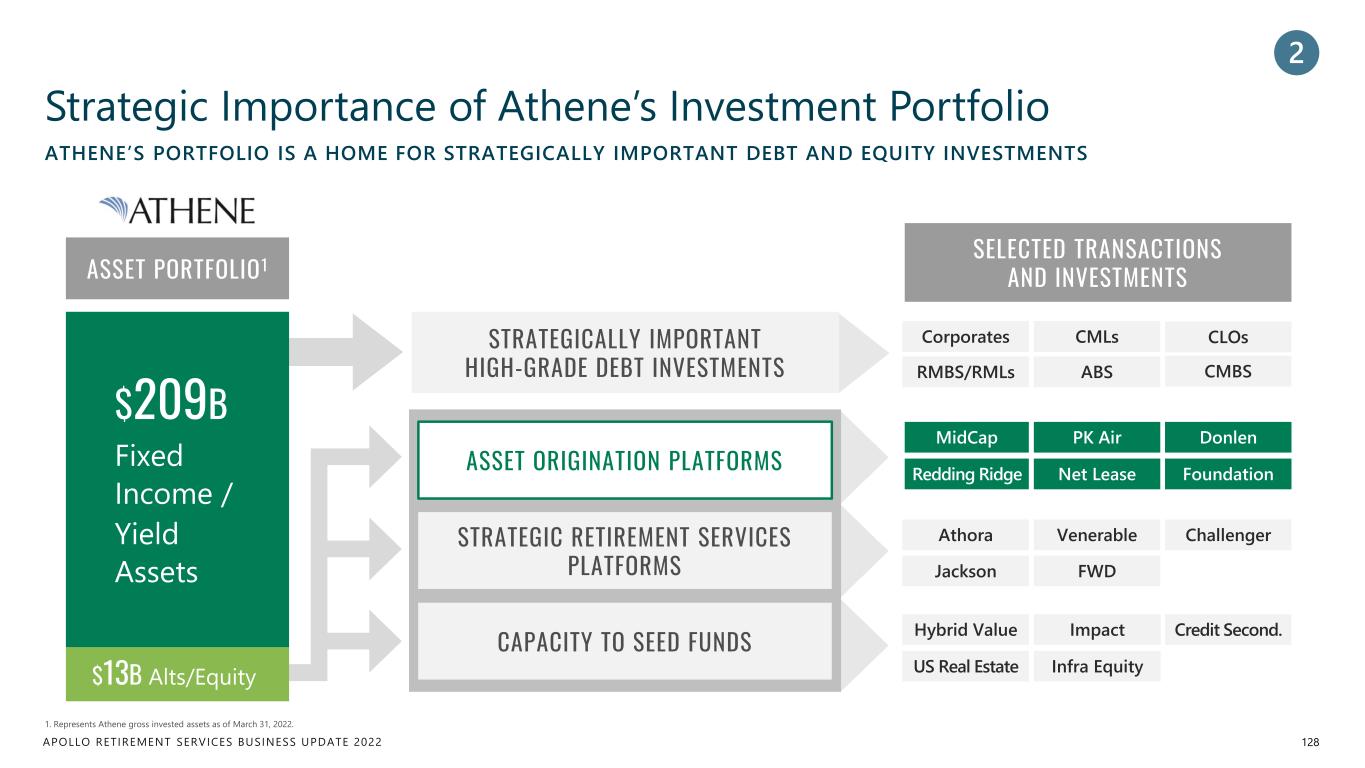

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Balance Sheet is Straightforward 20 Note: Data as of March 31, 2022. Spread-based liabilities equal to gross reserve liabilities. Equity equal to adjusted AHL common shareholder’s equity, ACRA non-controlling interest, and preferred equity. Gross invested assets of $222 billion includes $184 billion of net invested assets and $38 billion of assets associated with ADIP. 1. 95% of AFS fixed maturity securities, including related party and ACRA non-controlling interest, designated NAIC 1 or 2. 2. Other, net includes all other assets as defined by GAAP excluding gross invested fixed income and alternative assets, less other liabilities including debt and accumulated other comprehensive income. $209B $13B $209B $20B Nearly All Investment Grade1 Persistent, Predictable, 9 Year Weighted Average Life $7B SPREAD-BASED LIABILITIES FIXED INCOME / YIELD ASSETS 94% OF PORTFOLIO EQUITY ALTS, 6% OF PORTFOLIO OTHER, NET2

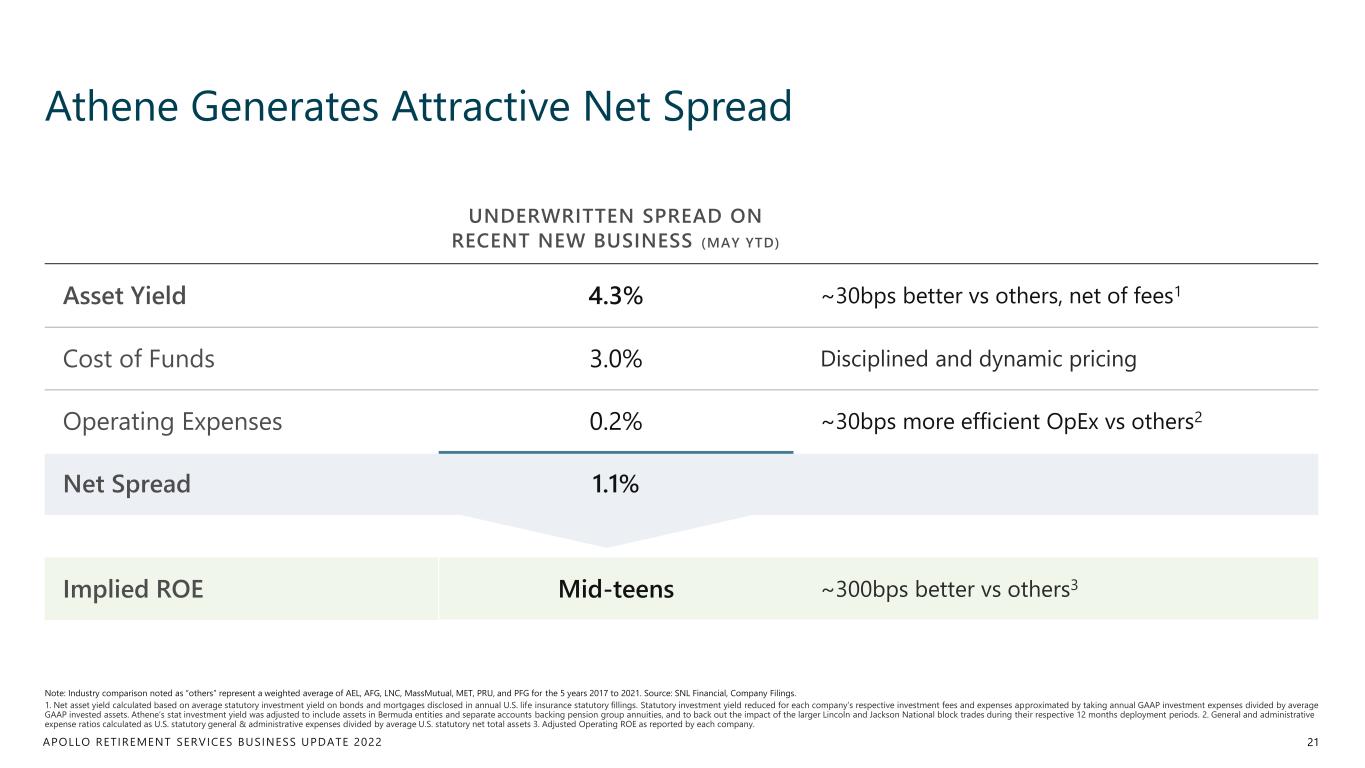

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 UNDERWRITTEN SPREAD ON RECENT NEW BUSINESS (MAY YTD) Asset Yield 4.3% ~30bps better vs others, net of fees1 Cost of Funds 3.0% Disciplined and dynamic pricing Operating Expenses 0.2% ~30bps more efficient OpEx vs others2 Net Spread 1.1% Implied ROE Mid-teens ~300bps better vs others3 Athene Generates Attractive Net Spread 21 Note: Industry comparison noted as “others” represent a weighted average of AEL, AFG, LNC, MassMutual, MET, PRU, and PFG for the 5 years 2017 to 2021. Source: SNL Financial, Company Filings. 1. Net asset yield calculated based on average statutory investment yield on bonds and mortgages disclosed in annual U.S. life insurance statutory fillings. Statutory investment yield reduced for each company’s respective investment fees and expenses approximated by taking annual GAAP investment expenses divided by average GAAP invested assets. Athene’s stat investment yield was adjusted to include assets in Bermuda entities and separate accounts backing pension group annuities, and to back out the impact of the larger Lincoln and Jackson National block trades during their respective 12 months deployment periods. 2. General and administrative expense ratios calculated as U.S. statutory general & administrative expenses divided by average U.S. statutory net total assets 3. Adjusted Operating ROE as reported by each company.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 What Do You Need to Understand About This Business? 22 With fixed funding costs, a spread model relies on consistent asset management Key to Success is Asset Yield We target only ~30-40 basis points of outperformance Consistency Over Heroism Full clarity on Athene’s portfolio and stress scenarios published annually Quality & Transparency Stable liabilities with recurring spread predictable on day one Predictable Liabilities PREDICTABLE, STABLE, AND GROWING OVER THE PAST 13 YEARS

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Team is One of the Industry’s Strongest 23 Note: Headcount as of March 31, 2022. JIM BELARDI Chief Executive Officer & Chief Investment Officer BILL WHEELER Vice Chairman GRANT KVALHEIM President Athene, CEO Athene USA MARTY KLEIN EVP, Chief Financial Officer JOHN GOLDEN EVP, General Counsel KATIE DALY EVP, Corporate Development SEAN BRENNAN EVP, Pension Group Annuities & Flow Reinsurance CHRIS GRADY EVP, Retail Sales CHRIS WELP EVP, Insurance Operations DOUG NIEMANN EVP, Chief Risk Officer MIKE DOWNING EVP, Chief Operating Officer & Chief Actuary RANDY EPRIGHT EVP, Chief Information Officer KRISTI KAYE BURMA EVP, Human Resources REBECCA TADIKONDA EVP, Strategy and Innovation 1,450+ TEAM MEMBERS Experienced Senior Leadership In Addition To… Deep Bench of Talented Executives Across the Business

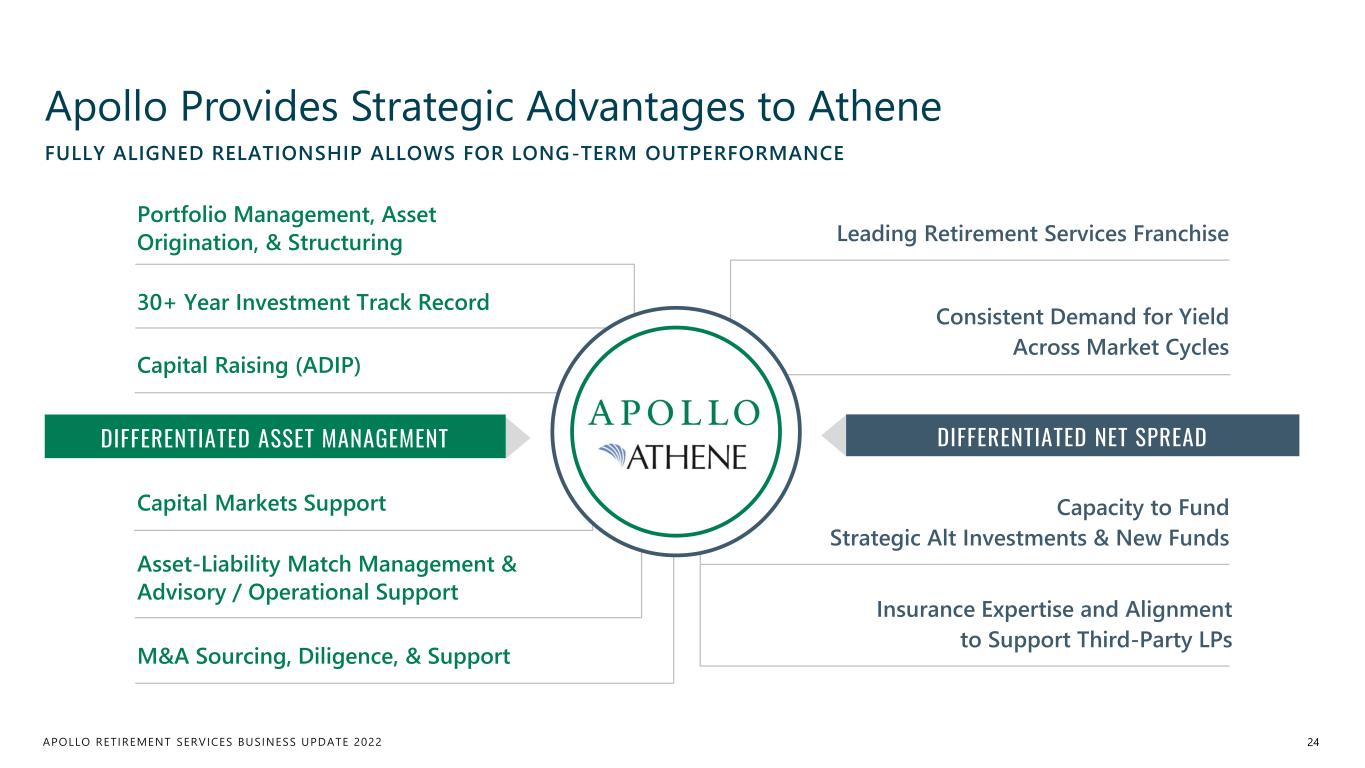

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Consistent Demand for Yield Across Market Cycles Apollo Provides Strategic Advantages to Athene 24 FULLY ALIGNED RELATIONSHIP ALLOWS FOR LONG-TERM OUTPERFORMANCE Portfolio Management, Asset Origination, & Structuring Capital Markets Support Insurance Expertise and Alignment to Support Third-Party LPs Leading Retirement Services Franchise Capital Raising (ADIP) Capacity to Fund Strategic Alt Investments & New Funds 30+ Year Investment Track Record DIFFERENTIATED ASSET MANAGEMENT DIFFERENTIATED NET SPREAD Asset-Liability Match Management & Advisory / Operational Support M&A Sourcing, Diligence, & Support

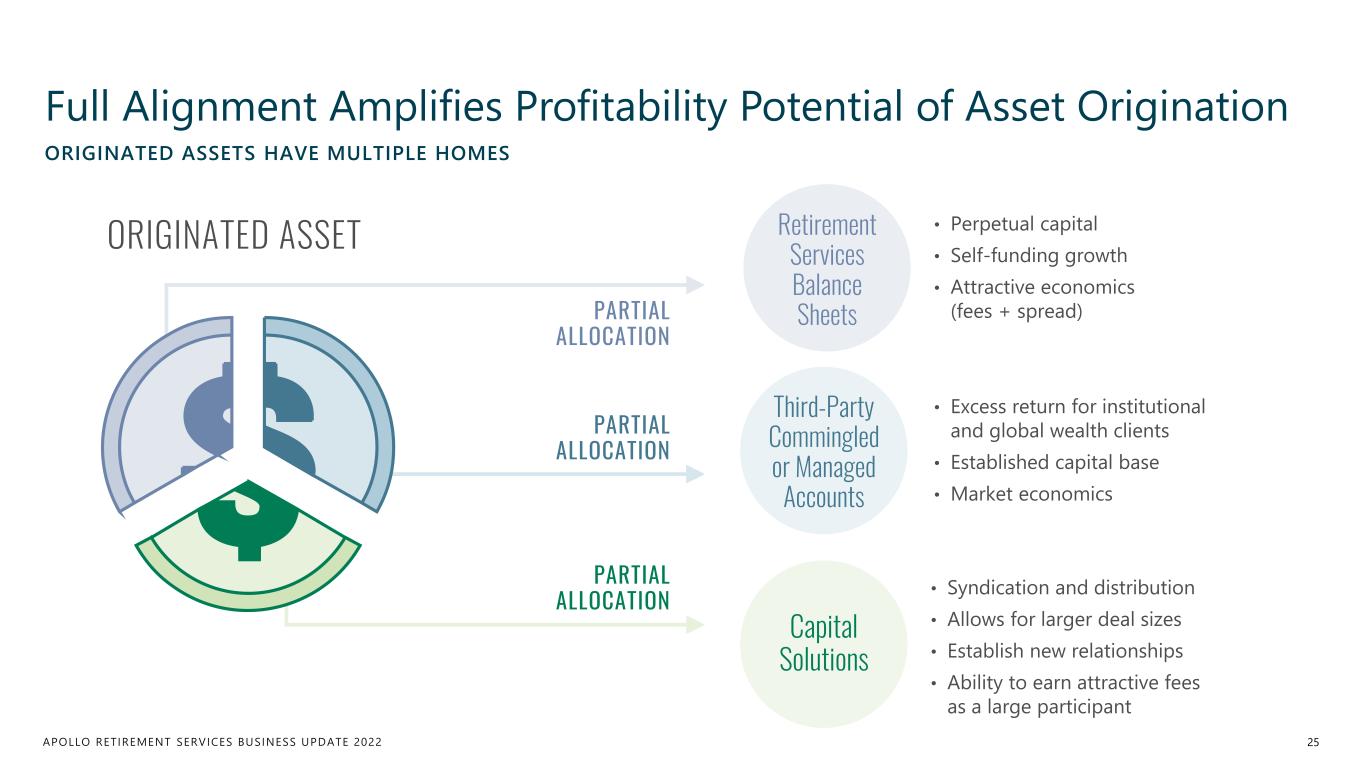

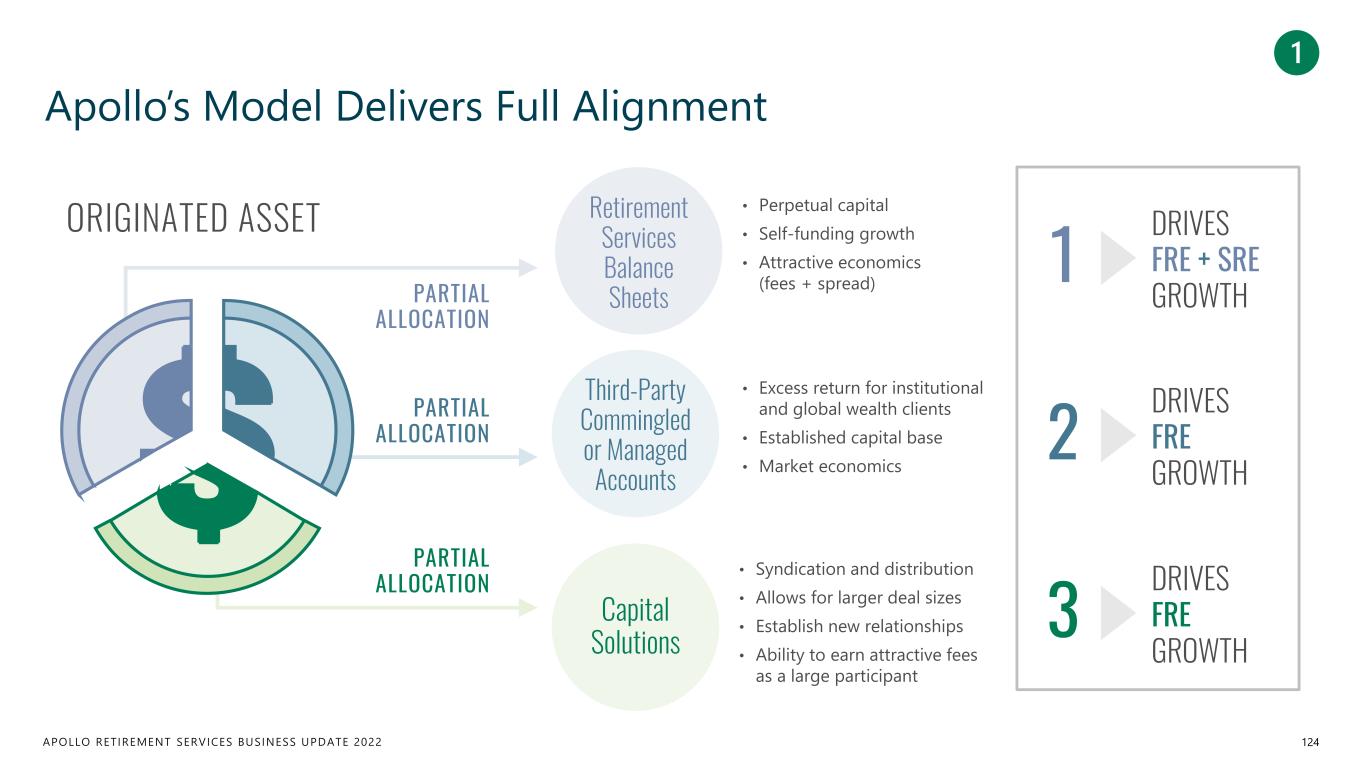

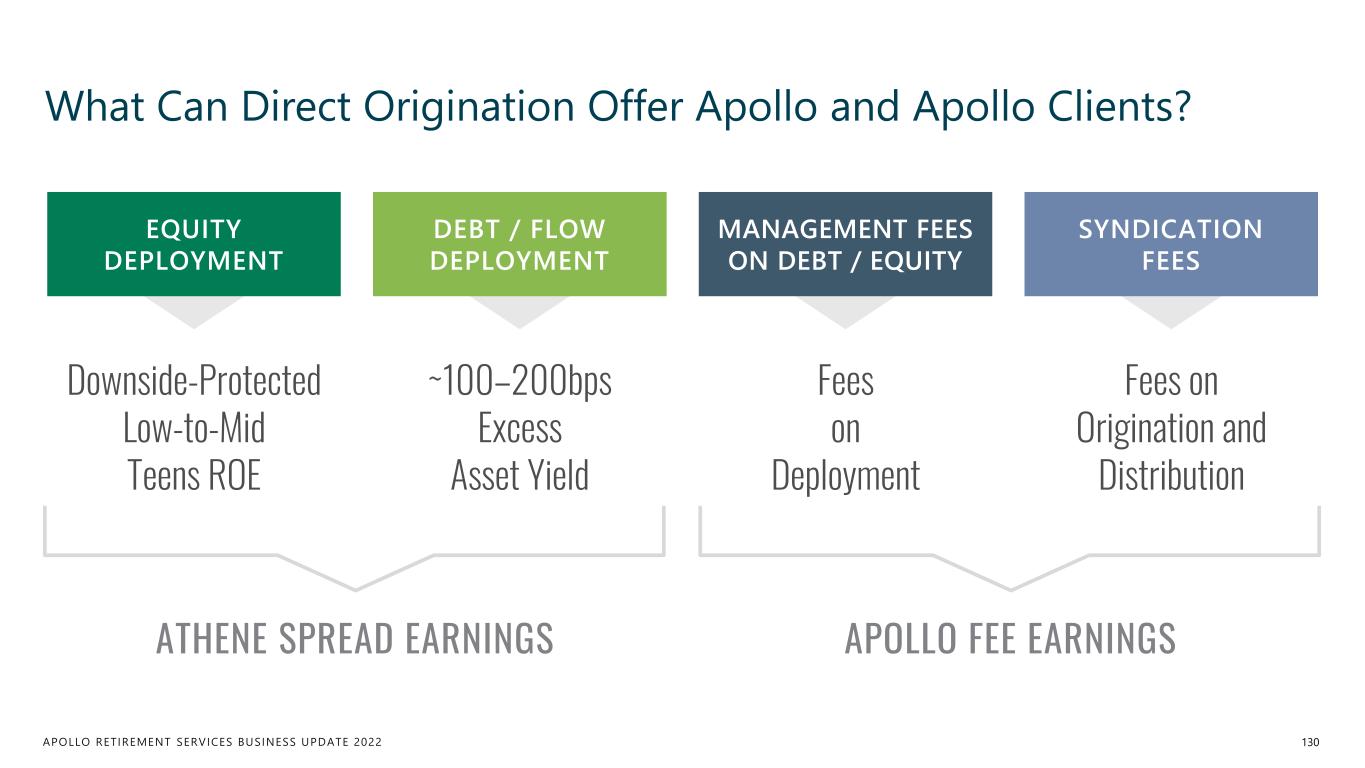

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Full Alignment Amplifies Profitability Potential of Asset Origination 25 ORIGINATED ASSETS HAVE MULTIPLE HOMES • Excess return for institutional and global wealth clients • Established capital base • Market economics Third-Party Commingled or Managed Accounts • Perpetual capital • Self-funding growth • Attractive economics (fees + spread) Retirement Services Balance Sheets • Syndication and distribution • Allows for larger deal sizes • Establish new relationships • Ability to earn attractive fees as a large participant Capital Solutions ORIGINATED ASSET PARTIAL ALLOCATION PARTIAL ALLOCATION PARTIAL ALLOCATION

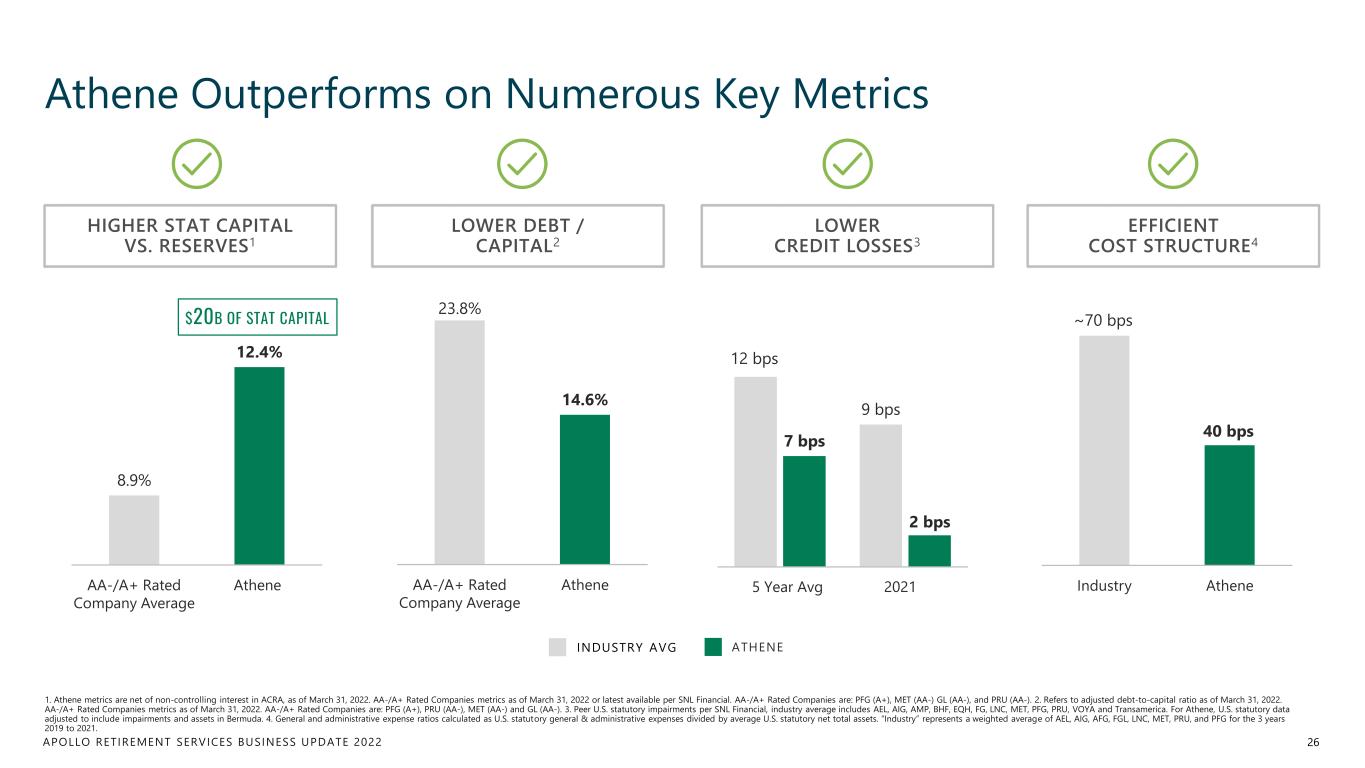

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene Outperforms on Numerous Key Metrics 26 1. Athene metrics are net of non-controlling interest in ACRA, as of March 31, 2022. AA-/A+ Rated Companies metrics as of March 31, 2022 or latest available per SNL Financial. AA-/A+ Rated Companies are: PFG (A+), MET (AA-) GL (AA-), and PRU (AA-). 2. Refers to adjusted debt-to-capital ratio as of March 31, 2022. AA-/A+ Rated Companies metrics as of March 31, 2022. AA-/A+ Rated Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). 3. Peer U.S. statutory impairments per SNL Financial, industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. 4. General and administrative expense ratios calculated as U.S. statutory general & administrative expenses divided by average U.S. statutory net total assets. “Industry” represents a weighted average of AEL, AIG, AFG, FGL, LNC, MET, PRU, and PFG for the 3 years 2019 to 2021. 12 bps 9 bps 7 bps 2 bps 5 Year Average 2021 8.9% 12.4% AA-/A+ Rated Company Average Athene 23.8% 14.6% AA-/A+ Rated Company Average Athene ~70 bps 40 bps Industry Athene20215 Year Av ATHENEINDUSTRY AVG HIGHER STAT CAPITAL VS. RESERVES1 LOWER DEBT / CAPITAL2 LOWER CREDIT LOSSES3 EFFICIENT COST STRUCTURE4 $20B OF STAT CAPITAL

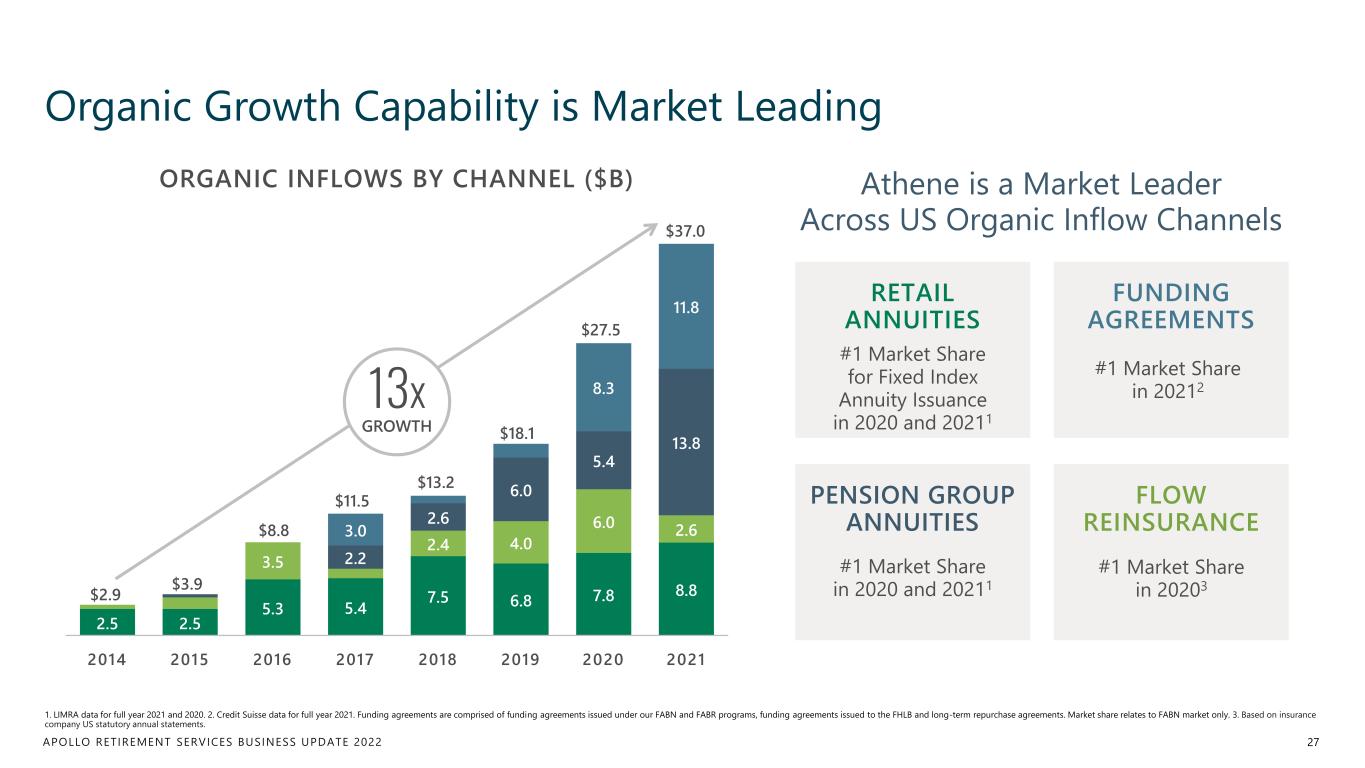

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 2.5 2.5 5.3 5.4 7.5 6.8 7.8 8.8 3.5 2.4 4.0 6.0 2.6 2.2 2.6 6.0 5.4 13.8 3.0 8.3 11.8 2014 2015 2016 2017 2018 2019 2020 2021 Organic Growth Capability is Market Leading 27 1. LIMRA data for full year 2021 and 2020. 2. Credit Suisse data for full year 2021. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding agreements issued to the FHLB and long-term repurchase agreements. Market share relates to FABN market only. 3. Based on insurance company US statutory annual statements. Athene is a Market Leader Across US Organic Inflow Channels 13x GROWTH $2.9 $3.9 $8.8 $11.5 $13.2 $18.1 $27.5 $37.0 ORGANIC INFLOWS BY CHANNEL ($B) PENSION GROUP ANNUITIES #1 Market Share in 2020 and 20211 FUNDING AGREEMENTS #1 Market Share in 20212 RETAIL ANNUITIES #1 Market Share for Fixed Index Annuity Issuance in 2020 and 20211 FLOW REINSURANCE #1 Market Share in 20203

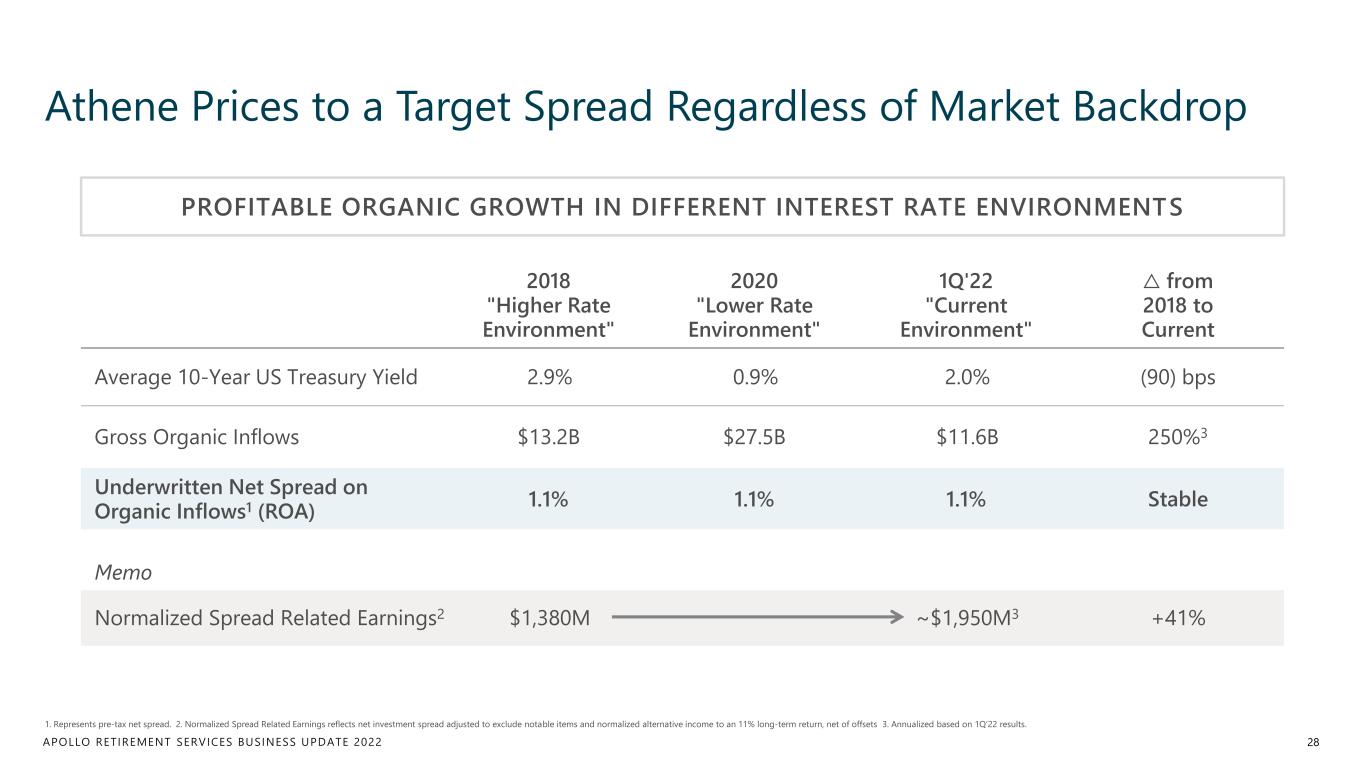

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene Prices to a Target Spread Regardless of Market Backdrop 28 1. Represents pre-tax net spread. 2. Normalized Spread Related Earnings reflects net investment spread adjusted to exclude notable items and normalized alternative income to an 11% long-term return, net of offsets 3. Annualized based on 1Q’22 results. 2018 "Higher Rate Environment" 2020 "Lower Rate Environment" 1Q'22 "Current Environment" △ from 2018 to Current Average 10-Year US Treasury Yield 2.9% 0.9% 2.0% (90) bps Gross Organic Inflows $13.2B $27.5B $11.6B 250%3 Underwritten Net Spread on Organic Inflows1 (ROA) 1.1% 1.1% 1.1% Stable Memo Normalized Spread Related Earnings2 $1,380M ~$1,950M3 +41% PROFITABLE ORGANIC GROWTH IN DIFFERENT INTEREST RATE ENVIRONMENTS

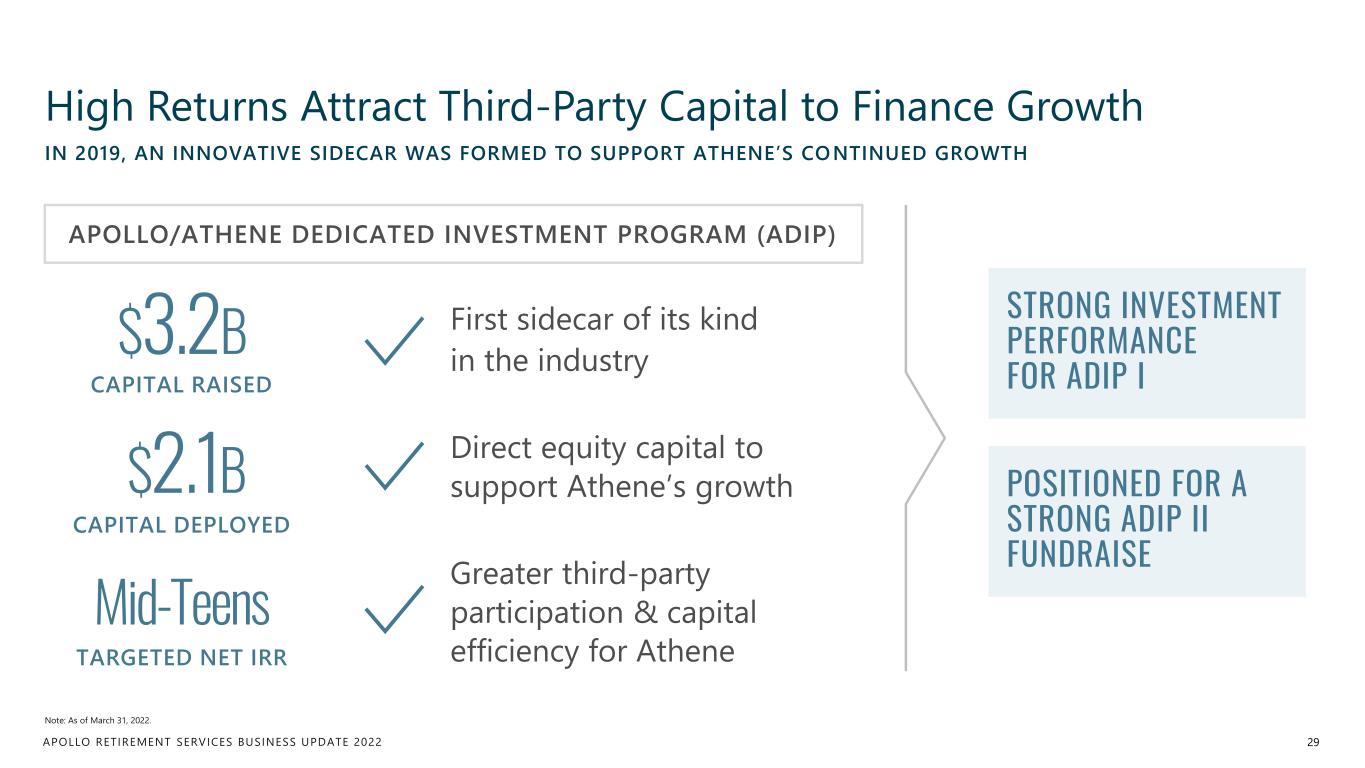

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 High Returns Attract Third-Party Capital to Finance Growth 29 Note: As of March 31, 2022. IN 2019, AN INNOVATIVE SIDECAR WAS FORMED TO SUPPORT ATHENE’S CONTINUED GROWTH APOLLO/ATHENE DEDICATED INVESTMENT PROGRAM (ADIP) CAPITAL RAISED $3.2B CAPITAL DEPLOYED $2.1B TARGETED NET IRR Mid-Teens First sidecar of its kind in the industry Direct equity capital to support Athene’s growth Greater third-party participation & capital efficiency for Athene STRONG INVESTMENT PERFORMANCE FOR ADIP I POSITIONED FOR A STRONG ADIP II FUNDRAISE

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene Has a Disciplined Investment Philosophy 30 Target higher and sustainable risk- adjusted returns by capturing illiquidity premia to drive consistent yield outperformance Focus on downside protection given long-dated liability profile and low cost of funding Dynamic asset allocation to take advantage of market dislocations Differentiation driven by proprietary asset origination and greater asset expertise

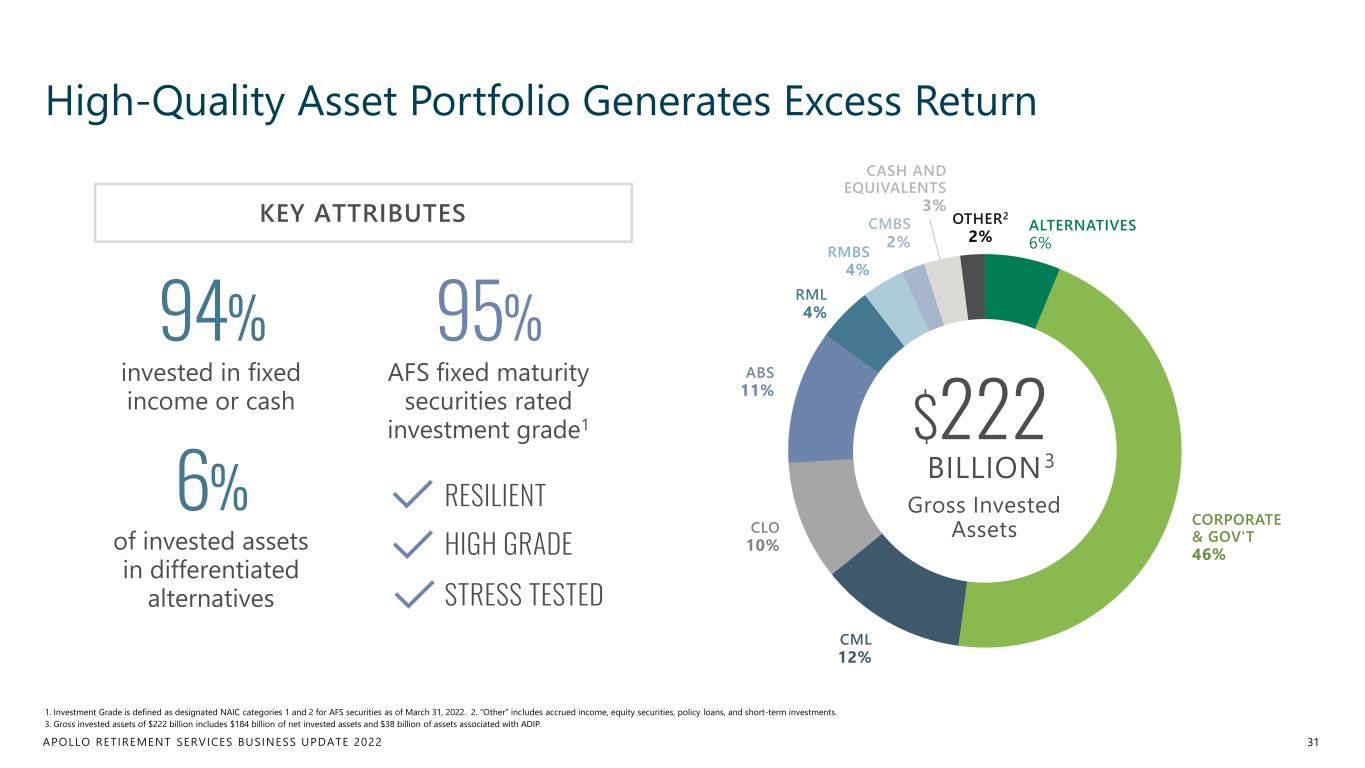

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 ALTERNATIVES 6% CORPORATE & GOV'T 46% CML 12% CLO 10% ABS 11% RML 4% RMBS 4% CMBS 2% CASH AND EQUIVALENTS 3% OTHER2 2% $222 BILLION High-Quality Asset Portfolio Generates Excess Return 31 1. Investment Grade is defined as designated NAIC categories 1 and 2 for AFS securities as of March 31, 2022. 2. “Other” includes accrued income, equity securities, policy loans, and short-term investments. 3. Gross invested assets of $222 billion includes $184 billion of net invested assets and $38 billion of assets associated with ADIP. AFS fixed maturity securities rated investment grade1 RESILIENT HIGH GRADE STRESS TESTED KEY ATTRIBUTES 95% invested in fixed income or cash 94% of invested assets in differentiated alternatives 6% 3 Gross Invested Assets

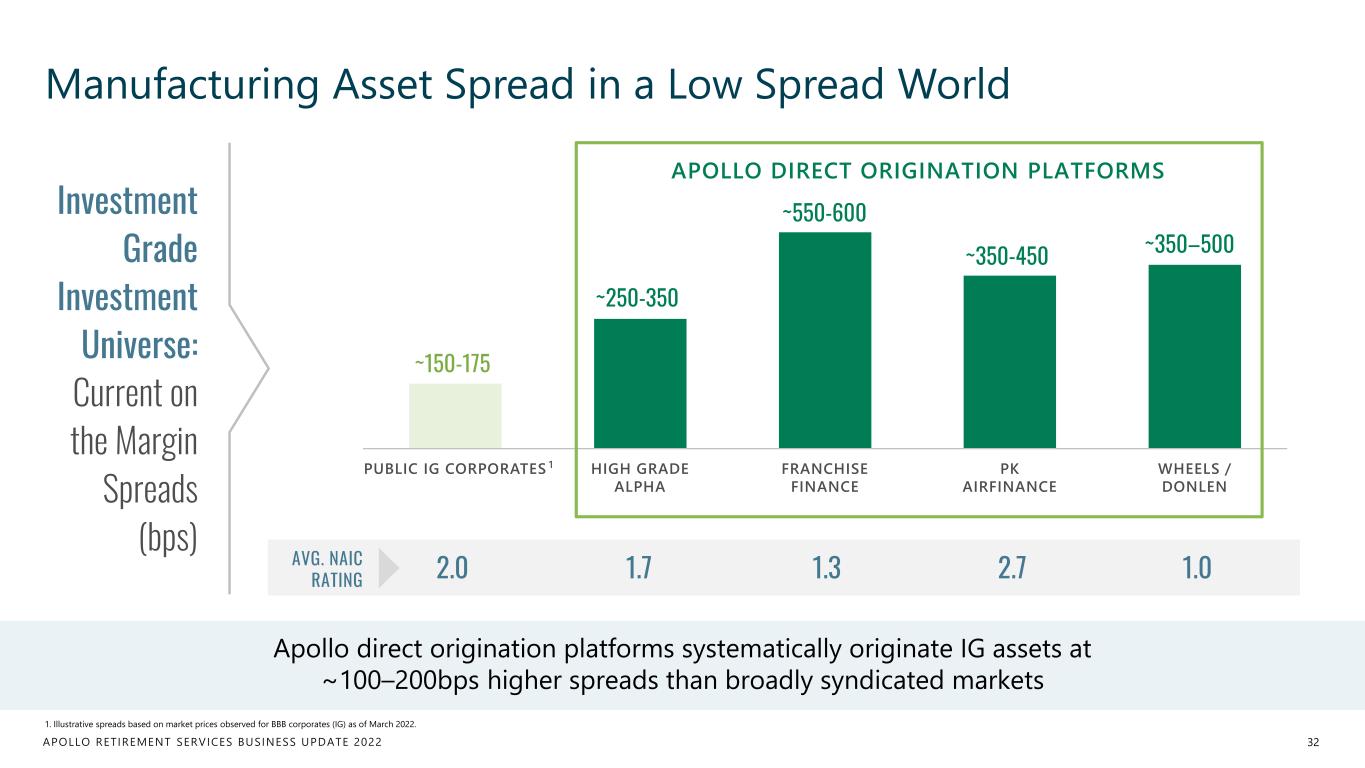

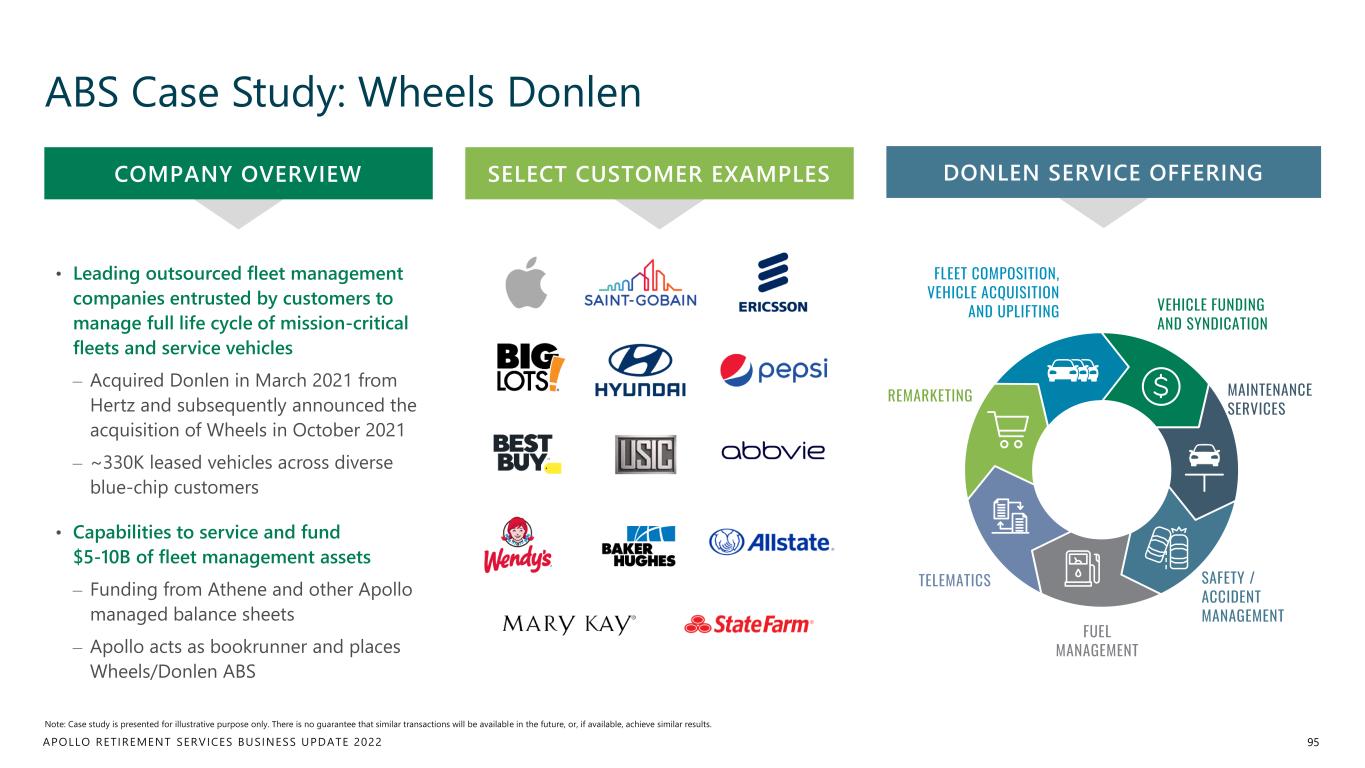

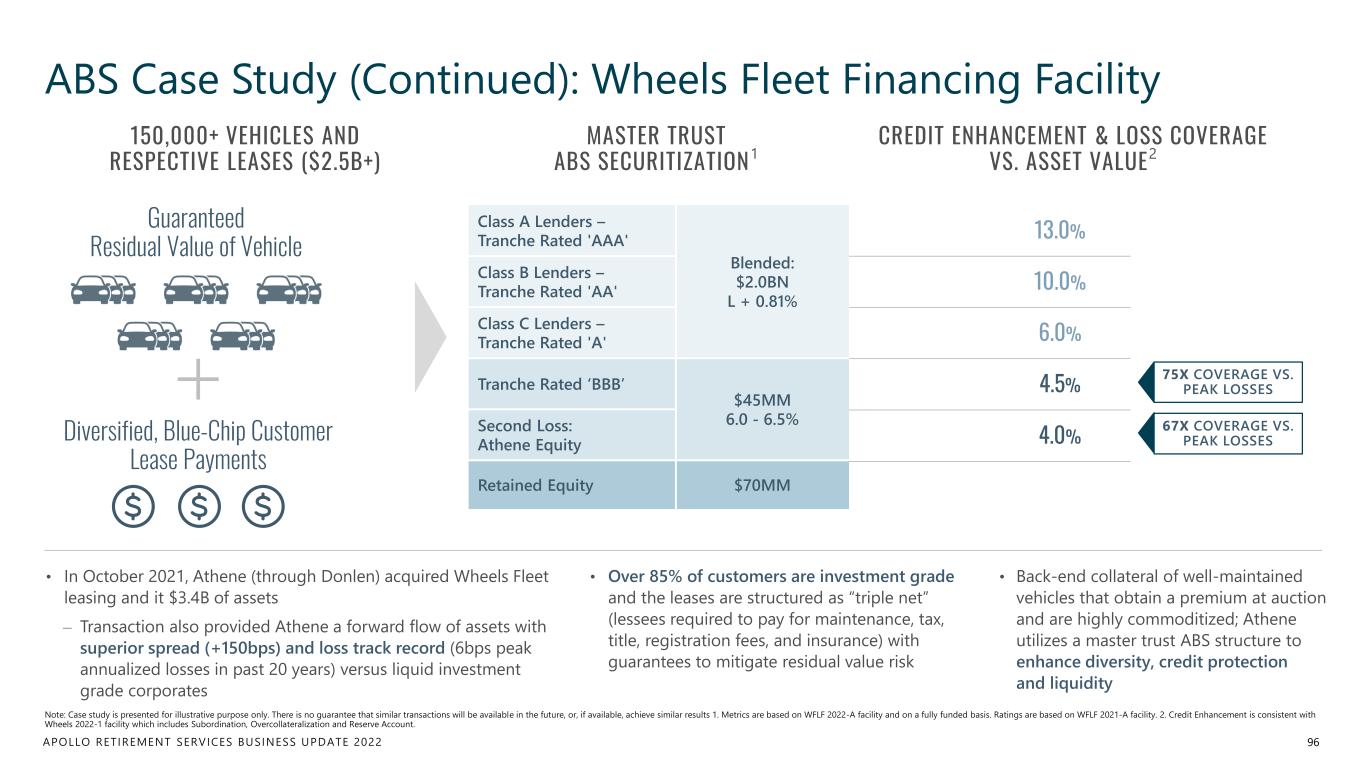

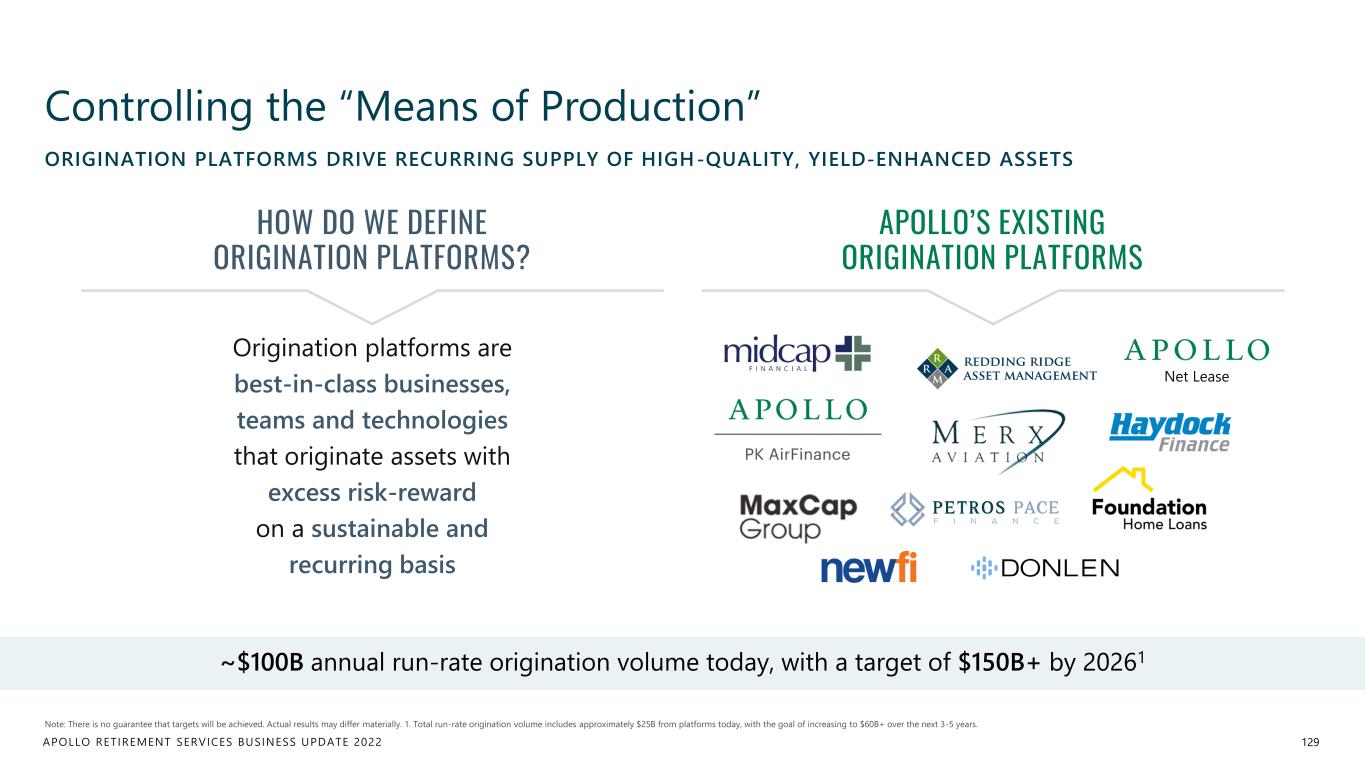

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Manufacturing Asset Spread in a Low Spread World 32 1. Illustrative spreads based on market prices observed for BBB corporates (IG) as of March 2022. PUBLIC IG CORPORATES HIGH GRADE ALPHA FRANCHISE FINANCE PK AIRFINANCE WHEELS / DONLEN ~550-600 ~350-450 ~350–500 ~250-350 ~150-175 Apollo direct origination platforms systematically originate IG assets at ~100–200bps higher spreads than broadly syndicated markets Investment Grade Investment Universe: Current on the Margin Spreads (bps) APOLLO DIRECT ORIGINATION PLATFORMS 1 AVG. NAIC RATING 2.0 1.7 1.3 2.7 1.0

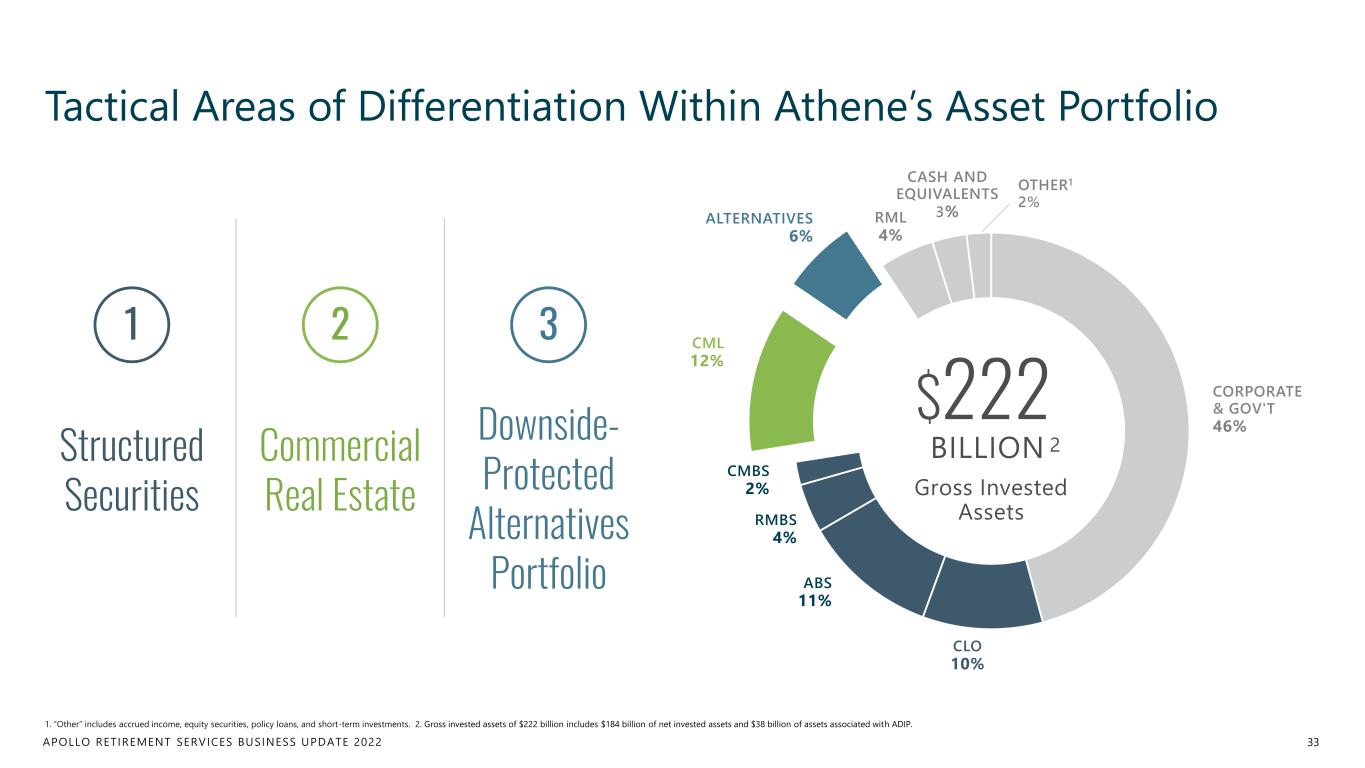

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Tactical Areas of Differentiation Within Athene’s Asset Portfolio 33 Structured Securities 1 Commercial Real Estate 2 Downside- Protected Alternatives Portfolio 3 CORPORATE & GOV'T 46% CLO 10% ABS 11% RMBS 4% CMBS 2% CML 12% ALTERNATIVES 6% RML 4% CASH AND EQUIVALENTS 3% OTHER1 2% $222 BILLION 2 Gross Invested Assets 1. “Other” includes accrued income, equity securities, policy loans, and short-term investments. 2. Gross invested assets of $222 billion includes $184 billion of net invested assets and $38 billion of assets associated with ADIP.

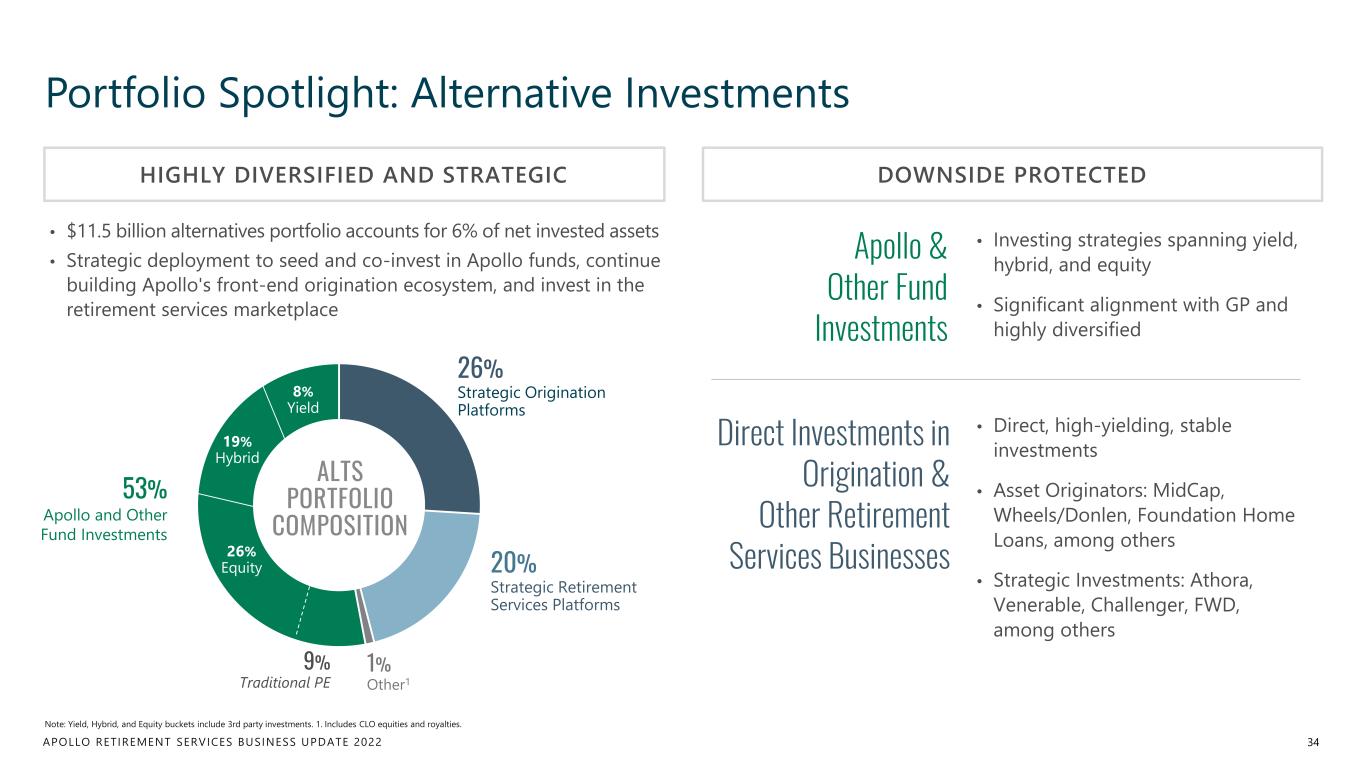

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 8% Yield 19% Hybrid 26% Equity 34 Note: Yield, Hybrid, and Equity buckets include 3rd party investments. 1. Includes CLO equities and royalties. • $11.5 billion alternatives portfolio accounts for 6% of net invested assets • Strategic deployment to seed and co-invest in Apollo funds, continue building Apollo's front-end origination ecosystem, and invest in the retirement services marketplace 53% Apollo and Other Fund Investments 26% Strategic Origination Platforms 20% Strategic Retirement Services Platforms 1% Other1 9% Traditional PE HIGHLY DIVERSIFIED AND STRATEGIC ALTS PORTFOLIO COMPOSITION • Investing strategies spanning yield, hybrid, and equity • Significant alignment with GP and highly diversified Apollo & Other Fund Investments Direct Investments in Origination & Other Retirement Services Businesses • Direct, high-yielding, stable investments • Asset Originators: MidCap, Wheels/Donlen, Foundation Home Loans, among others • Strategic Investments: Athora, Venerable, Challenger, FWD, among others DOWNSIDE PROTECTED Portfolio Spotlight: Alternative Investments

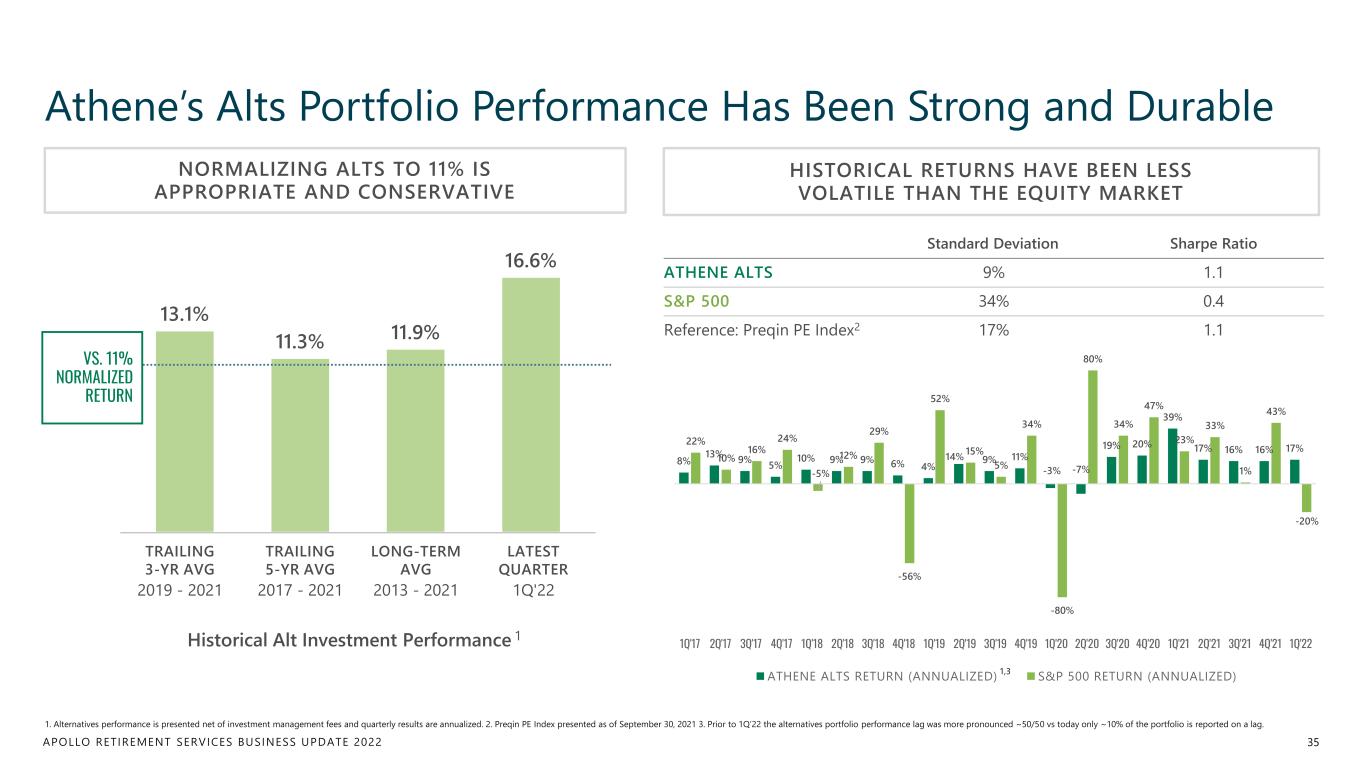

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 8% 13% 9% 5% 10% 9% 9% 6% 4% 14% 9% 11% -3% -7% 19% 20% 39% 17% 16% 16% 17% 22% 10% 16% 24% -5% 12% 29% -56% 52% 15% 5% 34% -80% 80% 34% 47% 23% 33% 1% 43% -20% 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 ATHENE ALTS RETURN (ANNUALIZED) S&P 500 RETURN (ANNUALIZED) Athene’s Alts Portfolio Performance Has Been Strong and Durable 35 1. Alternatives performance is presented net of investment management fees and quarterly results are annualized. 2. Preqin PE Index presented as of September 30, 2021 3. Prior to 1Q’22 the alternatives portfolio performance lag was more pronounced ~50/50 vs today only ~10% of the portfolio is reported on a lag. TRAILING 3-YR AVG TRAILING 5-YR AVG LONG-TERM AVG LATEST QUARTER 2019 - 2021 2017 - 2021 2013 - 2021 1Q'22 Standard Deviation Sharpe Ratio ATHENE ALTS 9% 1.1 S&P 500 34% 0.4 Reference: Preqin PE Index2 17% 1.1 NORMALIZING ALTS TO 11% IS APPROPRIATE AND CONSERVATIVE HISTORICAL RETURNS HAVE BEEN LESS VOLATILE THAN THE EQUITY MARKET 13.1% 11.3% 11.9% 16.6% VS. 11% NORMALIZED RETURN Historical Alt Investment Performance 1 1,3

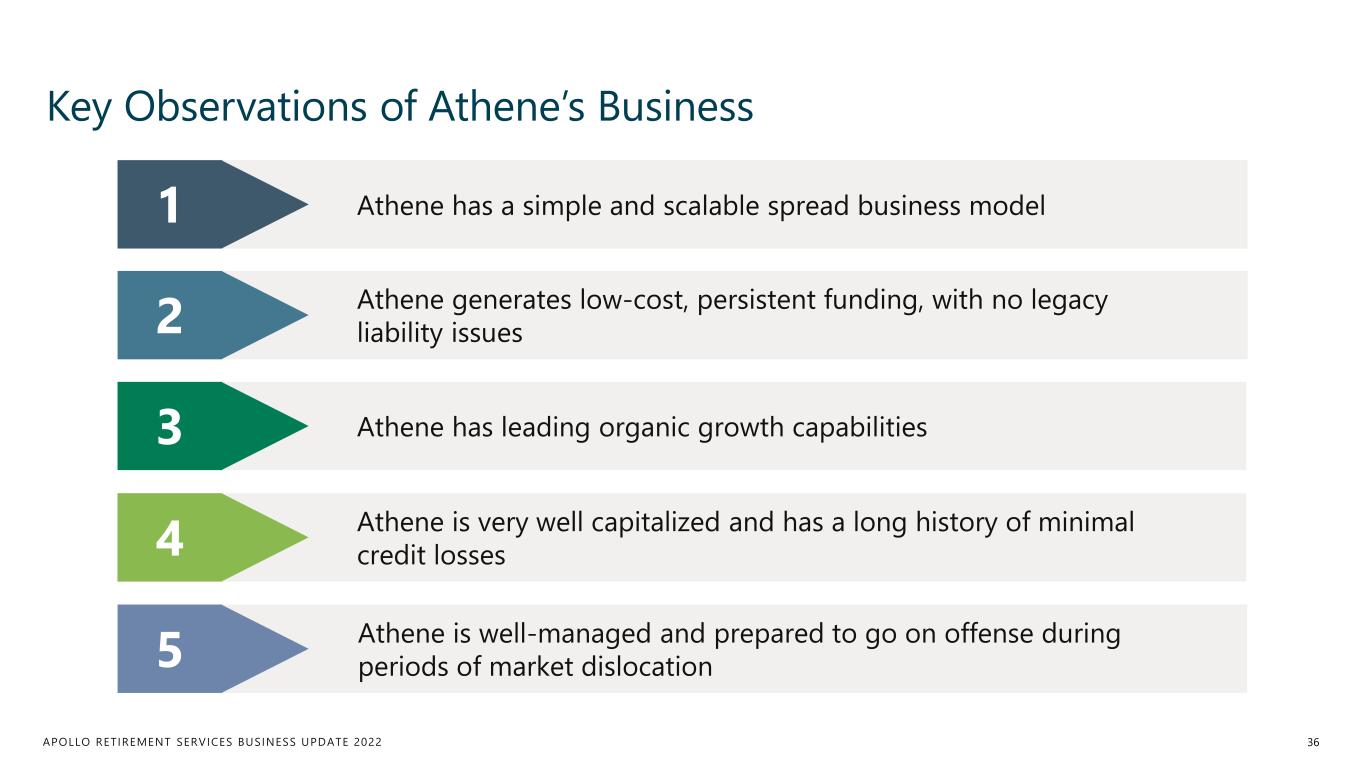

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Key Observations of Athene’s Business 36 Athene has a simple and scalable spread business model 1 2 Athene generates low-cost, persistent funding, with no legacy liability issues 3 Athene has leading organic growth capabilities 4 Athene is very well capitalized and has a long history of minimal credit losses 5 Athene is well-managed and prepared to go on offense during periods of market dislocation

Growth Engine GRANT KVALHEIM President & USA Chief Executive Officer, Athene

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 FLOW REINSURANCE FUNDING AGREEMENTS Athene Has Various Channels From Which to Generate Inflows 38 Organic Growth RETAIL ANNUITIES PENSION GROUP ANNUITIES Inorganic Growth BLOCK REINSURANCE ACQUISITIONS COMPELLING GROWTH STRONG RETURNS

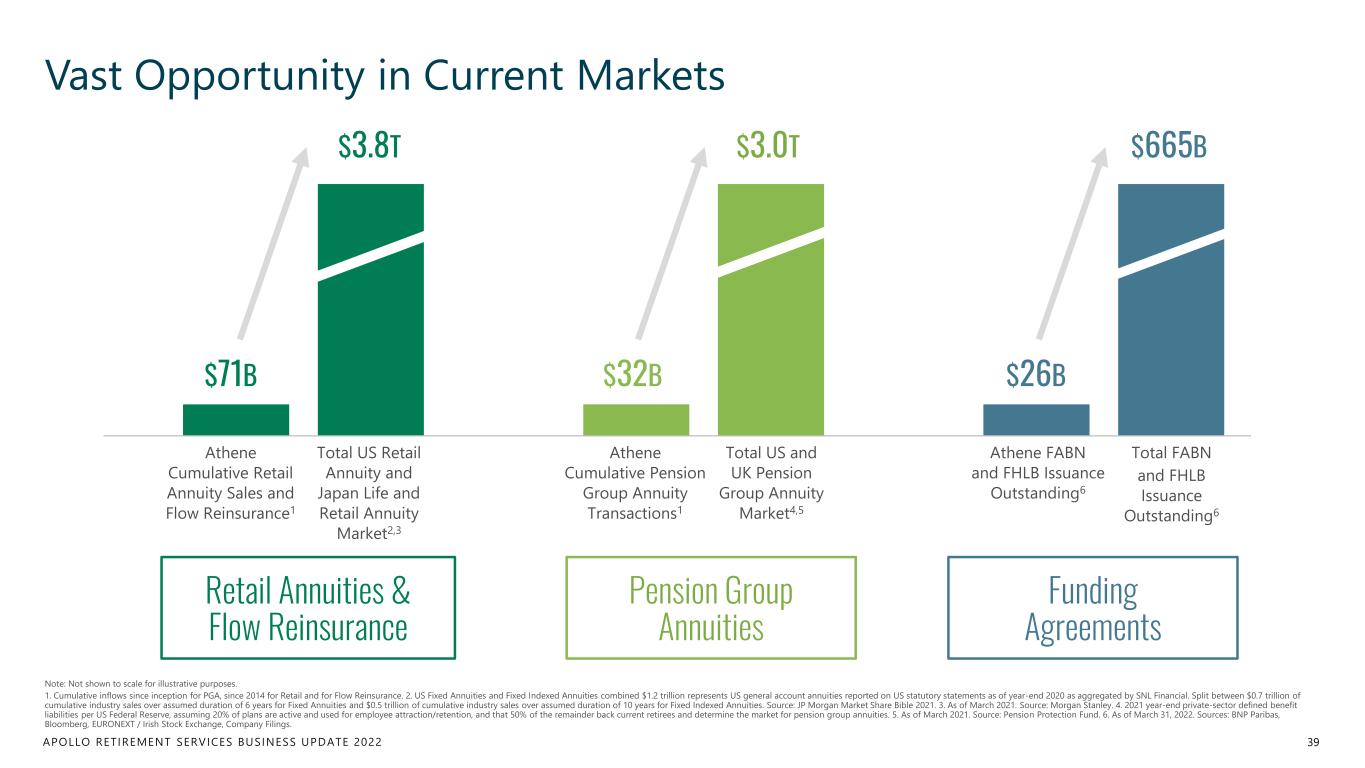

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Vast Opportunity in Current Markets 39 Note: Not shown to scale for illustrative purposes. 1. Cumulative inflows since inception for PGA, since 2014 for Retail and for Flow Reinsurance. 2. US Fixed Annuities and Fixed Indexed Annuities combined $1.2 trillion represents US general account annuities reported on US statutory statements as of year-end 2020 as aggregated by SNL Financial. Split between $0.7 trillion of cumulative industry sales over assumed duration of 6 years for Fixed Annuities and $0.5 trillion of cumulative industry sales over assumed duration of 10 years for Fixed Indexed Annuities. Source: JP Morgan Market Share Bible 2021. 3. As of March 2021. Source: Morgan Stanley. 4. 2021 year-end private-sector defined benefit liabilities per US Federal Reserve, assuming 20% of plans are active and used for employee attraction/retention, and that 50% of the remainder back current retirees and determine the market for pension group annuities. 5. As of March 2021. Source: Pension Protection Fund. 6. As of March 31, 2022. Sources: BNP Paribas, Bloomberg, EURONEXT / Irish Stock Exchange, Company Filings. $665B $26B $3.0T $32B$71B $3.8T Total FABN and FHLB Issuance Outstanding6 Athene FABN and FHLB Issuance Outstanding6 Athene Cumulative Pension Group Annuity Transactions1 Total US and UK Pension Group Annuity Market4,5 Athene Cumulative Retail Annuity Sales and Flow Reinsurance1 Total US Retail Annuity and Japan Life and Retail Annuity Market2,3 Retail Annuities & Flow Reinsurance Pension Group Annuities Funding Agreements

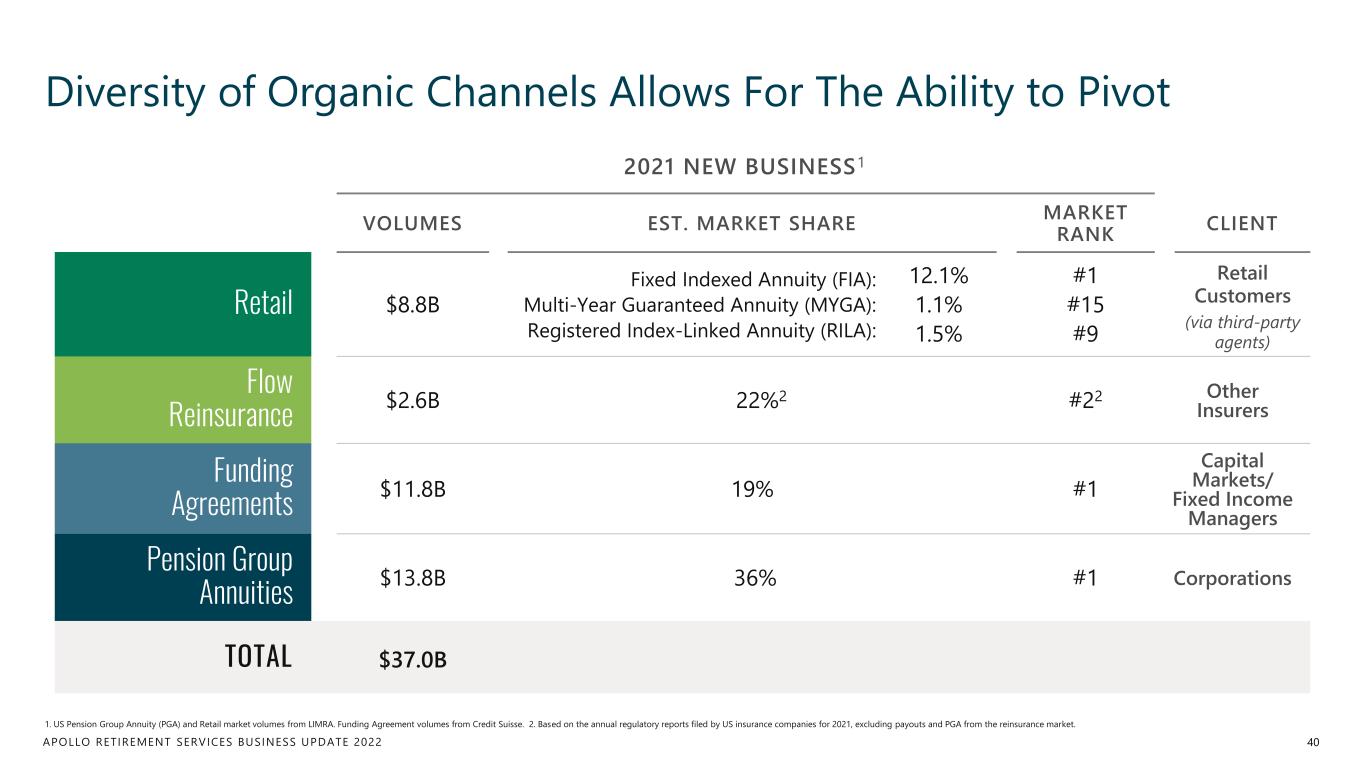

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Diversity of Organic Channels Allows For The Ability to Pivot 40 1. US Pension Group Annuity (PGA) and Retail market volumes from LIMRA. Funding Agreement volumes from Credit Suisse. 2. Based on the annual regulatory reports filed by US insurance companies for 2021, excluding payouts and PGA from the reinsurance market. VOLUMES EST. MARKET SHARE MARKET RANK CLIENT Retail $8.8B Fixed Indexed Annuity (FIA): Multi-Year Guaranteed Annuity (MYGA): Registered Index-Linked Annuity (RILA): 12.1% 1.1% 1.5% #1 #15 #9 Retail Customers (via third-party agents) Flow Reinsurance $2.6B 22%2 #22 Other Insurers Funding Agreements $11.8B 19% #1 Capital Markets/ Fixed Income Managers Pension Group Annuities $13.8B 36% #1 Corporations TOTAL $37.0B 2021 NEW BUSINESS1

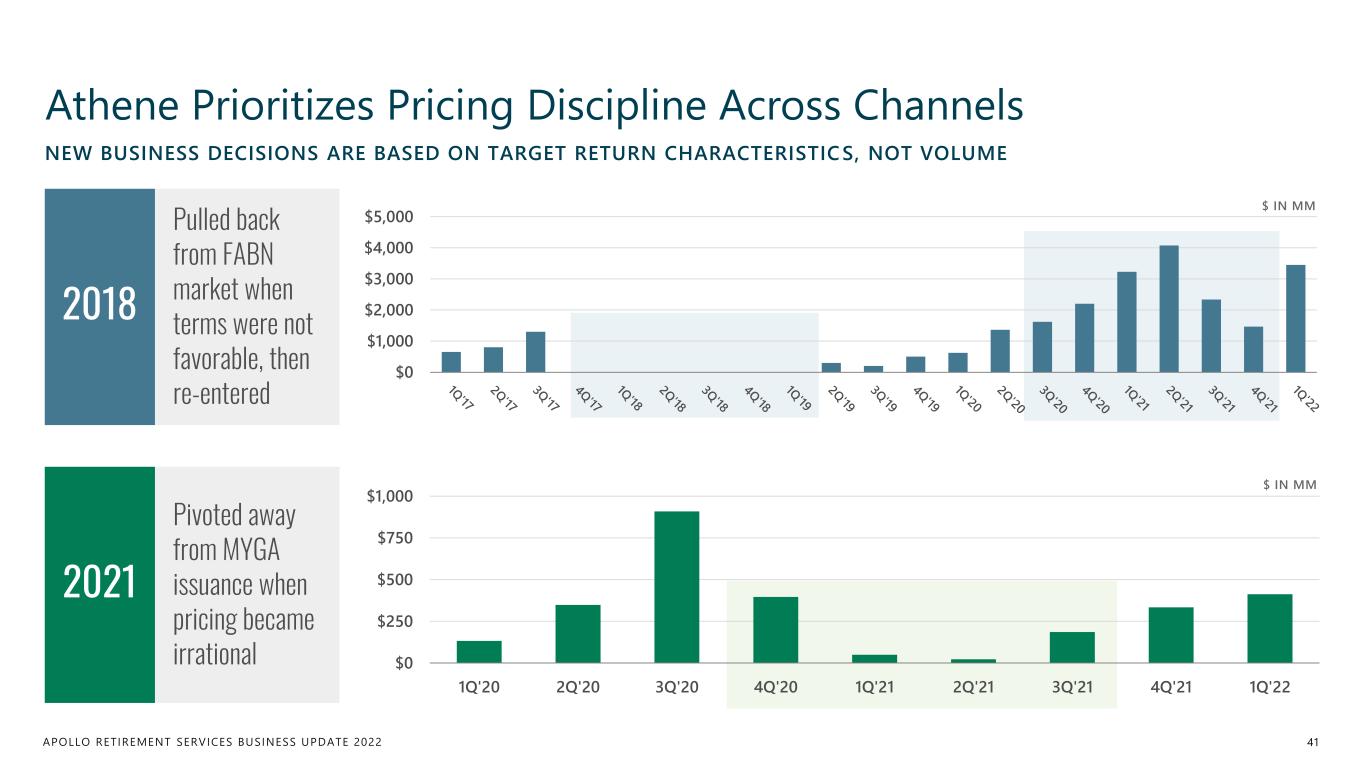

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 $0 $1,000 $2,000 $3,000 $4,000 $5,000 NEW BUSINESS DECISIONS ARE BASED ON TARGET RETURN CHARACTERISTIC S, NOT VOLUME Athene Prioritizes Pricing Discipline Across Channels 41 $0 $250 $500 $750 $1,000 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 2018 $ IN MM $ IN MM Pulled back from FABN market when terms were not favorable, then re-entered 2021 Pivoted away from MYGA issuance when pricing became irrational

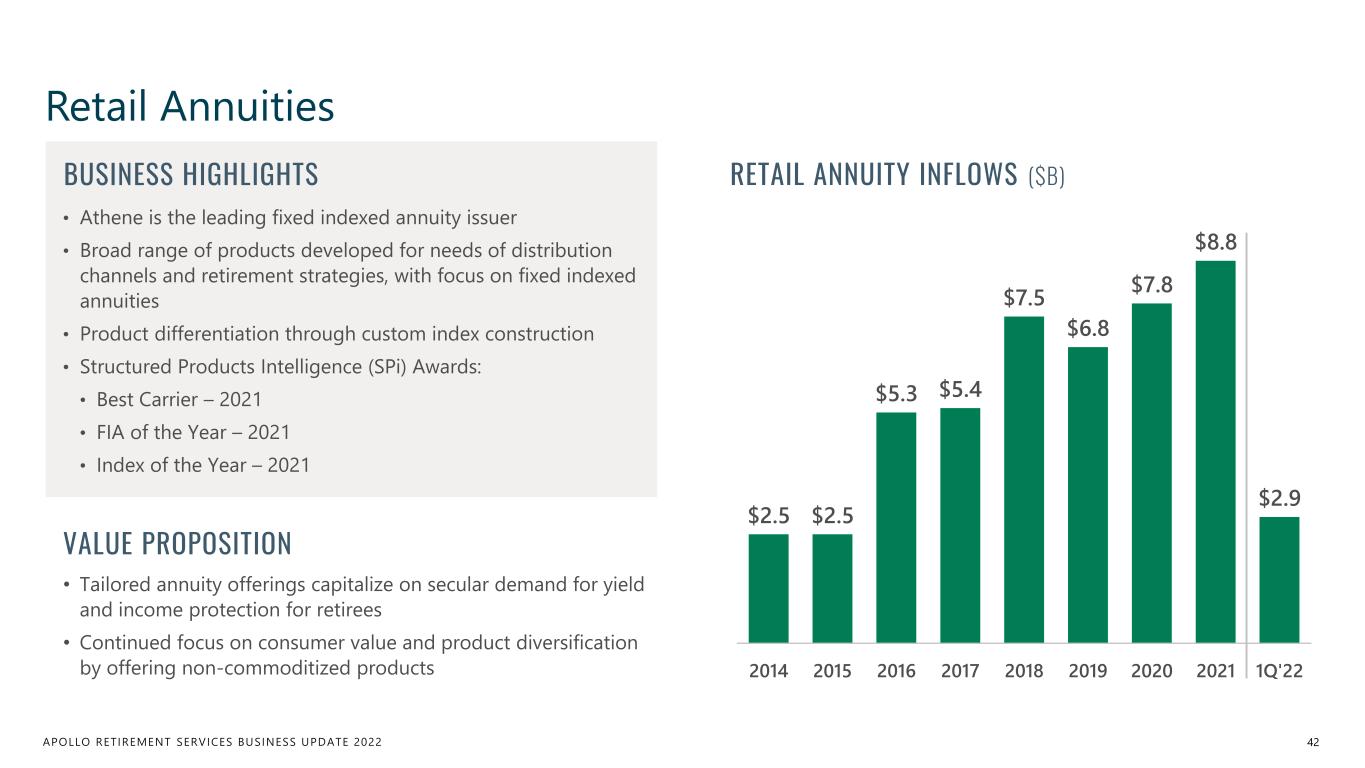

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Retail Annuities 42 $2.5 $2.5 $5.3 $5.4 $7.5 $6.8 $7.8 $8.8 $2.9 2014 2015 2016 2017 2018 2019 2020 2021 1Q'22 VALUE PROPOSITION • Tailored annuity offerings capitalize on secular demand for yield and income protection for retirees • Continued focus on consumer value and product diversification by offering non-commoditized products BUSINESS HIGHLIGHTS • Athene is the leading fixed indexed annuity issuer • Broad range of products developed for needs of distribution channels and retirement strategies, with focus on fixed indexed annuities • Product differentiation through custom index construction • Structured Products Intelligence (SPi) Awards: • Best Carrier – 2021 • FIA of the Year – 2021 • Index of the Year – 2021 RETAIL ANNUITY INFLOWS ($B)

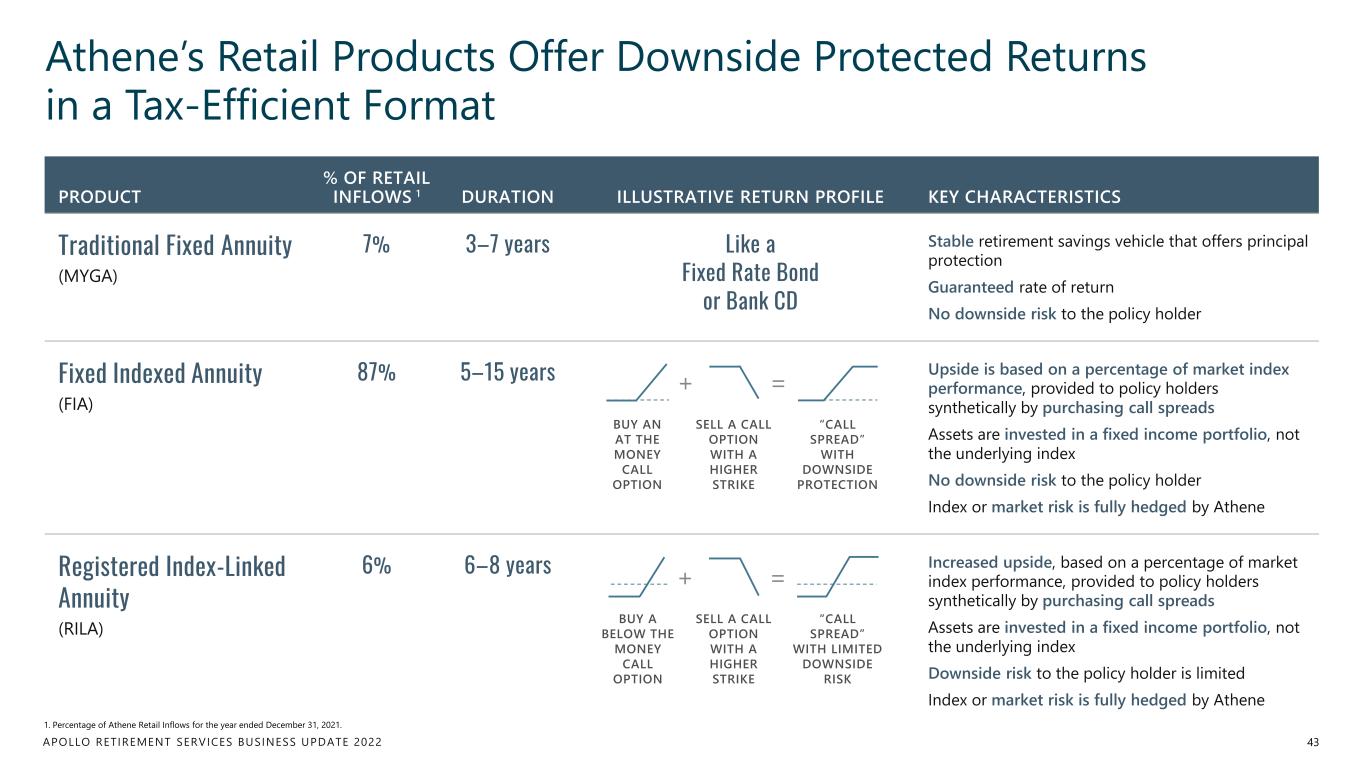

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 PRODUCT % OF RETAIL INFLOWS 1 DURATION ILLUSTRATIVE RETURN PROFILE KEY CHARACTERISTICS Traditional Fixed Annuity (MYGA) 7% 3–7 years Like a Fixed Rate Bond or Bank CD Stable retirement savings vehicle that offers principal protection Guaranteed rate of return No downside risk to the policy holder Fixed Indexed Annuity (FIA) 87% 5–15 years Upside is based on a percentage of market index performance, provided to policy holders synthetically by purchasing call spreads Assets are invested in a fixed income portfolio, not the underlying index No downside risk to the policy holder Index or market risk is fully hedged by Athene Registered Index-Linked Annuity (RILA) 6% 6–8 years Increased upside, based on a percentage of market index performance, provided to policy holders synthetically by purchasing call spreads Assets are invested in a fixed income portfolio, not the underlying index Downside risk to the policy holder is limited Index or market risk is fully hedged by Athene Athene’s Retail Products Offer Downside Protected Returns in a Tax-Efficient Format 43 1. Percentage of Athene Retail Inflows for the year ended December 31, 2021. SELL A CALL OPTION WITH A HIGHER STRIKE BUY AN AT THE MONEY CALL OPTION “CALL SPREAD” WITH DOWNSIDE PROTECTION + = + SELL A CALL OPTION WITH A HIGHER STRIKE = BUY A BELOW THE MONEY CALL OPTION “CALL SPREAD” WITH LIMITED DOWNSIDE RISK

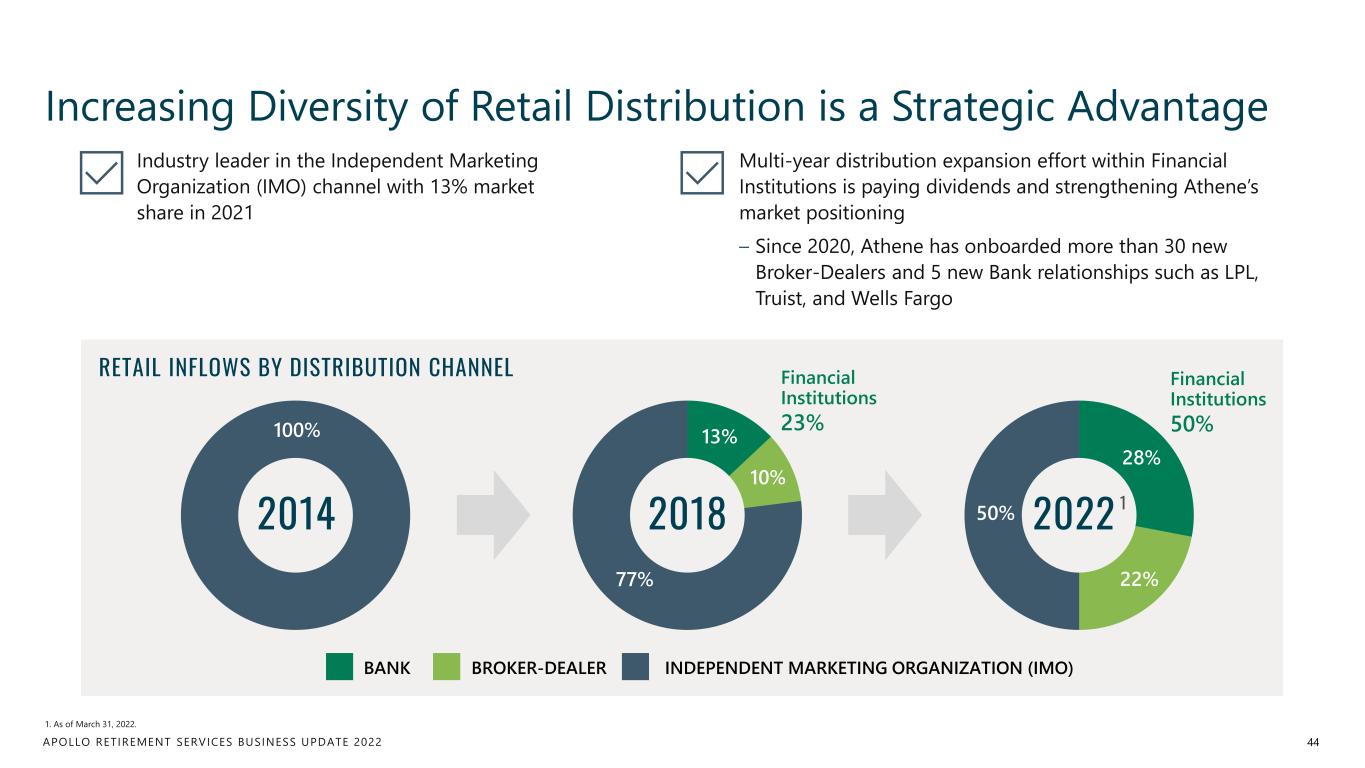

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Increasing Diversity of Retail Distribution is a Strategic Advantage RETAIL INFLOWS BY DISTRIBUTION CHANNEL Industry leader in the Independent Marketing Organization (IMO) channel with 13% market share in 2021 1. As of March 31, 2022. 44 Multi-year distribution expansion effort within Financial Institutions is paying dividends and strengthening Athene’s market positioning – Since 2020, Athene has onboarded more than 30 new Broker-Dealers and 5 new Bank relationships such as LPL, Truist, and Wells Fargo 2018 2022 1 Financial Institutions 23% Financial Institutions 50% 2014 100% 13% 10% 77% 28% 22% 50% BANK INDEPENDENT MARKETING ORGANIZATION (IMO)BROKER-DEALER

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 BUSINESS HIGHLIGHTS & KEY DRIVERS • Grew to be the market leader in 2020 and 2021 • Through several signature transactions, Athene has become a partner of choice for blue-chip corporate pension plan sponsors • Driven by long-term secular shift by corporations away from managing pension assets internally • Provides simplicity and consistent income to retirees while offering increased efficiency to corporations and plan sponsors Pension Group Annuities 45 $2.2 $2.6 $6.0 $5.4 $13.8 $2.0 2017 2018 2019 2020 2021 1Q'22 WHAT IS A PENSION GROUP ANNUITY? Occurs when a defined benefit pension plan sponsor transfers some or all of the plan’s liabilities to a highly rated insurer That company issues a group (“bulk”) annuity which provides benefit continuity for all the pensioners within the plan 1 2 PENSION GROUP ANNUITY INFLOWS ($B)

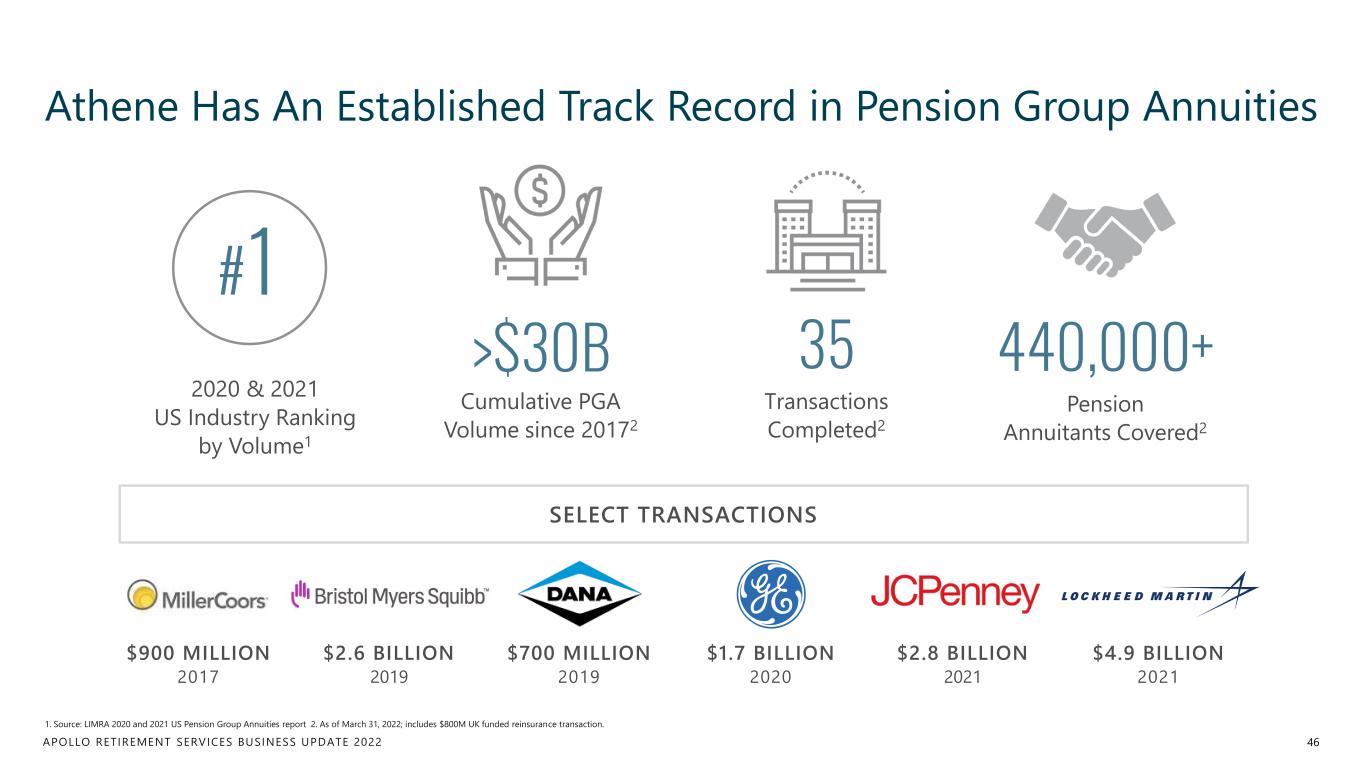

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene Has An Established Track Record in Pension Group Annuities SELECT TRANSACTIONS 1. Source: LIMRA 2020 and 2021 US Pension Group Annuities report 2. As of March 31, 2022; includes $800M UK funded reinsurance transaction. 46 Pension Annuitants Covered2 >$30B 35 440,000+ Cumulative PGA Volume since 20172 Transactions Completed2 2020 & 2021 US Industry Ranking by Volume1 #1 $2.6 BILLION 2019 $2.8 BILLION 2021 $900 MILLION 2017 $4.9 BILLION 2021 $1.7 BILLION 2020 $700 MILLION 2019

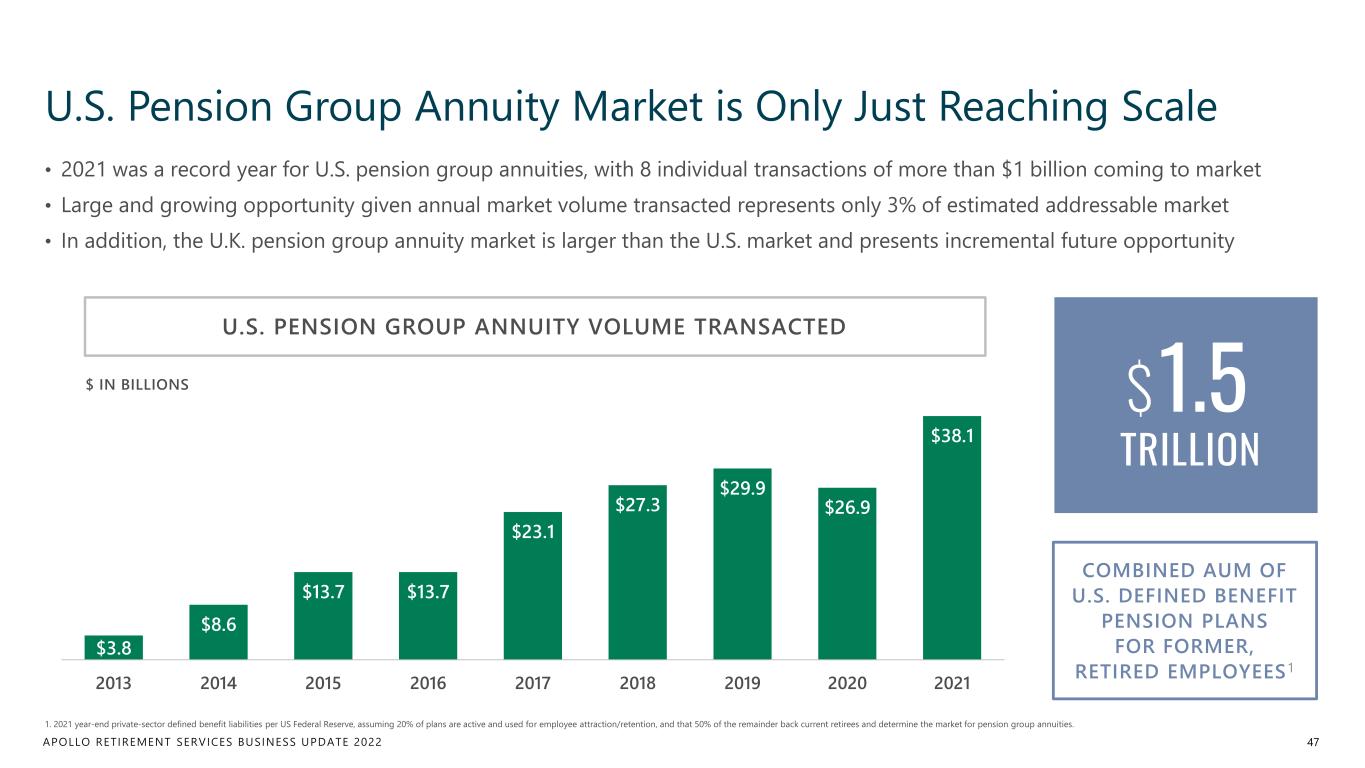

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 U.S. Pension Group Annuity Market is Only Just Reaching Scale 47 1. 2021 year-end private-sector defined benefit liabilities per US Federal Reserve, assuming 20% of plans are active and used for employee attraction/retention, and that 50% of the remainder back current retirees and determine the market for pension group annuities. $3.8 $8.6 $13.7 $13.7 $23.1 $27.3 $29.9 $26.9 $38.1 2013 2014 2015 2016 2017 2018 2019 2020 2021 $ IN BILLIONS U.S. PENSION GROUP ANNUITY VOLUME TRANSACTED COMBINED AUM OF U.S. DEFINED BENEFIT PENSION PLANS FOR FORMER, RETIRED EMPLOYEES1 • 2021 was a record year for U.S. pension group annuities, with 8 individual transactions of more than $1 billion coming to market • Large and growing opportunity given annual market volume transacted represents only 3% of estimated addressable market • In addition, the U.K. pension group annuity market is larger than the U.S. market and presents incremental future opportunity $1.5 TRILLION

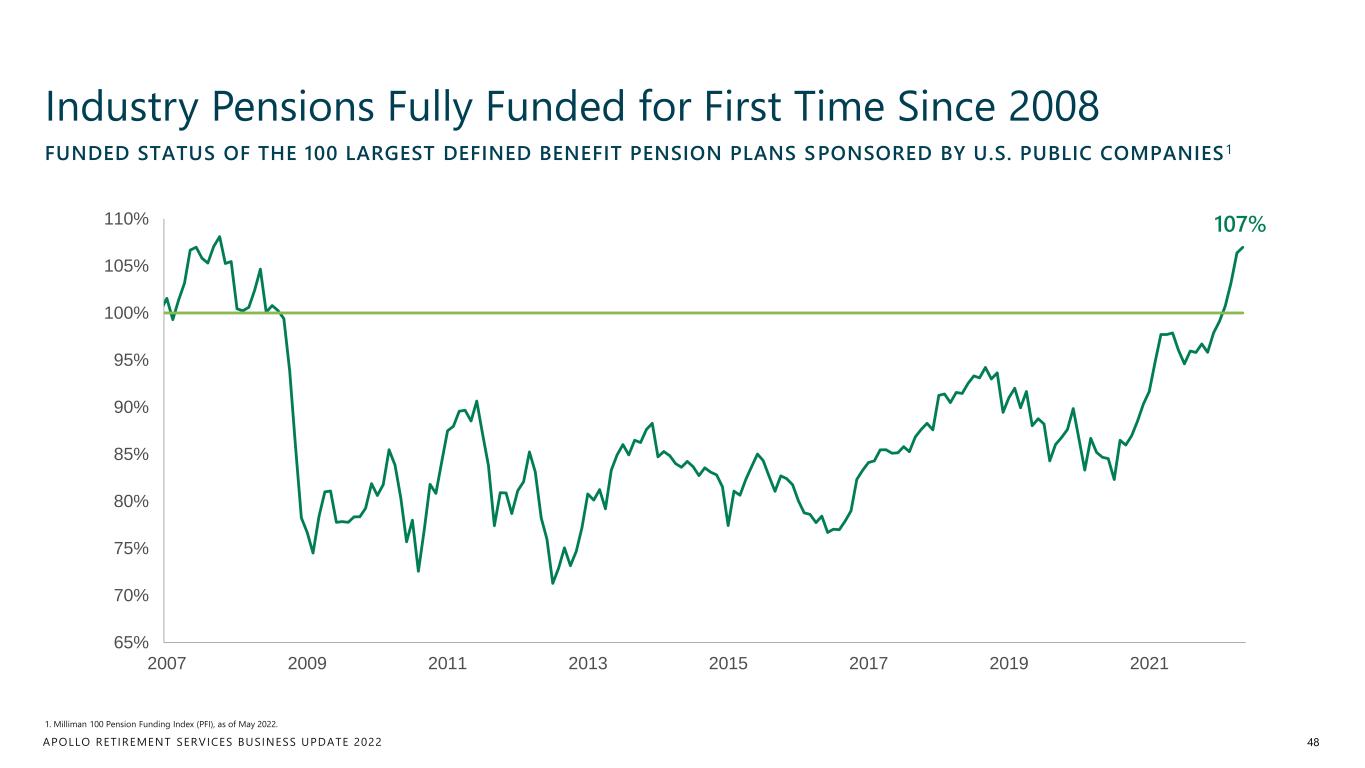

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Industry Pensions Fully Funded for First Time Since 2008 48 1. Milliman 100 Pension Funding Index (PFI), as of May 2022. FUNDED STATUS OF THE 100 LARGEST DEFINED BENEFIT PENSION PLANS SPONSORED BY U.S. PUBLIC COMPANIES1 107% 65% 70% 75% 80% 85% 90% 95% 100% 105% 110% 2007 2009 2011 2013 2015 2017 2019 2021

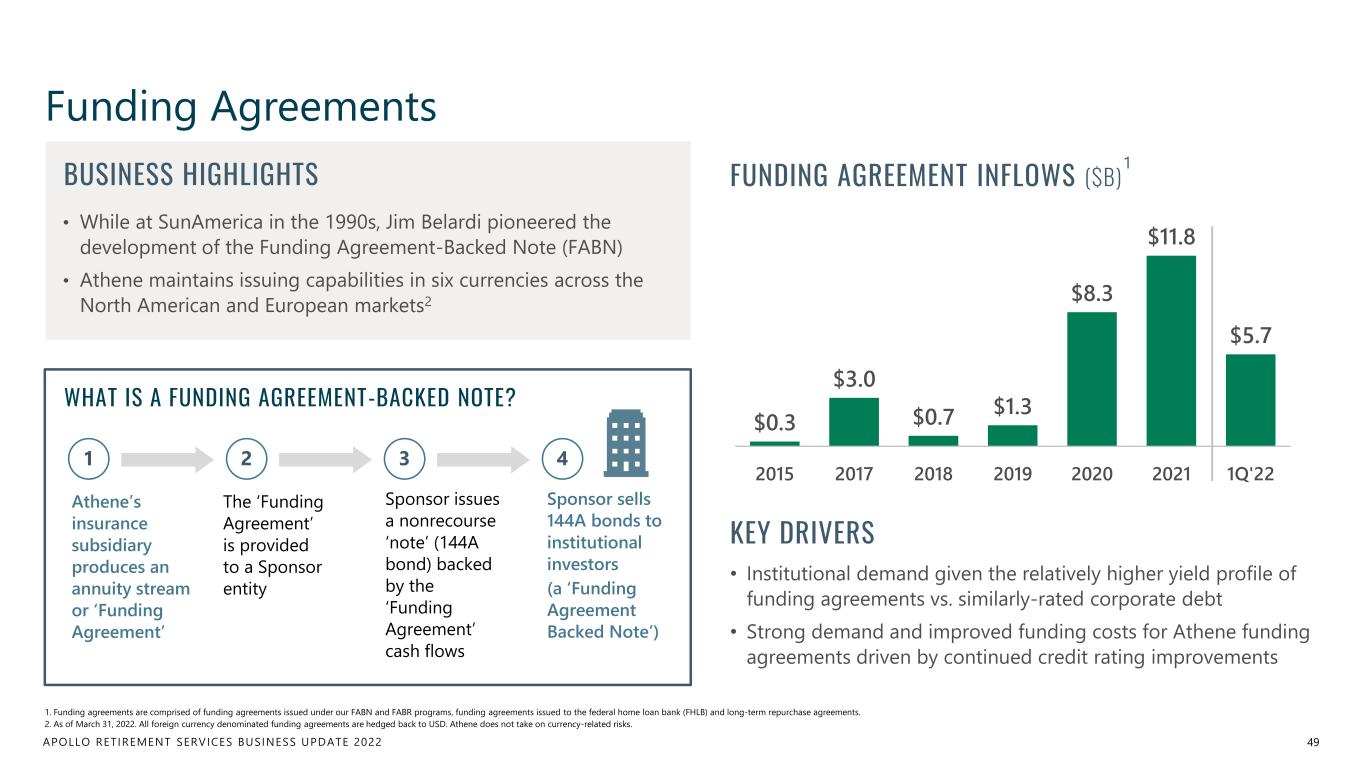

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 BUSINESS HIGHLIGHTS • While at SunAmerica in the 1990s, Jim Belardi pioneered the development of the Funding Agreement-Backed Note (FABN) • Athene maintains issuing capabilities in six currencies across the North American and European markets2 Funding Agreements 49 1. Funding agreements are comprised of funding agreements issued under our FABN and FABR programs, funding agreements issued to the federal home loan bank (FHLB) and long-term repurchase agreements. 2. As of March 31, 2022. All foreign currency denominated funding agreements are hedged back to USD. Athene does not take on currency-related risks. $0.3 $3.0 $0.7 $1.3 $8.3 $11.8 $5.7 2015 2017 2018 2019 2020 2021 1Q'22 FUNDING AGREEMENT INFLOWS ($B) 1 KEY DRIVERS • Institutional demand given the relatively higher yield profile of funding agreements vs. similarly-rated corporate debt • Strong demand and improved funding costs for Athene funding agreements driven by continued credit rating improvements WHAT IS A FUNDING AGREEMENT-BACKED NOTE? The ‘Funding Agreement’ is provided to a Sponsor entity 21 Athene’s insurance subsidiary produces an annuity stream or ‘Funding Agreement’ Sponsor issues a nonrecourse ‘note’ (144A bond) backed by the ‘Funding Agreement’ cash flows 3 Sponsor sells 144A bonds to institutional investors (a ‘Funding Agreement Backed Note’) 4

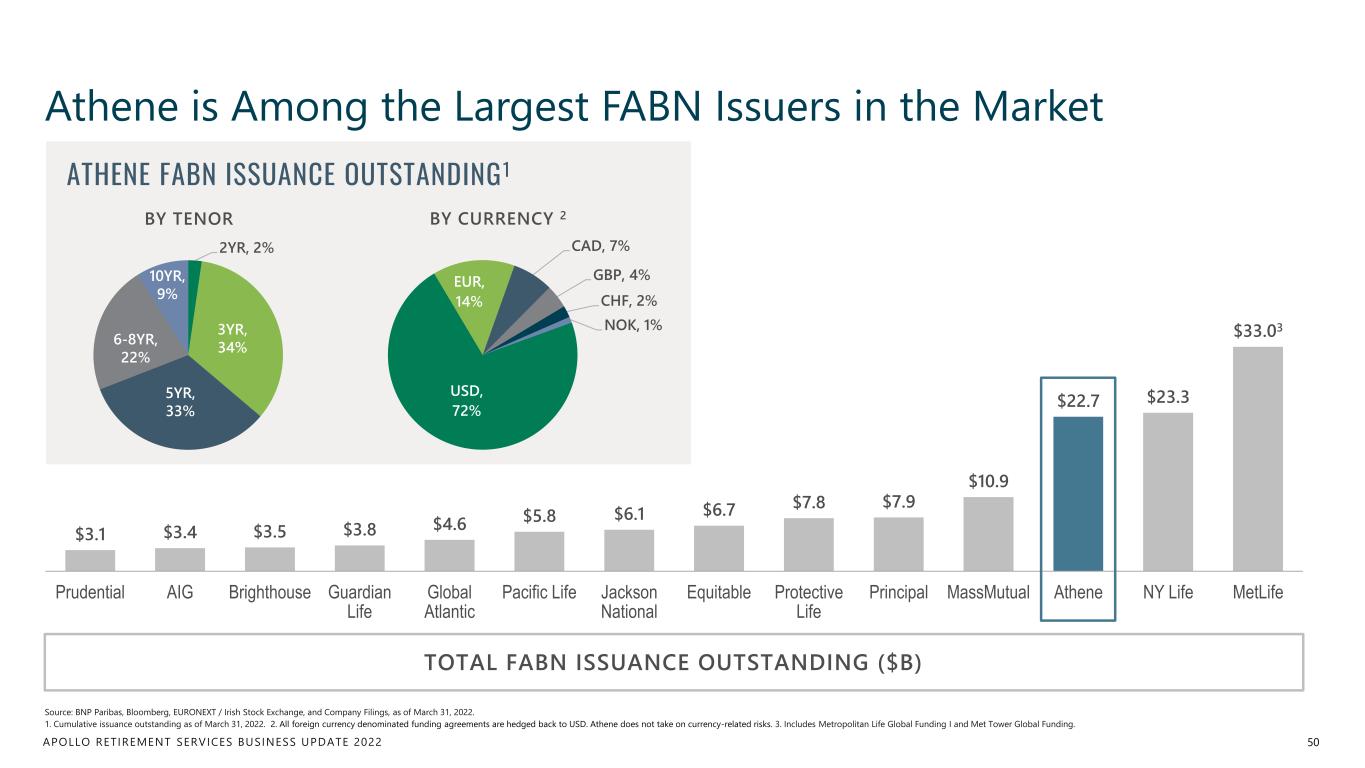

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 $3.1 $3.4 $3.5 $3.8 $4.6 $5.8 $6.1 $6.7 $7.8 $7.9 $10.9 $22.7 $23.3 $33.03 Prudential AIG Brighthouse Guardian Life Global Atlantic Pacific Life Jackson National Equitable Protective Life Principal MassMutual Athene NY Life MetLife TOTAL FABN ISSUANCE OUTSTANDING ($B) Athene is Among the Largest FABN Issuers in the Market 50 Source: BNP Paribas, Bloomberg, EURONEXT / Irish Stock Exchange, and Company Filings, as of March 31, 2022. 1. Cumulative issuance outstanding as of March 31, 2022. 2. All foreign currency denominated funding agreements are hedged back to USD. Athene does not take on currency-related risks. 3. Includes Metropolitan Life Global Funding I and Met Tower Global Funding. 2YR, 2% 3YR, 34% 5YR, 33% 6-8YR, 22% 10YR, 9% USD, 72% EUR, 14% CAD, 7% GBP, 4% CHF, 2% NOK, 1% BY TENOR BY CURRENCY 2 ATHENE FABN ISSUANCE OUTSTANDING1

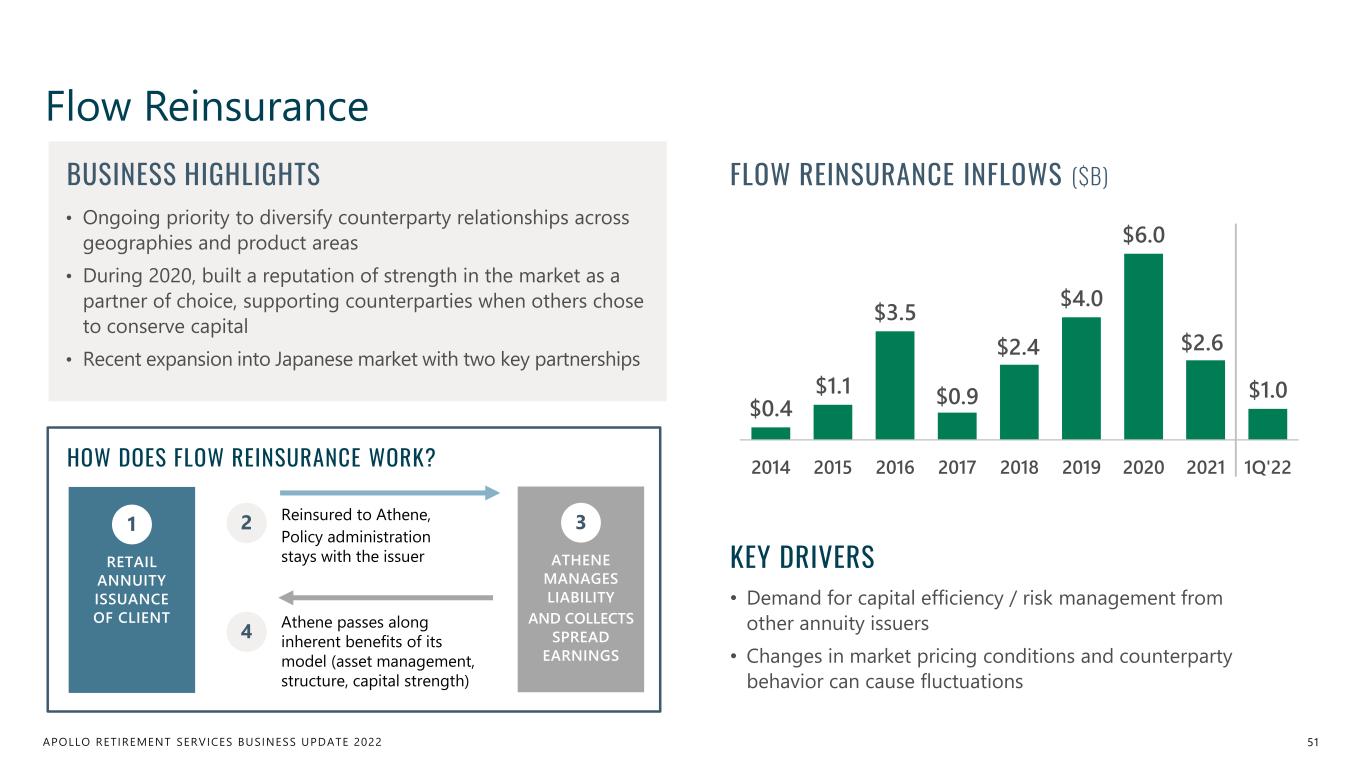

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Flow Reinsurance 51 $0.4 $1.1 $3.5 $0.9 $2.4 $4.0 $6.0 $2.6 $1.0 2014 2015 2016 2017 2018 2019 2020 2021 1Q'22 BUSINESS HIGHLIGHTS • Ongoing priority to diversify counterparty relationships across geographies and product areas • During 2020, built a reputation of strength in the market as a partner of choice, supporting counterparties when others chose to conserve capital • Recent expansion into Japanese market with two key partnerships FLOW REINSURANCE INFLOWS ($B) KEY DRIVERS • Demand for capital efficiency / risk management from other annuity issuers • Changes in market pricing conditions and counterparty behavior can cause fluctuations Reinsured to Athene, Policy administration stays with the issuer 2 Athene passes along inherent benefits of its model (asset management, structure, capital strength) 4 HOW DOES FLOW REINSURANCE WORK? 1 RETAIL ANNUITY ISSUANCE OF CLIENT 3 ATHENE MANAGES LIABILITY AND COLLECTS SPREAD EARNINGS

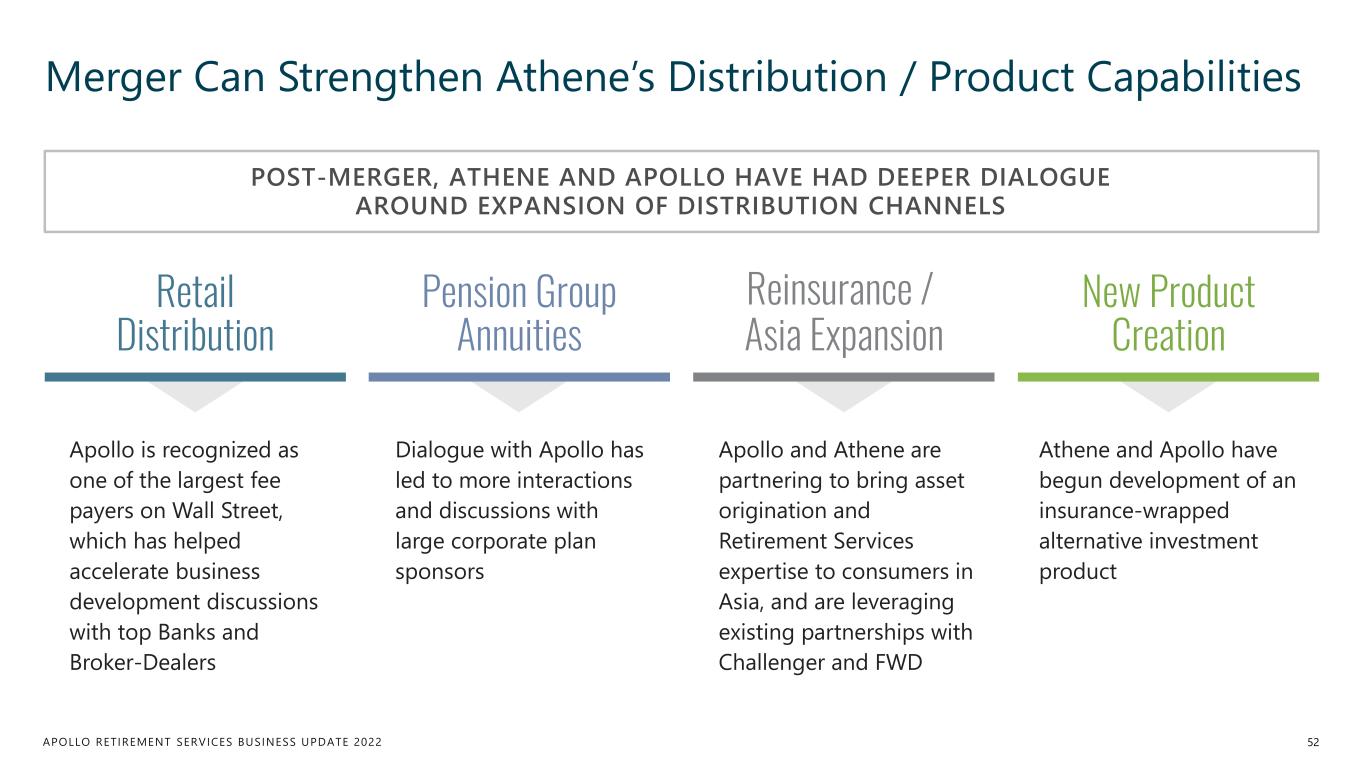

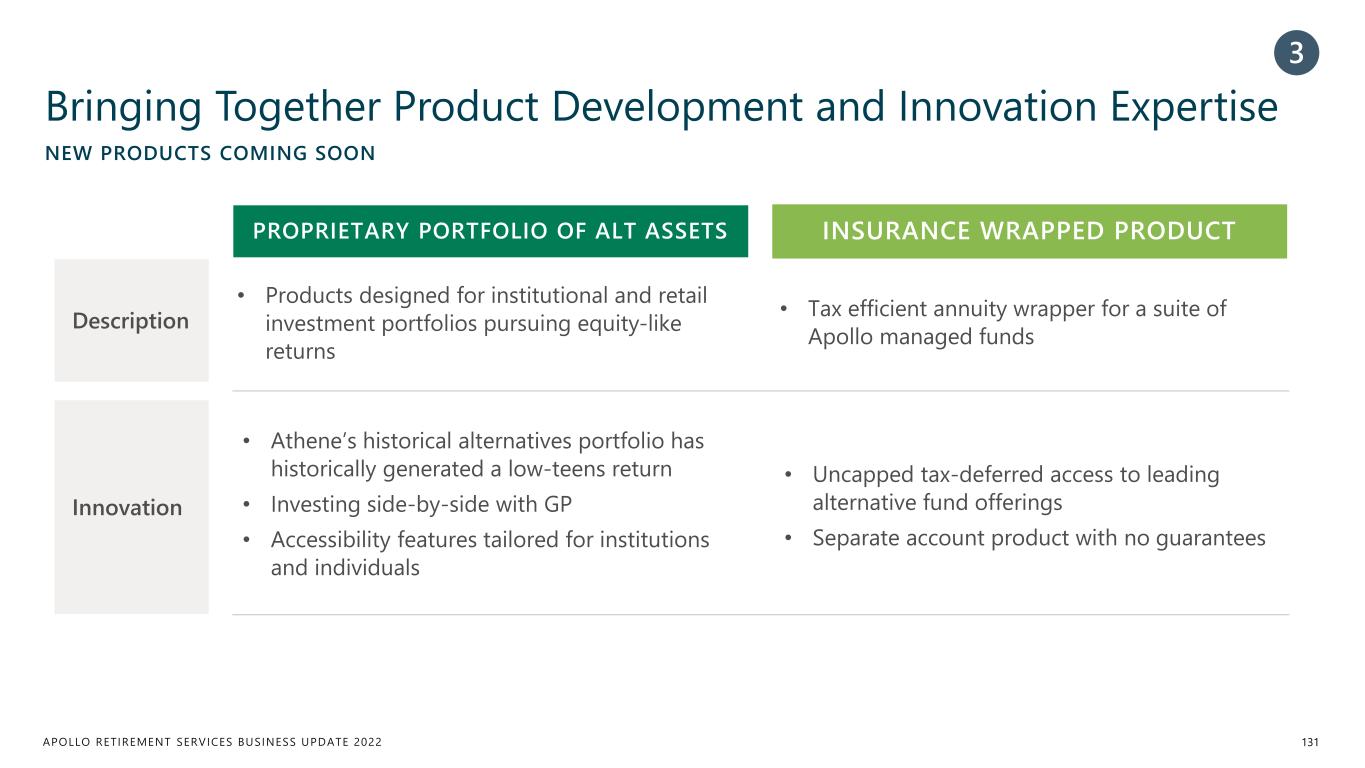

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Merger Can Strengthen Athene’s Distribution / Product Capabilities 52 Apollo is recognized as one of the largest fee payers on Wall Street, which has helped accelerate business development discussions with top Banks and Broker-Dealers Dialogue with Apollo has led to more interactions and discussions with large corporate plan sponsors Apollo and Athene are partnering to bring asset origination and Retirement Services expertise to consumers in Asia, and are leveraging existing partnerships with Challenger and FWD Athene and Apollo have begun development of an insurance-wrapped alternative investment product Retail Distribution Pension Group Annuities Reinsurance / Asia Expansion New Product Creation POST-MERGER, ATHENE AND APOLLO HAVE HAD DEEPER DIALOGUE AROUND EXPANSION OF DISTRIBUTION CHANNELS

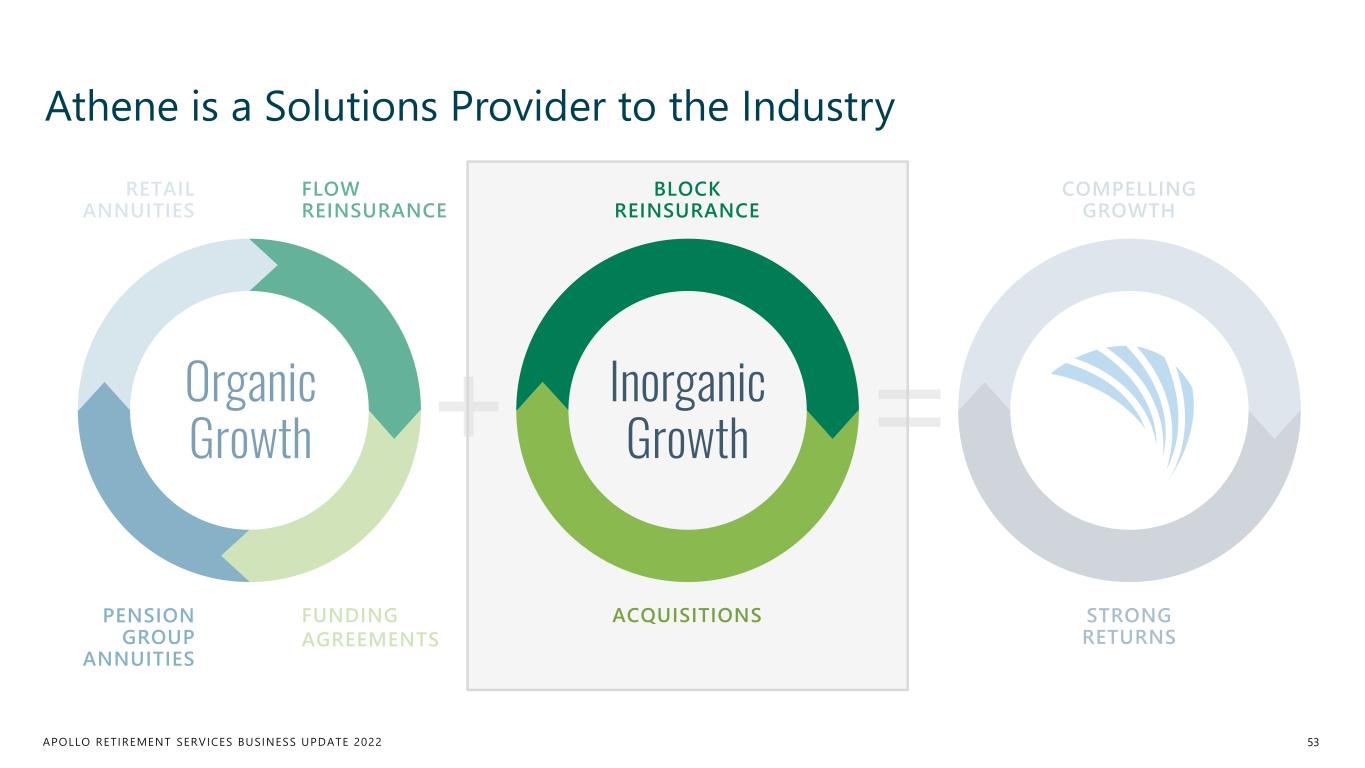

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 FLOW REINSURANCE FUNDING AGREEMENTS Athene is a Solutions Provider to the Industry 53 Organic Growth RETAIL ANNUITIES PENSION GROUP ANNUITIES Inorganic Growth BLOCK REINSURANCE ACQUISITIONS COMPELLING GROWTH STRONG RETURNS

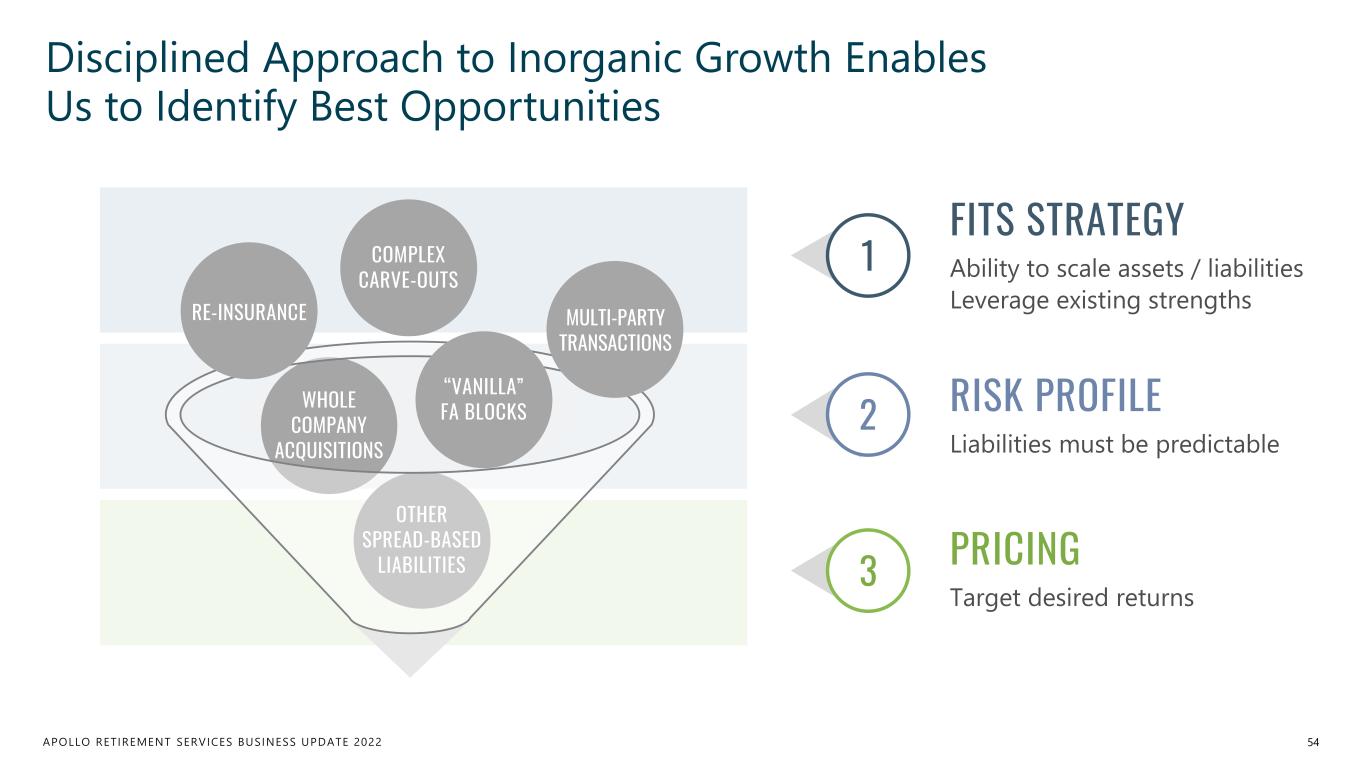

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Disciplined Approach to Inorganic Growth Enables Us to Identify Best Opportunities 54 WHOLE COMPANY ACQUISITIONS OTHER SPREAD-BASED LIABILITIES RE-INSURANCE MULTI-PARTY TRANSACTIONS COMPLEX CARVE-OUTS “VANILLA” FA BLOCKS 1 FITS STRATEGY Ability to scale assets / liabilities Leverage existing strengths 2 RISK PROFILE Liabilities must be predictable PRICING Target desired returns 3

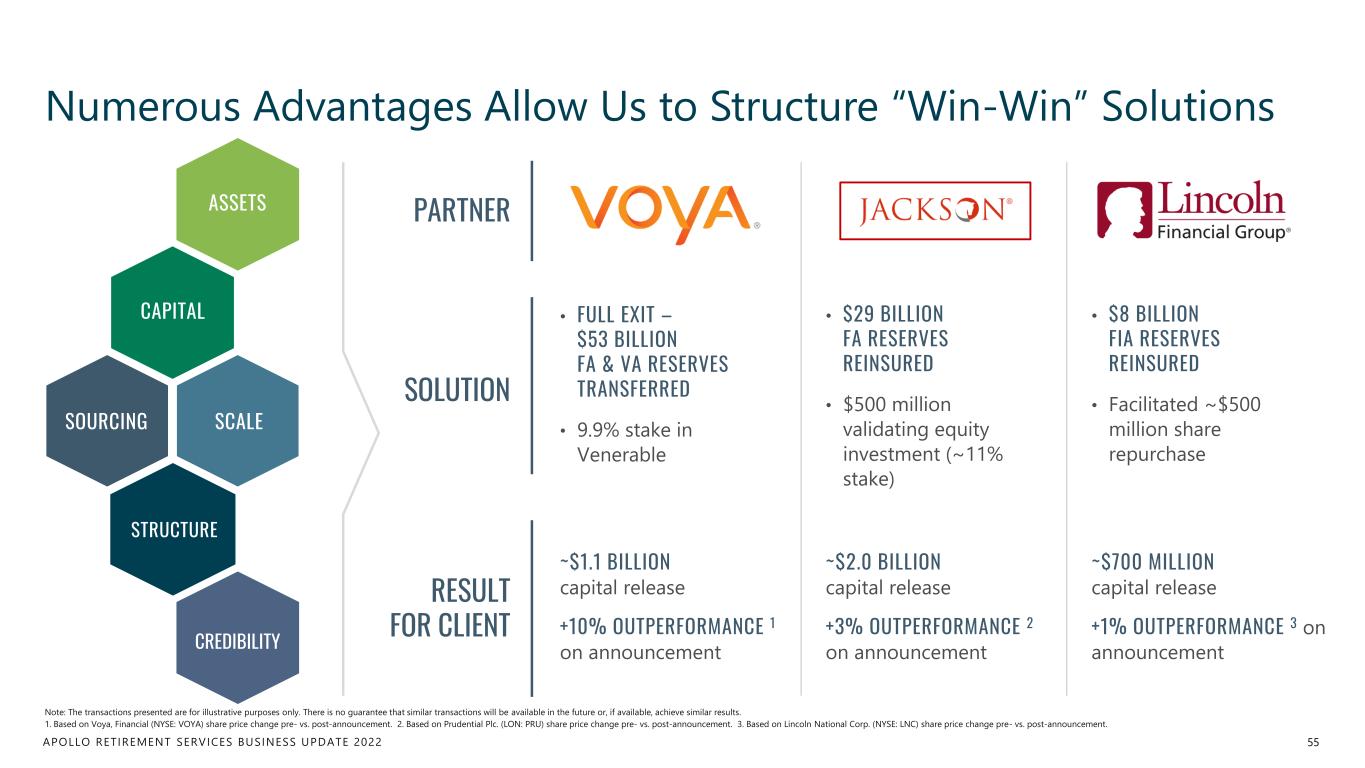

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Numerous Advantages Allow Us to Structure “Win-Win” Solutions ASSETS CAPITAL SCALE STRUCTURE CREDIBILITY SOURCING 55 PARTNER • FULL EXIT – $53 BILLION FA & VA RESERVES TRANSFERRED • 9.9% stake in Venerable ~$1.1 BILLION capital release +10% OUTPERFORMANCE 1 on announcement SOLUTION RESULT FOR CLIENT • $29 BILLION FA RESERVES REINSURED • $500 million validating equity investment (~11% stake) ~$2.0 BILLION capital release +3% OUTPERFORMANCE 2 on announcement • $8 BILLION FIA RESERVES REINSURED • Facilitated ~$500 million share repurchase ~$700 MILLION capital release +1% OUTPERFORMANCE 3 on announcement Note: The transactions presented are for illustrative purposes only. There is no guarantee that similar transactions will be available in the future or, if available, achieve similar results. 1. Based on Voya, Financial (NYSE: VOYA) share price change pre- vs. post-announcement. 2. Based on Prudential Plc. (LON: PRU) share price change pre- vs. post-announcement. 3. Based on Lincoln National Corp. (NYSE: LNC) share price change pre- vs. post-announcement.

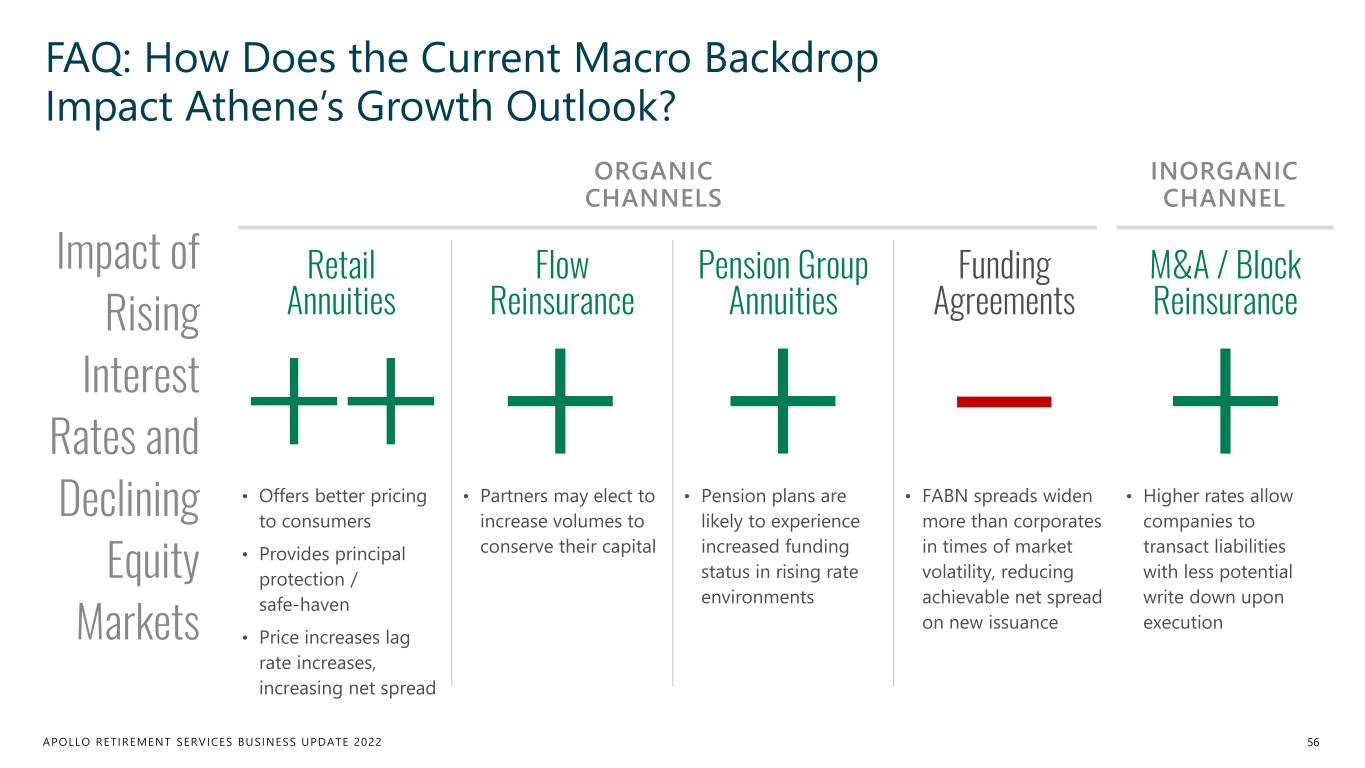

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 FAQ: How Does the Current Macro Backdrop Impact Athene’s Growth Outlook? Retail Annuities • Offers better pricing to consumers • Provides principal protection / safe-haven • Price increases lag rate increases, increasing net spread Flow Reinsurance • Partners may elect to increase volumes to conserve their capital Pension Group Annuities • Pension plans are likely to experience increased funding status in rising rate environments Funding Agreements • FABN spreads widen more than corporates in times of market volatility, reducing achievable net spread on new issuance Impact of Rising Interest Rates and Declining Equity Markets M&A / Block Reinsurance ORGANIC CHANNELS INORGANIC CHANNEL 56 • Higher rates allow companies to transact liabilities with less potential write down upon execution

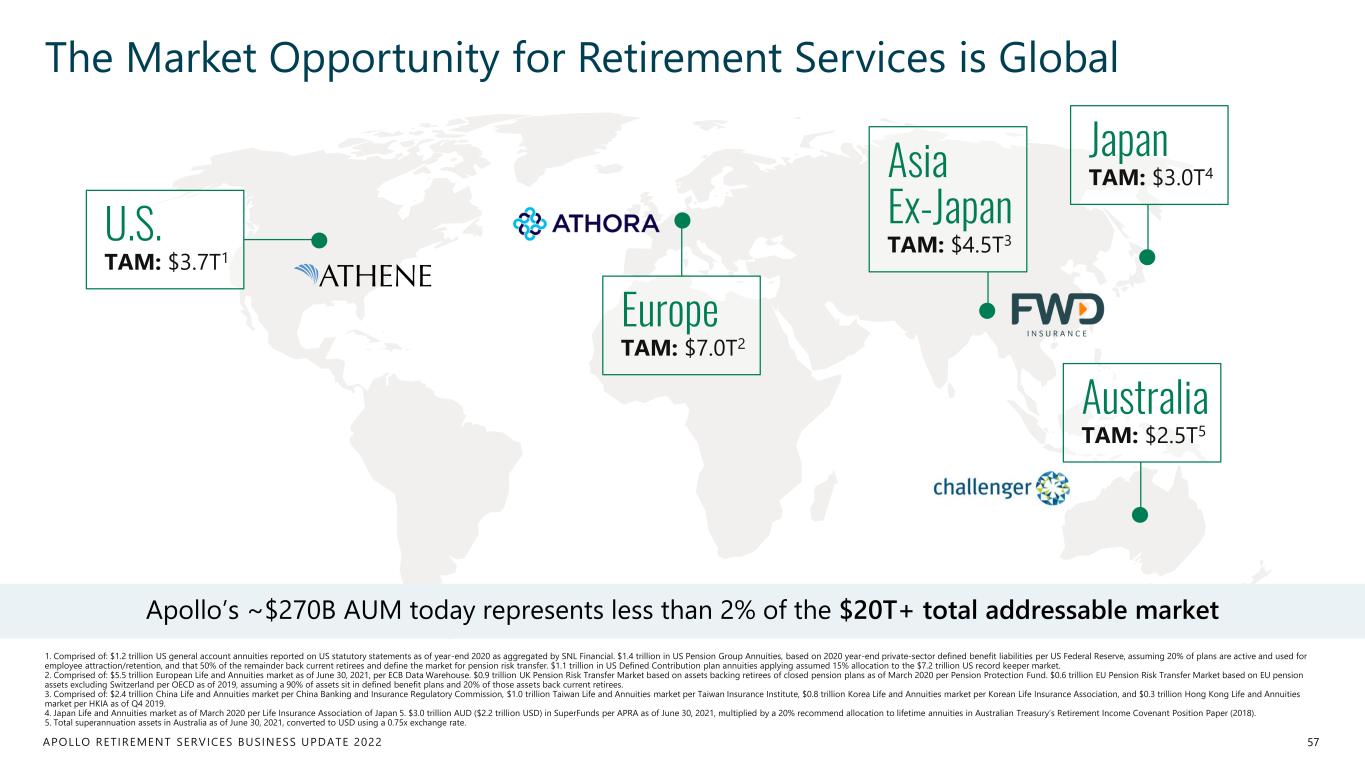

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 The Market Opportunity for Retirement Services is Global 57 1. Comprised of: $1.2 trillion US general account annuities reported on US statutory statements as of year-end 2020 as aggregated by SNL Financial. $1.4 trillion in US Pension Group Annuities, based on 2020 year-end private-sector defined benefit liabilities per US Federal Reserve, assuming 20% of plans are active and used for employee attraction/retention, and that 50% of the remainder back current retirees and define the market for pension risk transfer. $1.1 trillion in US Defined Contribution plan annuities applying assumed 15% allocation to the $7.2 trillion US record keeper market. 2. Comprised of: $5.5 trillion European Life and Annuities market as of June 30, 2021, per ECB Data Warehouse. $0.9 trillion UK Pension Risk Transfer Market based on assets backing retirees of closed pension plans as of March 2020 per Pension Protection Fund. $0.6 trillion EU Pension Risk Transfer Market based on EU pension assets excluding Switzerland per OECD as of 2019, assuming a 90% of assets sit in defined benefit plans and 20% of those assets back current retirees. 3. Comprised of: $2.4 trillion China Life and Annuities market per China Banking and Insurance Regulatory Commission, $1.0 trillion Taiwan Life and Annuities market per Taiwan Insurance Institute, $0.8 trillion Korea Life and Annuities market per Korean Life Insurance Association, and $0.3 trillion Hong Kong Life and Annuities market per HKIA as of Q4 2019. 4. Japan Life and Annuities market as of March 2020 per Life Insurance Association of Japan 5. $3.0 trillion AUD ($2.2 trillion USD) in SuperFunds per APRA as of June 30, 2021, multiplied by a 20% recommend allocation to lifetime annuities in Australian Treasury’s Retirement Income Covenant Position Paper (2018). 5. Total superannuation assets in Australia as of June 30, 2021, converted to USD using a 0.75x exchange rate. U.S. TAM: $3.7T1 Europe TAM: $7.0T2 Japan TAM: $3.0T4Asia Ex-Japan TAM: $4.5T3 Australia TAM: $2.5T5 Apollo’s ~$270B AUM today represents less than 2% of the $20T+ total addressable market

Liability Underwriting & Risk Profile MIKE DOWNING Chief Operating Officer & Chief Actuary, Athene

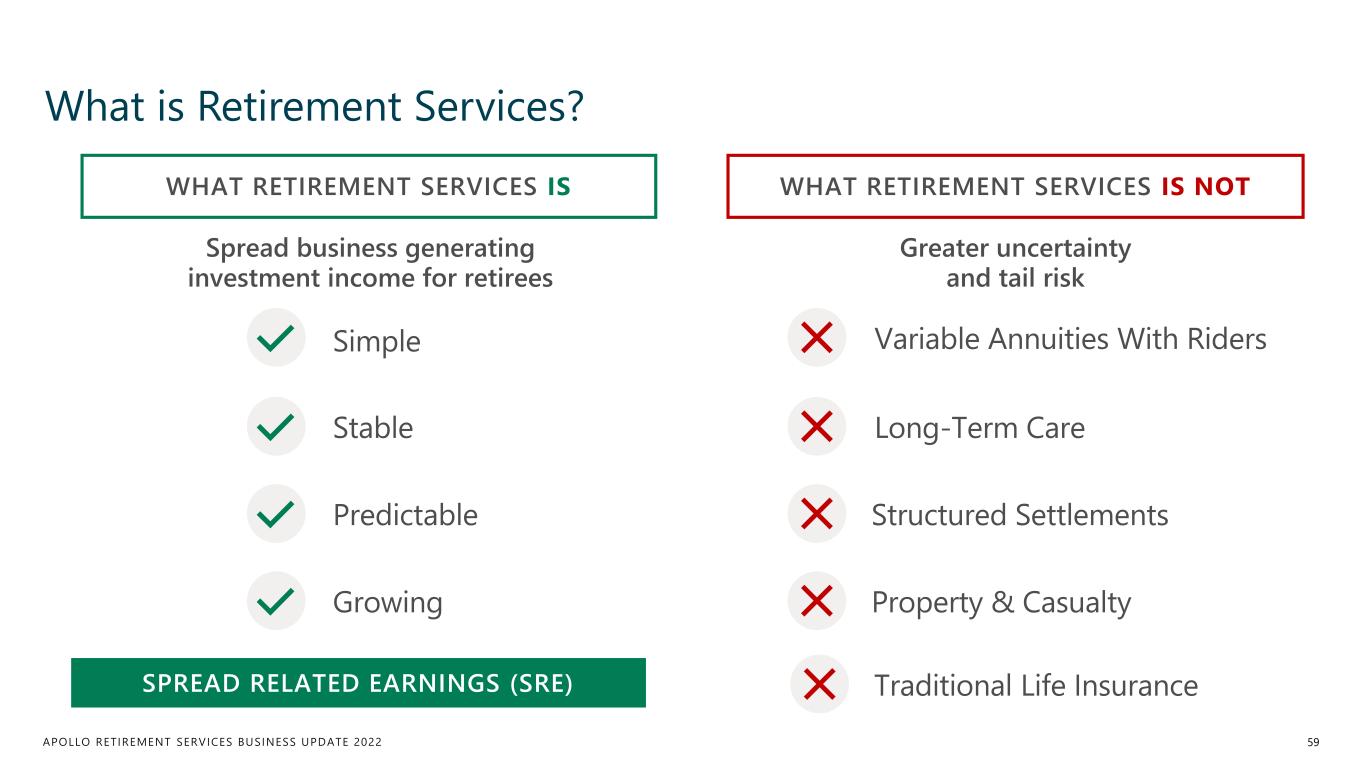

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 What is Retirement Services? 59 Spread business generating investment income for retirees SPREAD RELATED EARNINGS (SRE) Greater uncertainty and tail risk WHAT RETIREMENT SERVICES IS WHAT RETIREMENT SERVICES IS NOT Simple Stable Predictable Growing Variable Annuities With Riders Long-Term Care Structured Settlements Property & Casualty Traditional Life Insurance

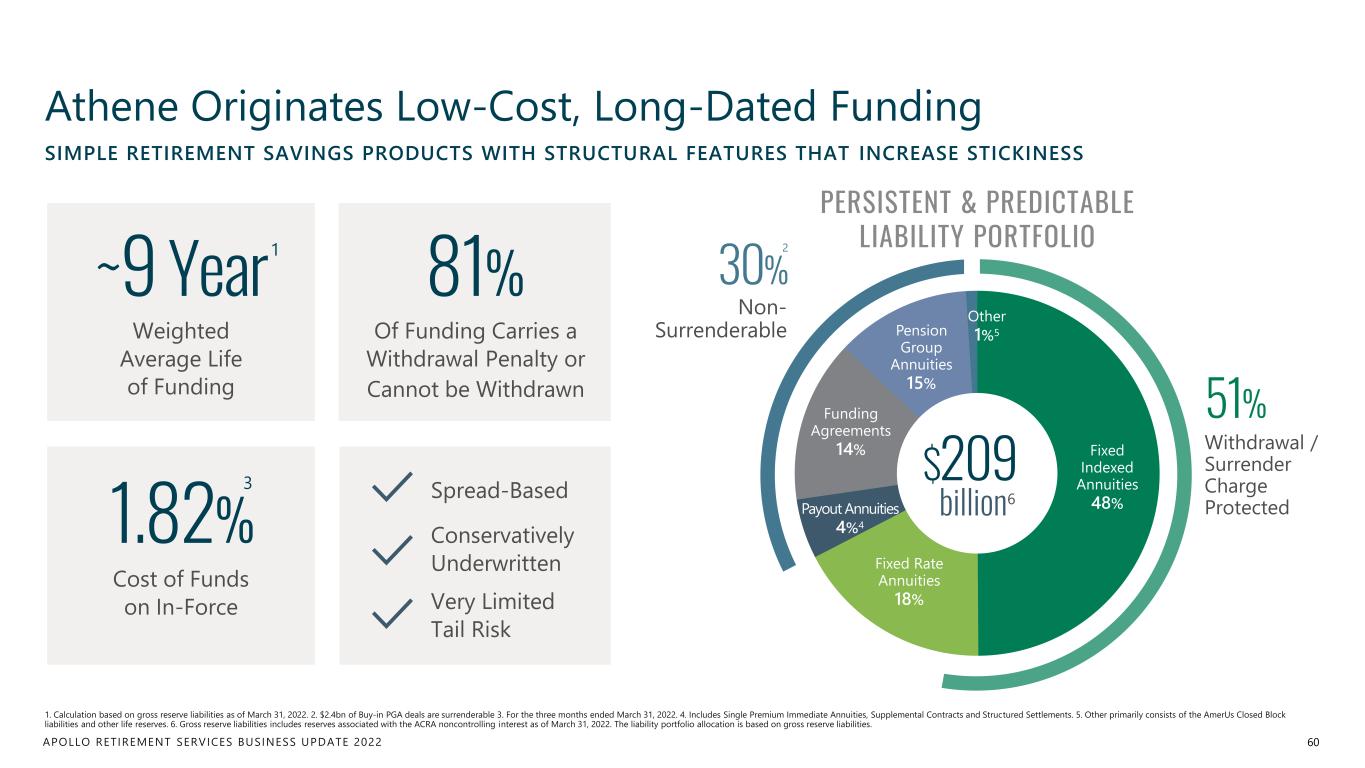

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Fixed Indexed Annuities 48% Fixed Rate Annuities 18% Payout Annuities 4%4 Funding Agreements 14% Pension Group Annuities 15% Other 1%5 1.82% Athene Originates Low-Cost, Long-Dated Funding 60 1. Calculation based on gross reserve liabilities as of March 31, 2022. 2. $2.4bn of Buy-in PGA deals are surrenderable 3. For the three months ended March 31, 2022. 4. Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements. 5. Other primarily consists of the AmerUs Closed Block liabilities and other life reserves. 6. Gross reserve liabilities includes reserves associated with the ACRA noncontrolling interest as of March 31, 2022. The liability portfolio allocation is based on gross reserve liabilities. SIMPLE RETIREMENT SAVINGS PRODUCTS WITH STRUCTURAL FEATURES THAT INCREASE STICKINESS Weighted Average Life of Funding Cost of Funds on In-Force 81% 3 Spread-Based Conservatively Underwritten Very Limited Tail Risk ~9 Year Of Funding Carries a Withdrawal Penalty or Cannot be Withdrawn PERSISTENT & PREDICTABLE LIABILITY PORTFOLIO 51% Withdrawal / Surrender Charge Protected 30% Non- Surrenderable $209 billion6 21

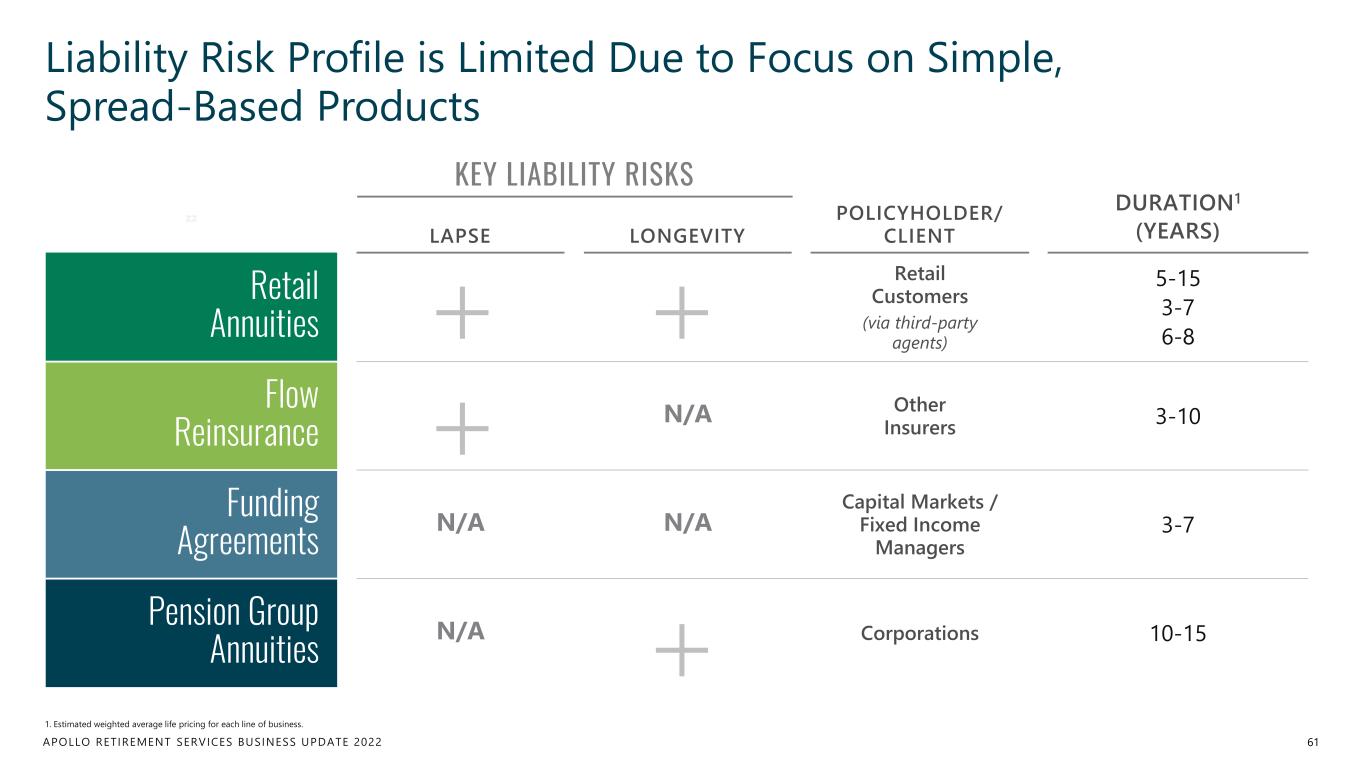

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 zz LAPSE LONGEVITY POLICYHOLDER/ CLIENT DURATION1 (YEARS) Retail Annuities Retail Customers (via third-party agents) 5-15 3-7 6-8 Flow Reinsurance N/A Other Insurers 3-10 Funding Agreements N/A N/A Capital Markets / Fixed Income Managers 3-7 Pension Group Annuities N/A Corporations 10-15 Liability Risk Profile is Limited Due to Focus on Simple, Spread-Based Products 61 KEY LIABILITY RISKS 1. Estimated weighted average life pricing for each line of business.

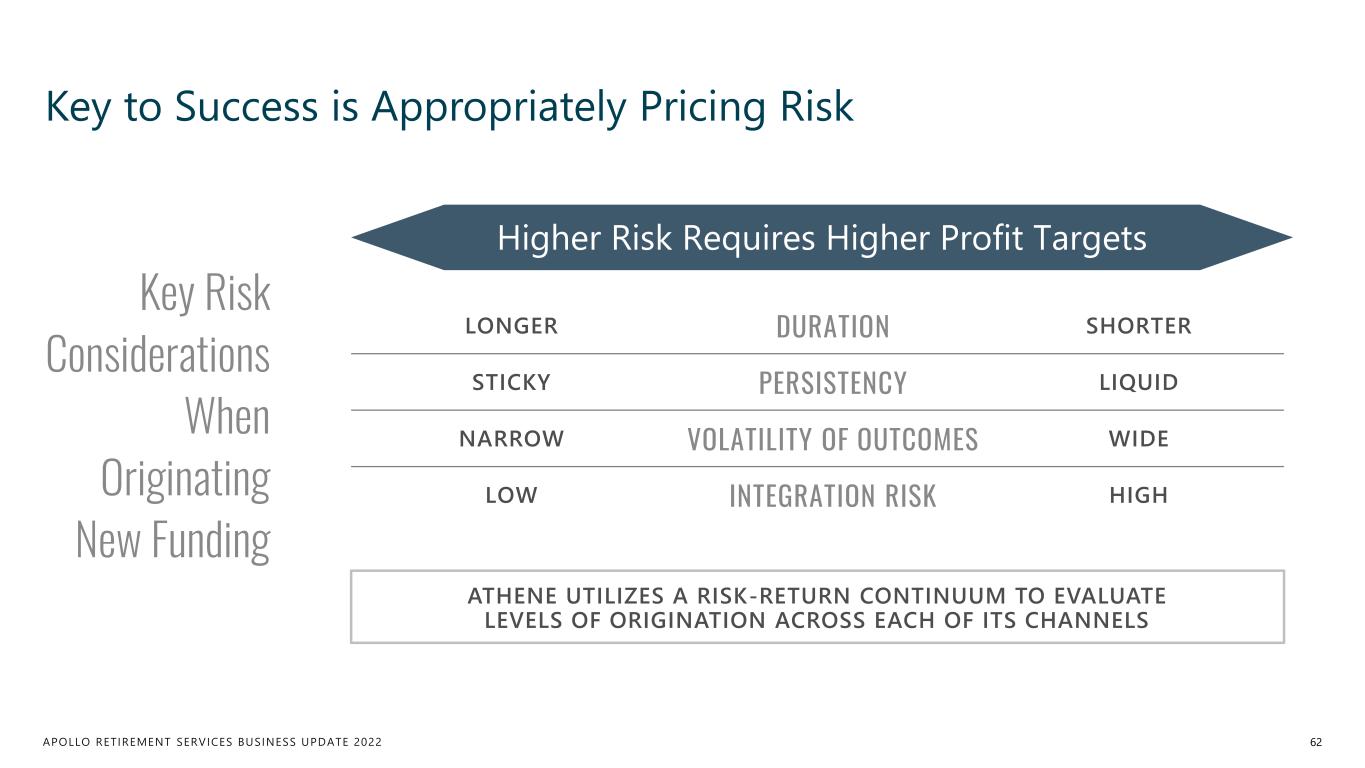

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Key to Success is Appropriately Pricing Risk Higher Risk Requires Higher Profit Targets LONGER DURATION SHORTER STICKY PERSISTENCY LIQUID NARROW VOLATILITY OF OUTCOMES WIDE LOW INTEGRATION RISK HIGH ATHENE UTILIZES A RISK-RETURN CONTINUUM TO EVALUATE LEVELS OF ORIGINATION ACROSS EACH OF ITS CHANNELS 62 Key Risk Considerations When Originating New Funding

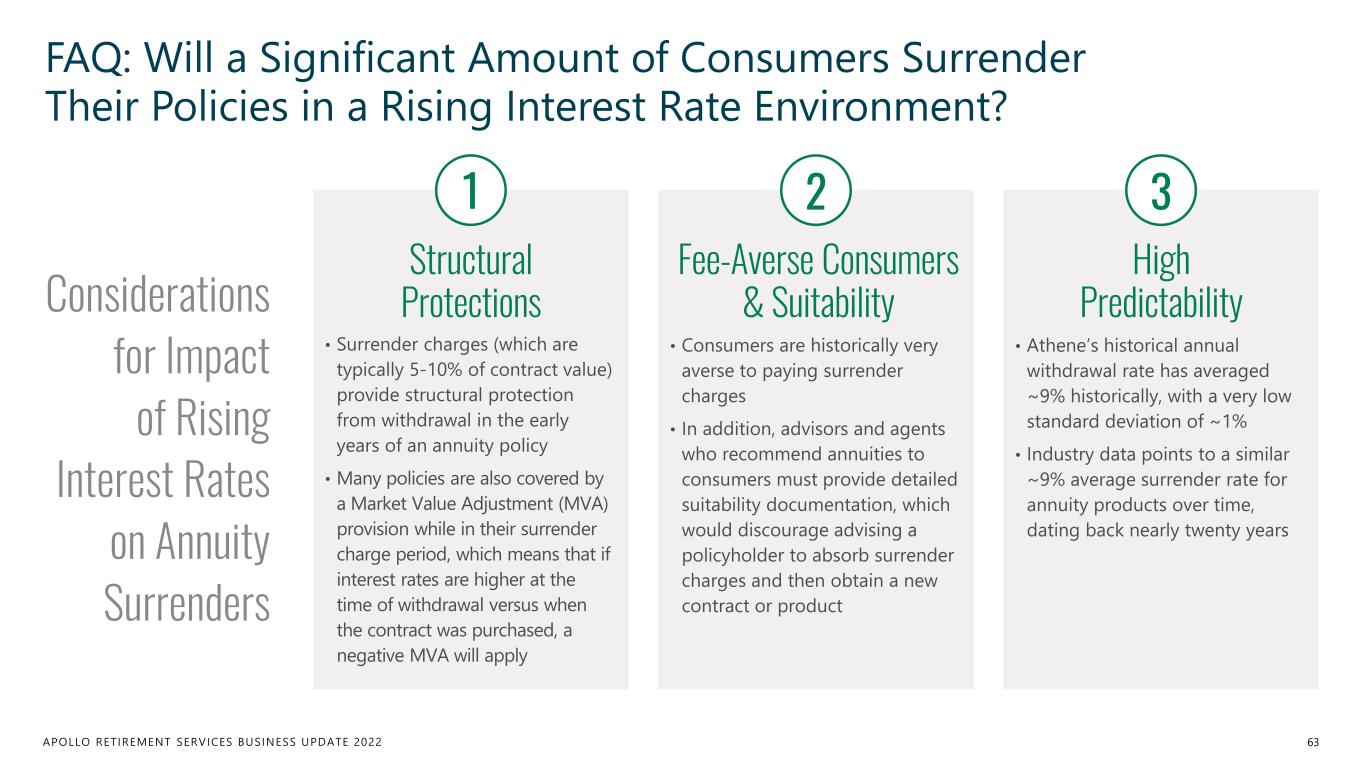

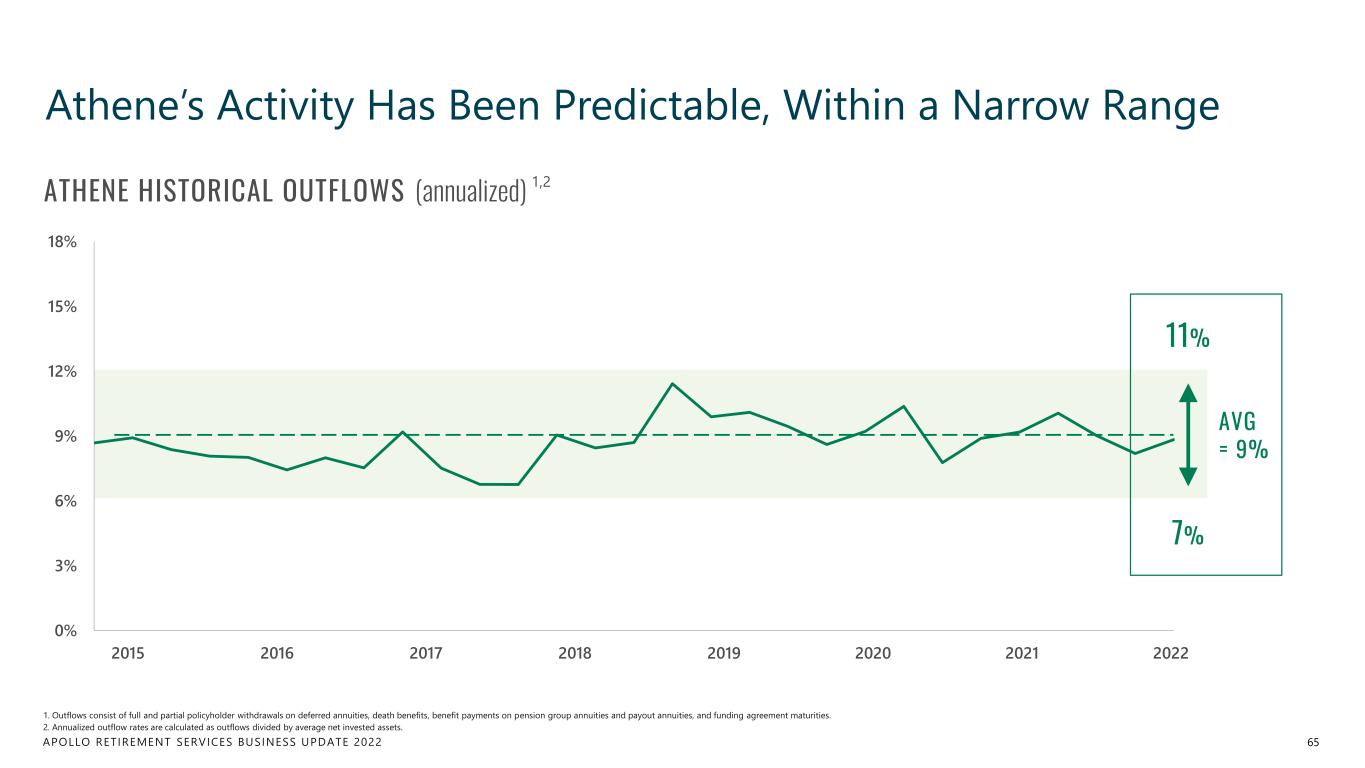

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 FAQ: Will a Significant Amount of Consumers Surrender Their Policies in a Rising Interest Rate Environment? 63 Considerations for Impact of Rising Interest Rates on Annuity Surrenders Structural Protections • Surrender charges (which are typically 5-10% of contract value) provide structural protection from withdrawal in the early years of an annuity policy • Many policies are also covered by a Market Value Adjustment (MVA) provision while in their surrender charge period, which means that if interest rates are higher at the time of withdrawal versus when the contract was purchased, a negative MVA will apply 1 Fee-Averse Consumers & Suitability • Consumers are historically very averse to paying surrender charges • In addition, advisors and agents who recommend annuities to consumers must provide detailed suitability documentation, which would discourage advising a policyholder to absorb surrender charges and then obtain a new contract or product 2 High Predictability • Athene’s historical annual withdrawal rate has averaged ~9% historically, with a very low standard deviation of ~1% • Industry data points to a similar ~9% average surrender rate for annuity products over time, dating back nearly twenty years 3

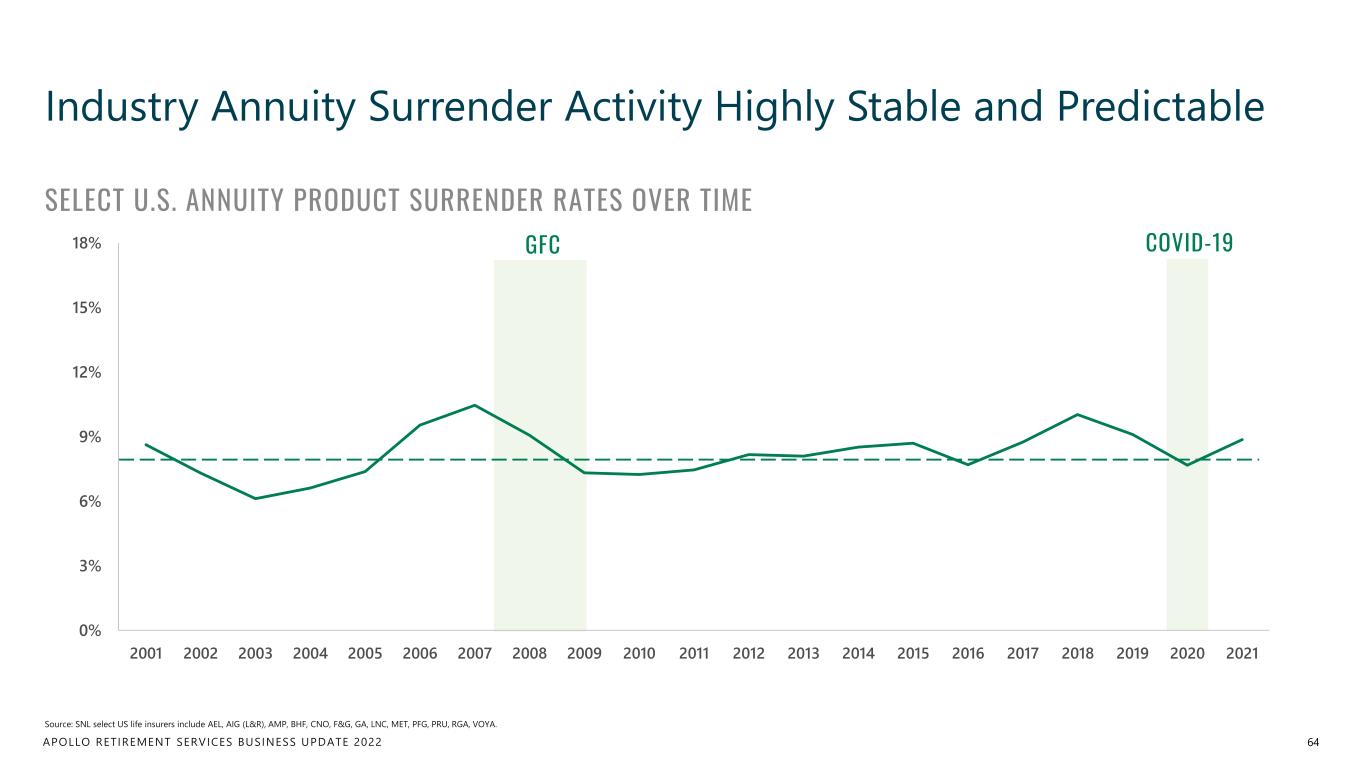

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 0% 3% 6% 9% 12% 15% 18% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 GFC COVID-19 Industry Annuity Surrender Activity Highly Stable and Predictable 64 Source: SNL select US life insurers include AEL, AIG (L&R), AMP, BHF, CNO, F&G, GA, LNC, MET, PFG, PRU, RGA, VOYA. SELECT U.S. ANNUITY PRODUCT SURRENDER RATES OVER TIME

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 0% 3% 6% 9% 12% 15% 18% Athene’s Activity Has Been Predictable, Within a Narrow Range 65 ATHENE HISTORICAL OUTFLOWS (annualized) 1,2 11% 7% 1. Outflows consist of full and partial policyholder withdrawals on deferred annuities, death benefits, benefit payments on pension group annuities and payout annuities, and funding agreement maturities. 2. Annualized outflow rates are calculated as outflows divided by average net invested assets. 2016 2017 2018 2019 2020 2021 20222015 AVG = 9%

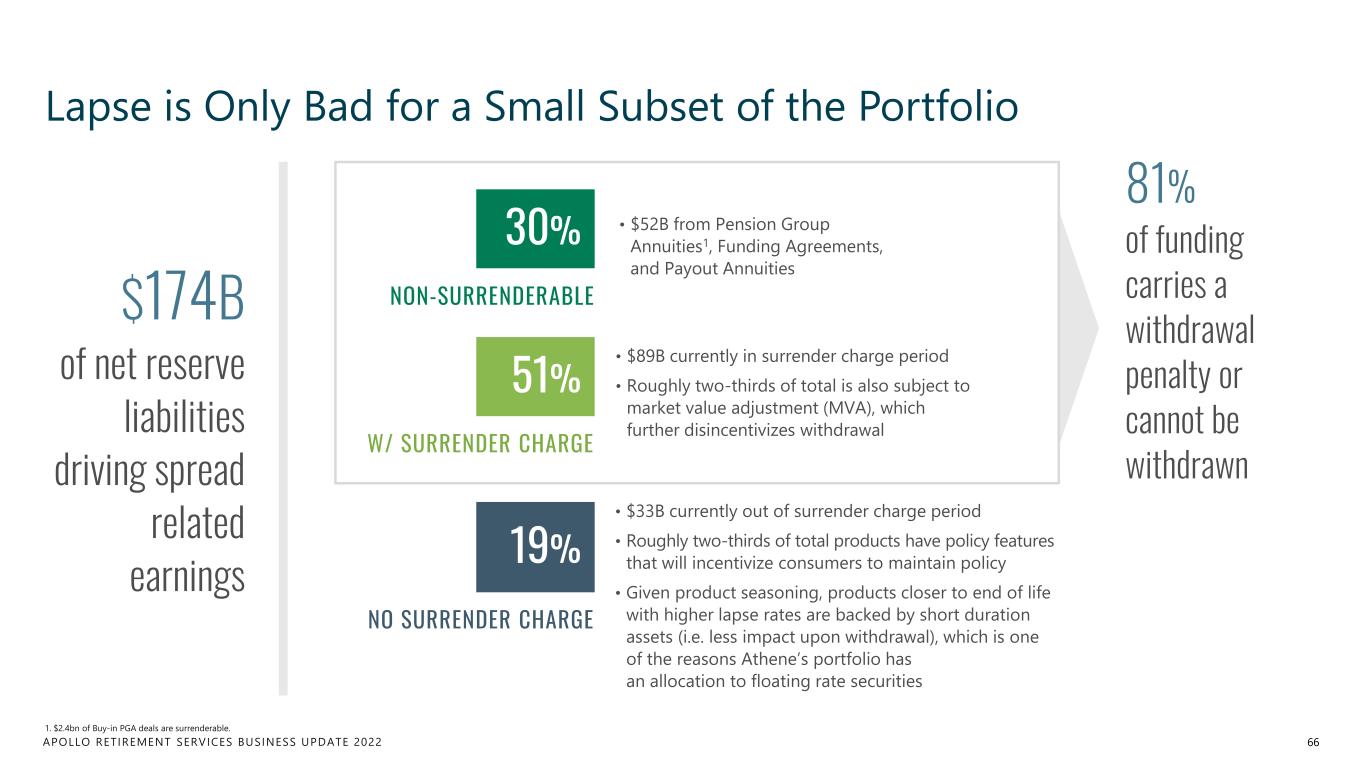

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 • $52B from Pension Group Annuities1, Funding Agreements, and Payout Annuities • $89B currently in surrender charge period • Roughly two-thirds of total is also subject to market value adjustment (MVA), which further disincentivizes withdrawal • $33B currently out of surrender charge period • Roughly two-thirds of total products have policy features that will incentivize consumers to maintain policy • Given product seasoning, products closer to end of life with higher lapse rates are backed by short duration assets (i.e. less impact upon withdrawal), which is one of the reasons Athene’s portfolio has an allocation to floating rate securities Lapse is Only Bad for a Small Subset of the Portfolio 66 51% 19% 81% of funding carries a withdrawal penalty or cannot be withdrawn $174B of net reserve liabilities driving spread related earnings W/ SURRENDER CHARGE NO SURRENDER CHARGE 30% NON-SURRENDERABLE 1. $2.4bn of Buy-in PGA deals are surrenderable.

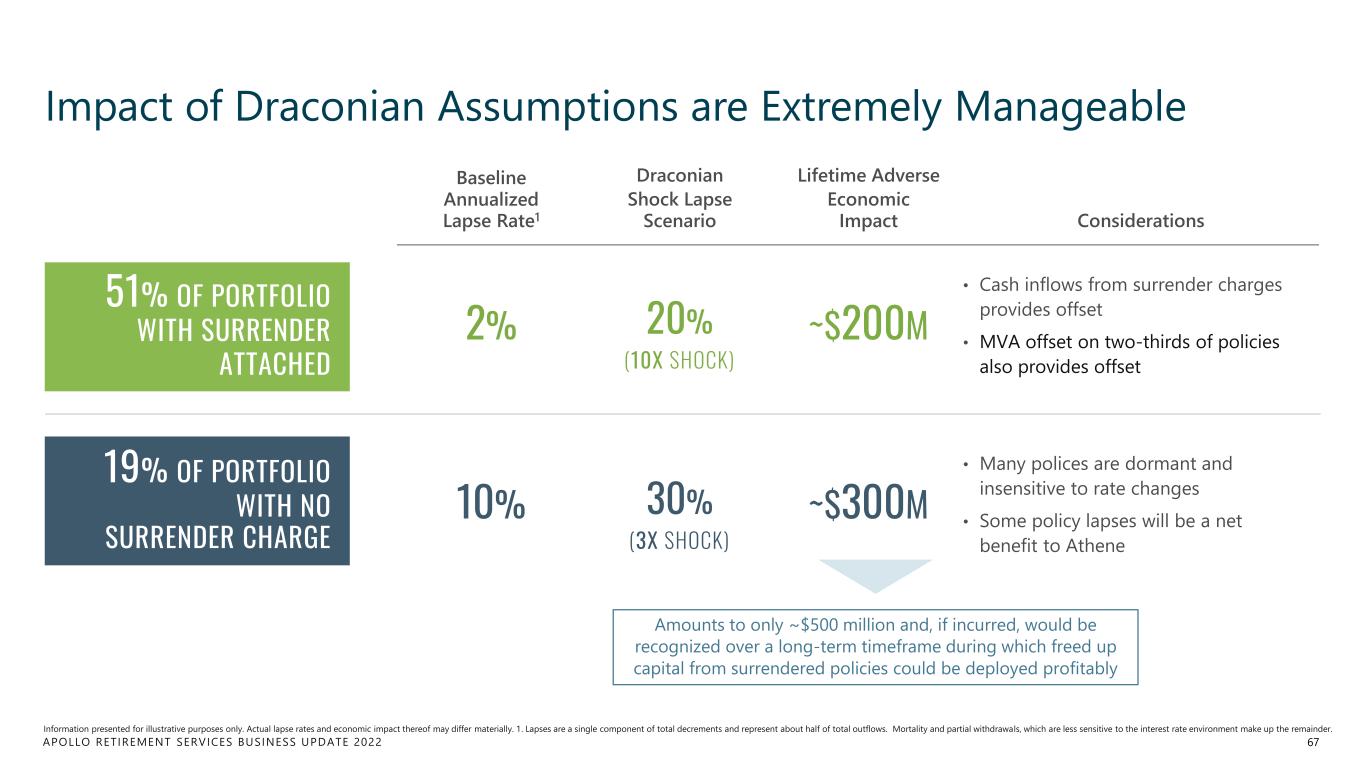

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Baseline Annualized Lapse Rate1 Draconian Shock Lapse Scenario Lifetime Adverse Economic Impact Considerations 2% ~$200M • Cash inflows from surrender charges provides offset • MVA offset on two-thirds of policies also provides offset 10% ~$300M • Many polices are dormant and insensitive to rate changes • Some policy lapses will be a net benefit to Athene Impact of Draconian Assumptions are Extremely Manageable 67 51% OF PORTFOLIO WITH SURRENDER ATTACHED 19% OF PORTFOLIO WITH NO SURRENDER CHARGE Amounts to only ~$500 million and, if incurred, would be recognized over a long-term timeframe during which freed up capital from surrendered policies could be deployed profitably Information presented for illustrative purposes only. Actual lapse rates and economic impact thereof may differ materially. 1. Lapses are a single component of total decrements and represent about half of total outflows. Mortality and partial withdrawals, which are less sensitive to the interest rate environment make up the remainder. 20% (10X SHOCK) 30% (3X SHOCK)

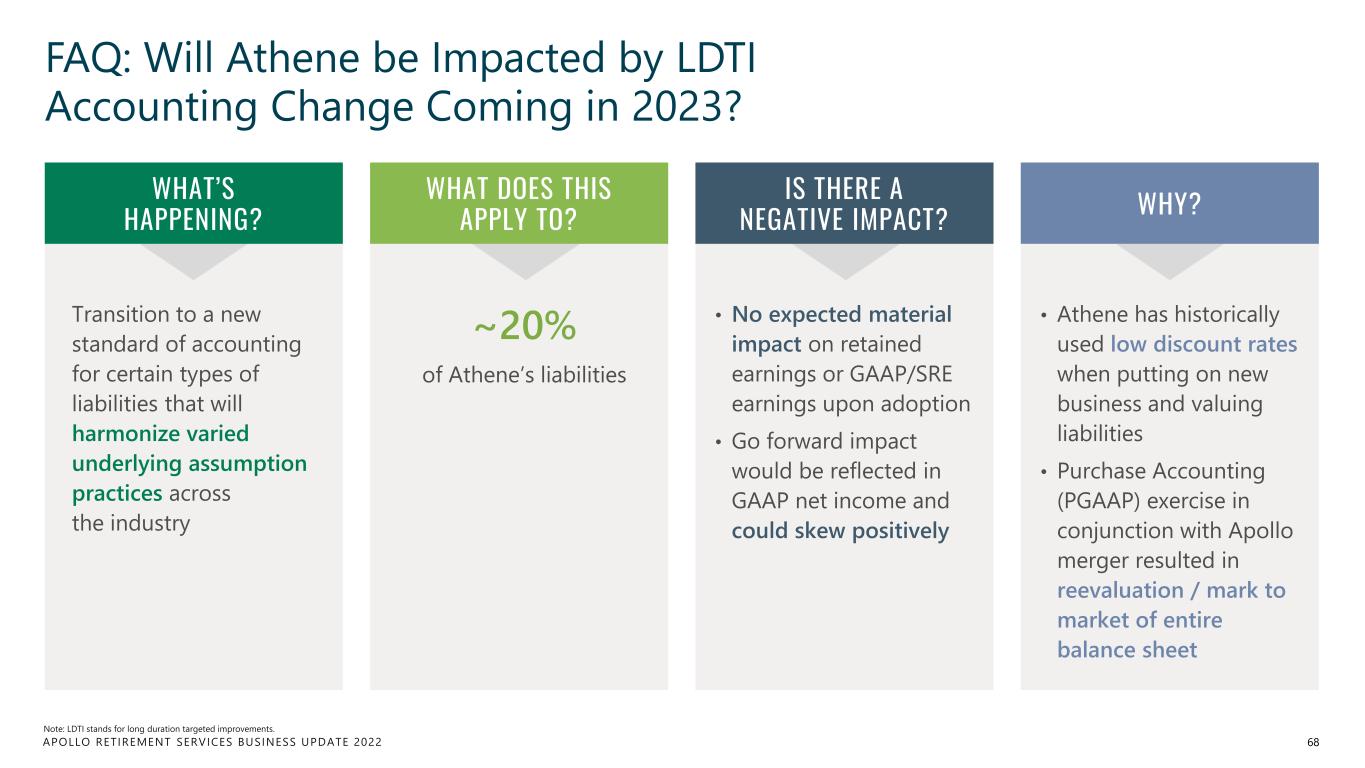

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 FAQ: Will Athene be Impacted by LDTI Accounting Change Coming in 2023? 68 Transition to a new standard of accounting for certain types of liabilities that will harmonize varied underlying assumption practices across the industry ~20% of Athene’s liabilities • No expected material impact on retained earnings or GAAP/SRE earnings upon adoption • Go forward impact would be reflected in GAAP net income and could skew positively • Athene has historically used low discount rates when putting on new business and valuing liabilities • Purchase Accounting (PGAAP) exercise in conjunction with Apollo merger resulted in reevaluation / mark to market of entire balance sheet WHAT’S HAPPENING? WHAT DOES THIS APPLY TO? IS THERE A NEGATIVE IMPACT? WHY? Note: LDTI stands for long duration targeted improvements.

Asset Risk Framework & Stress Results DOUG NIEMANN Chief Risk Officer, Athene

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 • Robust risk management framework and procedures underpin focus on protecting capital and aligning risks with stakeholder expectations • Risk strategy, investment, credit, asset-liability management (“ALM”) and liquidity risk policies, amongst others, at the board and management levels • Stress testing plays a key role in defining risk appetite, with tests performed on both sides of the balance sheet Risk Management is Embedded in Everything We Do 70 MANAGE ATHENE’S RISKS SUCH THAT IT CAN GROW PROFITABLY ACROSS MARKET ENVIRONMENTS ATHENE’S RISK MANAGEMENT Committed to transparency by publishing annual stress test

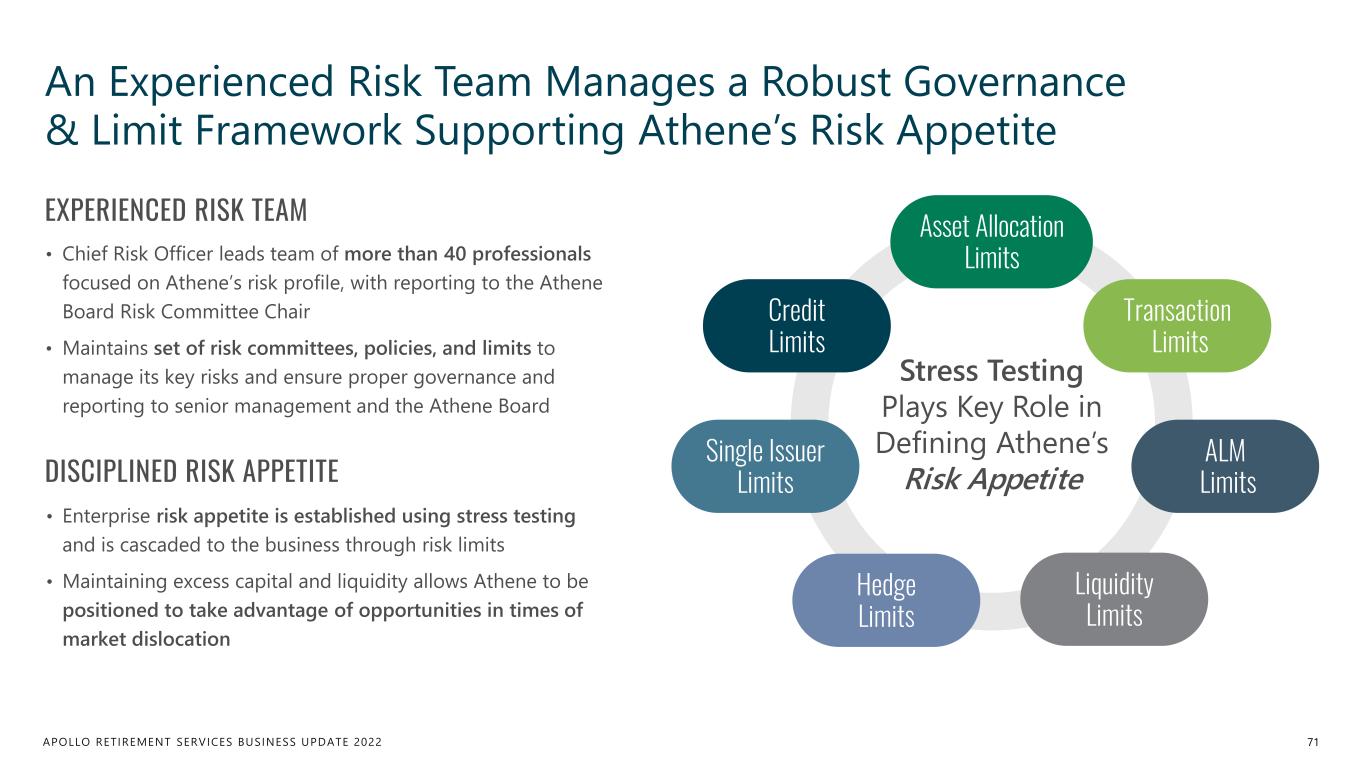

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 An Experienced Risk Team Manages a Robust Governance & Limit Framework Supporting Athene’s Risk Appetite 71 Stress Testing Plays Key Role in Defining Athene’s Risk Appetite ALM Limits Liquidity Limits Hedge Limits Single Issuer Limits Credit Limits Transaction Limits Asset Allocation Limits• Chief Risk Officer leads team of more than 40 professionals focused on Athene’s risk profile, with reporting to the Athene Board Risk Committee Chair • Maintains set of risk committees, policies, and limits to manage its key risks and ensure proper governance and reporting to senior management and the Athene Board EXPERIENCED RISK TEAM DISCIPLINED RISK APPETITE • Enterprise risk appetite is established using stress testing and is cascaded to the business through risk limits • Maintaining excess capital and liquidity allows Athene to be positioned to take advantage of opportunities in times of market dislocation

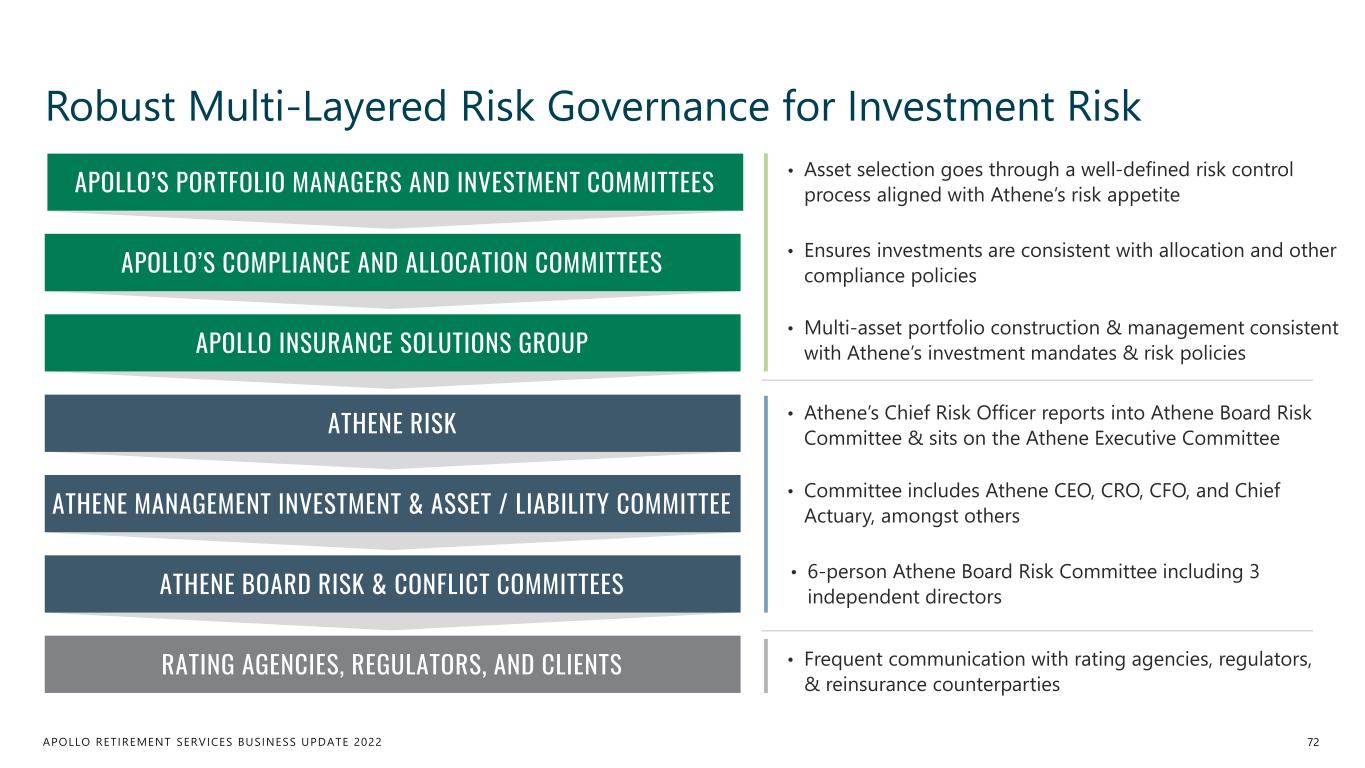

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Robust Multi-Layered Risk Governance for Investment Risk • Asset selection goes through a well-defined risk control process aligned with Athene’s risk appetite • Ensures investments are consistent with allocation and other compliance policies • Athene’s Chief Risk Officer reports into Athene Board Risk Committee & sits on the Athene Executive Committee • Frequent communication with rating agencies, regulators, & reinsurance counterparties • Multi-asset portfolio construction & management consistent with Athene’s investment mandates & risk policies • Committee includes Athene CEO, CRO, CFO, and Chief Actuary, amongst others 72 APOLLO’S PORTFOLIO MANAGERS AND INVESTMENT COMMITTEES APOLLO INSURANCE SOLUTIONS GROUP APOLLO’S COMPLIANCE AND ALLOCATION COMMITTEES ATHENE RISK ATHENE MANAGEMENT INVESTMENT & ASSET / LIABILITY COMMITTEE ATHENE BOARD RISK & CONFLICT COMMITTEES RATING AGENCIES, REGULATORS, AND CLIENTS • 6-person Athene Board Risk Committee including 3 independent directors

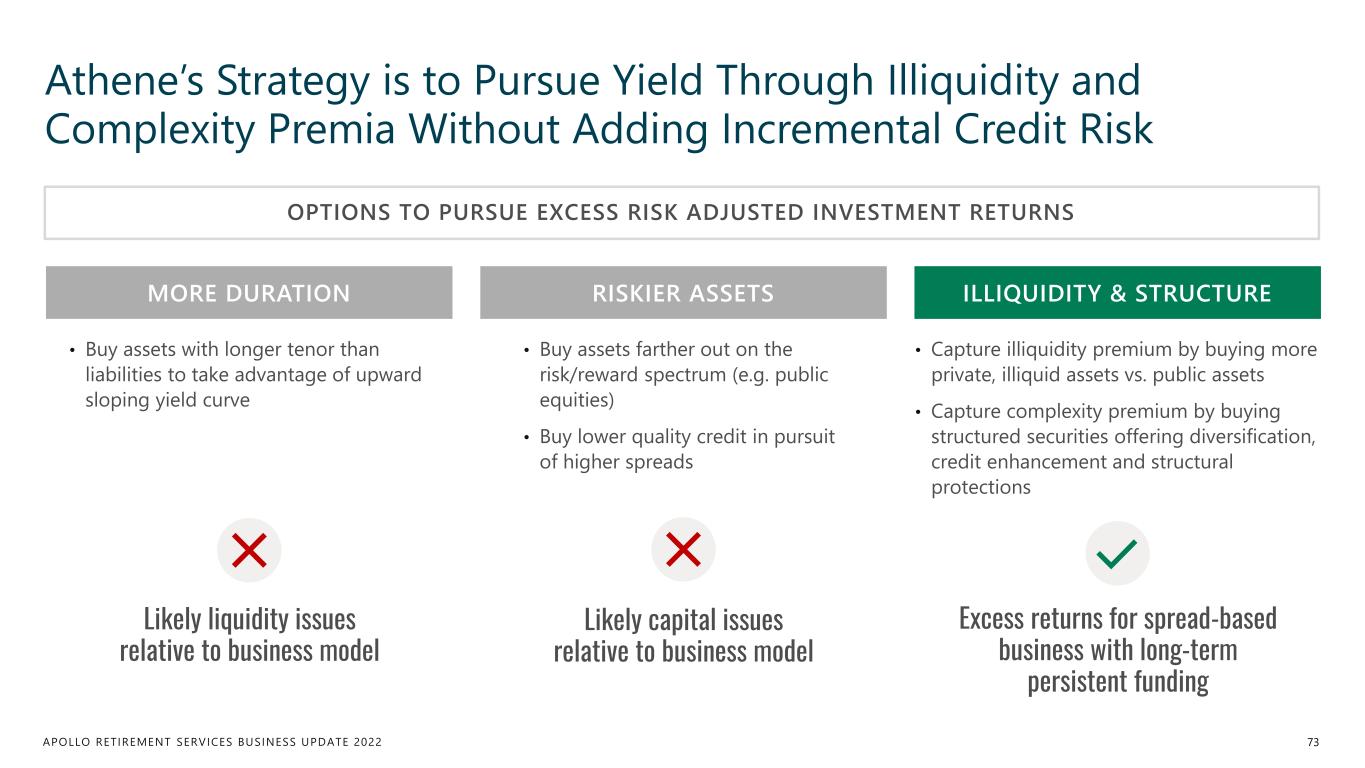

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Strategy is to Pursue Yield Through Illiquidity and Complexity Premia Without Adding Incremental Credit Risk 73 OPTIONS TO PURSUE EXCESS RISK ADJUSTED INVESTMENT RETURNS MORE DURATION RISKIER ASSETS ILLIQUIDITY & STRUCTURE • Buy assets with longer tenor than liabilities to take advantage of upward sloping yield curve • Buy assets farther out on the risk/reward spectrum (e.g. public equities) • Buy lower quality credit in pursuit of higher spreads • Capture illiquidity premium by buying more private, illiquid assets vs. public assets • Capture complexity premium by buying structured securities offering diversification, credit enhancement and structural protections Likely liquidity issues relative to business model Likely capital issues relative to business model Excess returns for spread-based business with long-term persistent funding

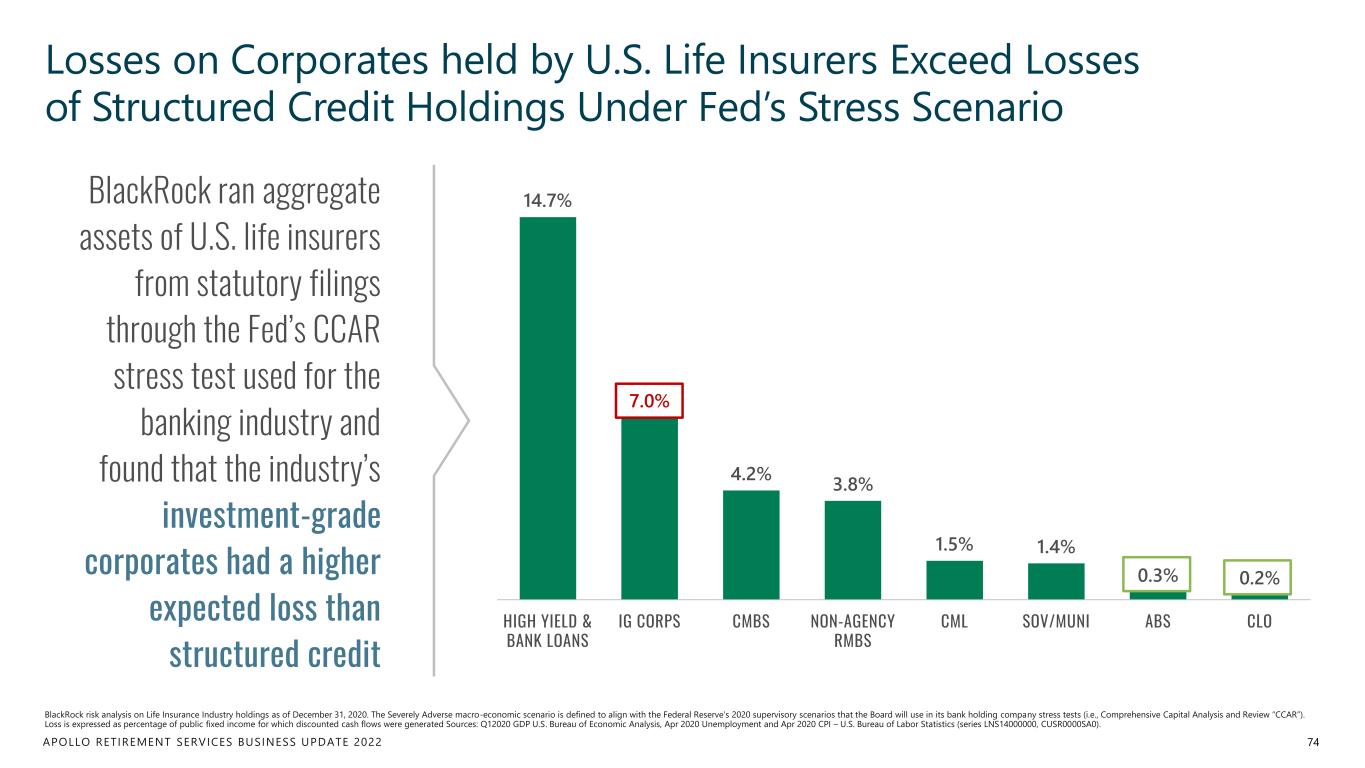

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 14.7% 7.0% 4.2% 3.8% 1.5% 1.4% 0.3% 0.2% HIGH YIELD & BANK LOANS IG CORPS CMBS NON-AGENCY RMBS CML SOV/MUNI ABS CLO Losses on Corporates held by U.S. Life Insurers Exceed Losses of Structured Credit Holdings Under Fed’s Stress Scenario BlackRock ran aggregate assets of U.S. life insurers from statutory filings through the Fed’s CCAR stress test used for the banking industry and found that the industry’s investment-grade corporates had a higher expected loss than structured credit BlackRock risk analysis on Life Insurance Industry holdings as of December 31, 2020. The Severely Adverse macro-economic scenario is defined to align with the Federal Reserve’s 2020 supervisory scenarios that the Board will use in its bank holding company stress tests (i.e., Comprehensive Capital Analysis and Review “CCAR”). Loss is expressed as percentage of public fixed income for which discounted cash flows were generated Sources: Q12020 GDP U.S. Bureau of Economic Analysis, Apr 2020 Unemployment and Apr 2020 CPI – U.S. Bureau of Labor Statistics (series LNS14000000, CUSR0000SA0). 74

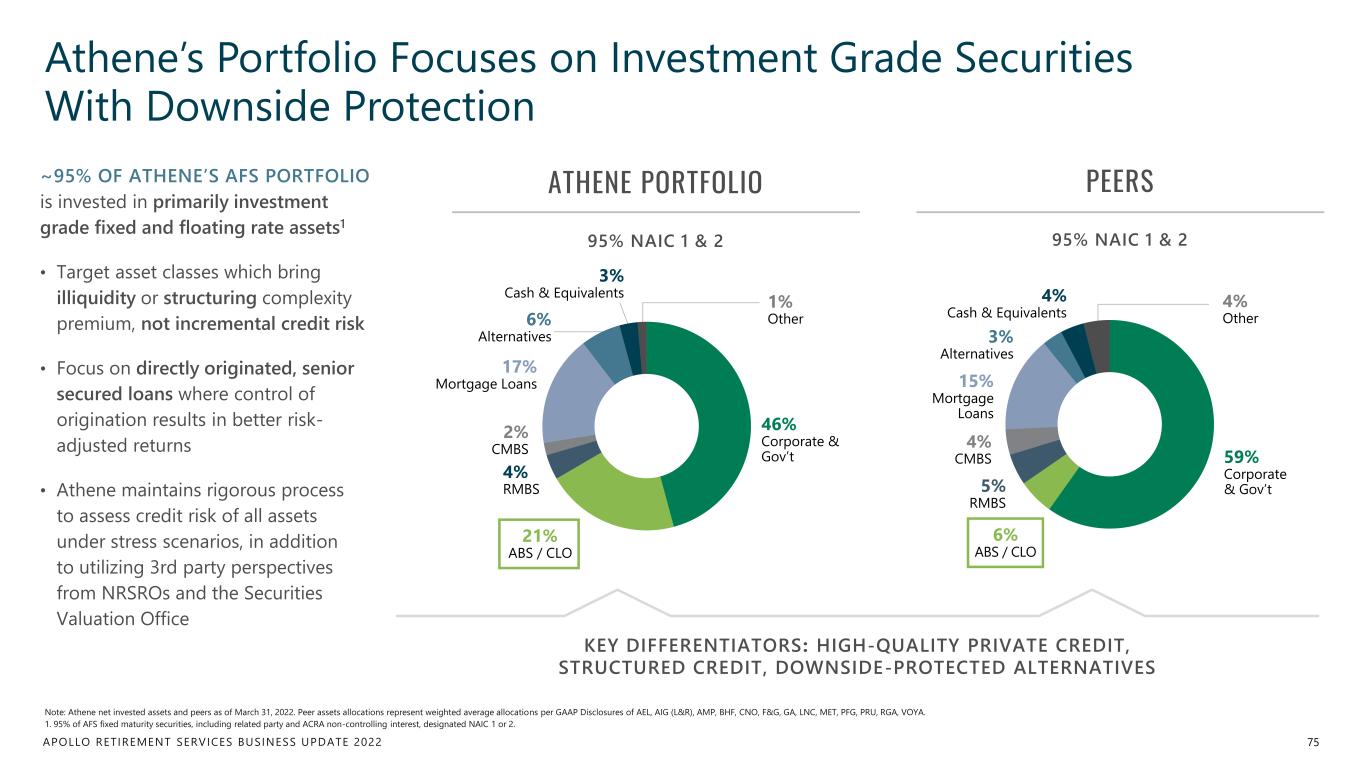

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 1% Other 3% Cash & Equivalents 46% Corporate & Gov’t 4% RMBS 21% ABS / CLO 2% CMBS 6% Alternatives 17% Mortgage Loans 4% Cash & Equivalents 59% Corporate & Gov’t5% RMBS 4% CMBS 15% Mortgage Loans 4% Other 6% ABS / CLO 3% Alternatives ~95% OF ATHENE’S AFS PORTFOLIO is invested in primarily investment grade fixed and floating rate assets1 • Target asset classes which bring illiquidity or structuring complexity premium, not incremental credit risk • Focus on directly originated, senior secured loans where control of origination results in better risk- adjusted returns • Athene maintains rigorous process to assess credit risk of all assets under stress scenarios, in addition to utilizing 3rd party perspectives from NRSROs and the Securities Valuation Office Athene’s Portfolio Focuses on Investment Grade Securities With Downside Protection 95% NAIC 1 & 2 PEERSATHENE PORTFOLIO 95% NAIC 1 & 2 Note: Athene net invested assets and peers as of March 31, 2022. Peer assets allocations represent weighted average allocations per GAAP Disclosures of AEL, AIG (L&R), AMP, BHF, CNO, F&G, GA, LNC, MET, PFG, PRU, RGA, VOYA. 1. 95% of AFS fixed maturity securities, including related party and ACRA non-controlling interest, designated NAIC 1 or 2. 75 KEY DIFFERENTIATORS : HIGH-QUALITY PRIVATE CREDIT, STRUCTURED CREDIT, DOWNSIDE-PROTECTED ALTERNATIVES

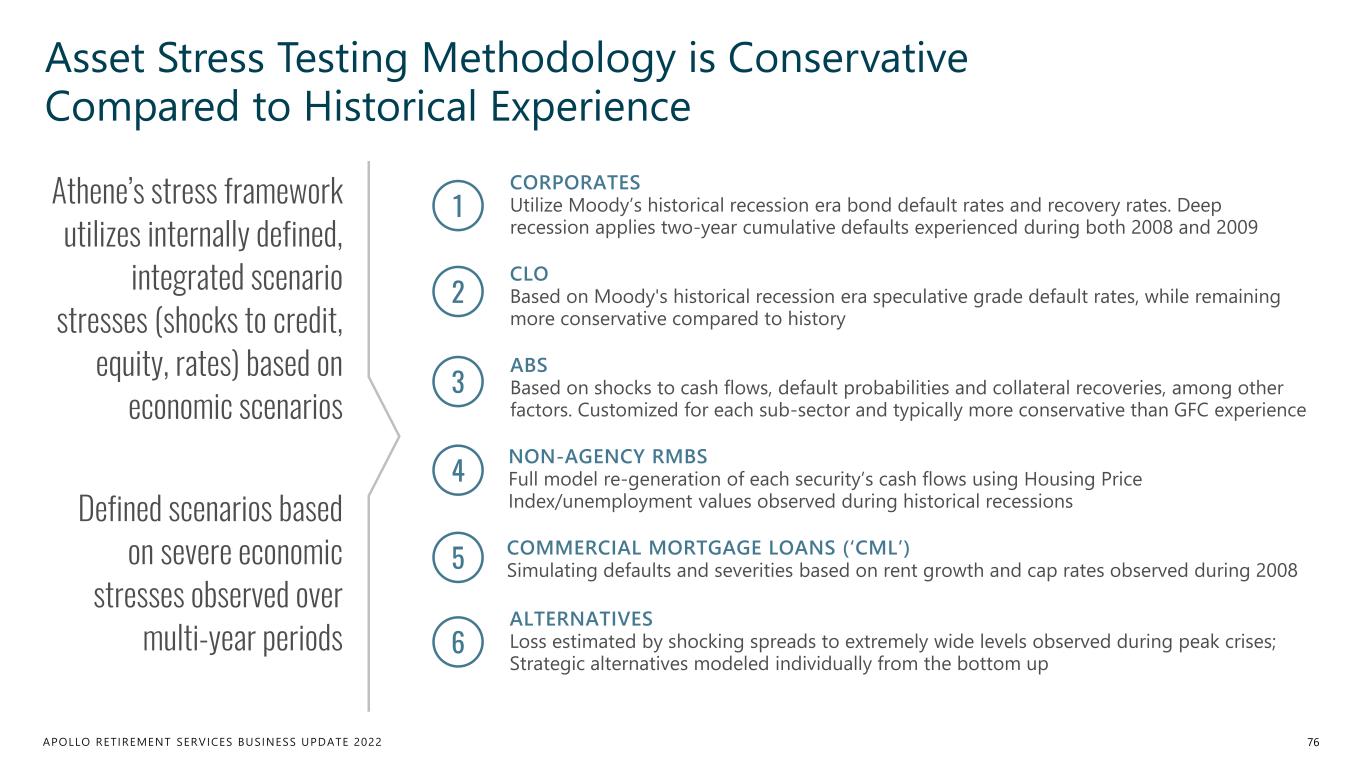

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Asset Stress Testing Methodology is Conservative Compared to Historical Experience 76 Athene’s stress framework utilizes internally defined, integrated scenario stresses (shocks to credit, equity, rates) based on economic scenarios Defined scenarios based on severe economic stresses observed over multi-year periods CORPORATES Utilize Moody’s historical recession era bond default rates and recovery rates. Deep recession applies two-year cumulative defaults experienced during both 2008 and 2009 CLO Based on Moody's historical recession era speculative grade default rates, while remaining more conservative compared to history NON-AGENCY RMBS Full model re-generation of each security’s cash flows using Housing Price Index/unemployment values observed during historical recessions COMMERCIAL MORTGAGE LOANS (‘CML’) Simulating defaults and severities based on rent growth and cap rates observed during 2008 ALTERNATIVES Loss estimated by shocking spreads to extremely wide levels observed during peak crises; Strategic alternatives modeled individually from the bottom up 1 2 4 5 6 3 ABS Based on shocks to cash flows, default probabilities and collateral recoveries, among other factors. Customized for each sub-sector and typically more conservative than GFC experience

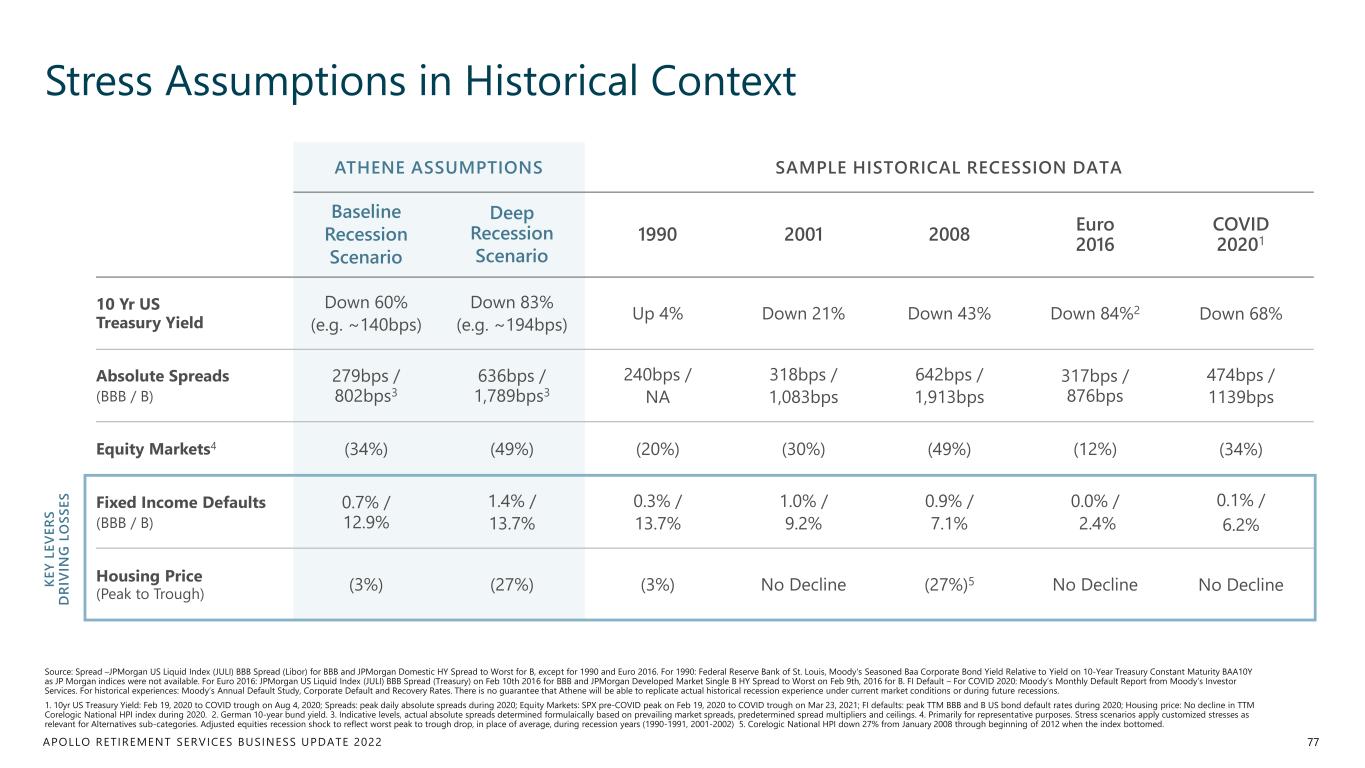

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 ATHENE ASSUMPTIONS SAMPLE HISTORICAL RECESSION DATA Baseline Recession Scenario Deep Recession Scenario 1990 2001 2008 Euro 2016 COVID 20201 10 Yr US Treasury Yield Down 60% (e.g. ~140bps) Down 83% (e.g. ~194bps) Up 4% Down 21% Down 43% Down 84%2 Down 68% Absolute Spreads (BBB / B) 279bps / 802bps3 636bps / 1,789bps3 240bps / NA 318bps / 1,083bps 642bps / 1,913bps 317bps / 876bps 474bps / 1139bps Equity Markets4 (34%) (49%) (20%) (30%) (49%) (12%) (34%) Fixed Income Defaults (BBB / B) 0.7% / 12.9% 1.4% / 13.7% 0.3% / 13.7% 1.0% / 9.2% 0.9% / 7.1% 0.0% / 2.4% 0.1% / 6.2% Housing Price (Peak to Trough) (3%) (27%) (3%) No Decline (27%)5 No Decline No Decline Stress Assumptions in Historical Context Source: Spread –JPMorgan US Liquid Index (JULI) BBB Spread (Libor) for BBB and JPMorgan Domestic HY Spread to Worst for B, except for 1990 and Euro 2016. For 1990: Federal Reserve Bank of St. Louis, Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity BAA10Y as JP Morgan indices were not available. For Euro 2016: JPMorgan US Liquid Index (JULI) BBB Spread (Treasury) on Feb 10th 2016 for BBB and JPMorgan Developed Market Single B HY Spread to Worst on Feb 9th, 2016 for B. FI Default – For COVID 2020: Moody’s Monthly Default Report from Moody’s Investor Services. For historical experiences: Moody’s Annual Default Study, Corporate Default and Recovery Rates. There is no guarantee that Athene will be able to replicate actual historical recession experience under current market conditions or during future recessions. 1. 10yr US Treasury Yield: Feb 19, 2020 to COVID trough on Aug 4, 2020; Spreads: peak daily absolute spreads during 2020; Equity Markets: SPX pre-COVID peak on Feb 19, 2020 to COVID trough on Mar 23, 2021; FI defaults: peak TTM BBB and B US bond default rates during 2020; Housing price: No decline in TTM Corelogic National HPI index during 2020. 2. German 10-year bund yield. 3. Indicative levels, actual absolute spreads determined formulaically based on prevailing market spreads, predetermined spread multipliers and ceilings. 4. Primarily for representative purposes. Stress scenarios apply customized stresses as relevant for Alternatives sub-categories. Adjusted equities recession shock to reflect worst peak to trough drop, in place of average, during recession years (1990-1991, 2001-2002) 5. Corelogic National HPI down 27% from January 2008 through beginning of 2012 when the index bottomed. 77 K E Y L E V E R S D R IV IN G L O S S E S

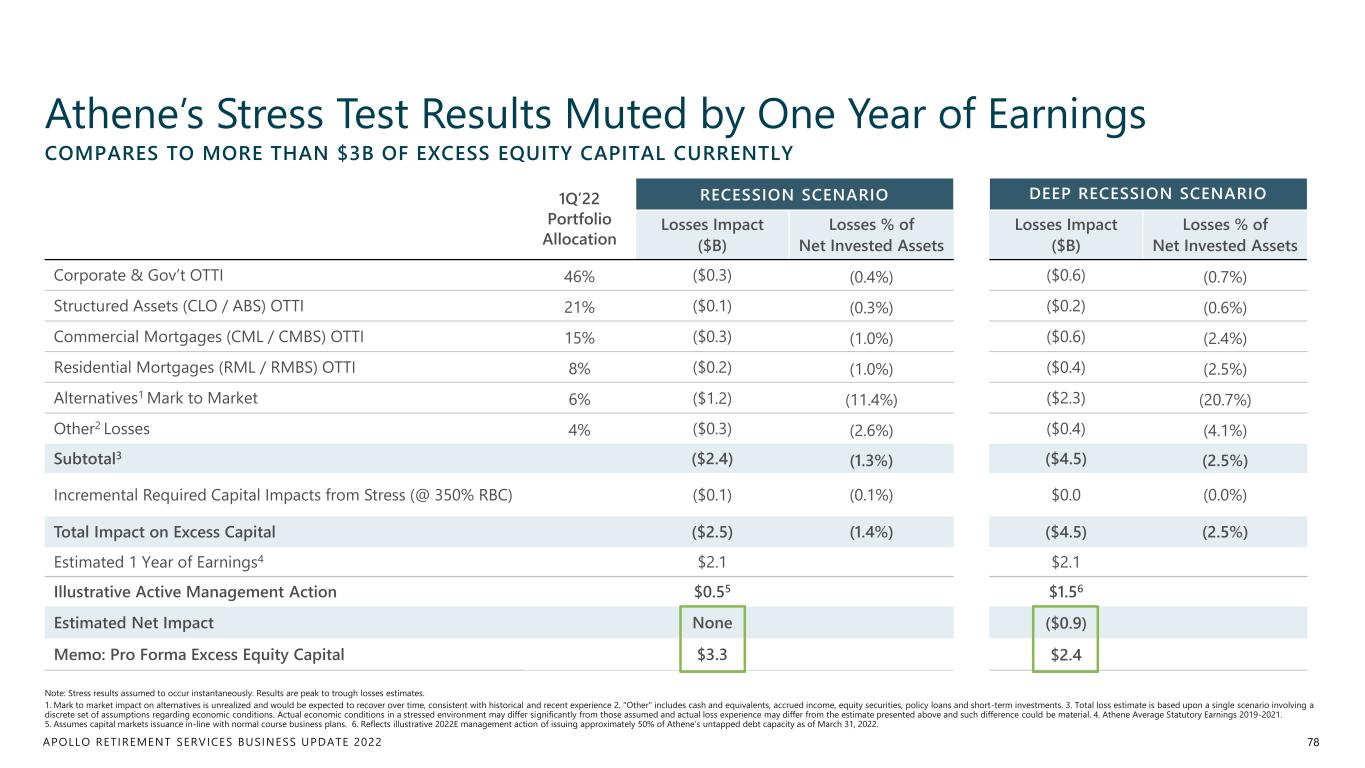

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Athene’s Stress Test Results Muted by One Year of Earnings 78 1Q’22 Portfolio Allocation RECESSION SCENARIO DEEP RECESSION SCENARIO Losses Impact ($B) Losses % of Net Invested Assets Losses Impact ($B) Losses % of Net Invested Assets Corporate & Gov’t OTTI 46% ($0.3) (0.4%) ($0.6) (0.7%) Structured Assets (CLO / ABS) OTTI 21% ($0.1) (0.3%) ($0.2) (0.6%) Commercial Mortgages (CML / CMBS) OTTI 15% ($0.3) (1.0%) ($0.6) (2.4%) Residential Mortgages (RML / RMBS) OTTI 8% ($0.2) (1.0%) ($0.4) (2.5%) Alternatives1 Mark to Market 6% ($1.2) (11.4%) ($2.3) (20.7%) Other2 Losses 4% ($0.3) (2.6%) ($0.4) (4.1%) Subtotal3 ($2.4) (1.3%) ($4.5) (2.5%) Incremental Required Capital Impacts from Stress (@ 350% RBC) ($0.1) (0.1%) $0.0 (0.0%) Total Impact on Excess Capital ($2.5) (1.4%) ($4.5) (2.5%) Estimated 1 Year of Earnings4 $2.1 $2.1 Illustrative Active Management Action $0.55 $1.56 Estimated Net Impact None ($0.9) Memo: Pro Forma Excess Equity Capital $3.3 $2.4 Note: Stress results assumed to occur instantaneously. Results are peak to trough losses estimates. 1. Mark to market impact on alternatives is unrealized and would be expected to recover over time, consistent with historical and recent experience 2. "Other" includes cash and equivalents, accrued income, equity securities, policy loans and short-term investments. 3. Total loss estimate is based upon a single scenario involving a discrete set of assumptions regarding economic conditions. Actual economic conditions in a stressed environment may differ significantly from those assumed and actual loss experience may differ from the estimate presented above and such difference could be material. 4. Athene Average Statutory Earnings 2019-2021. 5. Assumes capital markets issuance in-line with normal course business plans. 6. Reflects illustrative 2022E management action of issuing approximately 50% of Athene’s untapped debt capacity as of March 31, 2022. COMPARES TO MORE THAN $3B OF EXCESS EQUITY CAPITAL CURRENTLY

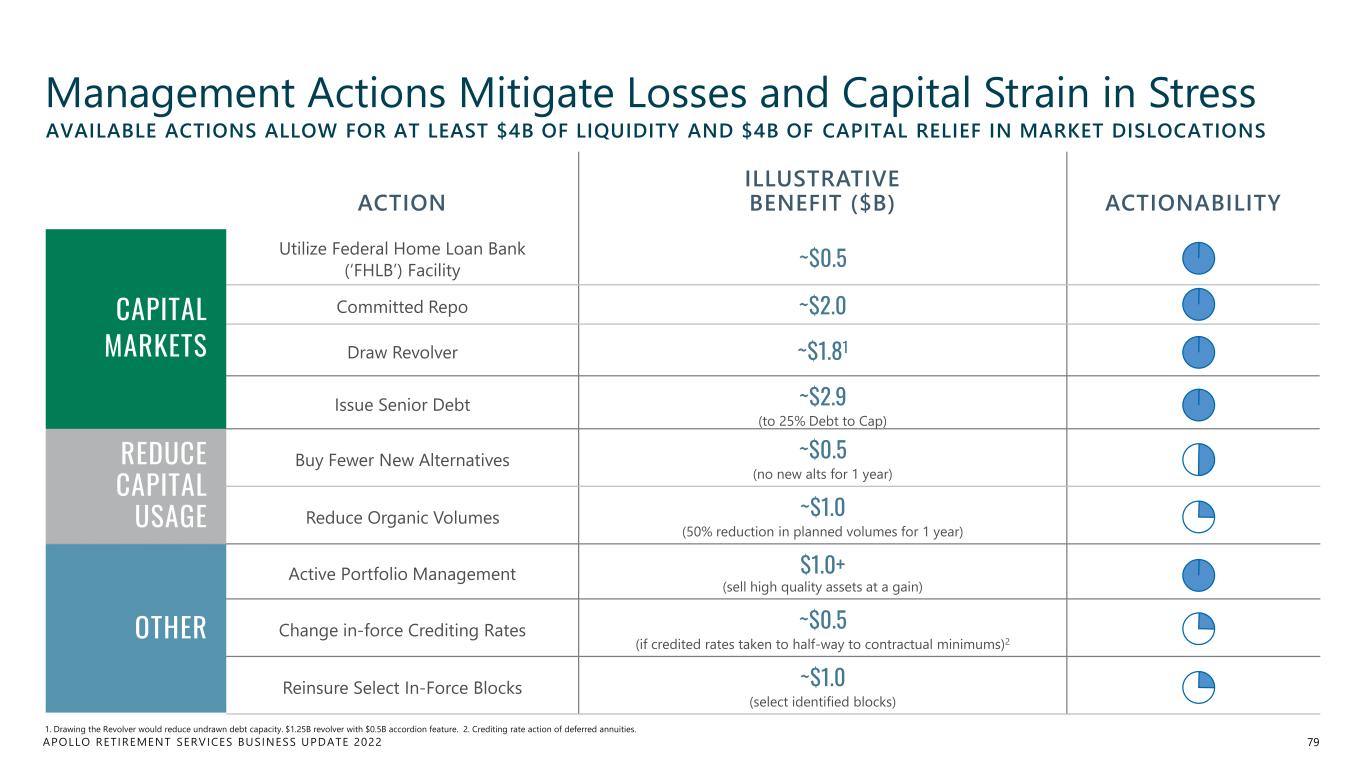

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Management Actions Mitigate Losses and Capital Strain in Stress ACTION ILLUSTRATIVE BENEFIT ($B) ACTIONABILITY CAPITAL MARKETS Utilize Federal Home Loan Bank (‘FHLB’) Facility ~$0.5 Committed Repo ~$2.0 Draw Revolver ~$1.81 Issue Senior Debt ~$2.9 (to 25% Debt to Cap) REDUCE CAPITAL USAGE Buy Fewer New Alternatives ~$0.5 (no new alts for 1 year) Reduce Organic Volumes ~$1.0 (50% reduction in planned volumes for 1 year) OTHER Active Portfolio Management $1.0+ (sell high quality assets at a gain) Change in-force Crediting Rates ~$0.5 (if credited rates taken to half-way to contractual minimums)2 Reinsure Select In-Force Blocks ~$1.0 (select identified blocks) 79 1. Drawing the Revolver would reduce undrawn debt capacity. $1.25B revolver with $0.5B accordion feature. 2. Crediting rate action of deferred annuities. AVAILABLE ACTIONS ALLOW FOR AT LEAST $4B OF LIQUIDITY AND $4B OF CAPITAL RELIEF IN MARKET DISLOCATIONS

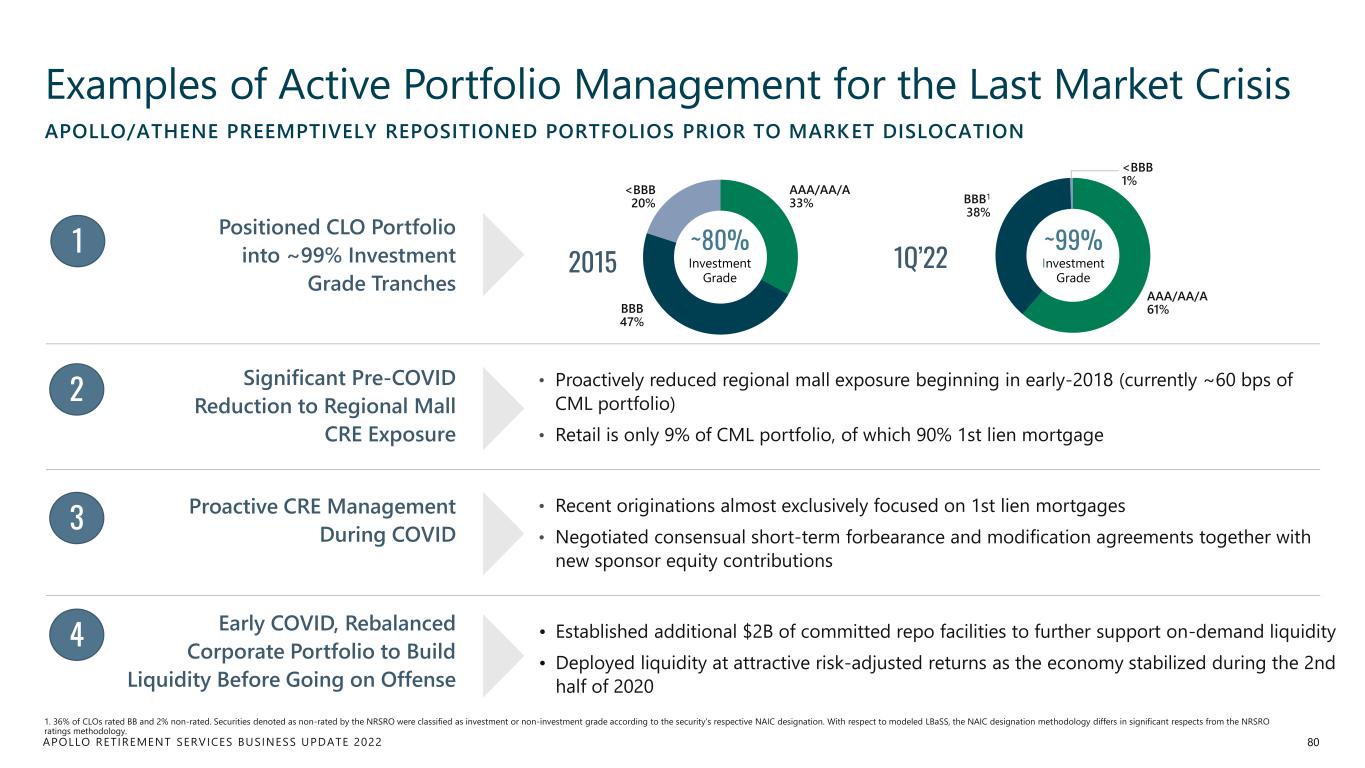

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 AAA/AA/A 33% BBB 47% <BBB 20% AAA/AA/A 61% BBB1 38% <BBB 1% Examples of Active Portfolio Management for the Last Market Crisis 80 2015 1Q’22 ~99% Investment Grade ~80% Investment Grade Positioned CLO Portfolio into ~99% Investment Grade Tranches • Proactively reduced regional mall exposure beginning in early-2018 (currently ~60 bps of CML portfolio) • Retail is only 9% of CML portfolio, of which 90% 1st lien mortgage Significant Pre-COVID Reduction to Regional Mall CRE Exposure • Recent originations almost exclusively focused on 1st lien mortgages • Negotiated consensual short-term forbearance and modification agreements together with new sponsor equity contributions Proactive CRE Management During COVID • Established additional $2B of committed repo facilities to further support on-demand liquidity • Deployed liquidity at attractive risk-adjusted returns as the economy stabilized during the 2nd half of 2020 Early COVID, Rebalanced Corporate Portfolio to Build Liquidity Before Going on Offense 1 2 3 4 APOLLO/ATHENE PREEMPTIVELY REPOSITIONED PORTFOLIOS PRIOR TO MARKET DISLOCATION 1. 36% of CLOs rated BB and 2% non-rated. Securities denoted as non-rated by the NRSRO were classified as investment or non-investment grade according to the security’s respective NAIC designation. With respect to modeled LBaSS, the NAIC designation methodology differs in significant respects from the NRSRO ratings methodology.

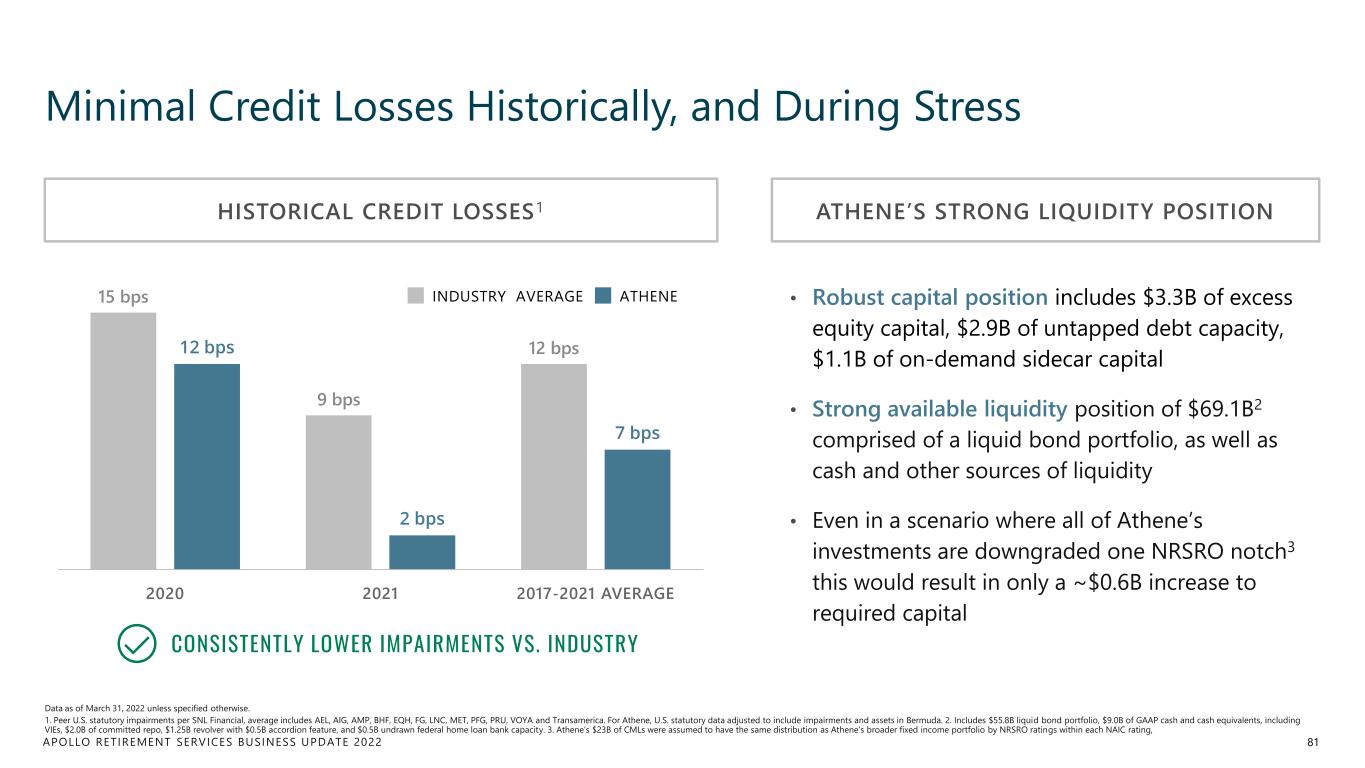

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Minimal Credit Losses Historically, and During Stress Data as of March 31, 2022 unless specified otherwise. 1. Peer U.S. statutory impairments per SNL Financial, average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. 2. Includes $55.8B liquid bond portfolio, $9.0B of GAAP cash and cash equivalents, including VIEs, $2.0B of committed repo, $1.25B revolver with $0.5B accordion feature, and $0.5B undrawn federal home loan bank capacity. 3. Athene’s $23B of CMLs were assumed to have the same distribution as Athene’s broader fixed income portfolio by NRSRO ratings within each NAIC rating, 81 ATHENEINDUSTRY AVERAGE15 bps 9 bps 12 bps12 bps 2 bps 7 bps 2020 2021 2017-2021 AVERAGE • Robust capital position includes $3.3B of excess equity capital, $2.9B of untapped debt capacity, $1.1B of on-demand sidecar capital • Strong available liquidity position of $69.1B2 comprised of a liquid bond portfolio, as well as cash and other sources of liquidity • Even in a scenario where all of Athene’s investments are downgraded one NRSRO notch3 this would result in only a ~$0.6B increase to required capital CONSISTENTLY LOWER IMPAIRMENTS VS. INDUSTRY HISTORICAL CREDIT LOSSES1 ATHENE’S STRONG LIQUIDITY POSITION

Asset Class Spotlight: Structured Credit BRET LEAS Partner, Structured Credit, Apollo

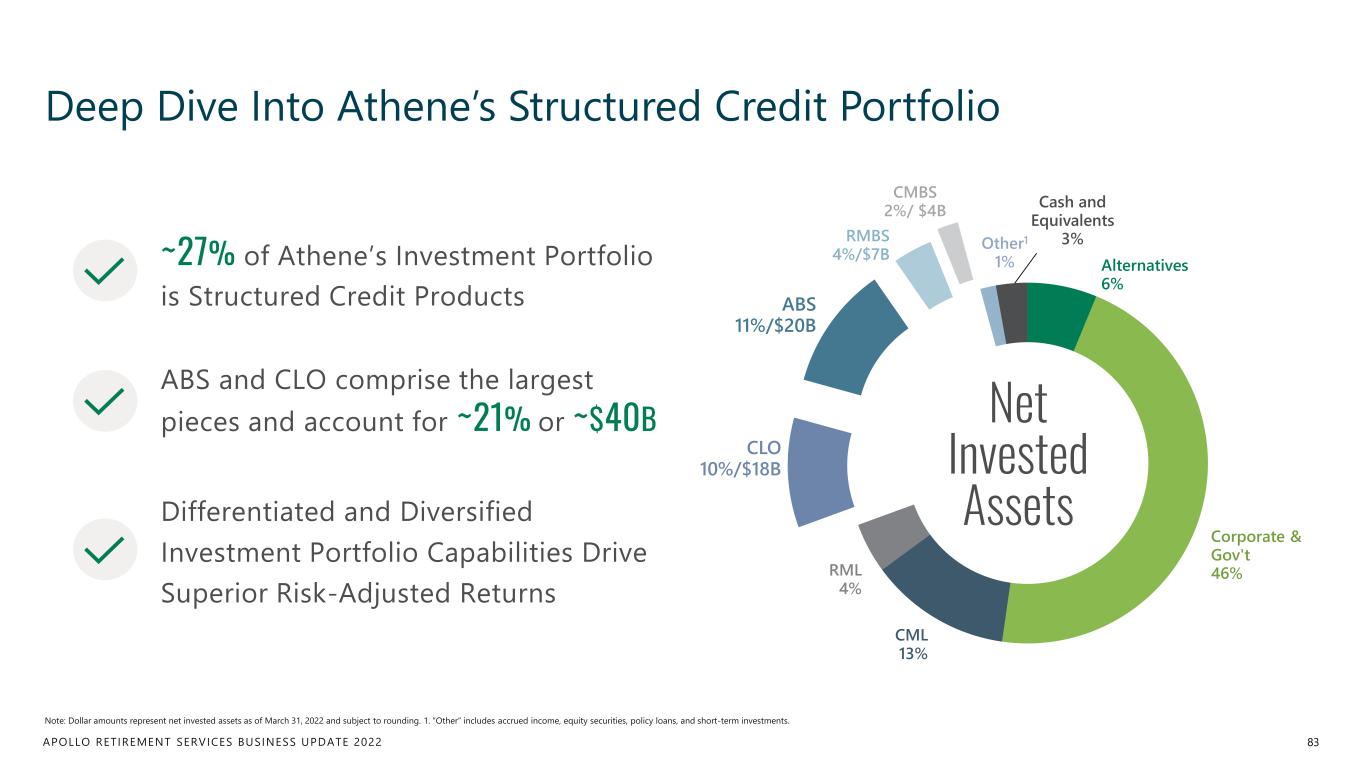

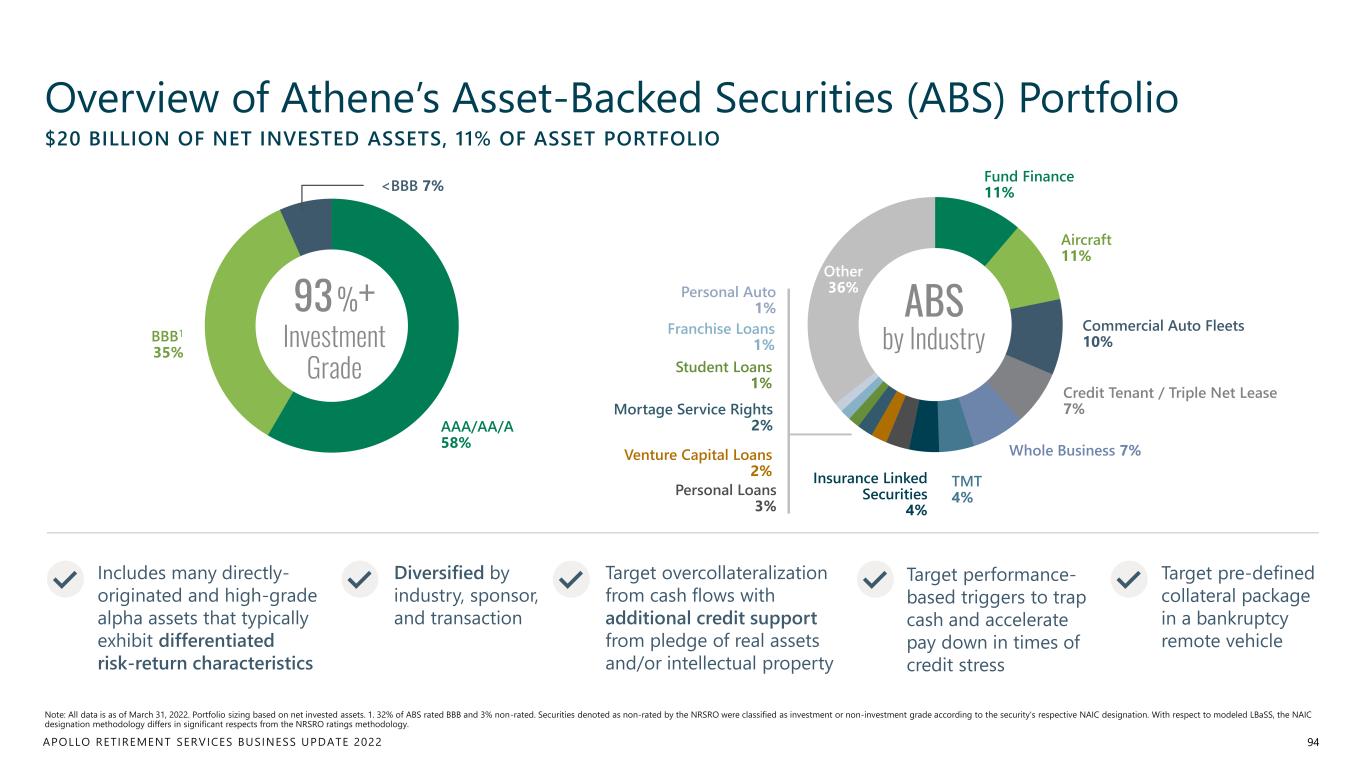

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Deep Dive Into Athene’s Structured Credit Portfolio 83 Note: Dollar amounts represent net invested assets as of March 31, 2022 and subject to rounding. 1. “Other” includes accrued income, equity securities, policy loans, and short-term investments. ~27% of Athene’s Investment Portfolio is Structured Credit Products ABS and CLO comprise the largest pieces and account for ~21% or ~$40B Differentiated and Diversified Investment Portfolio Capabilities Drive Superior Risk-Adjusted Returns Alternatives 6% Corporate & Gov't 46% CML 13% RML 4% CLO 10%/$18B ABS 11%/$20B RMBS 4%/$7B CMBS 2%/ $4B Other1 1% Cash and Equivalents 3% Net Invested Assets

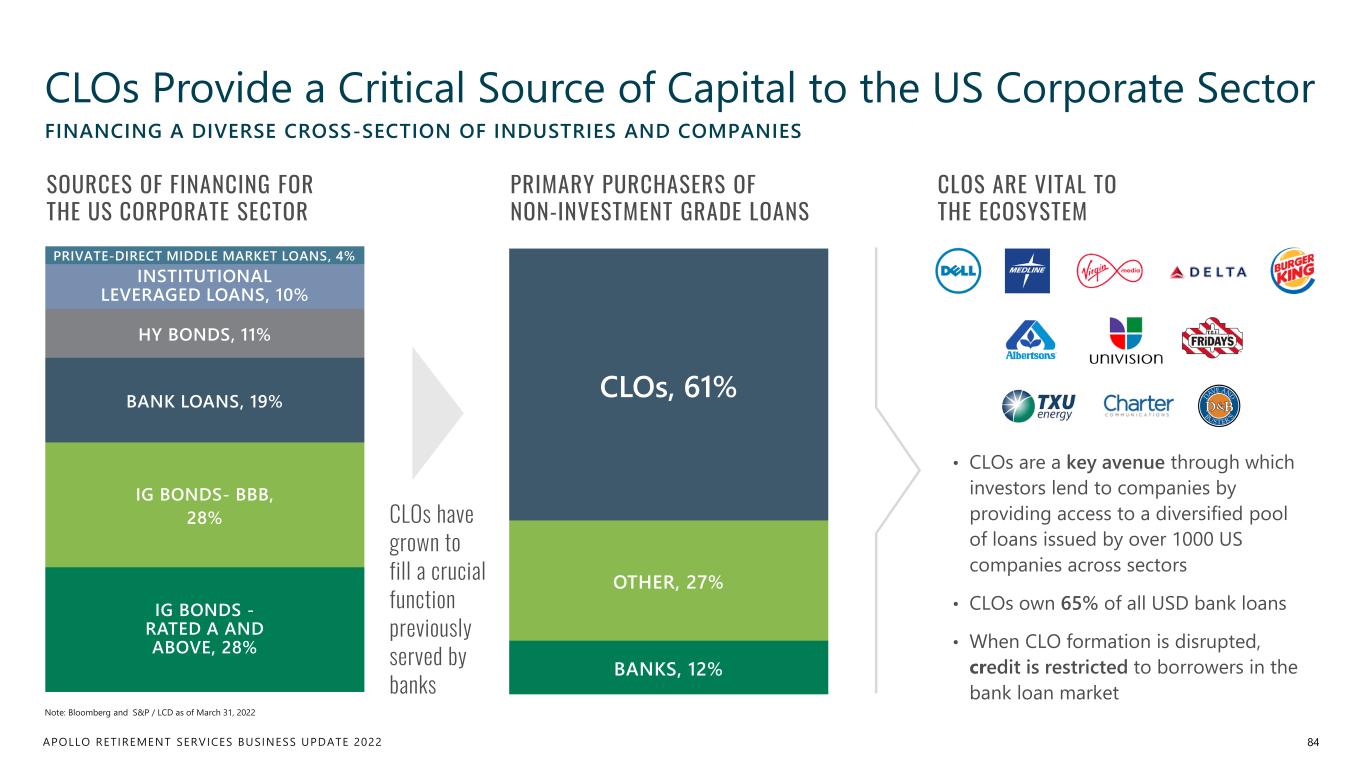

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 BANKS, 12% OTHER, 27% CLOs, 61% IG BONDS - RATED A AND ABOVE, 28% IG BONDS- BBB, 28% BANK LOANS, 19% HY BONDS, 11% INSTITUTIONAL LEVERAGED LOANS, 10% PRIVATE-DIRECT MIDDLE MARKET LOANS, 4% CLOs Provide a Critical Source of Capital to the US Corporate Sector 84 Note: Bloomberg and S&P / LCD as of March 31, 2022 FINANCING A DIVERSE CROSS-SECTION OF INDUSTRIES AND COMPANIES CLOs have grown to fill a crucial function previously served by banks • CLOs are a key avenue through which investors lend to companies by providing access to a diversified pool of loans issued by over 1000 US companies across sectors • CLOs own 65% of all USD bank loans • When CLO formation is disrupted, credit is restricted to borrowers in the bank loan market SOURCES OF FINANCING FOR THE US CORPORATE SECTOR PRIMARY PURCHASERS OF NON-INVESTMENT GRADE LOANS CLOS ARE VITAL TO THE ECOSYSTEM

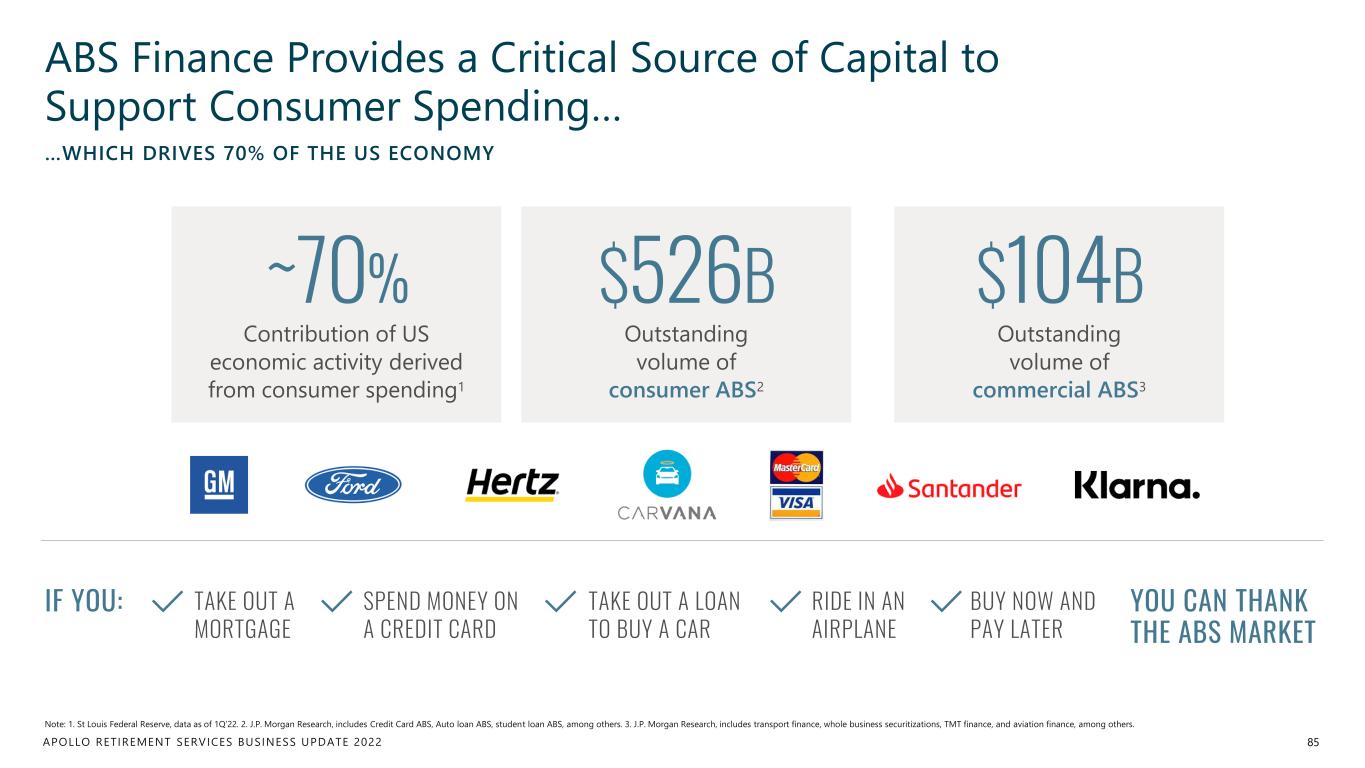

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 ABS Finance Provides a Critical Source of Capital to Support Consumer Spending… 85 Note: 1. St Louis Federal Reserve, data as of 1Q’22. 2. J.P. Morgan Research, includes Credit Card ABS, Auto loan ABS, student loan ABS, among others. 3. J.P. Morgan Research, includes transport finance, whole business securitizations, TMT finance, and aviation finance, among others. …WHICH DRIVES 70% OF THE US ECONOMY ~70% Contribution of US economic activity derived from consumer spending1 $526B Outstanding volume of consumer ABS2 $104B Outstanding volume of commercial ABS3 IF YOU: YOU CAN THANK THE ABS MARKET TAKE OUT A MORTGAGE SPEND MONEY ON A CREDIT CARD TAKE OUT A LOAN TO BUY A CAR RIDE IN AN AIRPLANE BUY NOW AND PAY LATER

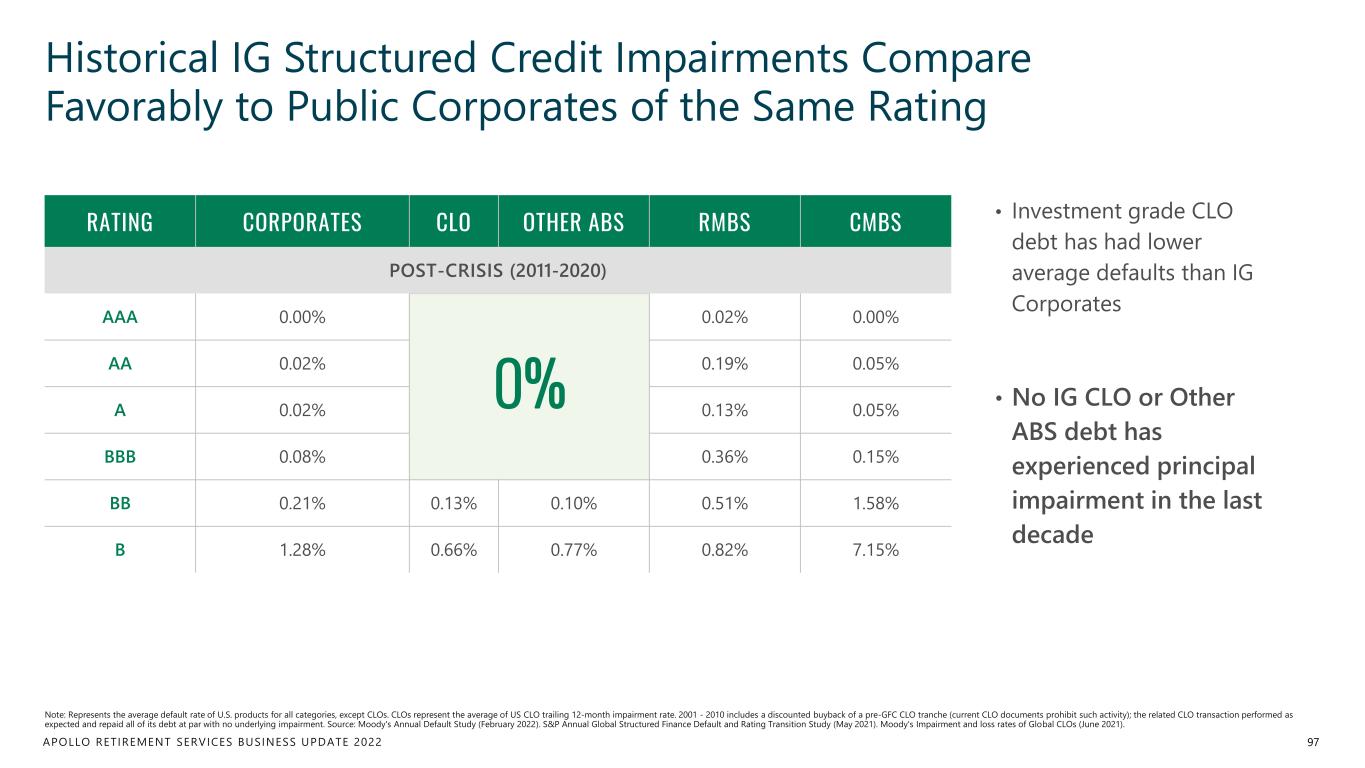

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022 Why is Structured Credit an Attractive Asset Class for Athene? 86 The illiquidity and complexity premia offered by structured credit provides an attractive means for investors with the appropriate expertise, stable funding, and capital to earn incremental yield without incremental credit risk STRUCTURAL PROTECTIONS THAT DIVERT CASH TO SUPPORT IG DEBT TRANCHES IN PERIODS OF STRESS CREDIT ENHANCEMENT DIVERSIFICATION BENEFIT