EX-99.1

Published on October 19, 2021

APOLLO INVESTOR DAY 2021 Forward Looking Statements and Important Disclosures 2 This presentation has been prepared by Apollo Global Management, Inc., a Delaware corporation (together with its subsidiaries, “Apollo”) solely for informational purposes for its public stockholders in connection with evaluating the business, operations and financial results of Apollo and Athene Holding Ltd., a Bermuda exempted company (together with its subsidiaries, “Athene”), and assumes that the previously announced merger of Apollo and Athene will be successfully consummated. Information and data in the materials are as of June 30, 2021 unless otherwise noted, including information and data labeled “2021”, “Current”, “Today” and similar labeled content. Information and data labeled “Tomorrow” is prospective and aspirational and not intended to denote a particular date in the future unless otherwise noted. Apollo makes no representation or warranty, express or implied, as to the fairness, accuracy, reasonableness or completeness of the information contained herein, including, but not limited to, information obtained from third parties. Unless otherwise specified, information included herein is sourced from and reflects the views and opinions of Apollo Analysts. Certain information contained in these materials has been obtained from sources other than Apollo. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and Apollo does not take any responsibility for such information. This presentation may contain trade names, trademarks and service marks of companies which (i) neither Apollo nor Apollo Funds own or (ii) are investments of Apollo or one or more Apollo Funds. We do not intend our use or display of these companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, such companies. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. No Offer or Solicitation This presentation is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities, products or services, including interests in the funds, vehicles or accounts sponsored or managed by Apollo (each, an “Apollo Fund”), any capital markets services offered by Apollo, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Additional Information Regarding the Transaction and Where to Find It This presentation is being made in respect of the proposed transaction involving Tango Holdings, Inc., a Delaware corporation and a direct wholly owned subsidiary of Apollo (“HoldCo”), Apollo and Athene. The proposed transaction will be submitted to the stockholders of Apollo and the shareholders of Athene for their respective consideration. In connection therewith, the parties intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive joint proxy statement/prospectus, which will be mailed to the stockholders of Apollo and the shareholders of Athene. However, such documents are not currently available. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, AS APPLICABLE, INVESTORS AND SECURITY HOLDERS OF APOLLO AND ATHENE ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive joint proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about Apollo and Athene, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Apollo will be available free of charge under the “Stockholders” section of Apollo’s website located at http://www.apollo.com or by contacting Apollo’s Investor Relations Department at (212) 822-0528 or ir@apollo.com. Copies of the documents filed with the SEC by Athene will be available free of charge under the “Investors” section of Athene’s website located at http://www.athene.com or by contacting Athene’s Investor Relations Department at (441) 279-8531 or ir@athene.com. Participants in the Solicitation Apollo, Athene, HoldCo and their respective directors, executive officers, members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Apollo and HoldCo is set forth in Apollo’s proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on August 16, 2021, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Information about the directors and executive officers of Athene is set forth in Athene’s proxy statement for its 2021 annual meeting of shareholders, which was filed with the SEC on July 22, 2021, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, its amendment to its annual report on Form 10-K/A for the fiscal year ended December 31, 2020, which was filed with the SEC on April 20, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above.

APOLLO INVESTOR DAY 2021 Forward Looking Statements and Important Disclosures 3 Other information regarding the participants in the proxy solicitations of the stockholders of Apollo and the shareholders of Athene, and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Forward Looking Statements Apollo Safe Harbor for Forward Looking Statements Disclaimer This presentation contains forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend”, “may”, “will”, “could”, “should”, “might”, “target”, “project”, “plan”, “seek”, “continue” and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. It is possible that actual results will differ, possibly materially, from the anticipated results indicated in these statements. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to Apollo’s dependence on certain key personnel, Apollo’s ability to raise new Apollo Funds, the impact of COVID-19, the impact of energy market dislocation, market conditions, generally, Apollo’s ability to manage its growth, fund performance, changes in Apollo’s regulatory environment and tax status, the variability of Apollo’s revenues, net income and cash flow, Apollo’s use of leverage to finance its businesses and investments by Apollo Funds, litigation risks and consummation of the merger of Apollo with Athene, potential governance changes and related transactions which are subject to regulatory, corporate and shareholders approvals, among others. Due to the COVID-19 pandemic, there has been uncertainty and disruption in the global economy and financial markets. While Apollo is unable to accurately predict the full impact that COVID-19 will have on Apollo’s results from operations, financial condition, liquidity and cash flows due to numerous uncertainties, including the duration and severity of the pandemic and containment measures, Apollo’s compliance with these measures has impacted Apollo’s day-to-day operations and could disrupt Apollo’s business and operations, as well as that of the Apollo Funds and their portfolio companies, for an indefinite period of time. Apollo believes these factors include but are not limited to those described under the section entitled “Risk Factors” in Apollo’s annual report on Form 10-K filed with the SEC on February 19, 2021 and Quarterly Report on Form 10-Q filed with the SEC on May 10, 2021, as such factors may be updated from time to time in Apollo’s periodic filings with the SEC, which are accessible on the SEC’s website at http://www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in other filings. The proposed transaction is subject to risks, uncertainties and assumptions, which include, but are not limited to: (i) that Apollo may be unable to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant or place material restrictions on its approval for the consummation of the proposed transaction; (ii) uncertainty as to the timing of completion of the proposed transaction; (iii) the inability to complete the proposed transaction due to the failure to obtain Apollo stockholder approval and Athene shareholder approval for the proposed transaction; (iv) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (v) risks related to disruption of management’s attention from Apollo’s ongoing business operations due to the proposed transaction; (vi) the effect of the announcement of the proposed transaction on Apollo’s relationships with its clients, operating results and business generally; (vii) the outcome of any legal proceedings to the extent initiated against Apollo or others following the announcement of the proposed transaction, as well as Apollo’s management’s response to any of the aforementioned factors; and (viii) industry conditions. Apollo undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law. This presentation does not constitute an offer of any Apollo Fund. Athene Safe Harbor for Forward-Looking Statements This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, statements regarding: the consummation of the proposed merger and the benefits to be derived therefrom; the future financial performance and growth prospects of the combined entity; the market environment in which the combined entity will operate; future capital allocation decisions, including the payment of dividends; the structure and operation of the company post-merger; and the tax treatment of the proposed transaction.

APOLLO INVESTOR DAY 2021 Forward Looking Statements and Important Disclosures 4 Factors that could cause actual results, events and developments to differ include, without limitation: Athene’s failure to obtain approval of the proposed transaction by its shareholders or regulators; Athene’s failure to recognize the benefits expected to be derived from the proposed transaction; unanticipated difficulties or expenditures relating to the proposed transaction; disruptions of Athene’s current plans, operations and relationships with customers, suppliers and other business partners caused by the announcement and pendency of the proposed transaction; legal proceedings, including those that may be instituted against Athene, Athene’s board of directors or special committee, Athene’s executive officers and others following announcement of the proposed transaction; the accuracy of Athene’s assumptions and estimates; Athene’s ability to maintain or improve financial strength ratings; Athene’s ability to manage its business in a highly regulated industry; regulatory changes or actions; the impact of Athene’s reinsurers failing to meet their assumed obligations; the impact of interest rate fluctuations; changes in the federal income tax laws and regulations; the accuracy of Athene’s interpretation of the Tax Cuts and Jobs Act, litigation (including class action litigation), enforcement investigations or regulatory scrutiny; the performance of third parties; the loss of key personnel; telecommunication, information technology and other operational systems failures; the continued availability of capital; new accounting rules or changes to existing accounting rules; general economic conditions; Athene’s ability to protect its intellectual property; the ability to maintain or obtain approval of the Delaware Department of Insurance, the Iowa Insurance Division and other regulatory authorities as required for Athene’s operations; and other factors discussed from time to time in Athene’s filings with the SEC, including its annual report on Form 10-K for the year ended December 31, 2020 and quarterly report on Form 10-Q filed for the period ended June 30, 2021, which can be found at the SEC’s website at http://www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The contents of any website referenced in this presentation are not incorporated by reference. Performance Information Past performance is not necessarily indicative of future results and there can be no assurance that Apollo, Athene or any Apollo Fund or strategy will achieve comparable results, or that any investments made by Apollo in the future will be profitable. Actual realized value of currently unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the current unrealized valuations are based. Accordingly, the actual realized values of unrealized investments may differ materially from the values indicated herein. Information contained herein may include information with respect to prior investment performance of one or more Apollo and Athene funds or investments, including gross and/or net internal rates of return (“IRR”) and gross and/or net multiple of investment cost (“MOIC”). Information with respect to prior performance, while a useful tool in evaluating investment activities, is not necessarily indicative of actual results that may be achieved for unrealized investments. The realization of such performance is dependent upon many factors, many of which are beyond the control of Apollo. Aggregated return information is not reflective of an investable product, and as such does not reflect the returns of any Apollo Fund. Please refer to the Appendix for additional important information.

APOLLO INVESTOR DAY 2021 Welcome Remarks NOAH GUNN Global Head of Investor Relations

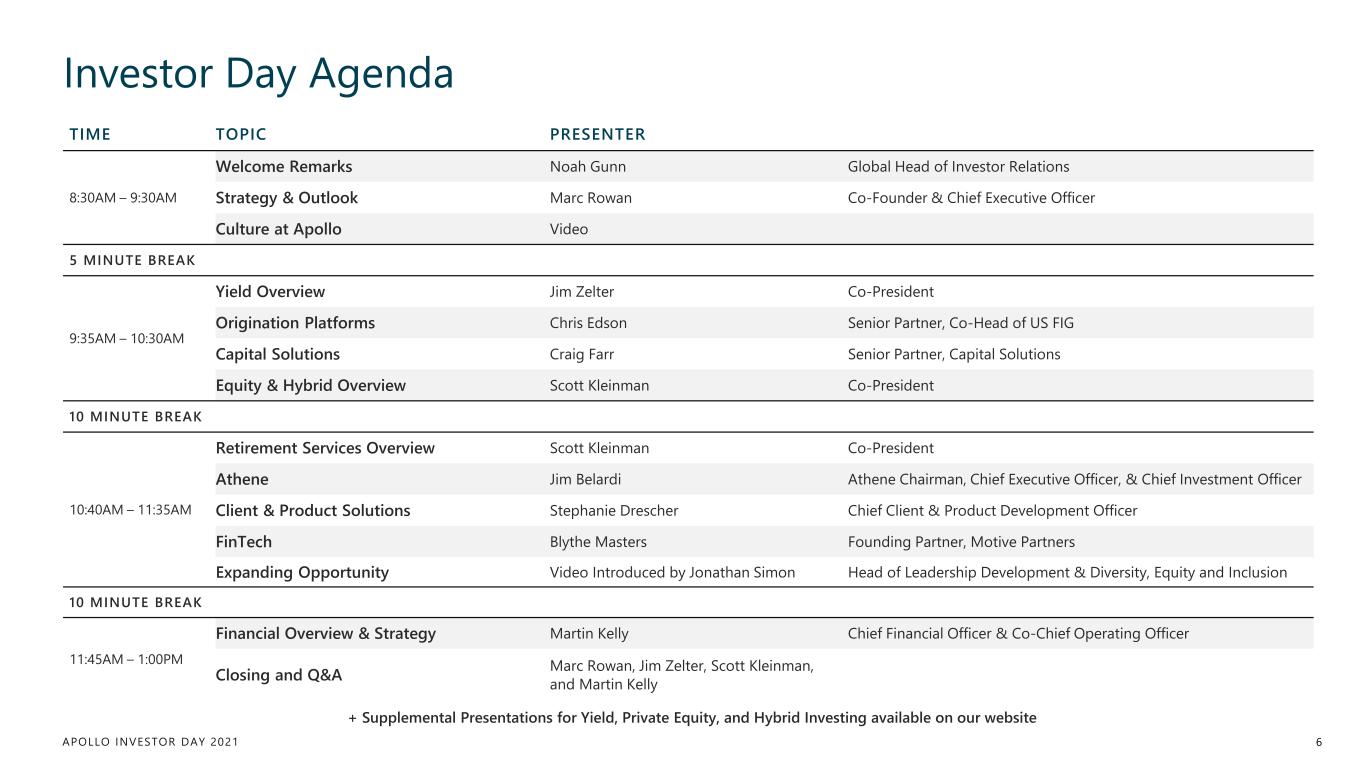

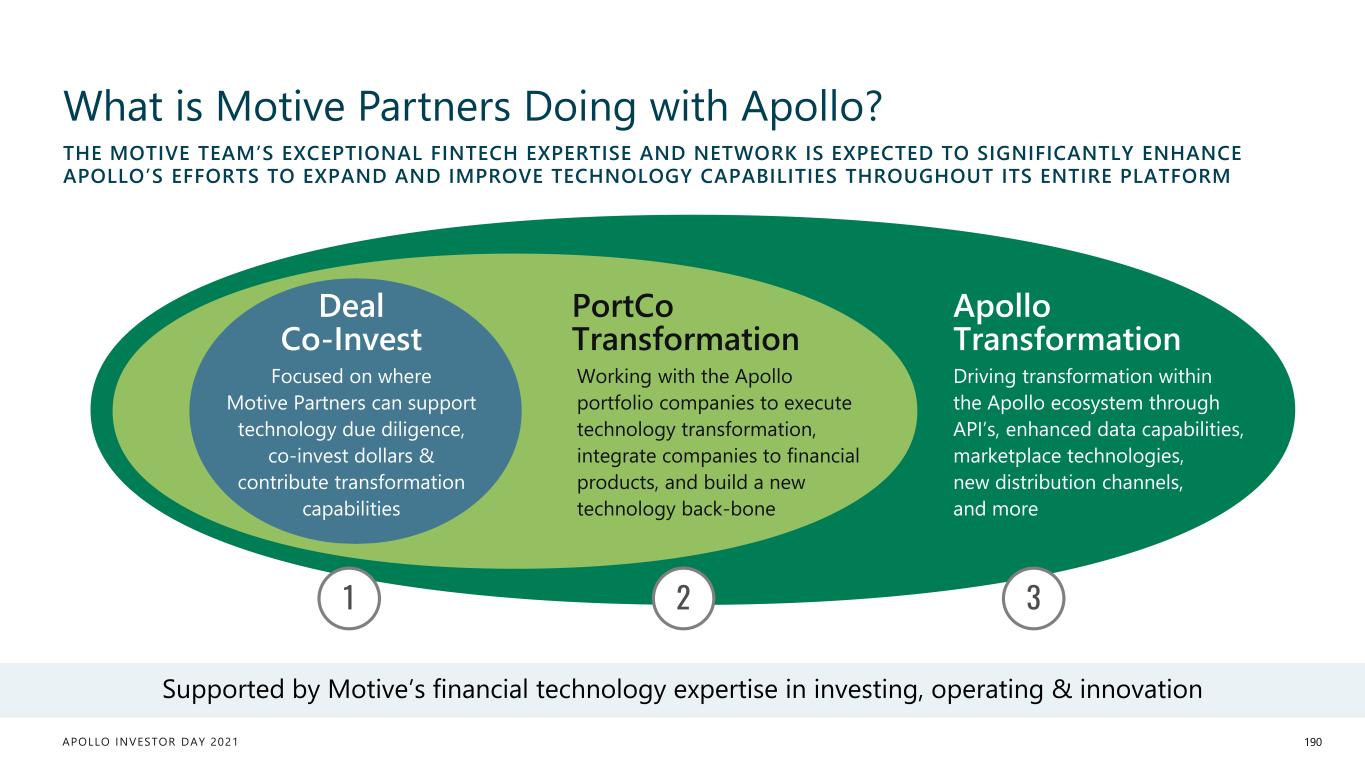

APOLLO INVESTOR DAY 2021 TIME TOPIC PRESENTER 8:30AM – 9:30AM Welcome Remarks Noah Gunn Global Head of Investor Relations Strategy & Outlook Marc Rowan Co-Founder & Chief Executive Officer Culture at Apollo Video 5 MINUTE BREAK 9:35AM – 10:30AM Yield Overview Jim Zelter Co-President Origination Platforms Chris Edson Senior Partner, Co-Head of US FIG Capital Solutions Craig Farr Senior Partner, Capital Solutions Equity & Hybrid Overview Scott Kleinman Co-President 10 MINUTE BREAK 10:40AM – 11:35AM Retirement Services Overview Scott Kleinman Co-President Athene Jim Belardi Athene Chairman, Chief Executive Officer, & Chief Investment Officer Client & Product Solutions Stephanie Drescher Chief Client & Product Development Officer FinTech Blythe Masters Founding Partner, Motive Partners Expanding Opportunity Video Introduced by Jonathan Simon Head of Leadership Development & Diversity, Equity and Inclusion 10 MINUTE BREAK 11:45AM – 1:00PM Financial Overview & Strategy Martin Kelly Chief Financial Officer & Co-Chief Operating Officer Closing and Q&A Marc Rowan, Jim Zelter, Scott Kleinman, and Martin Kelly Investor Day Agenda 6 + Supplemental Presentations for Yield, Private Equity, and Hybrid Investing available on our website

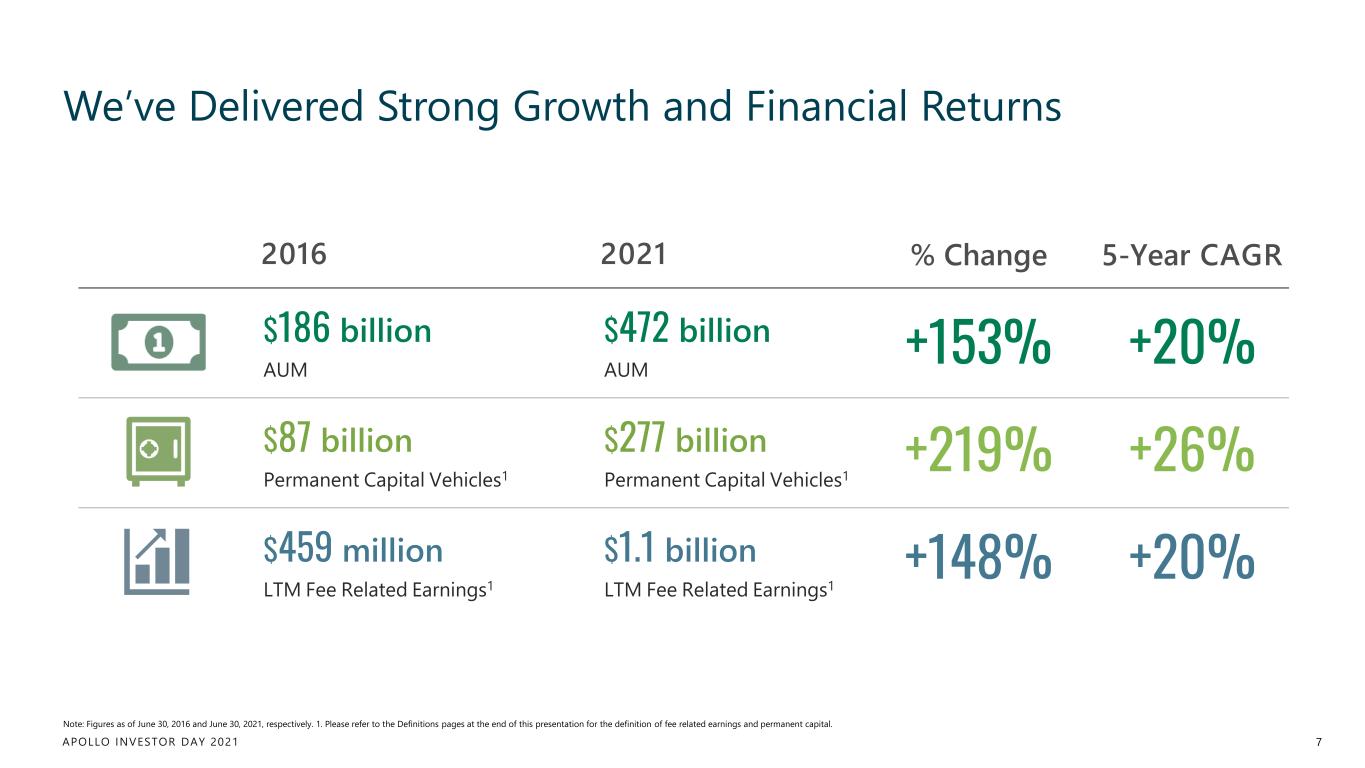

APOLLO INVESTOR DAY 2021 $186 billion AUM $472 billion AUM $87 billion Permanent Capital Vehicles1 $277 billion Permanent Capital Vehicles1 $459 million LTM Fee Related Earnings1 $1.1 billion LTM Fee Related Earnings1 We’ve Delivered Strong Growth and Financial Returns 7 Note: Figures as of June 30, 2016 and June 30, 2021, respectively. 1. Please refer to the Definitions pages at the end of this presentation for the definition of fee related earnings and permanent capital. +153% +219% +20% +26% 2021 % Change 5-Year CAGR +148% +20% 2016

APOLLO INVESTOR DAY 2021 Strategy & Outlook MARC ROWAN Co-Founder & Chief Executive Officer

APOLLO INVESTOR DAY 2021 9 AN AMAZING 31-YEAR JOURNEY $472B Total Assets Under Management across Yield, Hybrid, and Equity Investing Strategies 2,000+ Employees Around the World $40B Pro-Forma Market Capitalization and S&P 500 Eligible AUM as of June 30, 2021. Employees as of September 30, 2021. Market Cap based on current APO share price as of October 15, 2021 and pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset.

APOLLO INVESTOR DAY 2021 “Culture eats strategy for breakfast.” -PETER DRUCKER We Can’t Underestimate the Importance of Culture 10

APOLLO INVESTOR DAY 2021 People and Culture Are at the Core of What We Do 11 ONE APOLLO Challenging Conventional Thinking Collaboration Across Integrated Platform Partnership & Alignment with Clients Excellence in Investing Entrepreneurial Growth Mindset Focus on Expanding Opportunity Simplified Operating Philosophy Aligned Compensation Philosophy with Strong Performance Authenticity & Empowerment Lead Responsibly

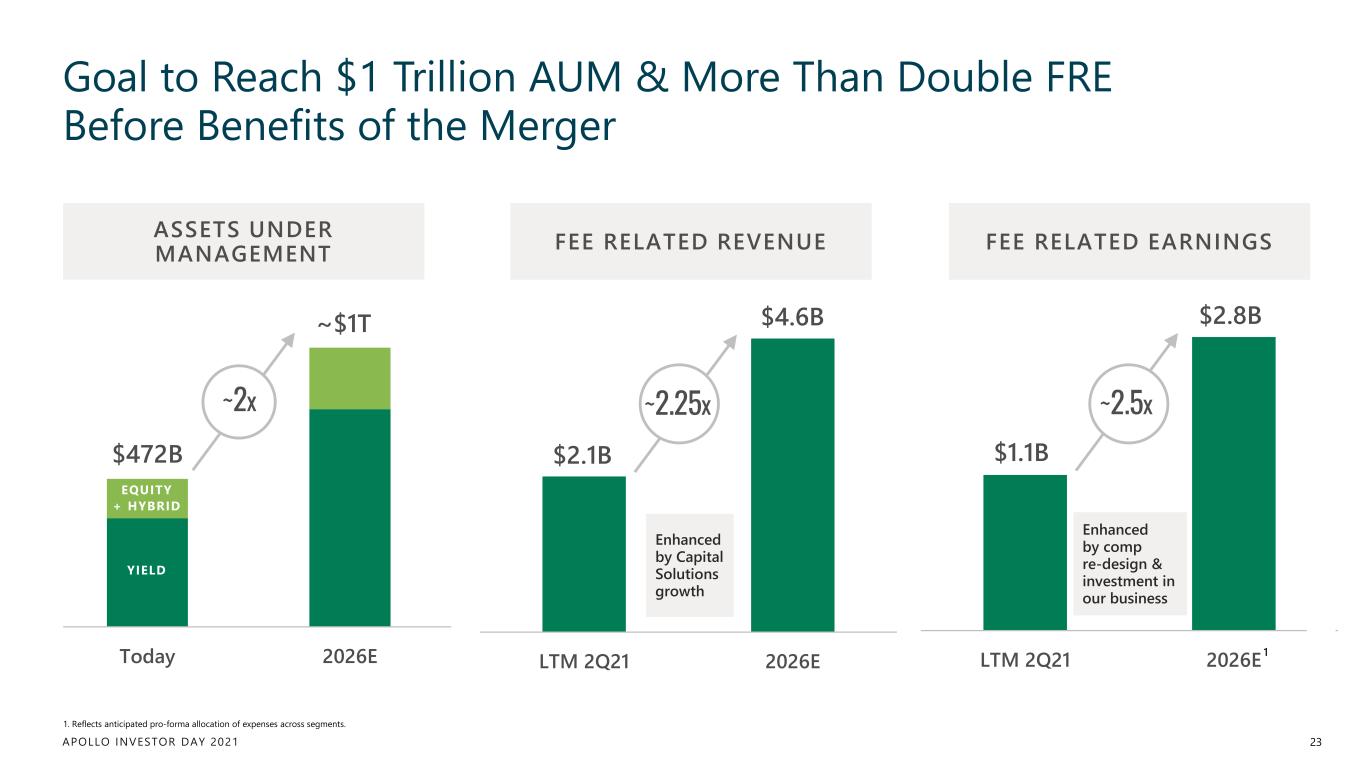

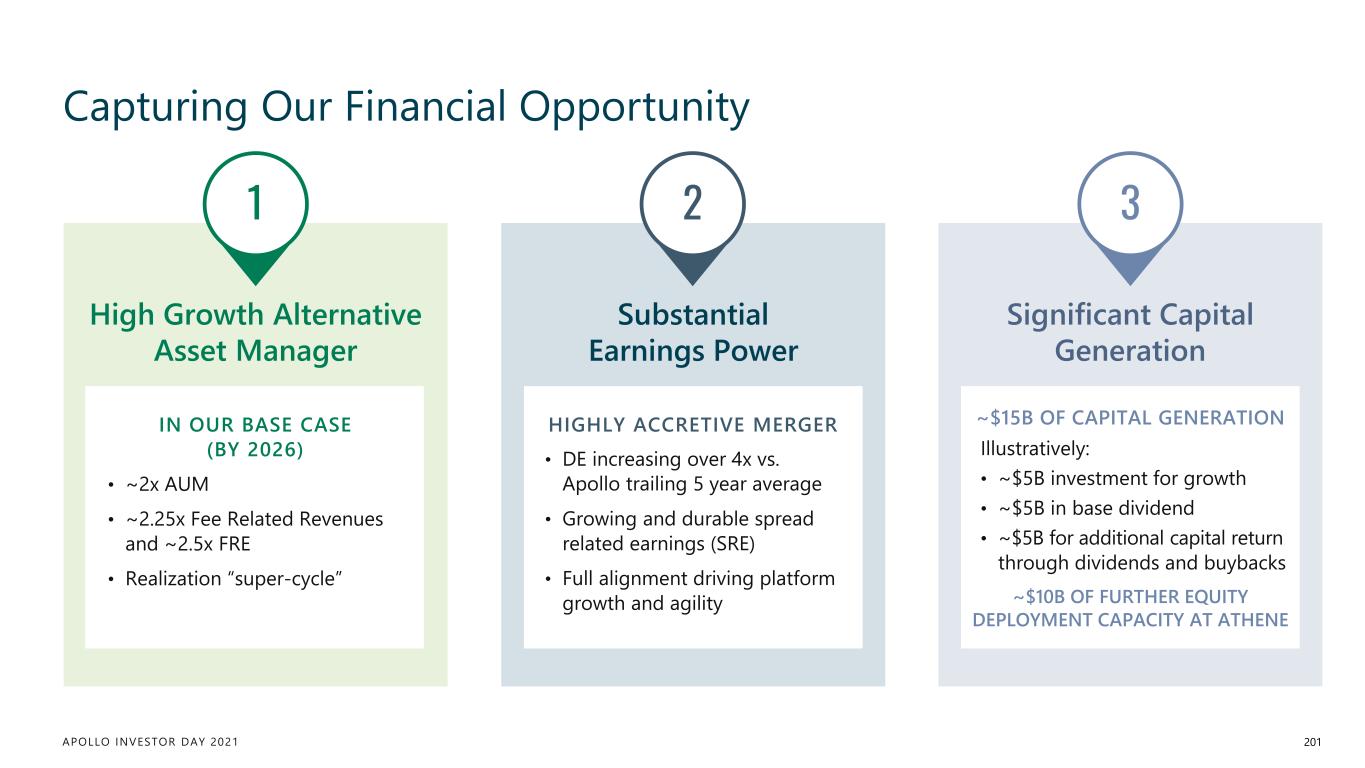

APOLLO INVESTOR DAY 2021 Five Key Takeaways 12 + earnings on ~$5 billion of growth capital1High growth base plan over next 5 years1 ~2x AUM ~2.25x Fee Revenue ~2.5x FRE Unique ecosystem built for massive credit opportunityLargest addressable market among alternatives peers 2 Merger has many strategic benefits and allows us to capture large amounts of undervalued spread earnings Athene is a competitive differentiator and growth accelerant3 $15 billion of capital generation over next 5 years to accelerate growth and return to shareholders Our model is highly capital efficient4 Industry’s best talent, aligned with changes to compensation philosophyStrong momentum behind aligned team5 1. Pro-forma for announced merger with Athene.

APOLLO INVESTOR DAY 2021 13 1 High Growth Base Plan Over The Next 5 Years

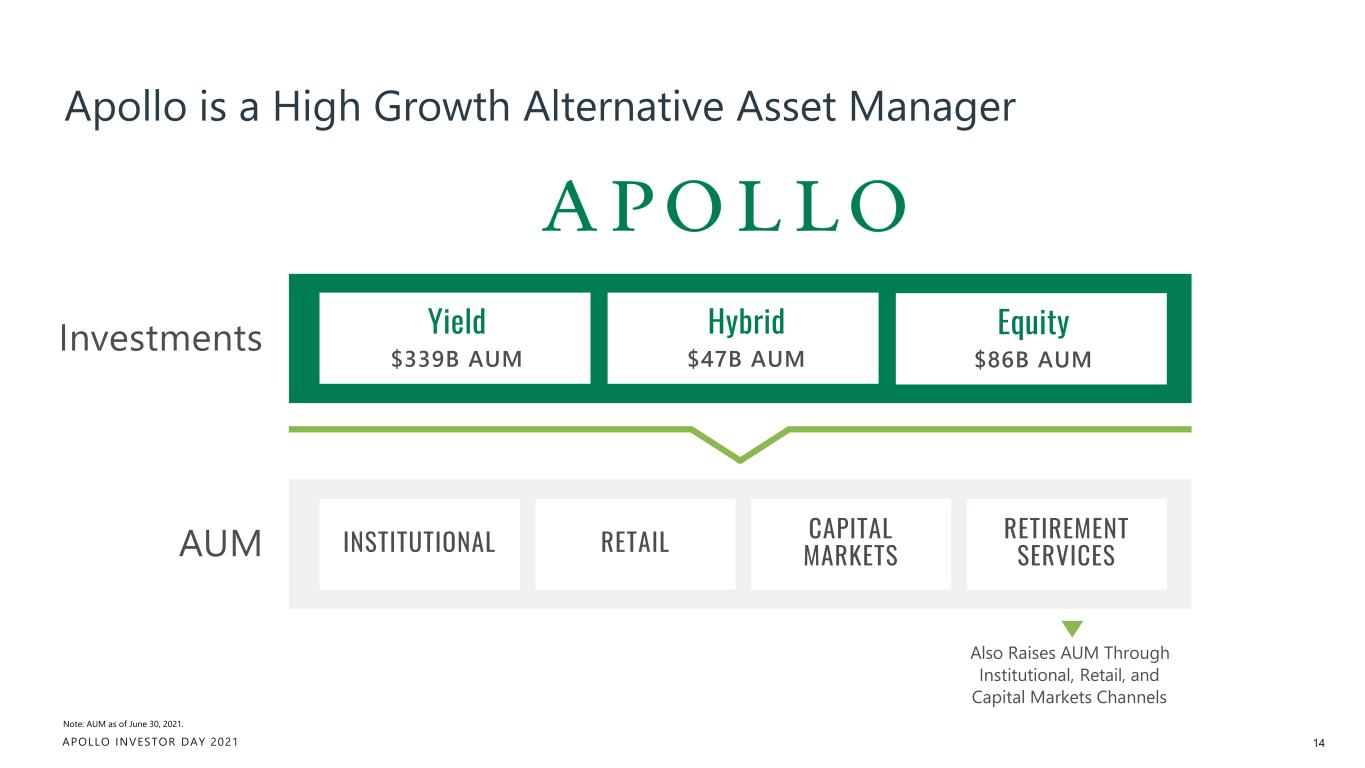

APOLLO INVESTOR DAY 2021 Apollo is a High Growth Alternative Asset Manager Note: AUM as of June 30, 2021. Also Raises AUM Through Institutional, Retail, and Capital Markets Channels AUM RETIREMENT SERVICESINSTITUTIONAL RETAIL CAPITAL MARKETS Investments Yield $339B AUM Hybrid $47B AUM Equity $86B AUM 14

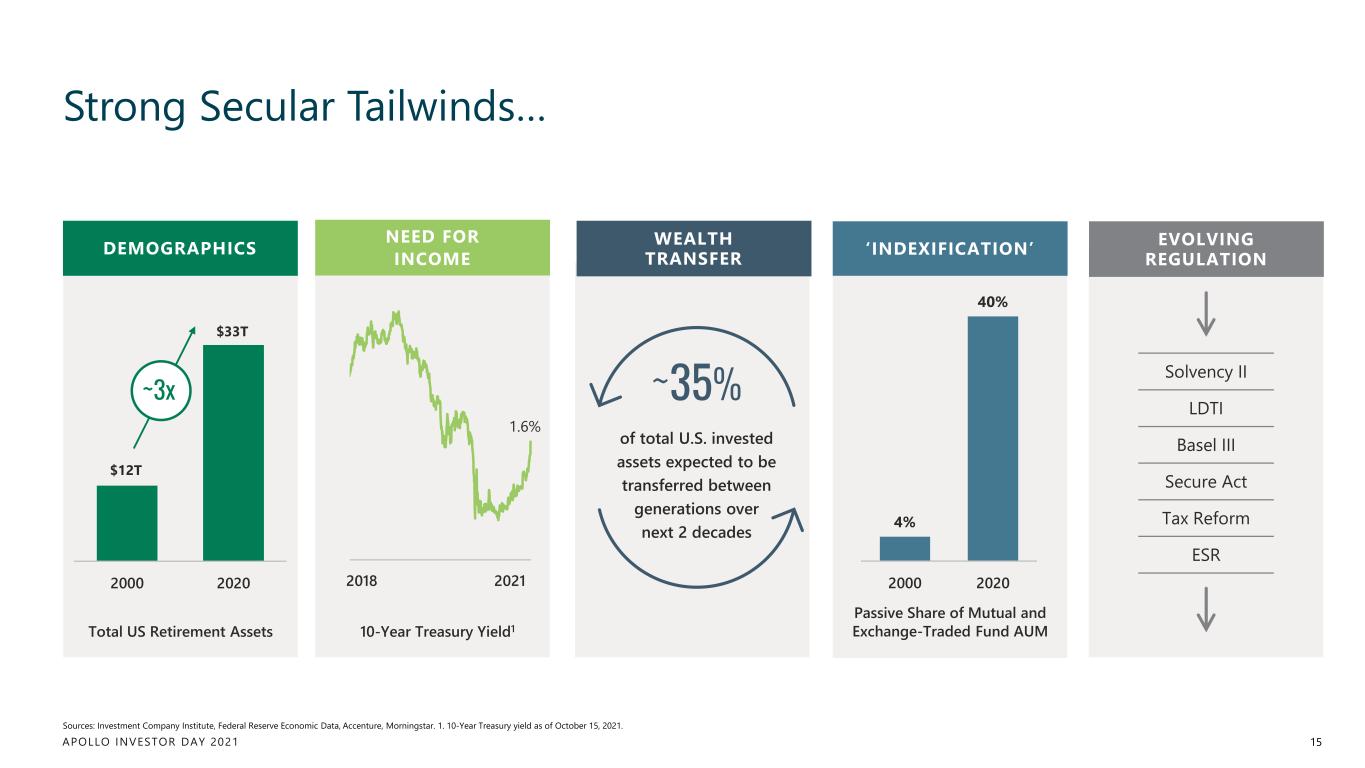

APOLLO INVESTOR DAY 2021 EVOLVING REGULATION‘INDEXIFICATION’WEALTH TRANSFER NEED FOR INCOMEDEMOGRAPHICS 15 Sources: Investment Company Institute, Federal Reserve Economic Data, Accenture, Morningstar. 1. 10-Year Treasury yield as of October 15, 2021. 1.6% 4% 40% 2000 20202018 2021 $12T $33T 2000 2020 ~3x Total US Retirement Assets 10-Year Treasury Yield1 Passive Share of Mutual and Exchange-Traded Fund AUM ~35% of total U.S. invested assets expected to be transferred between generations over next 2 decades Solvency II LDTI Basel III Secure Act Tax Reform ESR Strong Secular Tailwinds…

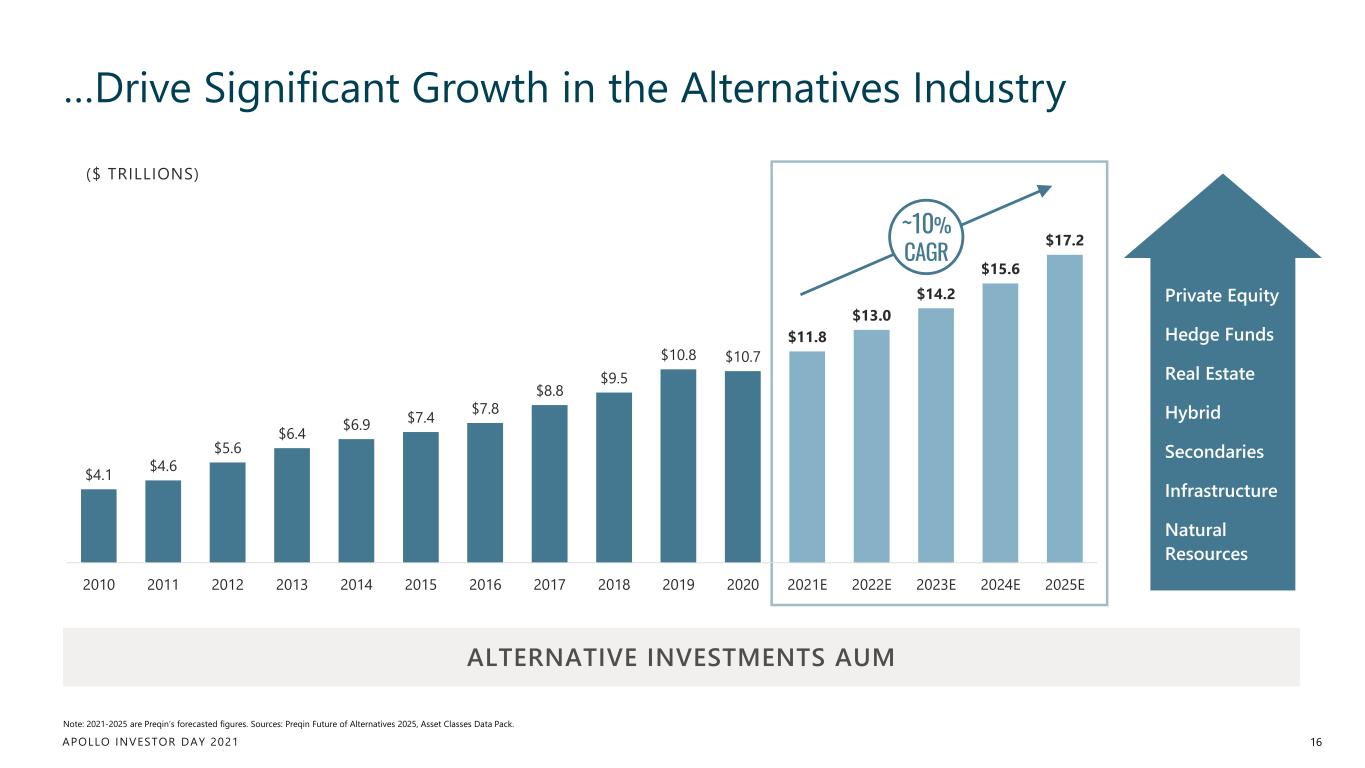

APOLLO INVESTOR DAY 2021 $4.1 $4.6 $5.6 $6.4 $6.9 $7.4 $7.8 $8.8 $9.5 $10.8 $10.7 $11.8 $13.0 $14.2 $15.6 $17.2 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 16 Note: 2021-2025 are Preqin’s forecasted figures. Sources: Preqin Future of Alternatives 2025, Asset Classes Data Pack. Private Equity Hedge Funds Real Estate Hybrid Secondaries Infrastructure Natural Resources …Drive Significant Growth in the Alternatives Industry ~10% CAGR ($ TRILLIONS) ALTERNATIVE INVESTMENTS AUM

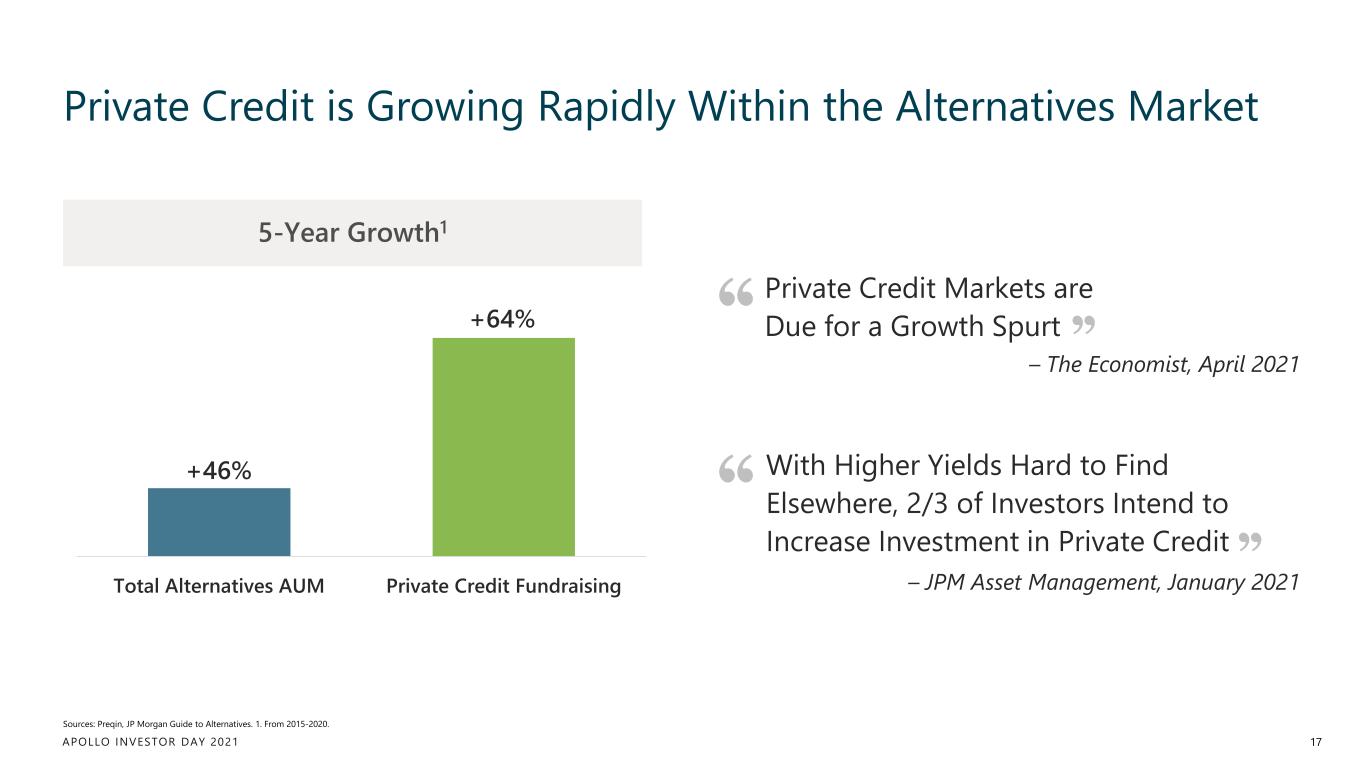

APOLLO INVESTOR DAY 2021 Private Credit is Growing Rapidly Within the Alternatives Market 17 5-Year Growth1 Sources: Preqin, JP Morgan Guide to Alternatives. 1. From 2015-2020. Private Credit Markets are Due for a Growth Spurt – The Economist, April 2021 With Higher Yields Hard to Find Elsewhere, 2/3 of Investors Intend to Increase Investment in Private Credit – JPM Asset Management, January 2021Total Alternatives AUM Private Credit Fundraising +46% +64%

APOLLO INVESTOR DAY 2021 WHAT WE DO We seek to provide excess returns to investors on a risk-adjusted basis 18 We serve a growing market driven by the need for retirement income

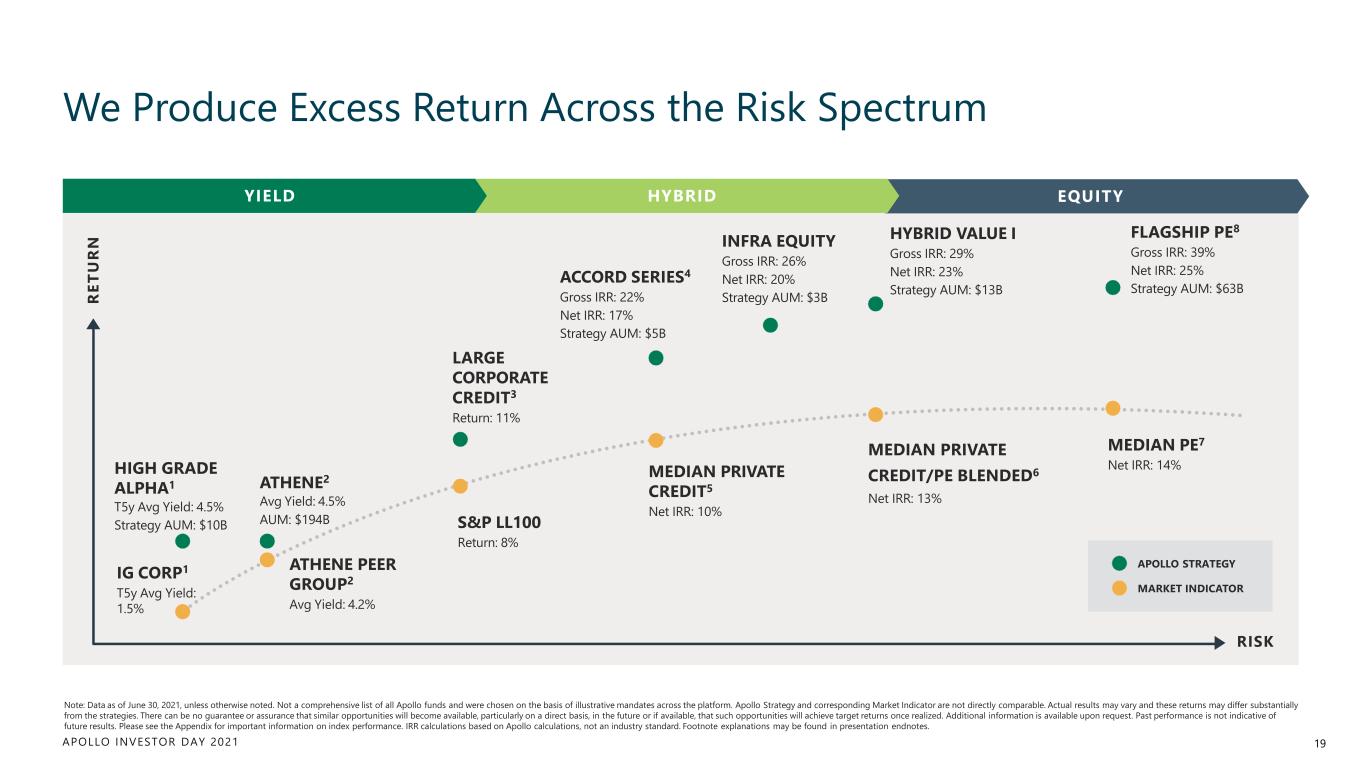

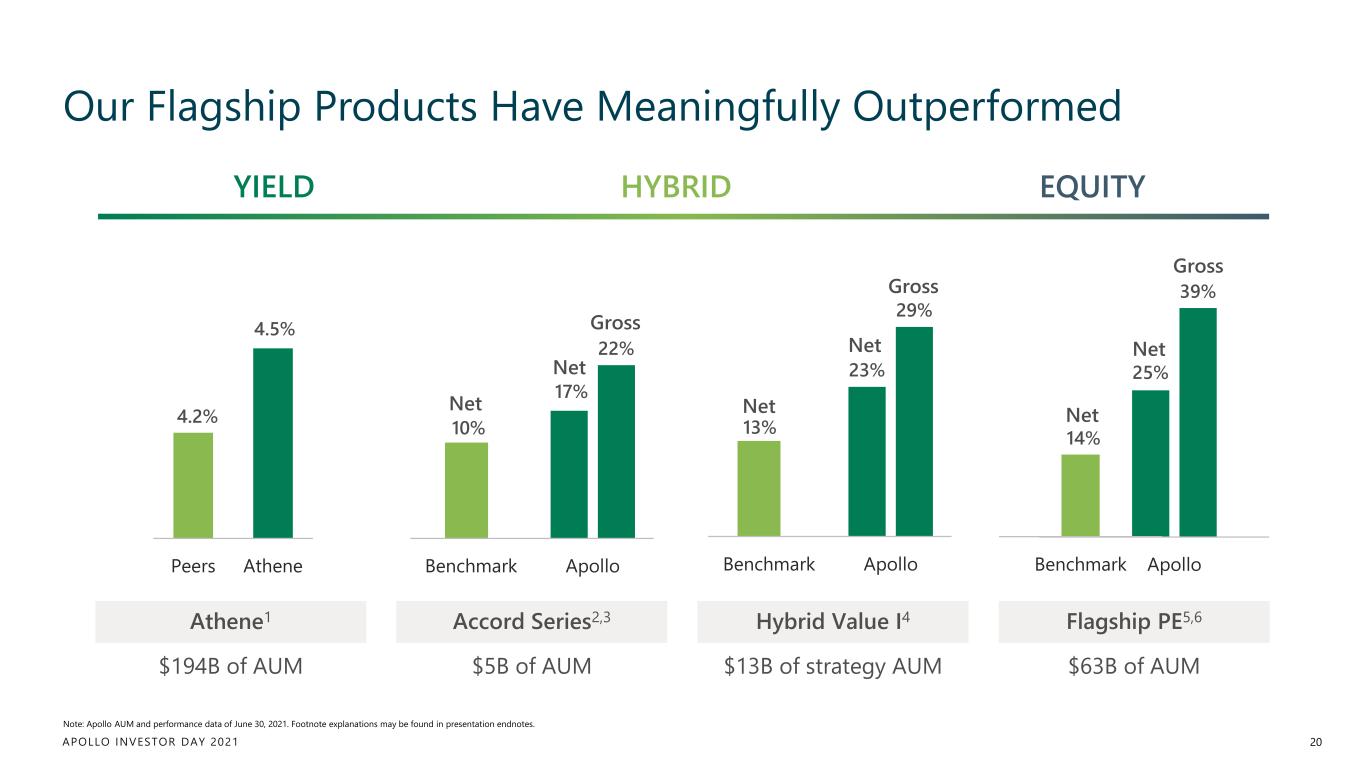

APOLLO INVESTOR DAY 2021 EQUITY We Produce Excess Return Across the Risk Spectrum Note: Data as of June 30, 2021, unless otherwise noted. Not a comprehensive list of all Apollo funds and were chosen on the basis of illustrative mandates across the platform. Apollo Strategy and corresponding Market Indicator are not directly comparable. Actual results may vary and these returns may differ substantially from the strategies. There can be no guarantee or assurance that similar opportunities will become available, particularly on a direct basis, in the future or if available, that such opportunities will achieve target returns once realized. Additional information is available upon request. Past performance is not indicative of future results. Please see the Appendix for important information on index performance. IRR calculations based on Apollo calculations, not an industry standard. Footnote explanations may be found in presentation endnotes. HYBRIDYIELD R ET U R N RISK HIGH GRADE ALPHA1 T5y Avg Yield: 4.5% Strategy AUM: $10B ATHENE2 Avg Yield: 4.5% AUM: $194B ATHENE PEER GROUP2 Avg Yield: 4.2% IG CORP1 T5y Avg Yield: 1.5% LARGE CORPORATE CREDIT3 Return: 11% ACCORD SERIES4 Gross IRR: 22% Net IRR: 17% Strategy AUM: $5B S&P LL100 Return: 8% MEDIAN PRIVATE CREDIT5 Net IRR: 10% MEDIAN PRIVATE CREDIT/PE BLENDED6 Net IRR: 13% MEDIAN PE7 Net IRR: 14% APOLLO STRATEGY MARKET INDICATOR FLAGSHIP PE8 Gross IRR: 39% Net IRR: 25% Strategy AUM: $63B HYBRID VALUE I Gross IRR: 29% Net IRR: 23% Strategy AUM: $13B INFRA EQUITY Gross IRR: 26% Net IRR: 20% Strategy AUM: $3B 19

APOLLO INVESTOR DAY 2021 Net Gross Net 23% 29% Benchmark Apollo 13% Our Flagship Products Have Meaningfully Outperformed 20 YIELD HYBRID EQUITY Flagship PE5,6Hybrid Value I4Accord Series2,3Athene1 Note: Apollo AUM and performance data of June 30, 2021. Footnote explanations may be found in presentation endnotes. $63B of AUM$13B of strategy AUM$5B of AUM$194B of AUM 17% 22% Benchmark Apollo Net Gross Net 10%4.2% 4.5% Peers Athene 25% 39% Apollo 14% Benchmark Net Net Gross

APOLLO INVESTOR DAY 2021 Our Lens on the Landscape 21 The market is growing Historical performance is strong Capital is plentiful OUR PHILOSOPHY Source good assets Seek to deliver excess return AUM is the reward for success, not the goal in itself

APOLLO INVESTOR DAY 2021 22 Let Us Take You Through Our Playbook We Seek to Provide Excess Returns Our Business is Aligned to a Larger Addressable Market Our Focus is on Scalable Businesses and Large Whitespace We are Building a Recurring Asset Origination Machine

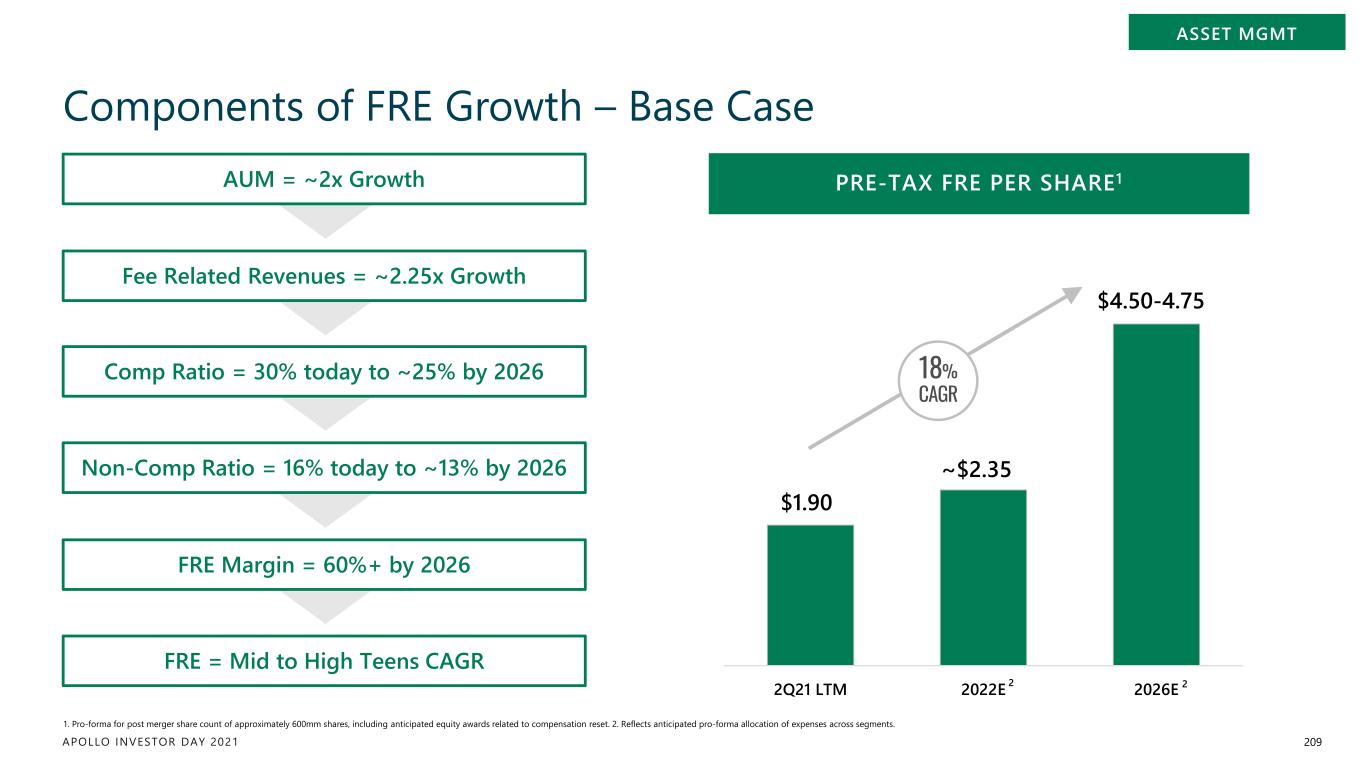

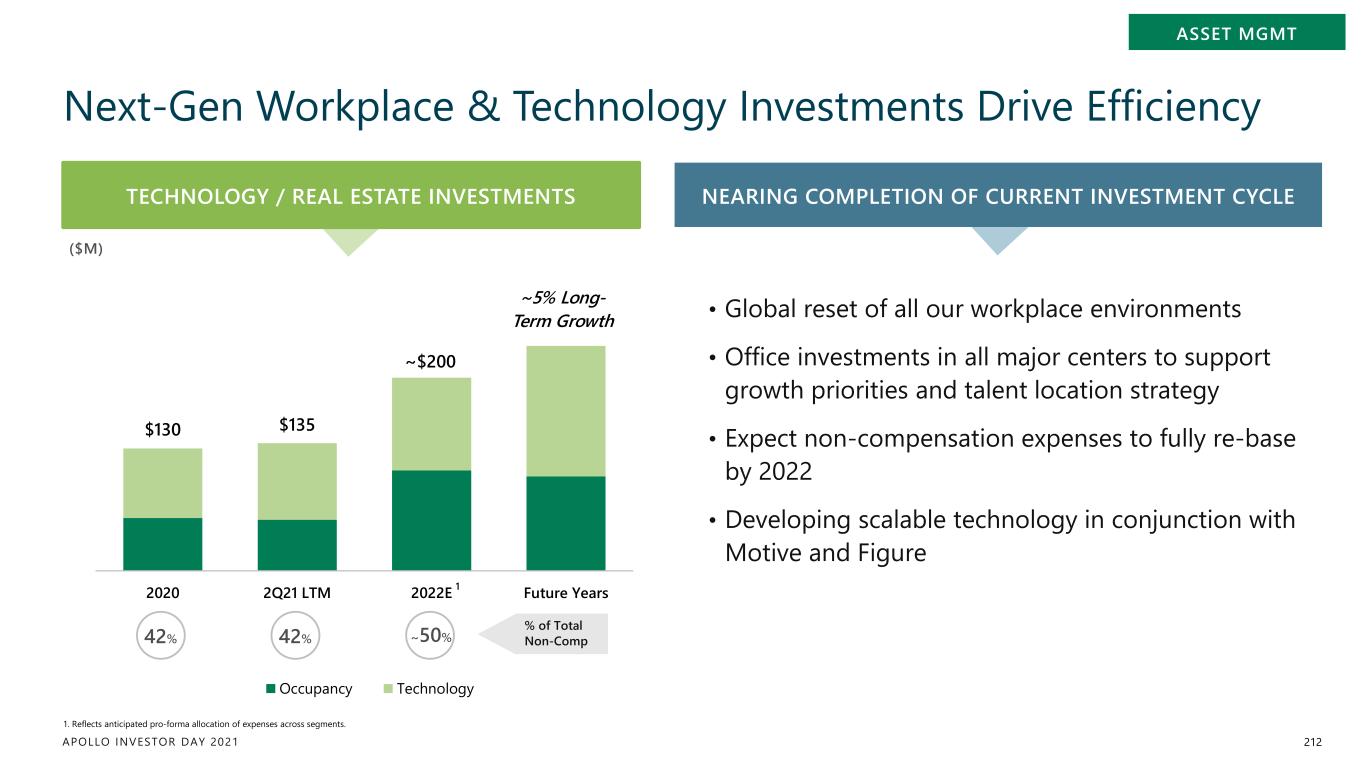

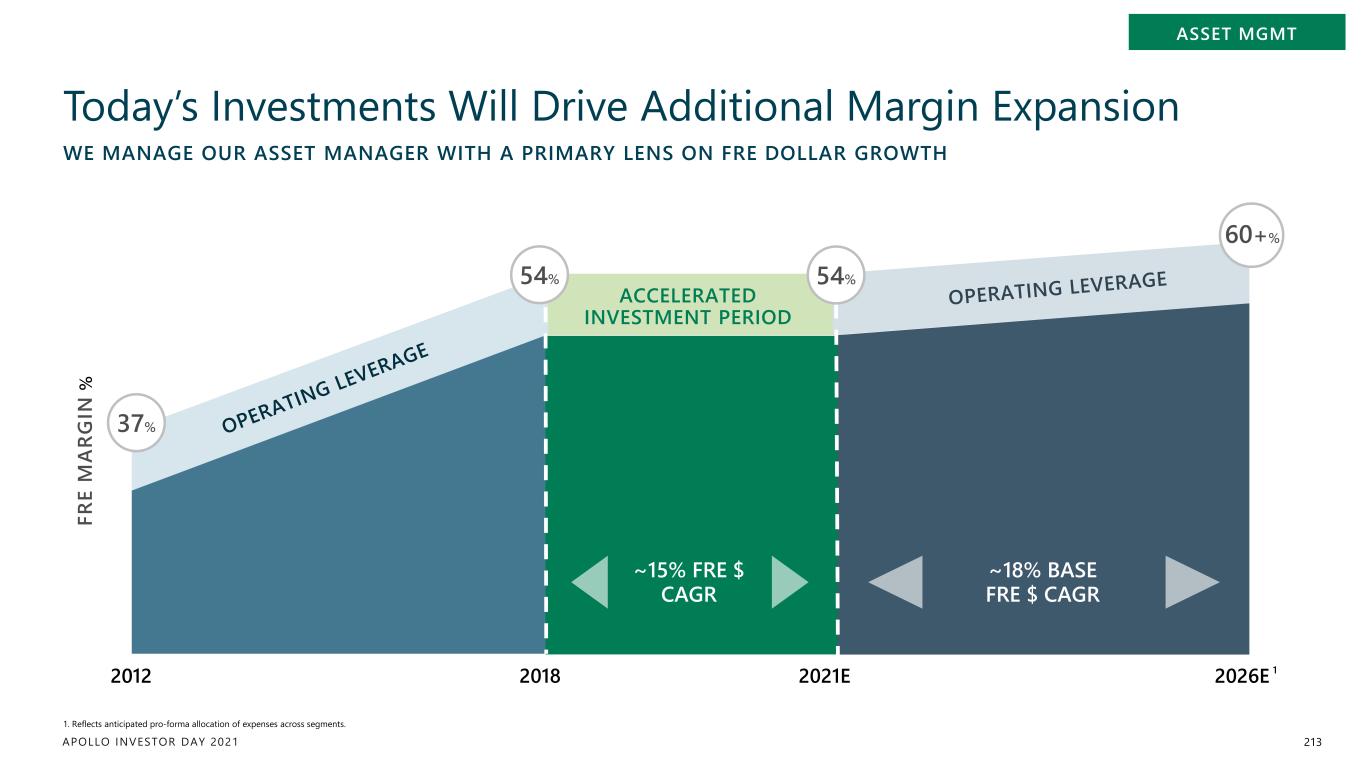

APOLLO INVESTOR DAY 2021 Goal to Reach $1 Trillion AUM & More Than Double FRE Before Benefits of the Merger 23 1. Reflects anticipated pro-forma allocation of expenses across segments. LTM 2Q21 2026E $2.1B $4.6B FEE RELATED REVENUE Enhanced by Capital Solutions growth ~2.25x Today 2026E YIELD EQUITY + HYBRID ~$1T ASSETS UNDER MANAGEMENT $472B ~2x LTM 2Q21 2026E $1.1B $2.8B FEE RELATED EARNINGS Enhanced by comp re-design & investment in our business ~2.5x 1

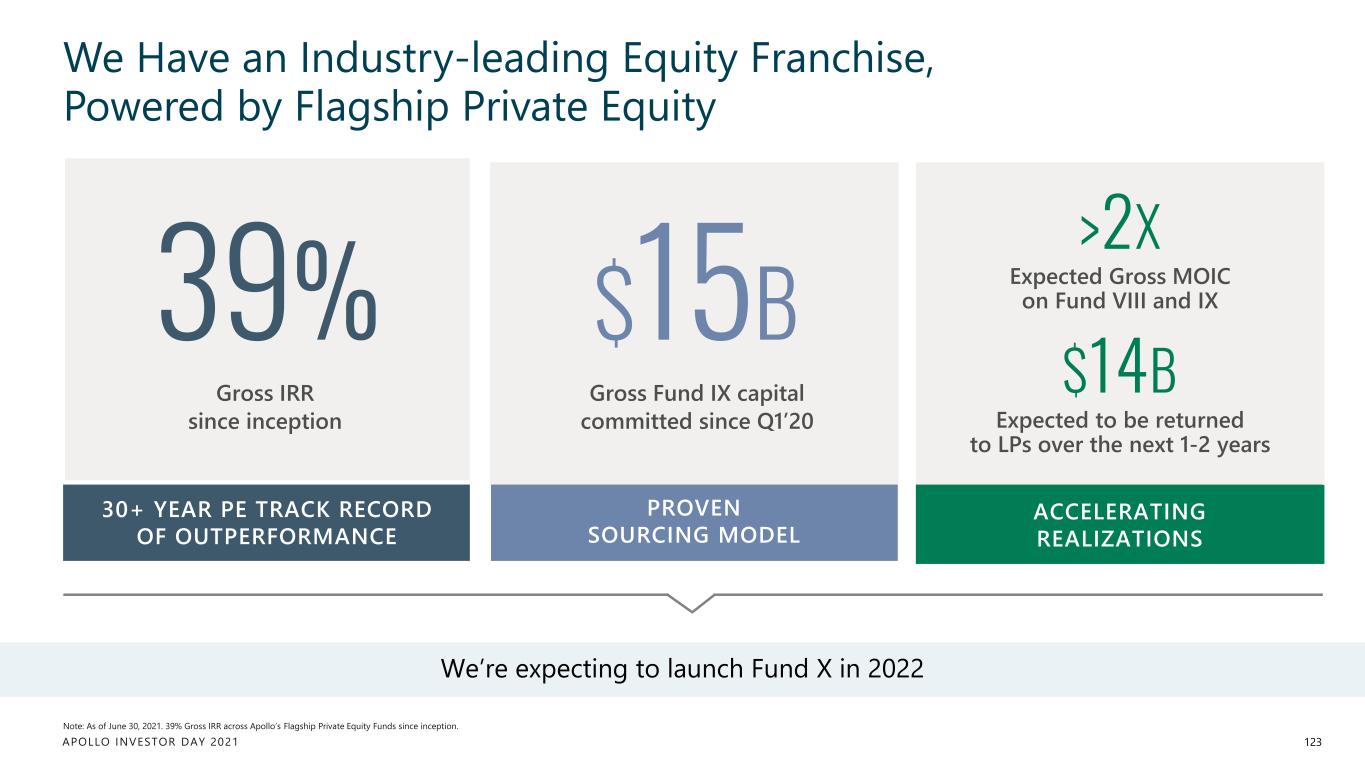

APOLLO INVESTOR DAY 2021 Continuing Leadership in the Equity Business 24 $86B ~1.5x ~$125B ASSETS UNDER MANAGEMENT DRIVERS OF GROWTH Today 2026E • Strong track record over long-term and short-term • High conviction fundraising assumptions • PE Fund X (expected launch in 2022) • Filling in the whitespace – Impact, US & Asia Real Estate • Important source of intellectual capital

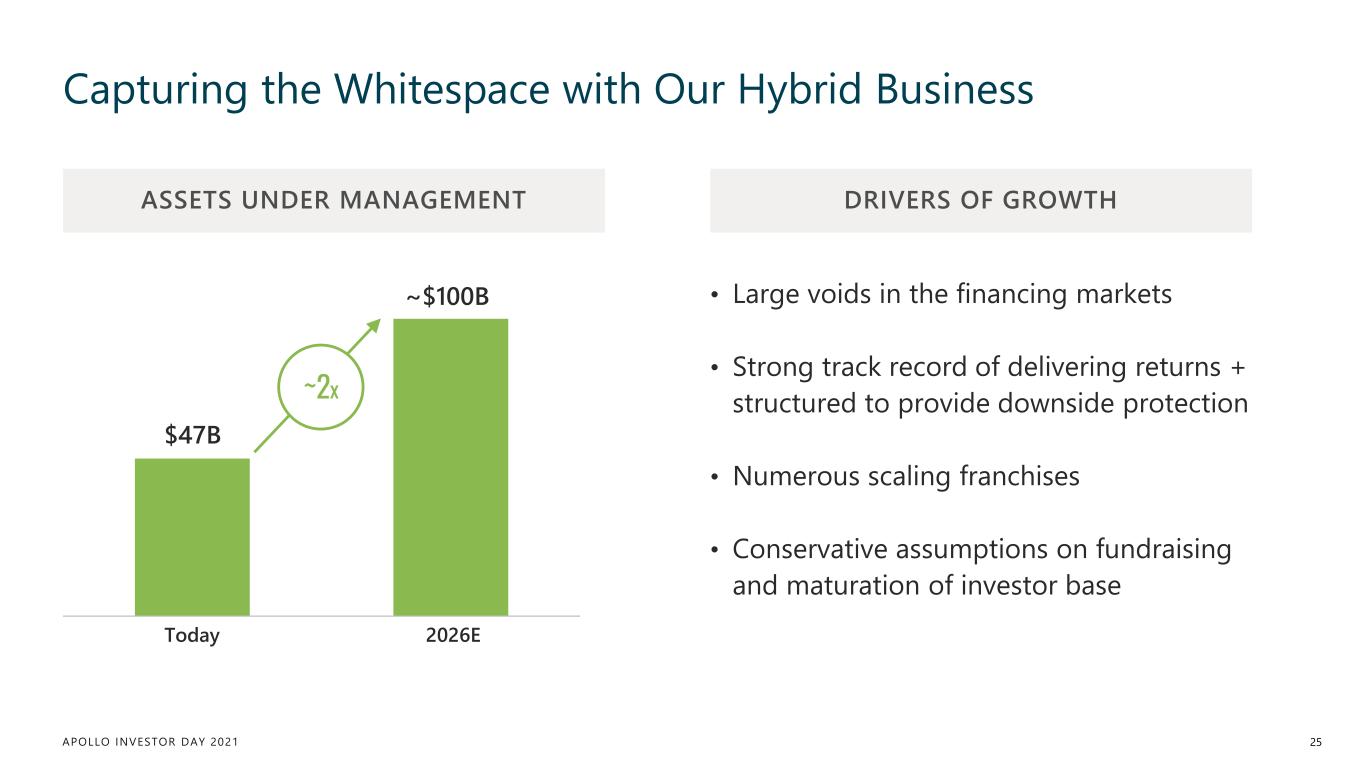

APOLLO INVESTOR DAY 2021 Capturing the Whitespace with Our Hybrid Business 25 $47B ~2x ~$100B Today 2026E • Large voids in the financing markets • Strong track record of delivering returns + structured to provide downside protection • Numerous scaling franchises • Conservative assumptions on fundraising and maturation of investor base ASSETS UNDER MANAGEMENT DRIVERS OF GROWTH

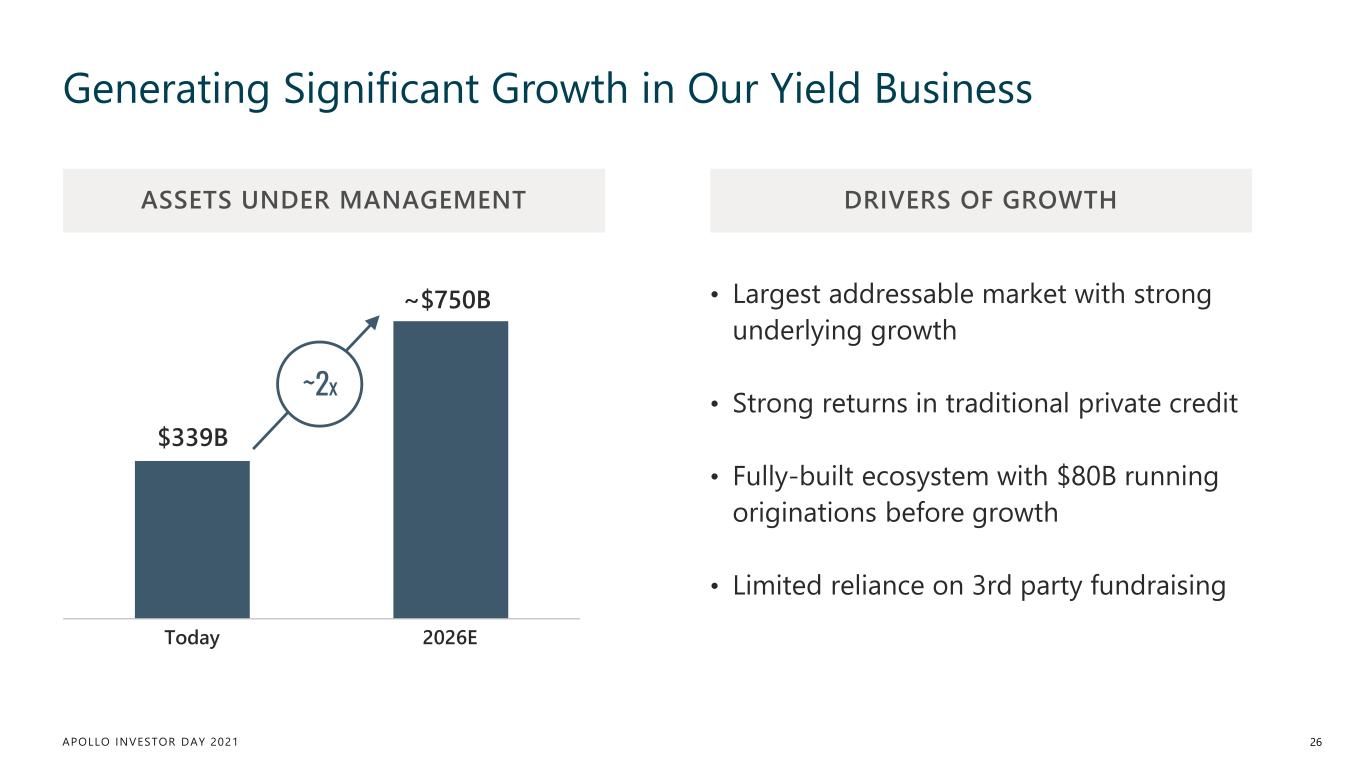

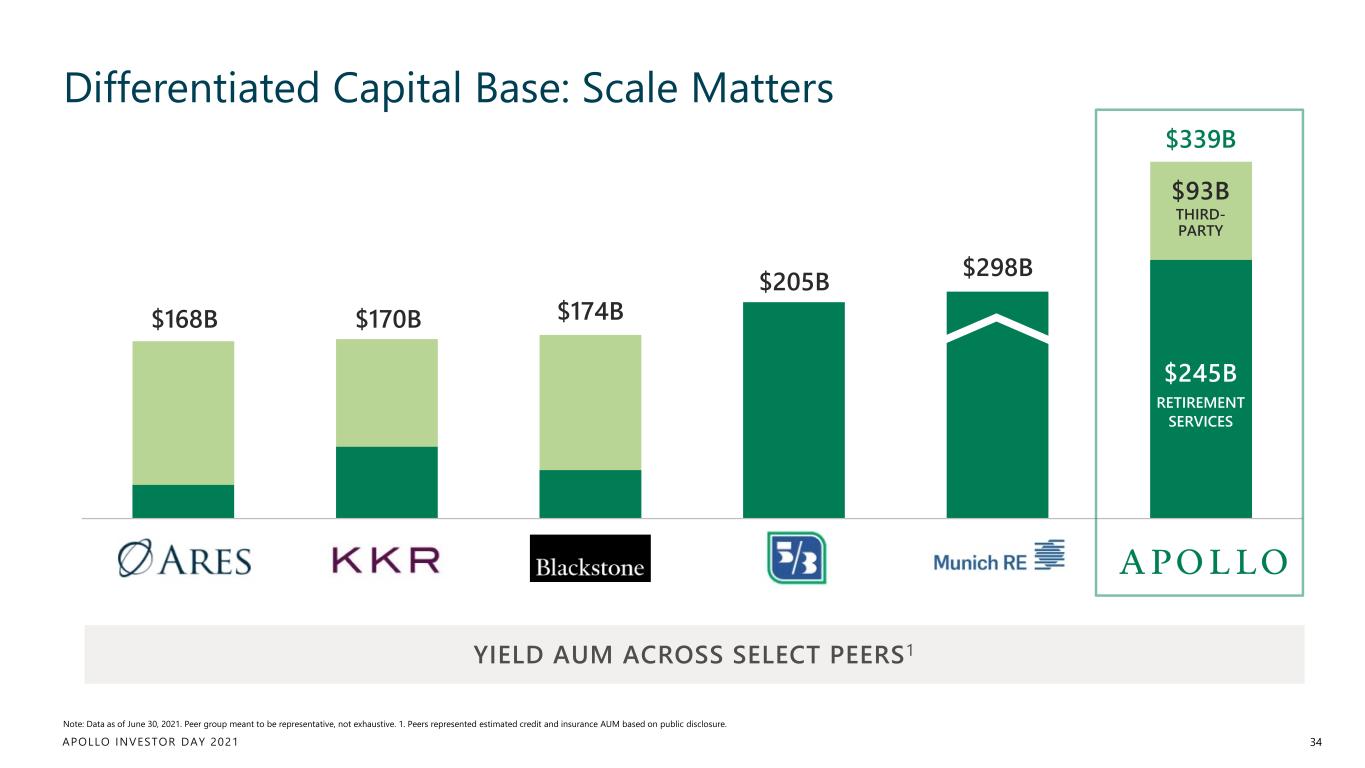

APOLLO INVESTOR DAY 2021 Generating Significant Growth in Our Yield Business 26 $339B ~2x ~$750B Today 2026E • Largest addressable market with strong underlying growth • Strong returns in traditional private credit • Fully-built ecosystem with $80B running originations before growth • Limited reliance on 3rd party fundraising ASSETS UNDER MANAGEMENT DRIVERS OF GROWTH

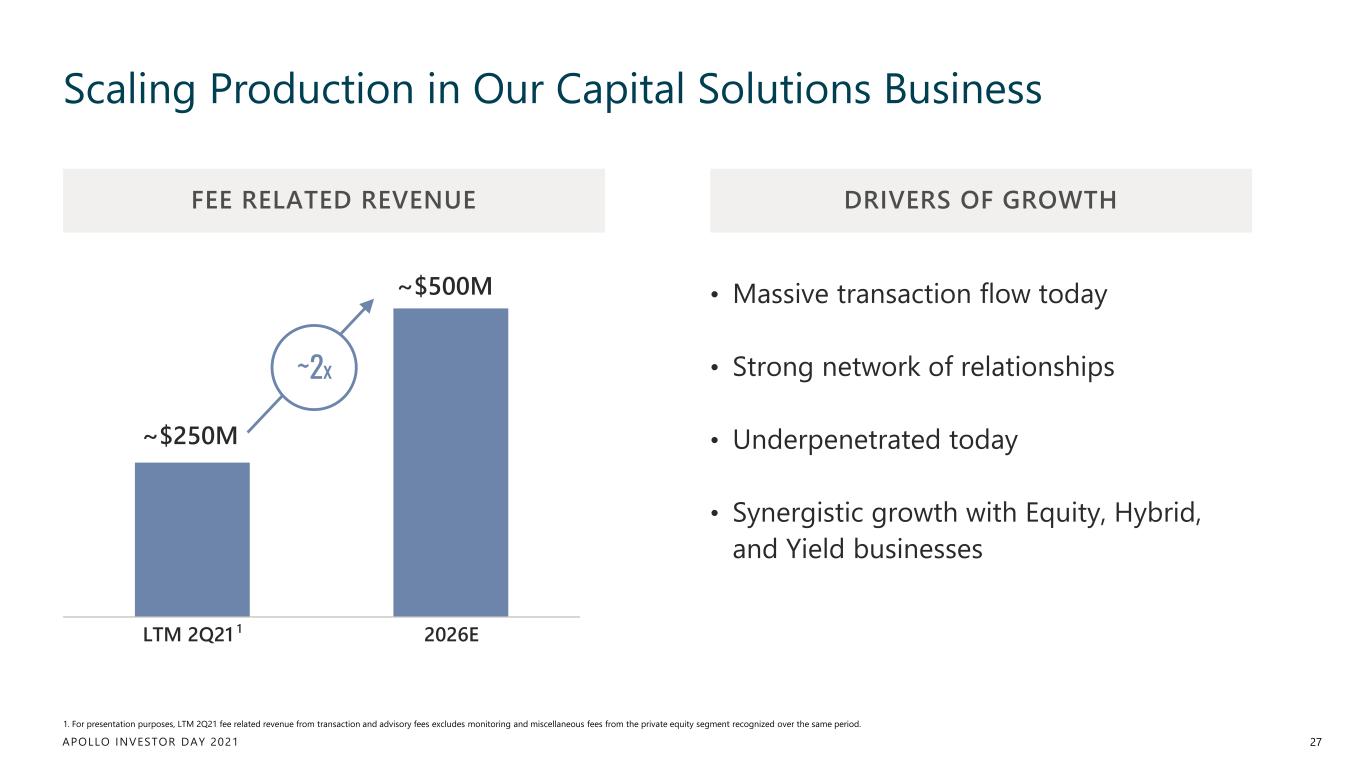

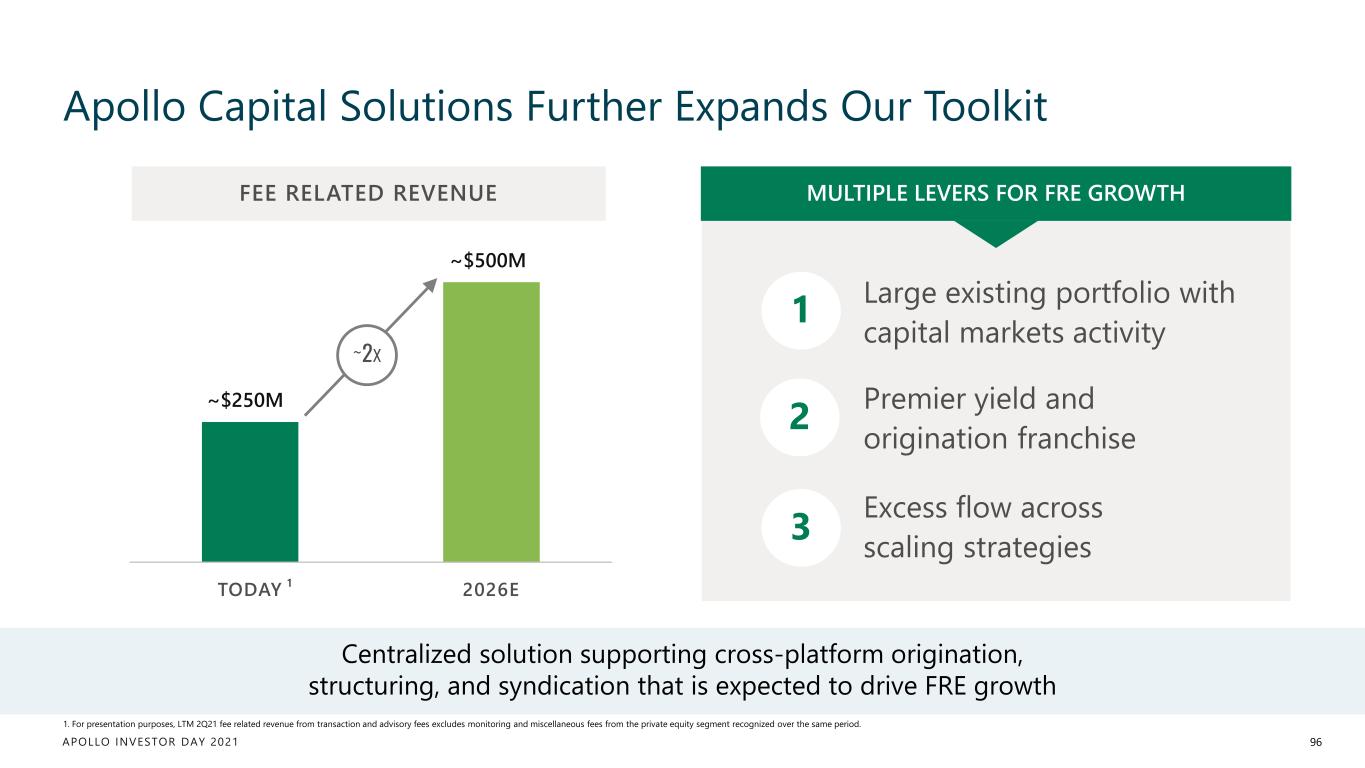

APOLLO INVESTOR DAY 2021 Scaling Production in Our Capital Solutions Business 27 ~$250M ~$500M ~2x LTM 2Q21 2026E • Massive transaction flow today • Strong network of relationships • Underpenetrated today • Synergistic growth with Equity, Hybrid, and Yield businesses 1. For presentation purposes, LTM 2Q21 fee related revenue from transaction and advisory fees excludes monitoring and miscellaneous fees from the private equity segment recognized over the same period. 1 FEE RELATED REVENUE DRIVERS OF GROWTH

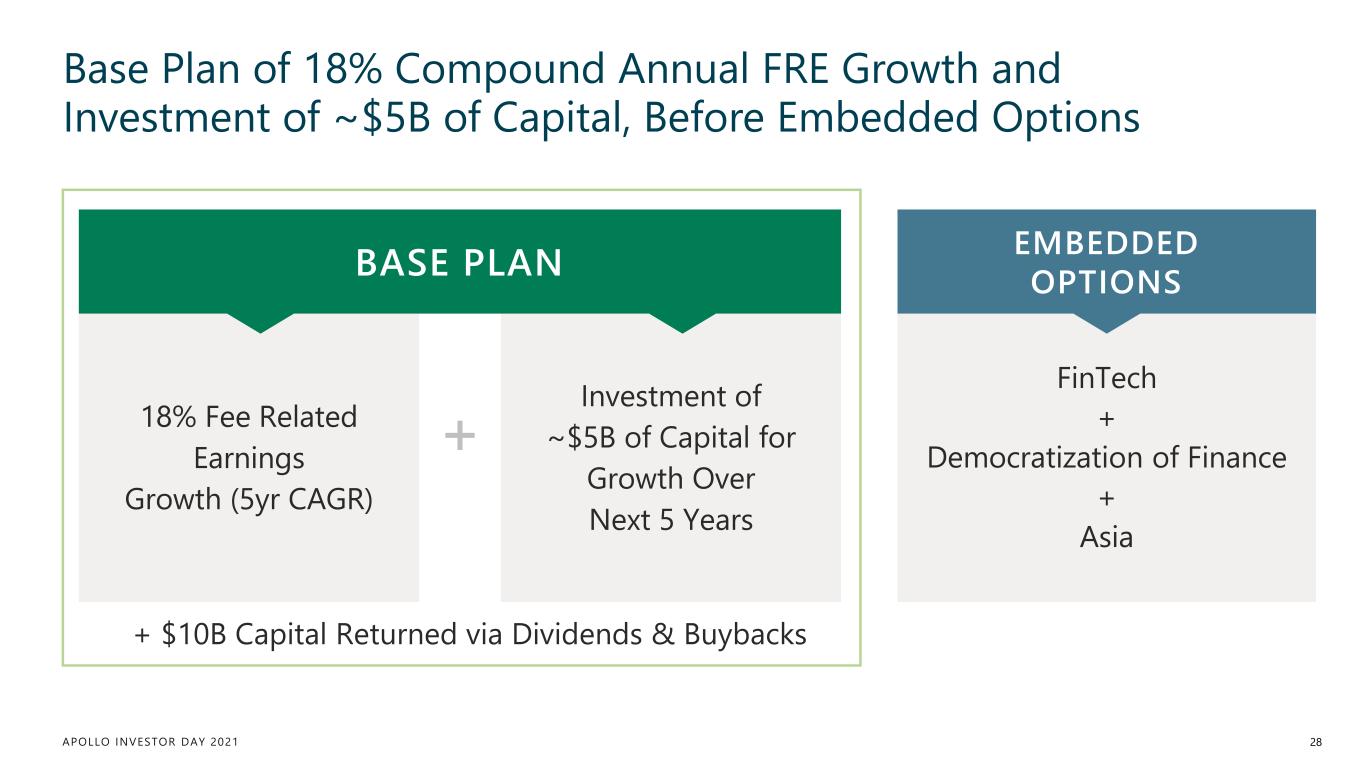

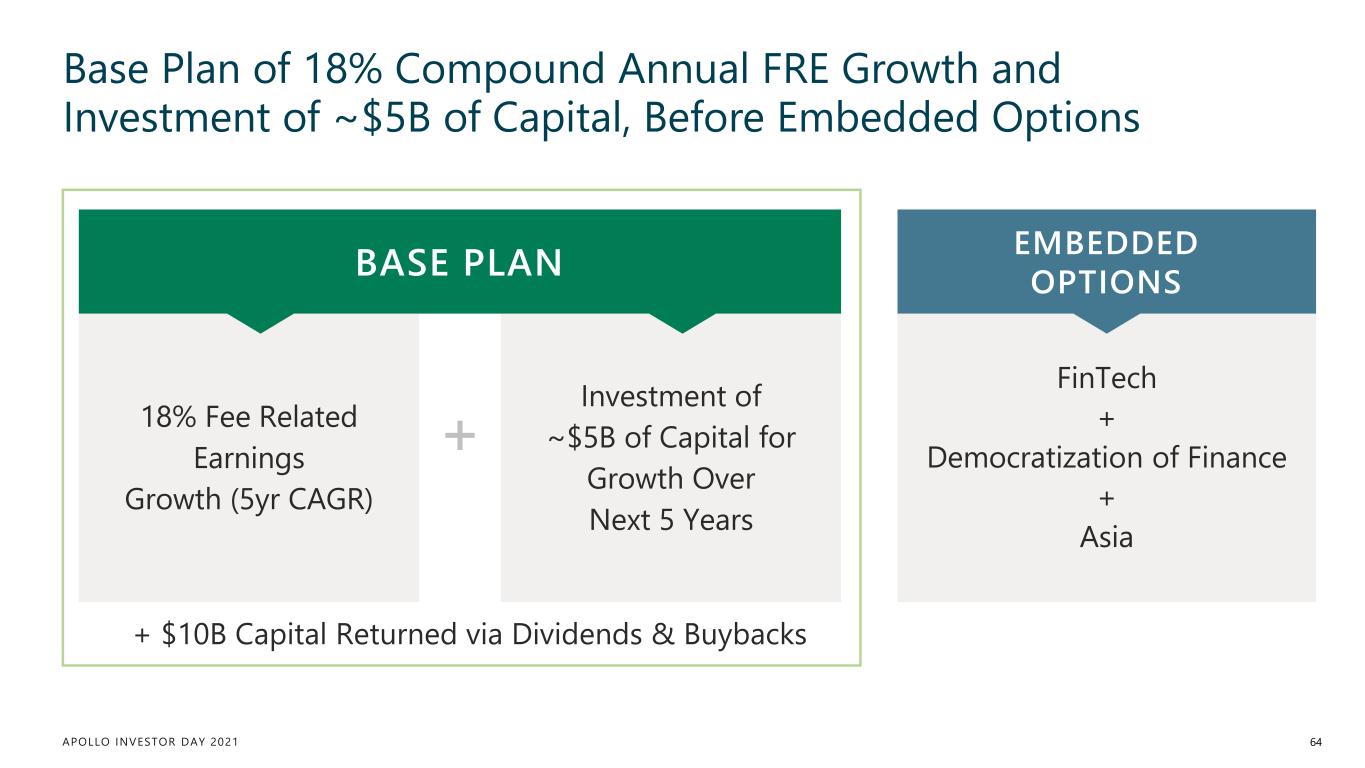

APOLLO INVESTOR DAY 2021 Investment of ~$5B of Capital for Growth Over Next 5 Years Base Plan of 18% Compound Annual FRE Growth and Investment of ~$5B of Capital, Before Embedded Options 28 18% Fee Related Earnings Growth (5yr CAGR) FinTech + Democratization of Finance + Asia EMBEDDED OPTIONSBASE PLAN + + $10B Capital Returned via Dividends & Buybacks

APOLLO INVESTOR DAY 2021 29 2 Largest Addressable Market Among Alternatives Peers

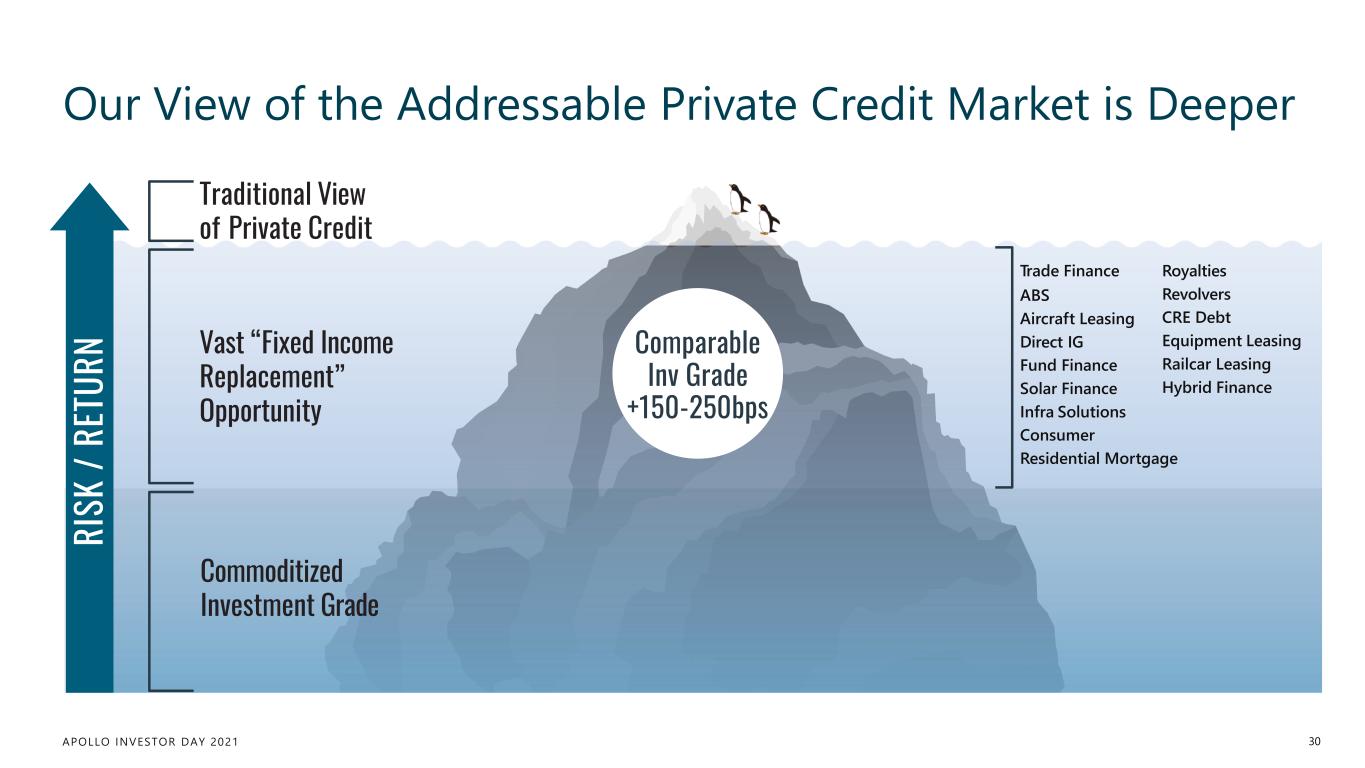

APOLLO INVESTOR DAY 2021 Our View of the Addressable Private Credit Market is Deeper Trade Finance ABS Aircraft Leasing Direct IG Fund Finance Solar Finance Infra Solutions Consumer Residential Mortgage Traditional View of Private Credit Vast “Fixed Income Replacement” Opportunity Commoditized Investment Grade RI SK / RE TU RN Comparable Inv Grade +150-250bps Royalties Revolvers CRE Debt Equipment Leasing Railcar Leasing Hybrid Finance 30

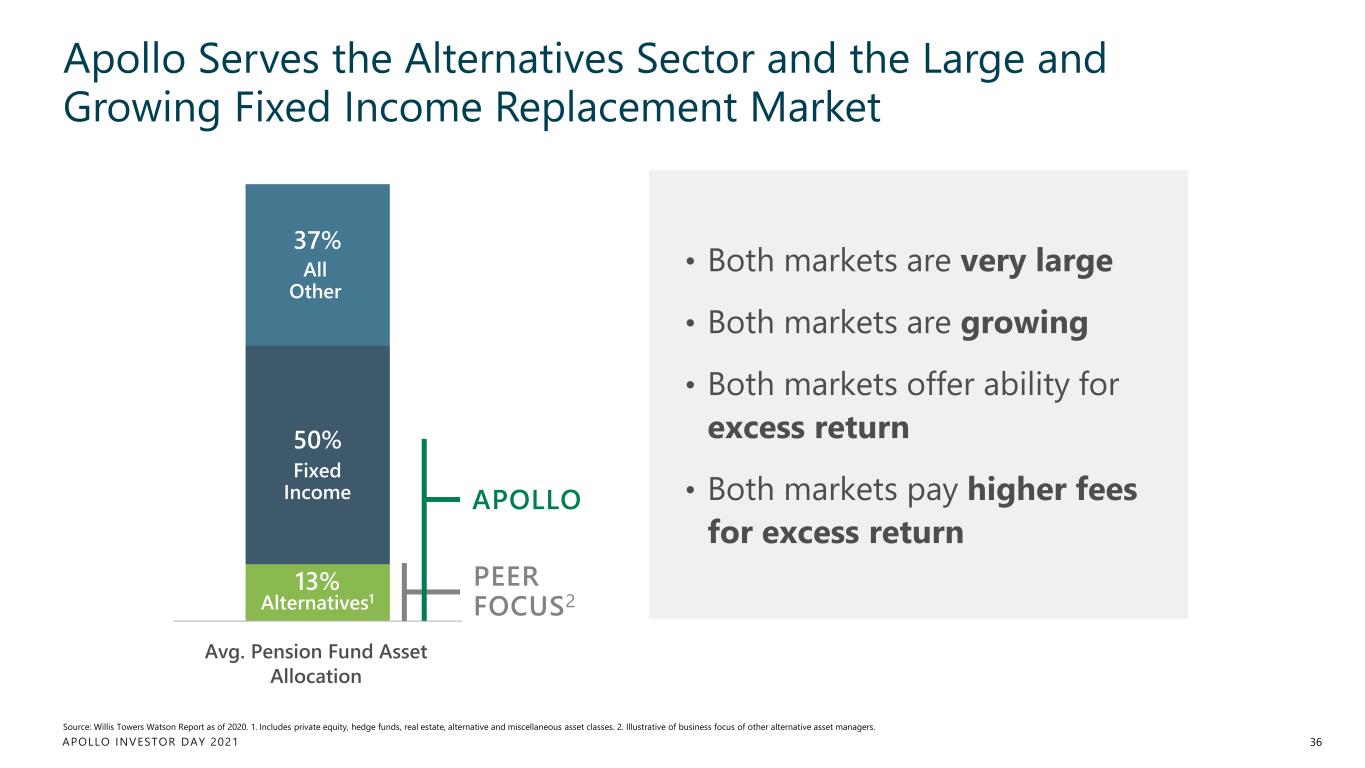

APOLLO INVESTOR DAY 2021 The Addressable Market for Fixed Income Replacement is Larger Than the Traditional Alternatives Market in its Entirety 31 Note: Alternative assets and private credit AUM based on forecasted Preqin data for 2021. Fixed income replacement market based on Apollo estimates. Sources: Apollo Chief Economist, Federal Reserve Board, S&P LCD, BofA, Preqin, SIFMA, Haver Analytics, Bloomberg. EVEN BIGGER Market LARGE MARKET GROWING QUICKLY ~$40T Fixed Income Replacement Addressable Market Private Credit 8%+ Return Profile ~$12T ~$1T Alternative Assets

APOLLO INVESTOR DAY 2021 BECAUSE THIS MARKET REQUIRES A COMPLETELY DIFFERENT ECOSYSTEM Why Aren’t Others Addressing the Vast Fixed Income Replacement Market? 32 DIFFERENTIATED ASSET ORIGINATION Reliable supply of senior- secured, low-risk assets with the right balance of yield and liquidity DIFFERENTIATED ORGANIZATION People, culture, systems, and proper risk-control DIFFERENTIATED CAPITAL BASE Large capital base generating the demand for yield return profile DIFFERENTIATED GROWTH CAPABILITIES Organic and inorganic growth capabilities to be able to source low-cost and persistent funding ECOSYSTEM

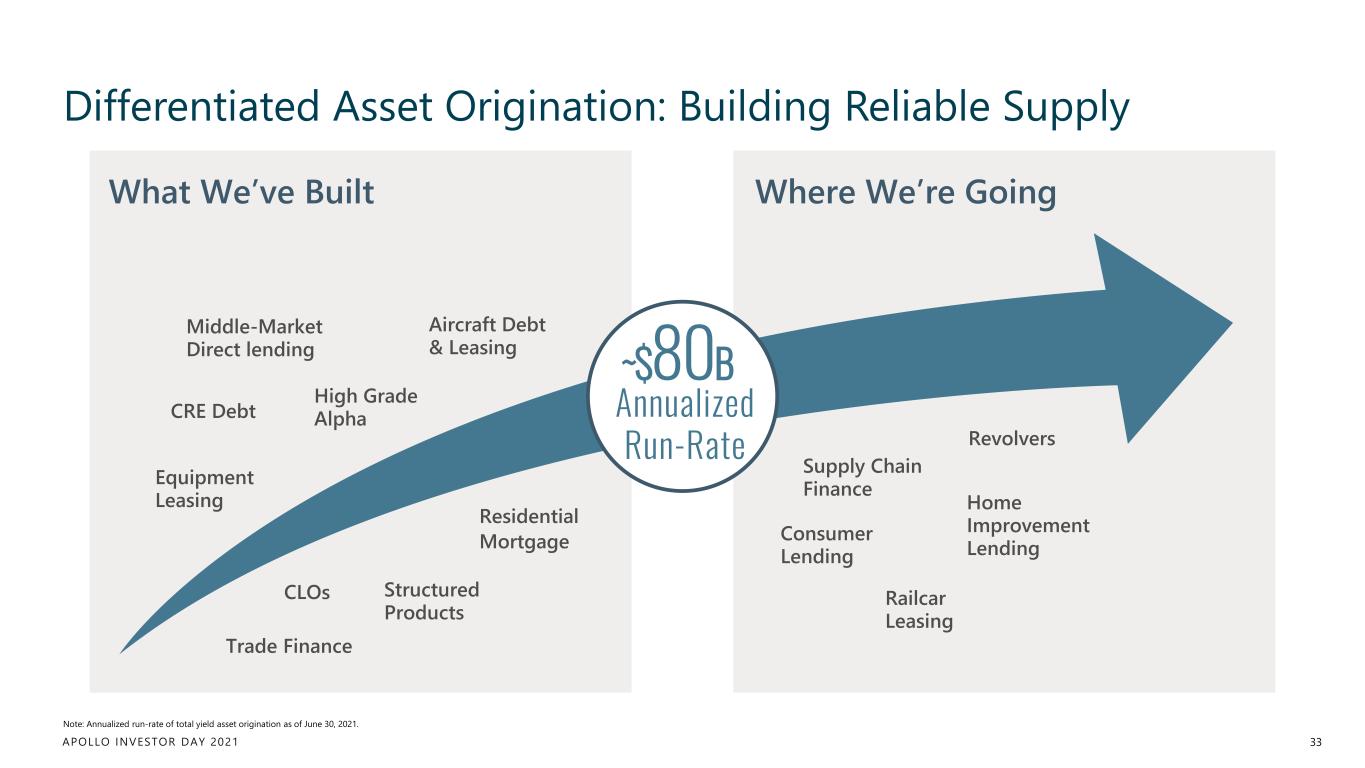

APOLLO INVESTOR DAY 2021 Differentiated Asset Origination: Building Reliable Supply 33 Note: Annualized run-rate of total yield asset origination as of June 30, 2021. Middle-Market Direct lending Residential Mortgage ~$80B Supply Chain Finance Revolvers Consumer Lending Home Improvement Lending Railcar Leasing CRE Debt Equipment Leasing Aircraft Debt & Leasing High Grade Alpha Structured Products CLOs Trade Finance What We’ve Built Annualized Run-Rate Where We’re Going

APOLLO INVESTOR DAY 2021 ALT PEER 1 CREDIT & INSURANCE AUM ALT PEER 2 CREDIT & INSURANCE AUM ALT PEER 3 CREDIT & INSURANCE AUM REGIONAL BANK PEER LARGEST GLOBAL REINSURER APOLLO YIELD AUM $339B Differentiated Capital Base: Scale Matters 34 Note: Data as of June 30, 2021. Peer group meant to be representative, not exhaustive. 1. Peers represented estimated credit and insurance AUM based on public disclosure. $174B$170B$168B $245B THIRD- PARTY RETIREMENT SERVICES $93B $298B$205B YIELD AUM ACROSS SELECT PEERS1

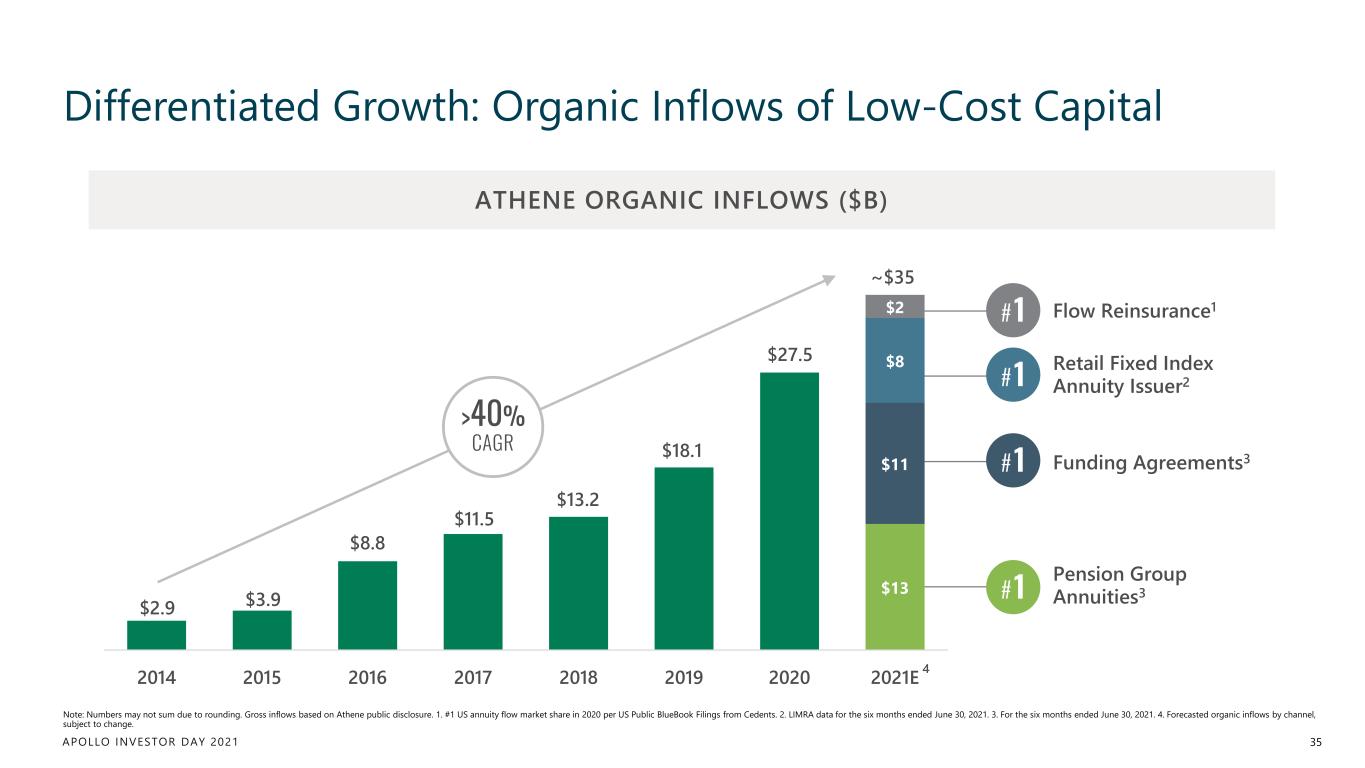

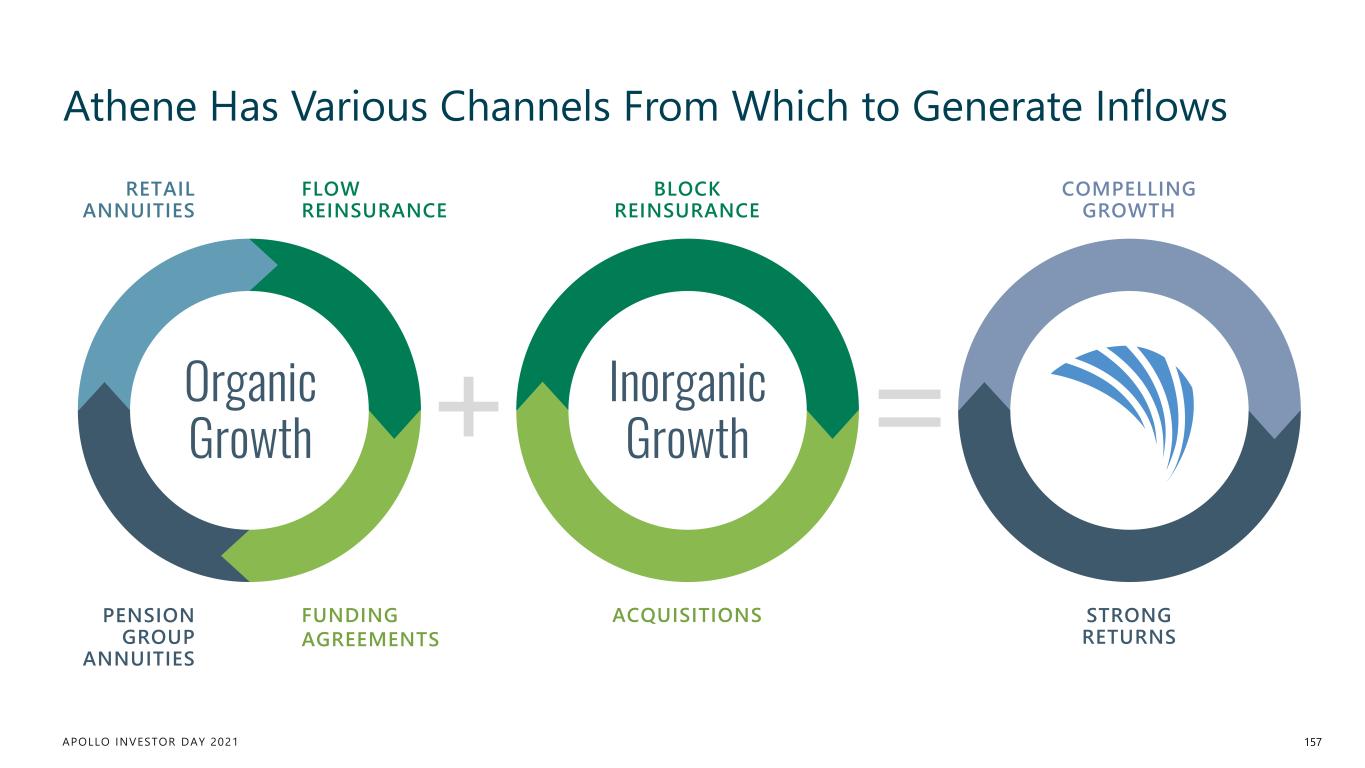

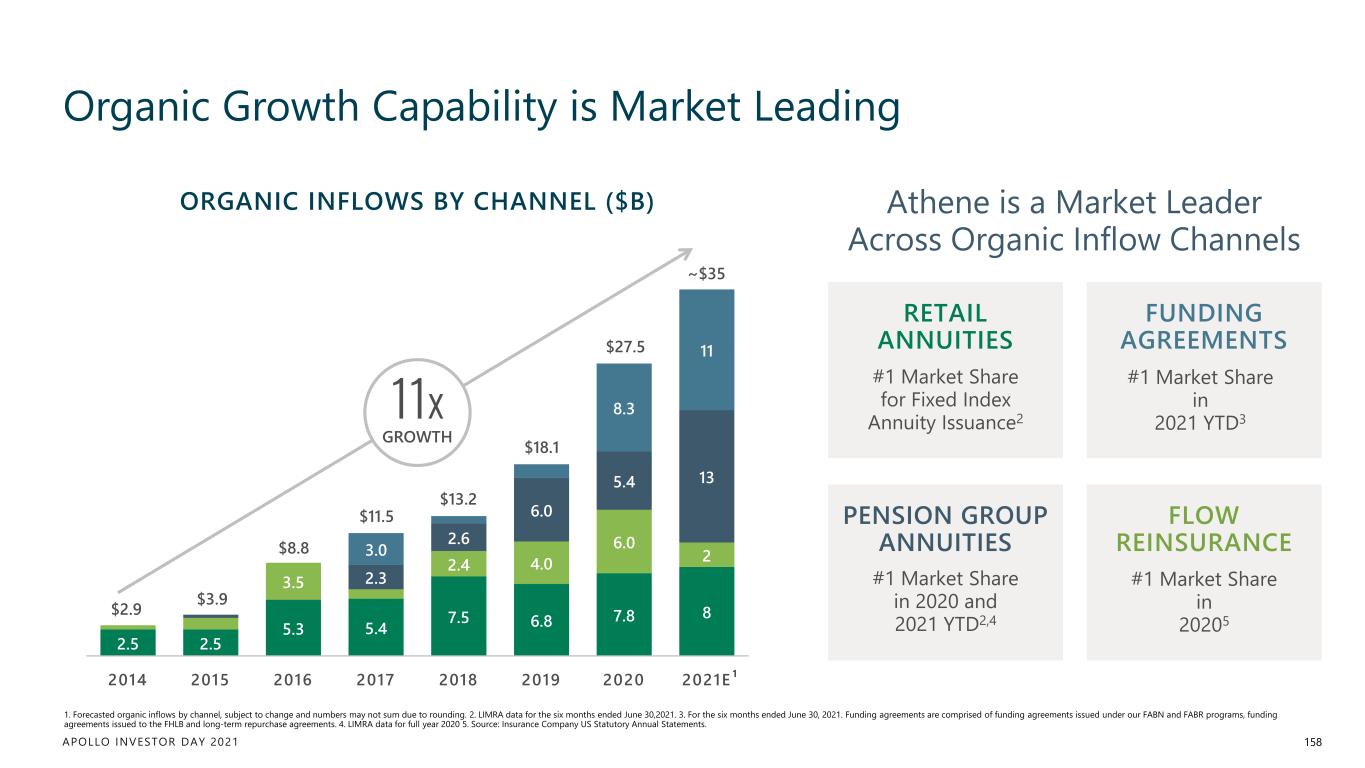

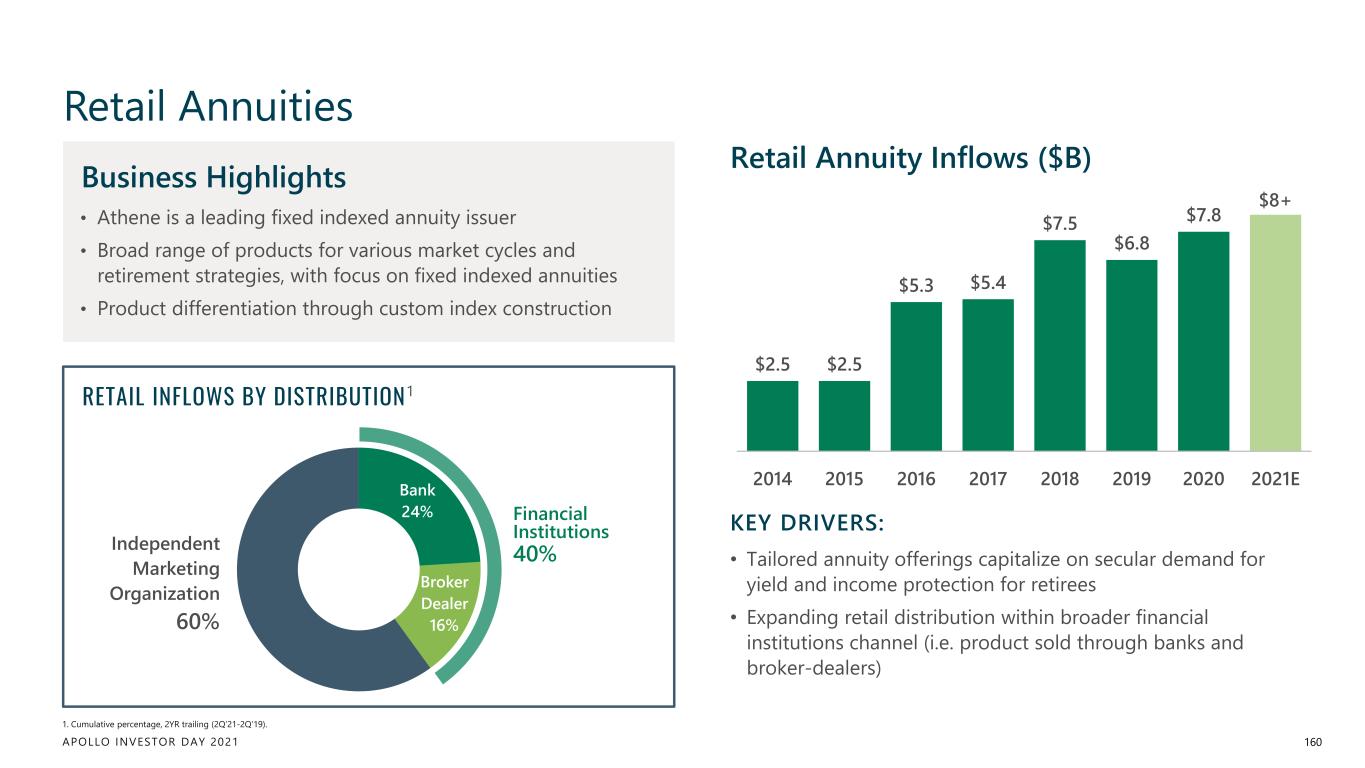

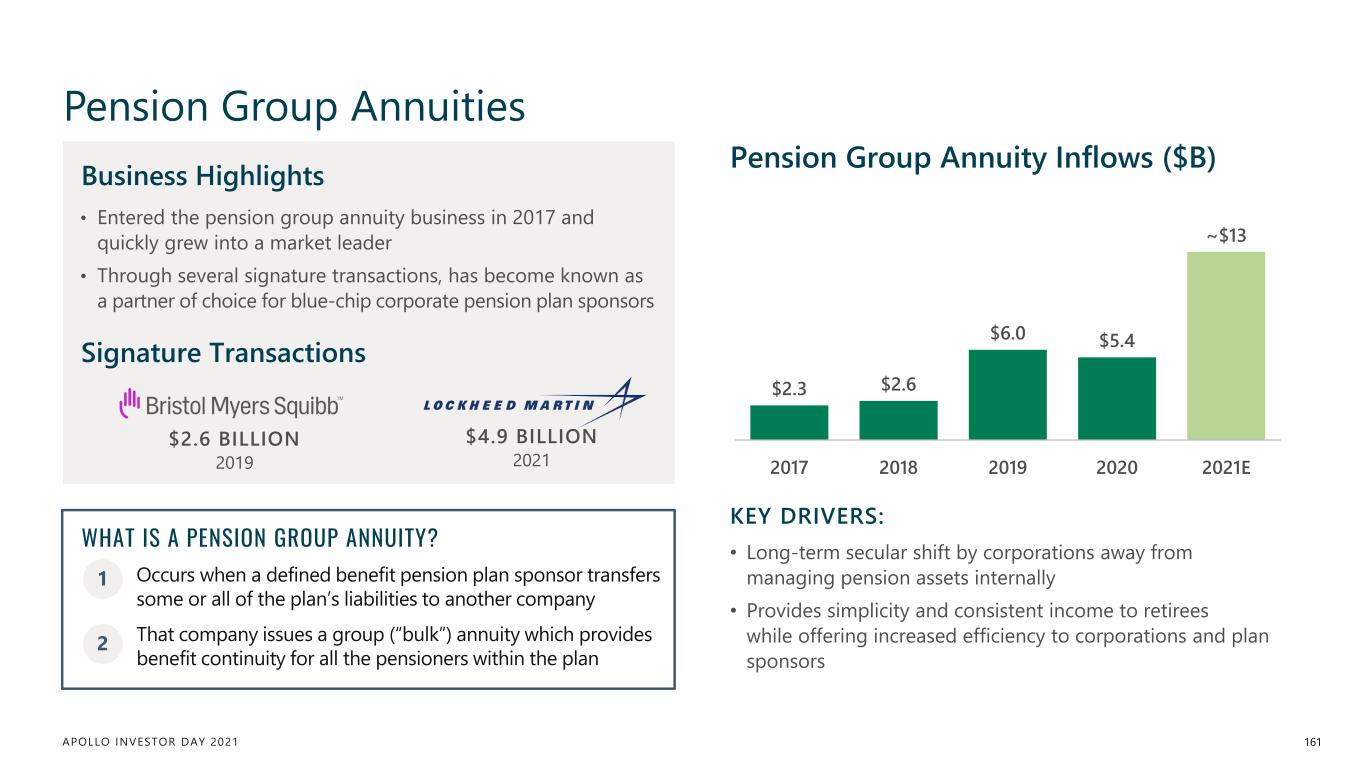

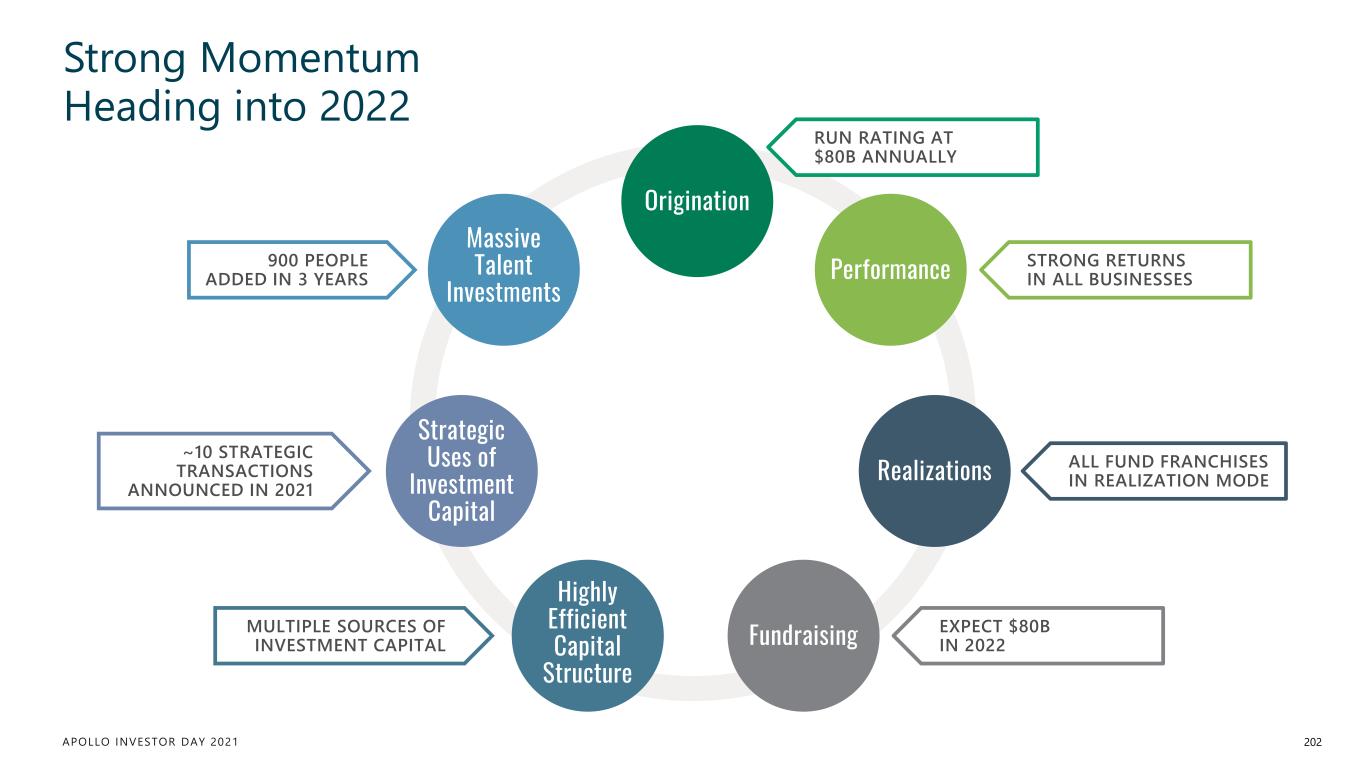

APOLLO INVESTOR DAY 2021 #1 #1 #1 #1 $13 $11 $8 $2 2014 2015 2016 2017 2018 2019 2020 2021E Differentiated Growth: Organic Inflows of Low-Cost Capital 35 Note: Numbers may not sum due to rounding. Gross inflows based on Athene public disclosure. 1. #1 US annuity flow market share in 2020 per US Public BlueBook Filings from Cedents. 2. LIMRA data for the six months ended June 30, 2021. 3. For the six months ended June 30, 2021. 4. Forecasted organic inflows by channel, subject to change. >40% CAGR $2.9 $3.9 $8.8 $11.5 $13.2 $18.1 $27.5 ~$35 Flow Reinsurance1 Retail Fixed Index Annuity Issuer2 Funding Agreements3 Pension Group Annuities3 ATHENE ORGANIC INFLOWS ($B) 4

APOLLO INVESTOR DAY 2021 13% 50% 37% Avg. Pension Fund Asset Allocation (2020) 36 Source: Willis Towers Watson Report as of 2020. 1. Includes private equity, hedge funds, real estate, alternative and miscellaneous asset classes. 2. Illustrative of business focus of other alternative asset managers. Apollo Serves the Alternatives Sector and the Large and Growing Fixed Income Replacement Market Alternatives1 Fixed Income All Other PEER FOCUS2 APOLLO • Both markets are very large • Both markets are growing • Both markets offer ability for excess return • Both markets pay higher fees for excess return . Allocation

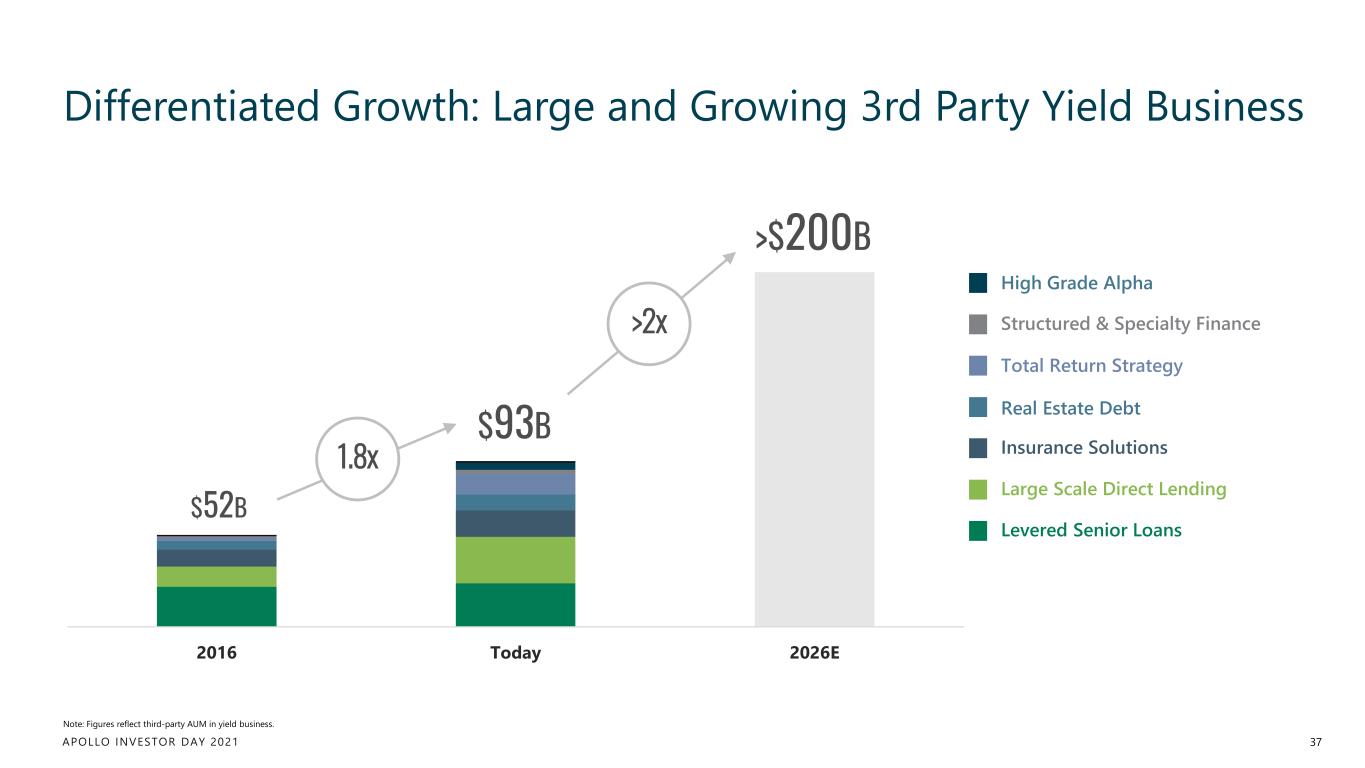

APOLLO INVESTOR DAY 2021 Differentiated Growth: Large and Growing 3rd Party Yield Business 37 Note: Figures reflect third-party AUM in yield business. 2016 Today 2026E $52B $93B >2x 1.8x >$200B Levered Senior Loans Large Scale Direct Lending Insurance Solutions Real Estate Debt Total Return Strategy Structured & Specialty Finance High Grade Alpha

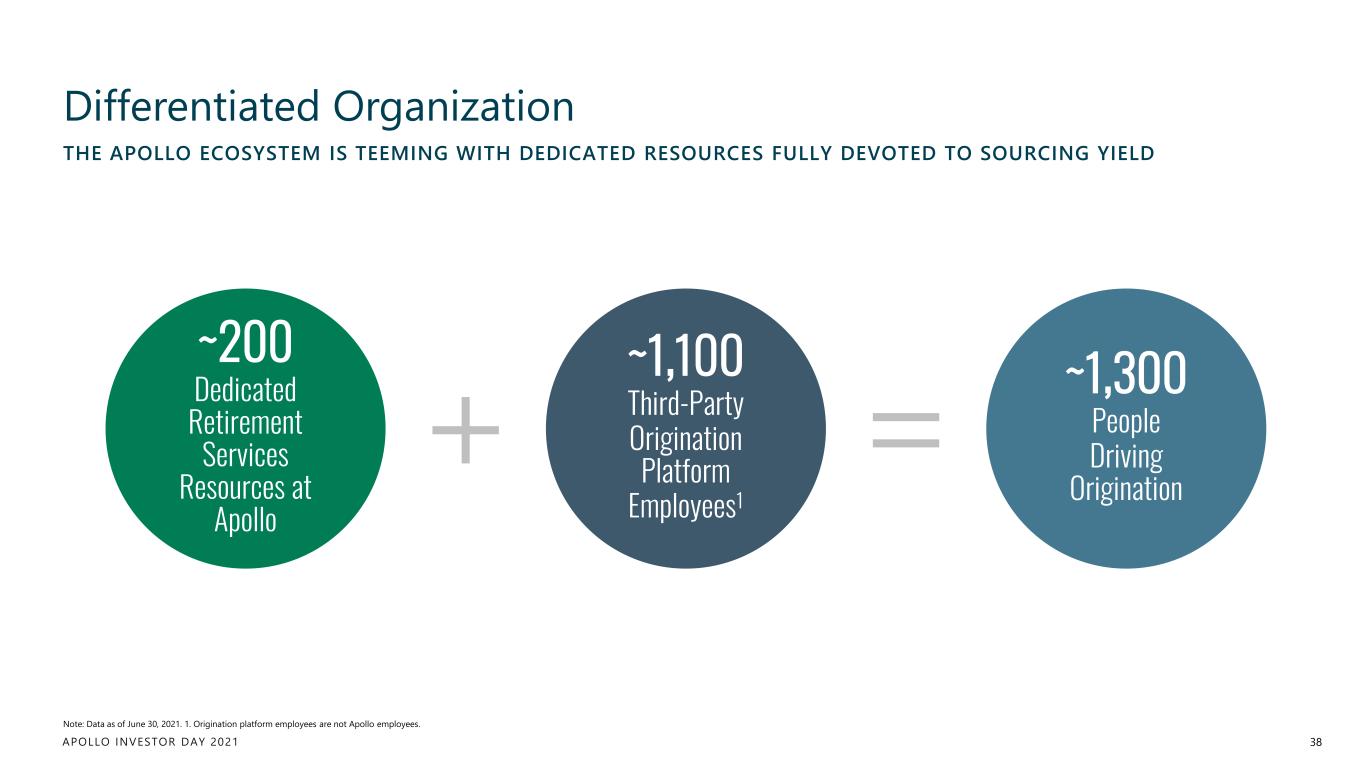

APOLLO INVESTOR DAY 2021 THE APOLLO ECOSYSTEM IS TEEMING WITH DEDICATED RESOURCES FULLY DEVOTED TO SOURCING YIELD Differentiated Organization 38 Note: Data as of June 30, 2021. 1. Origination platform employees are not Apollo employees. ~200 Dedicated Retirement Services Resources at Apollo ~1,300 People Driving Origination ~1,100 Third-Party Origination Platform Employees1

APOLLO INVESTOR DAY 2021 Why Do We Like This Market? 39 Note: Please refer to the Definitions pages at the end of this presentation for the definition of permanent. Large market size Ability to generate excess returns Permanent recurring origination Less cyclical More easily scalable Requires a completely differentiated ecosystem Different competitors

APOLLO INVESTOR DAY 2021 40 3 Athene is a Competitive Differentiator and Growth Accelerant

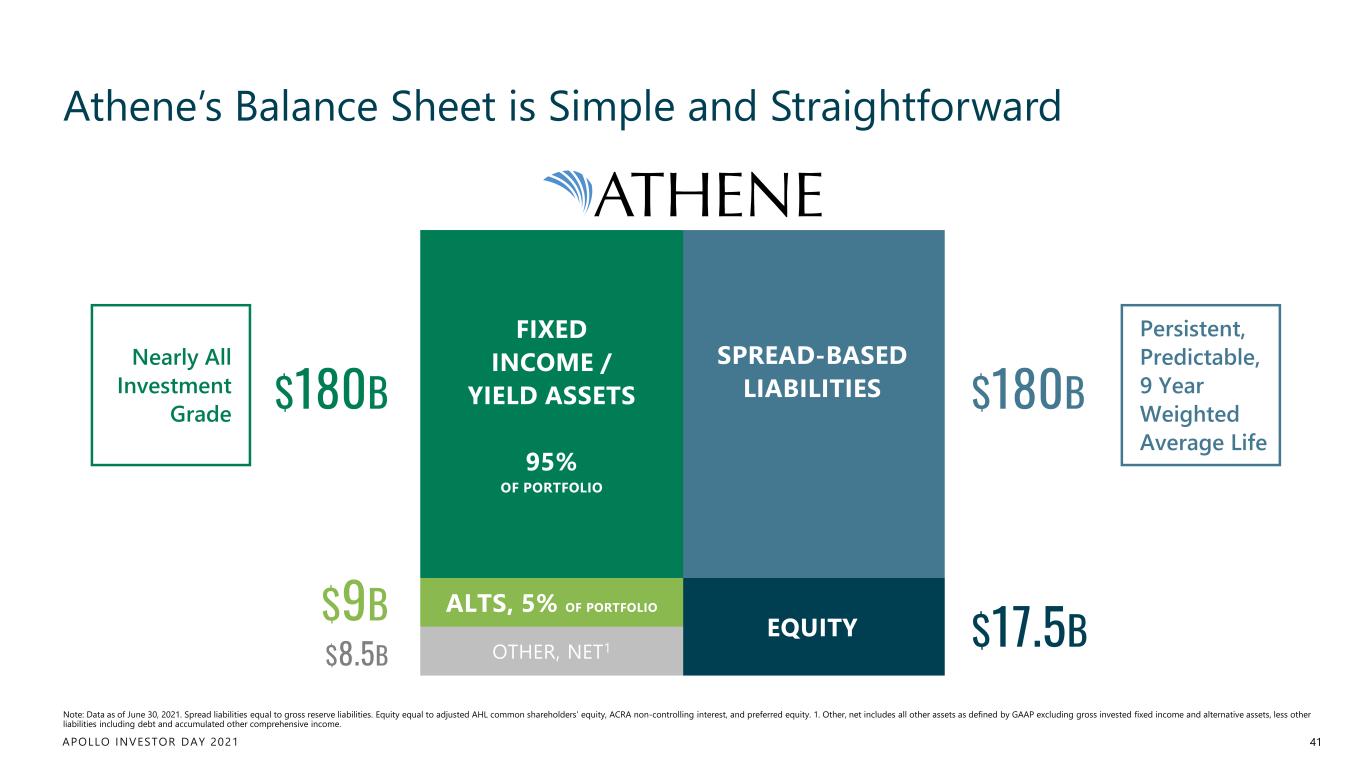

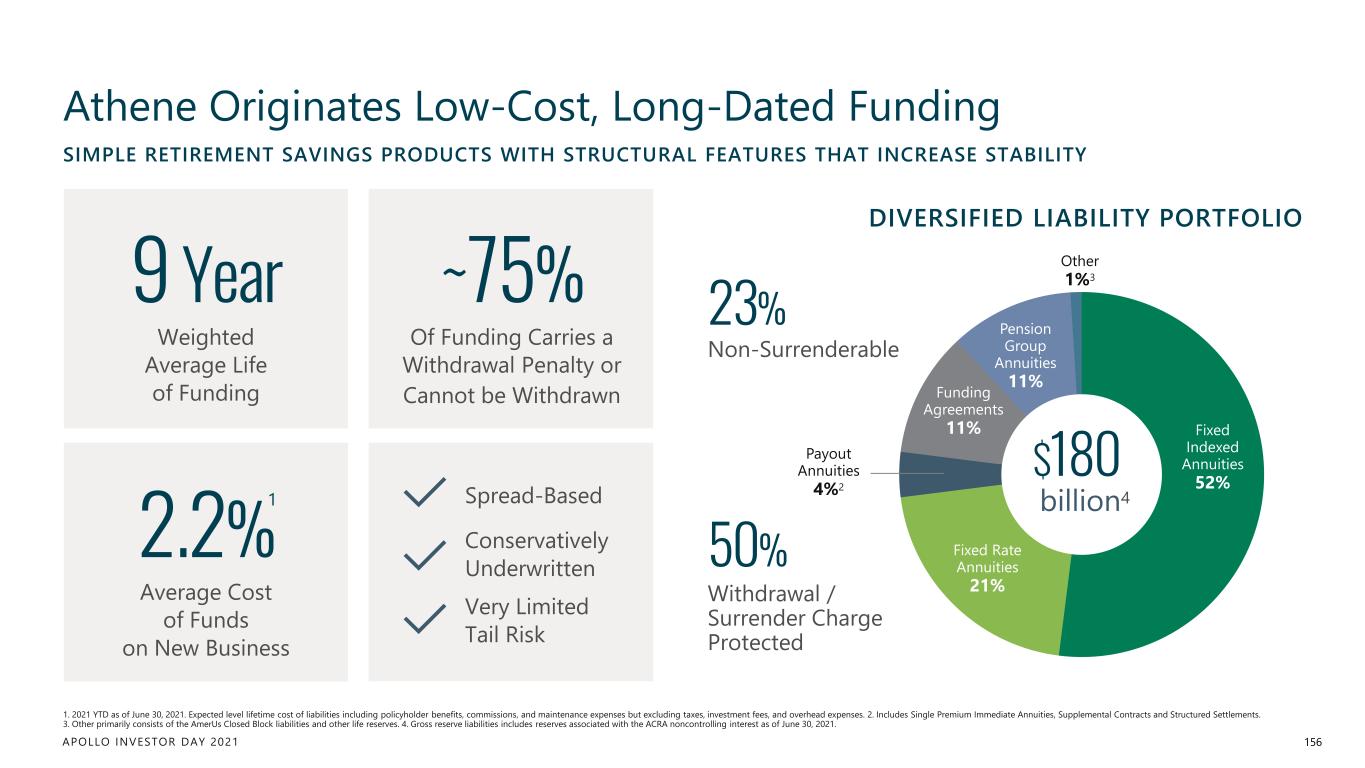

APOLLO INVESTOR DAY 2021 Athene’s Balance Sheet is Simple and Straightforward 41 Note: Data as of June 30, 2021. Spread liabilities equal to gross reserve liabilities. Equity equal to adjusted AHL common shareholders’ equity, ACRA non-controlling interest, and preferred equity. 1. Other, net includes all other assets as defined by GAAP excluding gross invested fixed income and alternative assets, less other liabilities including debt and accumulated other comprehensive income. $180B $9B $180B $17.5B Nearly All Investment Grade Persistent, Predictable, 9 Year Weighted Average Life $8.5B SPREAD-BASED LIABILITIES FIXED INCOME / YIELD ASSETS 95% OF PORTFOLIO EQUITY ALTS, 5% OF PORTFOLIO OTHER, NET1

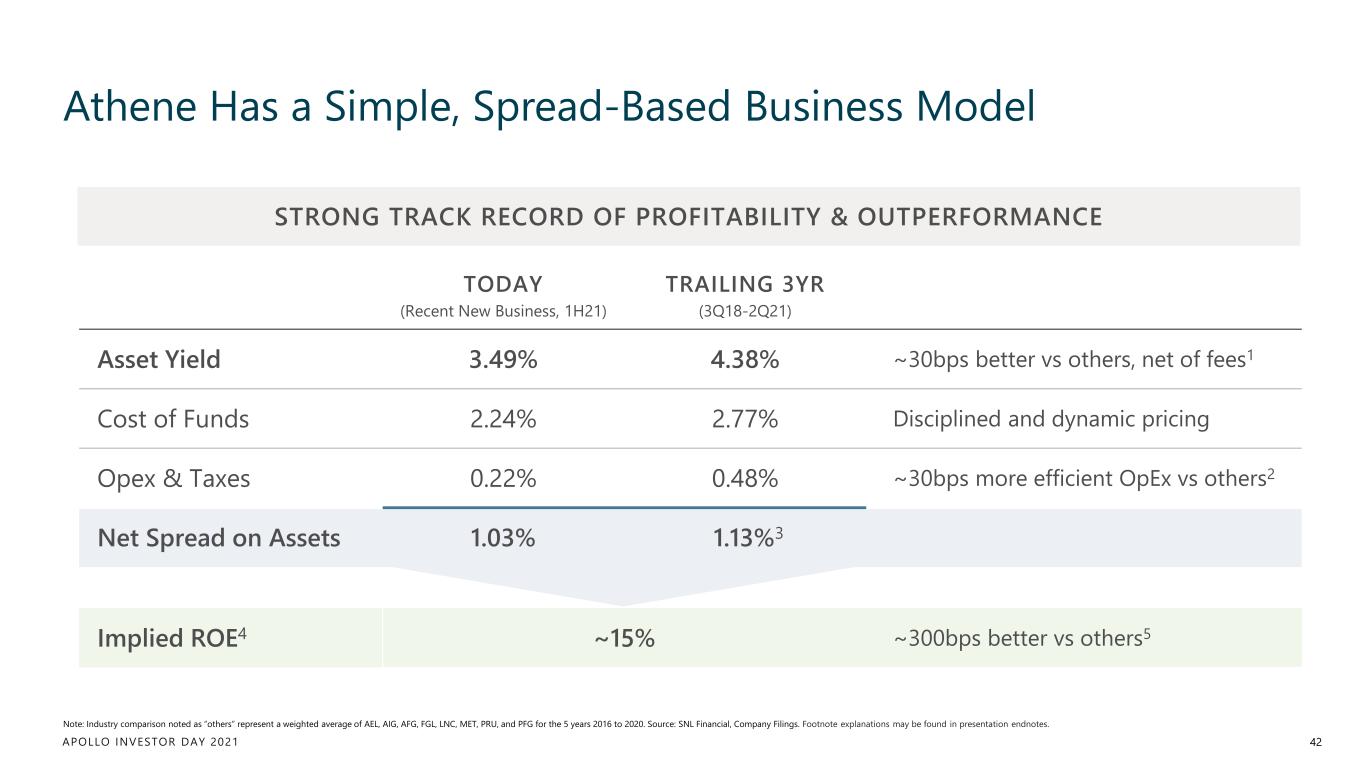

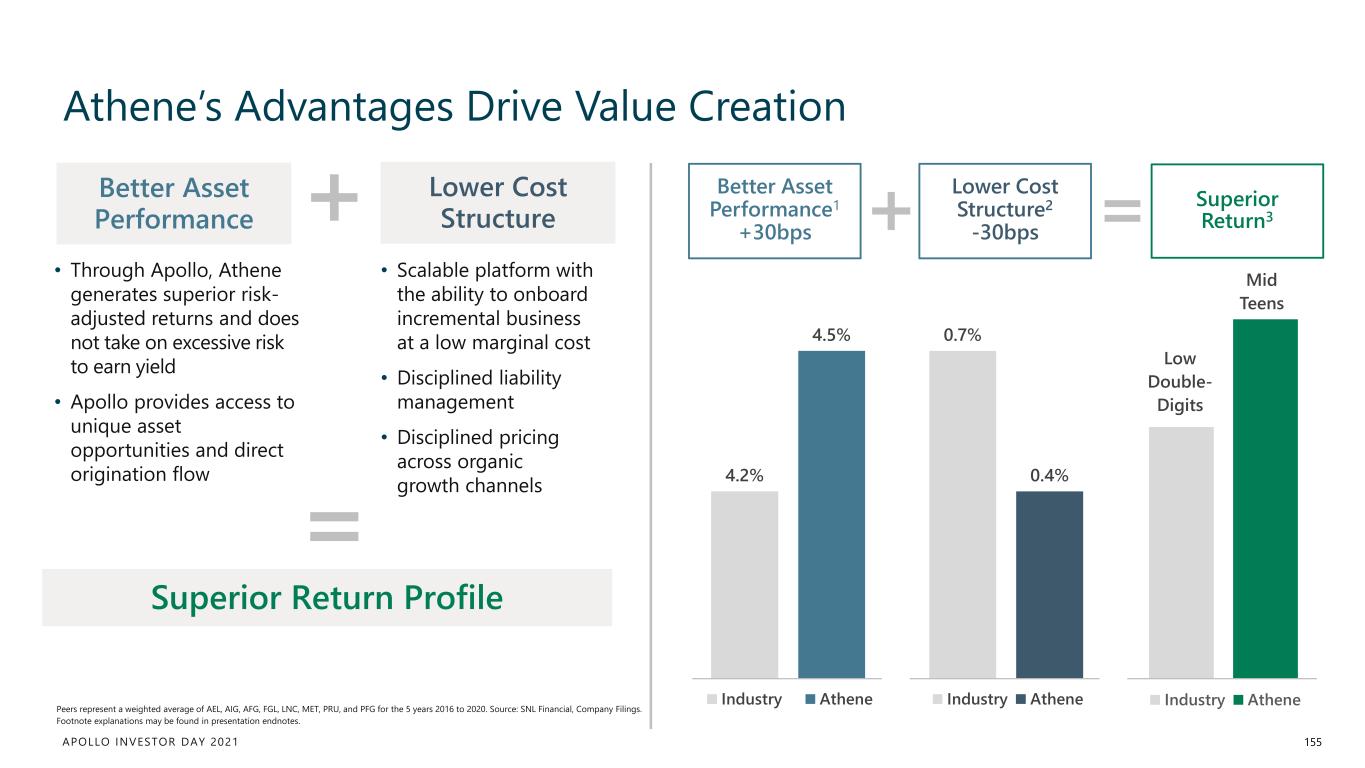

APOLLO INVESTOR DAY 2021 Athene Has a Simple, Spread-Based Business Model 42 Note: Industry comparison noted as “others” represent a weighted average of AEL, AIG, AFG, FGL, LNC, MET, PRU, and PFG for the 5 years 2016 to 2020. Source: SNL Financial, Company Filings. Footnote explanations may be found in presentation endnotes. TODAY (Recent New Business, 1H21) TRAILING 3YR (3Q18-2Q21) Asset Yield 3.49% 4.38% ~30bps better vs others, net of fees1 Cost of Funds 2.24% 2.77% Disciplined and dynamic pricing Opex & Taxes 0.22% 0.48% ~30bps more efficient OpEx vs others2 Net Spread on Assets 1.03% 1.13%3 Implied ROE4 ~15% ~300bps better vs others5 STRONG TRACK RECORD OF PROFITABILITY & OUTPERFORMANCE

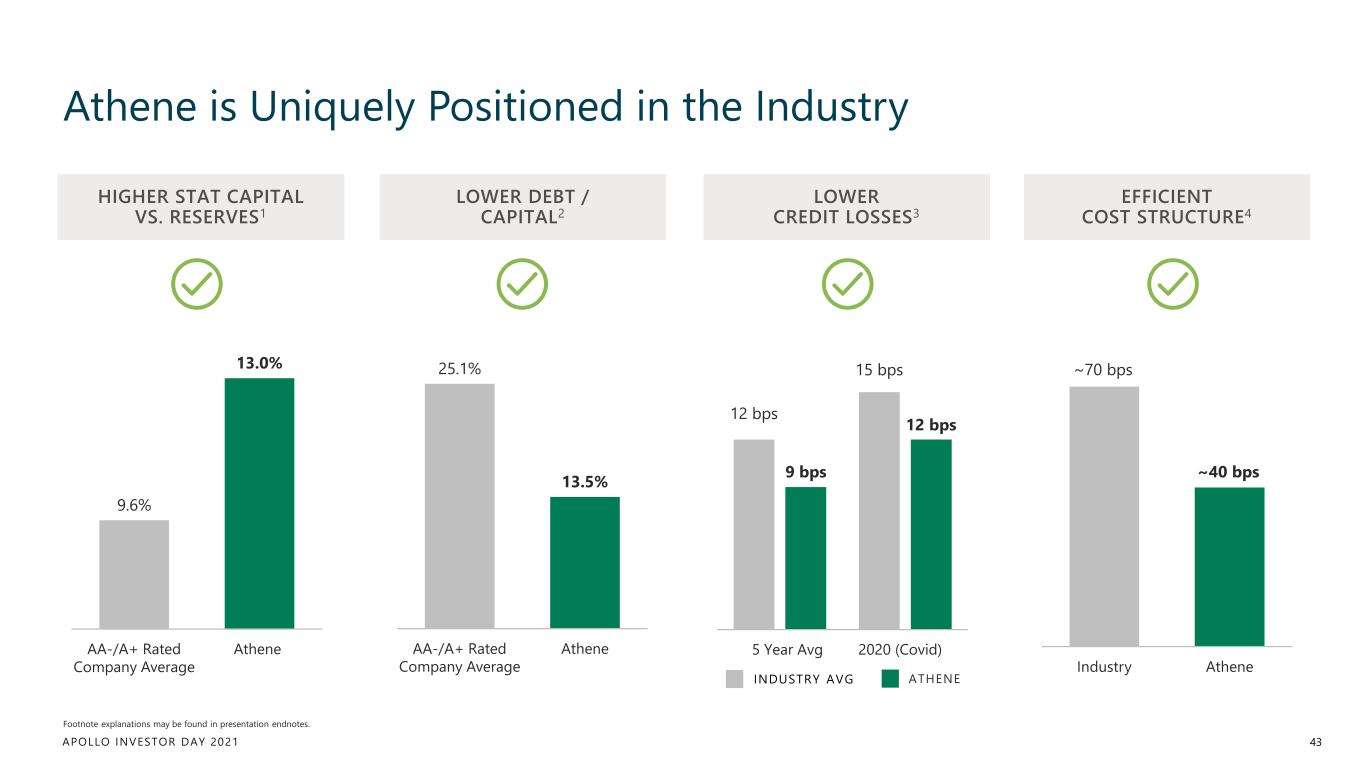

APOLLO INVESTOR DAY 2021 Athene is Uniquely Positioned in the Industry 43 Footnote explanations may be found in presentation endnotes. 12 bps 15 bps 9 bps 12 bps Annuity Issuer Peers Athene 9.6% 13.0% AA-/A+ Rated Company Average Athene 25.1% 13.5% AA-/A+ Rated Company Average Athene ~70 bps ~40 bps Industry Athene 2020 (Covid)5 Year Avg HIGHER STAT CAPITAL VS. RESERVES1 LOWER DEBT / CAPITAL2 LOWER CREDIT LOSSES3 EFFICIENT COST STRUCTURE4 ATHENEINDUSTRY AVG

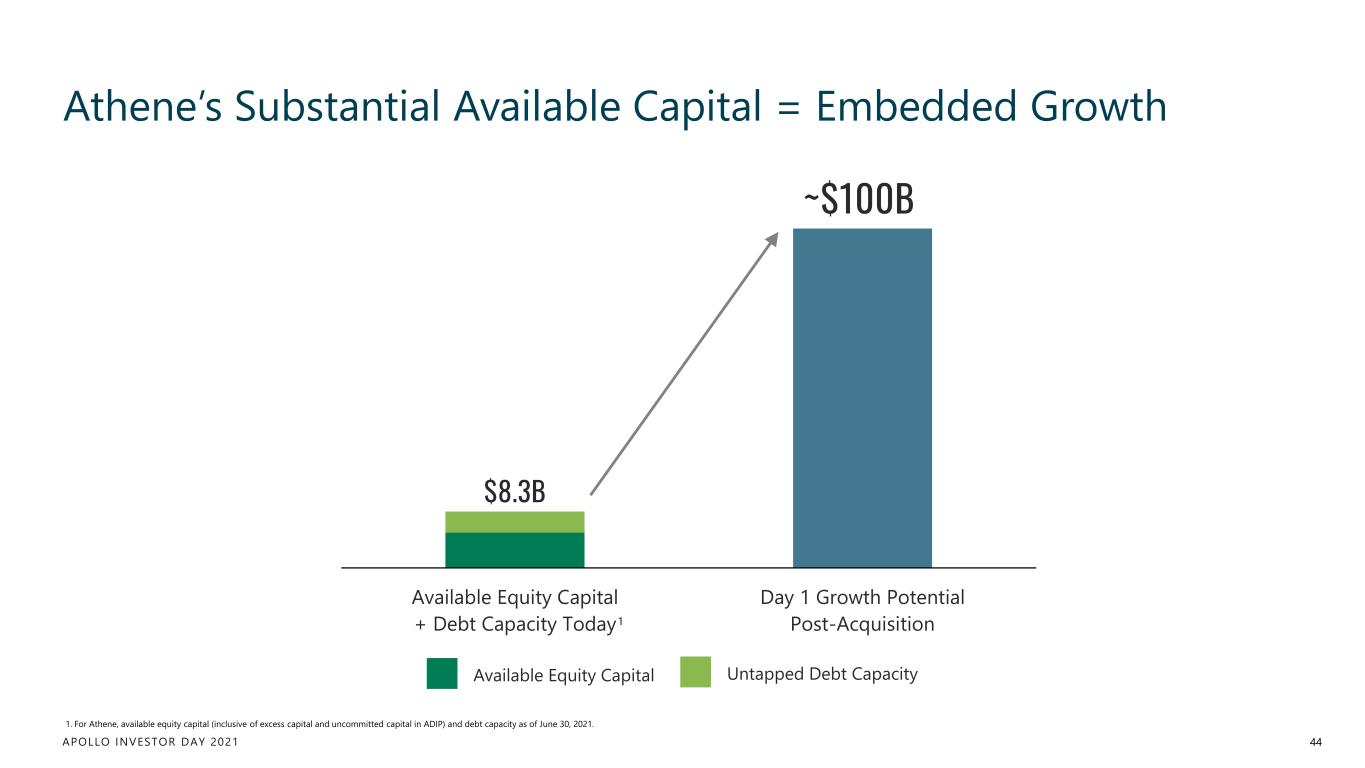

APOLLO INVESTOR DAY 2021 Available Equity Capital + Debt Capacity Today Day 1 Growth Potential Post-Acquisition 44 1. For Athene, available equity capital (inclusive of excess capital and uncommitted capital in ADIP) and debt capacity as of June 30, 2021. Athene’s Substantial Available Capital = Embedded Growth $8.3B ~$100B 1 Available Equity Capital Untapped Debt Capacity

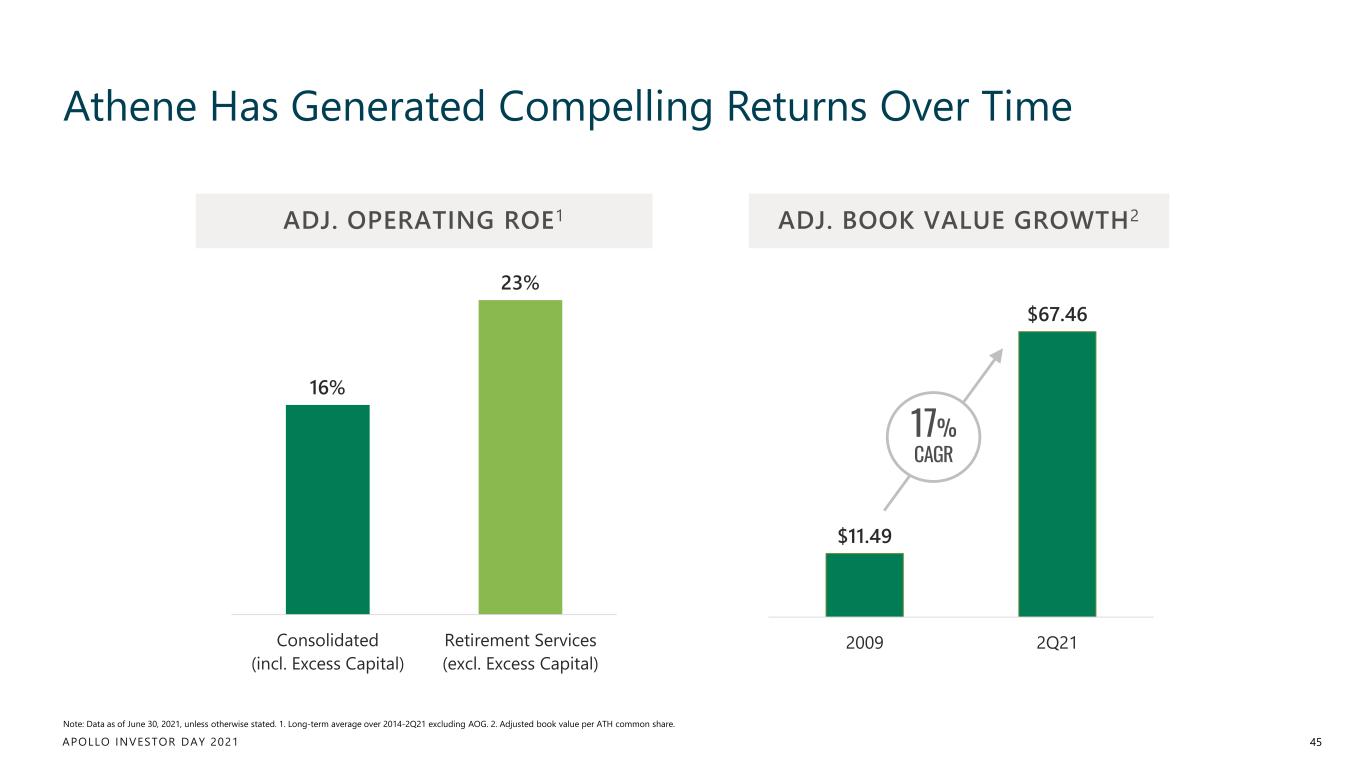

APOLLO INVESTOR DAY 2021 Athene Has Generated Compelling Returns Over Time 45 Note: Data as of June 30, 2021, unless otherwise stated. 1. Long-term average over 2014-2Q21 excluding AOG. 2. Adjusted book value per ATH common share. ADJ. OPERATING ROE1 16% 23% Consolidated (incl. Excess Capital) Retirement Services (excl. Excess Capital) ADJ. BOOK VALUE GROWTH2 $11.49 $67.46 2009 2Q21 17% CAGR

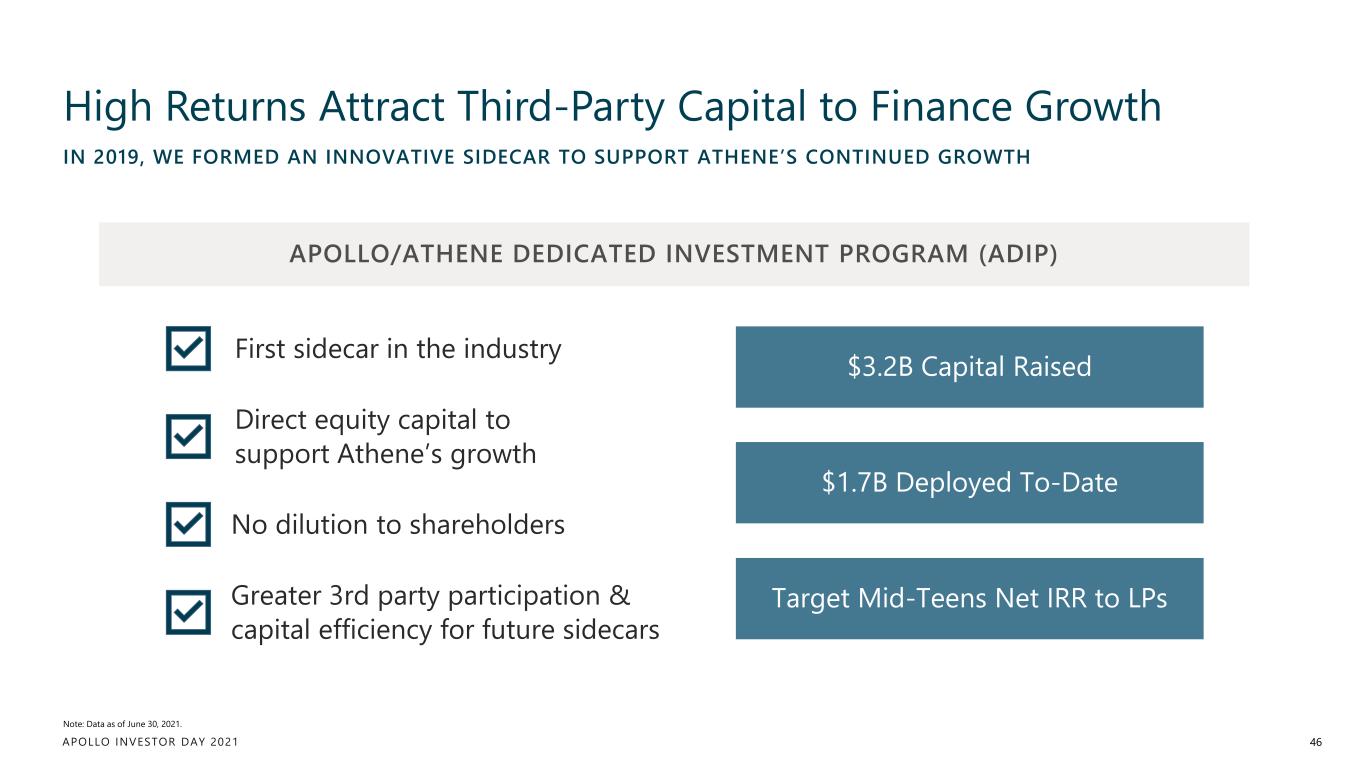

APOLLO INVESTOR DAY 2021 High Returns Attract Third-Party Capital to Finance Growth 46 Note: Data as of June 30, 2021. APOLLO/ATHENE DEDICATED INVESTMENT PROGRAM (ADIP) First sidecar in the industry $3.2B Capital Raised $1.7B Deployed To-Date Target Mid-Teens Net IRR to LPs IN 2019, WE FORMED AN INNOVATIVE SIDECAR TO SUPPORT ATHENE’S CONTINUED GROWTH Direct equity capital to support Athene’s growth No dilution to shareholders Greater 3rd party participation & capital efficiency for future sidecars

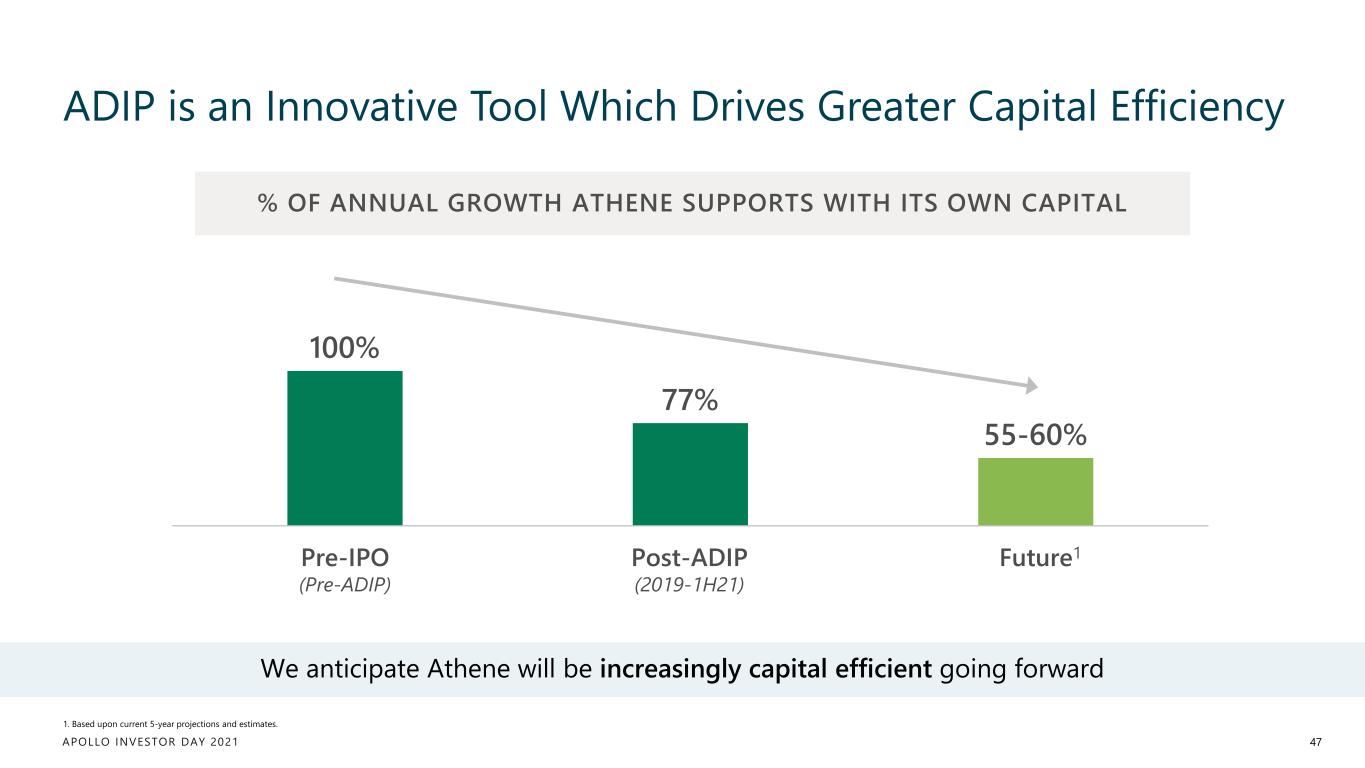

APOLLO INVESTOR DAY 2021 ADIP is an Innovative Tool Which Drives Greater Capital Efficiency 47 1. Based upon current 5-year projections and estimates. 100% 77% 55-60% Pre-ADIP 2019-1H21 Next 5 YearsPre-IPO (Pre-ADIP) Post-ADIP (2019-1H21) Future1 % OF ANNUAL GROWTH ATHENE SUPPORTS WITH ITS OWN CAPITAL We anticipate Athene will be increasingly capital efficient going forward

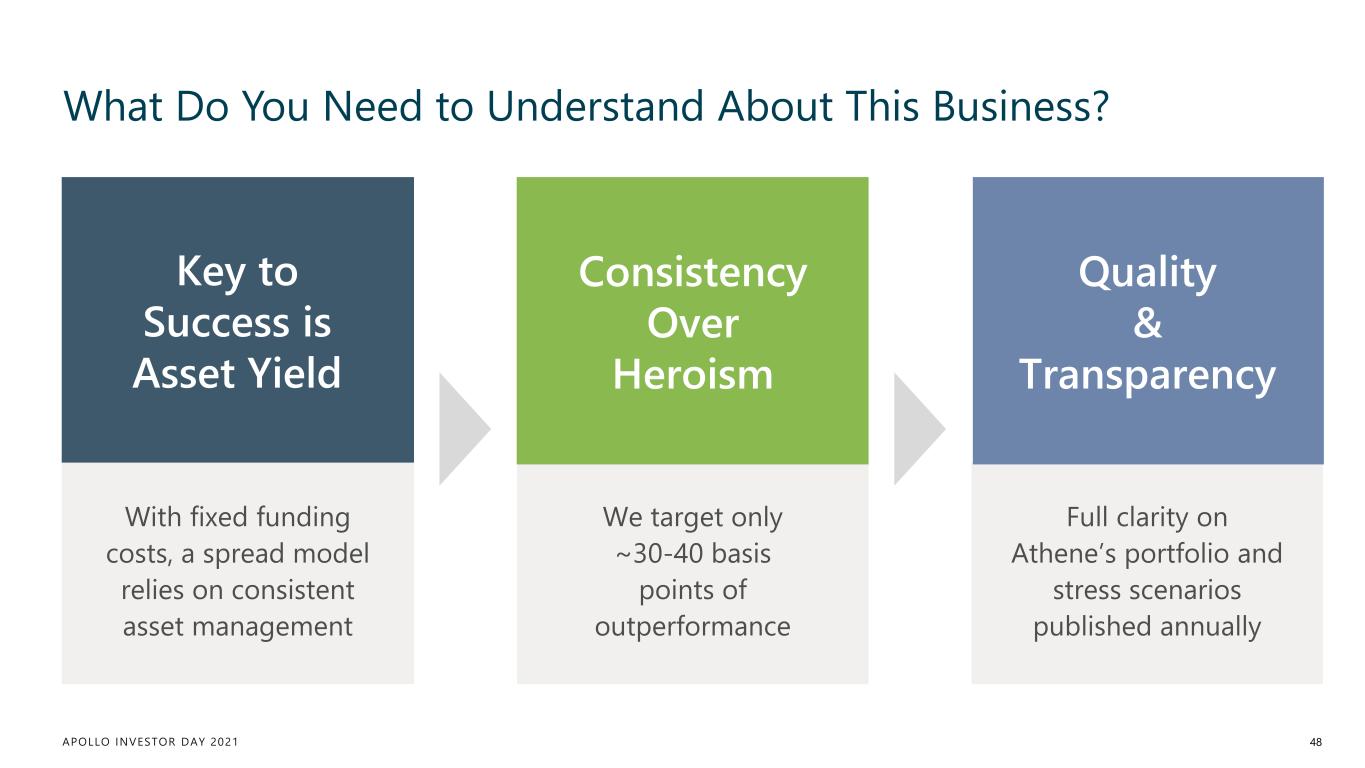

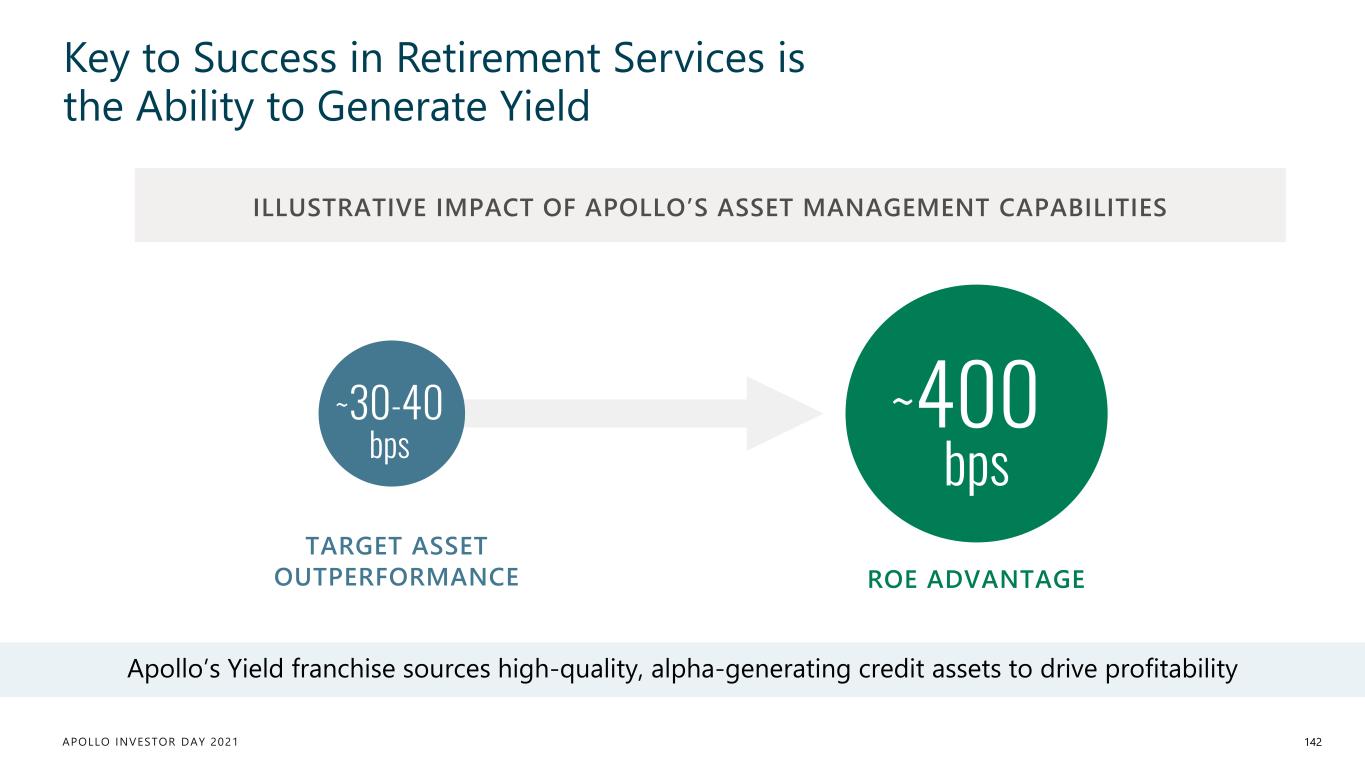

APOLLO INVESTOR DAY 2021 What Do You Need to Understand About This Business? 48 With fixed funding costs, a spread model relies on consistent asset management Key to Success is Asset Yield We target only ~30-40 basis points of outperformance Consistency Over Heroism Full clarity on Athene’s portfolio and stress scenarios published annually Quality & Transparency

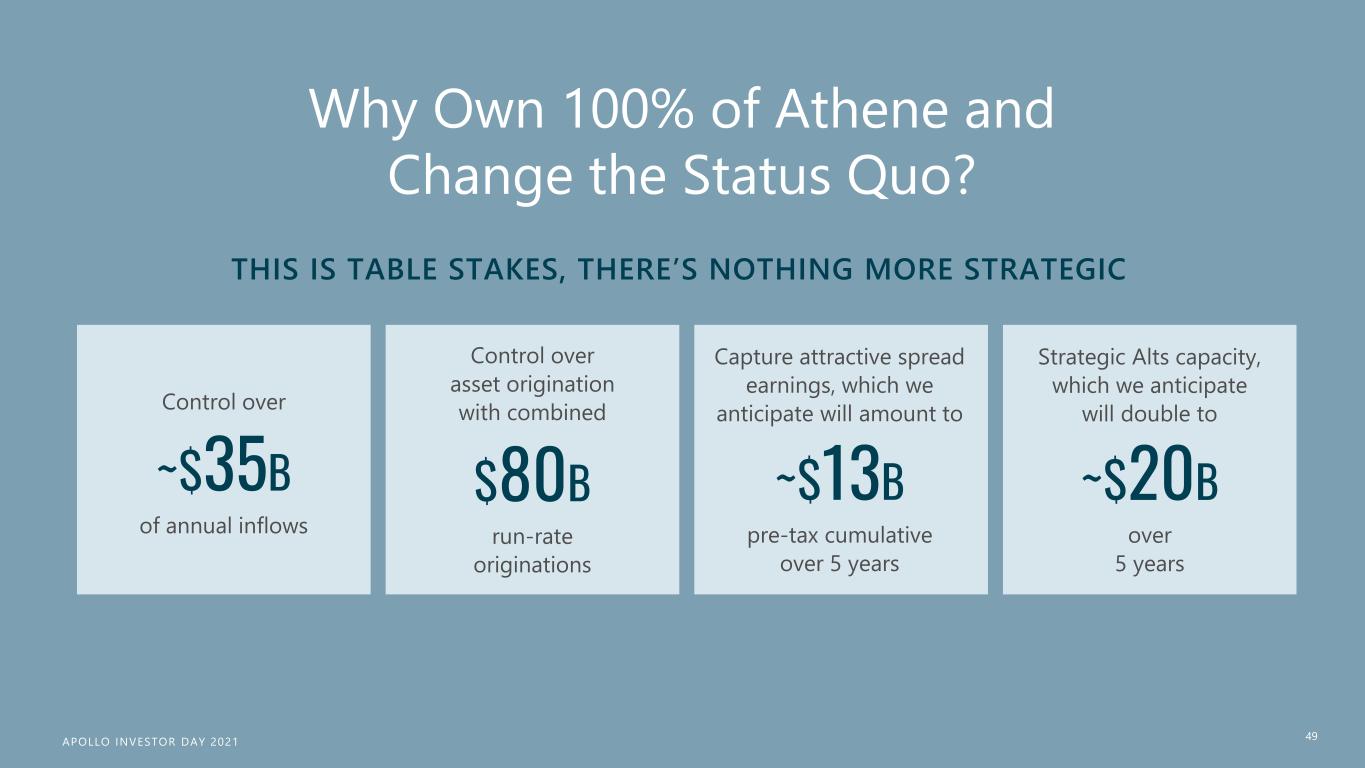

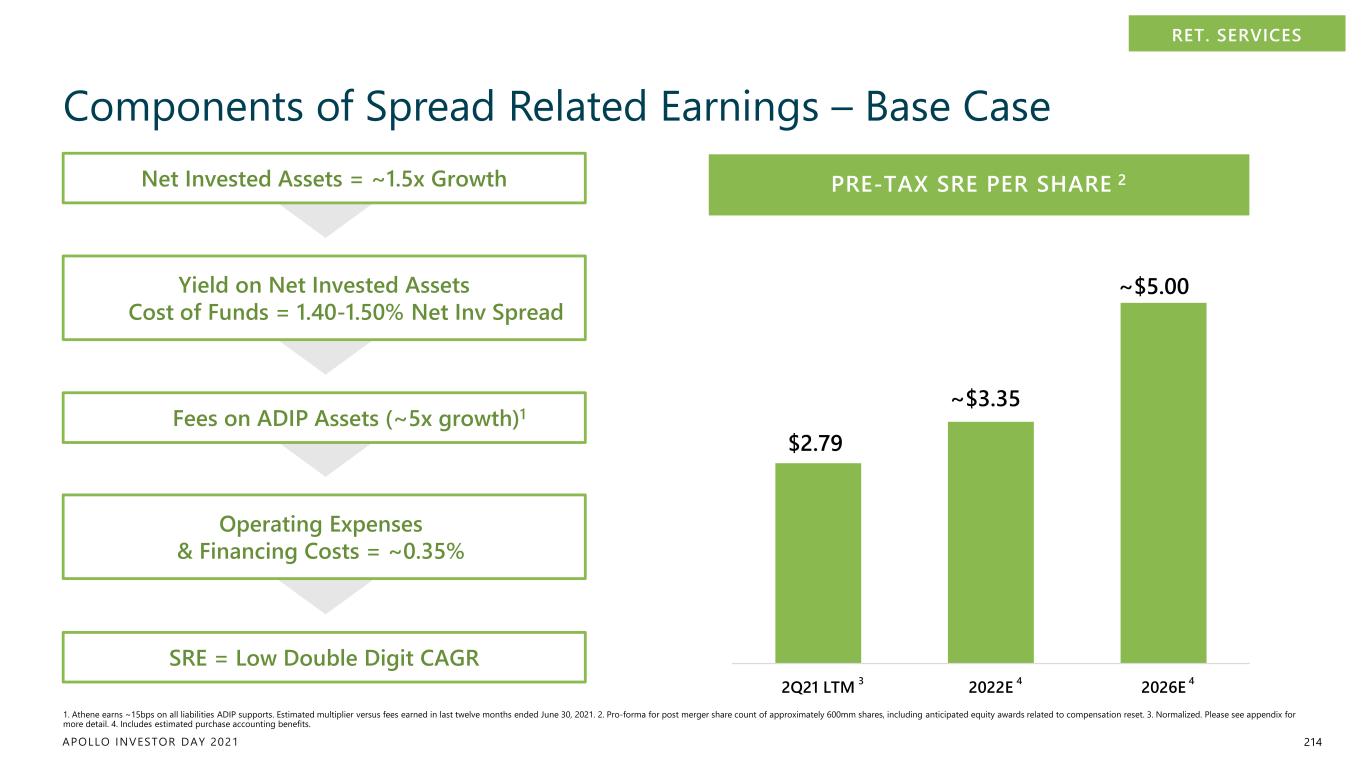

APOLLO INVESTOR DAY 2021 Why Own 100% of Athene and Change the Status Quo? THIS IS TABLE STAKES, THERE’S NOTHING MORE STRATEGIC 49 Control over ~$35B of annual inflows Control over asset origination with combined $80B run-rate originations Capture attractive spread earnings, which we anticipate will amount to ~$13B pre-tax cumulative over 5 years Strategic Alts capacity, which we anticipate will double to ~$20B over 5 years

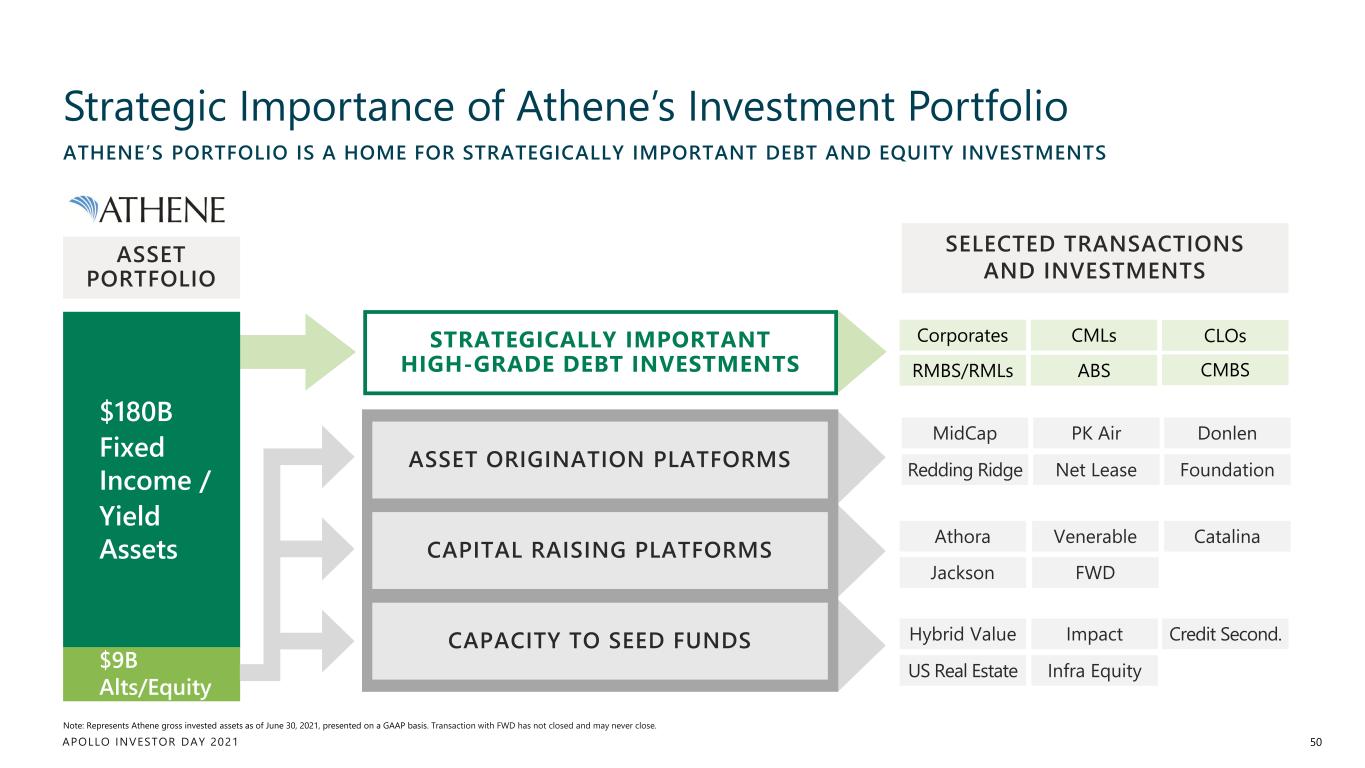

APOLLO INVESTOR DAY 2021 $180B Fixed Income / Yield Assets Strategic Importance of Athene’s Investment Portfolio 50 Note: Represents Athene gross invested assets as of June 30, 2021, presented on a GAAP basis. Transaction with FWD has not closed and may never close. $9B Alts/Equity ASSET PORTFOLIO SELECTED TRANSACTIONS AND INVESTMENTS ATHENE’S PORTFOLIO IS A HOME FOR STRATEGICALLY IMPORTANT DEBT AND EQUITY INVESTMENTS Corporates CMLs RMBS/RMLs CLOs CMBSABS MidCap PK Air Redding Ridge Donlen FoundationNet Lease Athora Venerable Jackson FWD Hybrid Value US Real Estate Infra Equity Credit Second.Impact Catalina STRATEGICALLY IMPORTANT HIGH-GRADE DEBT INVESTMENTS ASSET ORIGINATION PLATFORMS CAPITAL RAISING PLATFORMS CAPACITY TO SEED FUNDS

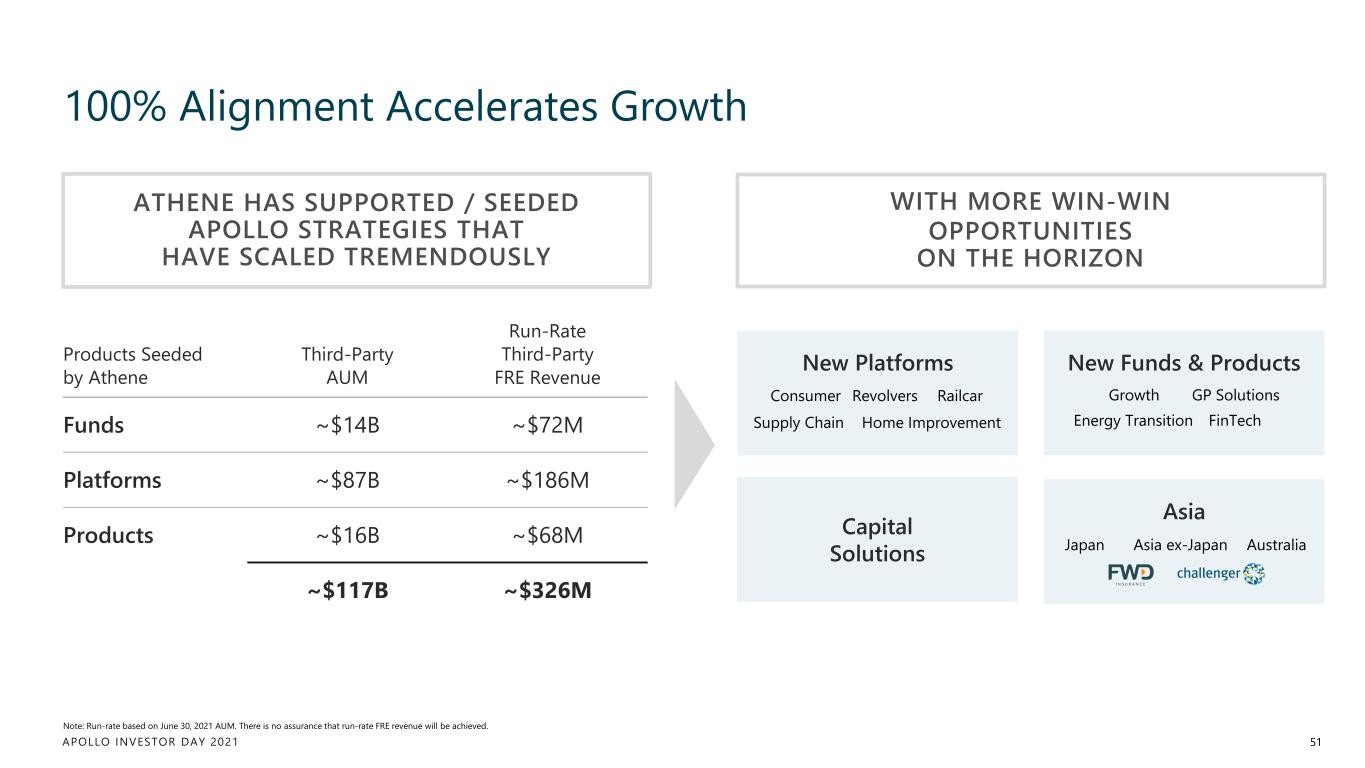

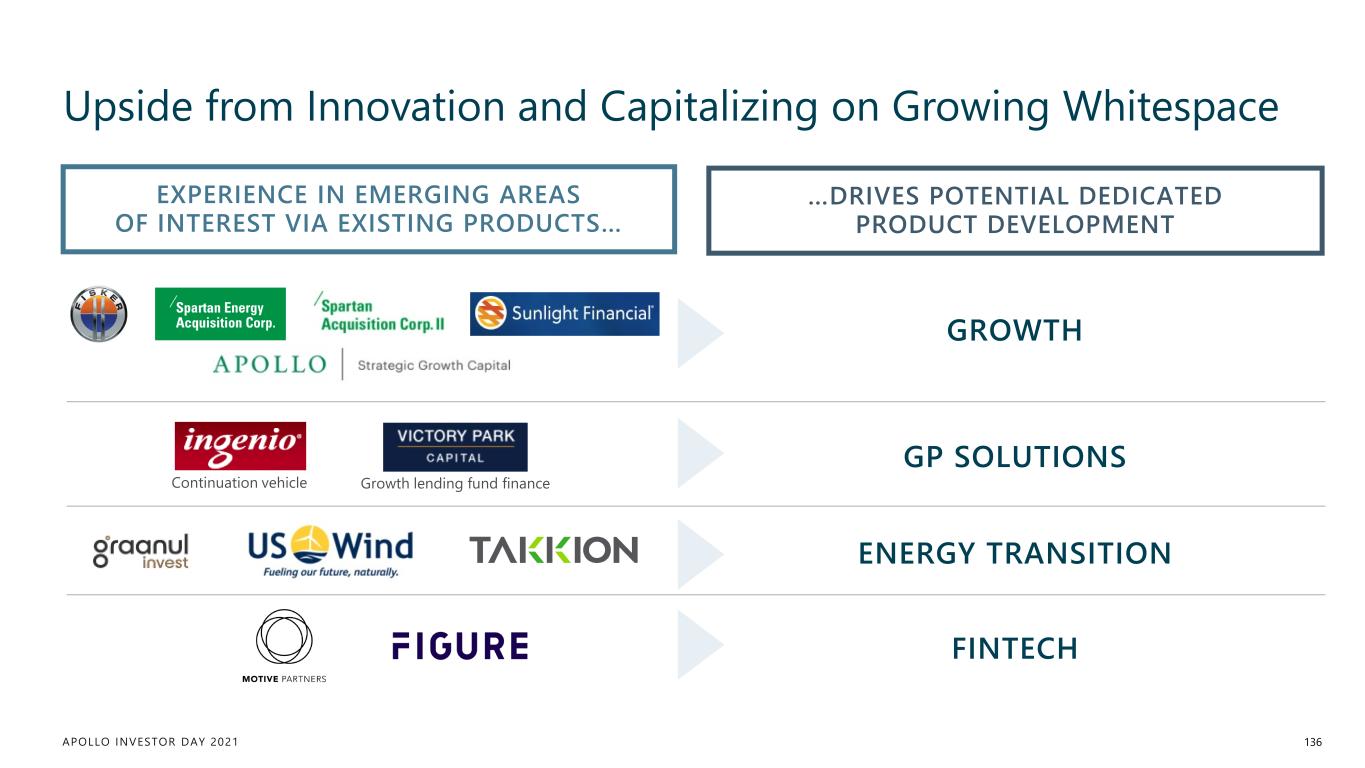

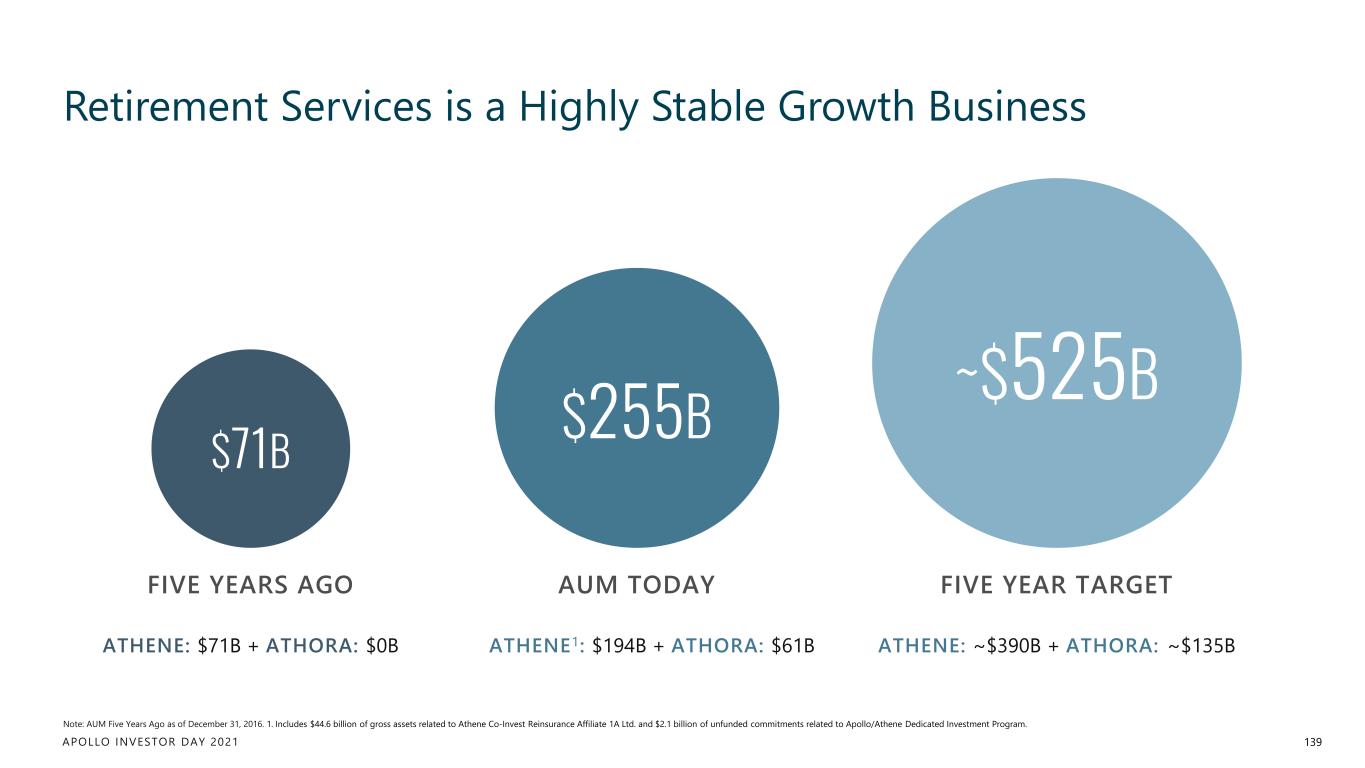

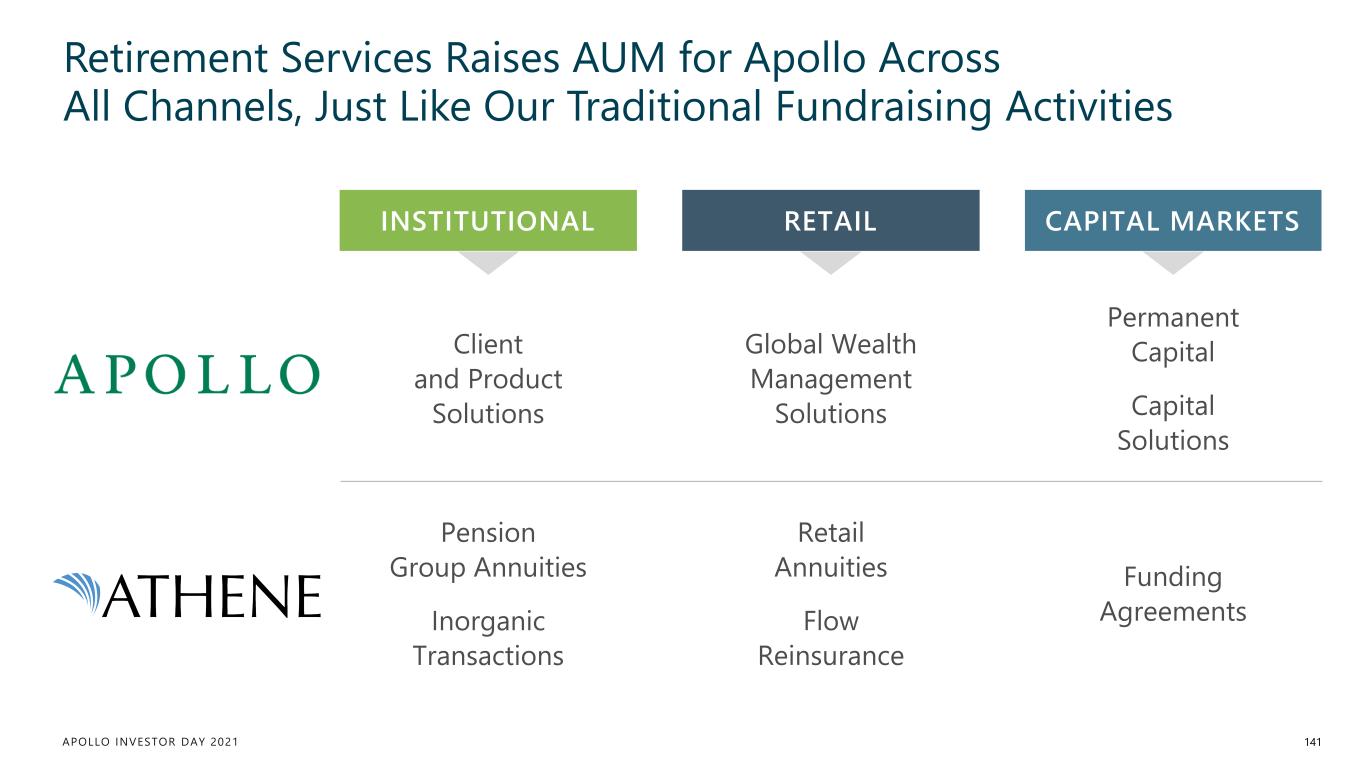

APOLLO INVESTOR DAY 2021 100% Alignment Accelerates Growth 51 Note: Run-rate based on June 30, 2021 AUM. There is no assurance that run-rate FRE revenue will be achieved. Products Seeded by Athene Third-Party AUM Run-Rate Third-Party FRE Revenue Funds ~$14B ~$72M Platforms ~$87B ~$186M Products ~$16B ~$68M ~$117B ~$326M ATHENE HAS SUPPORTED / SEEDED APOLLO STRATEGIES THAT HAVE SCALED TREMENDOUSLY WITH MORE WIN-WIN OPPORTUNITIES ON THE HORIZON New Platforms Capital Solutions New Funds & Products Asia Supply Chain Consumer RailcarRevolvers Home Improvement Growth GP Solutions Energy Transition FinTech Japan AustraliaAsia ex-Japan

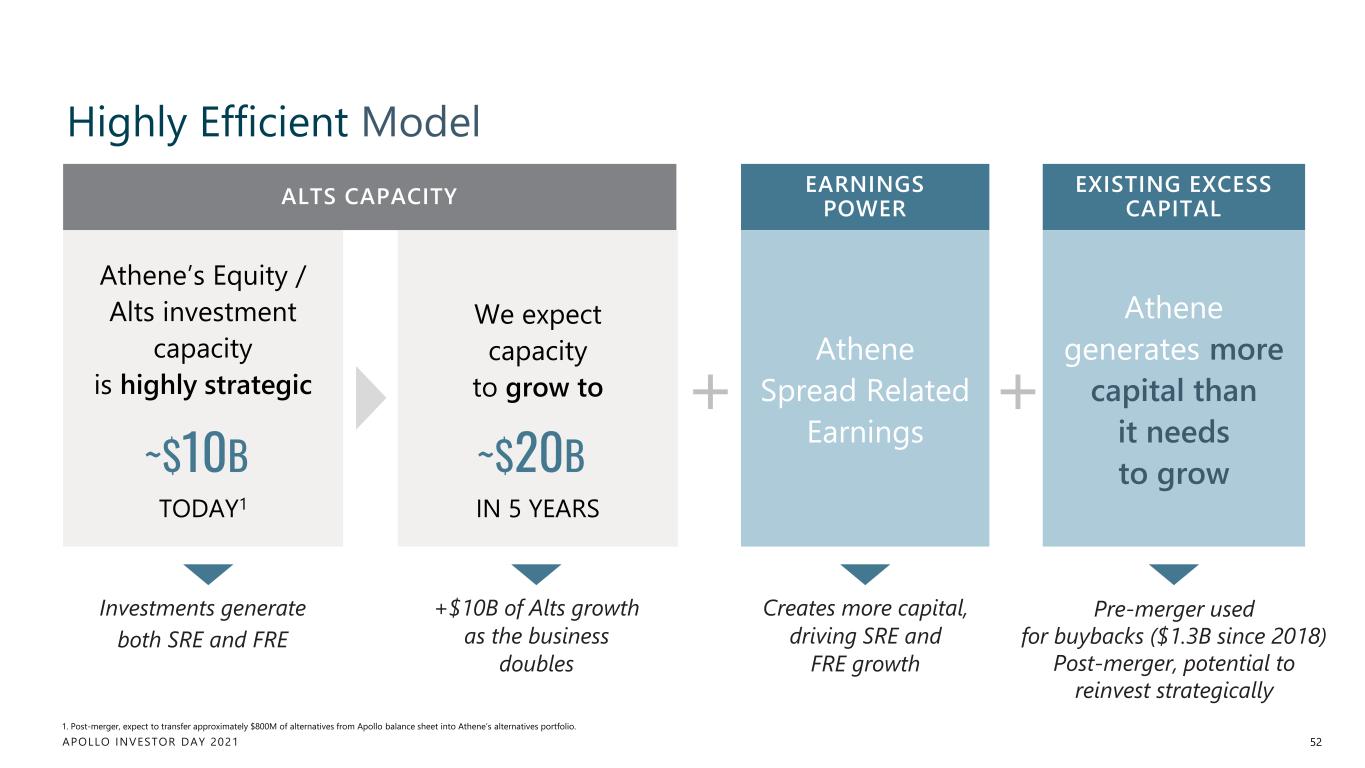

APOLLO INVESTOR DAY 2021 Highly Efficient Model 52 1. Post-merger, expect to transfer approximately $800M of alternatives from Apollo balance sheet into Athene’s alternatives portfolio. We expect capacity to grow to Investments generate both SRE and FRE +$10B of Alts growth as the business doubles + ALTS CAPACITY Athene’s Equity / Alts investment capacity is highly strategic ~$10B TODAY1 ~$20B IN 5 YEARS Creates more capital, driving SRE and FRE growth EARNINGS POWER Athene Spread Related Earnings Athene generates more capital than it needs to grow Pre-merger used for buybacks ($1.3B since 2018) Post-merger, potential to reinvest strategically EXISTING EXCESS CAPITAL +

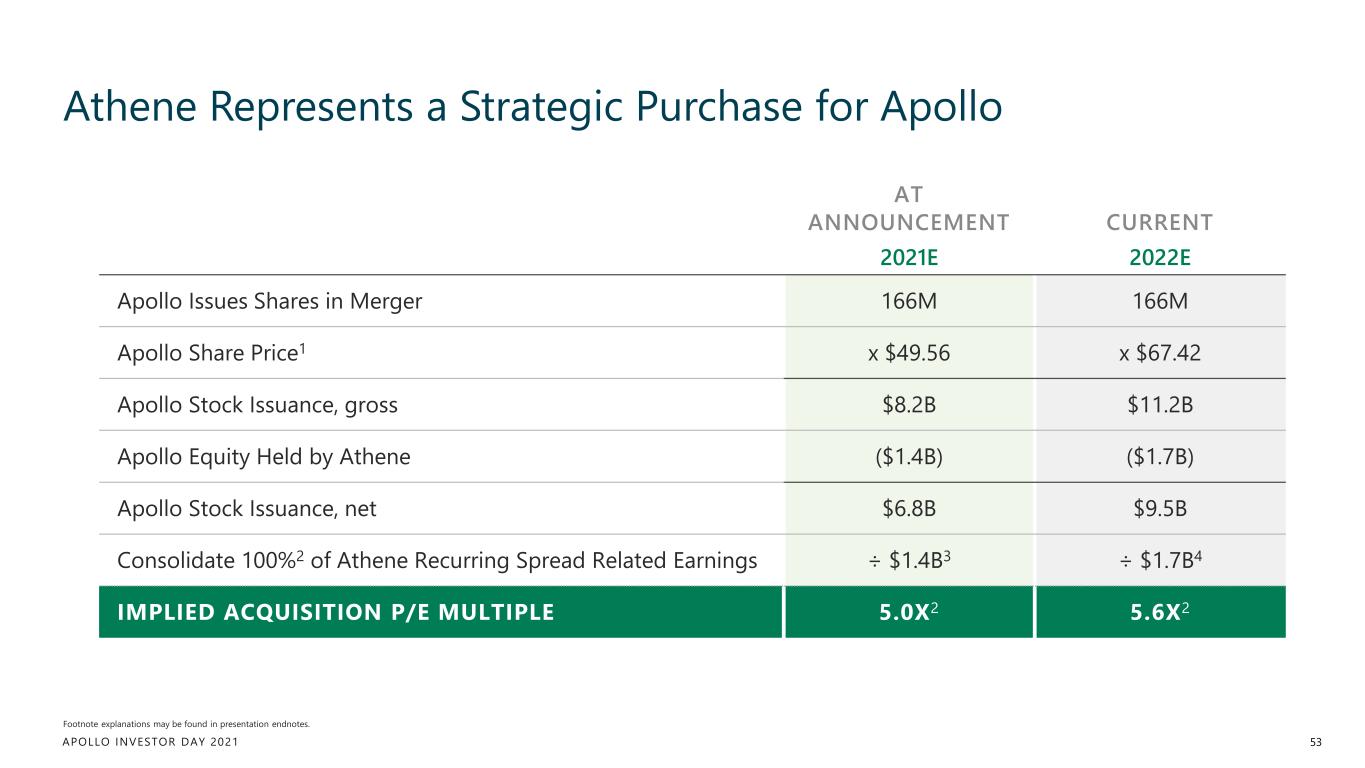

APOLLO INVESTOR DAY 2021 Athene Represents a Strategic Purchase for Apollo 53 Footnote explanations may be found in presentation endnotes. AT ANNOUNCEMENT CURRENT 2021E 2022E Apollo Issues Shares in Merger 166M 166M Apollo Share Price1 x $49.56 x $67.42 Apollo Stock Issuance, gross $8.2B $11.2B Apollo Equity Held by Athene ($1.4B) ($1.7B) Apollo Stock Issuance, net $6.8B $9.5B Consolidate 100%2 of Athene Recurring Spread Related Earnings ÷ $1.4B3 ÷ $1.7B4 IMPLIED ACQUISITION P/E MULTIPLE 5.0X2 5.6X2

APOLLO INVESTOR DAY 2021 Non-Traded BDC and REIT Growth Has Been Explosive 54 Source: Robert A. Stanger & Co, Inc. 1. Includes annualized 2021 sales. Non-Traded REIT sales through May 30, 2021. Non-Traded BDC sales through June 30, 2021. 2017 2018 2019 2020 2021E Cumulative Non-Traded REIT Sales Cumulative Non-Traded BDC Sales $5B $10B $22B $34B $70B 1 54

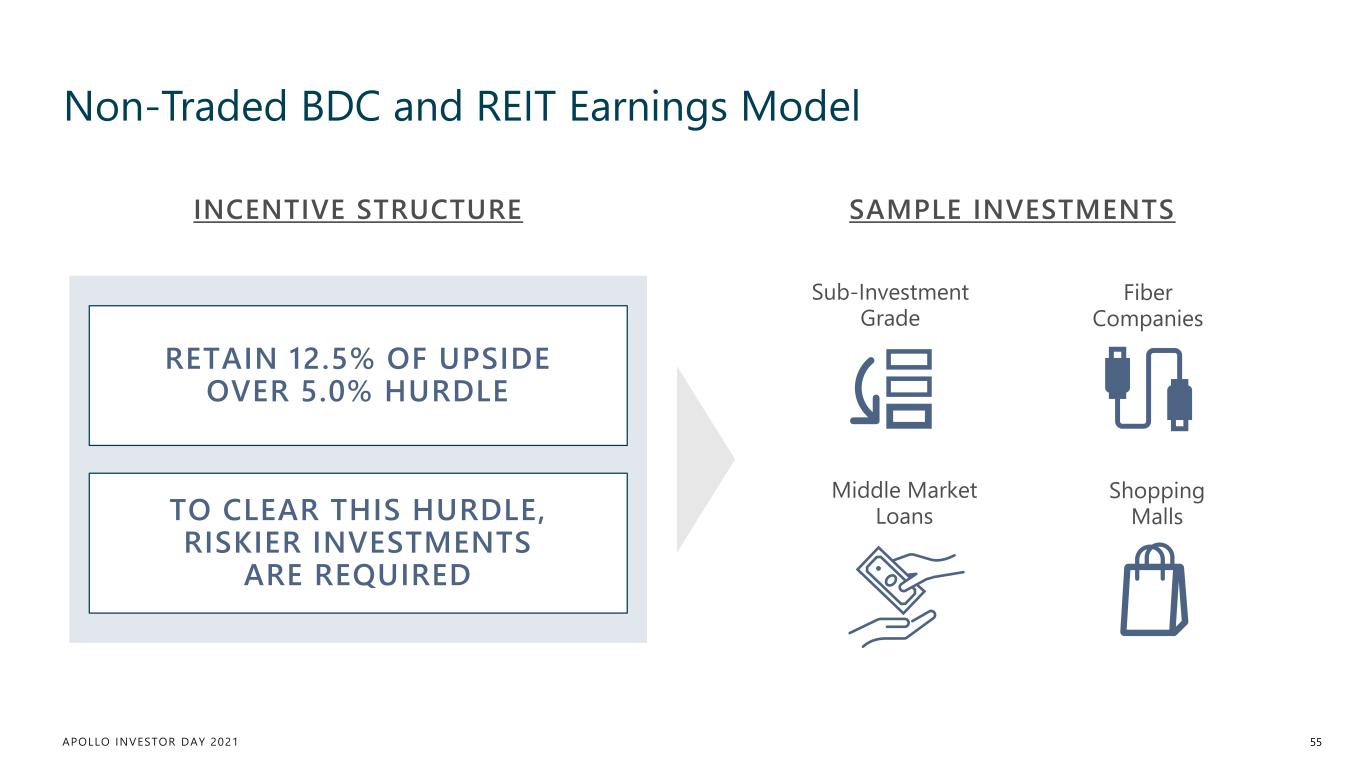

APOLLO INVESTOR DAY 2021 Non-Traded BDC and REIT Earnings Model 55 RETAIN 12.5% OF UPSIDE OVER 5.0% HURDLE TO CLEAR THIS HURDLE, RISKIER INVESTMENTS ARE REQUIRED SAMPLE INVESTMENTS Sub-Investment Grade Fiber Companies Middle Market Loans INCENTIVE STRUCTURE Shopping Malls

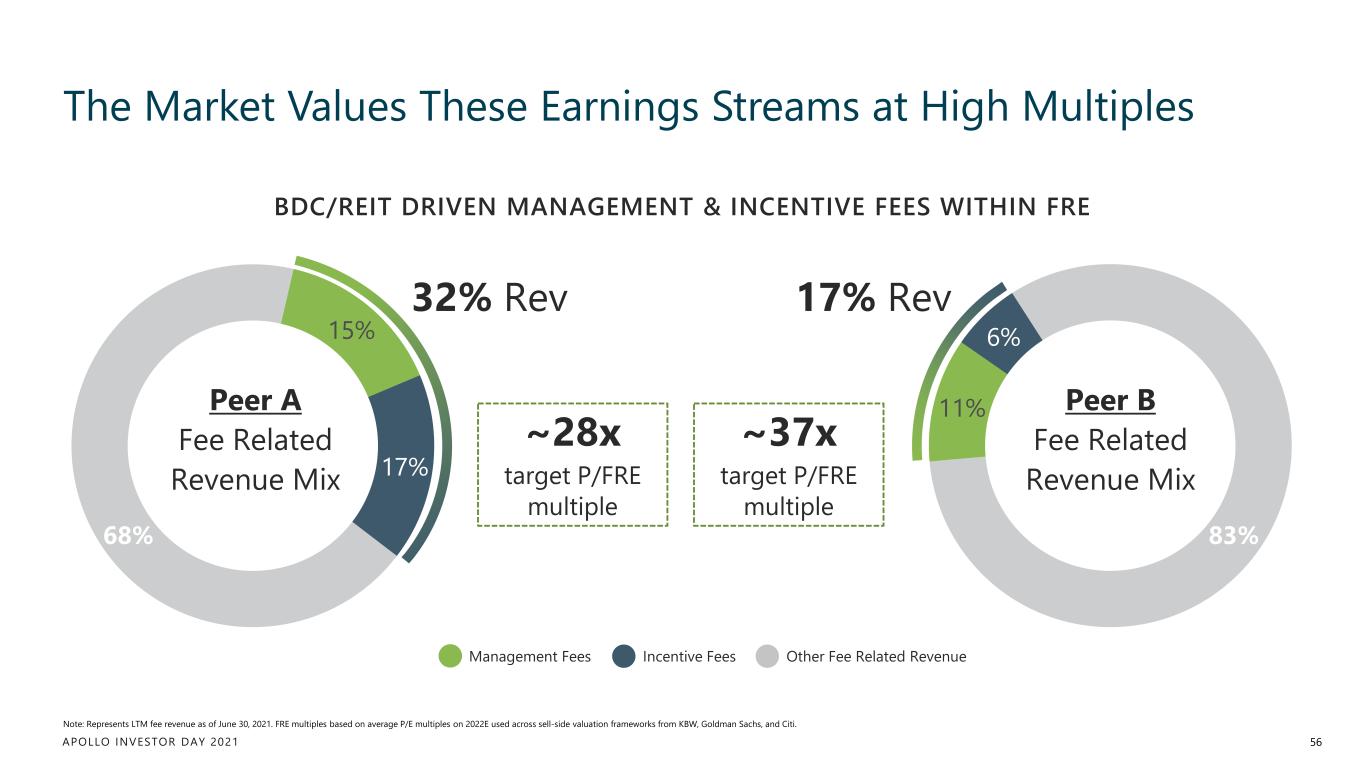

APOLLO INVESTOR DAY 2021 BDC/REIT DRIVEN MANAGEMENT & INCENTIVE FEES WITHIN FRE The Market Values These Earnings Streams at High Multiples 56 Note: Represents LTM fee revenue as of June 30, 2021. FRE multiples based on average P/E multiples on 2022E used across sell-side valuation frameworks from KBW, Goldman Sachs, and Citi. 11% 6%15% 17% 68% Management Fees Incentive Fees Other Fee Related Revenue 83% Peer A Fee Related Revenue Mix Peer B Fee Related Revenue Mix ~28x target P/FRE multiple 17% Rev ~37x target P/FRE multiple 32% Rev

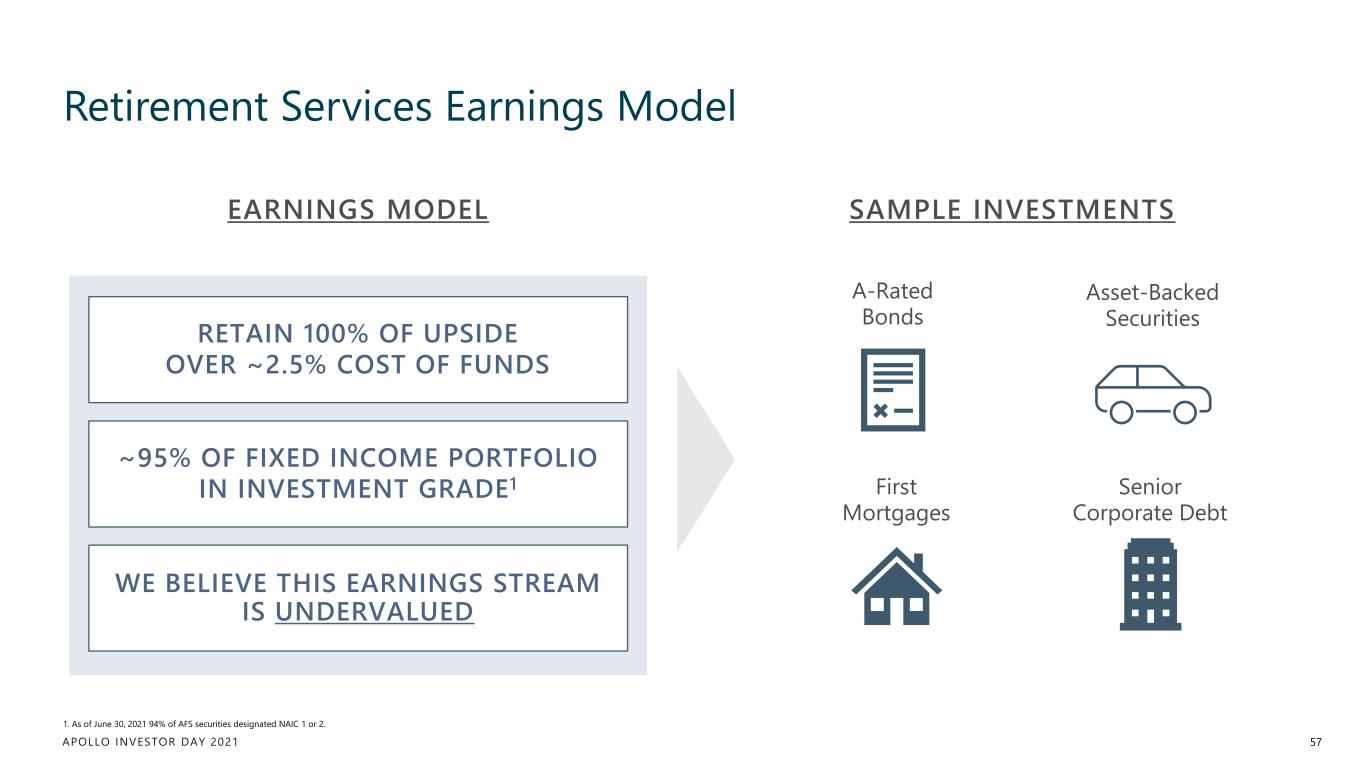

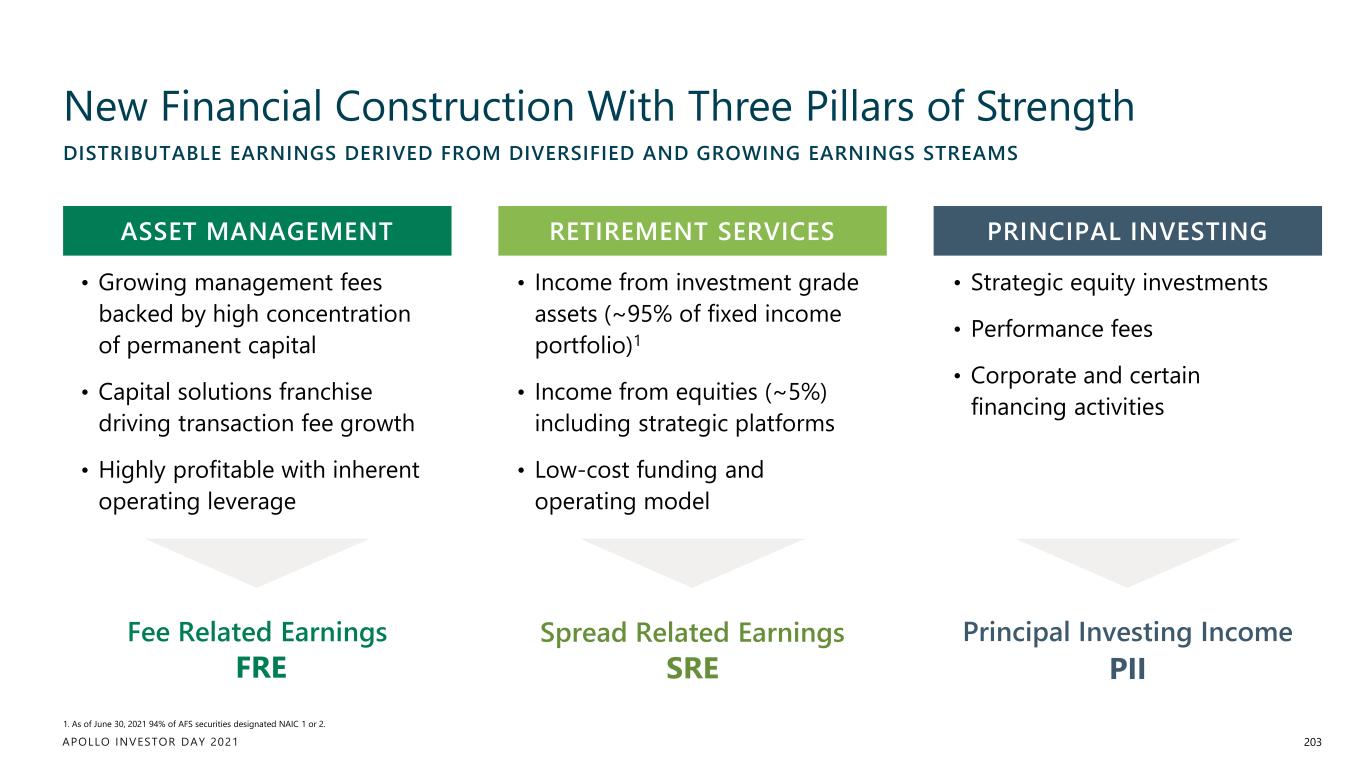

APOLLO INVESTOR DAY 2021 Retirement Services Earnings Model 57 RETAIN 100% OF UPSIDE OVER ~2.5% COST OF FUNDS ~95% OF FIXED INCOME PORTFOLIO IN INVESTMENT GRADE1 WE BELIEVE THIS EARNINGS STREAM IS UNDERVALUED SAMPLE INVESTMENTSEARNINGS MODEL Senior Corporate Debt A-Rated Bonds First Mortgages Asset-Backed Securities 1. As of June 30, 2021 94% of AFS securities designated NAIC 1 or 2.

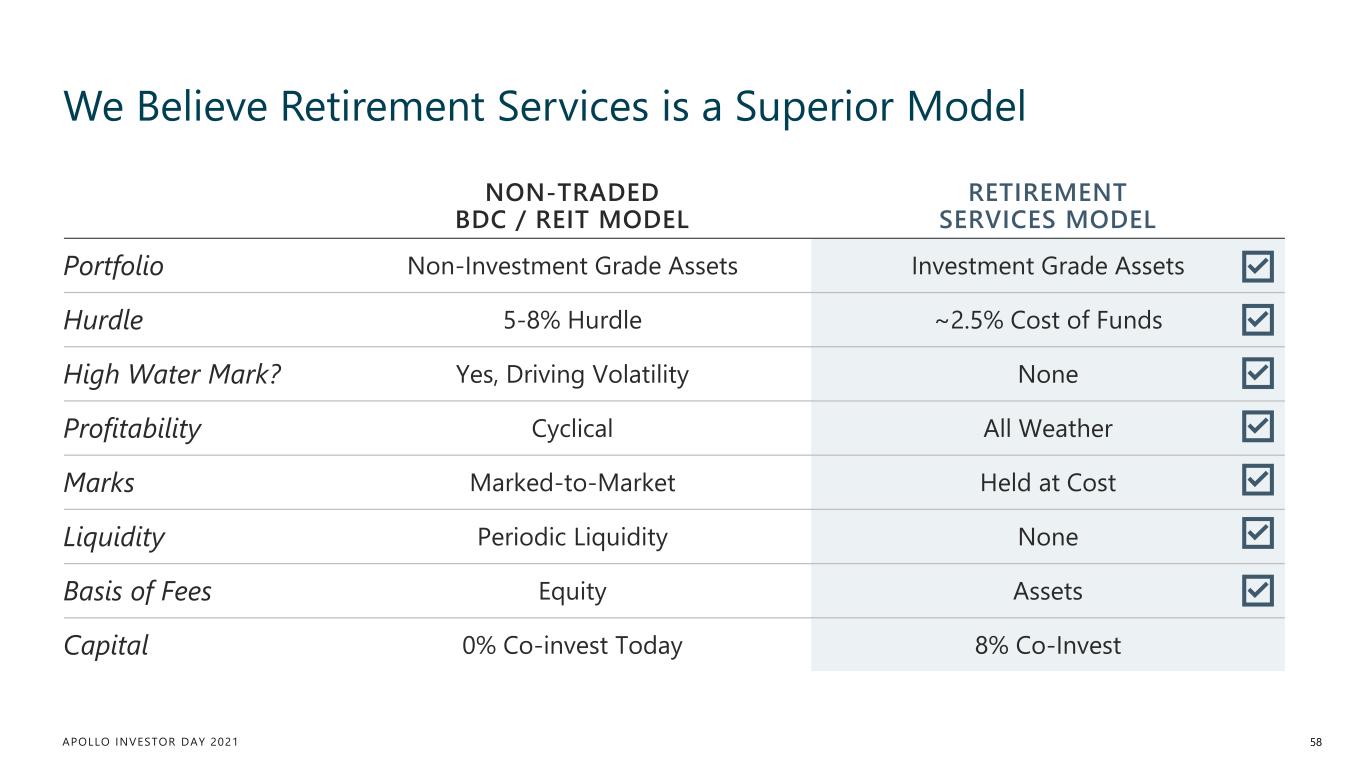

APOLLO INVESTOR DAY 2021 We Believe Retirement Services is a Superior Model 58 NON-TRADED BDC / REIT MODEL RETIREMENT SERVICES MODEL Portfolio Non-Investment Grade Assets Investment Grade Assets Hurdle 5-8% Hurdle ~2.5% Cost of Funds High Water Mark? Yes, Driving Volatility None Profitability Cyclical All Weather Marks Marked-to-Market Held at Cost Liquidity Periodic Liquidity None Basis of Fees Equity Assets Capital 0% Co-invest Today 8% Co-Invest

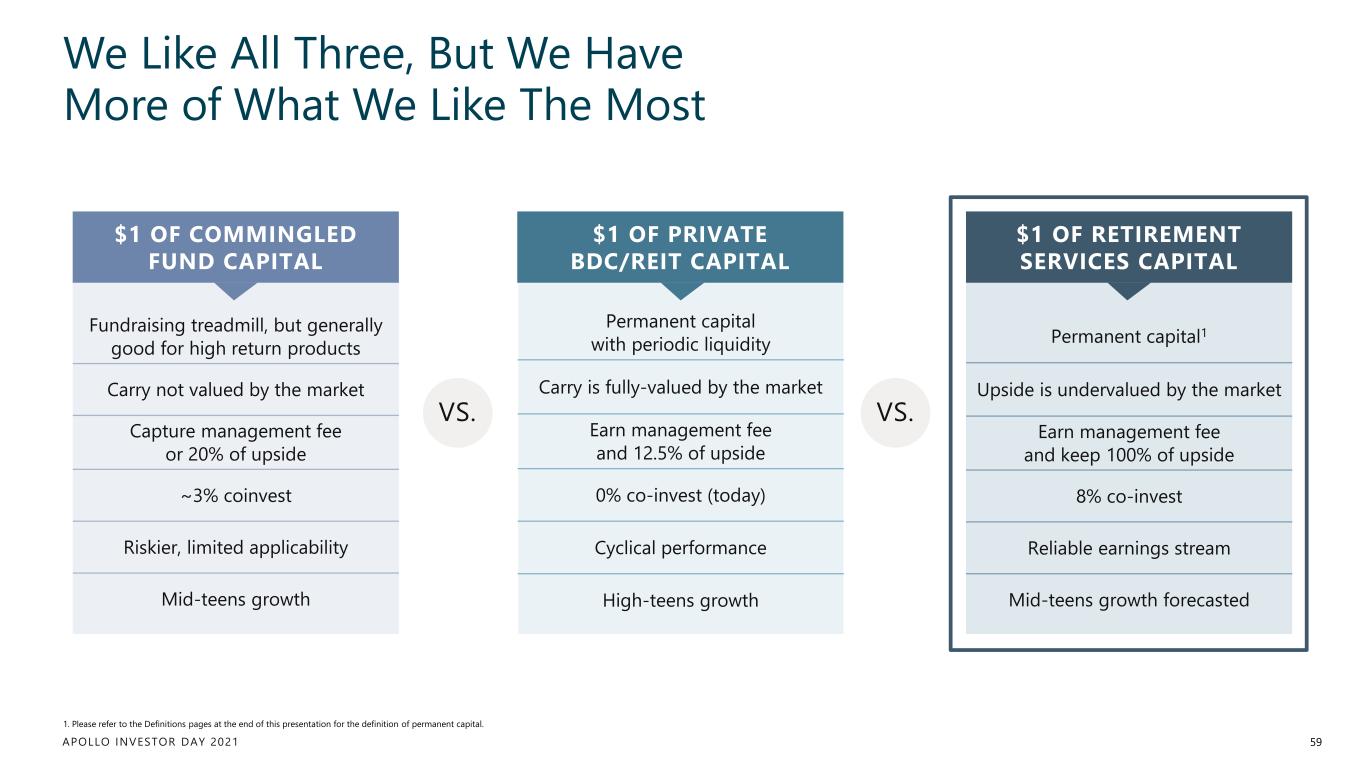

APOLLO INVESTOR DAY 2021 We Like All Three, But We Have More of What We Like The Most 59 $1 OF COMMINGLED FUND CAPITAL $1 OF RETIREMENT SERVICES CAPITAL $1 OF PRIVATE BDC/REIT CAPITAL VS. Fundraising treadmill, but generally good for high return products Carry not valued by the market Capture management fee or 20% of upside ~3% coinvest Riskier, limited applicability Mid-teens growth Permanent capital with periodic liquidity Carry is fully-valued by the market Earn management fee and 12.5% of upside 0% co-invest (today) Cyclical performance High-teens growth Permanent capital1 Upside is undervalued by the market Earn management fee and keep 100% of upside 8% co-invest Reliable earnings stream Mid-teens growth forecasted 1. Please refer to the Definitions pages at the end of this presentation for the definition of permanent capital. VS.

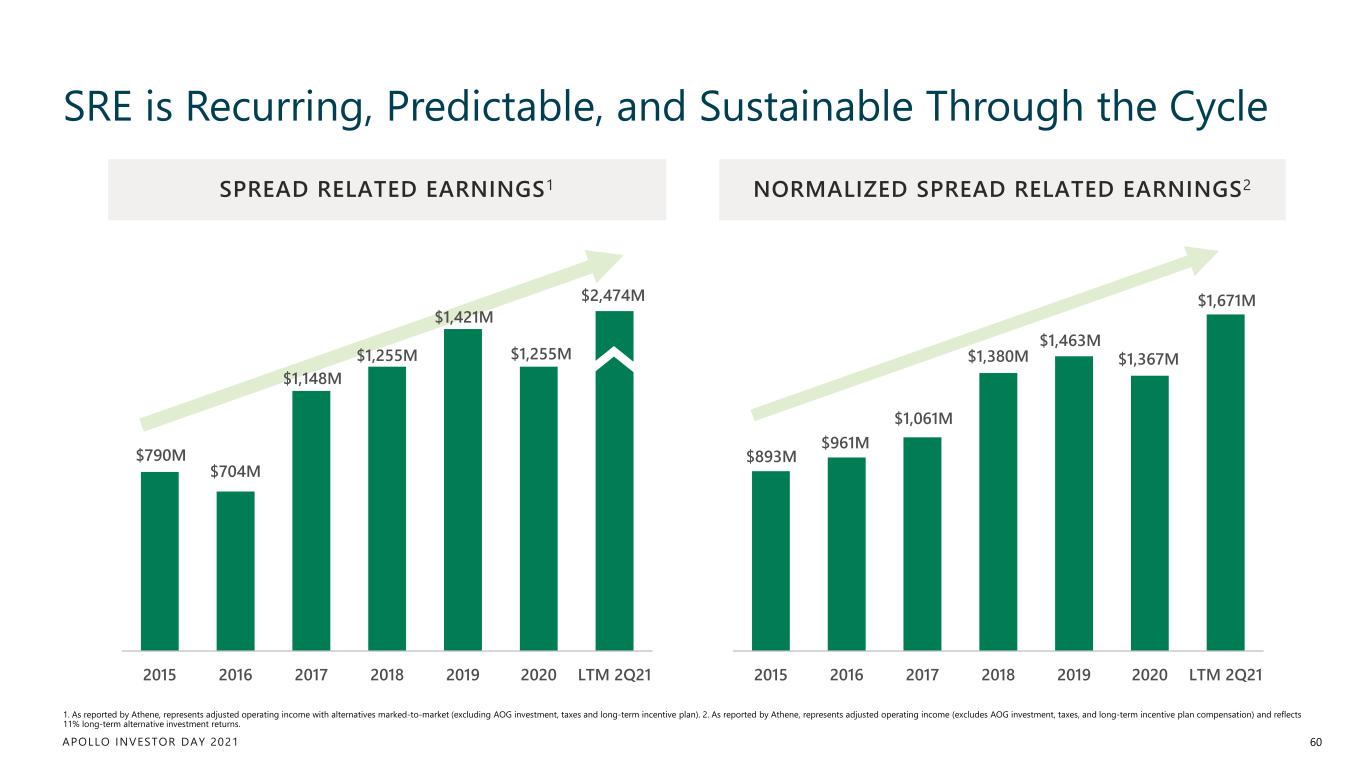

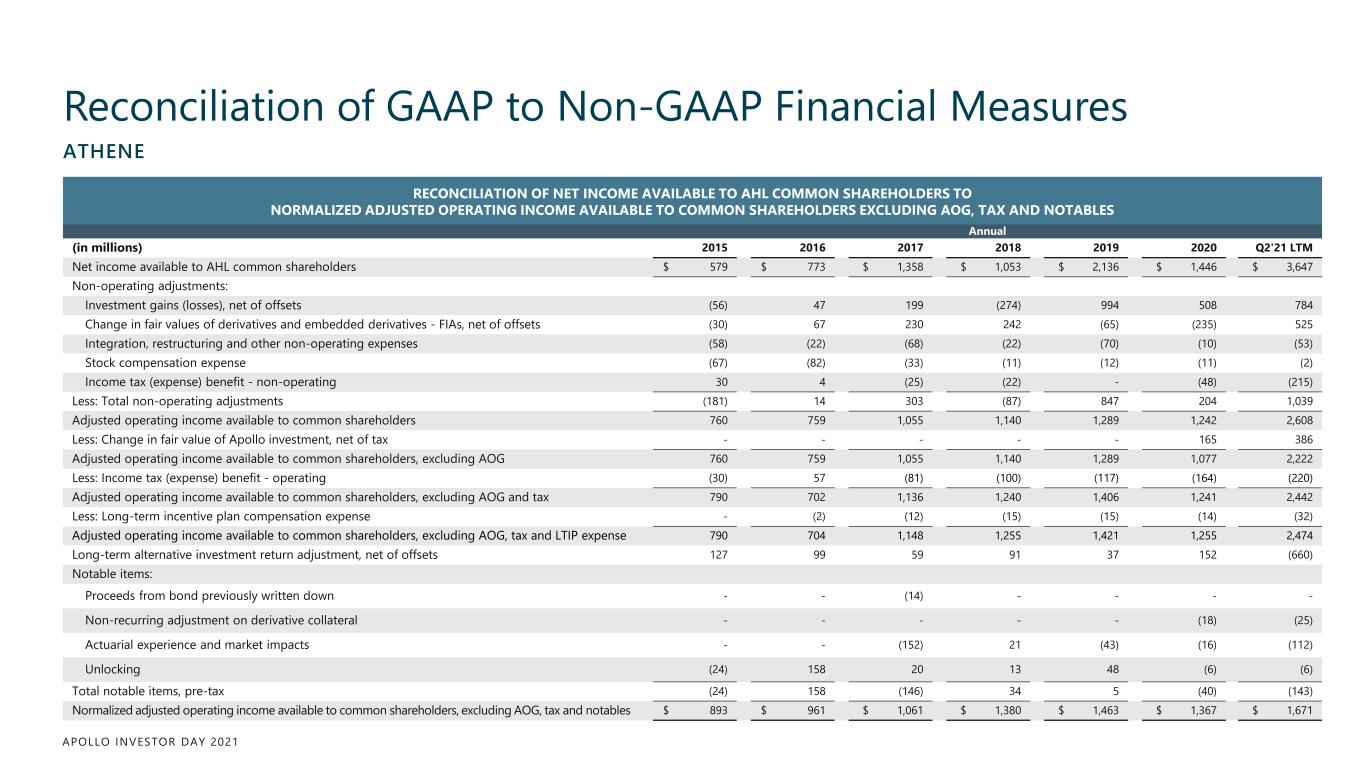

APOLLO INVESTOR DAY 2021 $893M $961M $1,061M $1,380M $1,463M $1,367M $1,671M 2015 2016 2017 2018 2019 2020 LTM 2Q21 NORMALIZED SPREAD RELATED EARNINGS2 SRE is Recurring, Predictable, and Sustainable Through the Cycle 60 1. As reported by Athene, represents adjusted operating income with alternatives marked-to-market (excluding AOG investment, taxes and long-term incentive plan). 2. As reported by Athene, represents adjusted operating income (excludes AOG investment, taxes, and long-term incentive plan compensation) and reflects 11% long-term alternative investment returns. SPREAD RELATED EARNINGS1 $790M $704M $1,148M $1,255M $1,421M $1,255M $2,474M 2015 2016 2017 2018 2019 2020 LTM 2Q21

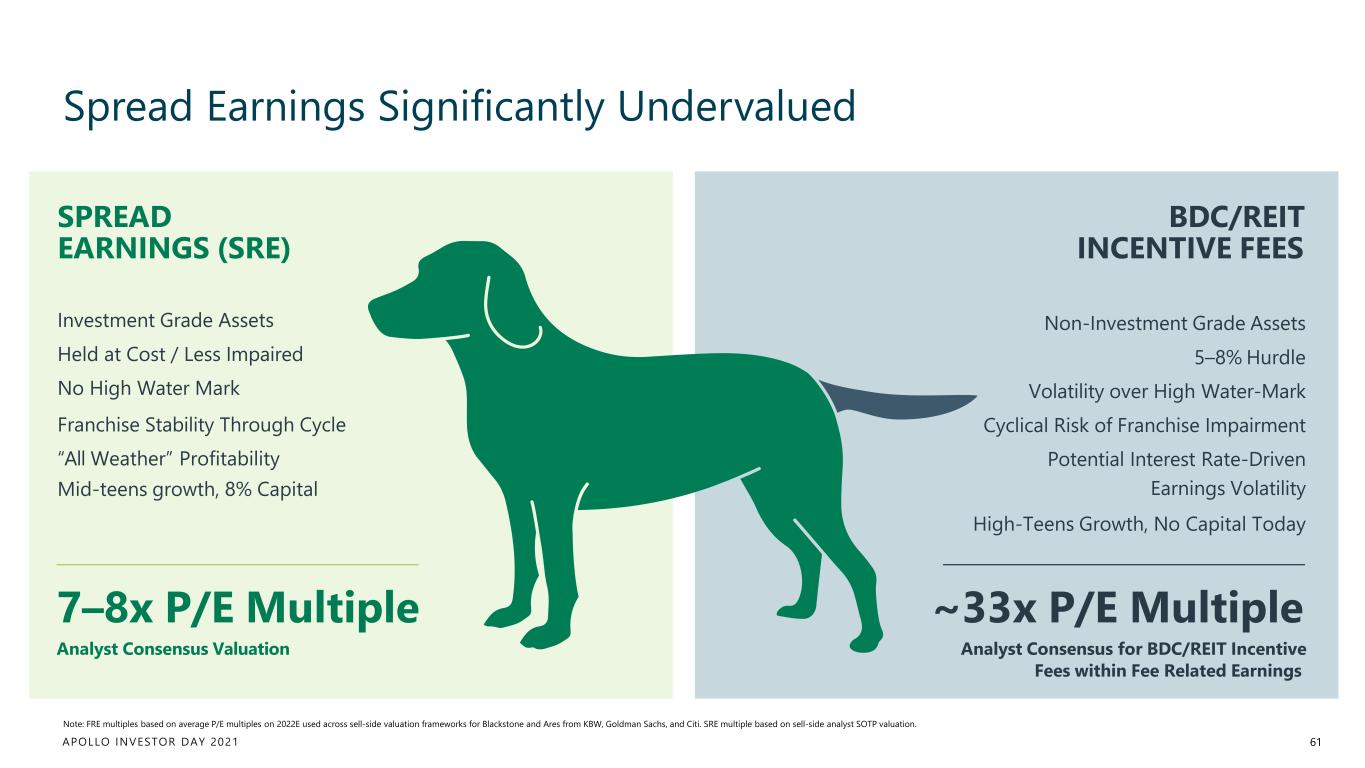

APOLLO INVESTOR DAY 2021 Spread Earnings Significantly Undervalued 61 Note: FRE multiples based on average P/E multiples on 2022E used across sell-side valuation frameworks for Blackstone and Ares from KBW, Goldman Sachs, and Citi. SRE multiple based on sell-side analyst SOTP valuation. SPREAD EARNINGS (SRE) Investment Grade Assets Held at Cost / Less Impaired No High Water Mark Franchise Stability Through Cycle “All Weather” Profitability Mid-teens growth, 8% Capital BDC/REIT INCENTIVE FEES Non-Investment Grade Assets 5–8% Hurdle Volatility over High Water-Mark Cyclical Risk of Franchise Impairment Potential Interest Rate-Driven Earnings Volatility High-Teens Growth, No Capital Today 7–8x P/E Multiple Analyst Consensus Valuation ~33x P/E Multiple Analyst Consensus for BDC/REIT Incentive Fees within Fee Related Earnings

APOLLO INVESTOR DAY 2021 62 4 Our Model Is Highly Capital Efficient

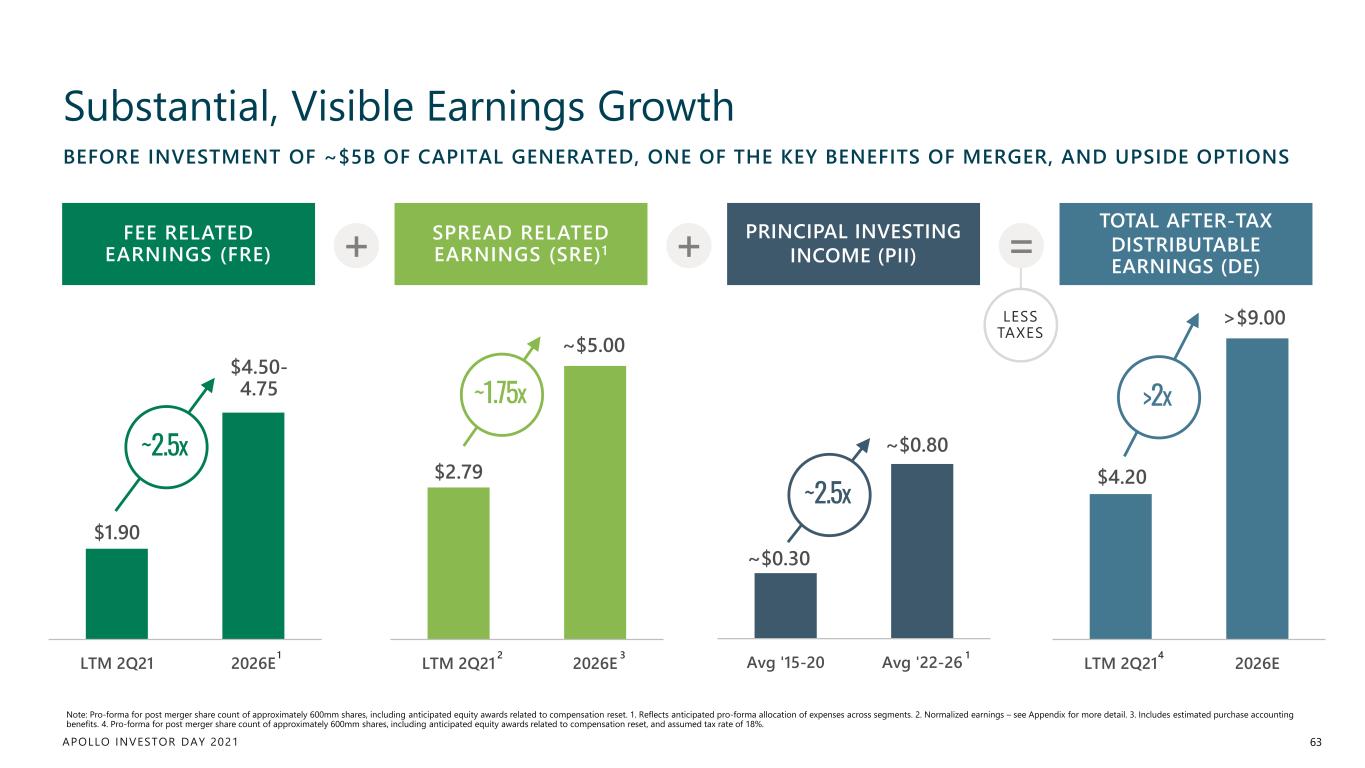

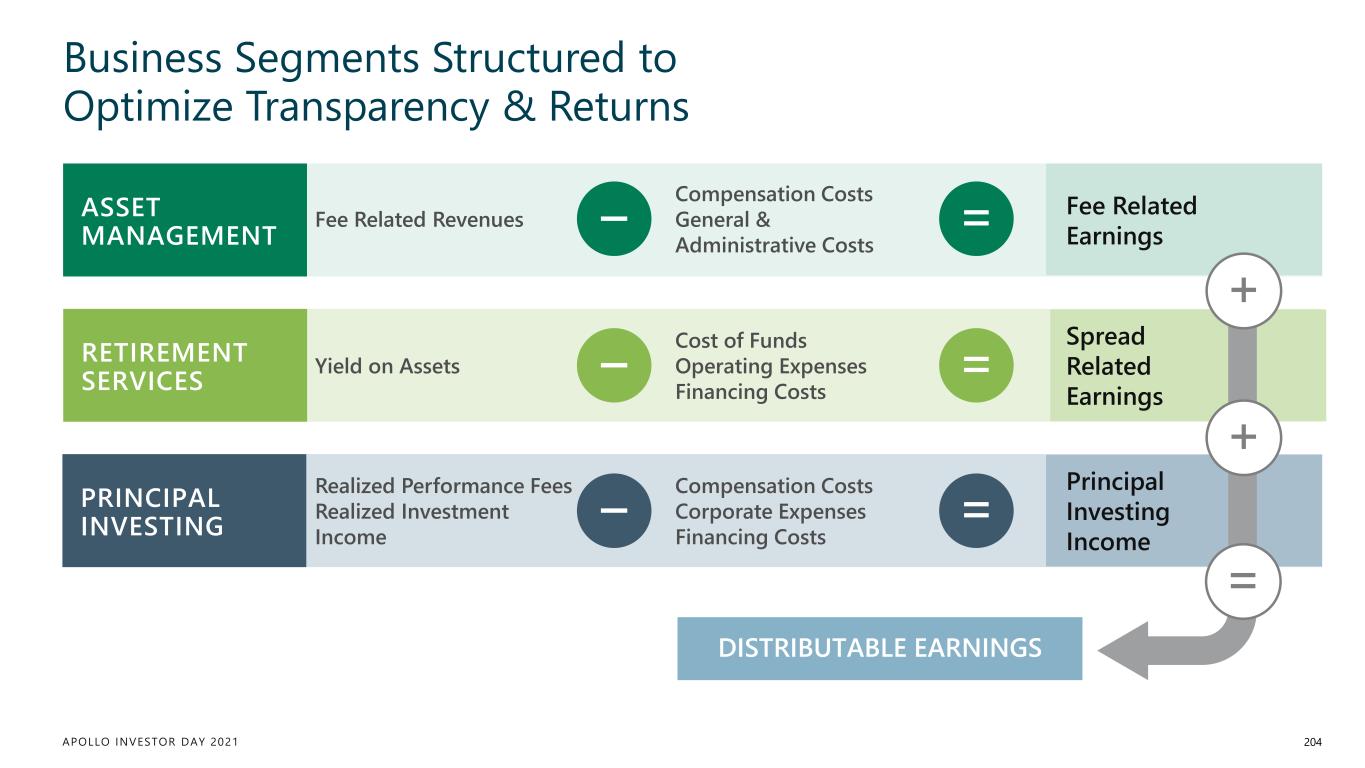

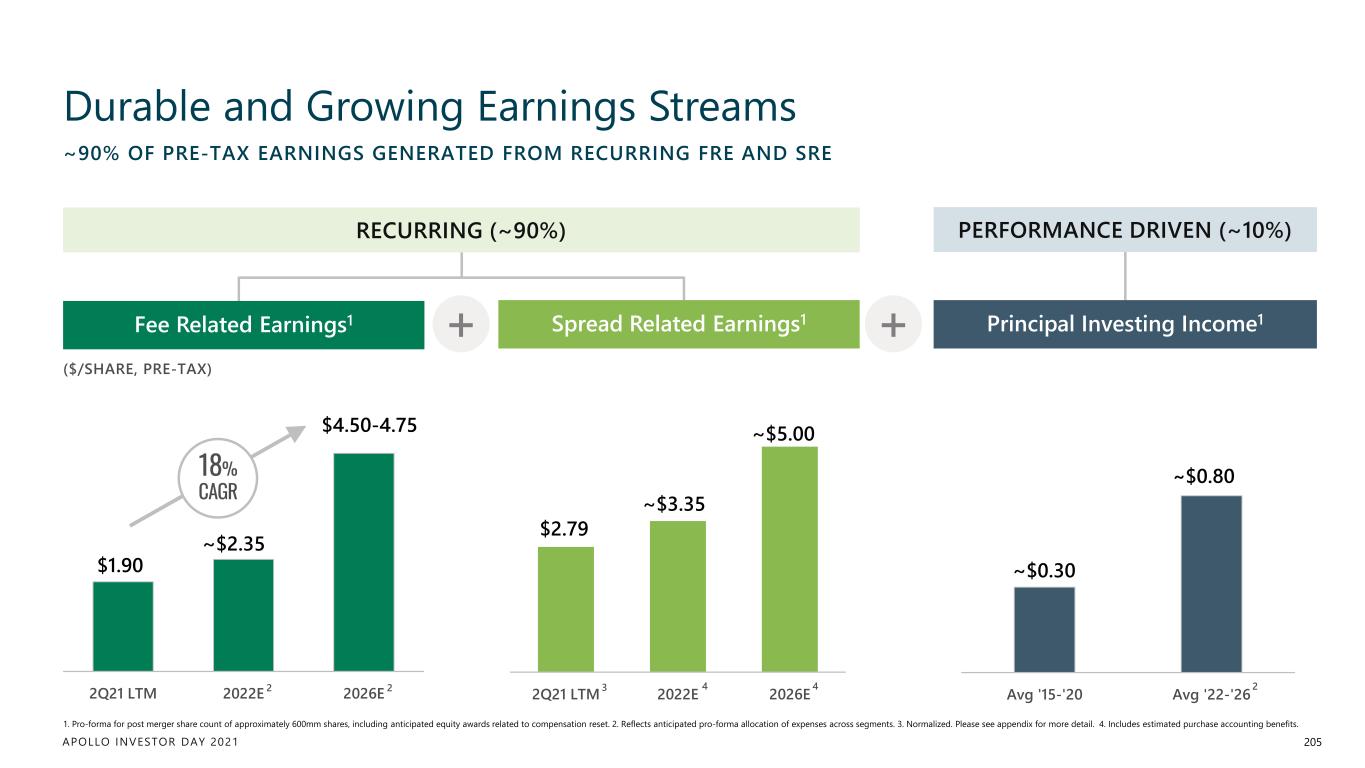

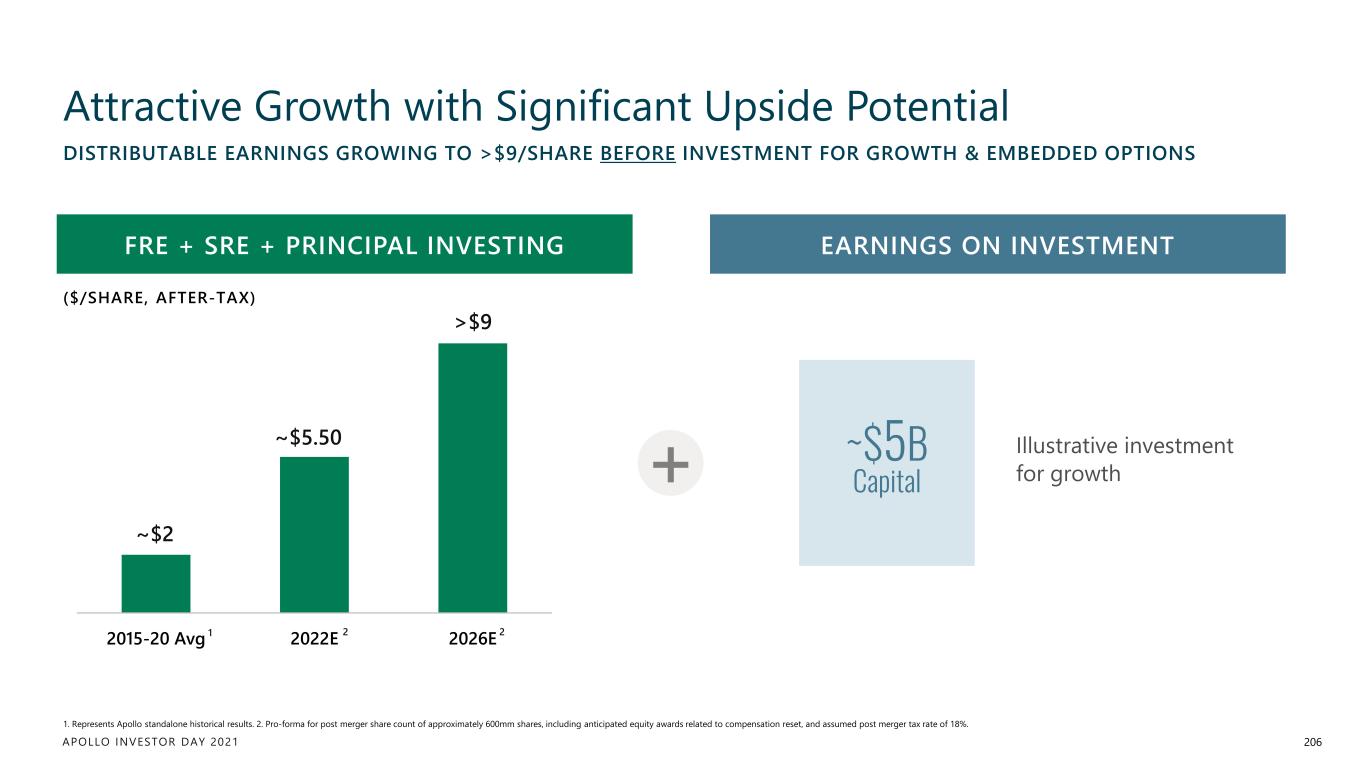

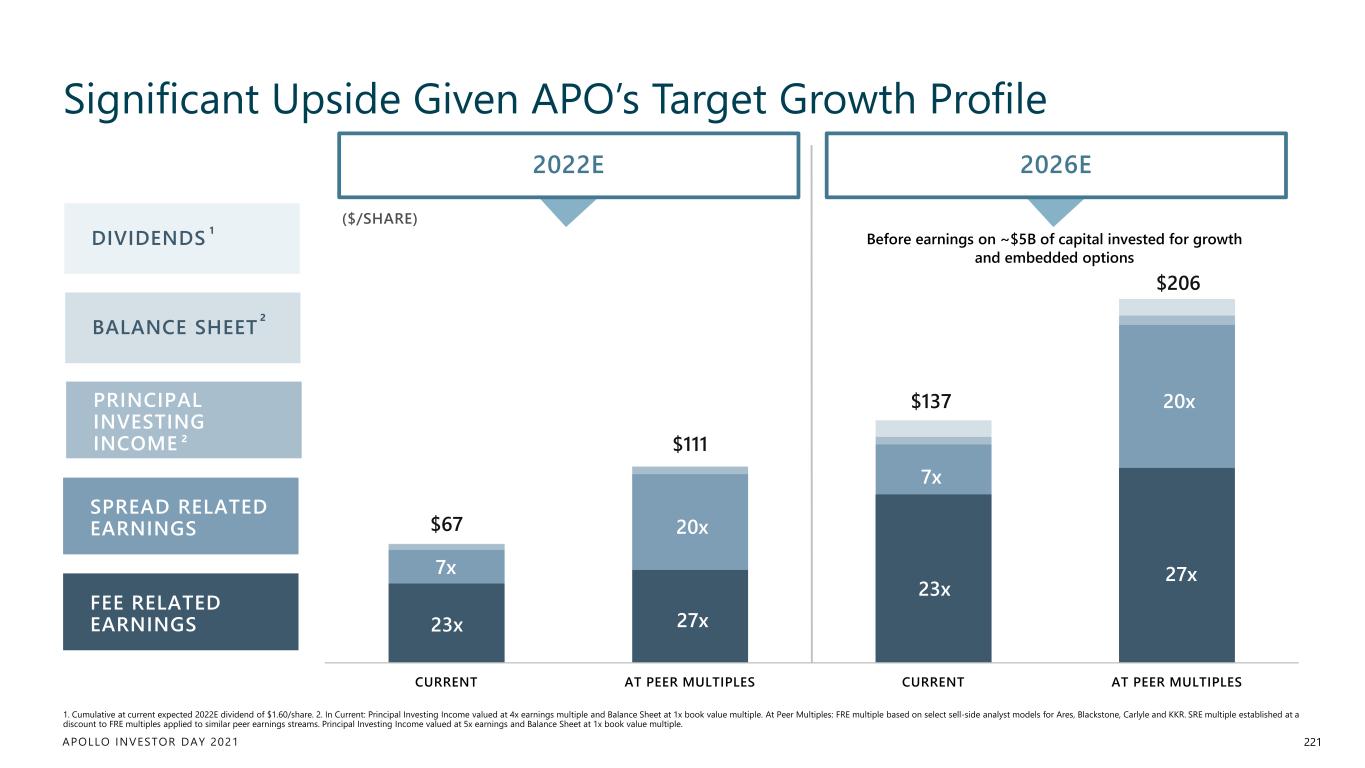

APOLLO INVESTOR DAY 2021 FEE RELATED EARNINGS (FRE) SPREAD RELATED EARNINGS (SRE)1 PRINCIPAL INVESTING INCOME (PII) TOTAL AFTER-TAX DISTRIBUTABLE EARNINGS (DE) Substantial, Visible Earnings Growth 63 Note: Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset. 1. Reflects anticipated pro-forma allocation of expenses across segments. 2. Normalized earnings – see Appendix for more detail. 3. Includes estimated purchase accounting benefits. 4. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset, and assumed tax rate of 18%. BEFORE INVESTMENT OF ~$5B OF CAPITAL GENERATED, ONE OF THE KEY BENEFITS OF MERGER, AND UPSIDE OPTIONS $1.90 LTM 2Q21 2026E ~2.5x + + $2.79 LTM 2Q21 2026E ~$0.30 Avg '15-20 Avg '22-26 $4.20 LTM 2Q21 2026E ~1.75x ~2.5x >2x $4.50- 4.75 ~$5.00 ~$0.80 >$9.00 1 12 3 4 = LESS TAXES

APOLLO INVESTOR DAY 2021 Investment of ~$5B of Capital for Growth Over Next 5 Years Base Plan of 18% Compound Annual FRE Growth and Investment of ~$5B of Capital, Before Embedded Options 64 18% Fee Related Earnings Growth (5yr CAGR) FinTech + Democratization of Finance + Asia EMBEDDED OPTIONSBASE PLAN + + $10B Capital Returned via Dividends & Buybacks

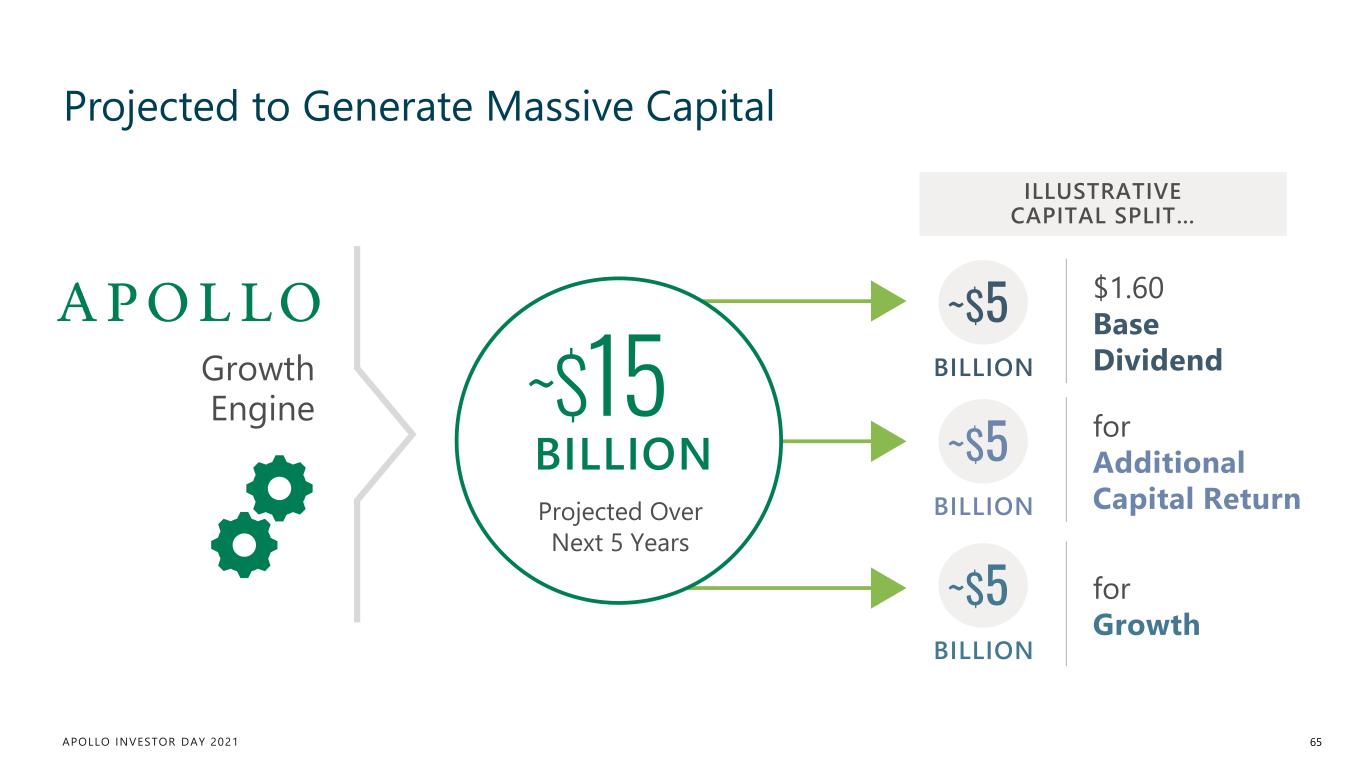

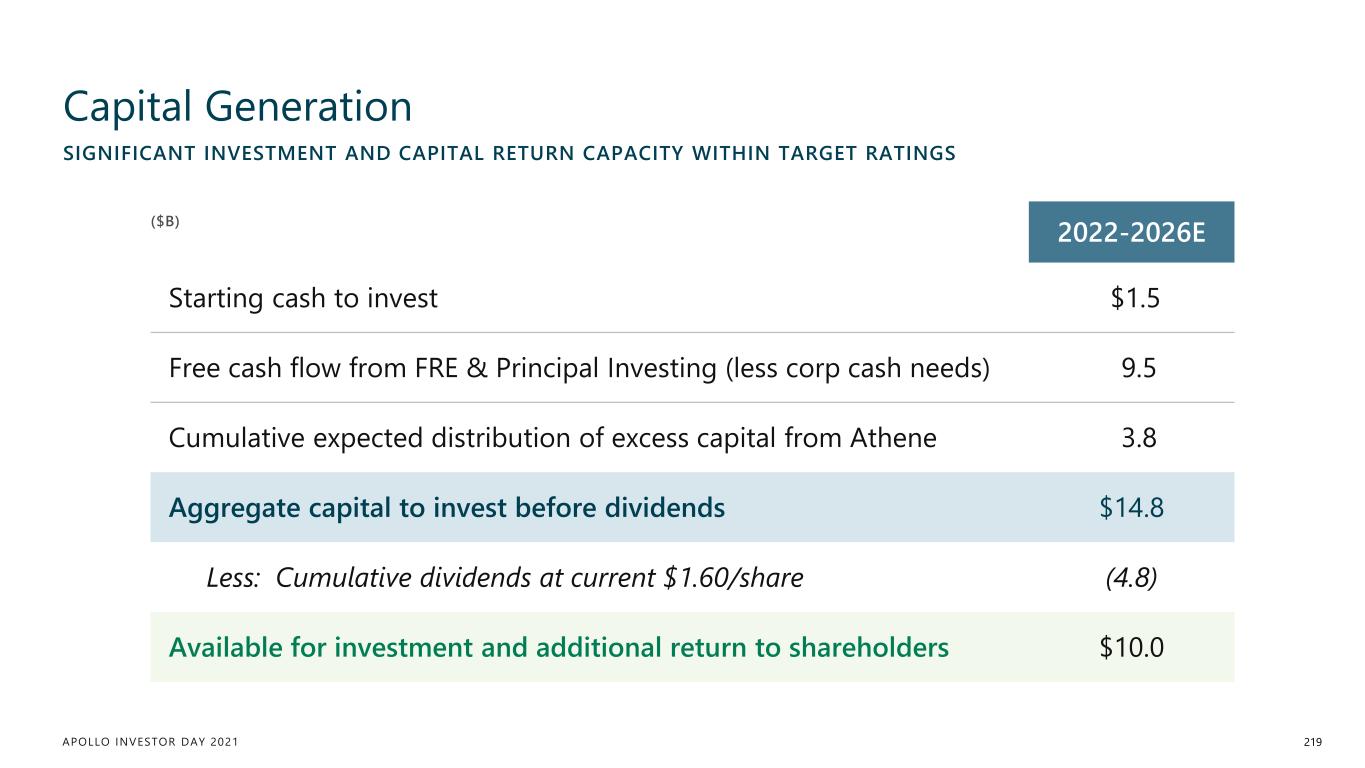

APOLLO INVESTOR DAY 2021 Projected to Generate Massive Capital 65 Growth Engine ILLUSTRATIVE CAPITAL SPLIT… $1.60 Base Dividend ~$5 BILLION for Additional Capital Return ~$5 BILLION for Growth ~$5 BILLION Projected Over Next 5 Years ~$15 BILLION

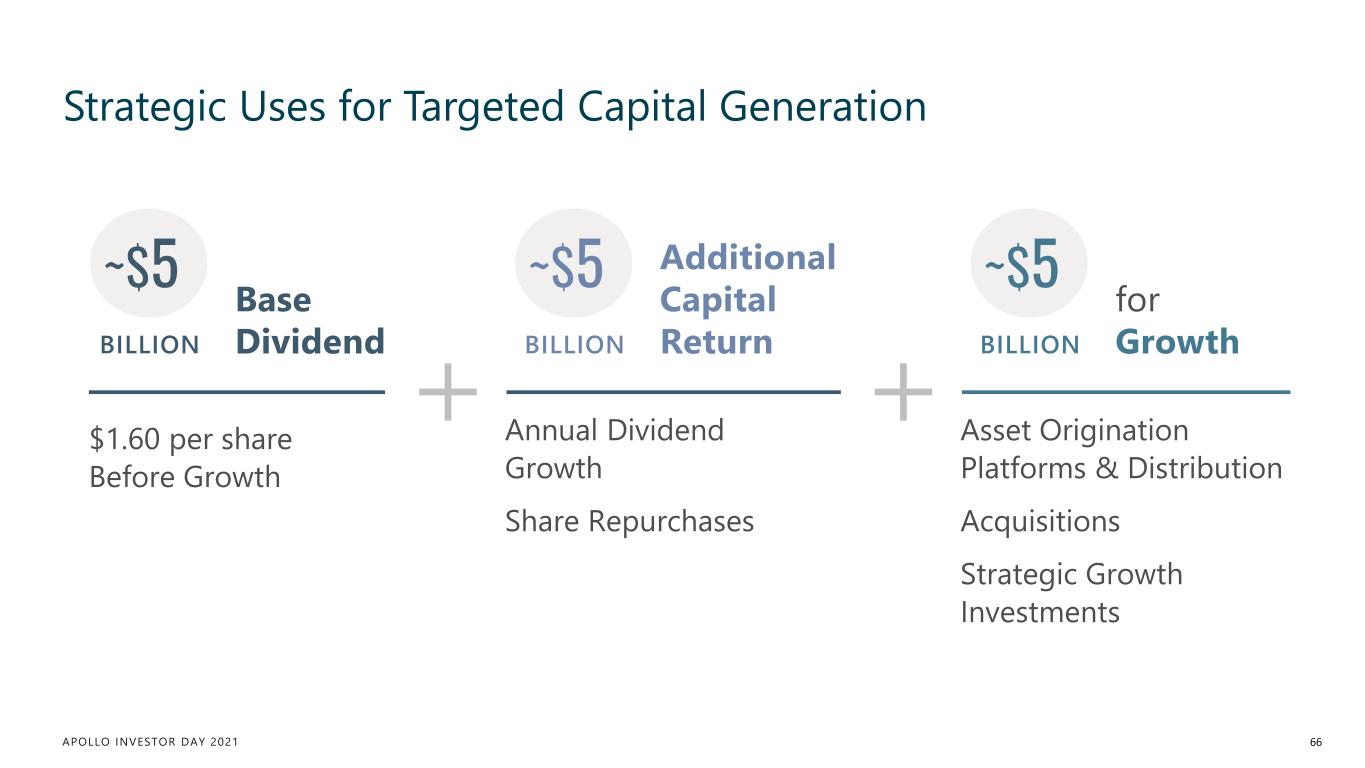

APOLLO INVESTOR DAY 2021 Strategic Uses for Targeted Capital Generation 66 $1.60 per share Before Growth Base Dividend ~$5 BILLION Annual Dividend Growth Share Repurchases Additional Capital Return ~$5 BILLION Asset Origination Platforms & Distribution Acquisitions Strategic Growth Investments for Growth ~$5 BILLION

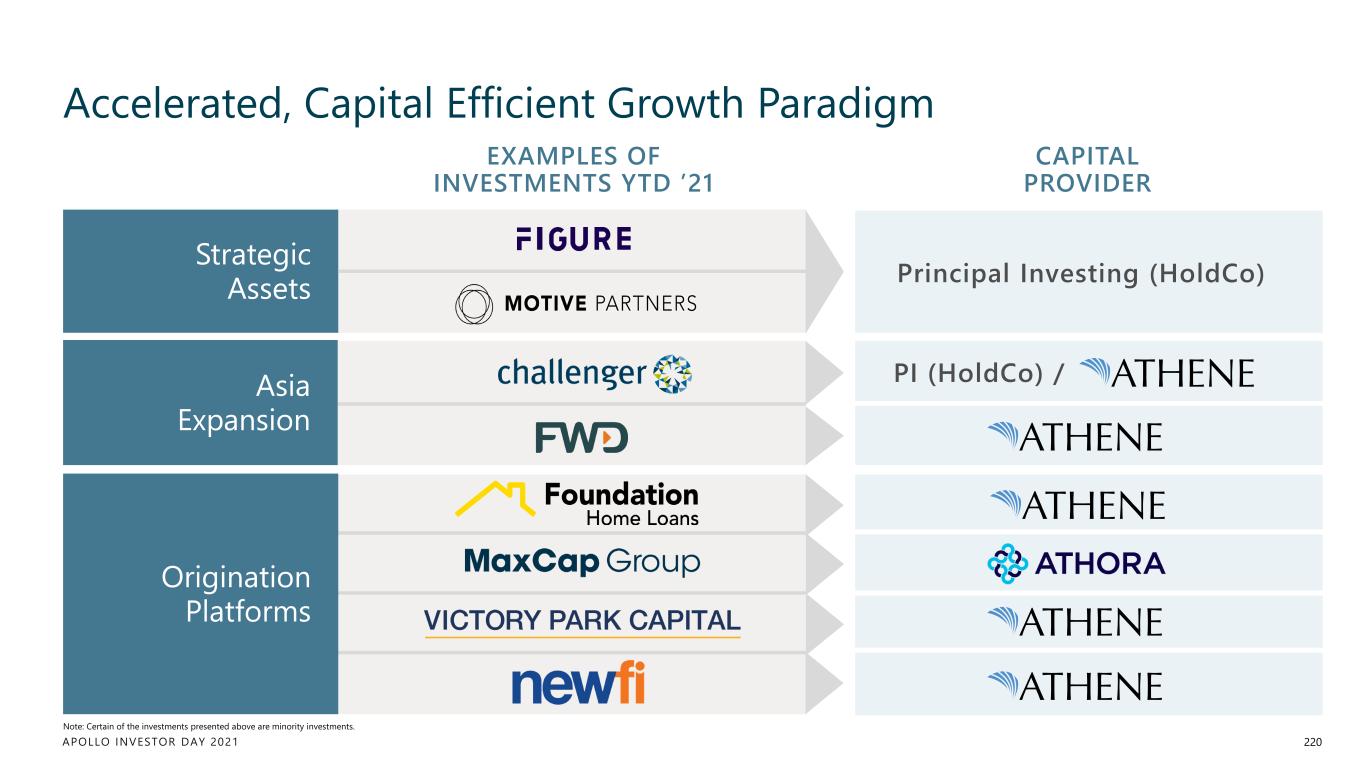

APOLLO INVESTOR DAY 2021 Three Components to Our Firepower 67 ~$100B of Embedded Growth Potential + ~$15B of Expected Aggregate Capital Available 1 ~$100B Potential embedded growth from existing Athene capital 2 Available strategic growth capital within Athene alternative portfolio $10B ~$20B 3 ~$5B Estimated capital earmarked for strategic growth over next 5 years

APOLLO INVESTOR DAY 2021 68 5 Strong Momentum Behind Aligned Team

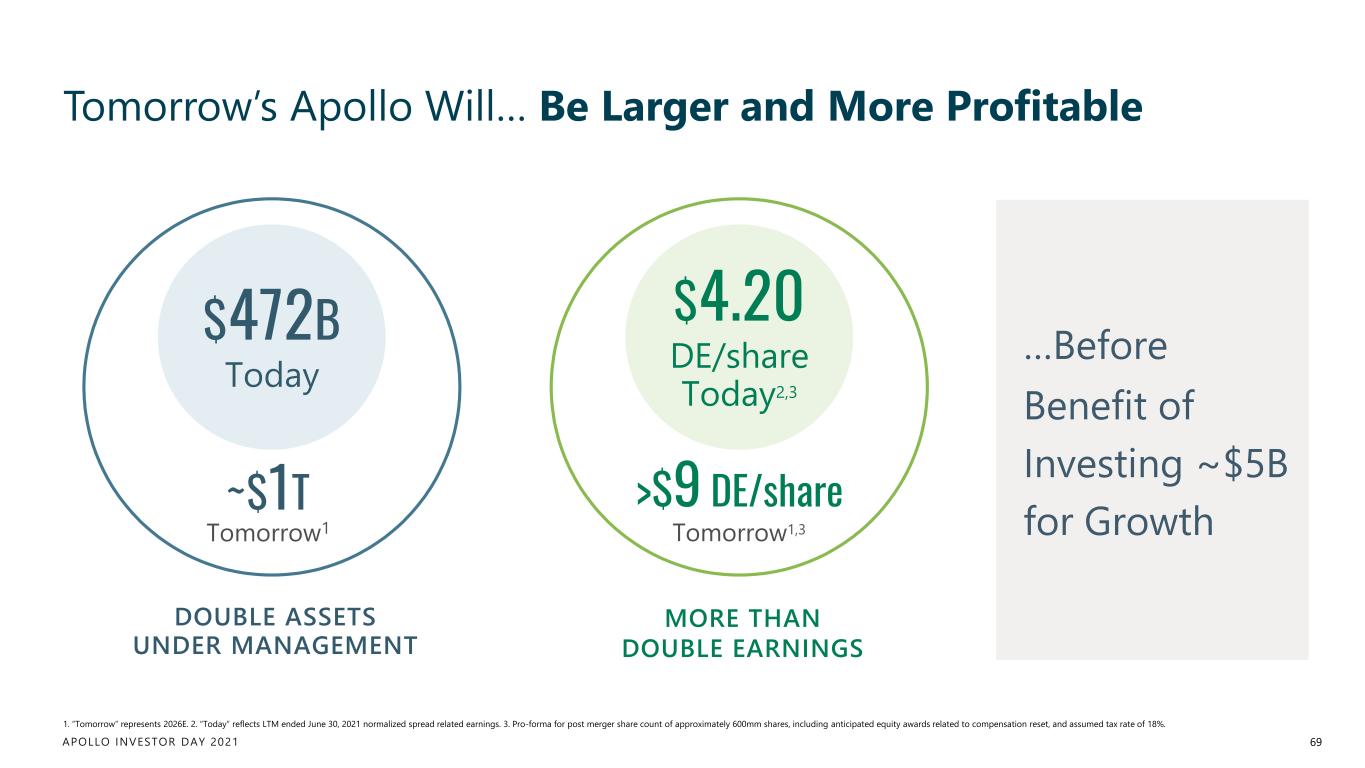

APOLLO INVESTOR DAY 2021 Tomorrow’s Apollo Will… Be Larger and More Profitable 69 1. “Tomorrow” represents 2026E. 2. “Today” reflects LTM ended June 30, 2021 normalized spread related earnings. 3. Pro-forma for post merger share count of approximately 600mm shares, including anticipated equity awards related to compensation reset, and assumed tax rate of 18%. …Before Benefit of Investing ~$5B for Growth DOUBLE ASSETS UNDER MANAGEMENT $472B Today ~$1T Tomorrow1 MORE THAN DOUBLE EARNINGS $4.20 DE/share Today2,3 >$9 DE/share Tomorrow1,3

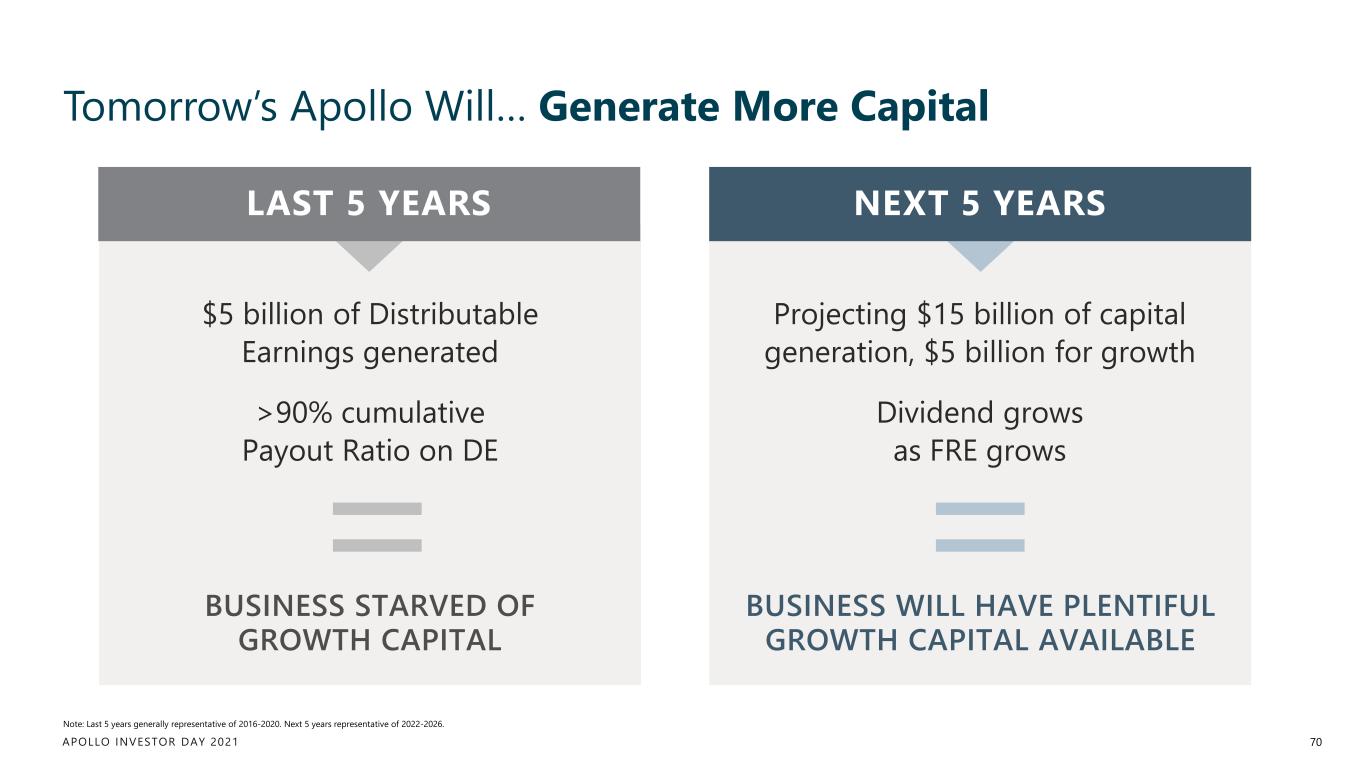

APOLLO INVESTOR DAY 2021 Tomorrow’s Apollo Will… Generate More Capital 70 Note: Last 5 years generally representative of 2016-2020. Next 5 years representative of 2022-2026. LAST 5 YEARS BUSINESS STARVED OF GROWTH CAPITAL $5 billion of Distributable Earnings generated >90% cumulative Payout Ratio on DE NEXT 5 YEARS BUSINESS WILL HAVE PLENTIFUL GROWTH CAPITAL AVAILABLE Projecting $15 billion of capital generation, $5 billion for growth Dividend grows as FRE grows

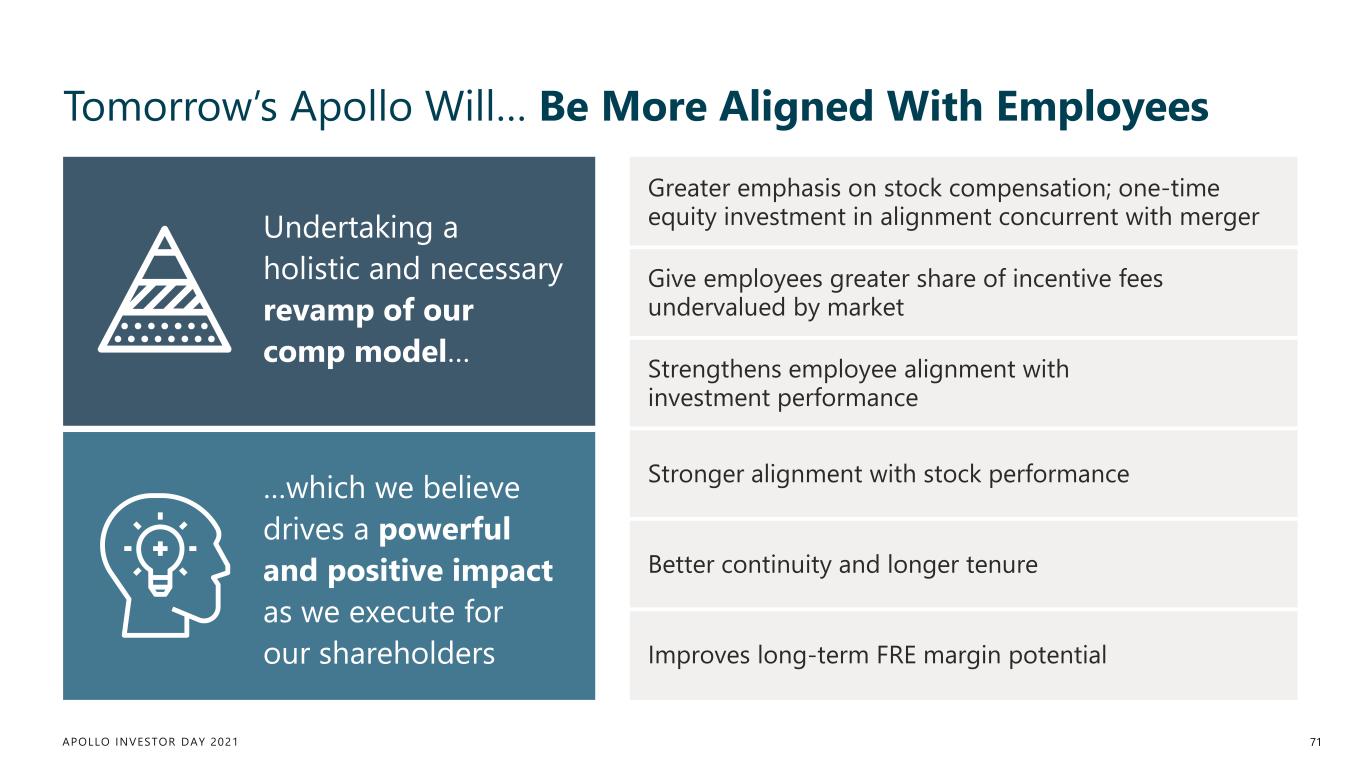

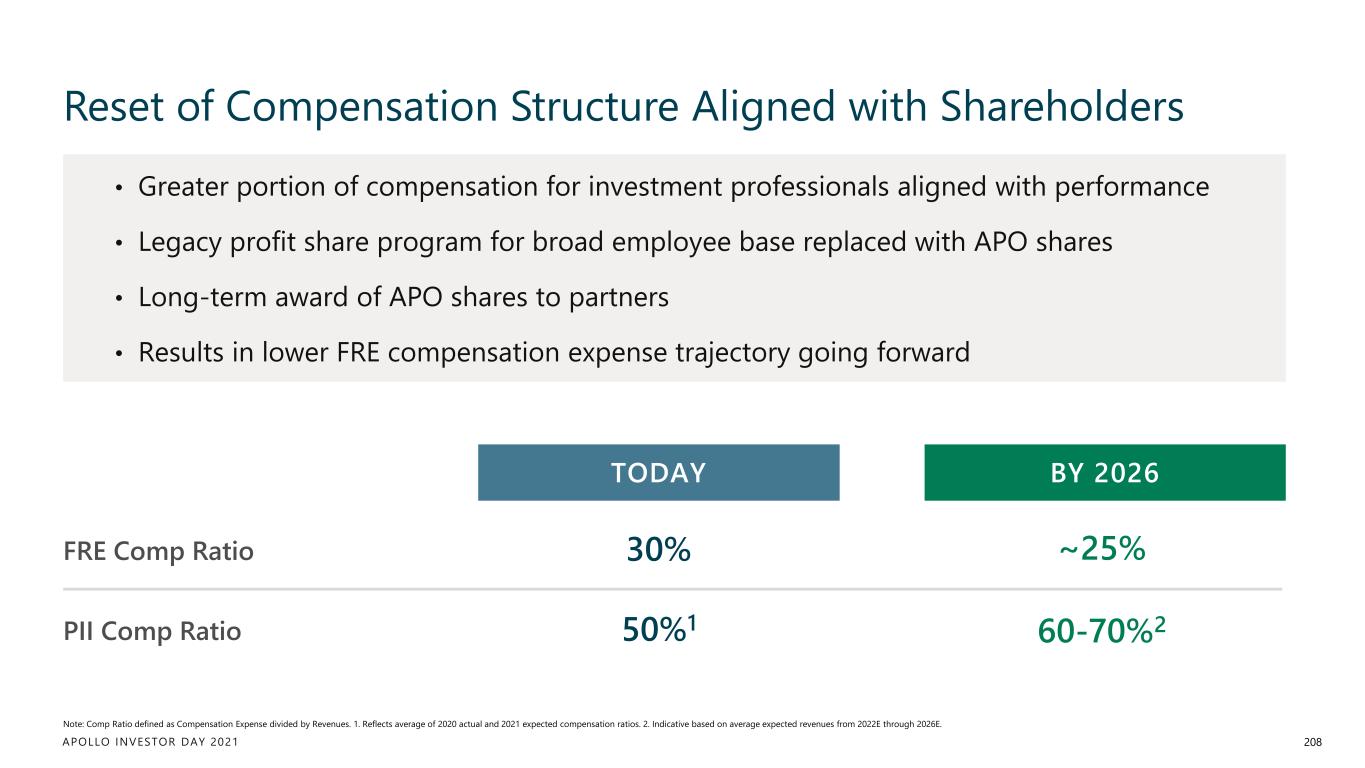

APOLLO INVESTOR DAY 2021 Tomorrow’s Apollo Will… Be More Aligned With Employees 71 Undertaking a holistic and necessary revamp of our comp model… …which we believe drives a powerful and positive impact as we execute for our shareholders Greater emphasis on stock compensation; one-time equity investment in alignment concurrent with merger Give employees greater share of incentive fees undervalued by market Strengthens employee alignment with investment performance Stronger alignment with stock performance Better continuity and longer tenure Improves long-term FRE margin potential

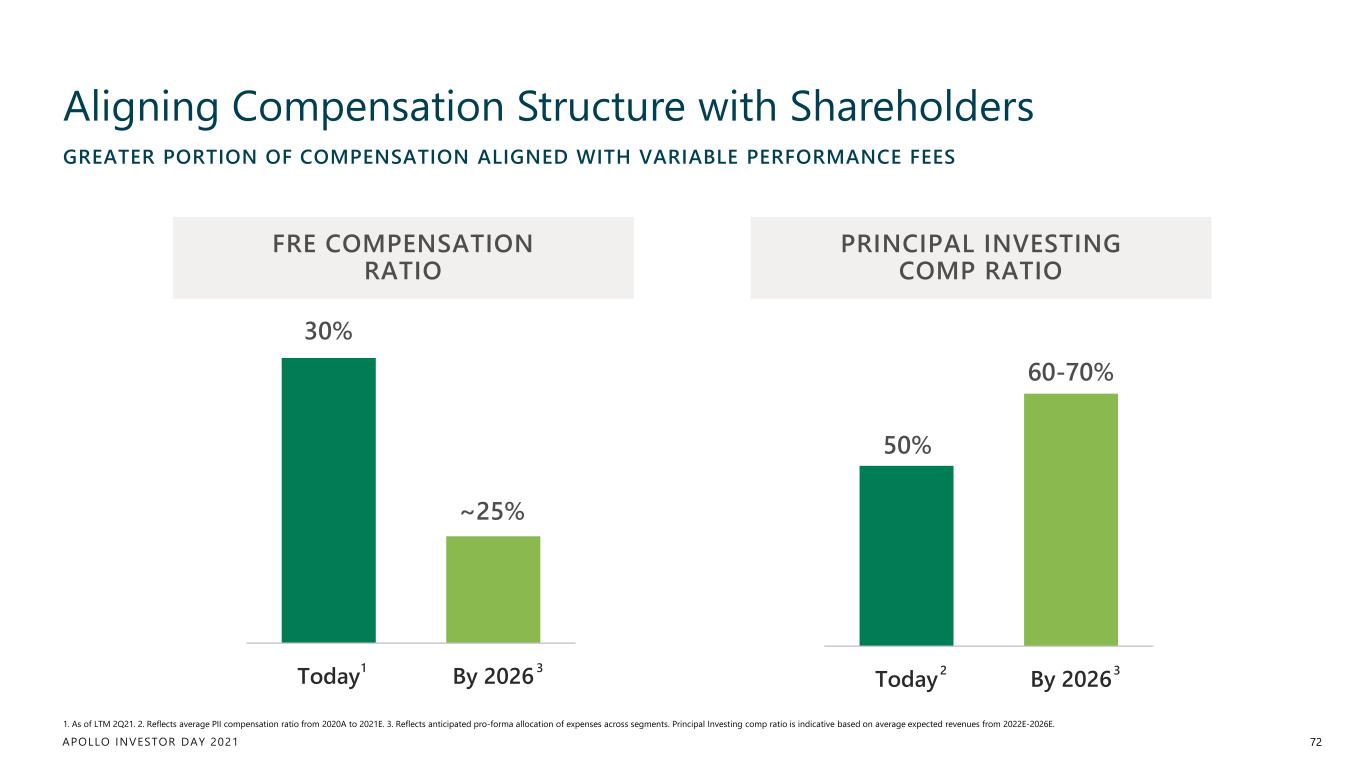

APOLLO INVESTOR DAY 2021 GREATER PORTION OF COMPENSATION ALIGNED WITH VARIABLE PERFORMANCE FEES Aligning Compensation Structure with Shareholders 72 1. As of LTM 2Q21. 2. Reflects average PII compensation ratio from 2020A to 2021E. 3. Reflects anticipated pro-forma allocation of expenses across segments. Principal Investing comp ratio is indicative based on average expected revenues from 2022E-2026E. FRE COMPENSATION RATIO PRINCIPAL INVESTING COMP RATIO 50% 60-70% Today By 20262 3 30% ~25% Today By 20261 3

APOLLO INVESTOR DAY 2021 BRINGING WORLD CLASS SENIOR TALENT TO APOLLO It’s All About Talent 73 Ian Bell Partner, Head of Asia Sales Jason Ourman Partner, Apollo Global Real Estate Gemma Gucci MD, Global Head of Talent Acquisition Bill Lewis Senior Partner, Private Equity David Krone Senior Partner, Global Head of Public Policy Jeff Sayers Senior Partner, Head of Insurance Solutions Group International Susan Kendall MD, Global Head of Strategic Finance Earl Hunt Partner, CEO of Apollo Debt Solutions & Co-Head of Credit LP Secondaries Jason D’Silva MD, Investment Technology and Innovation Howard Nifoussi MD, Head of U.S. Wealth Management Olga Kosters MD, Credit Secondaries Ria Nova Partner, Client & Partner Solutions David Lang MD, Chief Operating Officer, Enterprise Solutions Noah Gunn MD, Global Head of Investor Relations David Stangis Senior Partner, Chief Sustainability Officer Courtney Garcia MD, Head of Market Risk Renee Anderson MD, Chief Operating Officer, Technology Vikram Mahidhar Operating Partner, Data, Advanced Analytics & Digital Transformation Yael Levy Chief Compliance Officer Roger W. Ferguson Jr. Vice Chairman Craig Farr Senior Partner, Capital Solutions

APOLLO INVESTOR DAY 2021 Tomorrow’s Apollo Will… Be More Investable 74 1. To take effect following closing of previously announced merger with Athene. One Share, One Vote Structure with Full C-Corp Conversion1 Enhanced Corporate Governance with Majority Independent Board Larger Market Capitalization with Greater Liquidity and Broader Shareholder Base Additional Index Eligibility, including S&P 500

APOLLO INVESTOR DAY 2021 Tomorrow’s Apollo Will… Do More Good 75 Dedication to Promoting ESG & Sustainability Expanding Opportunity Apollo Veterans Initiative Apollo Women Empower WORKPLACE Apollo Pride MOSAIC COMMUNITY MARKETPLACE Apollo Family NetworkFocus on Responsible Due Diligence Engagement Throughout Ownership Data Availability, Transparency and Expanding Across the Platform

APOLLO INVESTOR DAY 2021 Culture at Apollo VIDEO MODULE

APOLLO INVESTOR DAY 2021 Yield Overview JIM ZELTER Co-President

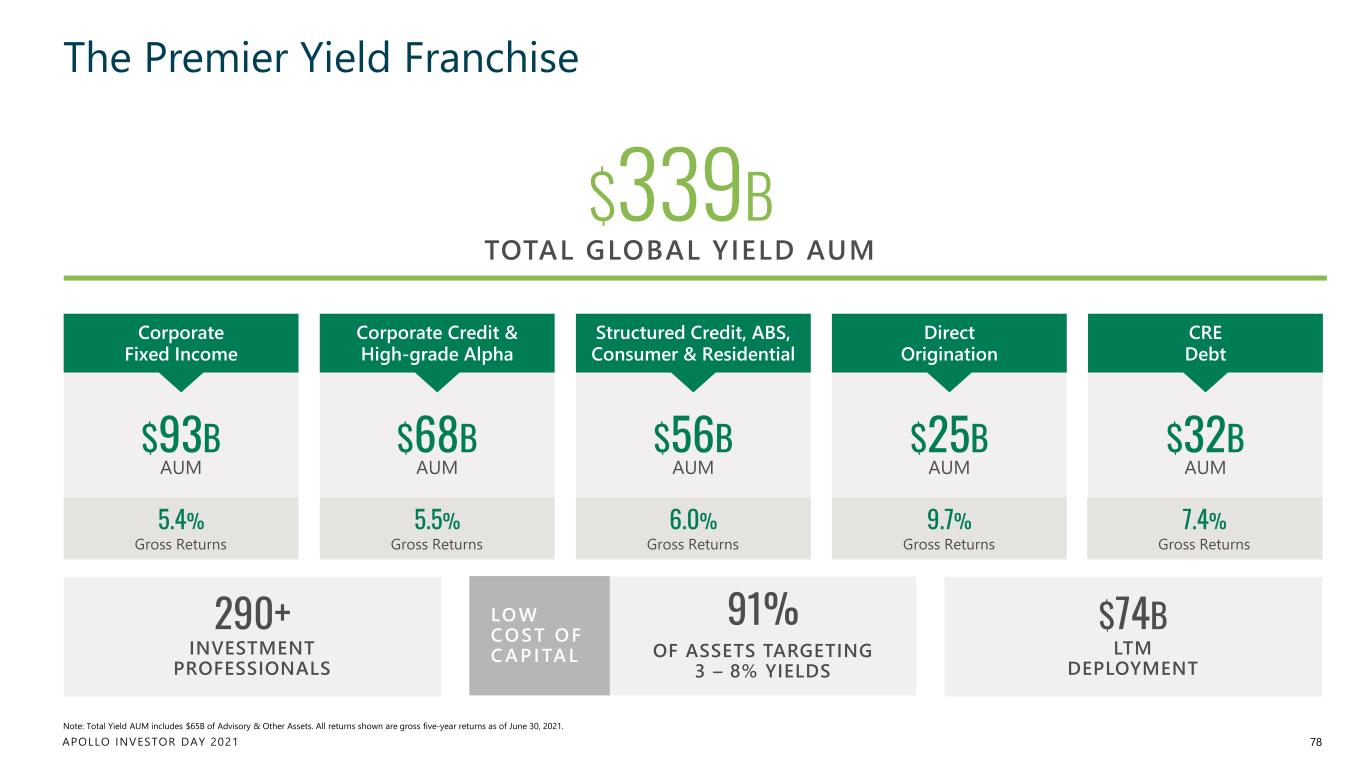

APOLLO INVESTOR DAY 2021 The Premier Yield Franchise 78 Note: Total Yield AUM includes $65B of Advisory & Other Assets. All returns shown are gross five-year returns as of June 30, 2021. $339B TOTAL GLOBAL YIELD AUM 290+ INVESTMENT PROFESSIONALS 91% OF ASSETS TARGETING 3 – 8% YIELDS LOW COST OF C AP ITAL $74B LTM DEPLOYMENT $93B AUM Corporate Fixed Income $68B AUM Corporate Credit & High-grade Alpha $56B AUM Structured Credit, ABS, Consumer & Residential $25B AUM Direct Origination $32B AUM CRE Debt 5.4% Gross Returns 5.5% Gross Returns 6.0% Gross Returns 9.7% Gross Returns 7.4% Gross Returns

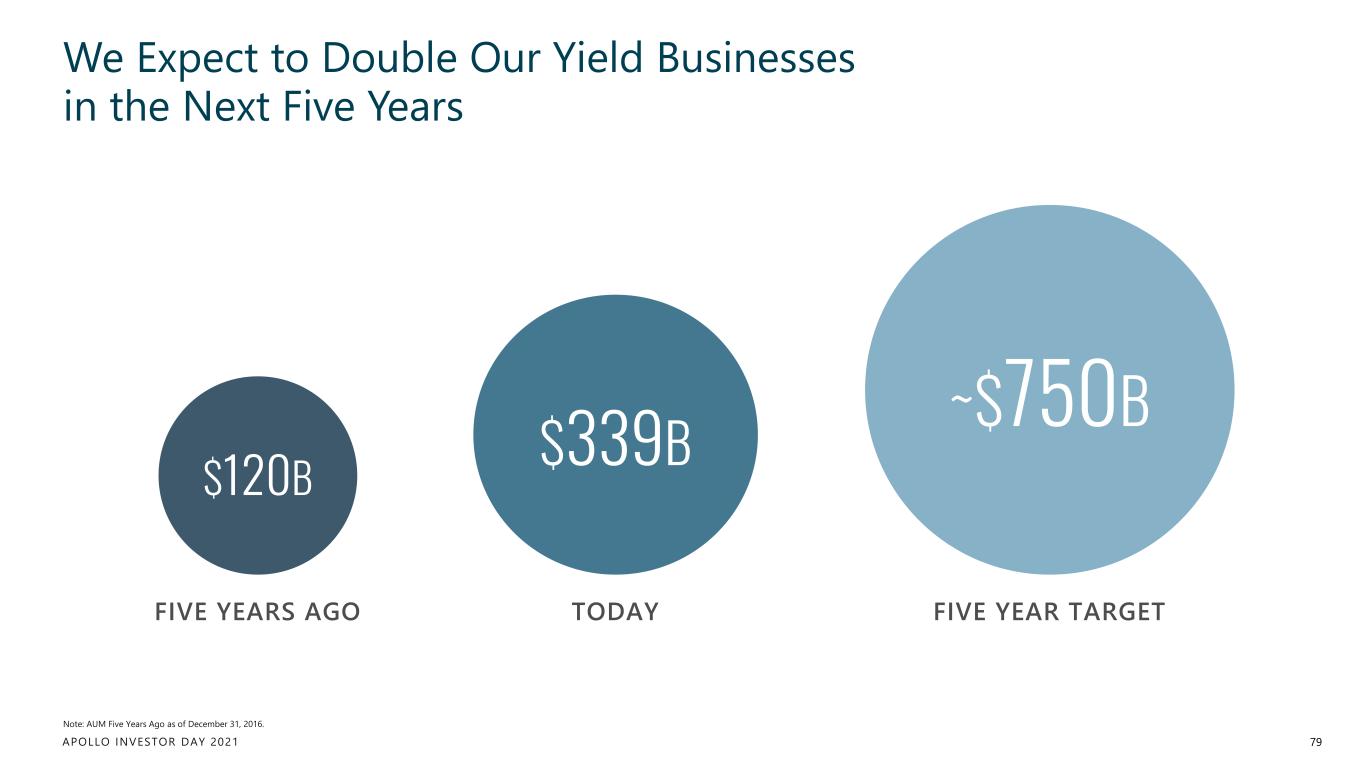

APOLLO INVESTOR DAY 2021 We Expect to Double Our Yield Businesses in the Next Five Years 79 FIVE YEARS AGO $120B TODAY $339B FIVE YEAR TARGET ~$750B Note: AUM Five Years Ago as of December 31, 2016.

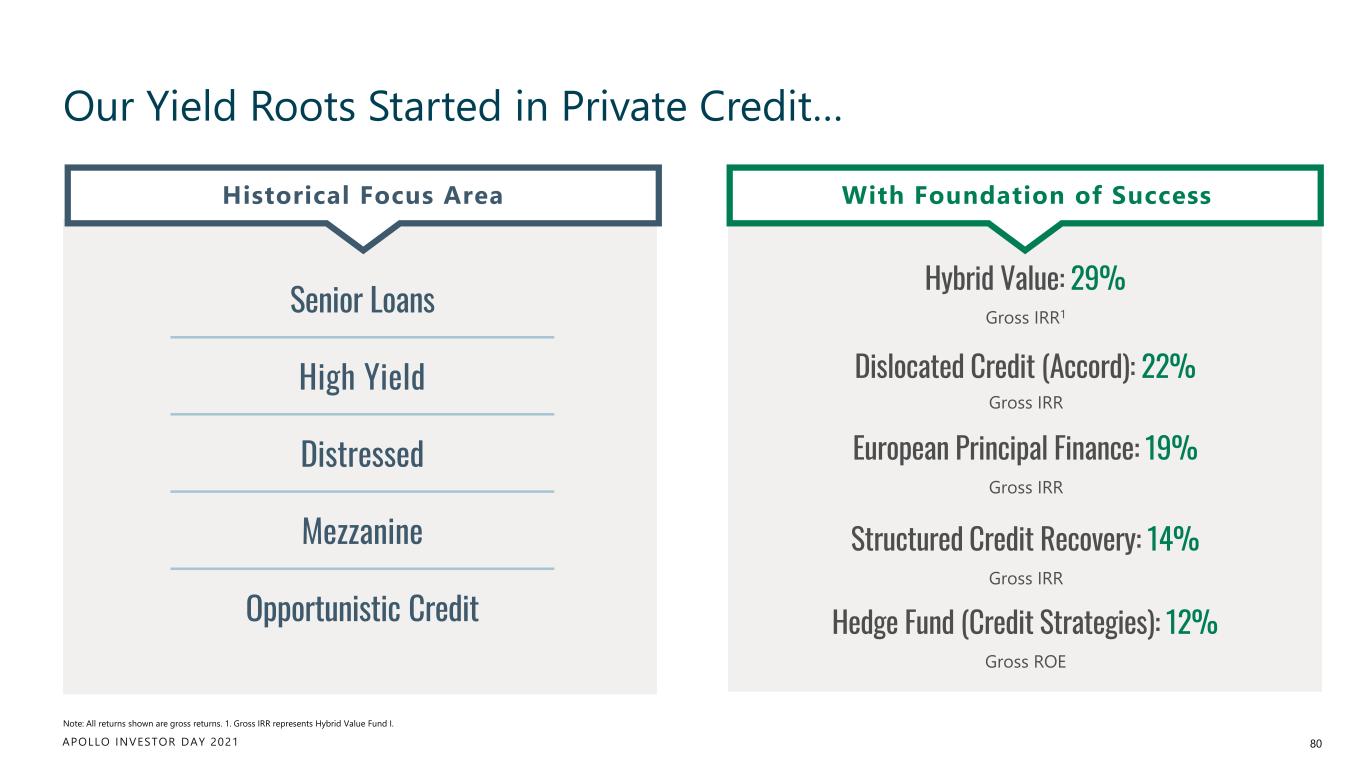

APOLLO INVESTOR DAY 2021 Our Yield Roots Started in Private Credit… 80 Note: All returns shown are gross returns. 1. Gross IRR represents Hybrid Value Fund I. Distressed Mezzanine Opportunistic Credit High Yield Senior Loans Historical Focus Area With Foundation of Success Gross IRR European Principal Finance: 19% Dislocated Credit (Accord): 22% Gross IRR Hybrid Value: 29% Gross IRR1 Structured Credit Recovery: 14% Gross IRR Hedge Fund (Credit Strategies): 12% Gross ROE

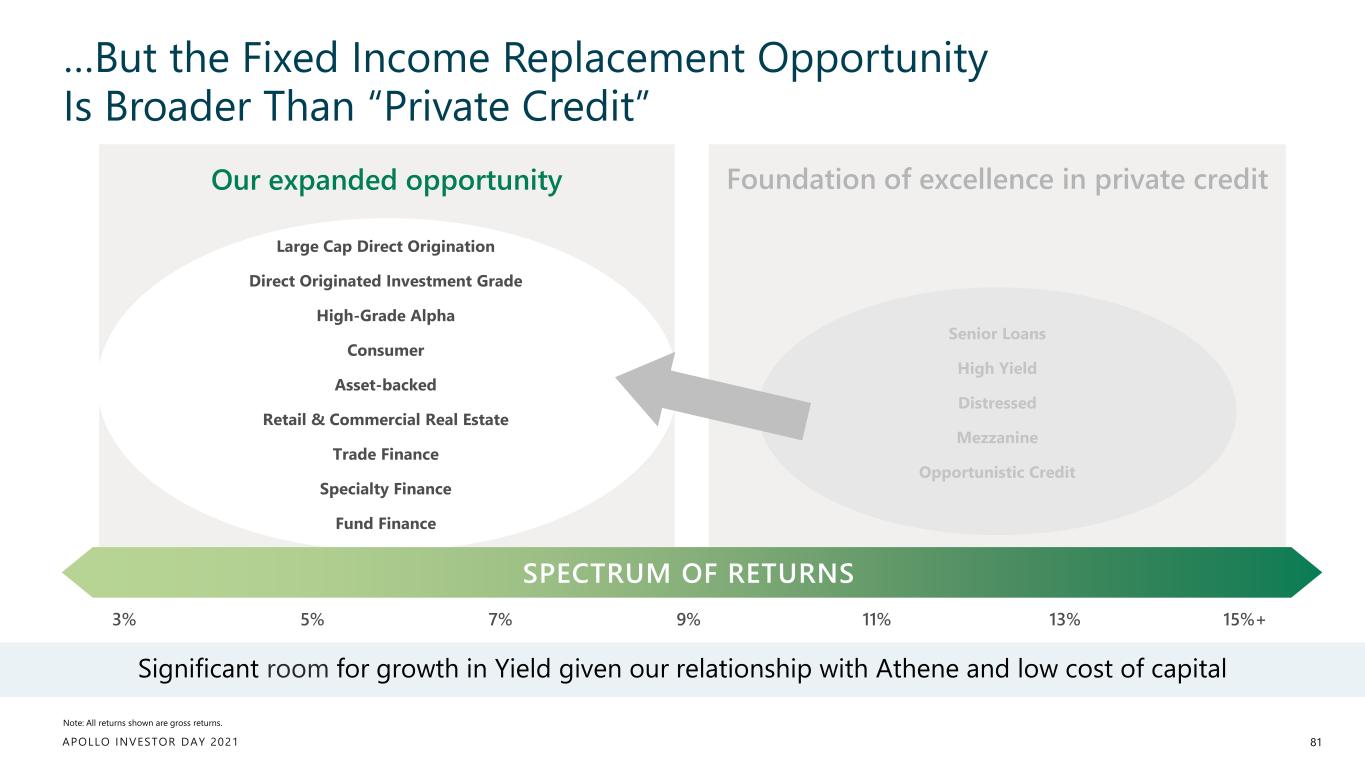

APOLLO INVESTOR DAY 2021 …But the Fixed Income Replacement Opportunity Is Broader Than “Private Credit” 81 Our expanded opportunity Note: All returns shown are gross returns. Significant room for growth in Yield given our relationship with Athene and low cost of capital SPECTRUM OF RETURNS 3% 5% 7% 9% 11% 13% 15%+ Senior Loans High Yield Distressed Mezzanine Opportunistic Credit Large Cap Direct Origination Direct Originated Investment Grade High-Grade Alpha Consumer Asset-backed Retail & Commercial Real Estate Trade Finance Specialty Finance Fund Finance Foundation of excellence in private credit

APOLLO INVESTOR DAY 2021 Apollo Provides Solutions Across The Entire “Fixed Income Replacement Universe” 82 APOLLO FOCUS AREA2PEER FOCUS AREA1 ~4-10x ~$4-11T 1. Based on peer disclosures from ARES & KKR. 2. Based on Apollo estimates. Sources: Apollo Chief Economist, Federal Reserve Board, S&P LCD, BofA, Preqin, SIFMA, Haver Analytics, Bloomberg. ~$40T FINANCING MARKET Growth in Private Credit is just the beginning Fixed Income Replacement is the new mantra Scale and broad capabilities lead to investor solutions Global demand for yield and excess return Focus area ~4-10x the size of our peers HOW WE SEE THE OPPORTUNITY Bank Loans & Trade Credit Mortgages & ABS Investment Grade Consumer Credit Other Fixed Income High Yield & Leveraged Loans ~$40T

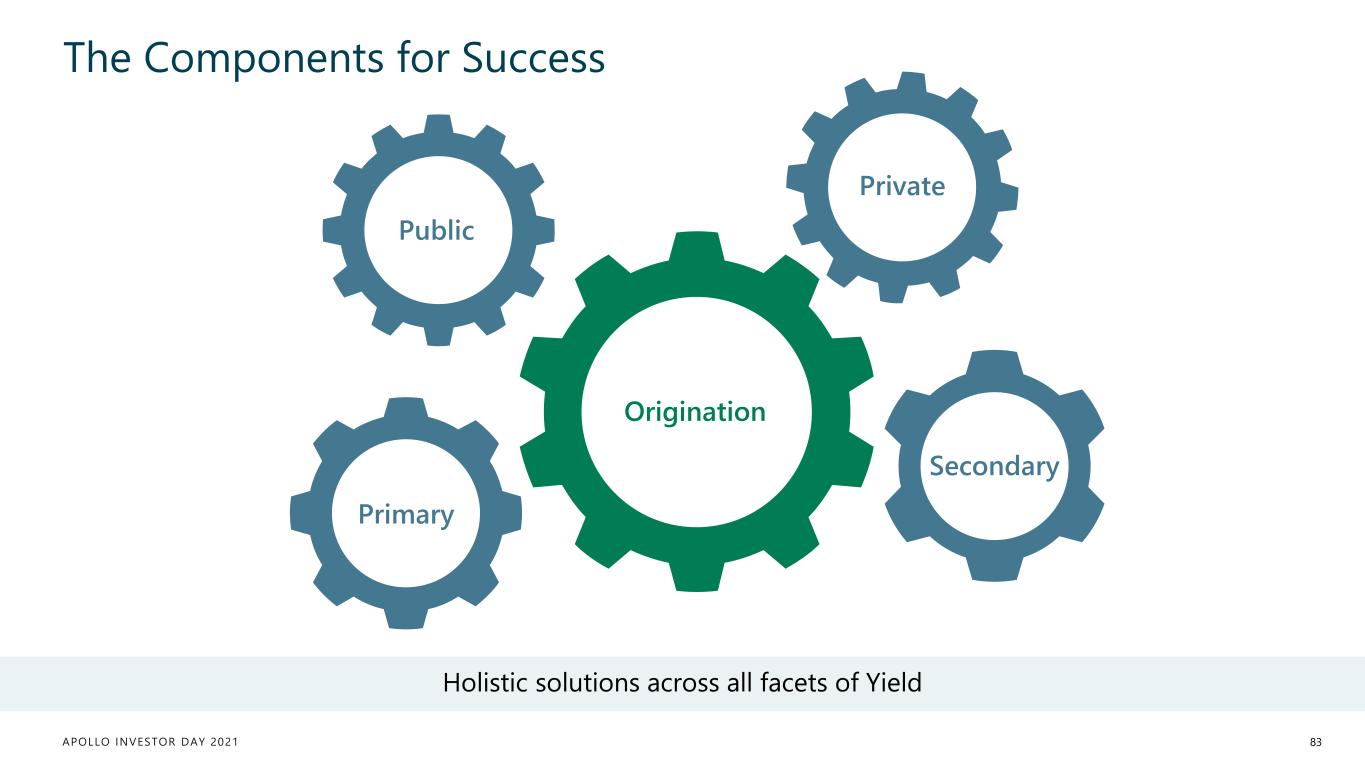

APOLLO INVESTOR DAY 2021 83 The Components for Success Holistic solutions across all facets of Yield Holistic solutions all facets of Yield Public Origination Private Primary Secondary

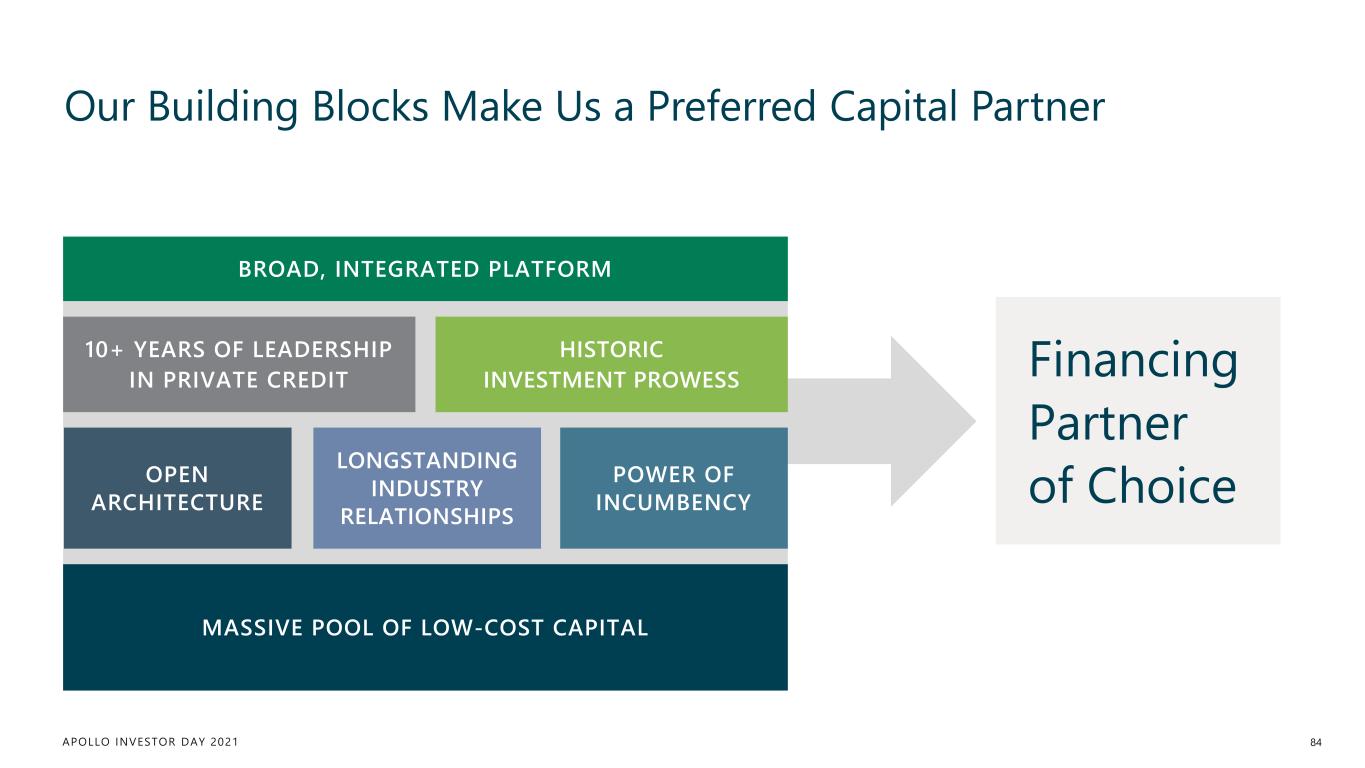

APOLLO INVESTOR DAY 2021 Financing Partner of Choicev Our Building Blocks Make Us a Preferred Capital Partner 84 BROAD, INTEGRATED PLATFORM 10+ YEARS OF LEADERSHIP IN PRIVATE CREDIT HISTORIC INVESTMENT PROWESS OPEN ARCHITECTURE LONGSTANDING INDUSTRY RELATIONSHIPS POWER OF INCUMBENCY MASSIVE POOL OF LOW-COST CAPITAL

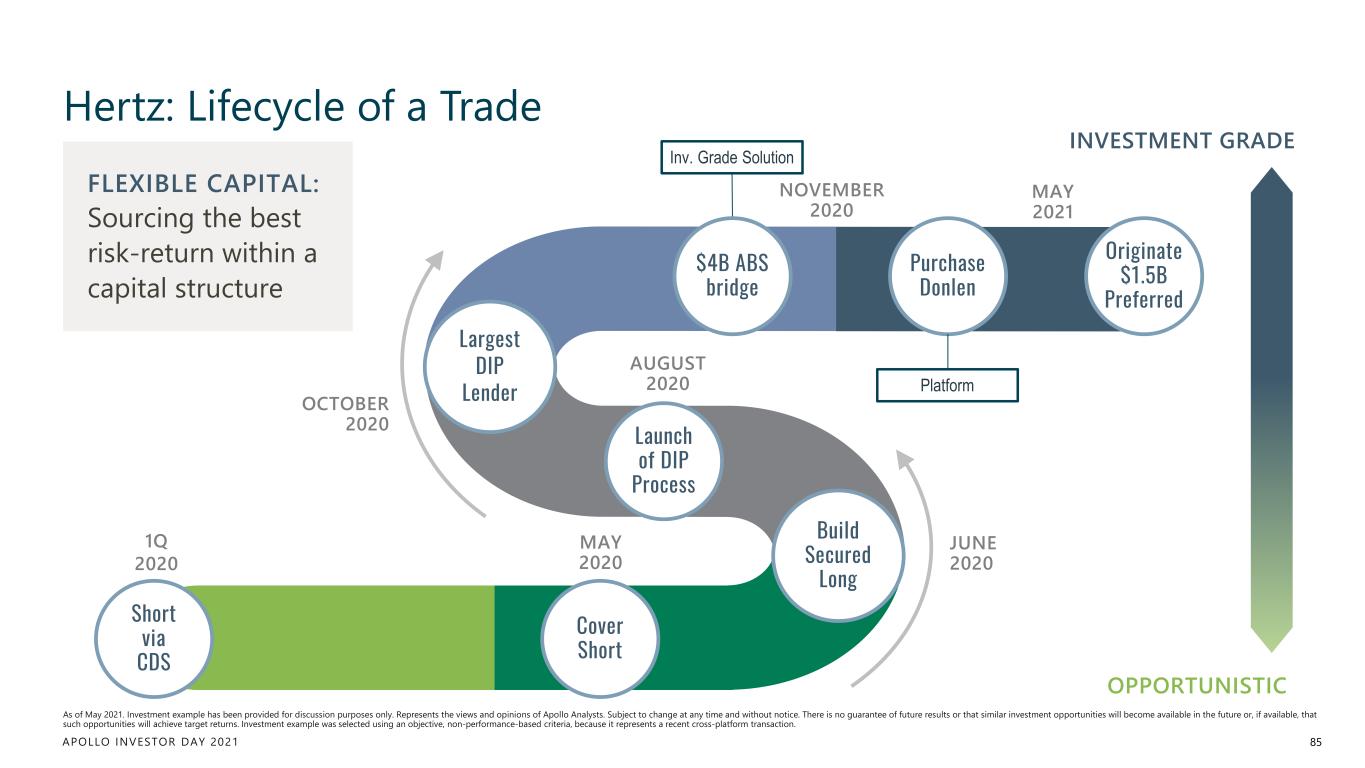

APOLLO INVESTOR DAY 2021 Hertz: Lifecycle of a Trade 85 As of May 2021. Investment example has been provided for discussion purposes only. Represents the views and opinions of Apollo Analysts. Subject to change at any time and without notice. There is no guarantee of future results or that similar investment opportunities will become available in the future or, if available, that such opportunities will achieve target returns. Investment example was selected using an objective, non-performance-based criteria, because it represents a recent cross-platform transaction. 1Q 2020 MAY 2020 JUNE 2020 AUGUST 2020 OCTOBER 2020 NOVEMBER 2020 MAY 2021 Purchase Donlen Originate $1.5B Preferred Largest DIP Lender Launch of DIP Process Build Secured Long Cover Short Short via CDS FLEXIBLE CAPITAL: Sourcing the best risk-return within a capital structure OPPORTUNISTIC INVESTMENT GRADE Platform Inv. Grade Solution $4B ABS bridge

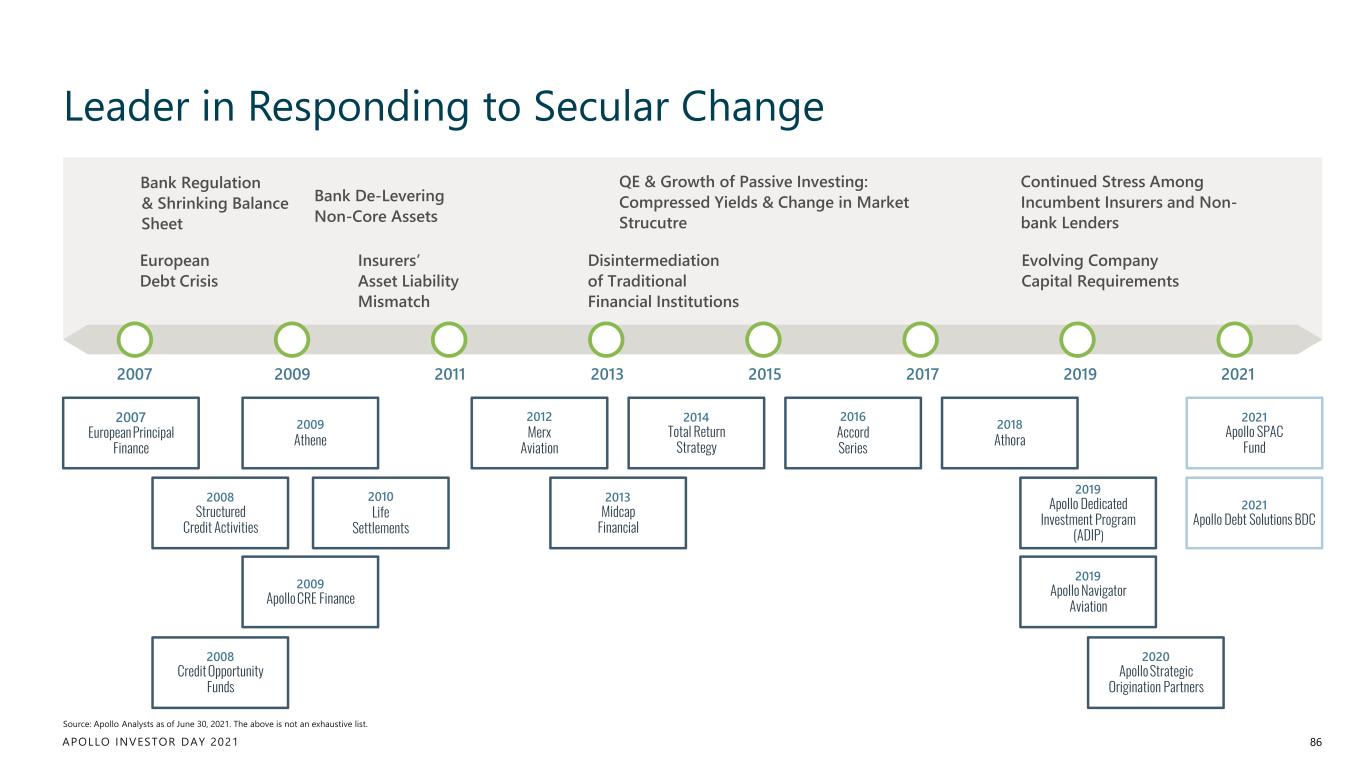

APOLLO INVESTOR DAY 2021 Leader in Responding to Secular Change 86 Bank De-Levering Non-Core Assets Bank Regulation & Shrinking Balance Sheet Insurers’ Asset Liability Mismatch Disintermediation of Traditional Financial Institutions Continued Stress Among Incumbent Insurers and Non- bank Lenders Evolving Company Capital Requirements QE & Growth of Passive Investing: Compressed Yields & Change in Market Strucutre European Debt Crisis 2007 European Principal Finance 2009 Athene 2012 Merx Aviation 2014 Total Return Strategy 2008 Structured Credit Activities 2009 Apollo CRE Finance 2010 Life Settlements 2008 Credit Opportunity Funds 2013 Midcap Financial 2016 Accord Series 2018 Athora 2019 Apollo Dedicated Investment Program (ADIP) 2020 ApolloStrategic Origination Partners 2019 Apollo Navigator Aviation 2021 Apollo SPAC Fund 2021 Apollo Debt Solutions BDC 2007 2009 2011 2013 2015 2017 2019 2021 Source: Apollo Analysts as of June 30, 2021. The above is not an exhaustive list.

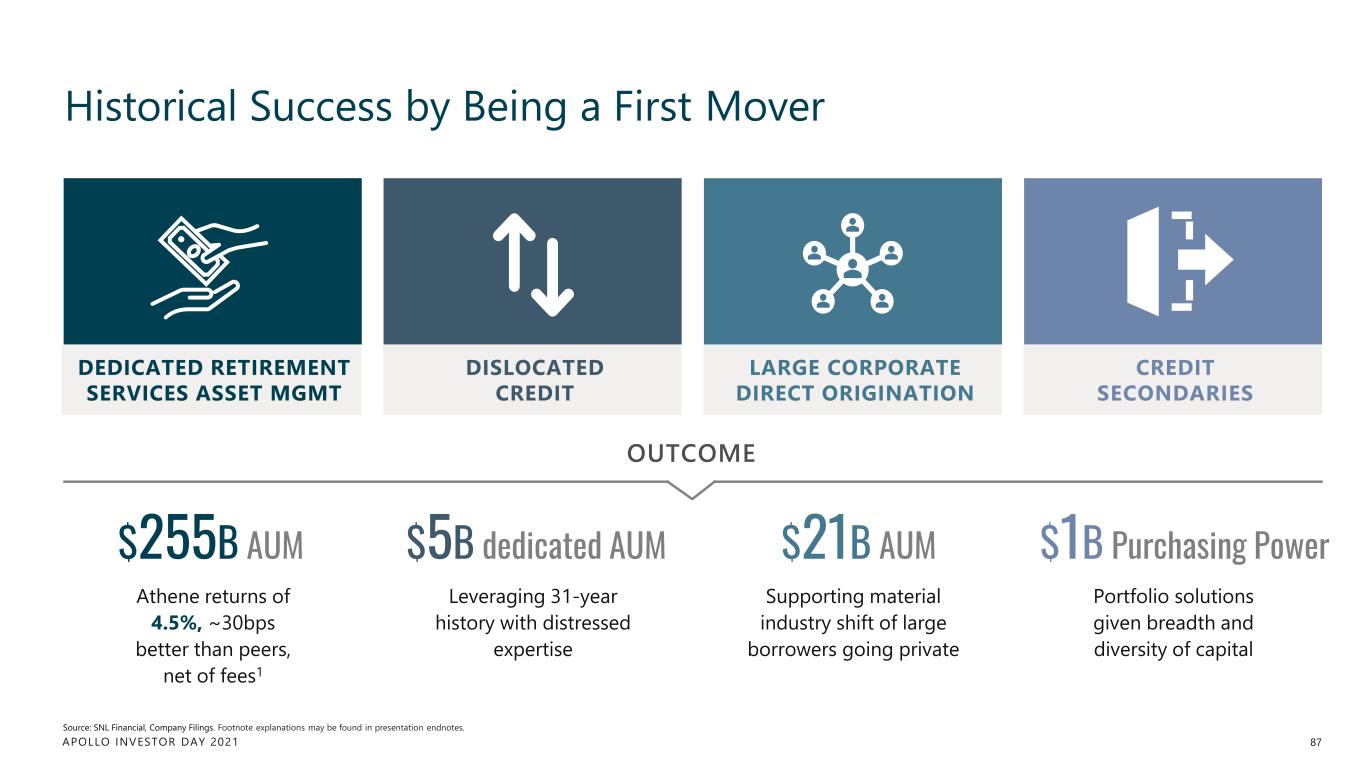

APOLLO INVESTOR DAY 2021 Historical Success by Being a First Mover 87 Source: SNL Financial, Company Filings. Footnote explanations may be found in presentation endnotes. CREDIT SECONDARIES OUTCOME LARGE CORPORATE DIRECT ORIGINATION DISLOCATED CREDIT DEDICATED RETIREMENT SERVICES ASSET MGMT $255B AUM Athene returns of 4.5%, ~30bps better than peers, net of fees1 $5B dedicated AUM Leveraging 31-year history with distressed expertise $21B AUM Supporting material industry shift of large borrowers going private $1B Purchasing Power Portfolio solutions given breadth and diversity of capital

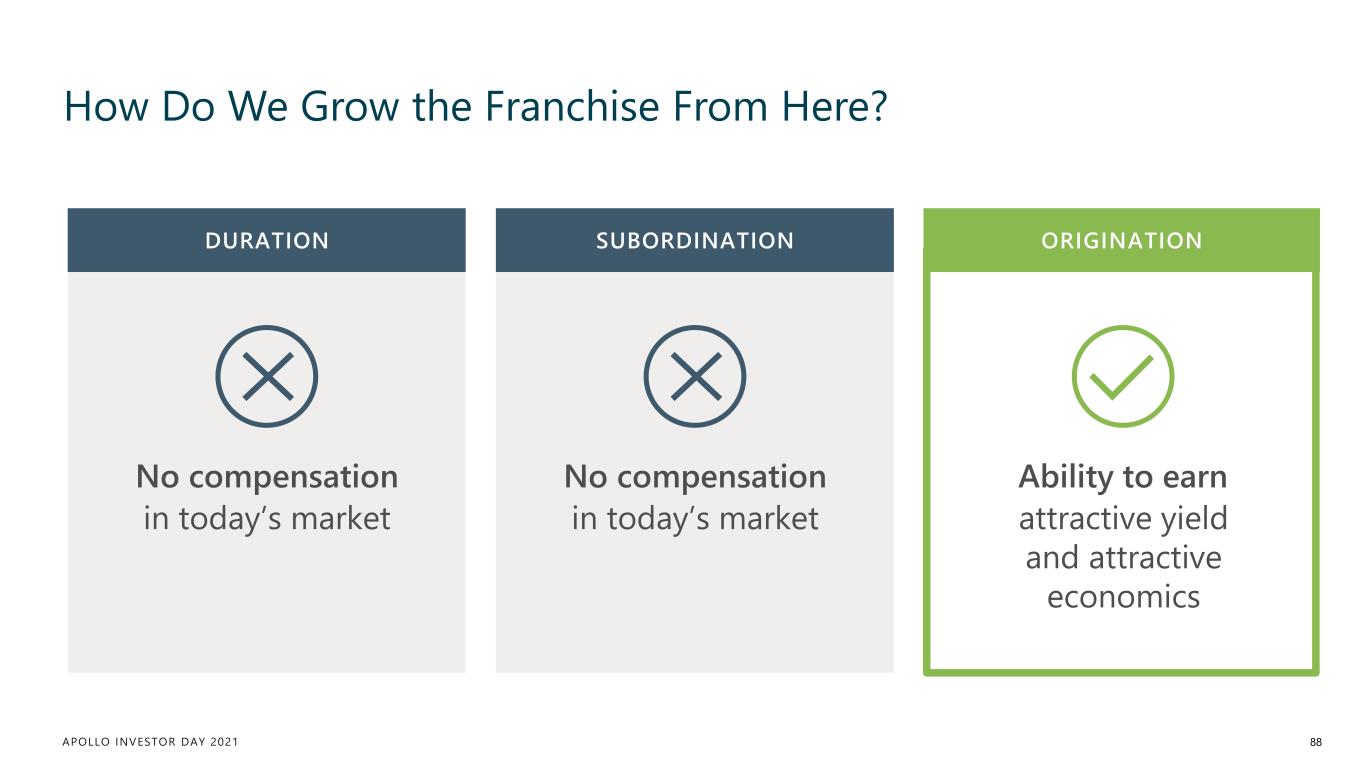

APOLLO INVESTOR DAY 2021 How Do We Grow the Franchise From Here? 88 No compensation in today’s market No compensation in today’s market Ability to earn attractive yield and attractive economics DURATION SUBORDINATION ORIGINATION

APOLLO INVESTOR DAY 2021 Why We Like Origination 89 Power of incumbency across entire platform Control of structure, process, and documents In-depth knowledge to minimize credit risk and own the collateral Ability to earn attractive economics Trade-off liquidity risk for a premium

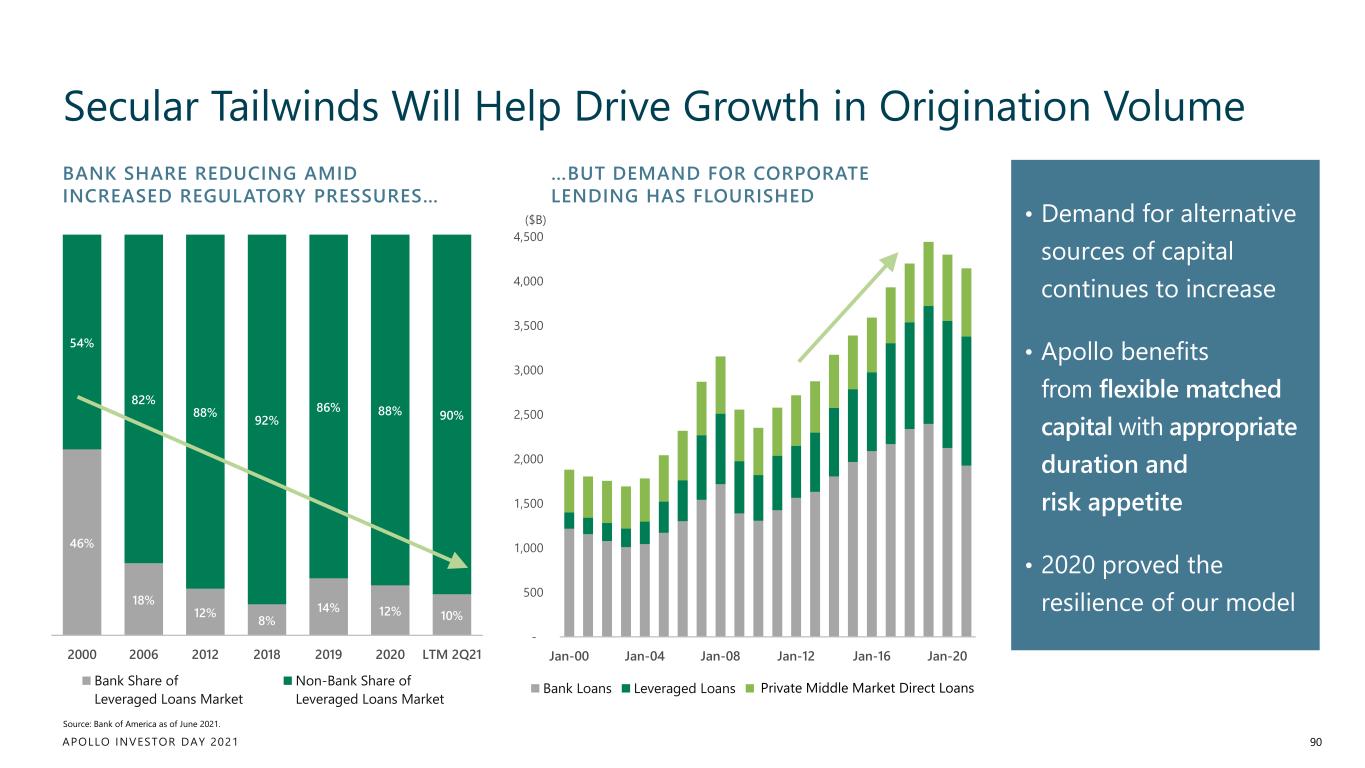

APOLLO INVESTOR DAY 2021 Secular Tailwinds Will Help Drive Growth in Origination Volume 90 Source: Bank of America as of June 2021. • Demand for alternative sources of capital continues to increase • Apollo benefits from flexible matched capital with appropriate duration and risk appetite • 2020 proved the resilience of our model 46% 18% 12% 8% 14% 12% 10% 54% 82% 88% 92% 86% 88% 90% 2000 2006 2012 2018 2019 2020 LTM 2Q21 Bank Share of Leveraged Loans Market Non-Bank Share of Leveraged Loans Market …BUT DEMAND FOR CORPORATE LENDING HAS FLOURISHED BANK SHARE REDUCING AMID INCREASED REGULATORY PRESSURES… - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 Jan-00 Jan-04 Jan-08 Jan-12 Jan-16 Jan-20 ($B) Bank Loans Leveraged Loans Private MM Direct LoansPrivate iddle Market Direct Loans

APOLLO INVESTOR DAY 2021 TRADITIONAL ORIGINATION STRATEGIES Multi-Pronged Approach to Origination 91 LARGE CAP ORIGINATION & HIGH-GRADE ALPHA APOLLO’S EDGE • Proprietary teams and technologies to originate and source assets with excess risk- reward on a recurring basis • Scaled corporate solutions • Proprietary, large transactions targeting ~100-200 bps of incremental yield • Excess alpha generation as a scale player PK Air Net Lease CLOs & Structured Products Direct Lending ORIGINATION PLATFORMS + +

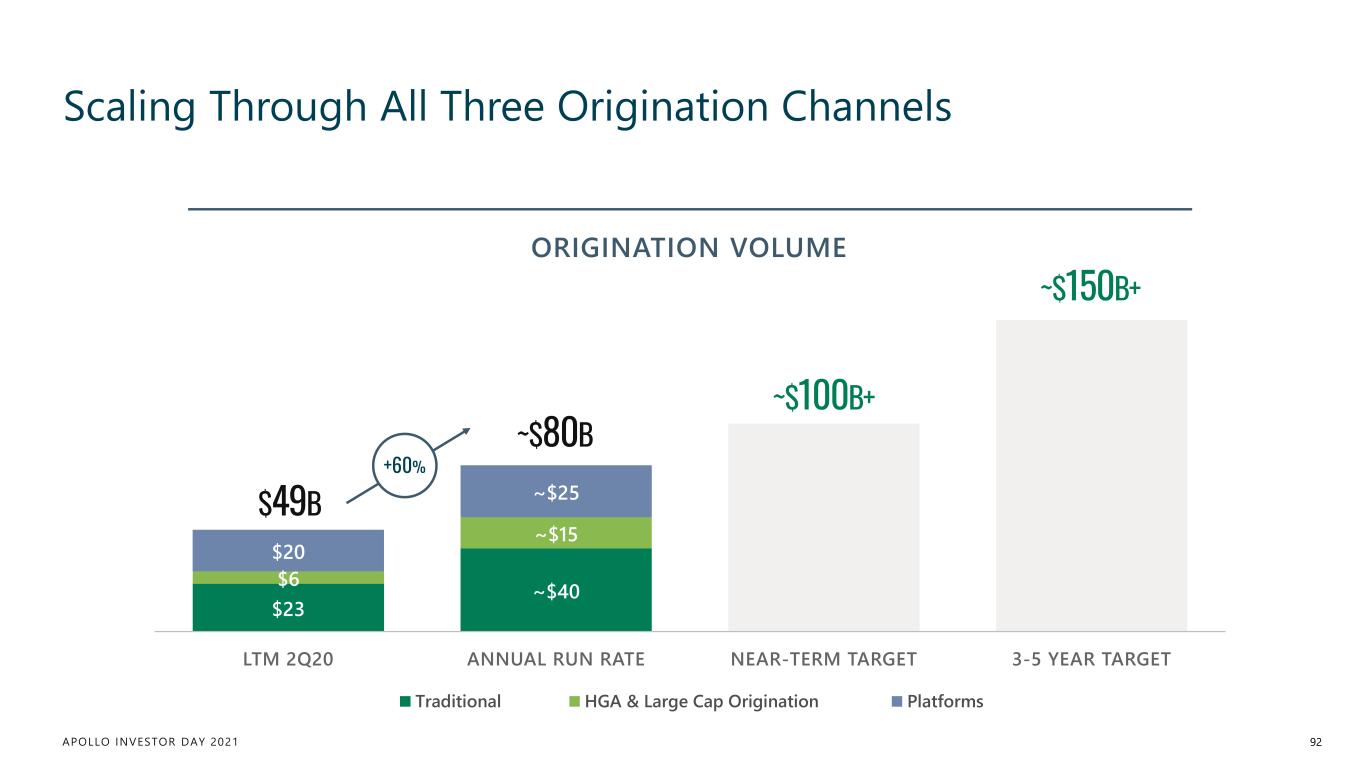

APOLLO INVESTOR DAY 2021 Scaling Through All Three Origination Channels 92 $23 ~$40$6 ~$15 $20 ~$25 LTM 2Q20 ANNUAL RUN RATE NEAR-TERM TARGET 3-5 YEAR TARGET Traditional HGA & Large Cap Origination Platforms ~$80B $49B ~$150B+ +60% ~$100B+ ORIGINATION VOLUME

APOLLO INVESTOR DAY 2021 Strong Yield Leadership with the Ability to Attract Top Talent 93 STRONG SENIOR LEADERSHIP WITH 23 YEARS AVERAGE INDUSTRY EXPERIENCE ~80 BEST-IN-CLASS CREDIT HIRES OVER THE LAST 18 MONTHS JOHN ZITO Deputy CIO, Credit PARTNER AT GOLDMAN SACHS HEAD OF EQUITIES AND CREDIT TRADING AT NOMURA MANAGING DIRECTOR AT ALCENTRA PORTFOLIO MANAGER AT ELLIOTTHEAD OF CREDIT TRADING AT BARCLAYS HEAD OF CREDIT AND CAPITAL MARKETS AT KKR NANCY DE LIBAN Head of Resi./Consumer Structured Products CRAIG FARR Head of Apollo Capital Solutions JIM GALOWSKI Head of European Credit ROB GRAHAM Resi./Consumer Credit JIM HASSETT Head of Corporate Fixed Income EARL HUNT Partner, CEO of Apollo Debt Solutions & Co- Head of Credit LP Secondaries JEFF JACOBS CIO, Insurance Solutions Group BRET LEAS Head of Global Corp. Structured Credit & ABS LESLIE MAPONDERA Partner, European Investment Grade JOE MORONEY Co-Head Corporate & Multi-Credit MATT O’MARA Alternatives, Insurance Solutions Group BRIGETTE POSCH Head of Emerging Markets Credit SCOTT WEINER Head of CRE Debt HOWARD WIDRA Head of Direct Origination JASJIT SINGH Chief Risk Officer

APOLLO INVESTOR DAY 2021 94 CAPITAL SOLUTIONS BROADENS OUR DISTRIBUTION FUNNEL

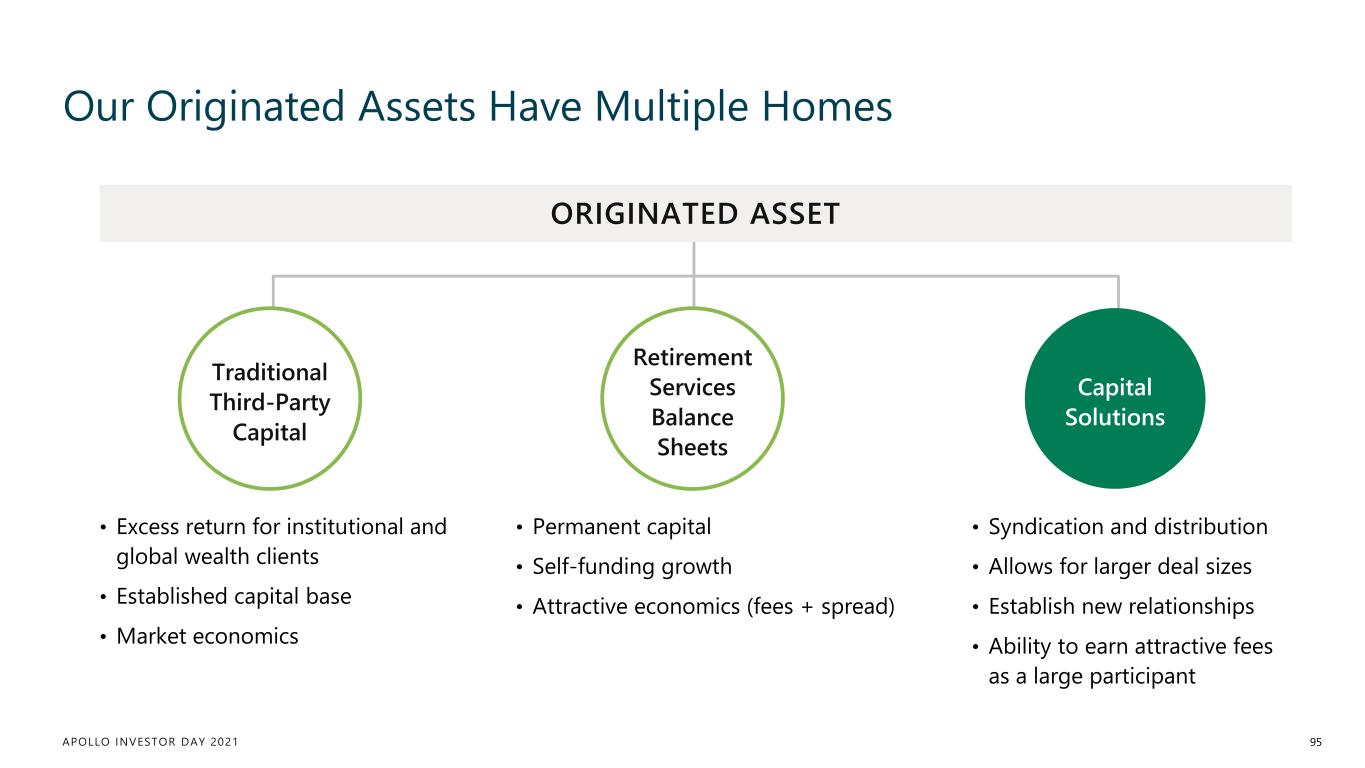

APOLLO INVESTOR DAY 2021 Our Originated Assets Have Multiple Homes 95 Traditional Third-Party Capital Capital Solutions Retirement Services Balance Sheets • Permanent capital • Self-funding growth • Attractive economics (fees + spread) • Syndication and distribution • Allows for larger deal sizes • Establish new relationships • Ability to earn attractive fees as a large participant • Excess return for institutional and global wealth clients • Established capital base • Market economics ORIGINATED ASSET

APOLLO INVESTOR DAY 2021 TODAY 2026E Apollo Capital Solutions Further Expands Our Toolkit 96 Large existing portfolio with capital markets activity1 FEE RELATED REVENUE ~2x Centralized solution supporting cross-platform origination, structuring, and syndication that is expected to drive FRE growth ~$250M ~$500M 2 Premier yield and origination franchise 3 Excess flow across scaling strategies MULTIPLE LEVERS FOR FRE GROWTH 1. For presentation purposes, LTM 2Q21 fee related revenue from transaction and advisory fees excludes monitoring and miscellaneous fees from the private equity segment recognized over the same period. 1

APOLLO INVESTOR DAY 2021 Key Takeaways for Our Yield and Capital Solutions Businesses 97 Private Credit is evolving into Fixed Income Replacement, a market which is magnitudes larger1 2 Apollo’s differentiated scale and cost of capital drives our competitive edge in origination 3 Capital Solutions expands our toolkit for distributing investments to our clients 4 We believe we have the capabilities and experience to drive sustainable growth and create enterprise value

APOLLO INVESTOR DAY 2021 Origination Platforms CHRIS EDSON Senior Partner, Co-Head of US FIG

APOLLO INVESTOR DAY 2021 Access to Direct Origination Is Now More Important Than Ever 99 1. Platforms are ongoing businesses that we may potentially never sell and thus provide us with the opportunity to originate assets over an indefinite time period. Owning origination platforms provides perpetual1, recurring access to attractive assets at scale TRADITIONAL ASSET BUYER DIRECT ORIGINATION PLATFORM Increasing Demand in Low Yield Environment Perpetual and Recurring Supply

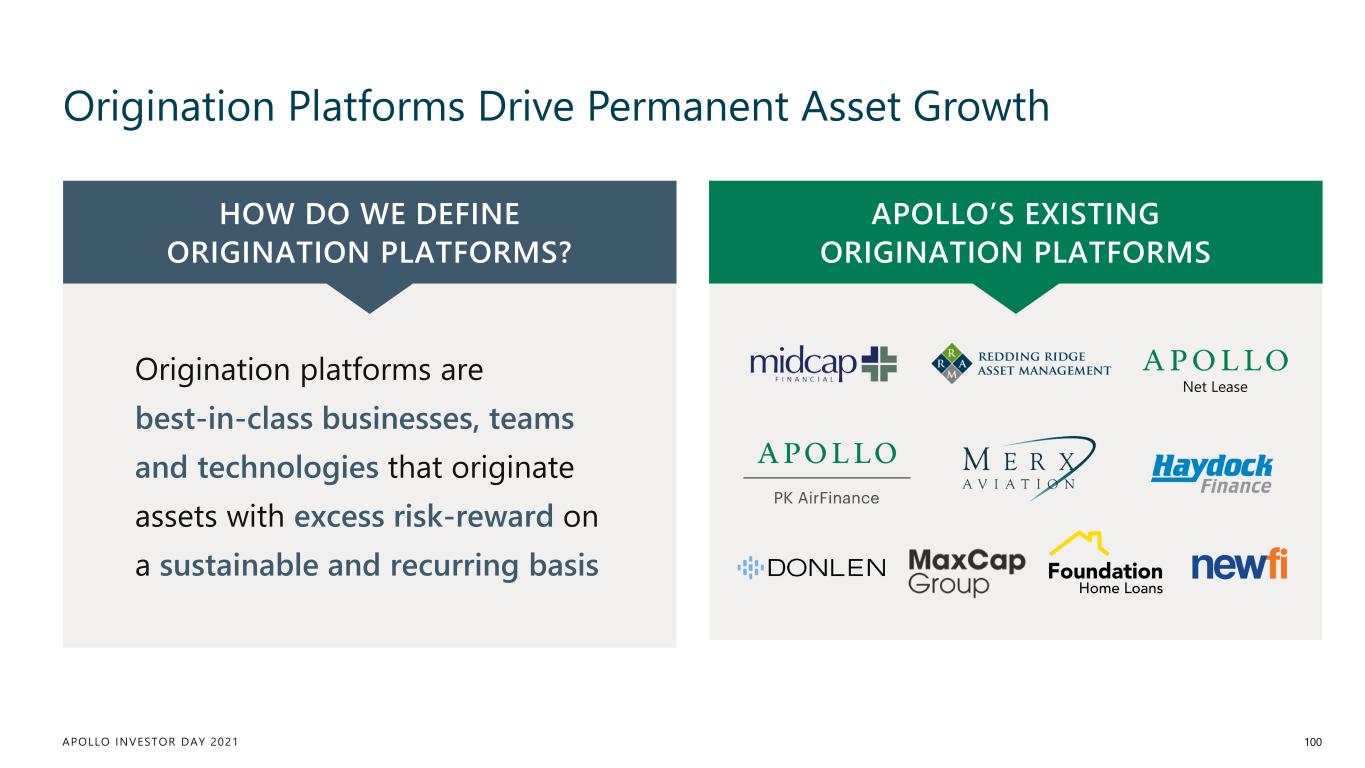

APOLLO INVESTOR DAY 2021 Origination Platforms Drive Permanent Asset Growth 100 Net Lease HOW DO WE DEFINE ORIGINATION PLATFORMS? APOLLO’S EXISTING ORIGINATION PLATFORMS Origination platforms are best-in-class businesses, teams and technologies that originate assets with excess risk-reward on a sustainable and recurring basis

APOLLO INVESTOR DAY 2021 What Can Direct Origination Offer Apollo and Apollo Clients? 101 EQUITY DEPLOYMENT Downside-Protected Low-to-Mid Teens ROE DEBT/FLOW DEPLOYMENT ~100–200bps Excess Spread MANAGEMENT FEES ON DEBT/EQUITY Fees on Deployment SYNDICATION FEES Fees on Origination ATHENE SPREAD EARNINGS APOLLO FEE EARNINGS

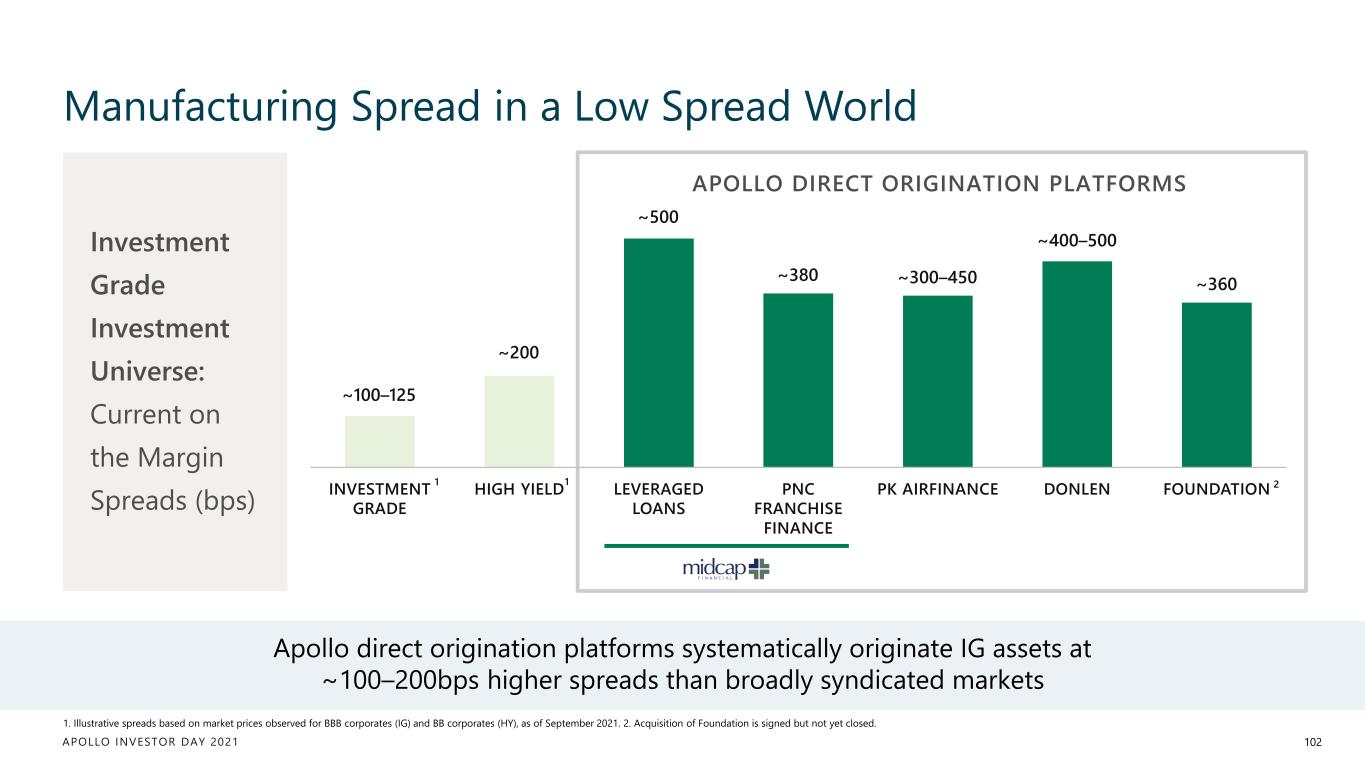

APOLLO INVESTOR DAY 2021 INVESTMENT GRADE HIGH YIELD LEVERAGED LOANS PNC FRANCHISE FINANCE PK AIRFINANCE DONLEN FOUNDATION 2 Manufacturing Spread in a Low Spread World 102 ~380 ~300–450 ~400–500 ~360 ~500 ~200 ~100–125 Apollo direct origination platforms systematically originate IG assets at ~100–200bps higher spreads than broadly syndicated markets Investment Grade Investment Universe: Current on the Margin Spreads (bps) APOLLO DIRECT ORIGINATION PLATFORMS 1. Illustrative spreads based on market prices observed for BBB corporates (IG) and BB corporates (HY), as of September 2021. 2. Acquisition of Foundation is signed but not yet closed. 1 1

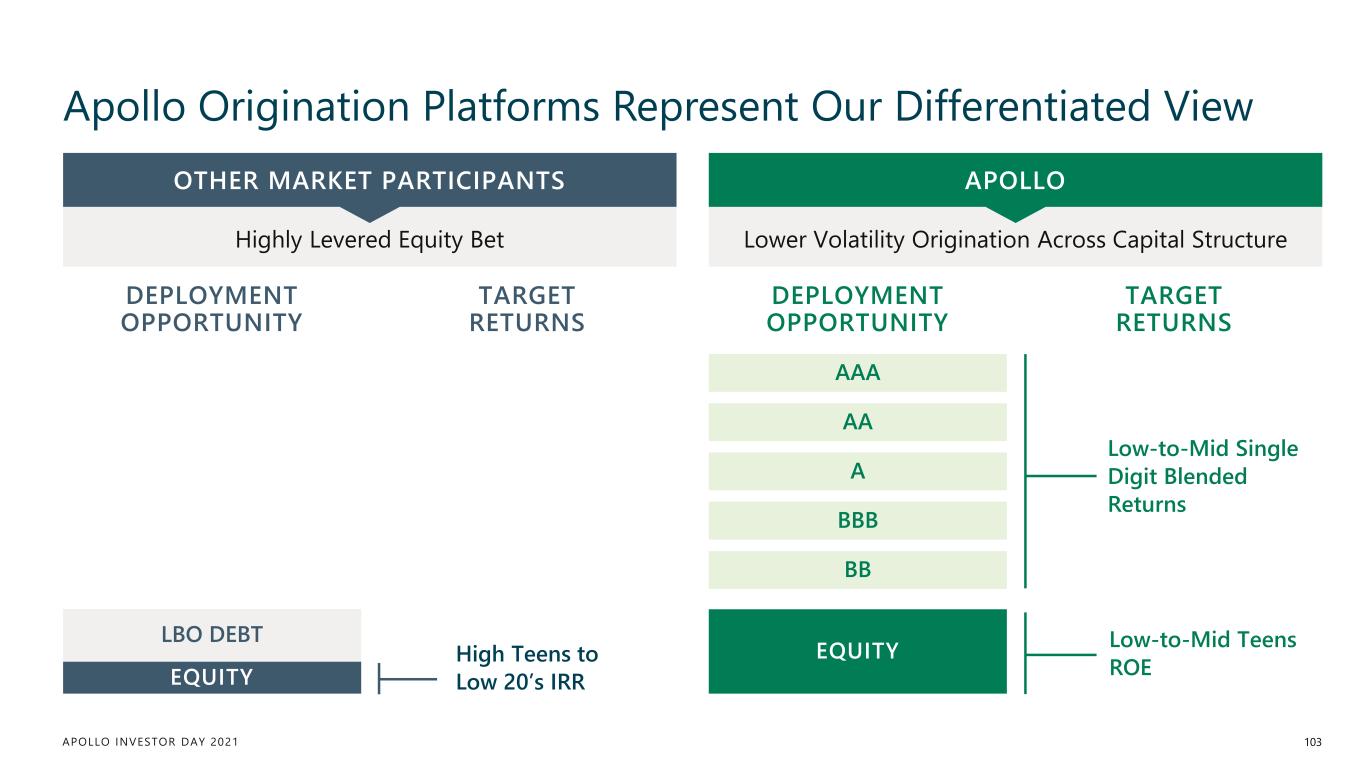

APOLLO INVESTOR DAY 2021 Apollo Origination Platforms Represent Our Differentiated View 103 EQUITY BB BBB A AAA AA EQUITY LBO DEBT Highly Levered Equity Bet Lower Volatility Origination Across Capital Structure OTHER MARKET PARTICIPANTS APOLLO DEPLOYMENT OPPORTUNITY DEPLOYMENT OPPORTUNITY TARGET RETURNS TARGET RETURNS High Teens to Low 20’s IRR Low-to-Mid Teens ROE Low-to-Mid Single Digit Blended Returns

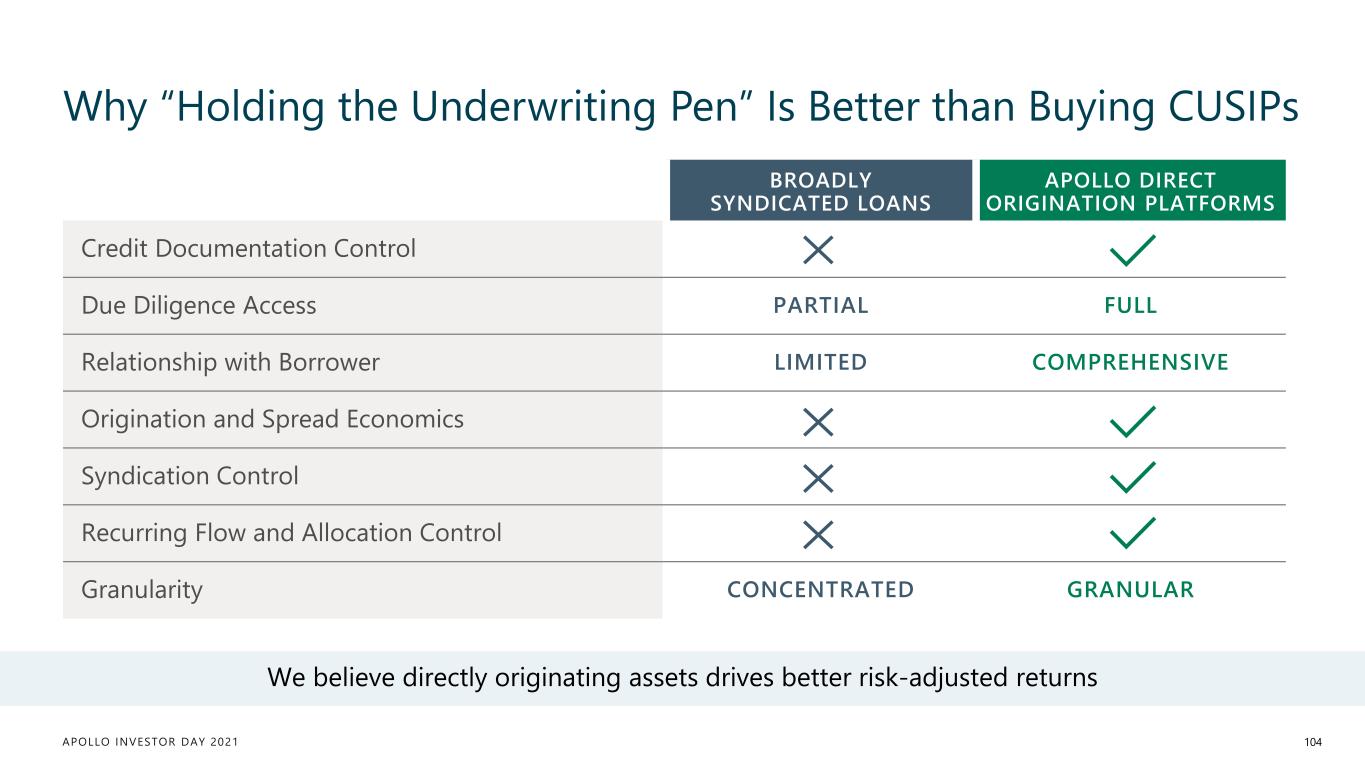

APOLLO INVESTOR DAY 2021 Why “Holding the Underwriting Pen” Is Better than Buying CUSIPs 104 We believe directly originating assets drives better risk-adjusted returns BROADLY SYNDICATED LOANS APOLLO DIRECT ORIGINATION PLATFORMS Credit Documentation Control Due Diligence Access PARTIAL FULL Relationship with Borrower LIMITED COMPREHENSIVE Origination and Spread Economics Syndication Control Recurring Flow and Allocation Control Granularity CONCENTRATED GRANULAR

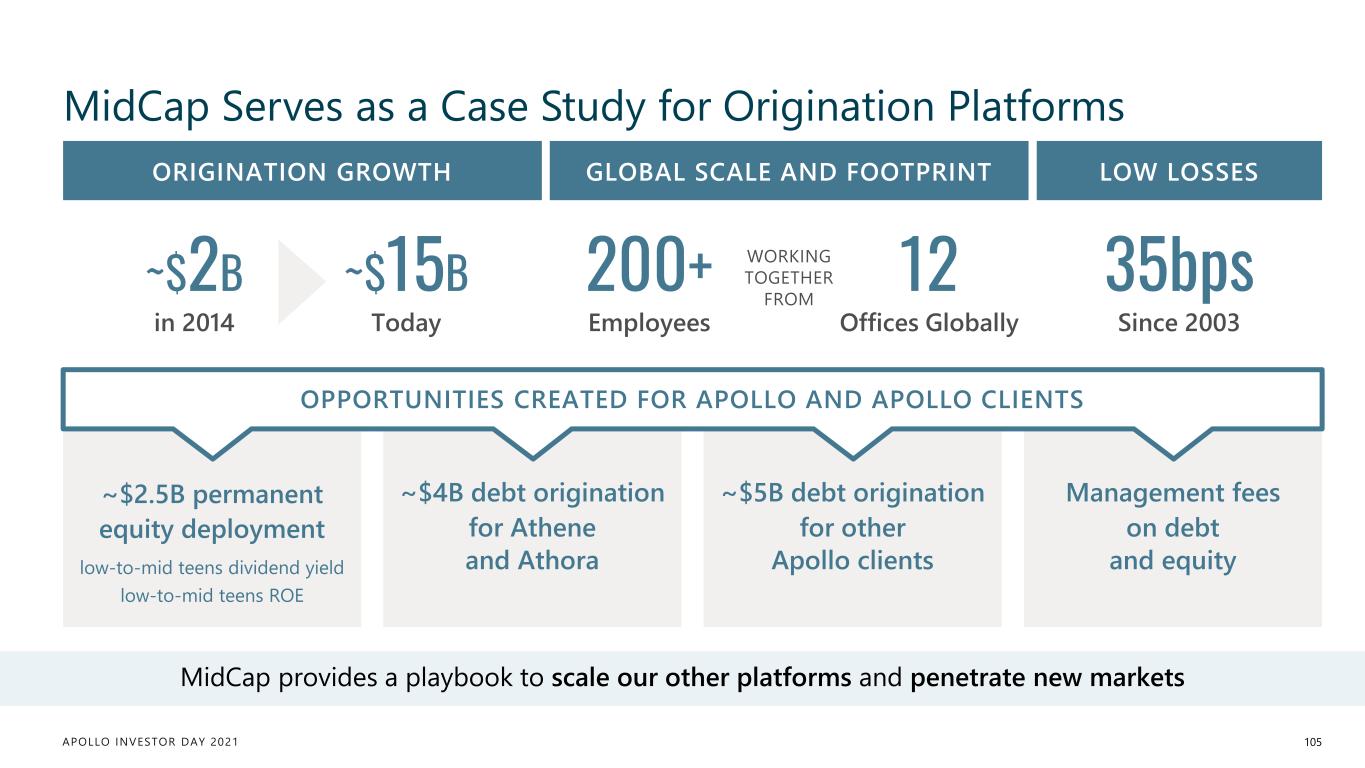

APOLLO INVESTOR DAY 2021 MidCap Serves as a Case Study for Origination Platforms 105 MidCap provides a playbook to scale our other platforms and penetrate new markets ORIGINATION GROWTH ~$2B in 2014 ~$15B Today GLOBAL SCALE AND FOOTPRINT 200+ Employees 12 Offices Globally WORKING TOGETHER FROM ~$2.5B permanent equity deployment low-to-mid teens dividend yield low-to-mid teens ROE ~$4B debt origination for Athene and Athora ~$5B debt origination for other Apollo clients Management fees on debt and equity OPPORTUNITIES CREATED FOR APOLLO AND APOLLO CLIENTS LOW LOSSES 35bps Since 2003

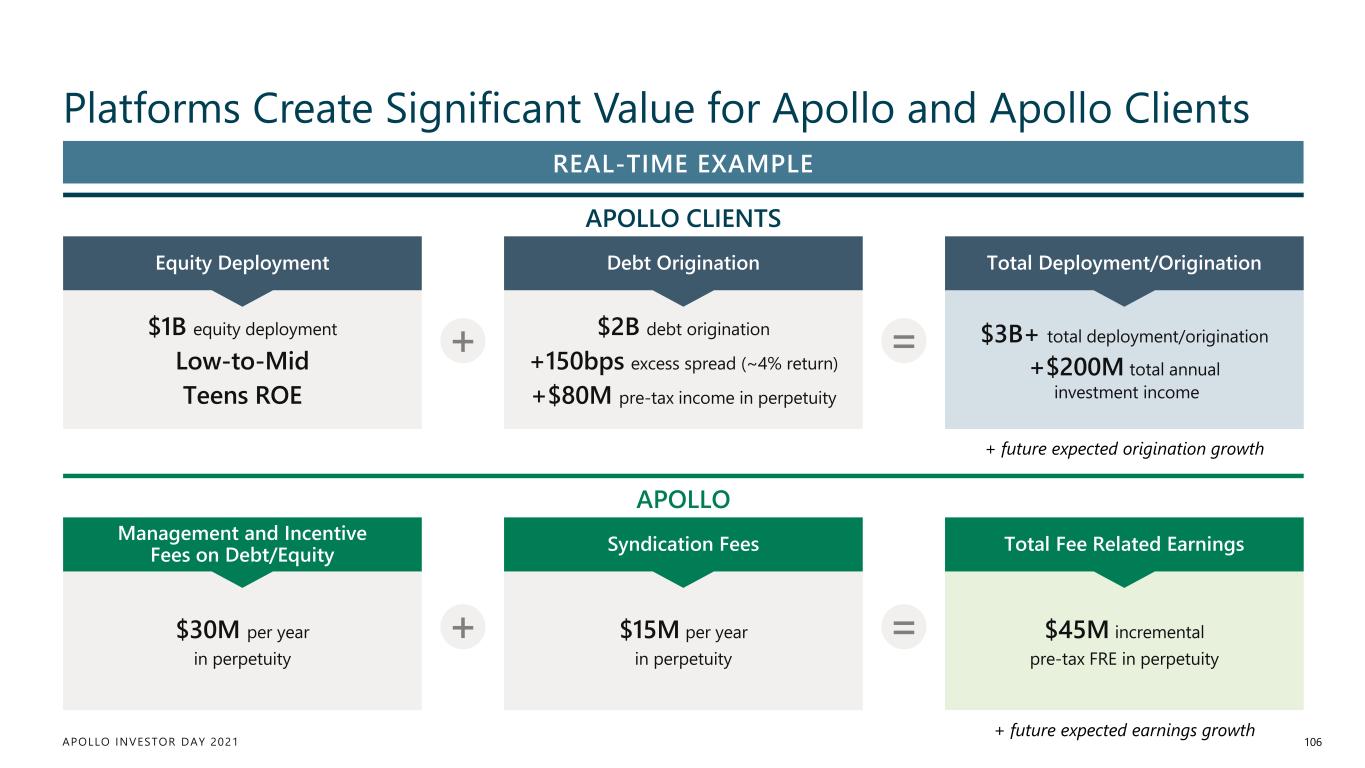

APOLLO INVESTOR DAY 2021 Platforms Create Significant Value for Apollo and Apollo Clients 106 $1B equity deployment Low-to-Mid Teens ROE Equity Deployment $2B debt origination +150bps excess spread (~4% return) +$80M pre-tax income in perpetuity Debt Origination $3B+ total deployment/origination +$200M total annual investment income Total Deployment/Origination APOLLO CLIENTS $30M per year in perpetuity Management and Incentive Fees on Debt/Equity $15M per year in perpetuity Syndication Fees $45M incremental pre-tax FRE in perpetuity Total Fee Related Earnings APOLLO + future expected origination growth REAL-TIME EXAMPLE + = + = + future expected earnings growth

APOLLO INVESTOR DAY 2021 There Are Plenty of Growth Opportunities Ahead 107 Consumer Finance US Mortgage Continental Europe Asia Pacific GP Solutions Fund Finance Trade Finance DEVELOPED WHITESPACEHIGH GROWTH While we have made material progress to date, significant whitespace remains $25B+ in annual originations and ~$50B in gross assets $15B ASSETS $15B ASSETS $8B ASSETS $2B ASSETS Net Lease $2B ASSETS $3B ASSETS $4B ASSETS $500M ASSETS $300M ASSETS

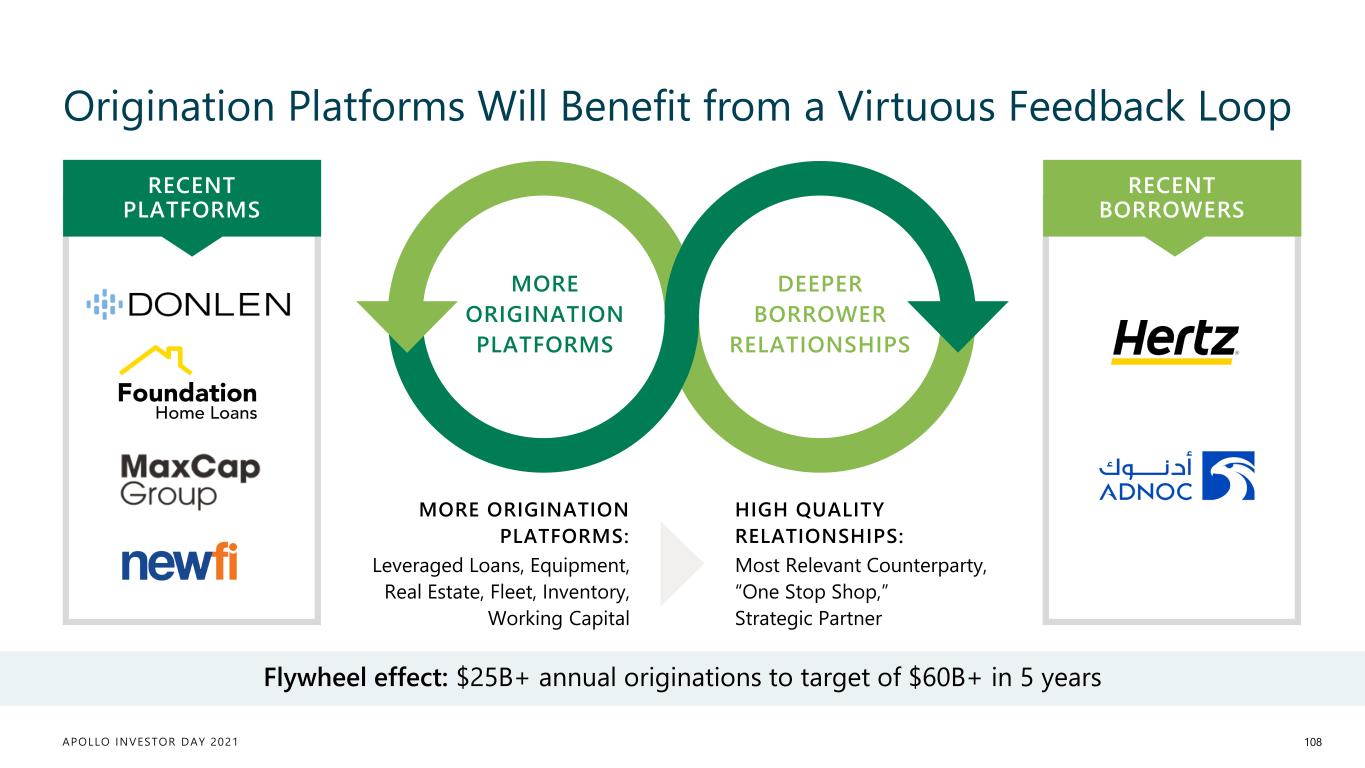

APOLLO INVESTOR DAY 2021 Origination Platforms Will Benefit from a Virtuous Feedback Loop 108 MORE ORIGINATION PLATFORMS: Leveraged Loans, Equipment, Real Estate, Fleet, Inventory, Working Capital HIGH QUALITY RELATIONSHIPS: Most Relevant Counterparty, “One Stop Shop,” Strategic Partner MORE ORIGINATION PLATFORMS DEEPER BORROWER RELATIONSHIPS Flywheel effect: $25B+ annual originations to target of $60B+ in 5 years RECENT PLATFORMS RECENT BORROWERS

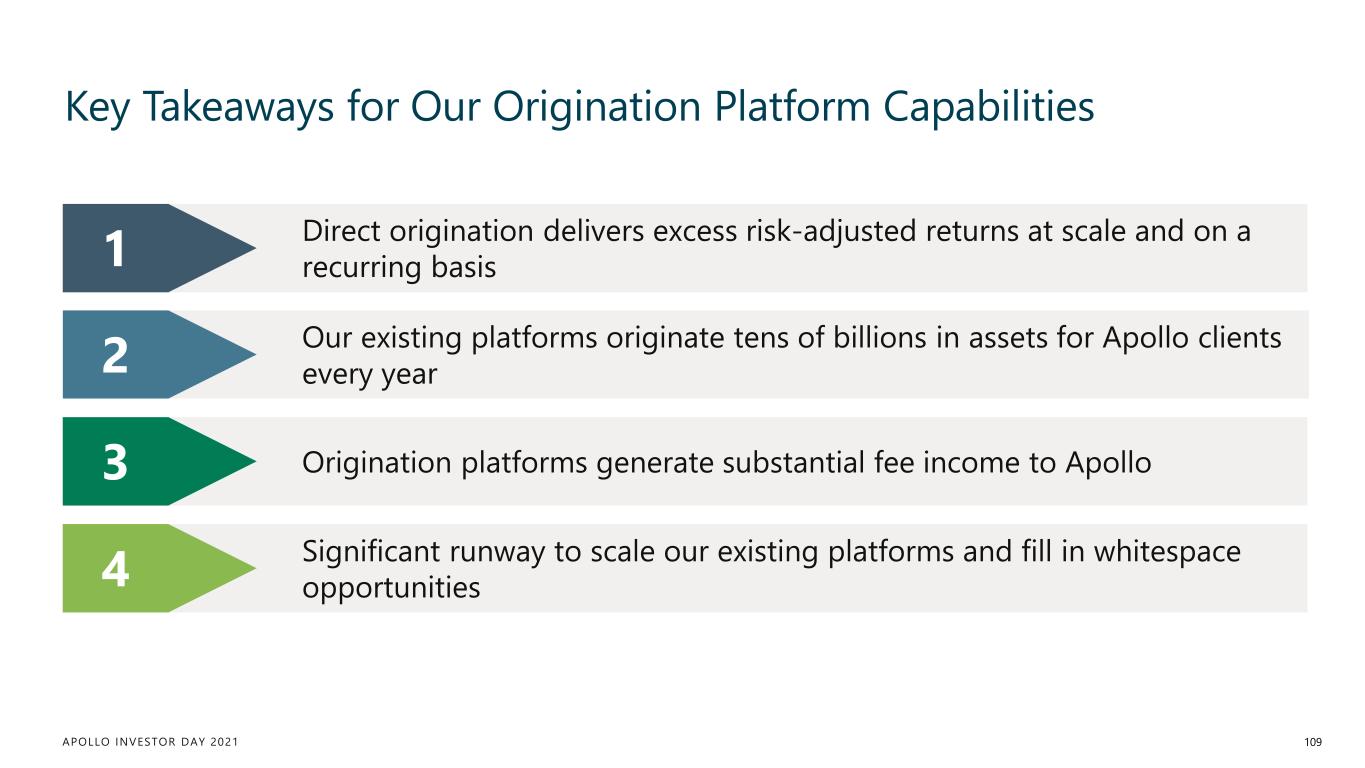

APOLLO INVESTOR DAY 2021 Key Takeaways for Our Origination Platform Capabilities 109 Direct origination delivers excess risk-adjusted returns at scale and on a recurring basis1 2 Our existing platforms originate tens of billions in assets for Apollo clients every year 3 Origination platforms generate substantial fee income to Apollo 4 Significant runway to scale our existing platforms and fill in whitespace opportunities

APOLLO INVESTOR DAY 2021 Capital Solutions CRAIG FARR Senior Partner, Capital Solutions

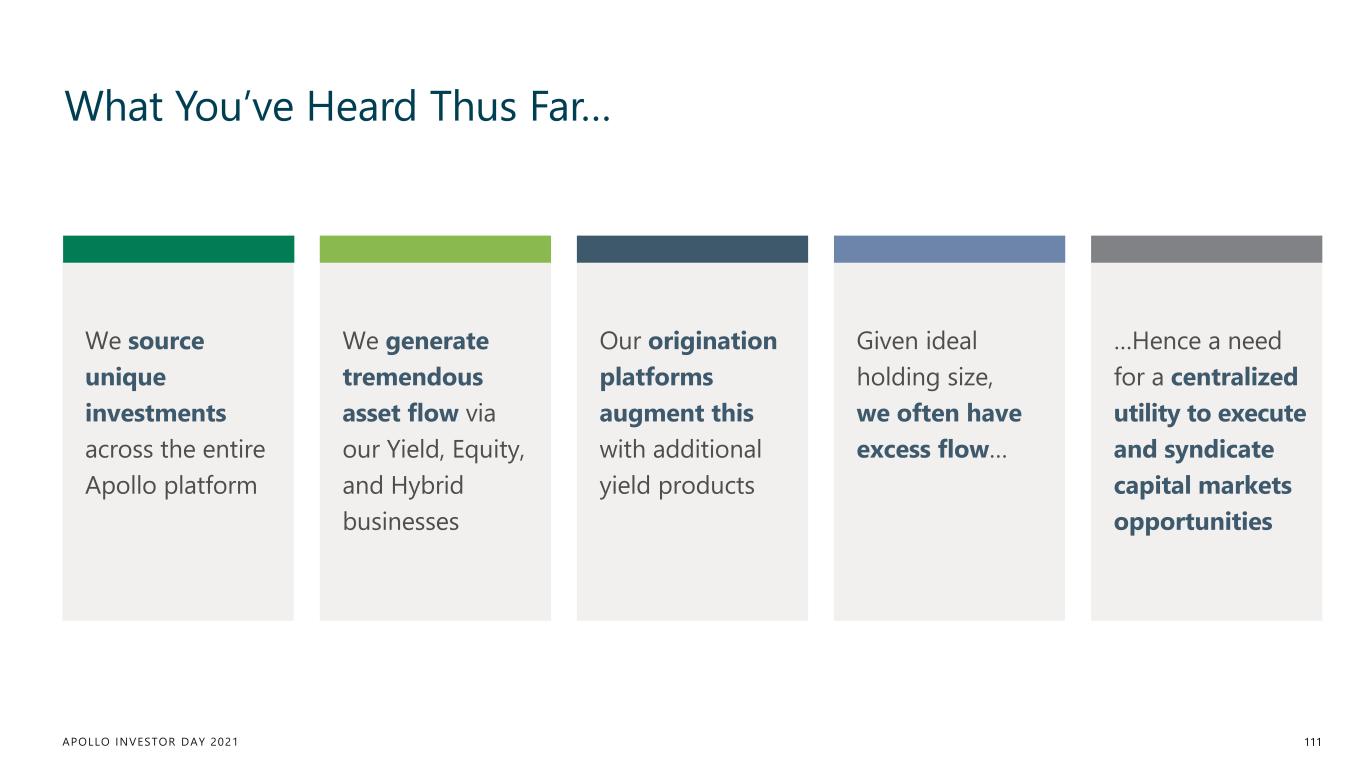

APOLLO INVESTOR DAY 2021 What You’ve Heard Thus Far… We source unique investments across the entire Apollo platform We generate tremendous asset flow via our Yield, Equity, and Hybrid businesses Our origination platforms augment this with additional yield products Given ideal holding size, we often have excess flow… …Hence a need for a centralized utility to execute and syndicate capital markets opportunities 111

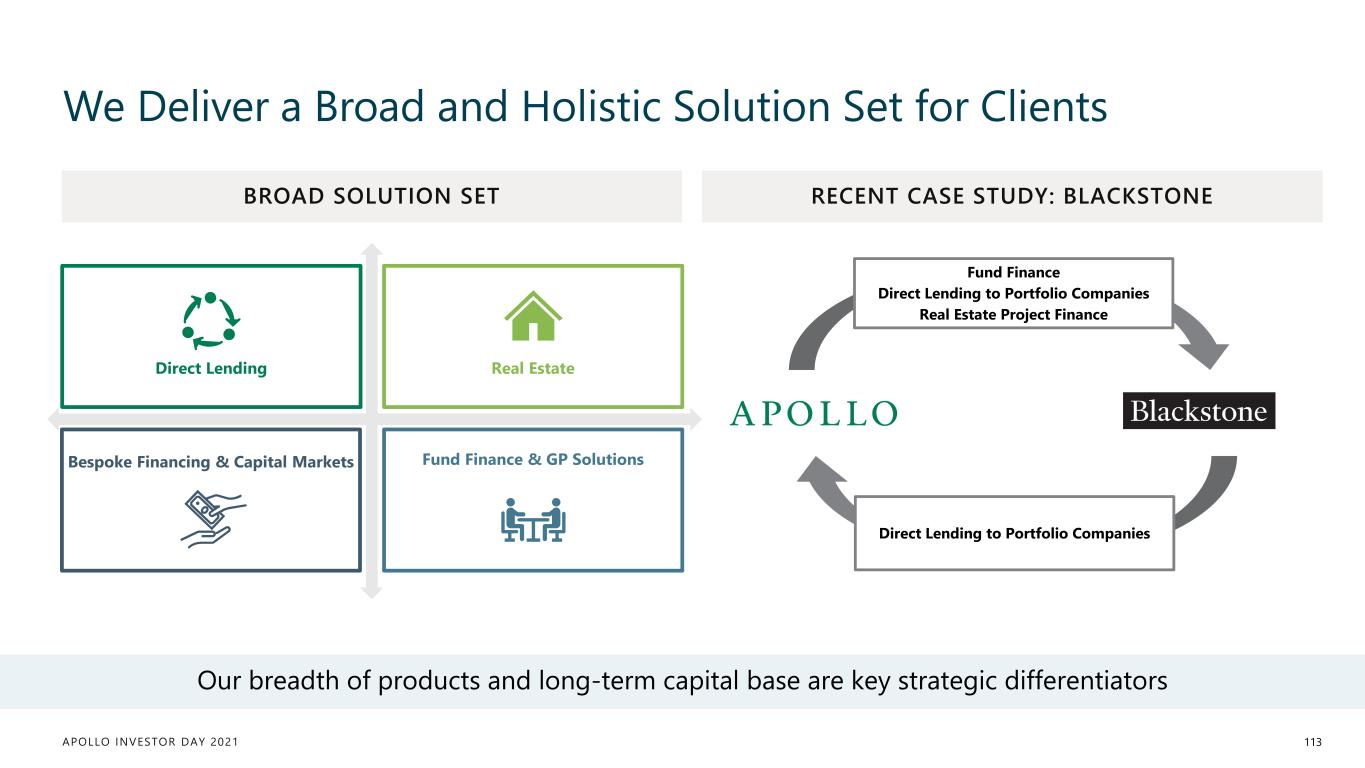

APOLLO INVESTOR DAY 2021 What is Apollo Capital Solutions? APOLLO CAPITAL SOLUTIONS (“ACS”) CAPITAL MARKETS Competitive pricing, flexible structuring, quick execution SYNDICATION Expand our investor reach, speak for greater volume ORIGINATION Directly originate more private transactions, provide flexible capital 112

APOLLO INVESTOR DAY 2021 Real Estate We Deliver a Broad and Holistic Solution Set for Clients Direct Lending Bespoke Financing & Capital Markets Fund Finance & GP Solutions BROAD SOLUTION SET RECENT CASE STUDY: BLACKSTONE Our breadth of products and long-term capital base are key strategic differentiators Fund Finance Direct Lending to Portfolio Companies Real Estate Project Finance Direct Lending to Portfolio Companies 113

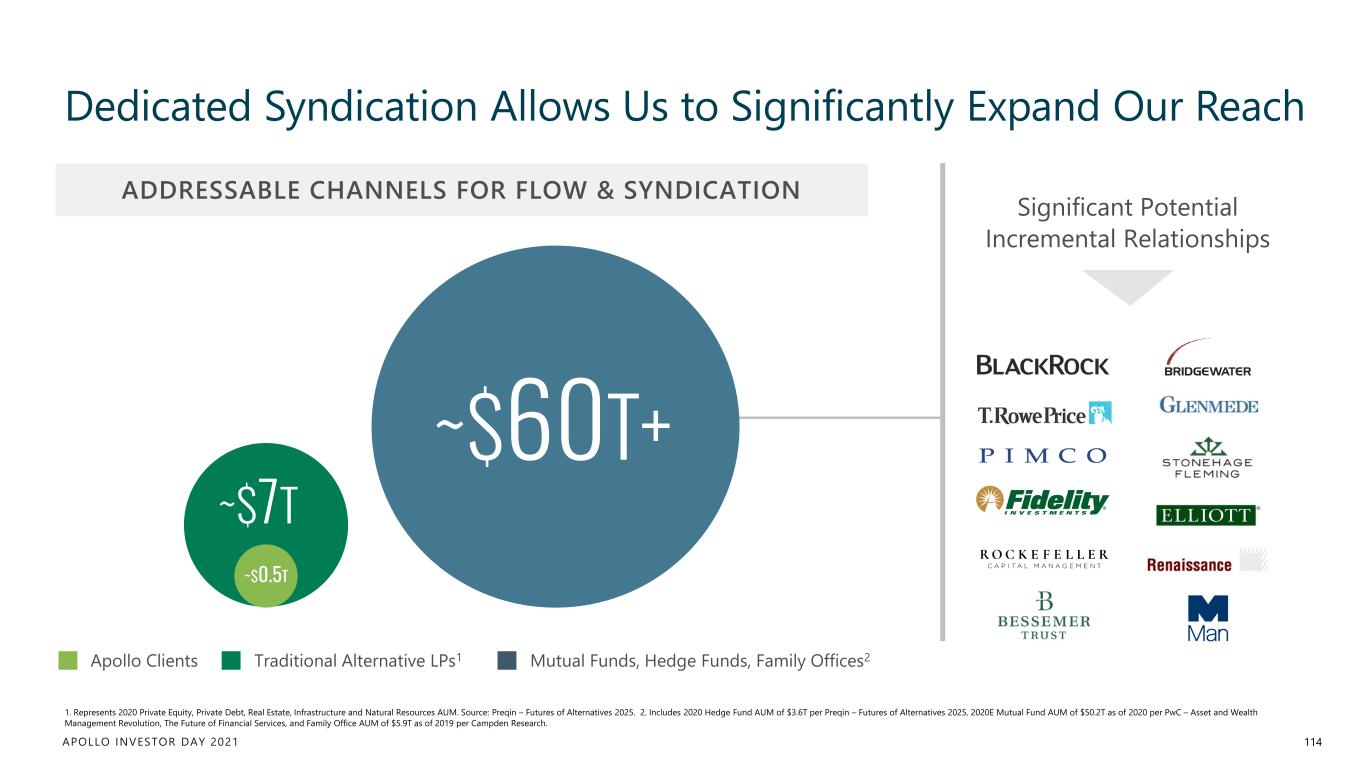

APOLLO INVESTOR DAY 2021 Dedicated Syndication Allows Us to Significantly Expand Our Reach ADDRESSABLE CHANNELS FOR FLOW & SYNDICATION 1. Represents 2020 Private Equity, Private Debt, Real Estate, Infrastructure and Natural Resources AUM. Source: Preqin – Futures of Alternatives 2025. 2. Includes 2020 Hedge Fund AUM of $3.6T per Preqin – Futures of Alternatives 2025, 2020E Mutual Fund AUM of $50.2T as of 2020 per PwC – Asset and Wealth Management Revolution, The Future of Financial Services, and Family Office AUM of $5.9T as of 2019 per Campden Research. Significant Potential Incremental Relationships Apollo Clients Traditional Alternative LPs1 Mutual Funds, Hedge Funds, Family Offices2 ~$60T+ ~$0.5T ~$7T 114

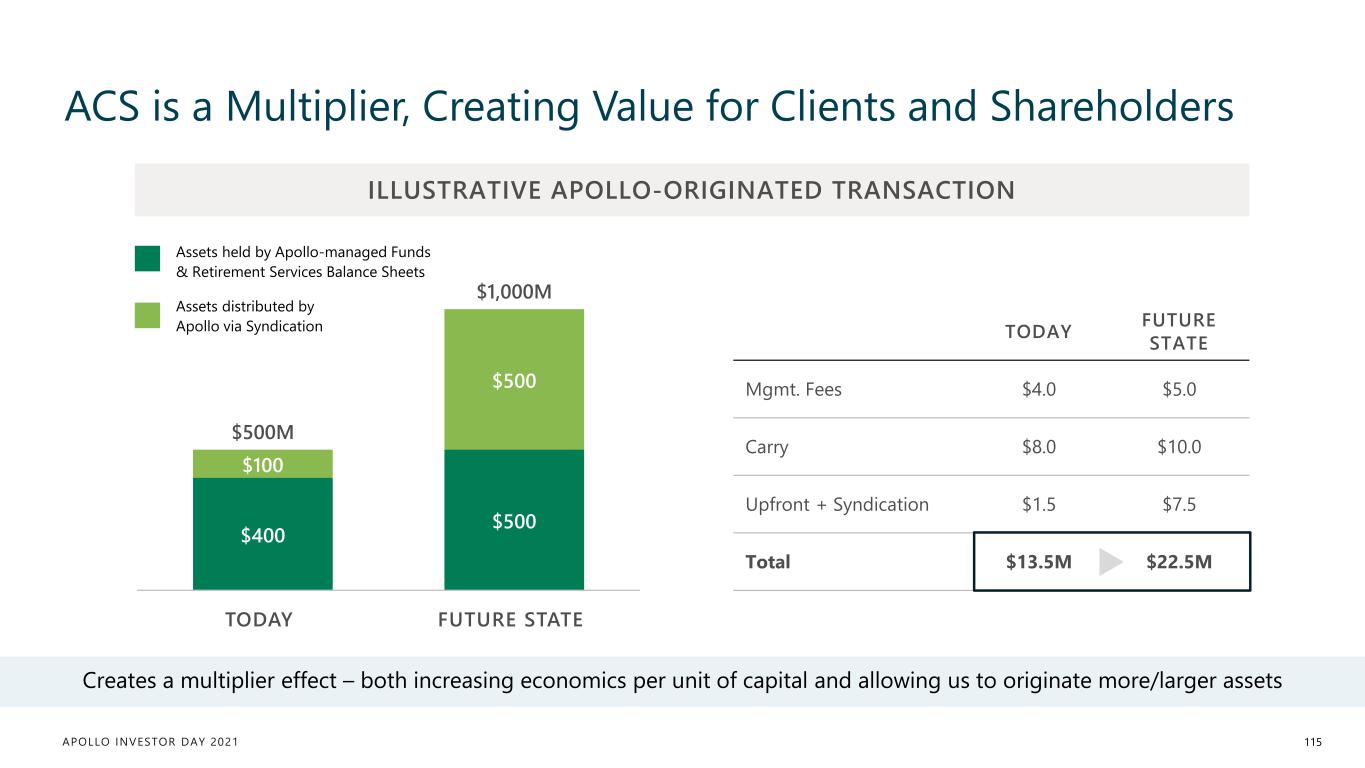

APOLLO INVESTOR DAY 2021 ACS is a Multiplier, Creating Value for Clients and Shareholders Assets distributed by Apollo via Syndication Assets held by Apollo-managed Funds & Retirement Services Balance Sheets $400 $500 $100 $500 $500M $1,000M TODAY FUTURE STATE TODAY FUTURE STATE Mgmt. Fees $4.0 $5.0 Carry $8.0 $10.0 Upfront + Syndication $1.5 $7.5 Total $13.5M $22.5M Creates a multiplier effect – both increasing economics per unit of capital and allowing us to originate more/larger assets ILLUSTRATIVE APOLLO-ORIGINATED TRANSACTION 115

APOLLO INVESTOR DAY 2021 Broad network of banks that value Apollo as a premier provider of long-term capital CAPITAL PARTNER OF CHOICE Benefit from being in both the “storage” and “moving” business – both buying and syndicating assets STRONG ORIGINATION Large retirement services capital generates demand for additional exposure and drive long-term alignment DIFFERENTIATED CAPITAL BASE 1,400+ strong, existing LP relationships, with significant room to expand our reach BROAD INVESTOR RELATIONSHIPS Apollo is the Perfect Home to Build This Business 116

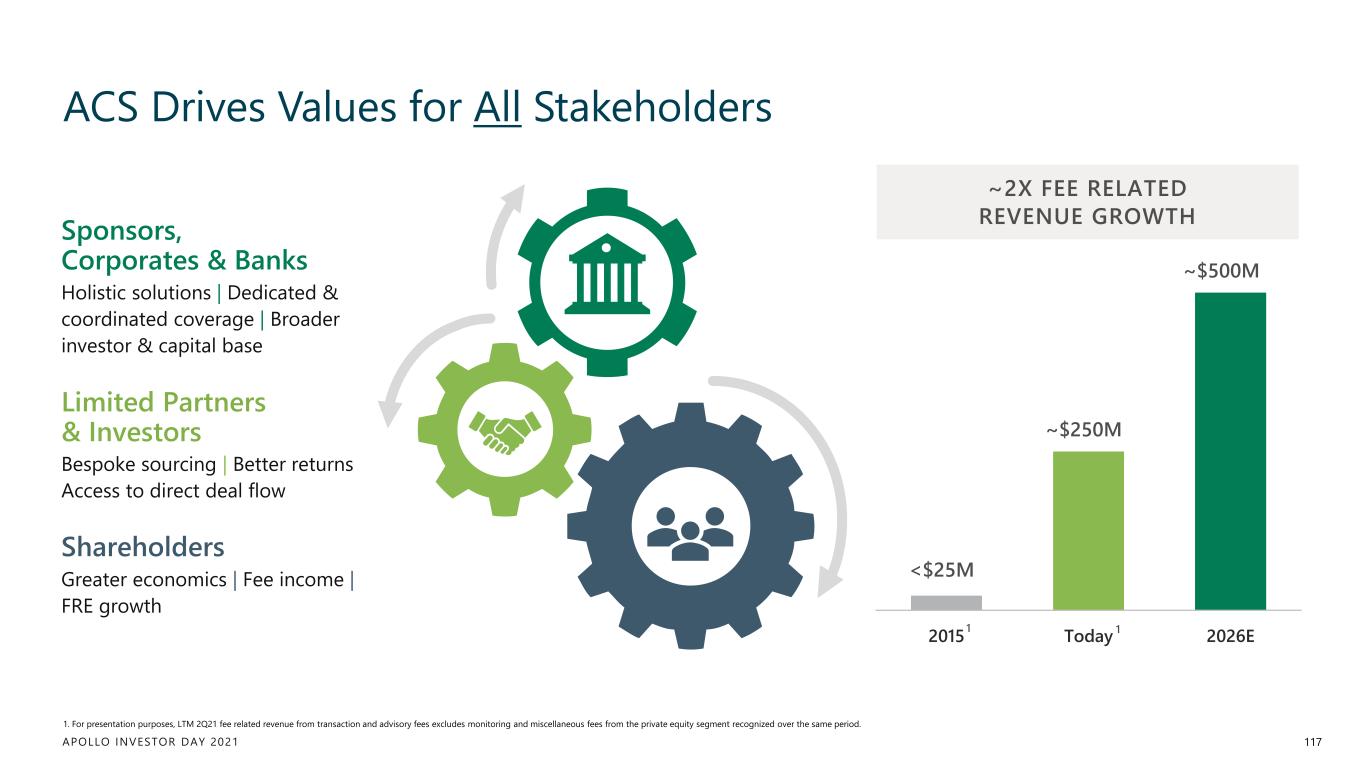

APOLLO INVESTOR DAY 2021 ACS Drives Values for All Stakeholders Holistic solutions | Dedicated & coordinated coverage | Broader investor & capital base Sponsors, Corporates & Banks 2015 Today 2026E ~$250M <$25M ~$500M Bespoke sourcing | Better returns Access to direct deal flow Limited Partners & Investors Greater economics | Fee income | FRE growth Shareholders ~2X FEE RELATED REVENUE GROWTH 1. For presentation purposes, LTM 2Q21 fee related revenue from transaction and advisory fees excludes monitoring and miscellaneous fees from the private equity segment recognized over the same period. 11 117

APOLLO INVESTOR DAY 2021 We Are Building ACS for the Future of Financial Markets More efficient Syndication to a larger investor pool TODAY THE FUTURE FinTech is already transforming access to products and funds. Direct deals will be the next frontier. Salesperson-intensive Syndication approach FINTECH 118

APOLLO INVESTOR DAY 2021 Key Takeaways for Apollo Capital Solutions Quality of our investments is the key to growth; originate strong assets and capital will quickly follow1 2 Dedicated syndication efforts connect our leading investment franchise with expansive capital pools 3 ACS creates a multiplier on Apollo’s existing business success, driving accelerated FRE growth and asset generation 119

APOLLO INVESTOR DAY 2021 Equity & Hybrid Overview SCOTT KLEINMAN Co-President

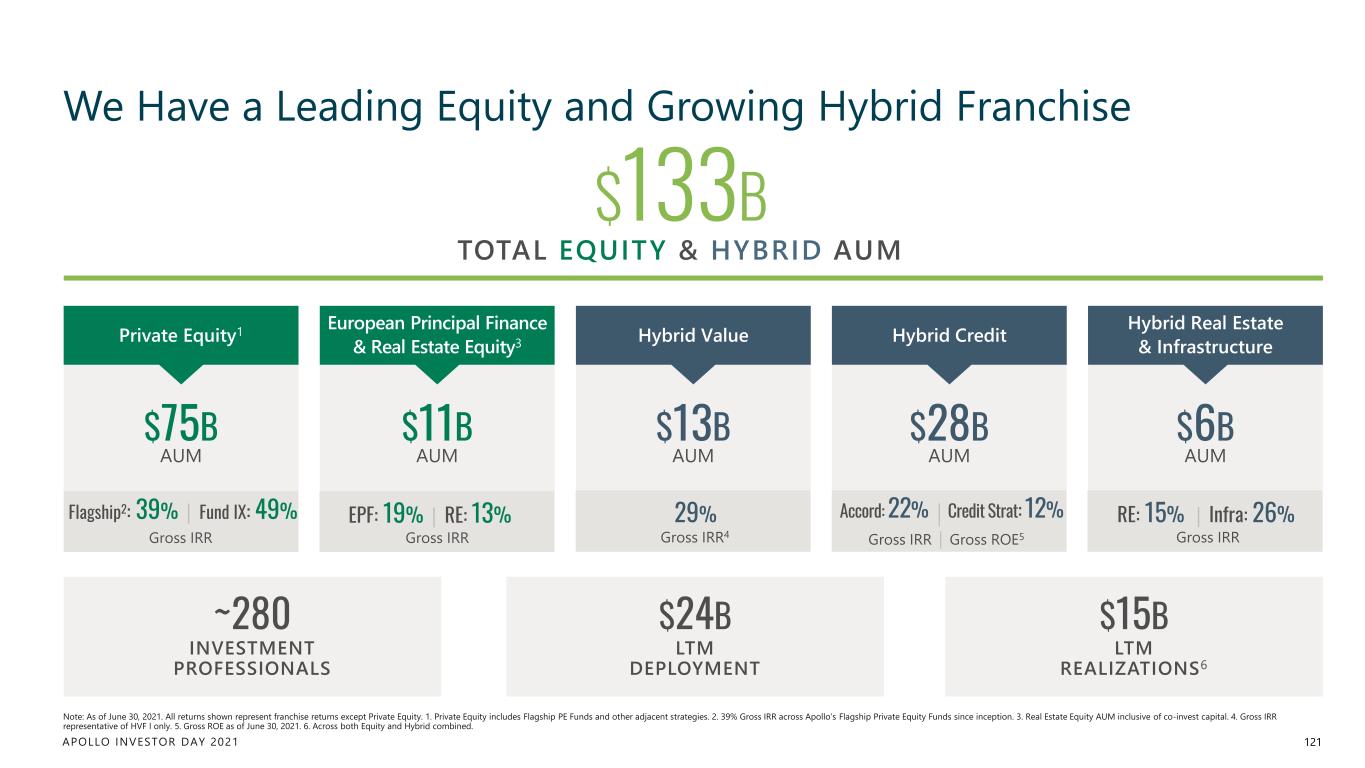

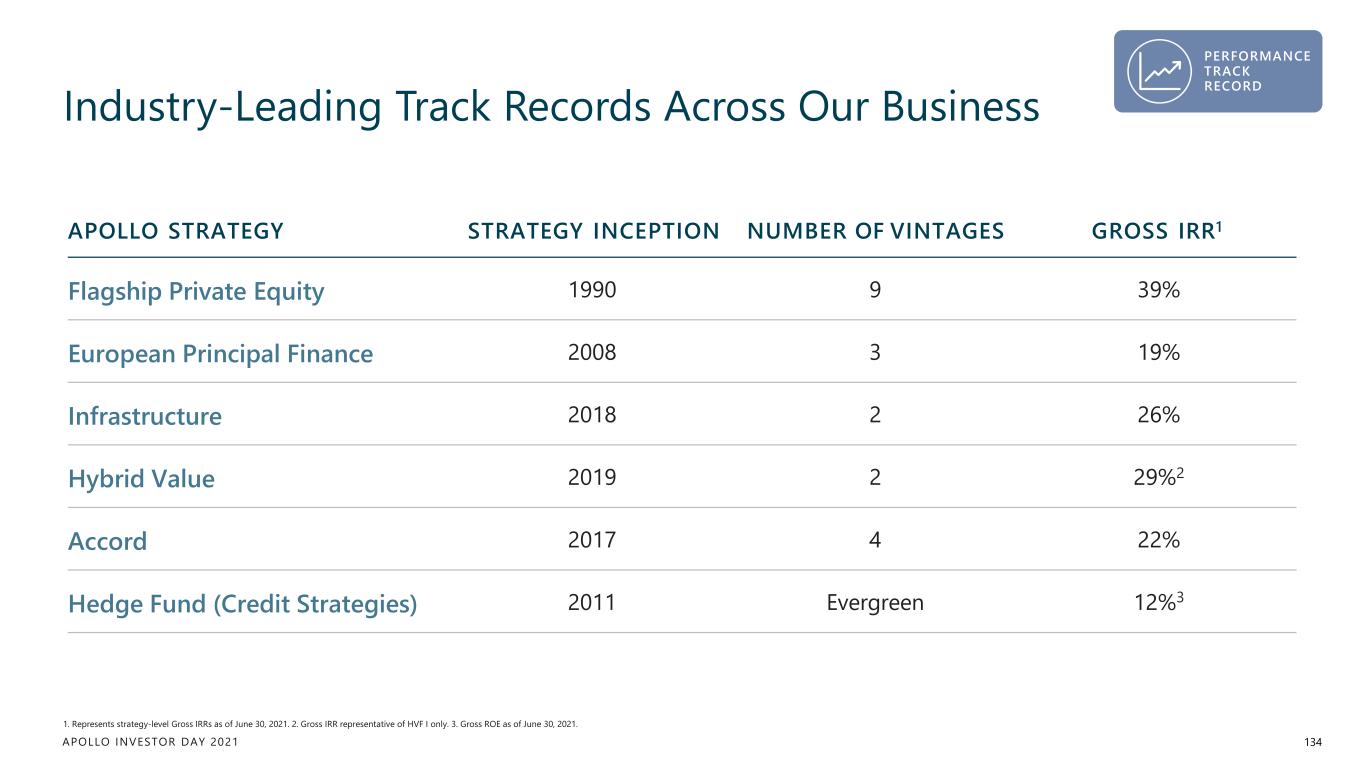

APOLLO INVESTOR DAY 2021 We Have a Leading Equity and Growing Hybrid Franchise 121 Note: As of June 30, 2021. All returns shown represent franchise returns except Private Equity. 1. Private Equity includes Flagship PE Funds and other adjacent strategies. 2. 39% Gross IRR across Apollo’s Flagship Private Equity Funds since inception. 3. Real Estate Equity AUM inclusive of co-invest capital. 4. Gross IRR representative of HVF I only. 5. Gross ROE as of June 30, 2021. 6. Across both Equity and Hybrid combined. $133B TOTAL EQUITY & HYBRID AUM ~280 INVESTMENT PROFESSIONALS $75B AUM Gross IRR Private Equity1 $11B AUM European Principal Finance & Real Estate Equity3 $13B AUM Hybrid Value $28B AUM Hybrid Credit $6B AUM Hybrid Real Estate & Infrastructure $24B LTM DEPLOYMENT $15B LTM REALIZATIONS6 EPF: 19% | RE: 13% Gross IRR 29% Gross IRR4 Gross IRR | Gross ROE5 Credit Strat: 12%Accord: 22% RE: 15% | Infra: 26% Gross IRR Flagship2: 39% | Fund IX: 49%

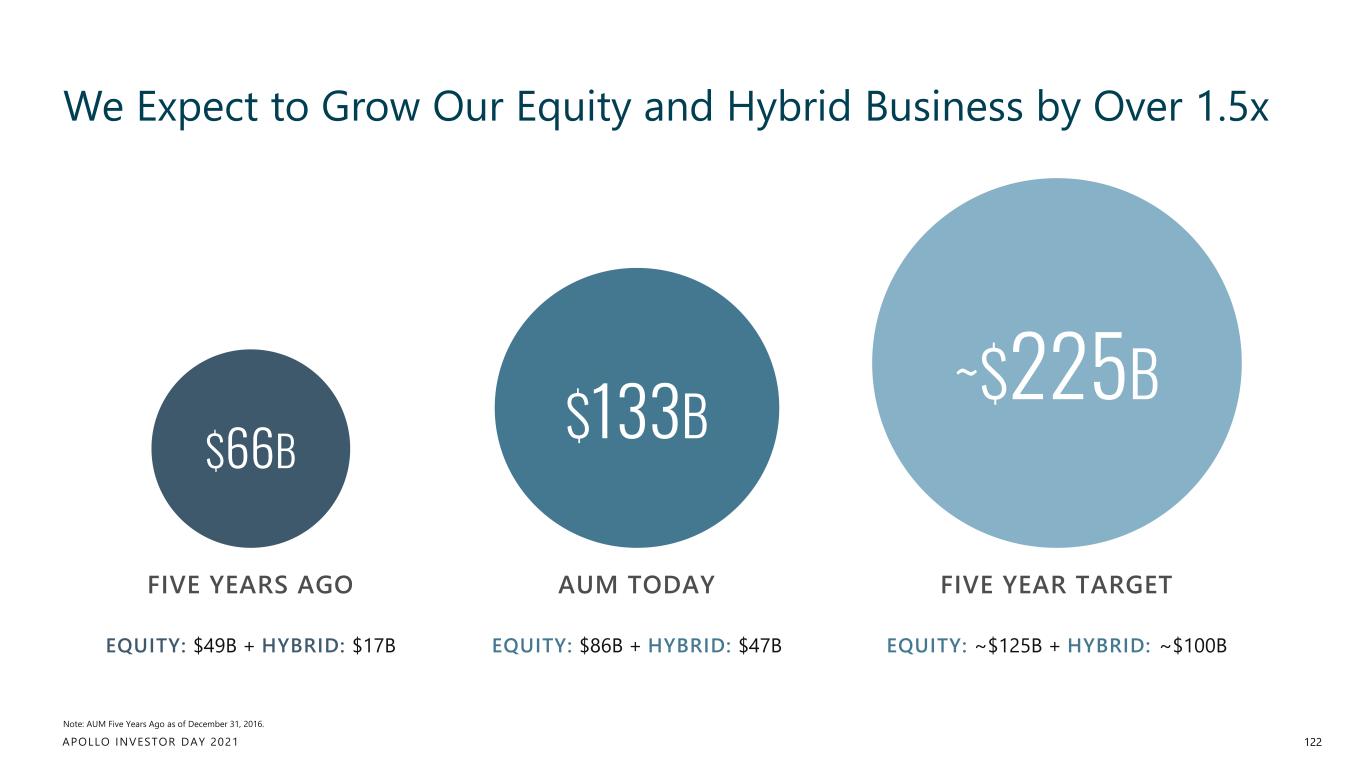

APOLLO INVESTOR DAY 2021 We Expect to Grow Our Equity and Hybrid Business by Over 1.5x 122 Note: AUM Five Years Ago as of December 31, 2016. EQUITY: $86B + HYBRID: $47B EQUITY: ~$125B + HYBRID: ~$100B EQUITY: $49B + HYBRID: $17B FIVE YEARS AGO $66B AUM TODAY $133B FIVE YEAR TARGET ~$225B

APOLLO INVESTOR DAY 2021 We Have an Industry-leading Equity Franchise, Powered by Flagship Private Equity 123 30+ YEAR PE TRACK RECORD OF OUTPERFORMANCE PROVEN SOURCING MODEL ACCELERATING REALIZATIONS $15B Gross Fund IX capital committed since Q1’20 >2X Expected Gross MOIC on Fund VIII and IX Note: As of June 30, 2021. 39% Gross IRR across Apollo’s Flagship Private Equity Funds since inception. $14B Expected to be returned to LPs over the next 1-2 years Gross IRR since inception 39% We’re expecting to launch Fund X in 2022

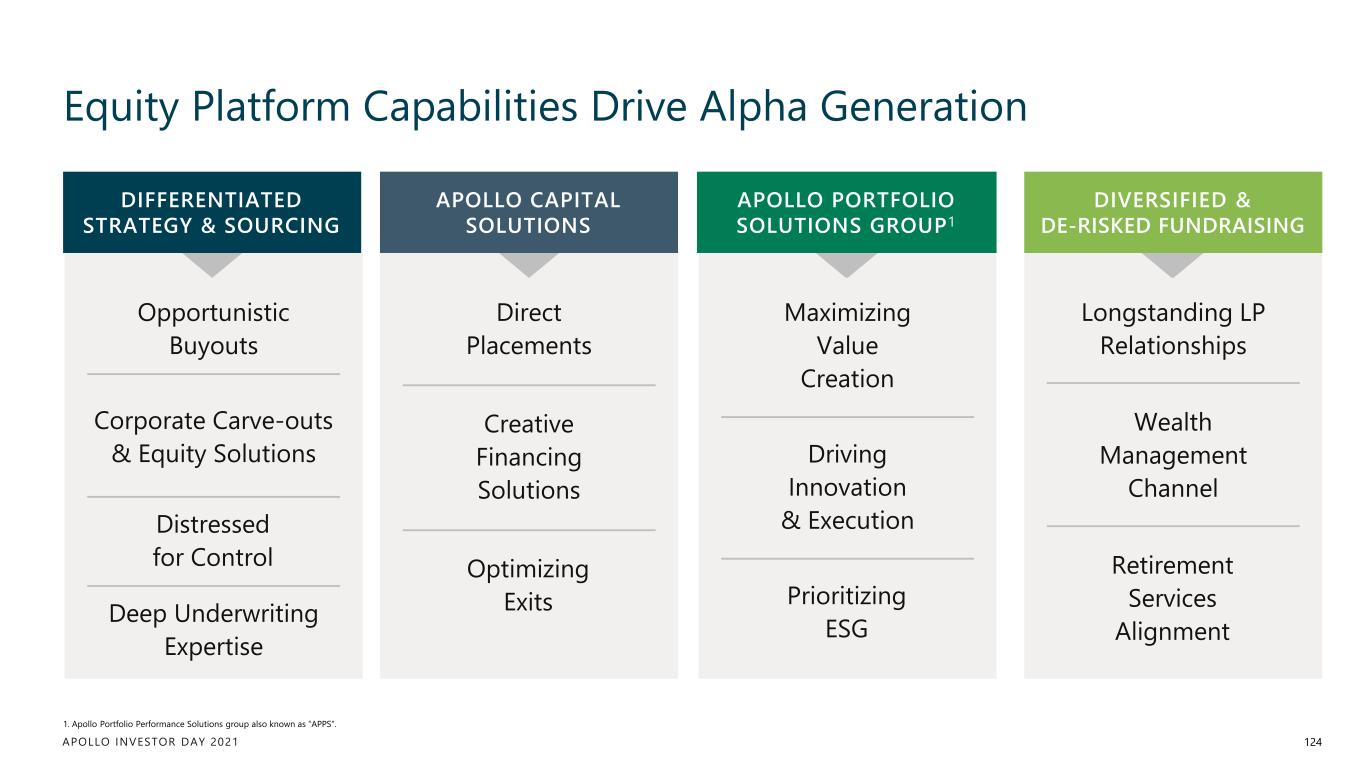

APOLLO INVESTOR DAY 2021 Equity Platform Capabilities Drive Alpha Generation 124 1. Apollo Portfolio Performance Solutions group also known as “APPS”. Direct Placements Creative Financing Solutions Optimizing Exits APOLLO CAPITAL SOLUTIONS Maximizing Value Creation Driving Innovation & Execution Prioritizing ESG APOLLO PORTFOLIO SOLUTIONS GROUP1 Longstanding LP Relationships Wealth Management Channel Retirement Services Alignment DIVERSIFIED & DE-RISKED FUNDRAISING DIFFERENTIATED STRATEGY & SOURCING Opportunistic Buyouts Corporate Carve-outs & Equity Solutions Distressed for Control Deep Underwriting Expertise

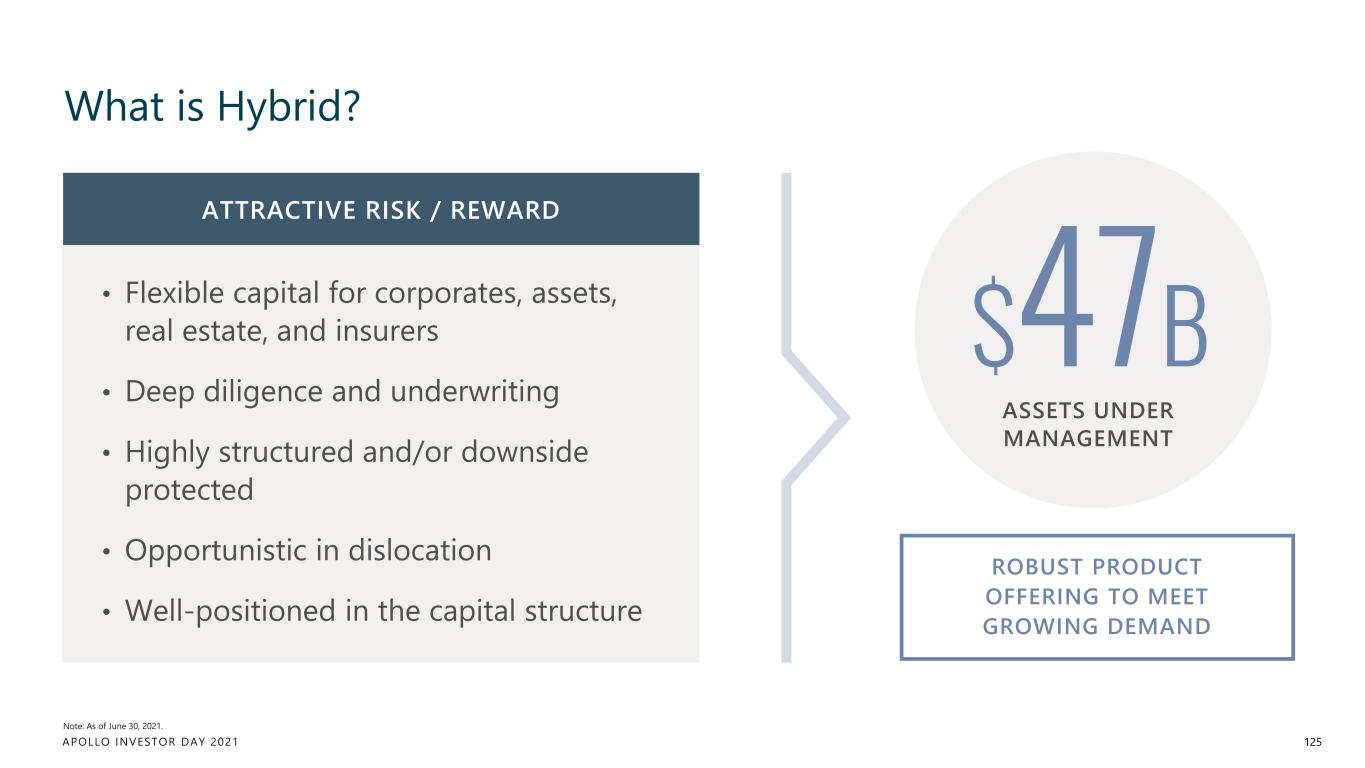

APOLLO INVESTOR DAY 2021 What is Hybrid? 125 ATTRACTIVE RISK / REWARD • Flexible capital for corporates, assets, real estate, and insurers • Deep diligence and underwriting • Highly structured and/or downside protected • Opportunistic in dislocation • Well-positioned in the capital structure ROBUST PRODUCT OFFERING TO MEET GROWING DEMAND $47B ASSETS UNDER MANAGEMENT Note: As of June 30, 2021.

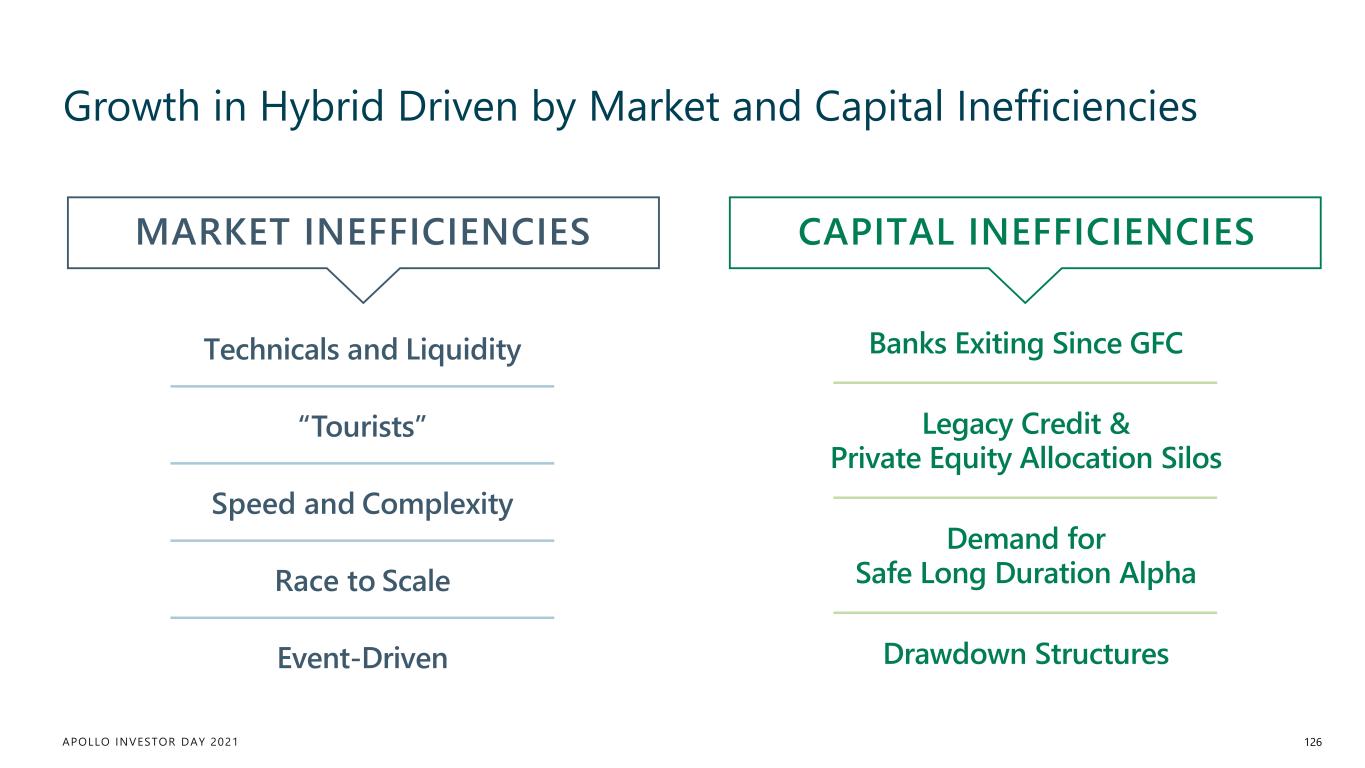

APOLLO INVESTOR DAY 2021 Growth in Hybrid Driven by Market and Capital Inefficiencies 126 Speed and Complexity Drawdown Structures Race to Scale Event-Driven “Tourists” Banks Exiting Since GFCTechnicals and Liquidity Legacy Credit & Private Equity Allocation Silos Demand for Safe Long Duration Alpha CAPITAL INEFFICIENCIESMARKET INEFFICIENCIES

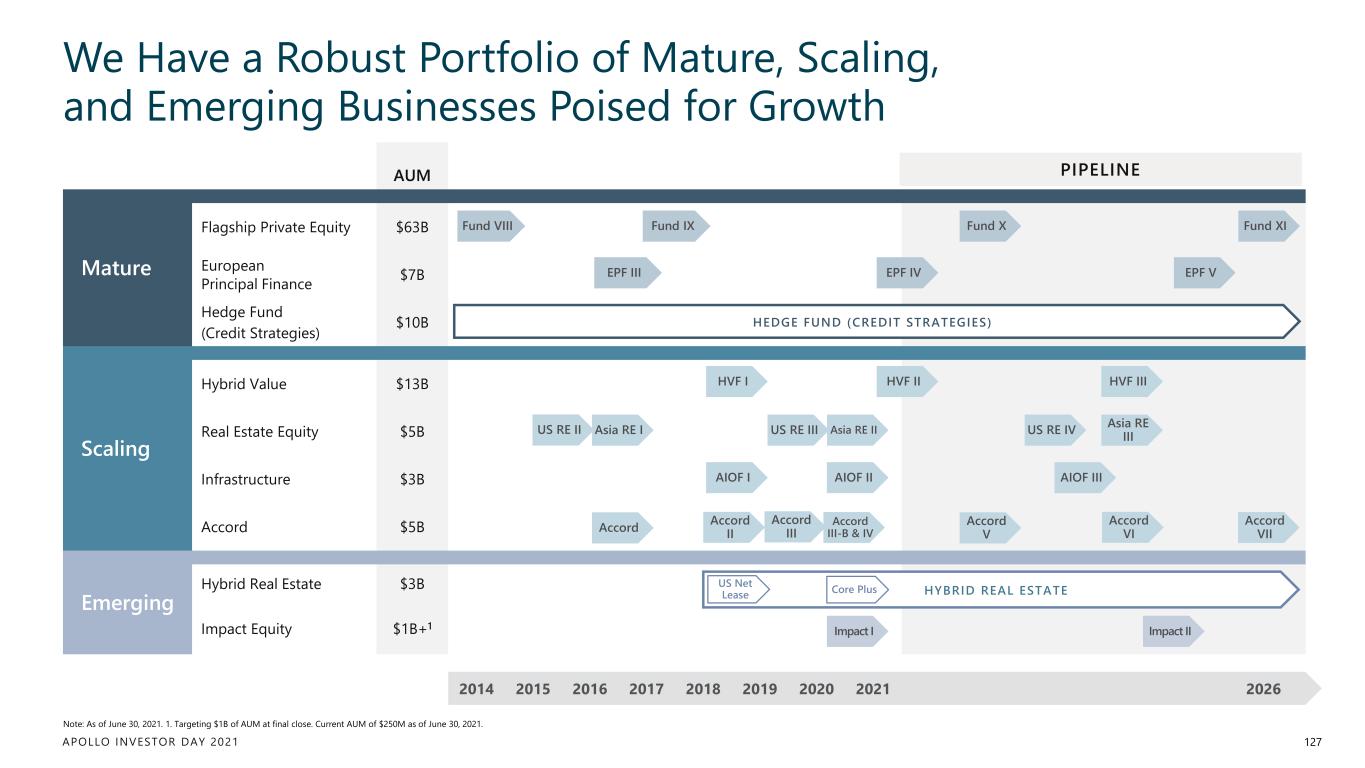

APOLLO INVESTOR DAY 2021 PIPELINE We Have a Robust Portfolio of Mature, Scaling, and Emerging Businesses Poised for Growth 127 Note: As of June 30, 2021. 1. Targeting $1B of AUM at final close. Current AUM of $250M as of June 30, 2021. AUM Mature Flagship Private Equity $63B European Principal Finance $7B Hedge Fund (Credit Strategies) $10B Scaling Hybrid Value $13B Real Estate Equity $5B Infrastructure $3B Accord $5B Emerging Hybrid Real Estate $3B Impact Equity $1B+1 2014 2015 2016 2017 2018 2019 2020 2021 2026 Impact I Impact II HEDGE FUND (CREDIT STRATEGIES) HVF I HVF II HVF III US RE II Asia RE I US RE III Asia RE II US RE IV Asia RE III AIOF I AIOF II AIOF III Accord V Accord VII Accord VIAccord Accord III-B & IV Accord II Accord III HYBRID REAL ESTATE Core PlusUS Net Lease Fund IX Fund X Fund XI EPF VEPF IVEPF III Fund VIII

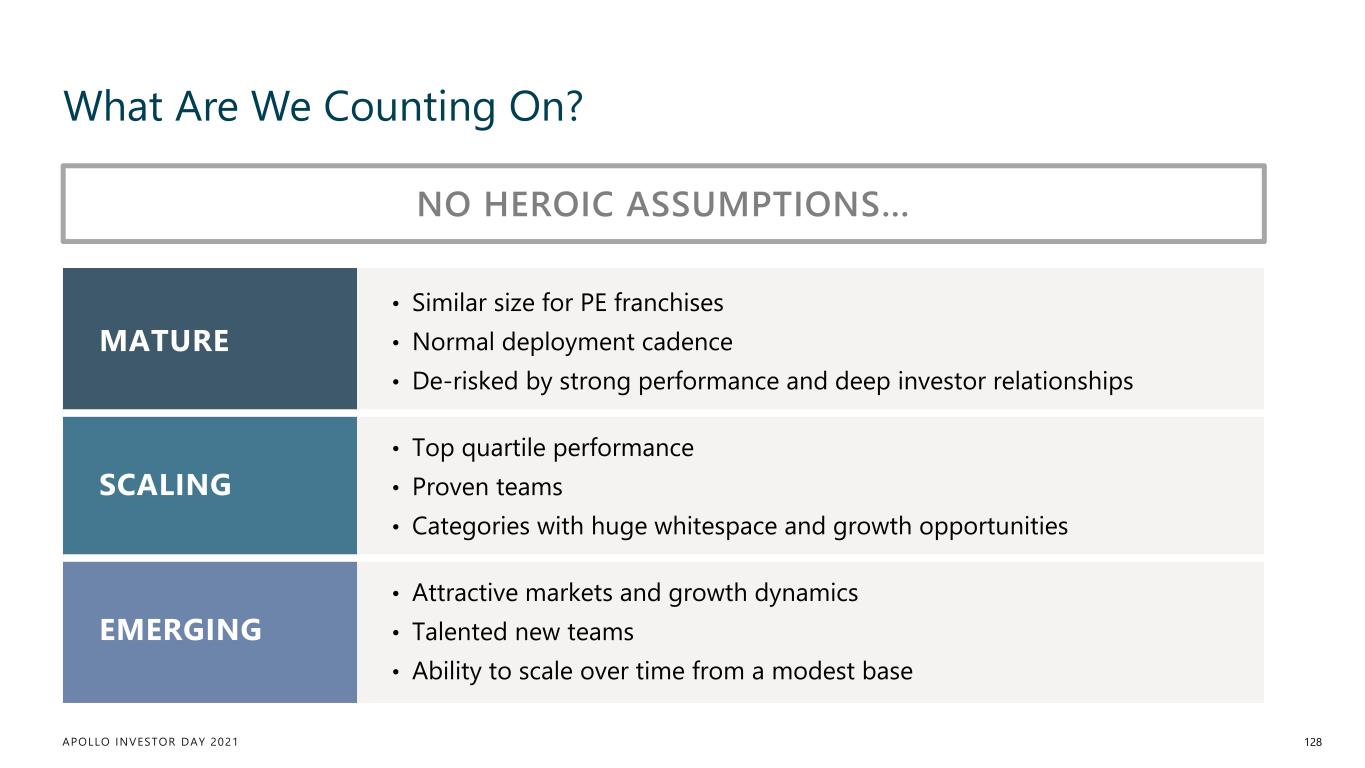

APOLLO INVESTOR DAY 2021 128 What Are We Counting On? MATURE • Similar size for PE franchises • Normal deployment cadence • De-risked by strong performance and deep investor relationships SCALING • Top quartile performance • Proven teams • Categories with huge whitespace and growth opportunities EMERGING • Attractive markets and growth dynamics • Talented new teams • Ability to scale over time from a modest base NO HEROIC ASSUMPTIONS…

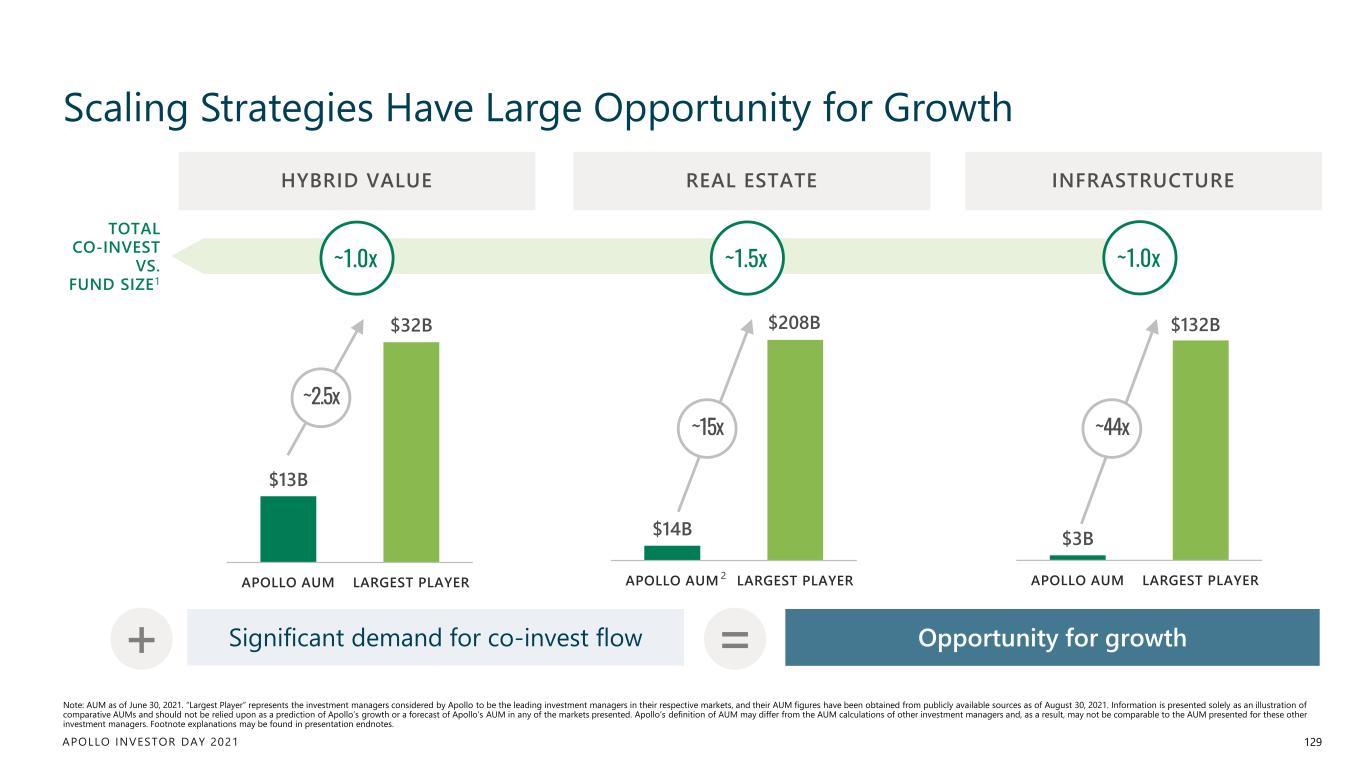

APOLLO INVESTOR DAY 2021 Scaling Strategies Have Large Opportunity for Growth 129 $13B $32B APOLLO AUM LARGEST PLAYER $14B $208B APOLLO AUM LARGEST PLAYER $3B $132B APOLLO AUM LARGEST PLAYER HYBRID VALUE REAL ESTATE INFRASTRUCTURE Significant demand for co-invest flow Opportunity for growth ~2.5x Note: AUM as of June 30, 2021. “Largest Player” represents the investment managers considered by Apollo to be the leading investment managers in their respective markets, and their AUM figures have been obtained from publicly available sources as of August 30, 2021. Information is presented solely as an illustration of comparative AUMs and should not be relied upon as a prediction of Apollo’s growth or a forecast of Apollo’s AUM in any of the markets presented. Apollo’s definition of AUM may differ from the AUM calculations of other investment managers and, as a result, may not be comparable to the AUM presented for these other investment managers. Footnote explanations may be found in presentation endnotes. ~15x TOTAL CO-INVEST VS. FUND SIZE1 ~1.0x ~1.5x ~1.0x ~44x 2 + =

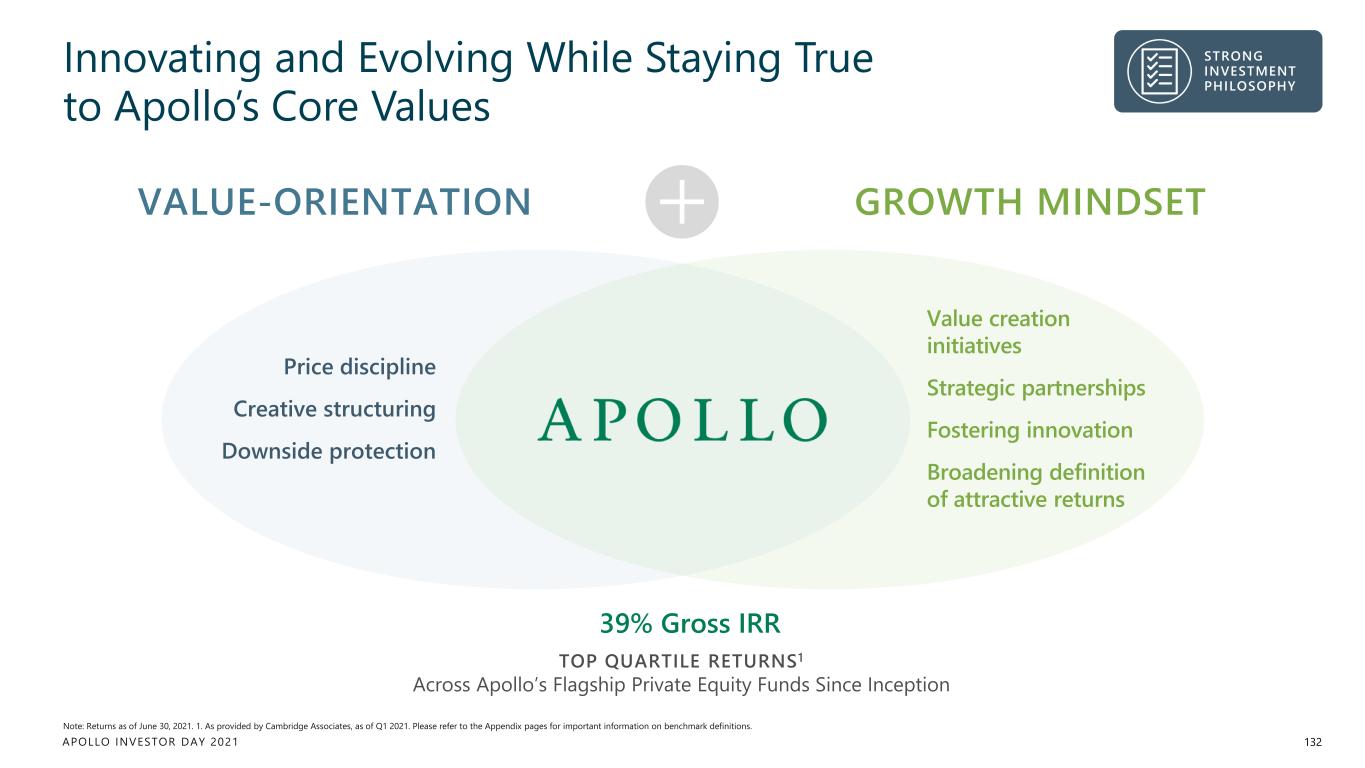

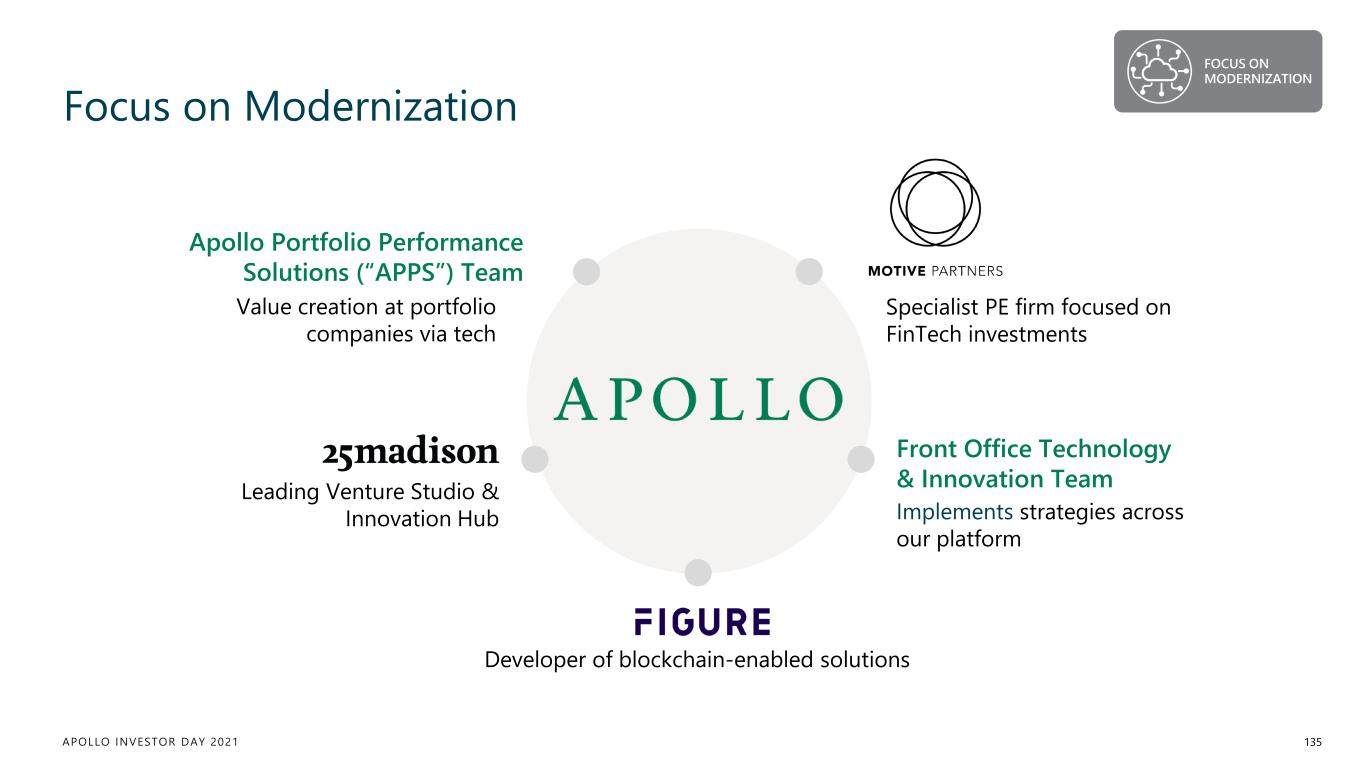

APOLLO INVESTOR DAY 2021 We Have De-Risked Our Ability to Scale Rapidly and Successfully 130 PROVEN PLATFORM ENSURES SUCCESS BEST-IN-CLASS TEAM STRONG INVESTMENT PHILOSOPHY PERFORMANCE TRACK RECORD FOCUS ON MODERNIZATION

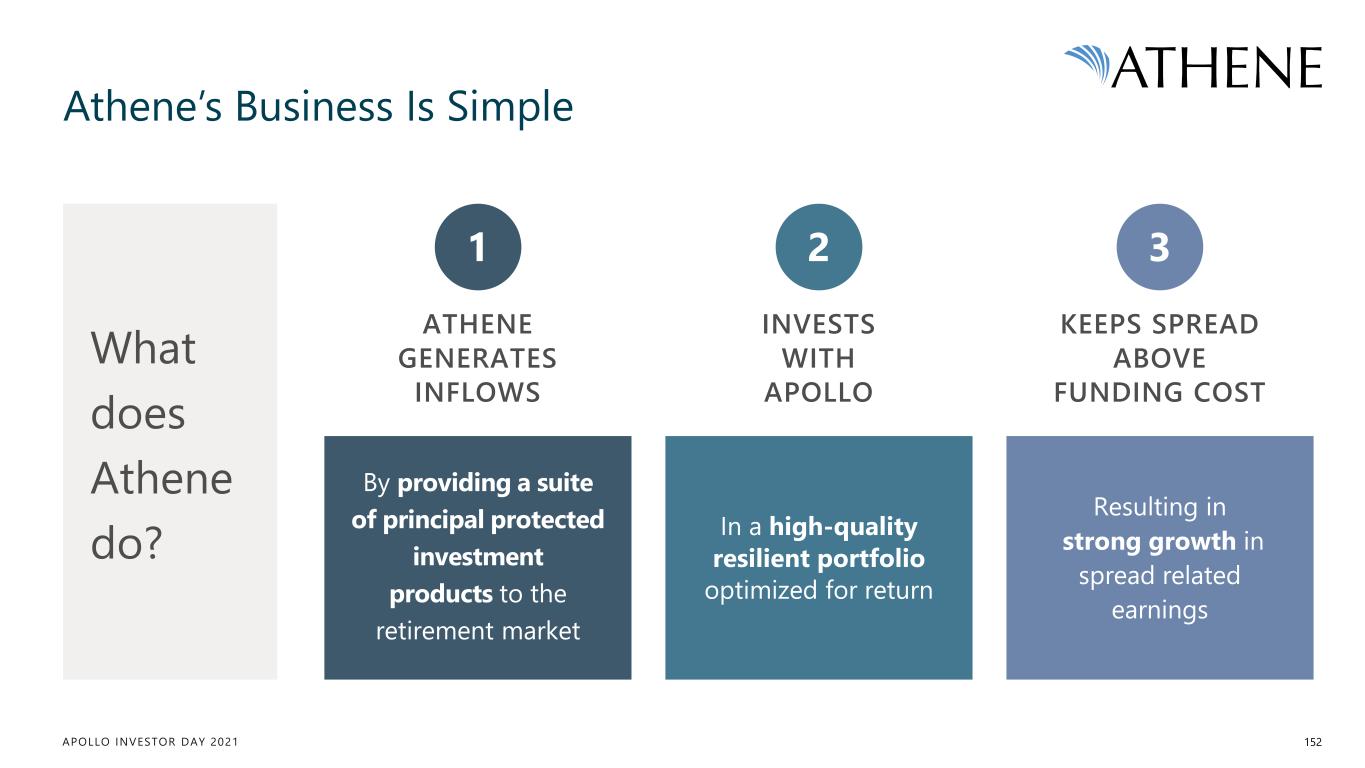

APOLLO INVESTOR DAY 2021 Best-in-class Team 131 STRONG SENIOR LEADERSHIP WITH 22 YEARS AVERAGE INDUSTRY EXPERIENCE, ~50% AT APOLLO Hybrid LeadershipEquity Leadership DEEP BENCH OF TALENT SUPPORTED BY ~280 INVESTMENT PROFESSIONALS JAMSHID EHSANI Head of Principal Structured Finance MATT MICHELINI Co-Head of Hybrid Value & Head of Asia Pacific ROB RUBERTON Co-Head of Hybrid Value MATT NORD Co-Head, PE DAVID SAMBUR Co-Head, PE SKARDON BAKER Head of EPF PHILIP MINTZ CIO US & Asia Real Estate Equity DYLAN FOO Co-Head of Infra GEOFF STRONG Co-Head of Infra / NR OLIVIA WASSENAAR Co-Head of NR MARC BECKER Co-Head of Impact JOANNA REISS Co-Head of Impact ANTOINE MUNFAKH Senior Partner, Private Equity MONTA OZOLINA Principal, Private Equity TRACY VO Principal, Private Equity TRACEY GAMBLE Managing Director, Real Estate Private Equity PHILIP GREUTER Principal, Private Equity, London JOHN ZITO Deputy CIO, Credit FINANCE AARON MILLER Head of APPS1 1. Apollo Portfolio Performance Solutions Team. BEST-IN- CLASS TEAM