EX-99.1

Published on May 9, 2024

Athene Fixed Income Investor Presentation May 2024

Disclaimer This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security of Athene Holding Ltd. (“AHL” or “Athene”). This presentation is not intended to constitute a solicitation of any insurance policy or contract or application therefor. Unless the context requires otherwise, references in this presentation to “Apollo" and "AGM" refer to Apollo Global Management, Inc., together with its subsidiaries, references in this presentation to "AGM HoldCo" refer to Apollo Global Management, Inc., and references in this presentation to “AAM” refer to Apollo Asset Management, Inc., a subsidiary of Apollo Global Management, Inc. This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks, uncertainties and assumptions that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, benefits to be derived from Athene's capital allocation decisions; the anticipated performance of Athene's portfolio in certain stress or recessionary environments; the performance of Athene's business; general economic conditions; expected future operating results; Athene's liquidity and capital resources; and other non-historical statements. Although Athene management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. For a discussion of other risks and uncertainties related to Athene's forward-looking statements, see its annual report on Form 10-K for the year ended December 31, 2023 and quarterly report on Form 10-Q filed for the period ended March 31, 2024, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Athene adopted the US GAAP accounting standard related to Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI) as of January 1, 2023, which required Athene to apply the new standard retrospectively back to January 1, 2022, the date of Athene’s merger with AGM. Certain 2022 US GAAP financial metrics and disclosures in this presentation have been retrospectively adjusted in accordance with the requirements of the adoption guidance of LDTI. Please refer to the discussion of Non-GAAP Measures and Definitions herein for additional information on items that are excluded from Athene’s non-GAAP measure of spread related earnings, which was retrospectively adjusted in accordance with the requirements of the adoption guidance of LDTI. Information contained herein may include information respecting prior performance of Athene. Information respecting prior performance, while a useful tool, is not necessarily indicative of actual results to be achieved in the future, which is dependent upon many factors, many of which are beyond Athene's control. The information contained herein is not a guarantee of future performance by Athene, and actual outcomes and results may differ materially from any historic, pro forma or projected financial results indicated herein. Certain of the financial information contained herein is unaudited or based on the application of non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. Furthermore, certain financial information is based on estimates of management. These estimates, which are based on the reasonable expectations of management, are subject to change and there can be no assurance that they will prove to be correct. The information contained herein does not purport to be all-inclusive or contain all information that an evaluator may require in order to properly evaluate the business, prospects or value of Athene. Athene does not have any obligation to update this presentation and the information may change at any time without notice. Models that may be contained herein (the “Models”) are being provided for illustrative and discussion purposes only and are not intended to forecast or predict future events. Information provided in the Models may not reflect the most current data and is subject to change. The Models are based on estimates and assumptions that are also subject to change and may be subject to significant business, economic and competitive uncertainties, including numerous uncontrollable market and event driven situations. There is no guarantee that the information presented in the Models is accurate. Actual results may differ materially from those reflected and contemplated in such hypothetical, forward- looking information. Undue reliance should not be placed on such information and investors should not use the Models to make investment decisions. Athene has no duty to update the Models in the future. Certain of the information used in preparing this presentation was obtained from third parties or public sources. No representation or warranty, express or implied, is made or given by or on behalf of Athene or any other person as to the accuracy, completeness or fairness of such information, and no responsibility or liability is accepted for any such information. The contents of any website referenced in this presentation are not incorporated by reference and only speak as of the date listed thereon. This document is not intended to be, nor should it be construed or used as, financial, legal, tax, insurance or investment advice. There can be no assurance that Athene will achieve its objectives. Past performance is not indicative of future success. All information is as of the dates indicated herein. 2

3 Key Credit Highlights Indicate Winning Strategy Remains the Same ASSET PORTFOLIO IS HIGH-QUALITY AND GENERATES SAFE INVESTMENT GRADE YIELD Athene has consistently delivered strong net spread generation with lower credit losses versus peers 3 ATHENE HAS BUILT A FORTRESS BALANCE SHEET Highly-rated and conservatively managed balance sheet with ample liquidity and no legacy liability issues 2 5 ATHENE IS THE MARKET LEADER IN RETIREMENT SERVICES Demonstrated ability to source stable, low-cost, long-dated funding across multiple organic business channels 1 FULL ALIGNMENT WITH APOLLO PROVIDES DIFFERENTIATED ACCESS TO THIRD-PARTY CAPITAL Innovative ADIP1 sidecar strategy provides on-demand equity capital to help fund growth 4 GOVERNANCE AND RISK CONTROLS ARE DEEPLY EMBEDDED IN THE BUSINESS Athene provides industry-leading disclosure around its balance sheet, investment, and risk management philosophies 1. Refers to Apollo/Athene Dedicated Investment Program (ADIP I) and Apollo/Athene Dedicated Investment Program II (ADIP II), collectively.

4 Athene has a Distinct Credit Profile Within Apollo $671 billion Assets Under Management ~$23 billion Regulatory Capital2 A+ from S&P, Fitch; A1 from Moody’s; A from AM Best3 ASSET MANAGEMENT RETIREMENT SERVICES 4,900+ Employees Globally Solutions across the alternative risk spectrum Separate capital structure which issues senior debt, subordinated debt and preferred stock Separate SEC filer with dedicated annual and quarterly disclosure via IR website: CLICK HERE Separate Board of Directors with conflicts committee and a majority of Independent Directors Continuity of established, tenured management A from S&P; A from Fitch; A2 from Moody’s As of March 31, 2024, unless otherwise noted. Please refer to the appendix of this presentation for the definition of Assets Under Management. 1. As of May 1, 2024. 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. Excludes capital from noncontrolling interests. 3. Financial strength ratings for primary insurance subsidiaries. Financial Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. $61 billion Market Capitalization1

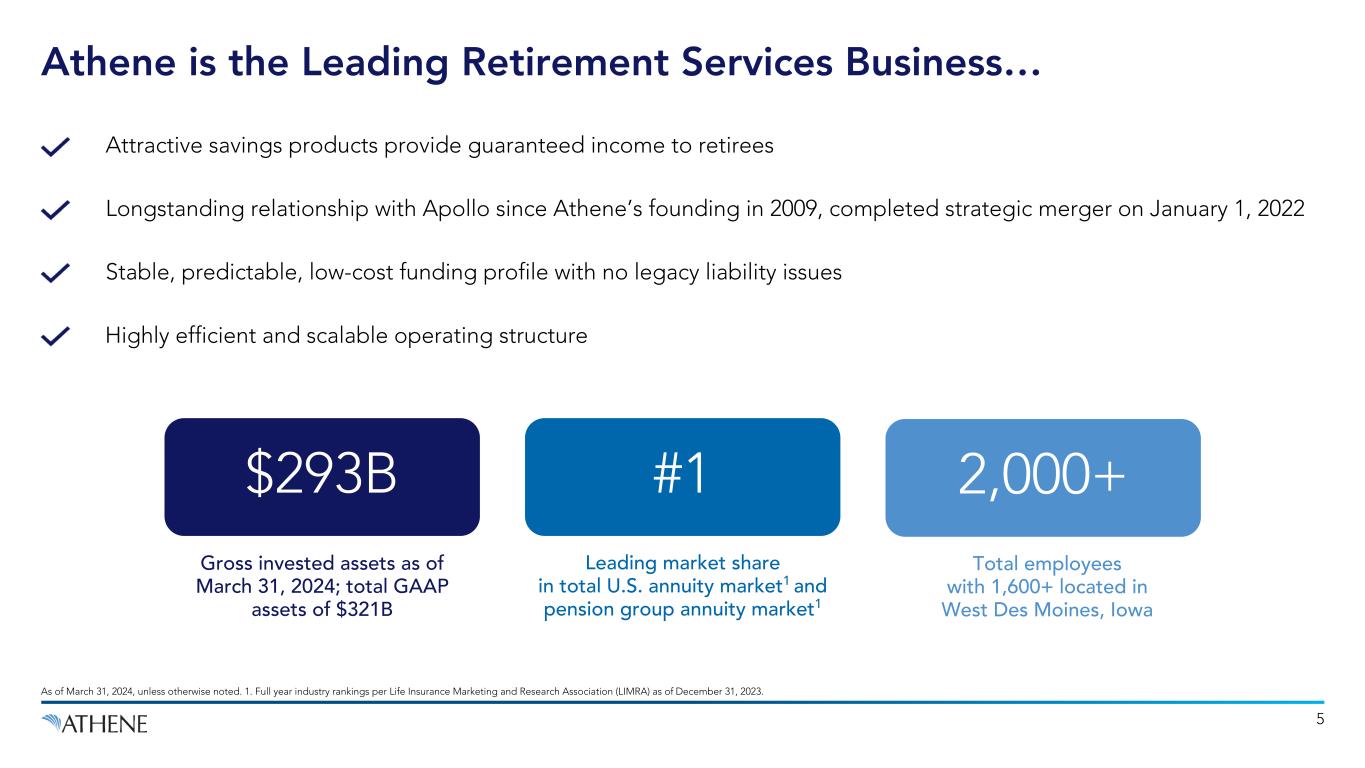

5 Athene is the Leading Retirement Services Business… As of March 31, 2024, unless otherwise noted. 1. Full year industry rankings per Life Insurance Marketing and Research Association (LIMRA) as of December 31, 2023. Attractive savings products provide guaranteed income to retirees Stable, predictable, low-cost funding profile with no legacy liability issues Longstanding relationship with Apollo since Athene’s founding in 2009, completed strategic merger on January 1, 2022 Highly efficient and scalable operating structure Total employees with 1,600+ located in West Des Moines, Iowa 2,000+ Leading market share in total U.S. annuity market1 and pension group annuity market1 #1 Gross invested assets as of March 31, 2024; total GAAP assets of $321B $293B

$3 $4 $9 $11 $13 $18 $28 $37 $48 $63 $20 3 3 5 5 7 7 8 9 21 35 10 4 2 4 6 2 6 11 2 2 3 6 6 14 11 10 3 8 12 10 7 8 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1Q’24 6 …Which Has Diligently Built Diversified Organic Growth Capabilities 1. LIMRA full year data as of December 31, 2023. 2. Source Morgan Stanley. Funding agreements are comprised of funding agreements issued under our Funding Agreement Backed Notes (FABN) program, secured and other funding agreements, funding agreements issued to the Federal Home Loan Bank (FHLB) and long-term repurchase agreements. Market share relates to FABN market only. Funding AgreementsRetail Annuities Flow Reinsurance Pension Group Annuities Athene is a Market Leader Across US Organic Inflow Channels Pension Group Annuities #1 Market Share in 20231 Funding Agreements #1 FABN Market Share in 1Q’242 Retail Annuities #1 Market Share in 20231 Flow Reinsurance Record Inflows in 2023 Gross Organic Inflows by Channel ($B)

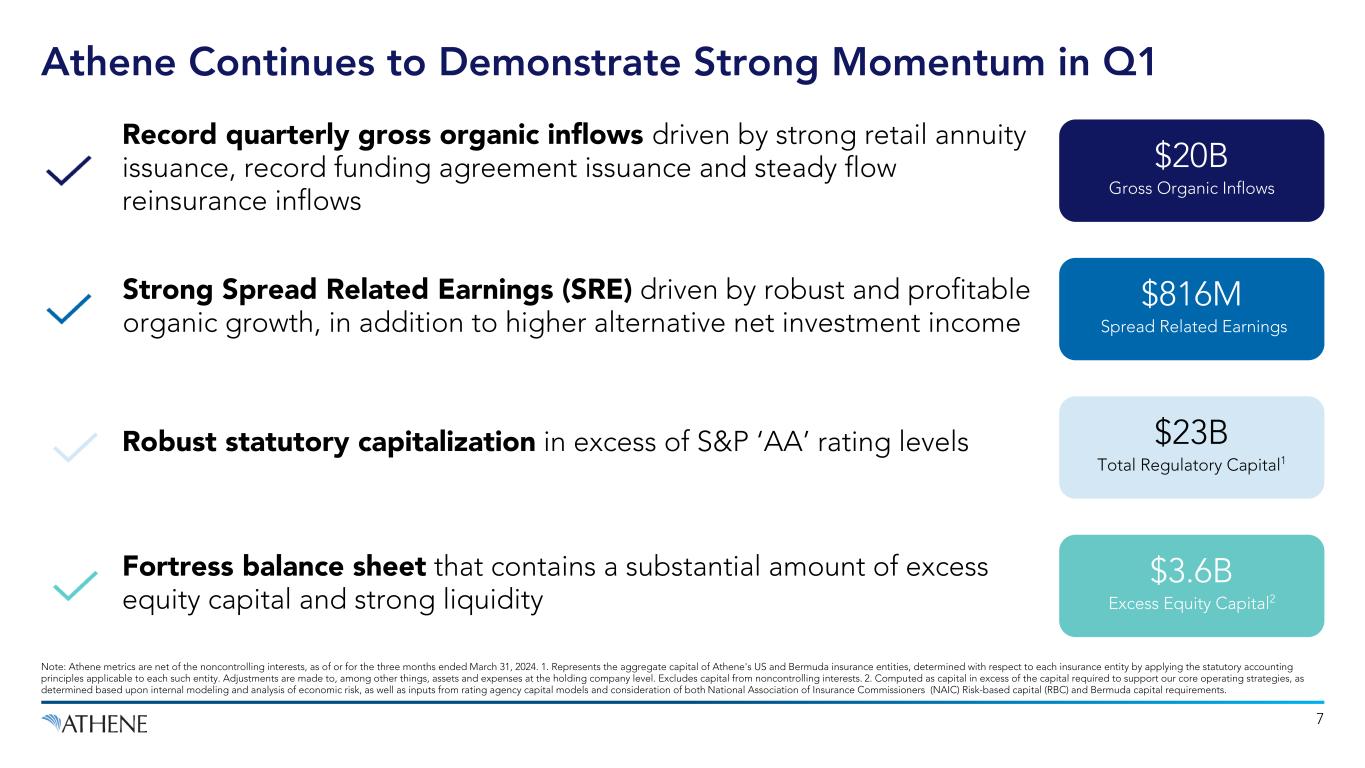

Record quarterly gross organic inflows driven by strong retail annuity issuance, record funding agreement issuance and steady flow reinsurance inflows 7 Athene Continues to Demonstrate Strong Momentum in Q1 Note: Athene metrics are net of the noncontrolling interests, as of or for the three months ended March 31, 2024. 1. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. Excludes capital from noncontrolling interests. 2. Computed as capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both National Association of Insurance Commissioners (NAIC) Risk-based capital (RBC) and Bermuda capital requirements. $20B Gross Organic Inflows Strong Spread Related Earnings (SRE) driven by robust and profitable organic growth, in addition to higher alternative net investment income $816M Spread Related Earnings $23B Total Regulatory Capital1 Robust statutory capitalization in excess of S&P ‘AA’ rating levels Fortress balance sheet that contains a substantial amount of excess equity capital and strong liquidity $3.6B Excess Equity Capital2

8 Note: Athene metrics are net of the noncontrolling interests, as of March 31, 2024. 1. Relates to Athene’s primary insurance subsidiaries; represents ratings from AM Best "A", Fitch "A+", S&P "A+" and Moody’s "A1". 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. Excludes capital from noncontrolling interests. 3. Computed as capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 4. Includes $10.3 billion of cash and cash equivalents, $2.6 billion AHL/Athene Life Re Ltd. (ALRe) liquidity facility with $0.5 billion accordion feature, $2.0 billion committed repos, $1.25 billion AHL credit facility with $0.5 billion accordion feature, $4.5 billion of FHLB capacity, and $59.7 billion liquid bond portfolio. Availability of accordion features subject to lender consent and other factors. 5. Includes $3.6 billion in excess equity capital, $3.2 billion in untapped leverage capacity and $2.5 billion in available undrawn capital at ACRA, including additional commitments to ADIP II completed subsequent to quarter-end. Untapped leverage capacity assumes an adjusted leverage ratio of not more than 30%, subject to maintaining a sufficient level of capital required to maintain our desired financial strength ratings from rating agencies. Athene Has Built a Fortress Balance Sheet… Financial Strength Profile A+ $3.6B Excess Equity Capital3 $23B Regulatory Capital2 $9.3B Total Deployable Capital5 Available Liquidity $81B 41

11.8% 10.6% 9 Note: Athene metrics are net of the noncontrolling interests, as of March 31, 2024. AA-/A+ Rated Companies are: PFG (A+), GL (AA-), MET (AA-), and PRU (AA-). 1. AA-/A+ Rated Company metrics as of December 31, 2023 per SNL Financial. 2. Refers to Athene’s adjusted senior debt-to- capital ratio as of March 31, 2024. AA-/A+ Rated company metrics as of March 31, 2024 per company filings. 3. Athene’s statutory fixed income impairments adjusted to include changes in mortgage loan specific reserves in relation to average invested assets of regulated entities in the US and Bermuda. 4. Athene’s impairments were adjusted to exclude an internal securitization where all the underlying commercial mortgage loans are performing. 5. Industry average represents US statutory impairments adjusted to include changes in mortgage loan specific reserves per SNL Financial. Industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. $23B of Stat Capital Trailing 5 Year Avg. (2019-2023) Higher Statutory Capital vs. Reserves1 Lower Adjusted Senior Debt-to-Capital2 Lower Credit Losses Athene AA-/A+ Rated Company Average 16.5% 21.6% Athene AA-/A+ Rated Company Average Athene3,4 Industry Average5 11bps 13bps …That Outperforms the Competition

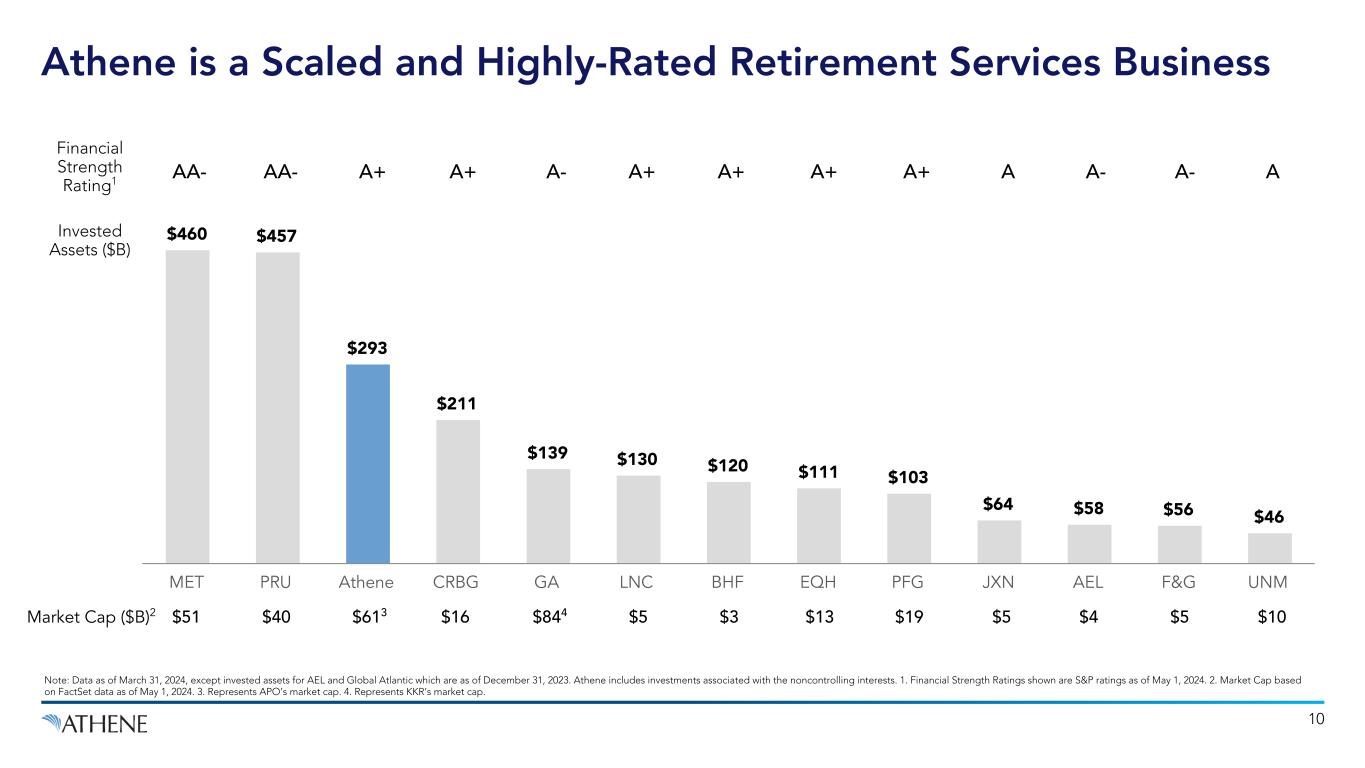

$460 $457 $293 $211 $139 $130 $120 $111 $103 $64 $58 $56 $46 MET PRU Athene CRBG GA LNC BHF EQH PFG JXN AEL F&G UNM 10 Athene is a Scaled and Highly-Rated Retirement Services Business Note: Data as of March 31, 2024, except invested assets for AEL and Global Atlantic which are as of December 31, 2023. Athene includes investments associated with the noncontrolling interests. 1. Financial Strength Ratings shown are S&P ratings as of May 1, 2024. 2. Market Cap based on FactSet data as of May 1, 2024. 3. Represents APO’s market cap. 4. Represents KKR’s market cap. Financial Strength Rating1 AA- AA- A+ A+ A- A+ A+ A+ A+ A AA- Invested Assets ($B) A- $51Market Cap ($B)2 $40 $613 $16 $844 $5 $3 $13 $19 $5 $4 $5 $10

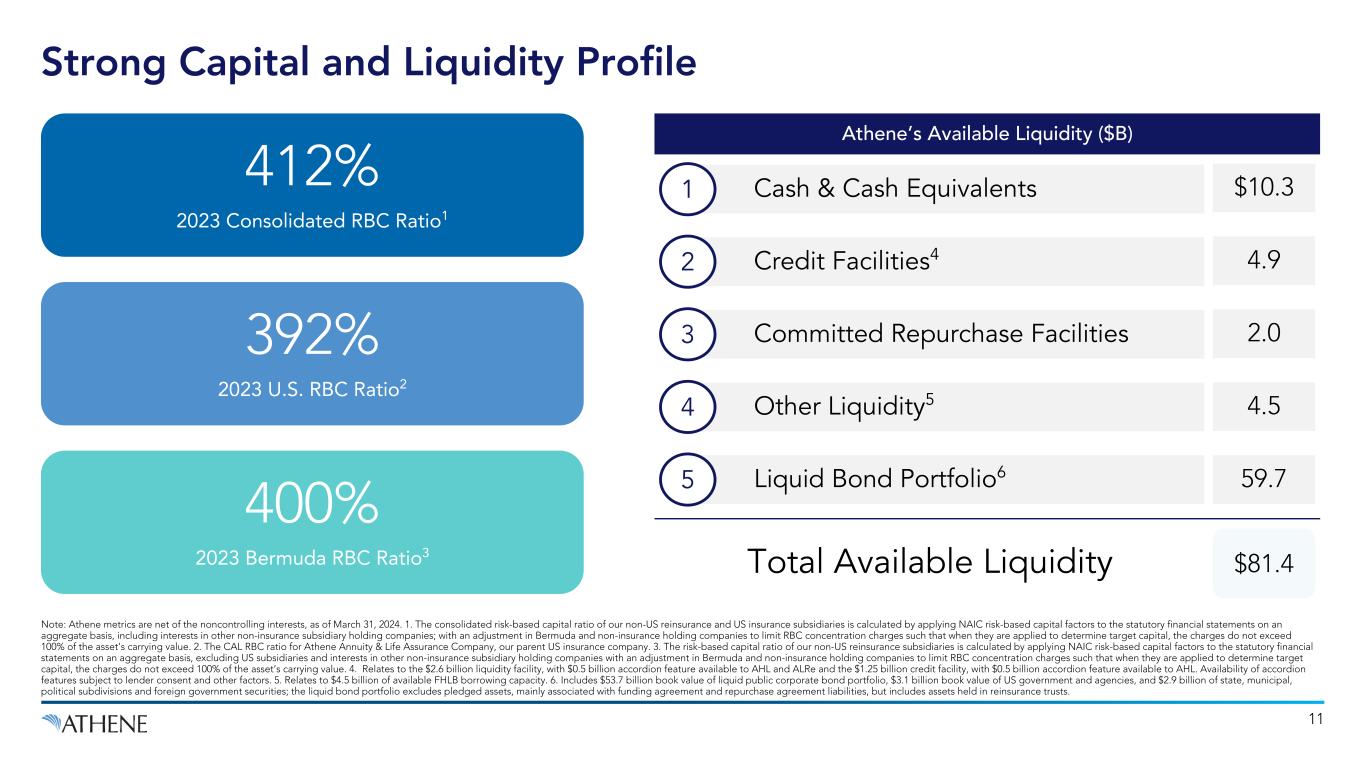

11 Strong Capital and Liquidity Profile Note: Athene metrics are net of the noncontrolling interests, as of March 31, 2024. 1. The consolidated risk-based capital ratio of our non-US reinsurance and US insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holding companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 2. The CAL RBC ratio for Athene Annuity & Life Assurance Company, our parent US insurance company. 3. The risk-based capital ratio of our non-US reinsurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, excluding US subsidiaries and interests in other non-insurance subsidiary holding companies with an adjustment in Bermuda and non-insurance holding companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 4. Relates to the $2.6 billion liquidity facility, with $0.5 billion accordion feature available to AHL and ALRe and the $1.25 billion credit facility, with $0.5 billion accordion feature available to AHL. Availability of accordion features subject to lender consent and other factors. 5. Relates to $4.5 billion of available FHLB borrowing capacity. 6. Includes $53.7 billion book value of liquid public corporate bond portfolio, $3.1 billion book value of US government and agencies, and $2.9 billion of state, municipal, political subdivisions and foreign government securities; the liquid bond portfolio excludes pledged assets, mainly associated with funding agreement and repurchase agreement liabilities, but includes assets held in reinsurance trusts. 412% 2023 Consolidated RBC Ratio1 392% 2023 U.S. RBC Ratio2 400% 2023 Bermuda RBC Ratio3 Athene’s Available Liquidity ($B) $81.4 Liquid Bond Portfolio6 5 59.7 Cash & Cash Equivalents1 $10.3 Committed Repurchase Facilities3 2.0 Credit Facilities42 4.9 Other Liquidity54 4.5 Total Available Liquidity

“Risk-adjusted capitalization is at the strongest level, as measured by Best's Capital Adequacy Ratio. Strong historical growth in premiums and deposits across its retail, institutional reinsurance, and pension risk transfer markets. Stable liability profile with concentration in retirement products with MVAs, surrender or economic protections.” “The A1 insurance financial strength rating of its US and Bermuda-based life insurance operating companies reflects the company's strong market position in its core insurance products, which include retail and pension group annuities, as well as flow reinsurance. Strengths also include very good capital levels, modest financial leverage, and strong interest coverage metrics, as well as solid profitability.” ‘A1’ Outlook Stable 12 ‘A+’ Outlook Stable “Athene benefits from material competitive advantages as a result of its significant operating scale. While the company remains focused on spread-based liabilities, Fitch views Athene as having favorable diversification relative to more modest annuity peers.” “We view Athene's competitive position as strong, as it has expanded its liability profile and market share over the past few years... In the past couple of years, the company has also expanded into flow reinsurance in Japan, and it has recently executed a small block acquisition there. These expansions reflect the strength of Athene's business model and its competitive advantage in its various spread-lending businesses..” ‘A+’ Outlook Stable ‘A’ Outlook Positive S&P, JANUARY 2024 FITCH, SEPTEMBER 2023 AM BEST, MAY 2023 MOODY’S, JULY 2023 Note: Ratings represent financial strength ratings for primary insurance subsidiaries. Financial Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. Athene is Committed to Strong Ratings, with an Upward Trajectory

Net Invested Assets ($B)1 $227 $211 $111 $103 1Q’24 LTM Operating Income ($M)2 $3,236 $3,306 $2,249 $1,630 Adjusted Senior Debt-to-Capital1 16.5% 24.6% 27.3% 21.8% Ratings1 A1/A+/A+ A2/A+/NR A1/A+/NR A1/A+/NR RBC Ratio (Consolidated)1 412% >400% 400-425% 427% 5-year FABN Secondary Credit Spread-to-US Treasury3 T+112 T+100 T+100 T+95 1. Total invested assets, adjusted senior debt-to-capital ratio and financial strength ratings as of March 31, 2024 from company filings and presentations. RBC ratios as of December 31, 2023. For Athene, total invested assets is net of the noncontrolling interests. Corebridge invested assets exclude Fortitude Re funds withheld assets. Financial strength ratings are from Moody’s/S&P/Fitch and are specific to the FABN program. 2. Operating income figures are on a pre-tax basis for the last twelve months ending March 31, 2024. 3. Source: JP Morgan data as of May 6, 2024. 13 Superior Financial Metrics Not Yet Fully Reflected in Secondary Spreads CRBG EQH PFG

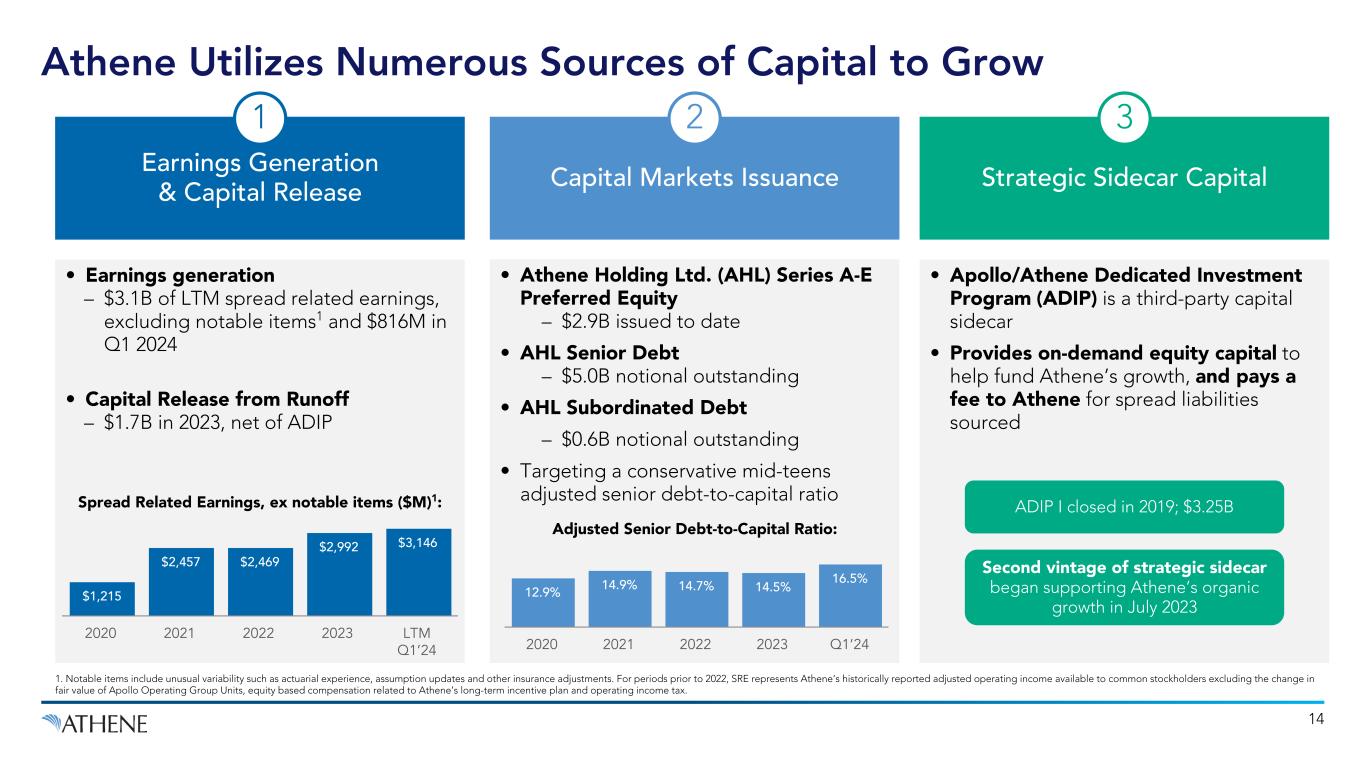

• Athene Holding Ltd. (AHL) Series A-E Preferred Equity – $2.9B issued to date • AHL Senior Debt – $5.0B notional outstanding • AHL Subordinated Debt – $0.6B notional outstanding • Targeting a conservative mid-teens adjusted senior debt-to-capital ratio 12.9% 14.9% 14.7% 14.5% 16.5% 2020 2021 2022 2023 Q1’24 • Earnings generation – $3.1B of LTM spread related earnings, excluding notable items1 and $816M in Q1 2024 • Capital Release from Runoff – $1.7B in 2023, net of ADIP $1,215 $2,457 $2,469 $2,992 $3,146 2020 2021 2022 2023 LTM Q1’24 14 Athene Utilizes Numerous Sources of Capital to Grow Earnings Generation & Capital Release 1 Capital Markets Issuance 2 • Apollo/Athene Dedicated Investment Program (ADIP) is a third-party capital sidecar • Provides on-demand equity capital to help fund Athene’s growth, and pays a fee to Athene for spread liabilities sourced Strategic Sidecar Capital 3 Adjusted Senior Debt-to-Capital Ratio: Spread Related Earnings, ex notable items ($M)1: ADIP I closed in 2019; $3.25B Second vintage of strategic sidecar began supporting Athene’s organic growth in July 2023 1. Notable items include unusual variability such as actuarial experience, assumption updates and other insurance adjustments. For periods prior to 2022, SRE represents Athene’s historically reported adjusted operating income available to common stockholders excluding the change in fair value of Apollo Operating Group Units, equity based compensation related to Athene’s long-term incentive plan and operating income tax.

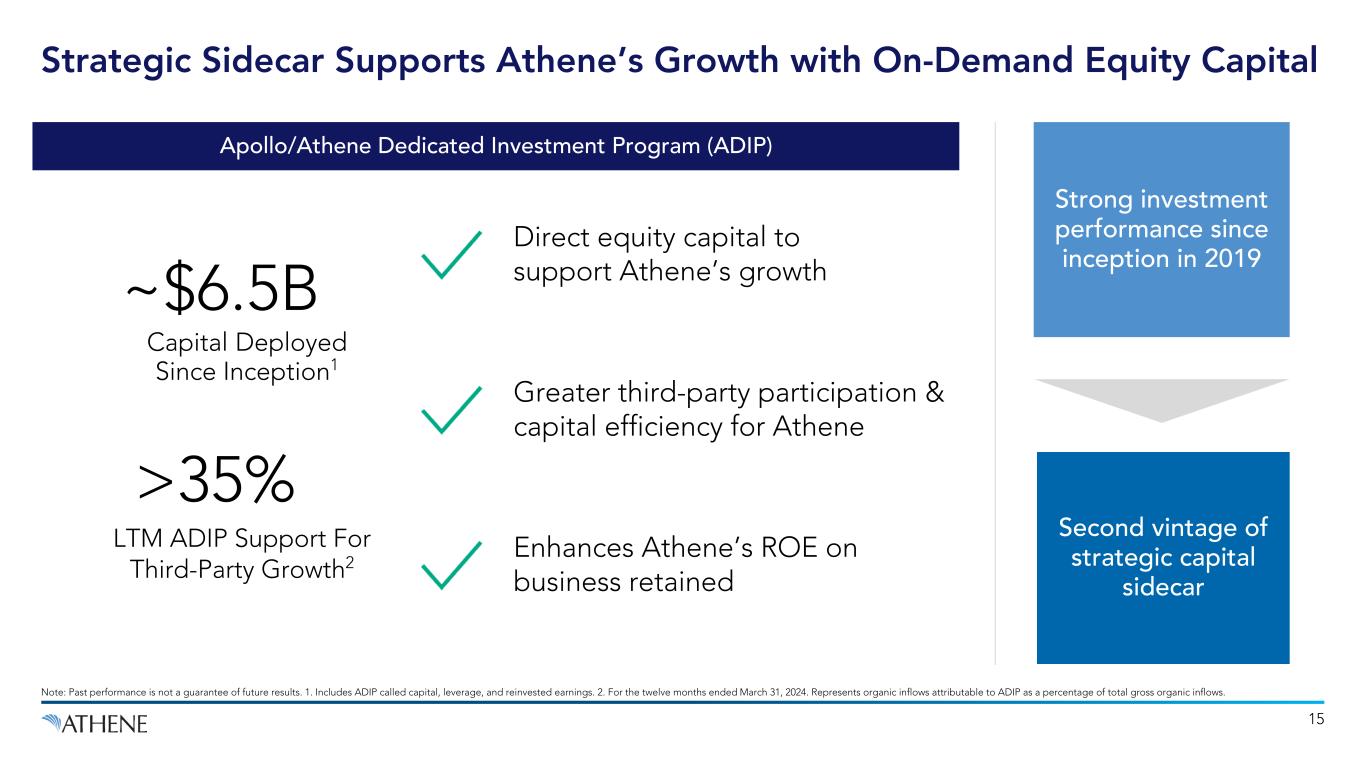

15 Strategic Sidecar Supports Athene’s Growth with On-Demand Equity Capital Note: Past performance is not a guarantee of future results. 1. Includes ADIP called capital, leverage, and reinvested earnings. 2. For the twelve months ended March 31, 2024. Represents organic inflows attributable to ADIP as a percentage of total gross organic inflows. Apollo/Athene Dedicated Investment Program (ADIP) Capital Deployed Since Inception1 ~$6.5B Direct equity capital to support Athene’s growth Greater third-party participation & capital efficiency for Athene Strong investment performance since inception in 2019 Second vintage of strategic capital sidecar Enhances Athene’s ROE on business retained LTM ADIP Support For Third-Party Growth2 >35%

$124.6 $175.4 $210.2 $238.3 $278.6 $292.8 $117.5 $150.2 $175.3 $196.5 $217.4 $227.4 $25.2 $34.9 $41.8 $61.2 $65.4 Net Invested Assets Invested Assets Attributable to Sidecars (ADIP) 2019 2020 2021 2022 2023 Q1’24 16 Strong Track Record of Invested Asset Growth 22% CAGR Composition of Athene’s Gross Invested Assets ($B) Note: ADIP refers to ADIP I and ADIP II and represents the noncontrolling interests in business ceded to ACRA. $7.1

$12.1 $13.4 $15.5 $18.3 $20.1 $21.3 $23.2 $23.6 $27.5 $30.3 $9.4 $10.2 $11.2 $13.5 $14.8 $15.6 $16.6 $17.0 $20.3 $21.5$1.2 $1.7 $2.3 $2.3 $2.3 $2.7 $3.2 $3.2 $3.2 $3.2 $0.6 $1.5 $1.5 $2.0 $2.5 $3.0 $3.0 $3.4 $3.4 $4.0 $5.0 Adjusted AHL Common Stockholder’s Equity Preferred Equity Notional Subordinated Debt Notional Senior Debt 12/31/2019 6/30/2020 12/31/2020 6/30/2021 12/31/2021 6/30/2022 12/31/2022 6/30/2023 12/31/2023 3/31/2024 17 Total Capitalization Mix Highlights Disciplined Capital Management Strategy 1. Includes both short-term and long-term debt, at notional. Composition of Athene’s Adjusted Capitalization ($B) Athene targets a conservative mid-teens adjusted senior debt-to-capital ratio 1

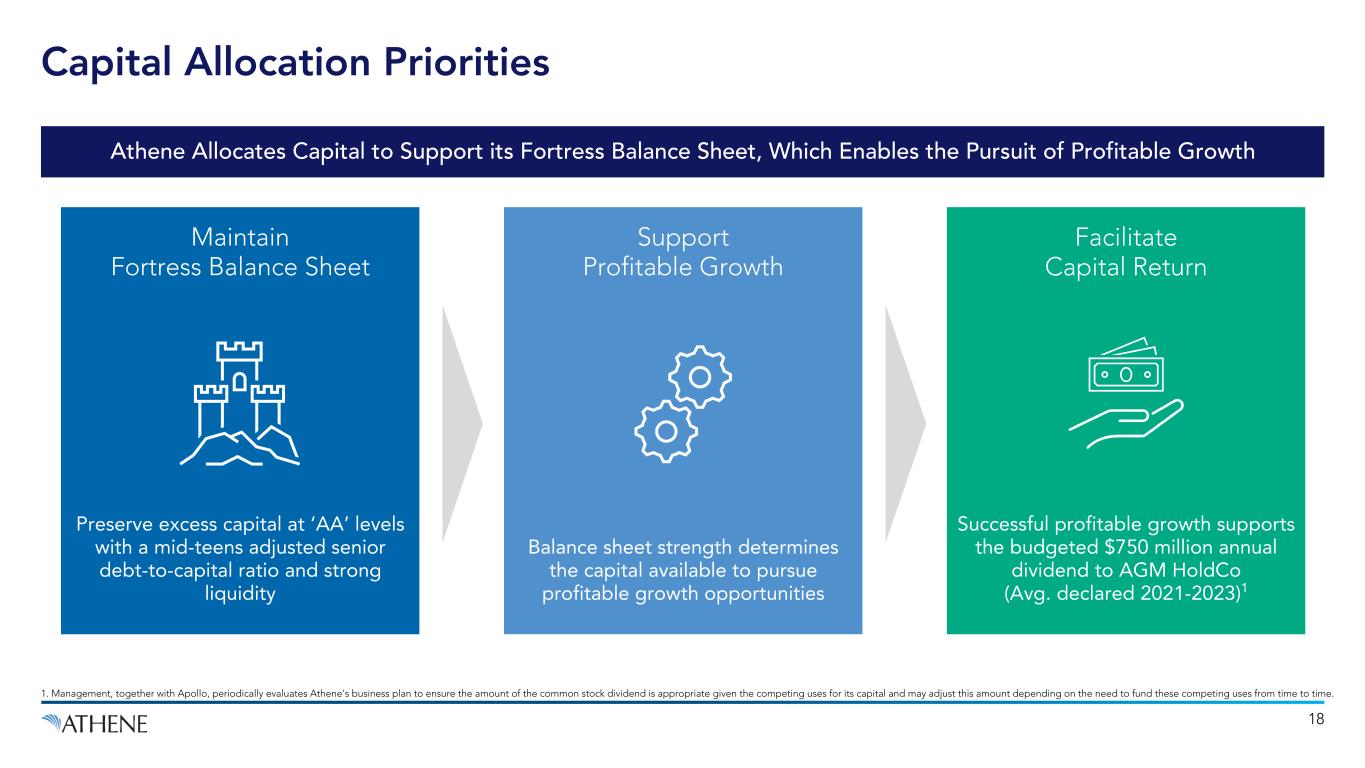

18 Capital Allocation Priorities Balance sheet strength determines the capital available to pursue profitable growth opportunities Support Profitable Growth Preserve excess capital at ‘AA’ levels with a mid-teens adjusted senior debt-to-capital ratio and strong liquidity Maintain Fortress Balance Sheet Athene Allocates Capital to Support its Fortress Balance Sheet, Which Enables the Pursuit of Profitable Growth Successful profitable growth supports the budgeted $750 million annual dividend to AGM HoldCo (Avg. declared 2021-2023)1 Facilitate Capital Return 1. Management, together with Apollo, periodically evaluates Athene’s business plan to ensure the amount of the common stock dividend is appropriate given the competing uses for its capital and may adjust this amount depending on the need to fund these competing uses from time to time.

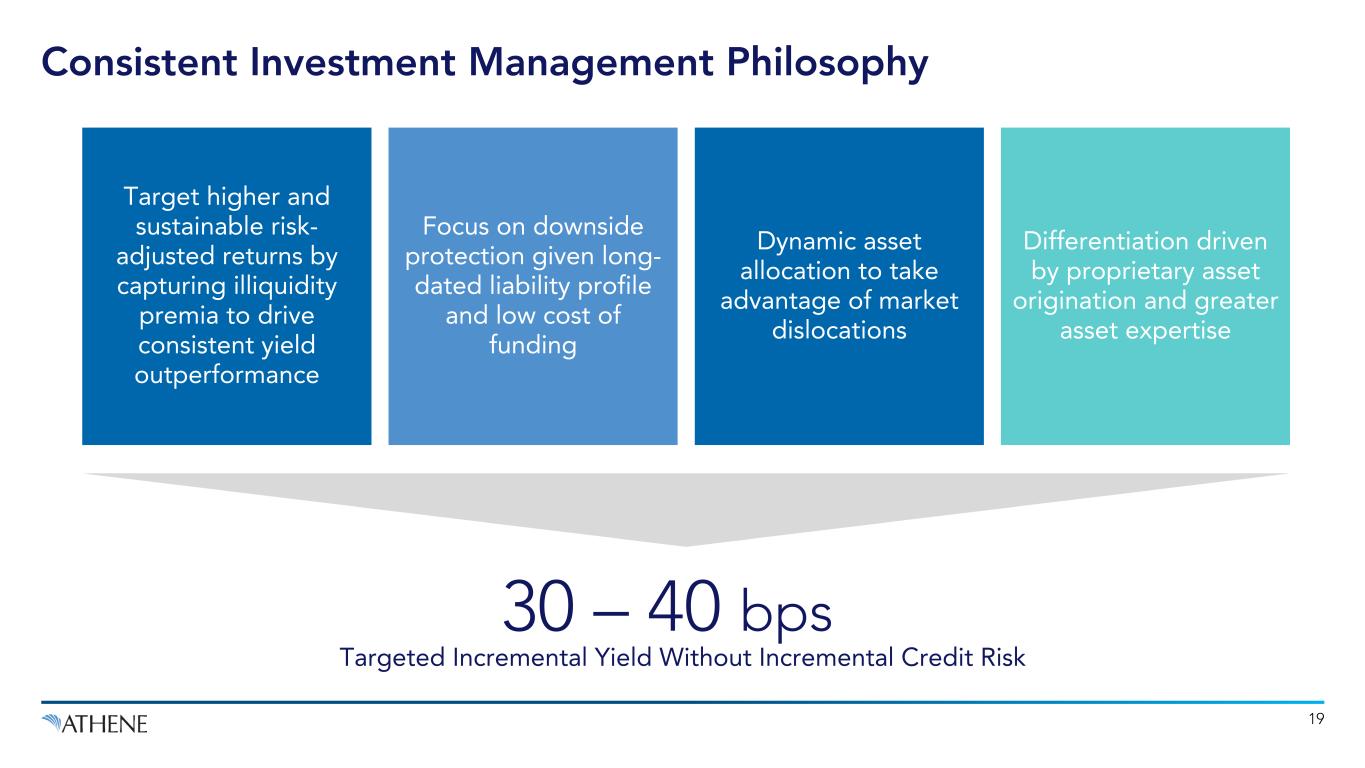

19 Consistent Investment Management Philosophy Target higher and sustainable risk- adjusted returns by capturing illiquidity premia to drive consistent yield outperformance Focus on downside protection given long- dated liability profile and low cost of funding Dynamic asset allocation to take advantage of market dislocations Differentiation driven by proprietary asset origination and greater asset expertise 30 – 40 bps Targeted Incremental Yield Without Incremental Credit Risk

6 13 3 17 16 8 14 6 20 18 COVID-19 Russia/Ukraine 20 Historical Credit Loss Experience Outperforms Industry Athene1 Industry2 Historical Asset Impairments (annualized, bps) 20203 2021 202320222019 1. Athene’s statutory fixed income impairments adjusted to include changes in mortgage loan specific reserves in relation to average invested assets of regulated entities in the US and Bermuda. 2. Industry average represents US statutory impairments adjusted to include changes in mortgage loan specific reserves per SNL Financial. Industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. 3. Athene’s impairments were adjusted to exclude an internal securitization where all the underlying commercial mortgage loans are performing. Athene (5Y Avg): 11bps Industry (5Y Avg): 13bps CRE/Regional Banking

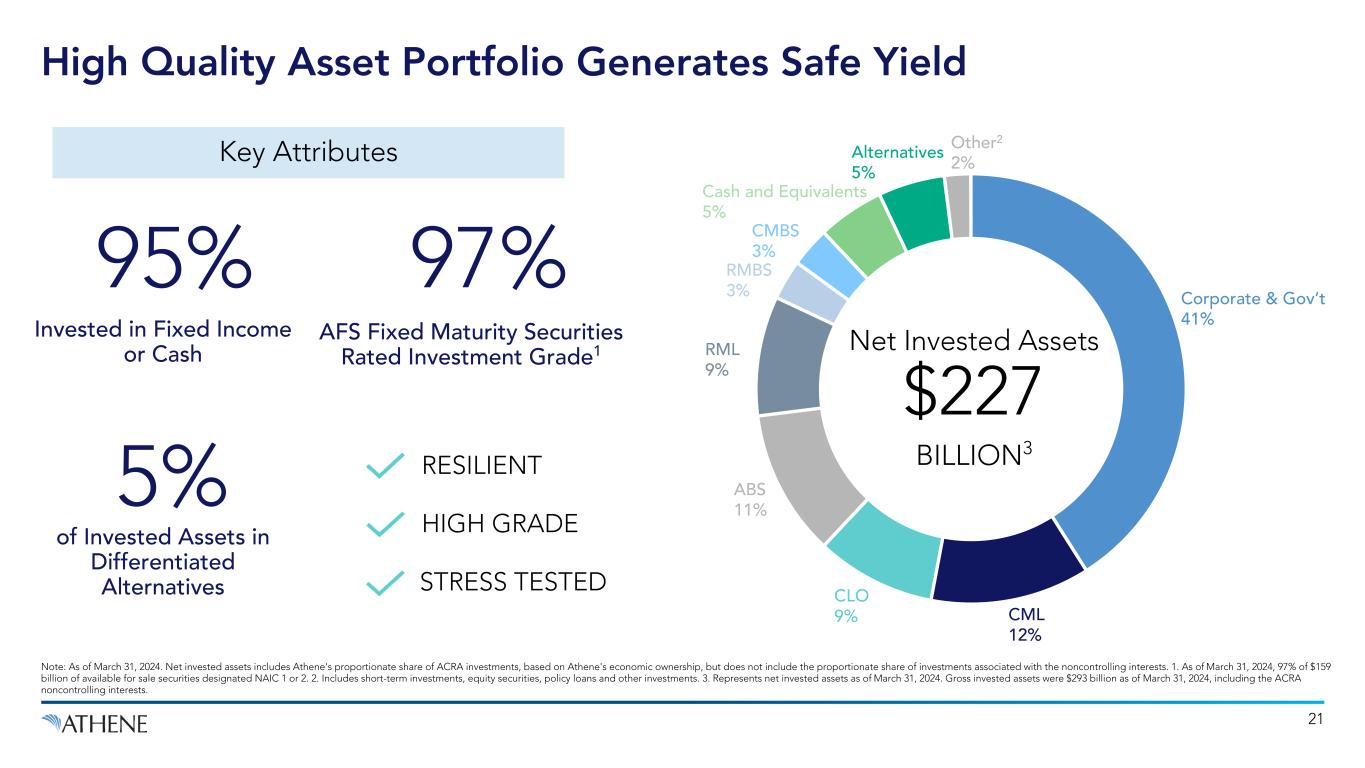

Corporate & Gov’t 41% CML 12% CLO 9% ABS 11% RML 9% RMBS 3% CMBS 3% Cash and Equivalents 5% Alternatives 5% Other 2% Net Invested Assets $227 BILLION3 Note: As of March 31, 2024. Net invested assets includes Athene's proportionate share of ACRA investments, based on Athene's economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interests. 1. As of March 31, 2024, 97% of $159 billion of available for sale securities designated NAIC 1 or 2. 2. Includes short-term investments, equity securities, policy loans and other investments. 3. Represents net invested assets as of March 31, 2024. Gross invested assets were $293 billion as of March 31, 2024, including the ACRA noncontrolling interests. High Quality Asset Portfolio Generates Safe Yield AFS Fixed Maturity Securities Rated Investment Grade1 RESILIENT HIGH GRADE STRESS TESTED 97% Invested in Fixed Income or Cash 95% of Invested Assets in Differentiated Alternatives 5% 21 Key Attributes 2

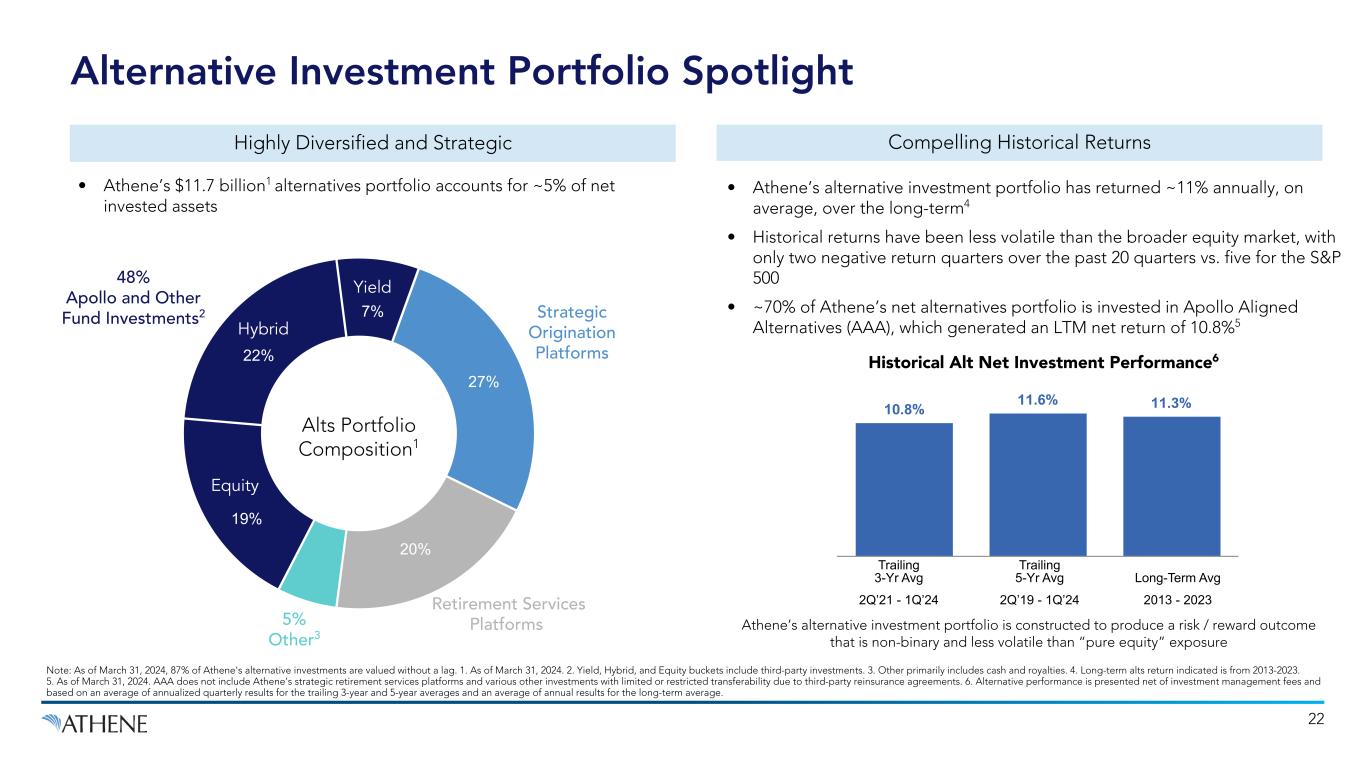

O t h e r Equity Hybrid Yield Highly Diversified and Strategic • Athene’s $11.7 billion1 alternatives portfolio accounts for ~5% of net invested assets 48% Apollo and Other Fund Investments2 Strategic Origination Platforms Retirement Services Platforms Alts Portfolio Composition1 19% 22% 7% Alternative Investment Portfolio Spotlight Note: As of March 31, 2024, 87% of Athene's alternative investments are valued without a lag. 1. As of March 31, 2024. 2. Yield, Hybrid, and Equity buckets include third-party investments. 3. Other primarily includes cash and royalties. 4. Long-term alts return indicated is from 2013-2023. 5. As of March 31, 2024. AAA does not include Athene’s strategic retirement services platforms and various other investments with limited or restricted transferability due to third-party reinsurance agreements. 6. Alternative performance is presented net of investment management fees and based on an average of annualized quarterly results for the trailing 3-year and 5-year averages and an average of annual results for the long-term average. 27% 20% 5% Other3 Compelling Historical Returns • Athene’s alternative investment portfolio has returned ~11% annually, on average, over the long-term4 • Historical returns have been less volatile than the broader equity market, with only two negative return quarters over the past 20 quarters vs. five for the S&P 500 • ~70% of Athene’s net alternatives portfolio is invested in Apollo Aligned Alternatives (AAA), which generated an LTM net return of 10.8%5 10.8% 11.6% 11.3% Historical Alt Net Investment Performance6 Trailing 3-Yr Avg Trailing 5-Yr Avg Long-Term Avg 2Q’21 - 1Q’24 2Q’19 - 1Q’24 2013 - 2023 Athene’s alternative investment portfolio is constructed to produce a risk / reward outcome that is non-binary and less volatile than “pure equity” exposure 22

Fixed Indexed Annuities 41% Fixed Rate Annuities 27% 2% Funding Agreements 16% Pension Group Annuities 12% $209 BILLION Persistent and Predictable Liability Portfolio Provides Long-Dated Funding Note: Metrics are as of or for the three months ended March 31, 2024. Liabilities composition and weighted average life of funding is based on net reserve liabilities. Gross reserve liabilities include the reserves associated with the ACRA noncontrolling interests and were $269 billion as of March 31, 2024. 1. Other primarily consists of the AmerUs Closed Block liabilities and other life reserves. 2. Non-surrenderable liabilities include buy-out pension group annuities other than those that can be withdrawn as lump sums, funding agreements and payout annuities. 3. Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements 29% Non-Surrenderable2 Retirement Savings Products with Structural Features That Increase Stability Of Funding Carries a Withdrawal Penalty or Cannot be Withdrawn 85% SPREAD BASED Weighted Average Life of Funding 8 Year Cost of Funds on In-Force 3.10% VERY LIMITED TAIL RISK 23 56% Withdrawal / Surrender Charge Protected Key Attributes CONSERVATIVELY UNDERWRITTEN Payout Annuities3 Other1 2% Net Reserve Liabilities

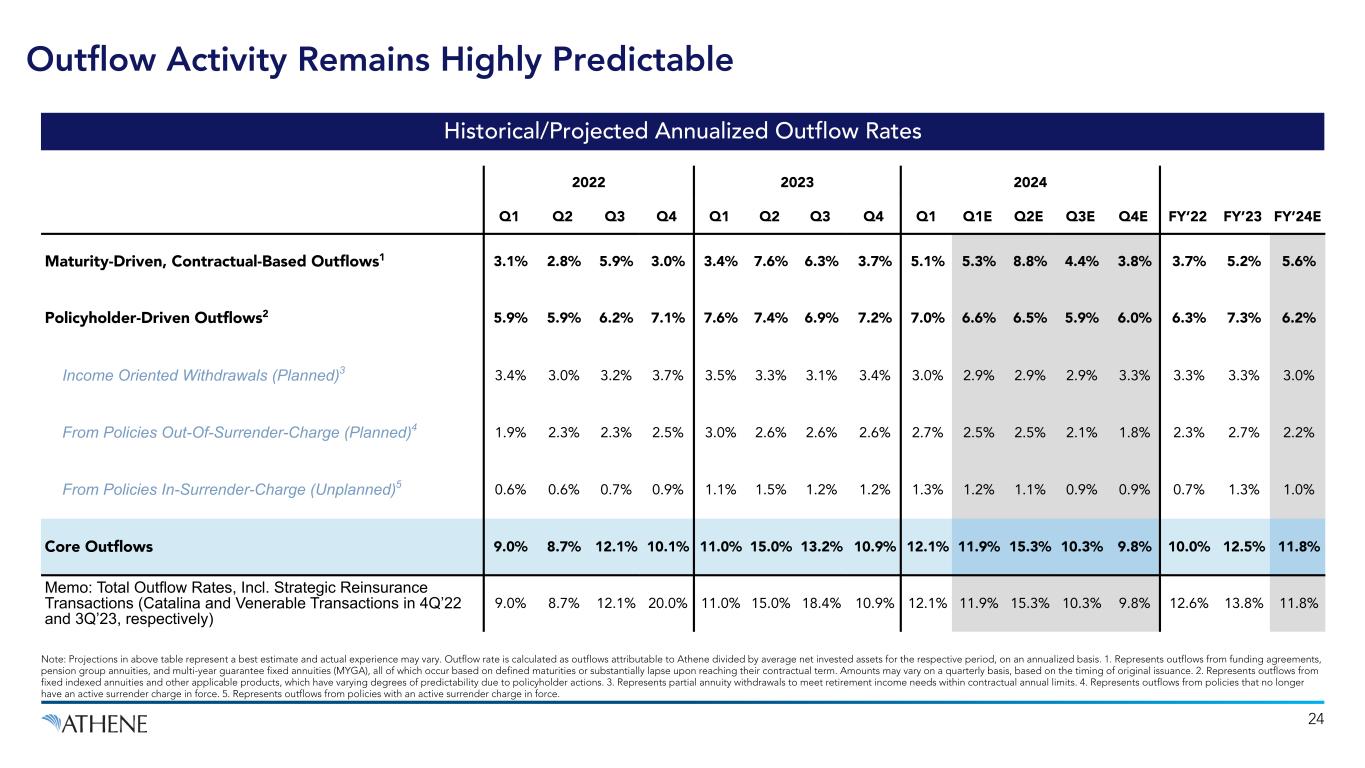

Historical/Projected Annualized Outflow Rates 24 Outflow Activity Remains Highly Predictable Note: Projections in above table represent a best estimate and actual experience may vary. Outflow rate is calculated as outflows attributable to Athene divided by average net invested assets for the respective period, on an annualized basis. 1. Represents outflows from funding agreements, pension group annuities, and multi-year guarantee fixed annuities (MYGA), all of which occur based on defined maturities or substantially lapse upon reaching their contractual term. Amounts may vary on a quarterly basis, based on the timing of original issuance. 2. Represents outflows from fixed indexed annuities and other applicable products, which have varying degrees of predictability due to policyholder actions. 3. Represents partial annuity withdrawals to meet retirement income needs within contractual annual limits. 4. Represents outflows from policies that no longer have an active surrender charge in force. 5. Represents outflows from policies with an active surrender charge in force. 2022 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q1E Q2E Q3E Q4E FY’22 FY’23 FY’24E Maturity-Driven, Contractual-Based Outflows1 3.1% 2.8% 5.9% 3.0% 3.4% 7.6% 6.3% 3.7% 5.1% 5.3% 8.8% 4.4% 3.8% 3.7% 5.2% 5.6% Policyholder-Driven Outflows2 5.9% 5.9% 6.2% 7.1% 7.6% 7.4% 6.9% 7.2% 7.0% 6.6% 6.5% 5.9% 6.0% 6.3% 7.3% 6.2% Income Oriented Withdrawals (Planned)3 3.4% 3.0% 3.2% 3.7% 3.5% 3.3% 3.1% 3.4% 3.0% 2.9% 2.9% 2.9% 3.3% 3.3% 3.3% 3.0% From Policies Out-Of-Surrender-Charge (Planned)4 1.9% 2.3% 2.3% 2.5% 3.0% 2.6% 2.6% 2.6% 2.7% 2.5% 2.5% 2.1% 1.8% 2.3% 2.7% 2.2% From Policies In-Surrender-Charge (Unplanned)5 0.6% 0.6% 0.7% 0.9% 1.1% 1.5% 1.2% 1.2% 1.3% 1.2% 1.1% 0.9% 0.9% 0.7% 1.3% 1.0% Core Outflows 9.0% 8.7% 12.1% 10.1% 11.0% 15.0% 13.2% 10.9% 12.1% 11.9% 15.3% 10.3% 9.8% 10.0% 12.5% 11.8% Memo: Total Outflow Rates, Incl. Strategic Reinsurance Transactions (Catalina and Venerable Transactions in 4Q’22 and 3Q’23, respectively) 9.0% 8.7% 12.1% 20.0% 11.0% 15.0% 18.4% 10.9% 12.1% 11.9% 15.3% 10.3% 9.8% 12.6% 13.8% 11.8%

25 Robust risk management framework and procedures underpin focus on protecting capital and aligning risks with stakeholder expectations Risk strategy, investment, credit, asset-liability management (“ALM”) and liquidity risk policies, amongst others, at the board and management levels Stress testing plays a key role in defining risk appetite, with tests performed on both sides of the balance sheet Risk Management is Embedded in Everything We Do Managing Risk Such That Athene Can Grow Profitably Across Market Environments CLICK HERE TO VIEW ATHENE’S ASSET STRESS TEST ANALYSIS Duration-Matched Portfolio with Quarterly Cash Flow Monitoring & Stress Testing

Athene Financial Supplement published quarterly Athene Holding Ltd. publishes 10-K’s and 10-Q’s as a ’34 Act SEC filer Parent company, Apollo Global Management, Inc., publishes 10-K’s and 10-Q’s as a ’34 Act SEC filer Statutory filings for main Athene operating subsidiaries, including Bermuda, available via IR website 26 Athene is Committed to Transparency and Ongoing Disclosure Supplemental Disclosure Items Provide Additional Perspective on Athene’s Strategy and Performance CLICK HERE 1 2 3 4 Asset Stress Test March 2024 Committed to publishing asset stress test results on an annual basis5 CLICK HERE Corporate Structure Overview April 2023 Commercial Real Estate Overview April 2023 CLICK HERE Funding Model / Surrenders May 2023 CLICK HERE CLICK HERE Structured Credit White Paper December 2022

Non-GAAP Definitions In addition to our results presented in accordance with accounting principles generally accepted in the United States of America (US GAAP), we present certain financial information that includes non-GAAP measures. Management believes the use of these non-GAAP measures, together with the relevant US GAAP measures, provides information that may enhance an investor’s understanding of our results of operations and the underlying profitability drivers of our business. The majority of these non-GAAP measures are intended to remove from the results of operations the impact of market volatility (other than with respect to alternative investments), which consists of investment gains (losses), net of offsets and non-operating change in insurance liabilities and related derivatives, as well as integration, restructuring, stock compensation and certain other expenses which are not part of our underlying profitability drivers, as such items fluctuate from period to period in a manner inconsistent with these drivers. These measures should be considered supplementary to our results in accordance with US GAAP and should not be viewed as a substitute for the corresponding US GAAP measures. Spread Related Earnings (SRE) Spread related earnings is a pre-tax non-GAAP measure used to evaluate our financial performance including the impact of any reinsurance transactions and excluding market volatility and expenses related to integration, restructuring, stock compensation and other expenses. Our spread related earnings equals net income (loss) available to AHL common stockholder adjusted to eliminate the impact of the following: (a) investment gains (losses), net of offsets; (b) non-operating change in insurance liabilities and related derivatives; (c) integration, restructuring, and other non-operating expenses; (d) stock compensation expense; and (e) income tax (expense) benefit. We consider these adjustments to be meaningful adjustments to net income (loss) available to AHL common stockholder. Accordingly, we believe using a measure which excludes the impact of these items is useful in analyzing our business performance and the trends in our results of operations. Together with net income (loss) available to AHL common stockholder, we believe spread related earnings provides a meaningful financial metric that helps investors understand our underlying results and profitability. Spread related earnings should not be used as a substitute for net income (loss) available to AHL common stockholder. SRE, Excluding Notable Items Spread related earnings, excluding notable items represents SRE with an adjustment to exclude notable items. Notable items include unusual variability such as actuarial experience, assumption updates and other insurance adjustments. We use this measure to assess the long-term performance of the business against projected earnings, by excluding items that are expected to be infrequent or not indicative of the ongoing operations of the business. We view this non-GAAP measure as an additional measure that provides insight to management and investors on the historical, period-to-period comparability of our key non-GAAP operating measures. Cost of Funds Cost of funds includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the noncontrolling interests. Cost of crediting on deferred annuities is the interest credited to the policyholders on our fixed strategies as well as the option costs on the indexed annuity strategies. With respect to FIAs, the cost of providing index credits includes the expenses incurred to fund the annual index credits, and where applicable, minimum guaranteed interest credited. Cost of crediting on institutional products is comprised of (1) pension group annuity costs, including interest credited, benefit payments and other reserve changes, net of premiums received when issued, and (2) funding agreement costs, including the interest payments and other reserve changes. Additionally, cost of crediting includes forward points gains and losses on foreign exchange derivative hedges. Other liability costs include DAC, DSI and VOBA amortization, certain market risk benefit costs, the cost of liabilities on products other than deferred annuities and institutional products, premiums and certain product charges and other revenues. We include the costs related to business added through assumed reinsurance transactions and exclude the costs on business related to ceded reinsurance transactions. Cost of funds is computed as the total liability costs divided by the average net invested assets for the relevant period. To enhance the ability to analyze these measures across periods, interim periods are annualized. We believe a measure like cost of funds is useful in analyzing the trends of our core business operations, profitability and pricing discipline. While we believe cost of funds is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total benefits and expenses presented under US GAAP. Non-GAAP Measures & Definitions 27

Non-GAAP Measures & Definitions 28 Adjusted Senior Debt-to-Capital Ratio Adjusted senior debt-to-capital ratio is a non-GAAP measure used to evaluate our capital structure excluding the impacts of AOCI and the cumulative changes in fair value of funds withheld and modco reinsurance assets as well as mortgage loan assets, net of tax. Adjusted senior debt-to-capital ratio is calculated as senior debt at notional value divided by adjusted capitalization. Adjusted capitalization includes our adjusted AHL common stockholder’s equity, preferred stock and the notional value of our total debt. Adjusted AHL common stockholder’s equity is calculated as the ending AHL stockholders’ equity excluding AOCI, the cumulative changes in fair value of funds withheld and modco reinsurance assets and mortgage loan assets as well as preferred stock. These adjustments fluctuate period to period in a manner inconsistent with our underlying profitability drivers as the majority of such fluctuation is related to the market volatility of the unrealized gains and losses associated with our AFS securities, reinsurance assets and mortgage loans. Except with respect to reinvestment activity relating to acquired blocks of businesses, we typically buy and hold investments to maturity throughout the duration of market fluctuations, therefore, the period-over-period impacts in unrealized gains and losses are not necessarily indicative of current operating fundamentals or future performance. Adjusted senior debt-to-capital ratio should not be used as a substitute for the debt-to-capital ratio. However, we believe the adjustments to stockholders’ equity and debt are significant to gaining an understanding of our capitalization, debt utilization and debt capacity. Net Invested Assets In managing our business, we analyze net invested assets, which does not correspond to total investments, including investments in related parties, as disclosed in our condensed consolidated financial statements and notes thereto. Net invested assets represent the investments that directly back our net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which allows us to analyze the profitability of our investment portfolio. Net invested assets include (a) total investments on the condensed consolidated balance sheets, with AFS securities, trading securities and mortgage loans at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets exclude the derivative collateral offsetting the related cash positions. We include the underlying investments supporting our assumed funds withheld and modco agreements and exclude the underlying investments related to ceded reinsurance transactions in our net invested assets calculation in order to match the assets with the income received. We believe the adjustments for reinsurance provide a view of the assets for which we have economic exposure. Net invested assets include our proportionate share of ACRA investments, based on our economic ownership, but do not include the proportionate share of investments associated with the noncontrolling interests. Our net invested assets are averaged over the number of quarters in the relevant period to compute our net investment earned rate for such period. While we believe net invested assets is a meaningful financial metric and enhances our understanding of the underlying drivers of our investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under US GAAP. Net Reserve Liabilities In managing our business, we also analyze net reserve liabilities, which does not correspond to total liabilities as disclosed in our condensed consolidated financial statements and notes thereto. Net reserve liabilities represent our policyholder liability obligations net of reinsurance and are used to analyze the costs of our liabilities. Net reserve liabilities include (a) interest sensitive contract liabilities, (b) future policy benefits, (c) net market risk benefits, (d) long-term repurchase obligations, (e) dividends payable to policyholders and (f) other policy claims and benefits, offset by reinsurance recoverable, excluding policy loans ceded. Net reserve liabilities include our proportionate share of ACRA reserve liabilities, based on our economic ownership, but do not include the proportionate share of reserve liabilities associated with the noncontrolling interests. Net reserve liabilities are net of the ceded liabilities to third-party reinsurers as the costs of the liabilities are passed to such reinsurers and, therefore, we have no net economic exposure to such liabilities, assuming our reinsurance counterparties perform under our agreements. The majority of our ceded reinsurance is a result of strategic reinsurance transactions as well as reinsuring large blocks of life insurance business following acquisitions. For such transactions, US GAAP requires the ceded liabilities and related reinsurance recoverables to continue to be recorded in our consolidated financial statements despite the transfer of economic risk to the counterparty in connection with the reinsurance transaction. We include the underlying liabilities assumed through modco reinsurance agreements in our net reserve liabilities calculation in order to match the liabilities with the expenses incurred. While we believe net reserve liabilities is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total liabilities presented under US GAAP.

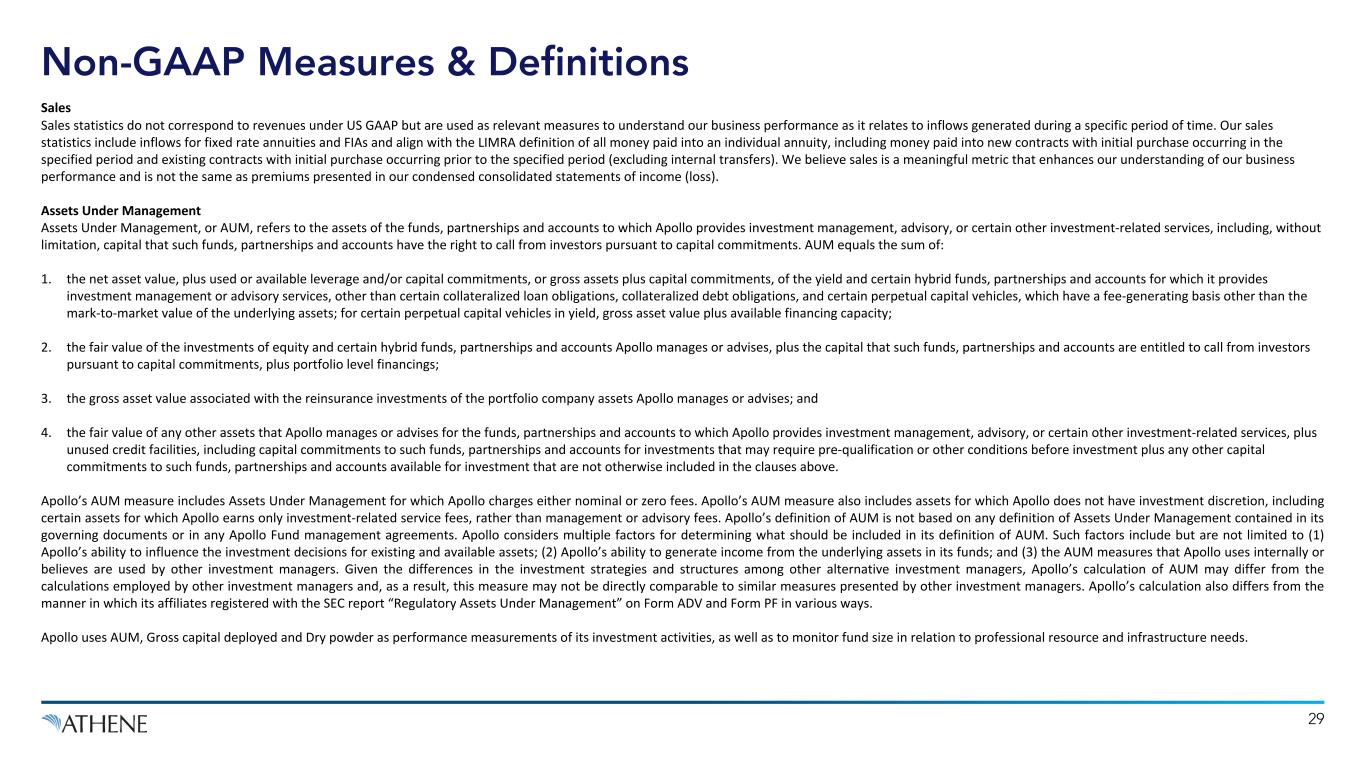

Non-GAAP Measures & Definitions 29 Sales Sales statistics do not correspond to revenues under US GAAP but are used as relevant measures to understand our business performance as it relates to inflows generated during a specific period of time. Our sales statistics include inflows for fixed rate annuities and FIAs and align with the LIMRA definition of all money paid into an individual annuity, including money paid into new contracts with initial purchase occurring in the specified period and existing contracts with initial purchase occurring prior to the specified period (excluding internal transfers). We believe sales is a meaningful metric that enhances our understanding of our business performance and is not the same as premiums presented in our condensed consolidated statements of income (loss). Assets Under Management Assets Under Management, or AUM, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. the net asset value, plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which it provides investment management or advisory services, other than certain collateralized loan obligations, collateralized debt obligations, and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of equity and certain hybrid funds, partnerships and accounts Apollo manages or advises, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any Apollo Fund management agreements. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in its funds; and (3) the AUM measures that Apollo uses internally or believes are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM, Gross capital deployed and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs.

Non-GAAP Measure Reconciliations (In millions, except percentages) 30 RECONCILIATION OF TOTAL AHL STOCKHOLDERS’ EQUITY TO TOTAL ADJUSTED AHL COMMON STOCKHOLDER’S EQUITY Dec. 31, 2019 June 30, 2020 Dec. 31, 2020 June 30, 2021 Dec. 31, 2021 June 30, 2022 Dec. 31, 2022 June 30, 2023 Dec. 31, 2023 March 31, 2024 Total AHL stockholders’ equity $ 13,391 $ 14,711 $ 18,657 $ 20,006 $ 20,130 $ 8,697 $ 7,158 $ 8,701 $ 13,838 $ 14,760 Less: Preferred stock 1,172 1,755 2,312 2,312 2,312 2,667 3,154 3,154 3,154 3,154 Total AHL common stockholder’s equity 12,219 12,956 16,345 17,694 17,818 6,030 4,004 5,547 10,684 11,606 Less: Accumulated other comprehensive income (loss) 2,281 2,184 3,971 3,337 2,430 (5,698) (7,321) (6,376) (5,569) (5,628) Less: Accumulated change in fair value of reinsurance assets 493 615 1,142 886 585 (2,521) (3,127) (2,843) (1,882) (1,880) Less: Accumulated change in fair value of mortgage loan assets — — — — — (1,340) (2,201) (2,235) (2,233) (2,426) Total adjusted AHL common stockholder’s equity $ 9,445 $ 10,157 $ 11,232 $ 13,471 $ 14,803 $ 15,589 $ 16,653 $ 17,001 $ 20,368 $ 21,540 RECONCILIATION OF DEBT-TO-CAPITAL RATIO TO ADJUSTED SENIOR DEBT-TO-CAPITAL RATIO Dec. 31, 2019 June 30, 2020 Dec. 31, 2020 June 30, 2021 Dec. 31, 2021 June 30, 2022 Dec. 31, 2022 June 30, 2023 Dec. 31, 2023 March 31, 2024 Total debt $ 1,467 $ 1,486 $ 1,976 $ 2,468 $ 2,964 $ 3,279 $ 3,658 $ 3,642 $ 4,209 $ 5,740 Less: Subordinated debt — — — — — — — — — 575 Less: Adjustment to arrive at notional debt (8) (14) (24) (32) (36) 279 258 242 209 165 Notional senior debt $ 1,475 $ 1,500 $ 2,000 $ 2,500 $ 3,000 $ 3,000 $ 3,400 $ 3,400 $ 4,000 $ 5,000 Total debt $ 1,467 $ 1,486 $ 1,976 $ 2,468 $ 2,964 $ 3,279 $ 3,658 $ 3,642 $ 4,209 $ 5,740 Total AHL stockholders’ equity 13,391 14,711 18,657 20,006 20,130 8,697 7,158 8,701 13,838 14,760 Total capitalization 14,858 16,197 20,633 22,474 23,094 11,976 10,816 12,343 18,047 20,500 Less: Accumulated other comprehensive income (loss) 2,281 2,184 3,971 3,337 2,430 (5,698) (7,321) (6,376) (5,569) (5,628) Less: Accumulated change in fair value of reinsurance assets 493 615 1,142 886 585 (2,521) (3,127) (2,843) (1,882) (1,880) Less: Accumulated change in fair value of mortgage loan assets — — — — — (1,340) (2,201) (2,235) (2,233) (2,426) Less: Adjustment to arrive at notional debt (8) (14) (24) (32) (36) 279 258 242 209 165 Total adjusted capitalization $ 12,092 $ 13,412 $ 15,544 $ 18,283 $ 20,115 $ 21,256 $ 23,207 $ 23,555 $ 27,522 $ 30,269 Debt-to-capital ratio 9.9 % 9.2 % 9.6 % 11.0 % 12.8 % 27.4 % 33.8 % 29.5 % 23.3 % 28.0 % Accumulated other comprehensive income (loss) 1.8 % 1.5 % 2.4 % 2.0 % 1.6 % (7.3) % (10.5) % (7.9) % (4.7) % (5.2) % Accumulated change in fair value of reinsurance assets 0.4 % 0.4 % 0.7 % 0.5 % 0.4 % (3.2) % (4.5) % (3.5) % (1.6) % (1.7) % Accumulated change in fair value of mortgage loan assets — % — % — % — % — % (1.7) % (3.2) % (2.8) % (1.9) % (2.2) % Adjustment to exclude subordinated debt — % — % — % — % — % — % — % — % — % (1.9) % Adjustment to arrive at notional debt 0.1 % 0.1 % 0.2 % 0.2 % 0.1 % (1.1) % (0.9) % (0.9) % (0.6) % (0.5) % Adjusted senior debt-to-capital ratio 12.2 % 11.2 % 12.9 % 13.7 % 14.9 % 14.1 % 14.7 % 14.4 % 14.5 % 16.5 %

Non-GAAP Measure Reconciliations (In millions, except percentages) 31 RECONCILIATION OF NET INCOME (LOSS) AVAILABLE TO AHL COMMON STOCKHOLDER TO SPREAD RELATED EARNINGS, EXCLUDING NOTABLE ITEMS Year ended December 31 Twelve Months ended March 31, 2024 Three months ended March 31, 20242020 2021 2022 2023 Net income (loss) available to Athene Holding Ltd. common stockholder $ 1,446 $ 3,718 $ (3,051) $ 4,484 $ 4,910 $ 1,147 Preferred stock dividends 95 141 141 181 179 45 Net income (loss) attributable to noncontrolling interests 380 (59) (2,106) 1,087 915 283 Net income (loss) 1,921 3,800 (5,016) 5,752 6,004 1,475 Income tax expense (benefit) 285 386 (646) (1,161) (1,017) 307 Income (loss) before income taxes 2,206 4,186 (5,662) 4,591 4,987 1,782 Investment gains (losses), net of offsets 733 1,024 (7,434) 170 (249) (22) Non-operating change in insurance liabilities and related derivatives, net of offsets1 (235) 692 1,433 182 990 673 Integration, restructuring and other non-operating expenses (10) (124) (133) (130) (131) (30) Stock compensation expense (25) (38) (56) (88) (85) (13) Preferred stock dividends 95 141 141 181 179 45 Noncontrolling interests - pre-tax income (loss) and VIE adjustments 393 (18) (2,079) 1,169 1,047 313 Less: Total adjustments to income (loss) before income taxes 951 1,677 (8,128) 1,484 1,751 966 Spread related earnings 1,255 2,509 2,466 3,107 3,236 816 Notable items (40) (52) 3 (115) (90) — Spread related earnings, excluding notable items $ 1,215 $ 2,457 $ 2,469 $ 2,992 $ 3,146 $ 816 RECONCILIATION OF BENEFITS AND EXPENSES TO COST OF FUNDS Three months ended March 31, 2024 US GAAP benefits and expenses $ 3,939 7.08 % Premiums (101) (0.18) % Product charges (238) (0.43) % Other revenues (2) — % FIA option costs 392 0.70 % Reinsurance impacts (42) (0.08) % Non-operating change in insurance liabilities and embedded derivatives (1,339) (2.41) % Policy and other operating expenses, excluding policy acquisition expenses (341) (0.61) % AmerUs Closed Block fair value liability 15 0.03 % ACRA noncontrolling interests (692) (1.24) % Other 132 0.24 % Total adjustments to arrive at cost of funds (2,216) (3.98) % Total cost of funds $ 1,723 3.10 % Average net invested assets $ 222,391 1 Prior to the adoption of LDTI, effective January 1, 2023, with a retrospective application back to January 1, 2022, offsets related to deferred acquisition costs, deferred sales inducements, value of business acquired and rider reserves.

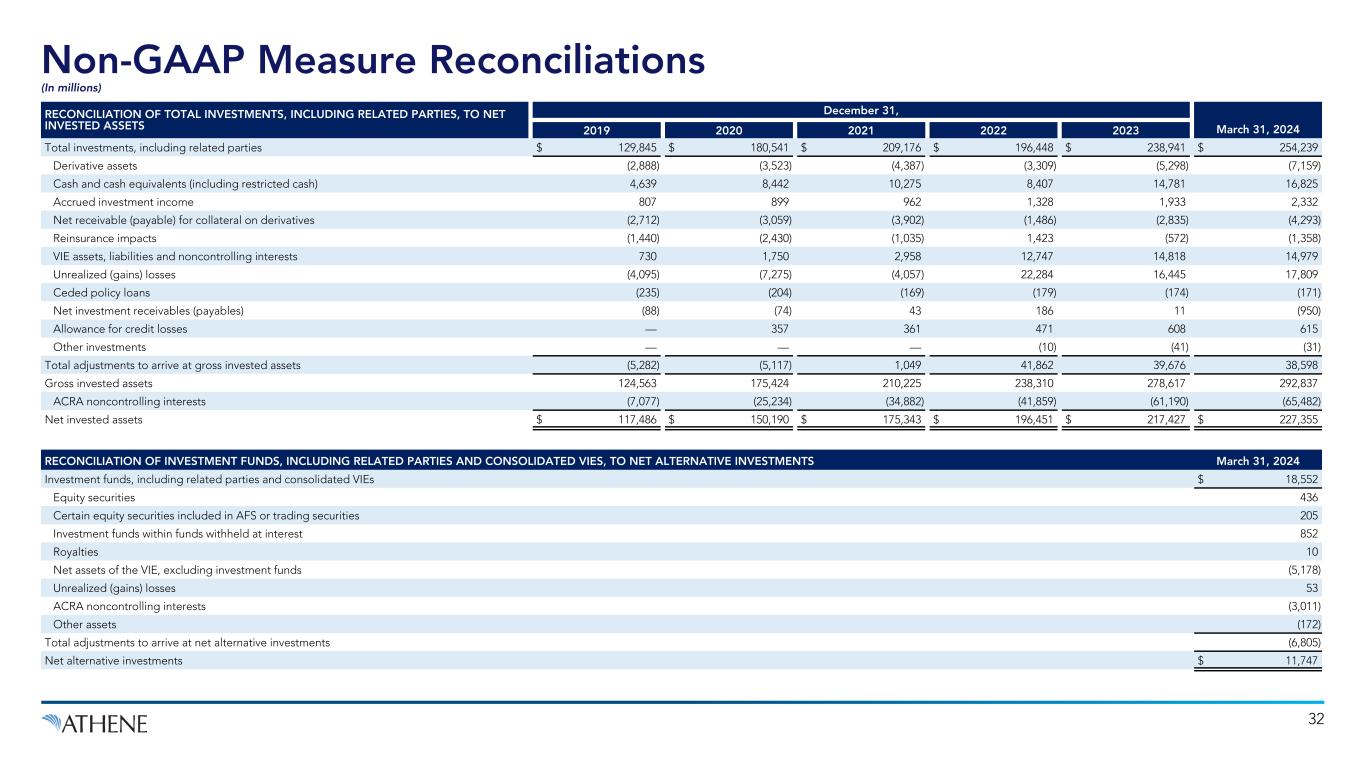

Non-GAAP Measure Reconciliations (In millions) 32 RECONCILIATION OF TOTAL INVESTMENTS, INCLUDING RELATED PARTIES, TO NET INVESTED ASSETS December 31, March 31, 20242019 2020 2021 2022 2023 Total investments, including related parties $ 129,845 $ 180,541 $ 209,176 $ 196,448 $ 238,941 $ 254,239 Derivative assets (2,888) (3,523) (4,387) (3,309) (5,298) (7,159) Cash and cash equivalents (including restricted cash) 4,639 8,442 10,275 8,407 14,781 16,825 Accrued investment income 807 899 962 1,328 1,933 2,332 Net receivable (payable) for collateral on derivatives (2,712) (3,059) (3,902) (1,486) (2,835) (4,293) Reinsurance impacts (1,440) (2,430) (1,035) 1,423 (572) (1,358) VIE assets, liabilities and noncontrolling interests 730 1,750 2,958 12,747 14,818 14,979 Unrealized (gains) losses (4,095) (7,275) (4,057) 22,284 16,445 17,809 Ceded policy loans (235) (204) (169) (179) (174) (171) Net investment receivables (payables) (88) (74) 43 186 11 (950) Allowance for credit losses — 357 361 471 608 615 Other investments — — — (10) (41) (31) Total adjustments to arrive at gross invested assets (5,282) (5,117) 1,049 41,862 39,676 38,598 Gross invested assets 124,563 175,424 210,225 238,310 278,617 292,837 ACRA noncontrolling interests (7,077) (25,234) (34,882) (41,859) (61,190) (65,482) Net invested assets $ 117,486 $ 150,190 $ 175,343 $ 196,451 $ 217,427 $ 227,355 RECONCILIATION OF INVESTMENT FUNDS, INCLUDING RELATED PARTIES AND CONSOLIDATED VIES, TO NET ALTERNATIVE INVESTMENTS March 31, 2024 Investment funds, including related parties and consolidated VIEs $ 18,552 Equity securities 436 Certain equity securities included in AFS or trading securities 205 Investment funds within funds withheld at interest 852 Royalties 10 Net assets of the VIE, excluding investment funds (5,178) Unrealized (gains) losses 53 ACRA noncontrolling interests (3,011) Other assets (172) Total adjustments to arrive at net alternative investments (6,805) Net alternative investments $ 11,747

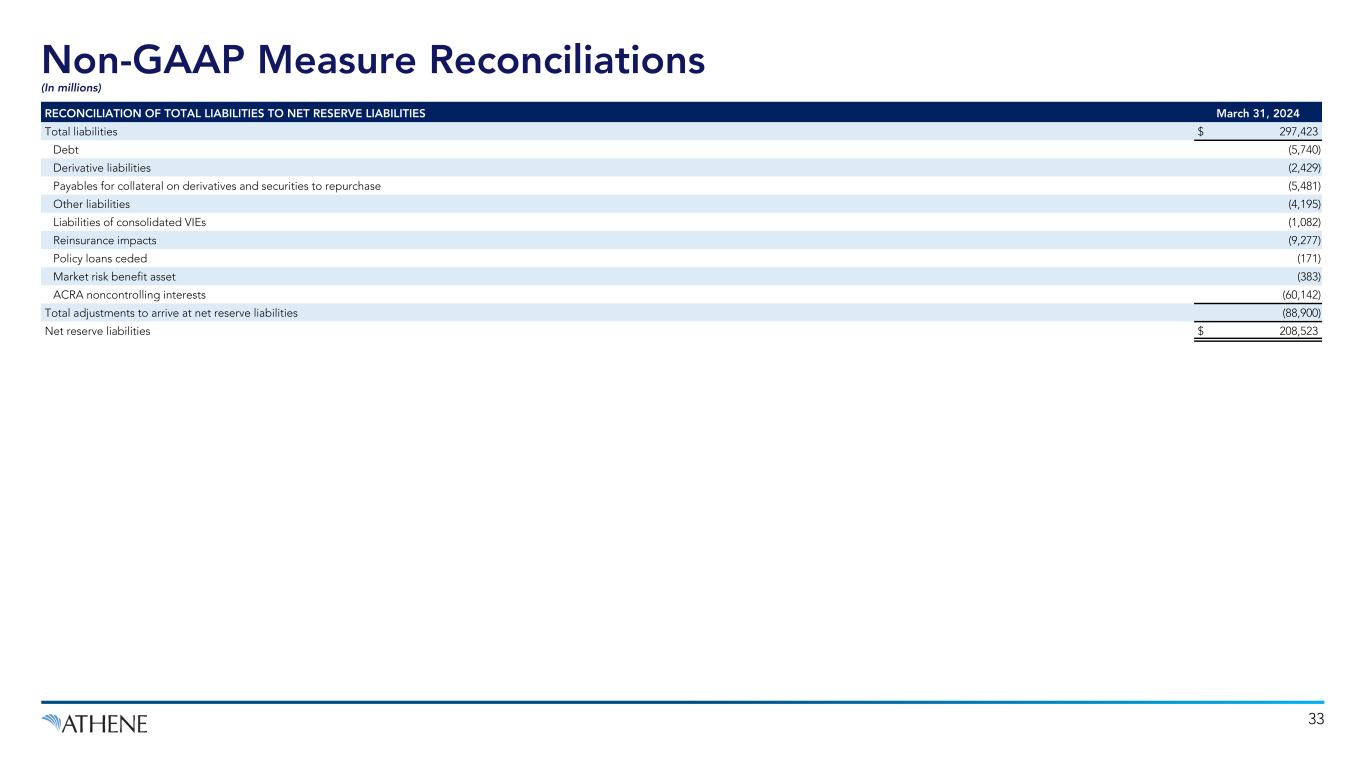

Non-GAAP Measure Reconciliations (In millions) 33 RECONCILIATION OF TOTAL LIABILITIES TO NET RESERVE LIABILITIES March 31, 2024 Total liabilities $ 297,423 Debt (5,740) Derivative liabilities (2,429) Payables for collateral on derivatives and securities to repurchase (5,481) Other liabilities (4,195) Liabilities of consolidated VIEs (1,082) Reinsurance impacts (9,277) Policy loans ceded (171) Market risk benefit asset (383) ACRA noncontrolling interests (60,142) Total adjustments to arrive at net reserve liabilities (88,900) Net reserve liabilities $ 208,523