EX-99.1

Published on March 13, 2024

Athene Asset Portfolio Risk & Stress Considerations Update March 2024

Disclaimer This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security of Athene Holding Ltd. (“AHL” or “Athene”). Unless the context requires otherwise, references in this presentation to “Apollo" and "AGM" refer to Apollo Global Management, Inc., together with its subsidiaries, references in this presentation to "AGM HoldCo" refer to Apollo Global Management, Inc., and references in this presentation to “AAM” refer to Apollo Asset Management, Inc., a subsidiary of Apollo Global Management, Inc. This presentation contains, and certain oral statements made by Athene’s representatives from time to time may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are subject to risks, uncertainties and assumptions that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of Athene’s management and the management of Athene’s subsidiaries. Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Forward looking statements within this presentation include, but are not limited to, benefits to be derived from Athene's capital allocation decisions; the anticipated performance of Athene's portfolio in certain stress or recessionary environments; the performance of Athene's business; general economic conditions; expected future operating results; Athene's liquidity and capital resources; and other non-historical statements. Although Athene management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. For a discussion of other risks and uncertainties related to Athene's forward-looking statements, see its annual report on Form 10-K for the year ended December 31, 2023, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. Athene does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. Athene adopted the US GAAP accounting standard related to Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI) as of January 1, 2023, which required Athene to apply the new standard retrospectively back to January 1, 2022, the date of Athene’s merger with AGM. Certain 2022 US GAAP financial metrics and disclosures in this presentation have been retrospectively adjusted in accordance with the requirements of the adoption guidance of LDTI. Please refer to the discussion of Non-GAAP Measures and Definitions herein for additional information on items that are excluded from Athene’s non-GAAP measure of spread related earnings, which was retrospectively adjusted in accordance with the requirements of the adoption guidance of LDTI. Information contained herein may include information respecting prior performance of Athene. Information respecting prior performance, while a useful tool, is not necessarily indicative of actual results to be achieved in the future, which is dependent upon many factors, many of which are beyond Athene's control. The information contained herein is not a guarantee of future performance by Athene, and actual outcomes and results may differ materially from any historic, pro forma or projected financial results indicated herein. Certain of the financial information contained herein is unaudited or based on the application of non-GAAP financial measures. These non-GAAP financial measures should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. Furthermore, certain financial information is based on estimates of management. These estimates, which are based on the reasonable expectations of management, are subject to change and there can be no assurance that they will prove to be correct. The information contained herein does not purport to be all-inclusive or contain all information that an evaluator may require in order to properly evaluate the business, prospects or value of Athene. Athene does not have any obligation to update this presentation and the information may change at any time without notice. Models that may be contained herein (the “Models”) are being provided for illustrative and discussion purposes only and are not intended to forecast or predict future events. Information provided in the Models may not reflect the most current data and is subject to change. The Models are based on estimates and assumptions that are also subject to change and may be subject to significant business, economic and competitive uncertainties, including numerous uncontrollable market and event driven situations. There is no guarantee that the information presented in the Models is accurate. Actual results may differ materially from those reflected and contemplated in such hypothetical, forward- looking information. Undue reliance should not be placed on such information and investors should not use the Models to make investment decisions. Athene has no duty to update the Models in the future. Certain of the information used in preparing this presentation was obtained from third parties or public sources. No representation or warranty, express or implied, is made or given by or on behalf of Athene or any other person as to the accuracy, completeness or fairness of such information, and no responsibility or liability is accepted for any such information. The contents of any website referenced in this presentation are not incorporated by reference and only speak as of the date listed thereon. This document is not intended to be, nor should it be construed or used as, financial, legal, tax, insurance or investment advice. There can be no assurance that Athene will achieve its objectives. Past performance is not indicative of future success. All information is as of the dates indicated herein. 2

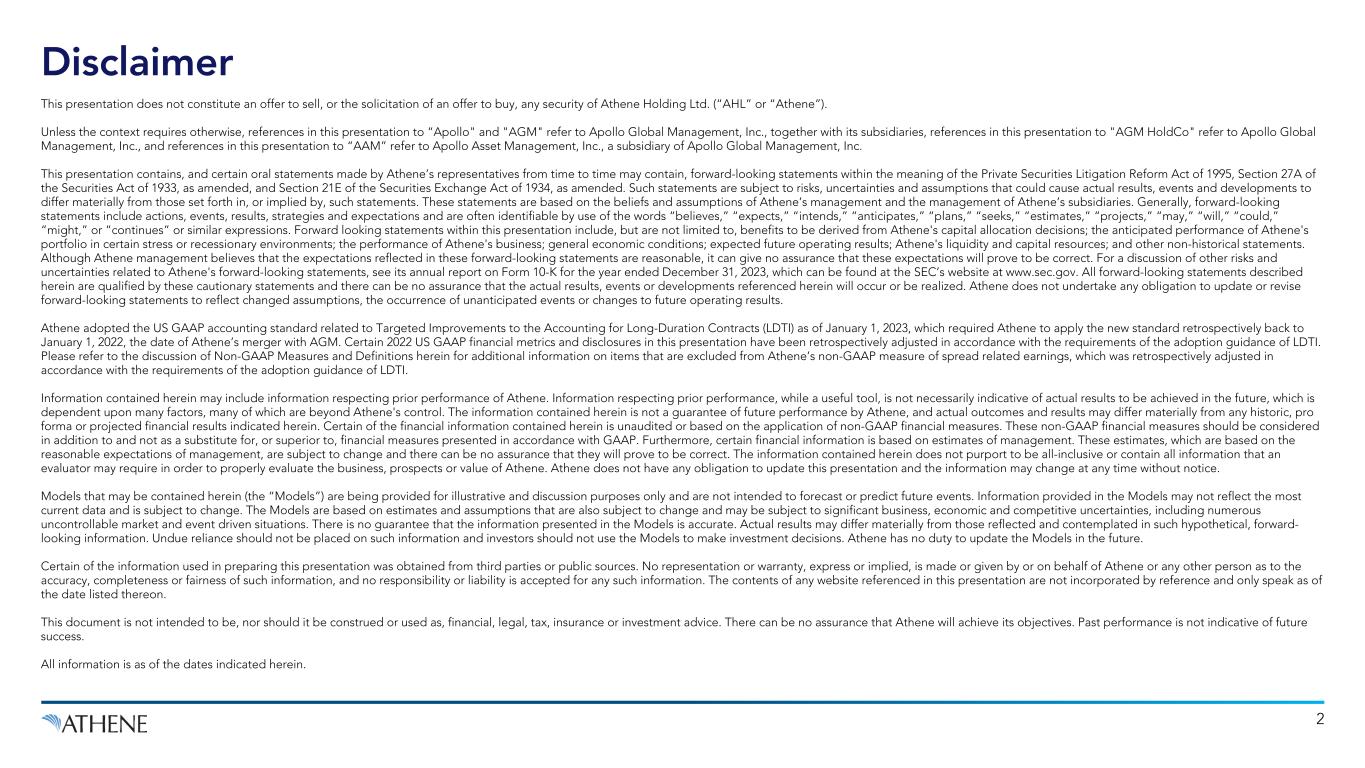

5% 9% 14% 22% 30% 37% 45% 52% 57% 66% 72% 77% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 YTD 2023 3 The Industry Has Focused on Capital Return, Leaving Many Companies With Less Capital Flexibility U.S. and European Life Insurers Cumulative Capital Return as % of Current Market Capitalization1 Over the past decade, U.S. and European life insurers have returned capital to shareholders equal to 77% of current market capitalization1 $4B+ total capital charges on higher-risk liabilities2 from U.S. life insurers since 2H’22 Source: Capital IQ as of February 19, 2024. Includes US insurers AEL, AIG, LNC, MET, PFG, PRU, and VOYA, and European insurers AXA, Generali, Allianz, Aviva, Swiss Life, Phoenix, L&G, NN, ASR, Ageas and Aegon. 1. 2023 capital return through September 30, 2023. 2. Higher-risk liabilities relate to guaranteed universal life, long-term care, and traditional variable annuities, none of which Athene has direct exposure to.

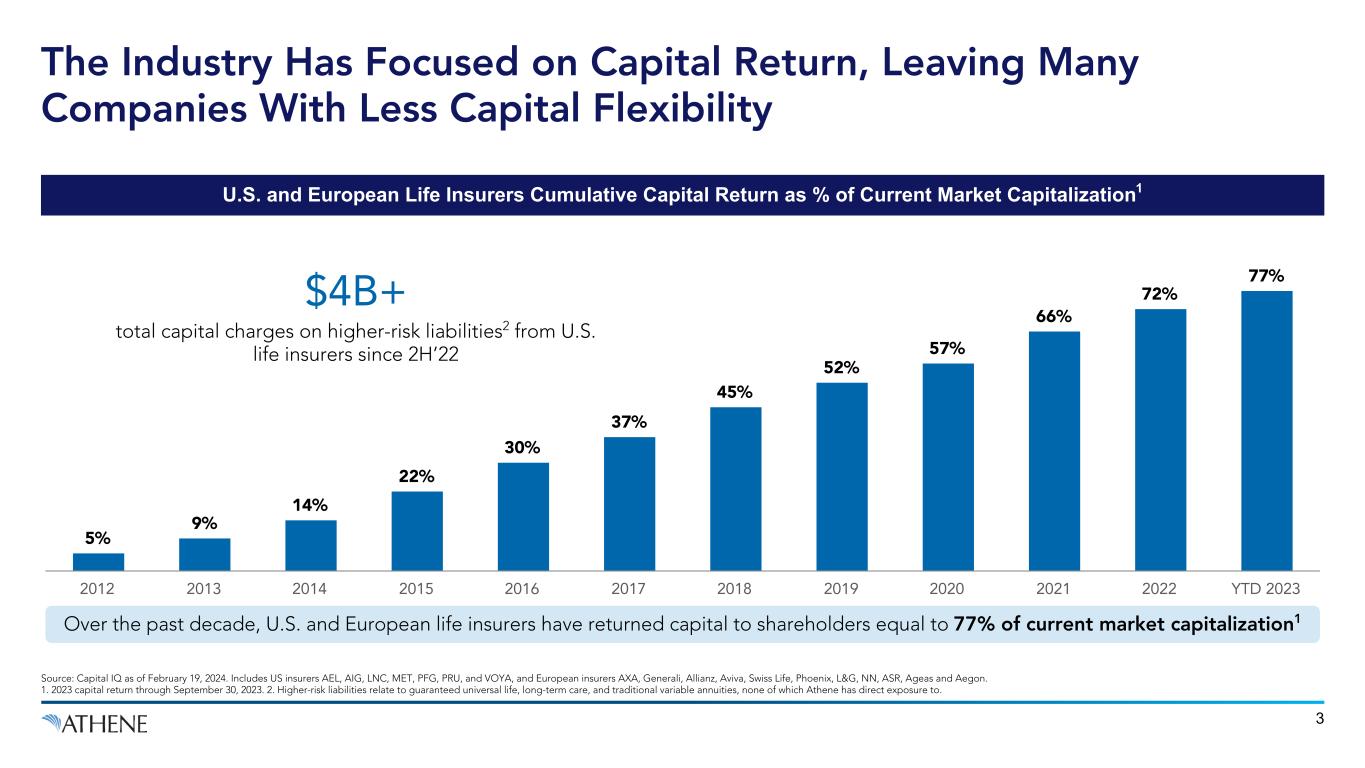

Note: Ratings represent financial strength ratings for primary insurance subsidiaries. 1. Calculated as the sum of total primary capital raised across Apollo retirement services platform entities via equity, preferred equity, debt, and third-party capital from 2010 through January 31, 2024. 4 Acquires Aviva USA 20152014 20212017 202220182013 Rated ‘A-’ Rated ‘A-’ Upgraded to ‘A’ Upgraded to ‘A’ Upgraded to ‘A+’ Upgraded to ‘A+’ Rated ‘A1’ Merger Completed 2009 Company Founded 2019 Upgraded to ‘A’ Athene Has Spent Years Diligently Raising Capital to Improve Its Financial Strength Apollo has been the largest single contributor of capital to the retirement services industry in the US and Europe since 2010 having raised approximately $17 billion of primary capital across its platform ~$17 Billion1

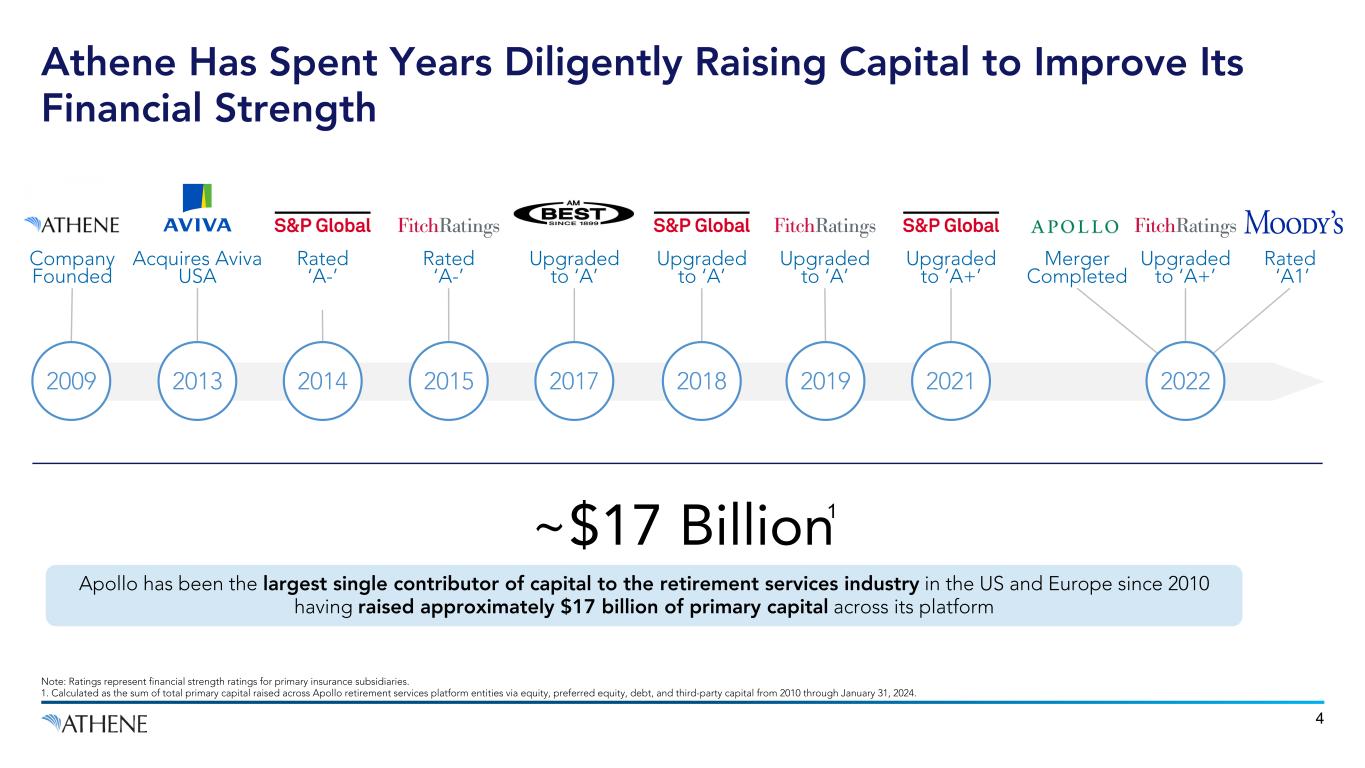

5 Note: Athene metrics are net of the noncontrolling interests, as of December 31, 2023. 1. Relates to Athene’s primary insurance subsidiaries; represents ratings from AM Best "A", Fitch "A+", S&P "A+" and Moody’s "A1". 2. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. Excludes capital from noncontrolling interests. 3. Computed as capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 4. Includes $10.5 billion of cash and cash equivalents, $2.6 billion AHL/Athene Life Re Ltd. (ALRe) liquidity facility with $0.5 billion accordion feature, $2.0 billion committed repos, $1.25 billion AHL credit facility with $0.5 billion accordion feature, $3.7 billion of FHLB capacity, and $60.5 billion liquid bond portfolio. Availability of accordion features subject to lender consent and other factors. 5. Includes $2.6 billion in excess equity capital, $3.8 billion in untapped debt capacity and $1.6 billion in available undrawn capital at ACRA. Untapped debt capacity assumes capacity of 25% debt-to-capitalization and is subject to general availability and market conditions. Athene Has Built a Fortress Balance Sheet… Financial Strength Profile A+ $2.6B Excess Equity Capital3 $22B Regulatory Capital2 $8.0B Total Deployable Capital5 Available Liquidity $82B 41

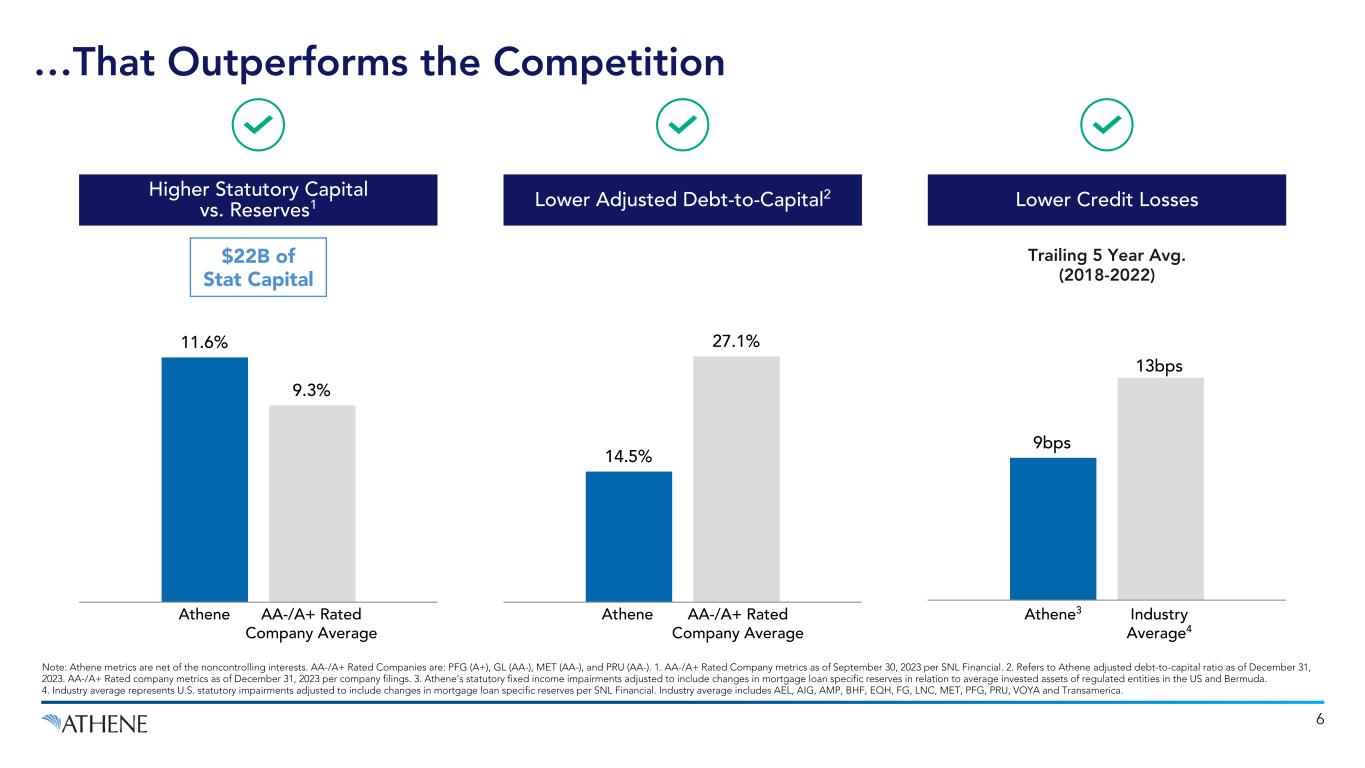

11.6% 9.3% 6 Note: Athene metrics are net of the noncontrolling interests. AA-/A+ Rated Companies are: PFG (A+), GL (AA-), MET (AA-), and PRU (AA-). 1. AA-/A+ Rated Company metrics as of September 30, 2023 per SNL Financial. 2. Refers to Athene adjusted debt-to-capital ratio as of December 31, 2023. AA-/A+ Rated company metrics as of December 31, 2023 per company filings. 3. Athene’s statutory fixed income impairments adjusted to include changes in mortgage loan specific reserves in relation to average invested assets of regulated entities in the US and Bermuda. 4. Industry average represents U.S. statutory impairments adjusted to include changes in mortgage loan specific reserves per SNL Financial. Industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. $22B of Stat Capital Trailing 5 Year Avg. (2018-2022) Higher Statutory Capital vs. Reserves1 Lower Adjusted Debt-to-Capital2 Lower Credit Losses Athene AA-/A+ Rated Company Average 14.5% 27.1% Athene AA-/A+ Rated Company Average Athene3 Industry Average4 9bps 13bps …That Outperforms the Competition

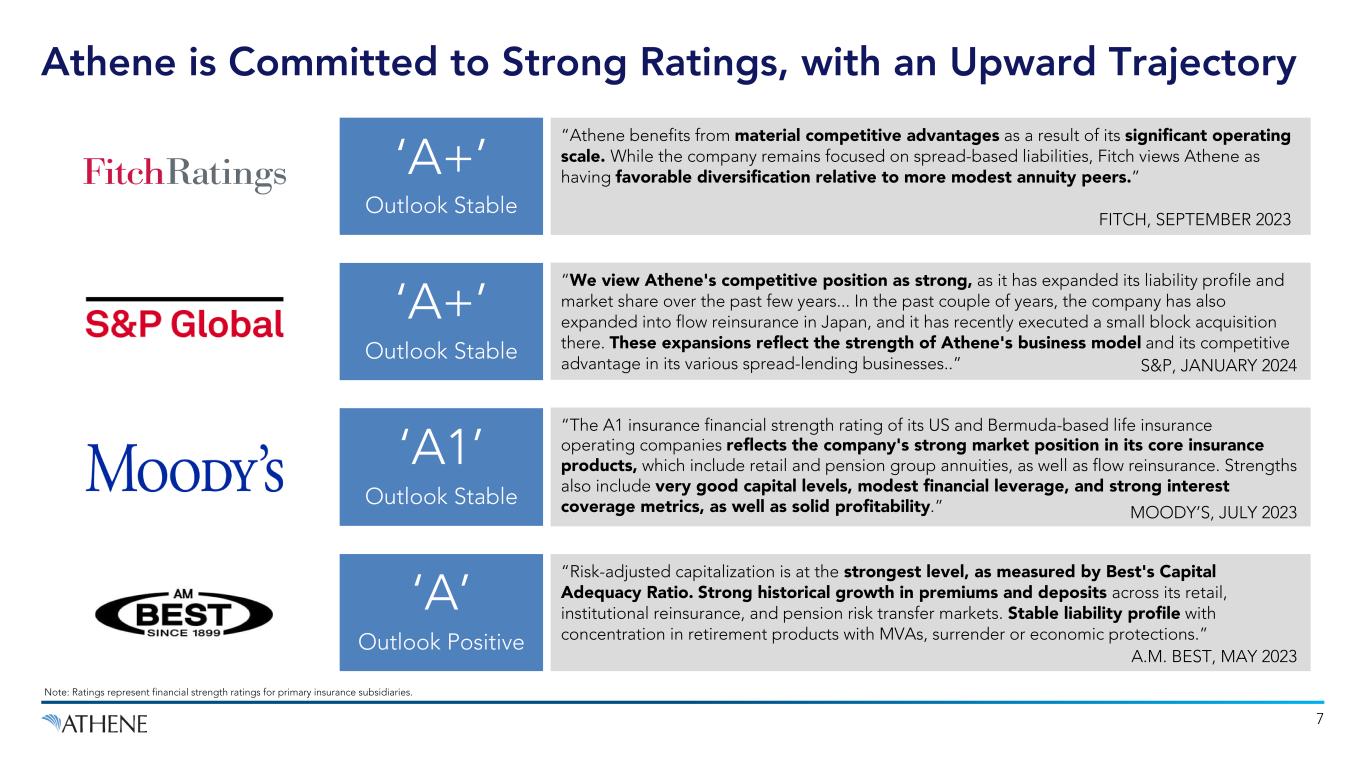

“Risk-adjusted capitalization is at the strongest level, as measured by Best's Capital Adequacy Ratio. Strong historical growth in premiums and deposits across its retail, institutional reinsurance, and pension risk transfer markets. Stable liability profile with concentration in retirement products with MVAs, surrender or economic protections.” “The A1 insurance financial strength rating of its US and Bermuda-based life insurance operating companies reflects the company's strong market position in its core insurance products, which include retail and pension group annuities, as well as flow reinsurance. Strengths also include very good capital levels, modest financial leverage, and strong interest coverage metrics, as well as solid profitability.” ‘A1’ Outlook Stable 7 ‘A+’ Outlook Stable “Athene benefits from material competitive advantages as a result of its significant operating scale. While the company remains focused on spread-based liabilities, Fitch views Athene as having favorable diversification relative to more modest annuity peers.” “We view Athene's competitive position as strong, as it has expanded its liability profile and market share over the past few years... In the past couple of years, the company has also expanded into flow reinsurance in Japan, and it has recently executed a small block acquisition there. These expansions reflect the strength of Athene's business model and its competitive advantage in its various spread-lending businesses..” ‘A+’ Outlook Stable ‘A’ Outlook Positive S&P, JANUARY 2024 FITCH, SEPTEMBER 2023 A.M. BEST, MAY 2023 MOODY’S, JULY 2023 Note: Ratings represent financial strength ratings for primary insurance subsidiaries. Athene is Committed to Strong Ratings, with an Upward Trajectory

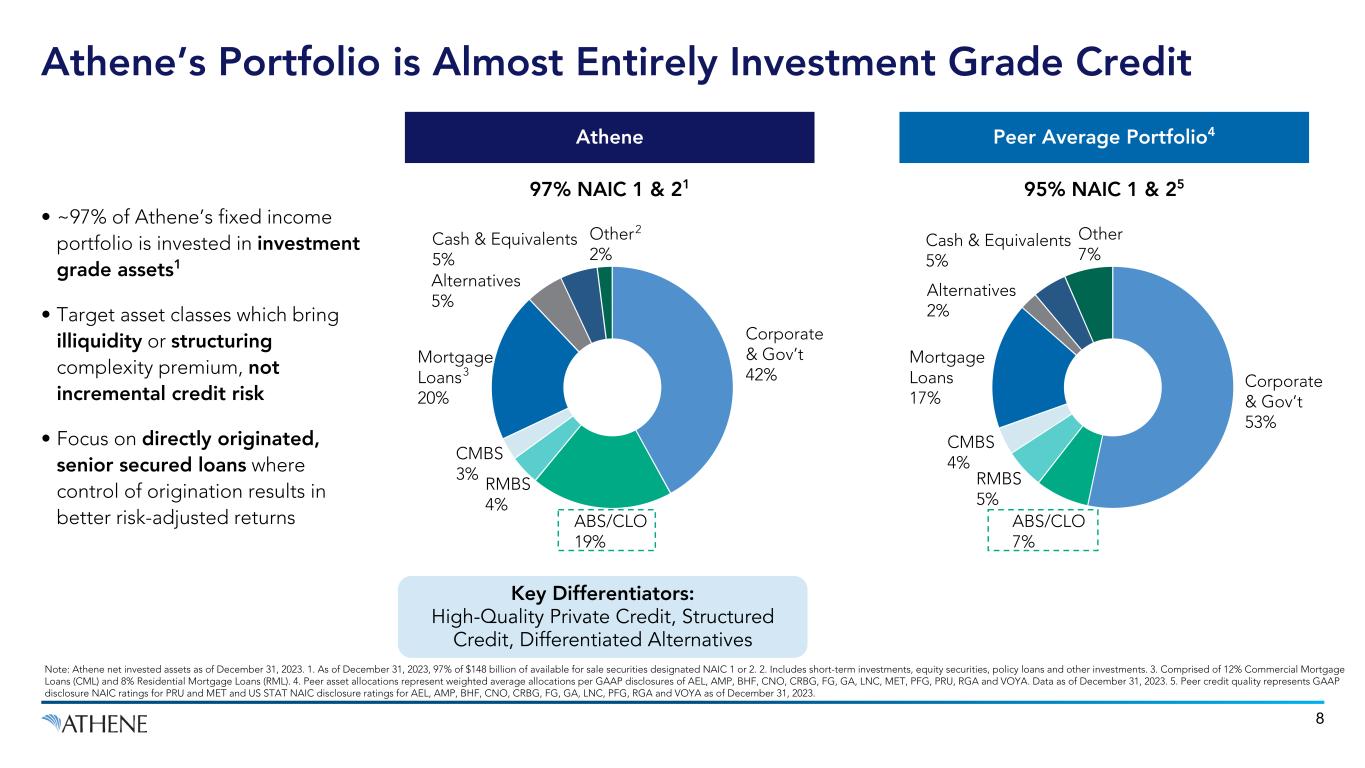

8 95% NAIC 1 & 2597% NAIC 1 & 21 Note: Athene net invested assets as of December 31, 2023. 1. As of December 31, 2023, 97% of $148 billion of available for sale securities designated NAIC 1 or 2. 2. Includes short-term investments, equity securities, policy loans and other investments. 3. Comprised of 12% Commercial Mortgage Loans (CML) and 8% Residential Mortgage Loans (RML). 4. Peer asset allocations represent weighted average allocations per GAAP disclosures of AEL, AMP, BHF, CNO, CRBG, FG, GA, LNC, MET, PFG, PRU, RGA and VOYA. Data as of December 31, 2023. 5. Peer credit quality represents GAAP disclosure NAIC ratings for PRU and MET and US STAT NAIC disclosure ratings for AEL, AMP, BHF, CNO, CRBG, FG, GA, LNC, PFG, RGA and VOYA as of December 31, 2023. Athene Peer Average Portfolio4 Key Differentiators: High-Quality Private Credit, Structured Credit, Differentiated Alternatives Athene’s Portfolio is Almost Entirely Investment Grade Credit Corporate & Gov’t 42% ABS/CLO 19% RMBS 4% CMBS 3% Mortgage Loans 20% Alternatives 5% Cash & Equivalents 5% Other 2% Corporate & Gov’t 53% ABS/CLO 7% RMBS 5% CMBS 4% Mortgage Loans 17% Alternatives 2% Cash & Equivalents 5% Other 7% 2 3 • ~97% of Athene’s fixed income portfolio is invested in investment grade assets1 • Target asset classes which bring illiquidity or structuring complexity premium, not incremental credit risk • Focus on directly originated, senior secured loans where control of origination results in better risk-adjusted returns

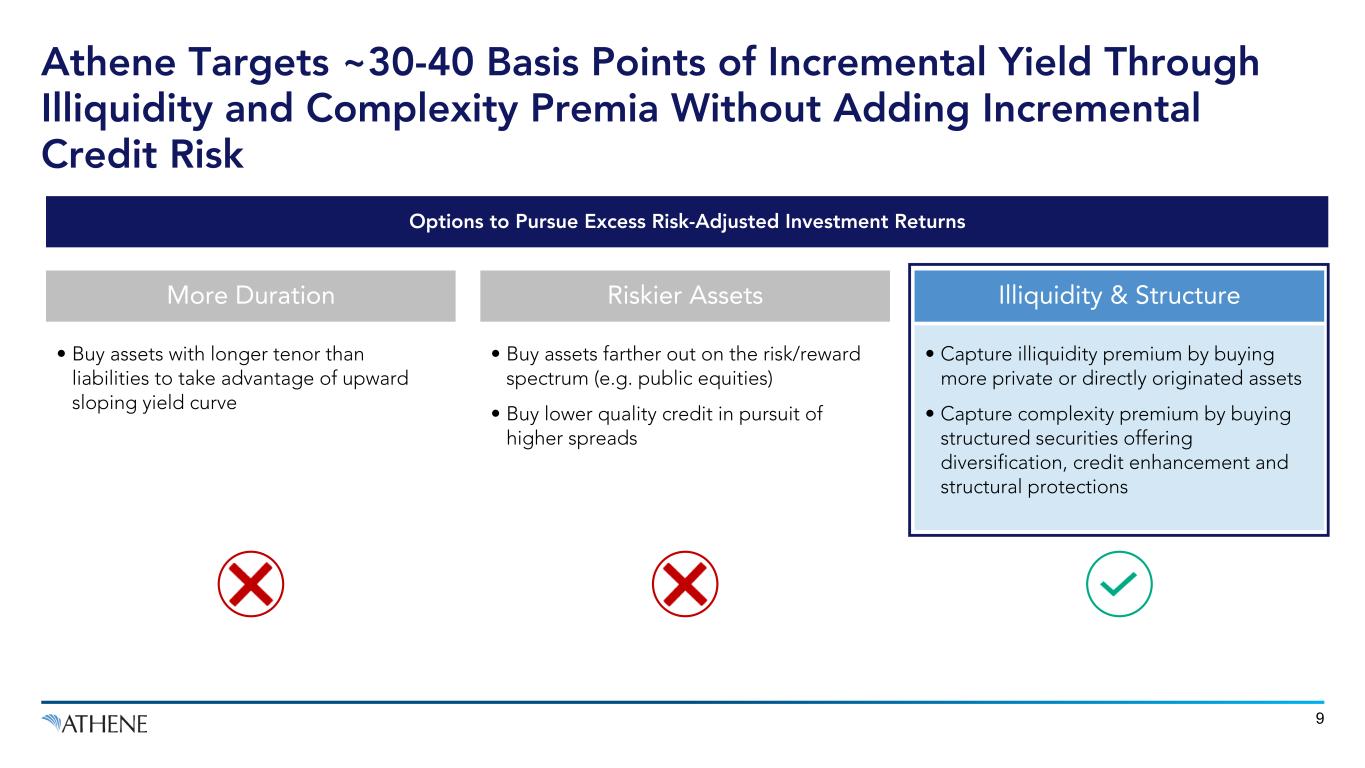

More Duration Riskier Assets Illiquidity & Structure • Buy assets with longer tenor than liabilities to take advantage of upward sloping yield curve • Buy assets farther out on the risk/reward spectrum (e.g. public equities) • Buy lower quality credit in pursuit of higher spreads • Capture illiquidity premium by buying more private or directly originated assets • Capture complexity premium by buying structured securities offering diversification, credit enhancement and structural protections Options to Pursue Excess Risk-Adjusted Investment Returns Athene Targets ~30-40 Basis Points of Incremental Yield Through Illiquidity and Complexity Premia Without Adding Incremental Credit Risk 9

Today, Investment Grade Structured Credit is Safer Credit Risk Than Equivalently Rated Corporate Debt Athene continues to be a leader in transparency around its investment philosophy in structured credit, and published a Structured Credit Whitepaper in December 2022 Highlights key features of investment grade structured credit, which help to provide safer yield than comparably rated corporate credit: Diversification Credit Enhancement Structural Protections Investors with the expertise to understand complexity, and long-dated, stable funding to withstand illiquidity and price volatility, can capture incremental yield without taking on incremental credit risk CLICK HERE TO VIEW ATHENE’S STRUCTURED CREDIT WHITEPAPER 10

11 Risk Management is Embedded in Everything We Do Manage Risk Such That Athene Can Grow Profitably Across Market Environments Robust risk management framework and procedures underpin focus on protecting capital and aligning risks with stakeholder expectations Risk strategy, investment, credit, asset-liability management (“ALM”), liability and liquidity risk policies, amongst others, at the board and management levels Stress testing plays a key role in defining risk appetite, with tests performed on both sides of the balance sheet Duration-Matched Portfolio with Quarterly Cash Flow Monitoring & Stress Testing Committed to transparency by publishing stress test results at least annually

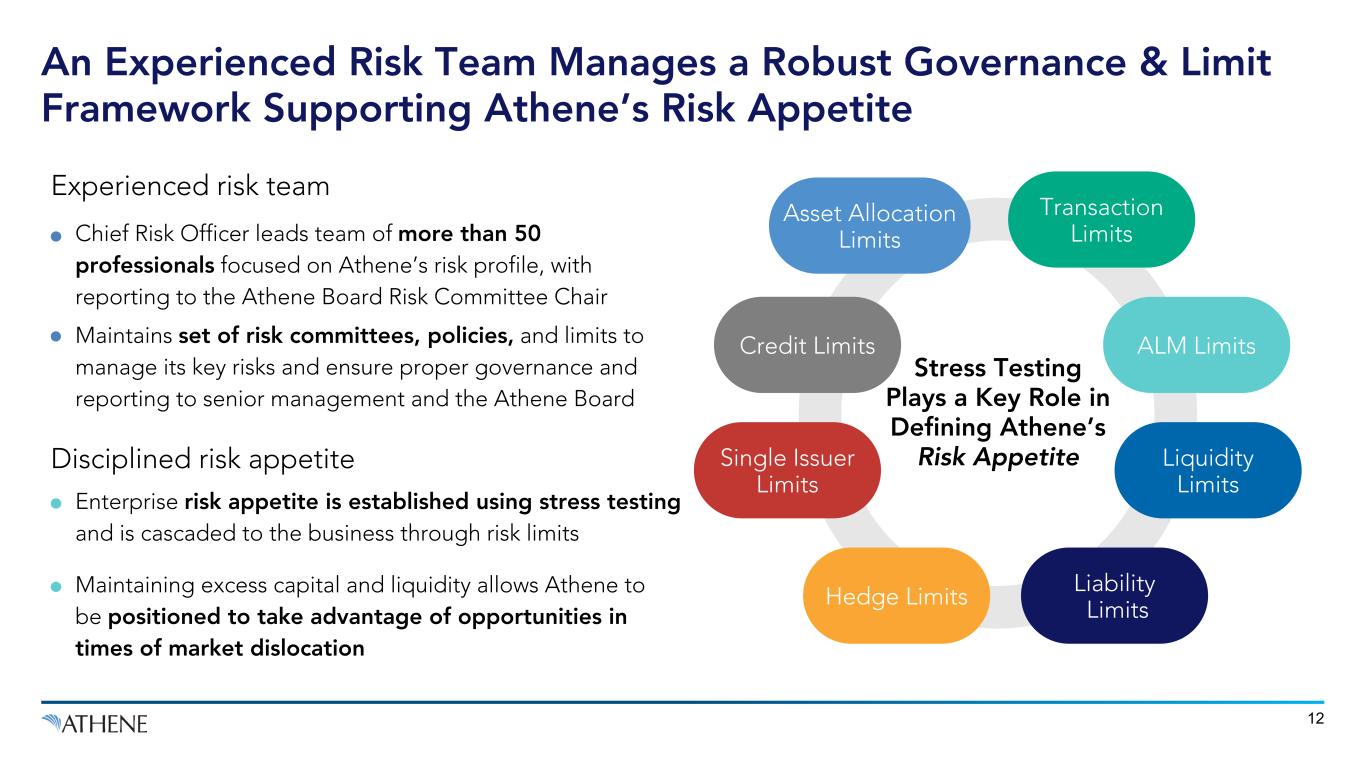

12 Disciplined risk appetite Experienced risk team Enterprise risk appetite is established using stress testing and is cascaded to the business through risk limits Maintaining excess capital and liquidity allows Athene to be positioned to take advantage of opportunities in times of market dislocation Chief Risk Officer leads team of more than 50 professionals focused on Athene’s risk profile, with reporting to the Athene Board Risk Committee Chair Maintains set of risk committees, policies, and limits to manage its key risks and ensure proper governance and reporting to senior management and the Athene Board Stress Testing Plays a Key Role in Defining Athene’s Risk Appetite ALM Limits Liquidity Limits Hedge Limits Single Issuer Limits Credit Limits Transaction Limits Asset Allocation Limits An Experienced Risk Team Manages a Robust Governance & Limit Framework Supporting Athene’s Risk Appetite Liability Limits

13 Apollo’s Portfolio Managers and Investment Committees Apollo Insurance Solutions Group Apollo’s Compliance and Allocation Committees Athene Risk Athene Investment & Asset / Liability Committee Athene Board Risk & Conflict Committees Rating Agencies, Regulators, and Clients Ensures investments are consistent with allocation and other compliance policies Athene’s Chief Risk Officer reports to Athene Board Risk Committee & sits on the Athene Executive Committee Frequent communication with rating agencies, regulators, & reinsurance counterparties Multi-asset portfolio construction & management consistent with Athene’s investment mandates & risk policies Committee includes Athene CEO, President, CRO, CFO, COO, amongst others 6-person Athene Board Risk Committee including 4 independent directors Robust, Multi-Layered Governance for Investment Risk Asset selection goes through a well-defined risk control process aligned with Athene’s risk appetite

14 Athene’s stress framework utilizes internally defined, integrated scenario stresses (shocks to credit, equity, rates) based on economic scenarios Defined scenarios based on severe economic stresses observed over multi-year periods Corporates Utilize Moody’s historical recession era bond default rates and recovery rates. Deep recession applies two-year cumulative defaults experienced during both 2008 and 2009 1 CLO Based on Moody's historical recession era speculative grade default rates, while remaining more conservative compared to history 2 Non-Agency RMBS Full model re-generation of each security’s cash flows using Housing Price Index/ unemployment values observed during historical recessions 4 Commercial Mortgage Loans (‘CML’) Simulating defaults and severities based on rent growth and commercial property price movement observed during 2008 5 Alternatives Loss estimated based on total return sensitivity of investment specific benchmark indices during periods of peak equity market stress; Strategic alternatives modeled individually from the bottom up 6 3 ABS Based on shocks to cash flows, default probabilities and collateral recoveries, among other factors. Customized for each sub-sector and typically more conservative than GFC experience Asset Stress Testing Methodology is Conservative Compared to Historical Experience

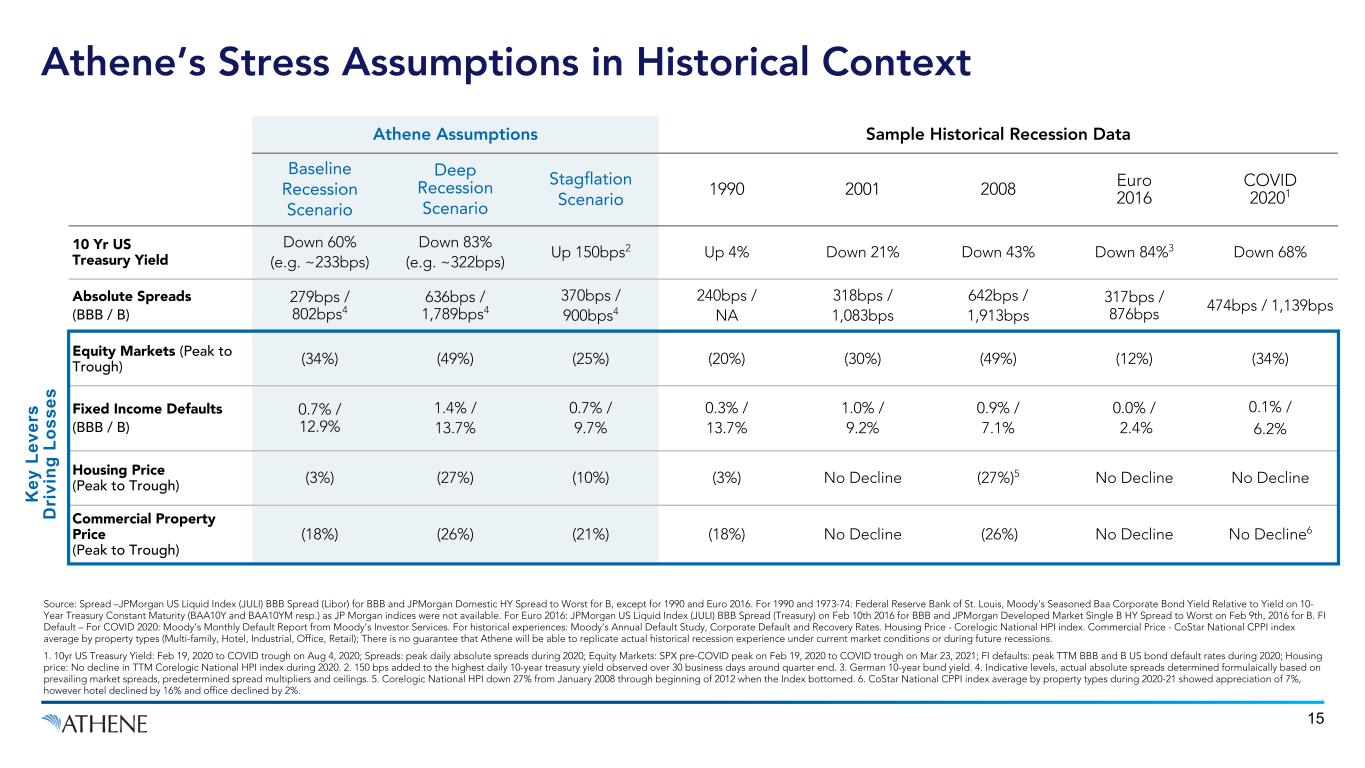

15 Athene Assumptions Sample Historical Recession Data Baseline Recession Scenario Deep Recession Scenario Stagflation Scenario 1990 2001 2008 Euro 2016 COVID 20201 10 Yr US Treasury Yield Down 60% (e.g. ~233bps) Down 83% (e.g. ~322bps) Up 150bps2 Up 4% Down 21% Down 43% Down 84%3 Down 68% Absolute Spreads (BBB / B) 279bps / 802bps4 636bps / 1,789bps4 370bps / 900bps4 240bps / NA 318bps / 1,083bps 642bps / 1,913bps 317bps / 876bps 474bps / 1,139bps Equity Markets (Peak to Trough) (34%) (49%) (25%) (20%) (30%) (49%) (12%) (34%) Fixed Income Defaults (BBB / B) 0.7% / 12.9% 1.4% / 13.7% 0.7% / 9.7% 0.3% / 13.7% 1.0% / 9.2% 0.9% / 7.1% 0.0% / 2.4% 0.1% / 6.2% Housing Price (Peak to Trough) (3%) (27%) (10%) (3%) No Decline (27%)5 No Decline No Decline Commercial Property Price (Peak to Trough) (18%) (26%) (21%) (18%) No Decline (26%) No Decline No Decline6 K ey L ev er s D ri vi ng L os se s Source: Spread –JPMorgan US Liquid Index (JULI) BBB Spread (Libor) for BBB and JPMorgan Domestic HY Spread to Worst for B, except for 1990 and Euro 2016. For 1990 and 1973-74: Federal Reserve Bank of St. Louis, Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10- Year Treasury Constant Maturity (BAA10Y and BAA10YM resp.) as JP Morgan indices were not available. For Euro 2016: JPMorgan US Liquid Index (JULI) BBB Spread (Treasury) on Feb 10th 2016 for BBB and JPMorgan Developed Market Single B HY Spread to Worst on Feb 9th, 2016 for B. FI Default – For COVID 2020: Moody’s Monthly Default Report from Moody’s Investor Services. For historical experiences: Moody’s Annual Default Study, Corporate Default and Recovery Rates. Housing Price - Corelogic National HPI index. Commercial Price - CoStar National CPPI index average by property types (Multi-family, Hotel, Industrial, Office, Retail); There is no guarantee that Athene will be able to replicate actual historical recession experience under current market conditions or during future recessions. 1. 10yr US Treasury Yield: Feb 19, 2020 to COVID trough on Aug 4, 2020; Spreads: peak daily absolute spreads during 2020; Equity Markets: SPX pre-COVID peak on Feb 19, 2020 to COVID trough on Mar 23, 2021; FI defaults: peak TTM BBB and B US bond default rates during 2020; Housing price: No decline in TTM Corelogic National HPI index during 2020. 2. 150 bps added to the highest daily 10-year treasury yield observed over 30 business days around quarter end. 3. German 10-year bund yield. 4. Indicative levels, actual absolute spreads determined formulaically based on prevailing market spreads, predetermined spread multipliers and ceilings. 5. Corelogic National HPI down 27% from January 2008 through beginning of 2012 when the Index bottomed. 6. CoStar National CPPI index average by property types during 2020-21 showed appreciation of 7%, however hotel declined by 16% and office declined by 2%. Athene’s Stress Assumptions in Historical Context

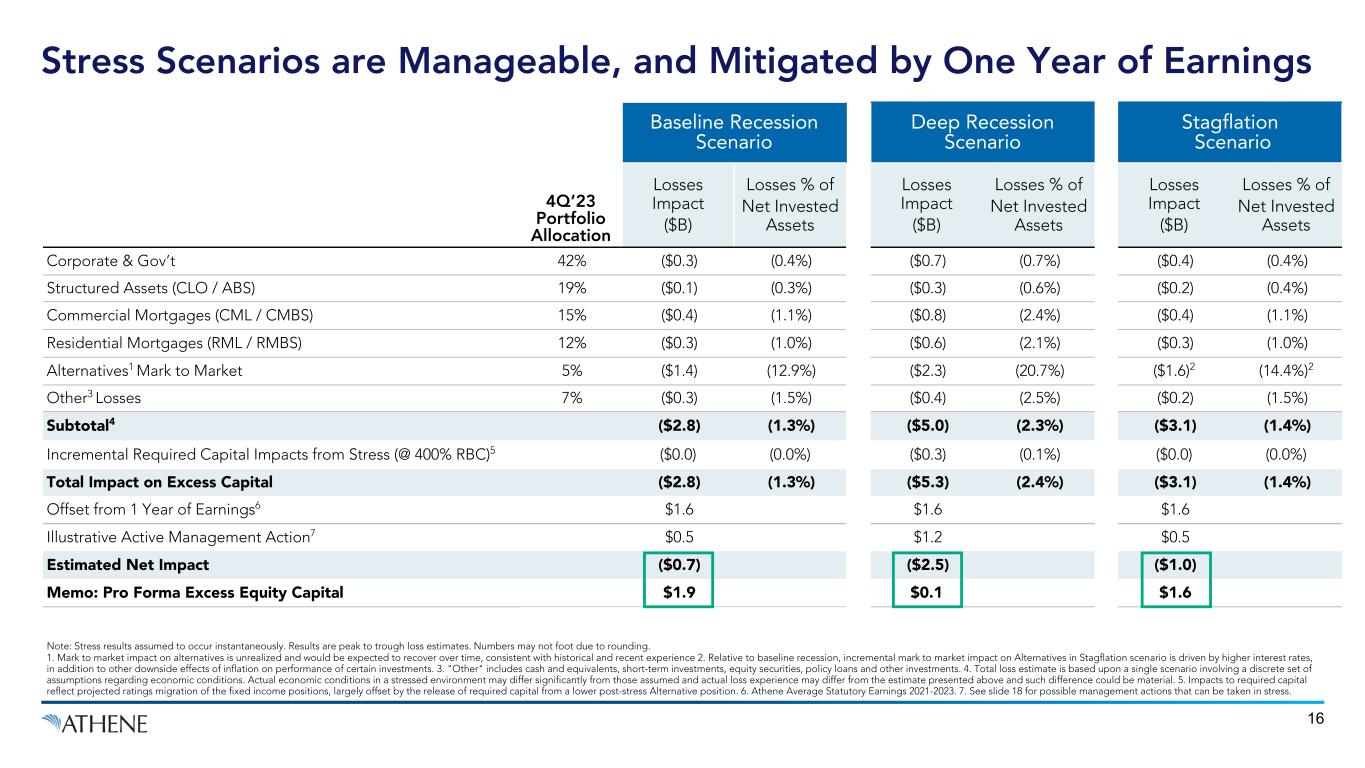

16 4Q’23 Portfolio Allocation Baseline Recession Scenario Deep Recession Scenario Stagflation Scenario Losses Impact ($B) Losses % of Net Invested Assets Losses Impact ($B) Losses % of Net Invested Assets Losses Impact ($B) Losses % of Net Invested Assets Corporate & Gov’t 42% ($0.3) (0.4%) ($0.7) (0.7%) ($0.4) (0.4%) Structured Assets (CLO / ABS) 19% ($0.1) (0.3%) ($0.3) (0.6%) ($0.2) (0.4%) Commercial Mortgages (CML / CMBS) 15% ($0.4) (1.1%) ($0.8) (2.4%) ($0.4) (1.1%) Residential Mortgages (RML / RMBS) 12% ($0.3) (1.0%) ($0.6) (2.1%) ($0.3) (1.0%) Alternatives1 Mark to Market 5% ($1.4) (12.9%) ($2.3) (20.7%) ($1.6)2 (14.4%)2 Other3 Losses 7% ($0.3) (1.5%) ($0.4) (2.5%) ($0.2) (1.5%) Subtotal4 ($2.8) (1.3%) ($5.0) (2.3%) ($3.1) (1.4%) Incremental Required Capital Impacts from Stress (@ 400% RBC)5 ($0.0) (0.0%) ($0.3) (0.1%) ($0.0) (0.0%) Total Impact on Excess Capital ($2.8) (1.3%) ($5.3) (2.4%) ($3.1) (1.4%) Offset from 1 Year of Earnings6 $1.6 $1.6 $1.6 Illustrative Active Management Action7 $0.5 $1.2 $0.5 Estimated Net Impact ($0.7) ($2.5) ($1.0) Memo: Pro Forma Excess Equity Capital $1.9 $0.1 $1.6 Note: Stress results assumed to occur instantaneously. Results are peak to trough loss estimates. Numbers may not foot due to rounding. 1. Mark to market impact on alternatives is unrealized and would be expected to recover over time, consistent with historical and recent experience 2. Relative to baseline recession, incremental mark to market impact on Alternatives in Stagflation scenario is driven by higher interest rates, in addition to other downside effects of inflation on performance of certain investments. 3. "Other" includes cash and equivalents, short-term investments, equity securities, policy loans and other investments. 4. Total loss estimate is based upon a single scenario involving a discrete set of assumptions regarding economic conditions. Actual economic conditions in a stressed environment may differ significantly from those assumed and actual loss experience may differ from the estimate presented above and such difference could be material. 5. Impacts to required capital reflect projected ratings migration of the fixed income positions, largely offset by the release of required capital from a lower post-stress Alternative position. 6. Athene Average Statutory Earnings 2021-2023. 7. See slide 18 for possible management actions that can be taken in stress. Stress Scenarios are Manageable, and Mitigated by One Year of Earnings

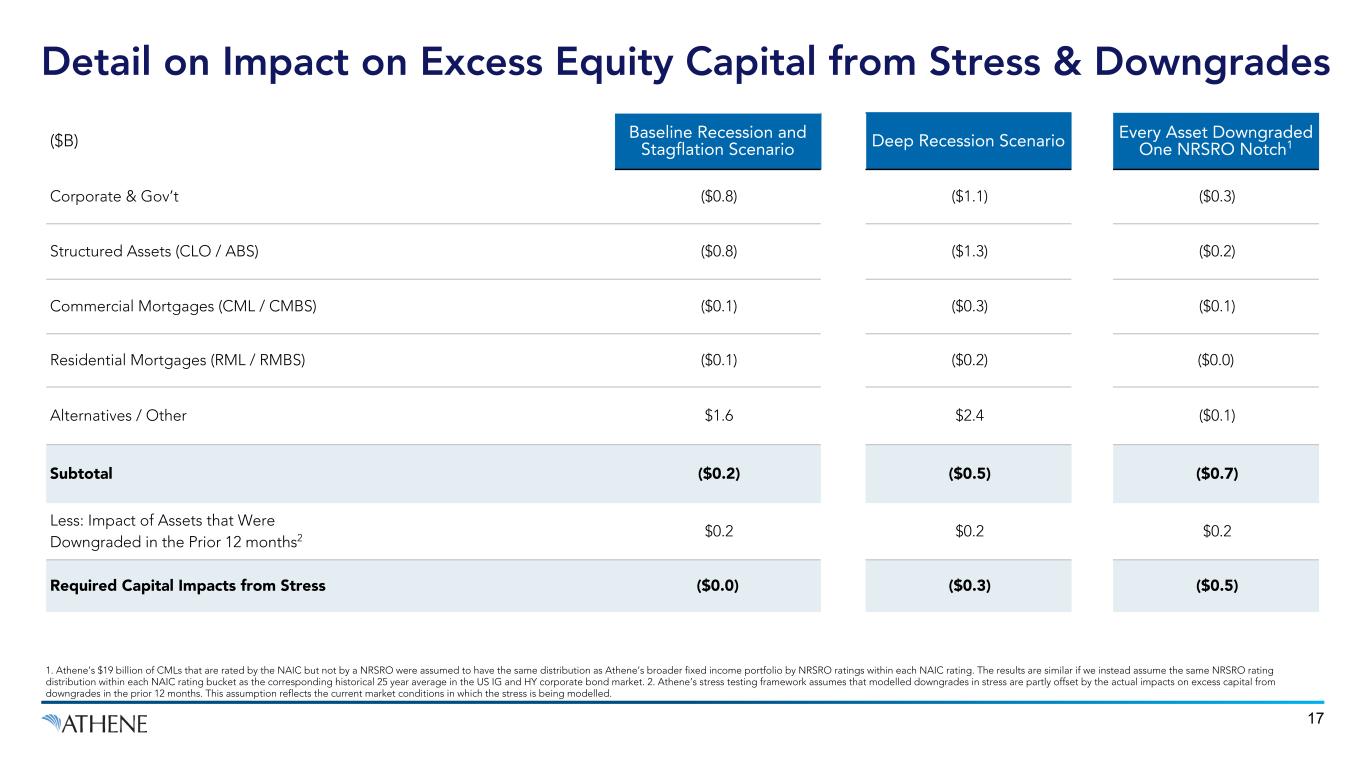

17 ($B) Baseline Recession and Stagflation Scenario Deep Recession Scenario Every Asset Downgraded One NRSRO Notch1 Corporate & Gov’t ($0.8) ($1.1) ($0.3) Structured Assets (CLO / ABS) ($0.8) ($1.3) ($0.2) Commercial Mortgages (CML / CMBS) ($0.1) ($0.3) ($0.1) Residential Mortgages (RML / RMBS) ($0.1) ($0.2) ($0.0) Alternatives / Other $1.6 $2.4 ($0.1) Subtotal ($0.2) ($0.5) ($0.7) Less: Impact of Assets that Were Downgraded in the Prior 12 months2 $0.2 $0.2 $0.2 Required Capital Impacts from Stress ($0.0) ($0.3) ($0.5) 1. Athene’s $19 billion of CMLs that are rated by the NAIC but not by a NRSRO were assumed to have the same distribution as Athene’s broader fixed income portfolio by NRSRO ratings within each NAIC rating. The results are similar if we instead assume the same NRSRO rating distribution within each NAIC rating bucket as the corresponding historical 25 year average in the US IG and HY corporate bond market. 2. Athene’s stress testing framework assumes that modelled downgrades in stress are partly offset by the actual impacts on excess capital from downgrades in the prior 12 months. This assumption reflects the current market conditions in which the stress is being modelled. Detail on Impact on Excess Equity Capital from Stress & Downgrades

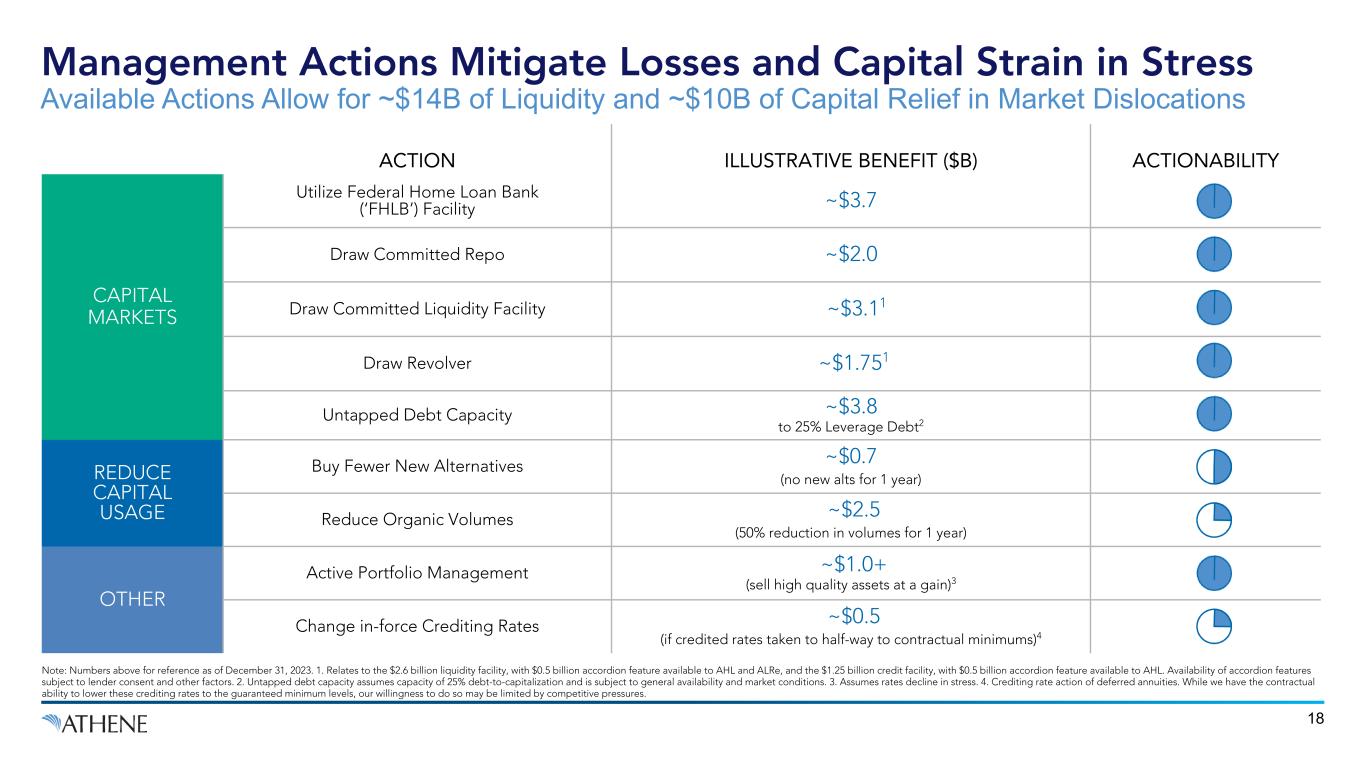

Available Actions Allow for ~$14B of Liquidity and ~$10B of Capital Relief in Market Dislocations 18 ACTION ILLUSTRATIVE BENEFIT ($B) ACTIONABILITY CAPITAL MARKETS Utilize Federal Home Loan Bank (‘FHLB’) Facility ~$3.7 Draw Committed Repo ~$2.0 Draw Committed Liquidity Facility ~$3.11 Draw Revolver ~$1.751 Untapped Debt Capacity ~$3.8 to 25% Leverage Debt2 REDUCE CAPITAL USAGE Buy Fewer New Alternatives ~$0.7 (no new alts for 1 year) Reduce Organic Volumes ~$2.5 (50% reduction in volumes for 1 year) OTHER Active Portfolio Management ~$1.0+ (sell high quality assets at a gain)3 Change in-force Crediting Rates ~$0.5 (if credited rates taken to half-way to contractual minimums)4 Note: Numbers above for reference as of December 31, 2023. 1. Relates to the $2.6 billion liquidity facility, with $0.5 billion accordion feature available to AHL and ALRe, and the $1.25 billion credit facility, with $0.5 billion accordion feature available to AHL. Availability of accordion features subject to lender consent and other factors. 2. Untapped debt capacity assumes capacity of 25% debt-to-capitalization and is subject to general availability and market conditions. 3. Assumes rates decline in stress. 4. Crediting rate action of deferred annuities. While we have the contractual ability to lower these crediting rates to the guaranteed minimum levels, our willingness to do so may be limited by competitive pressures. Management Actions Mitigate Losses and Capital Strain in Stress

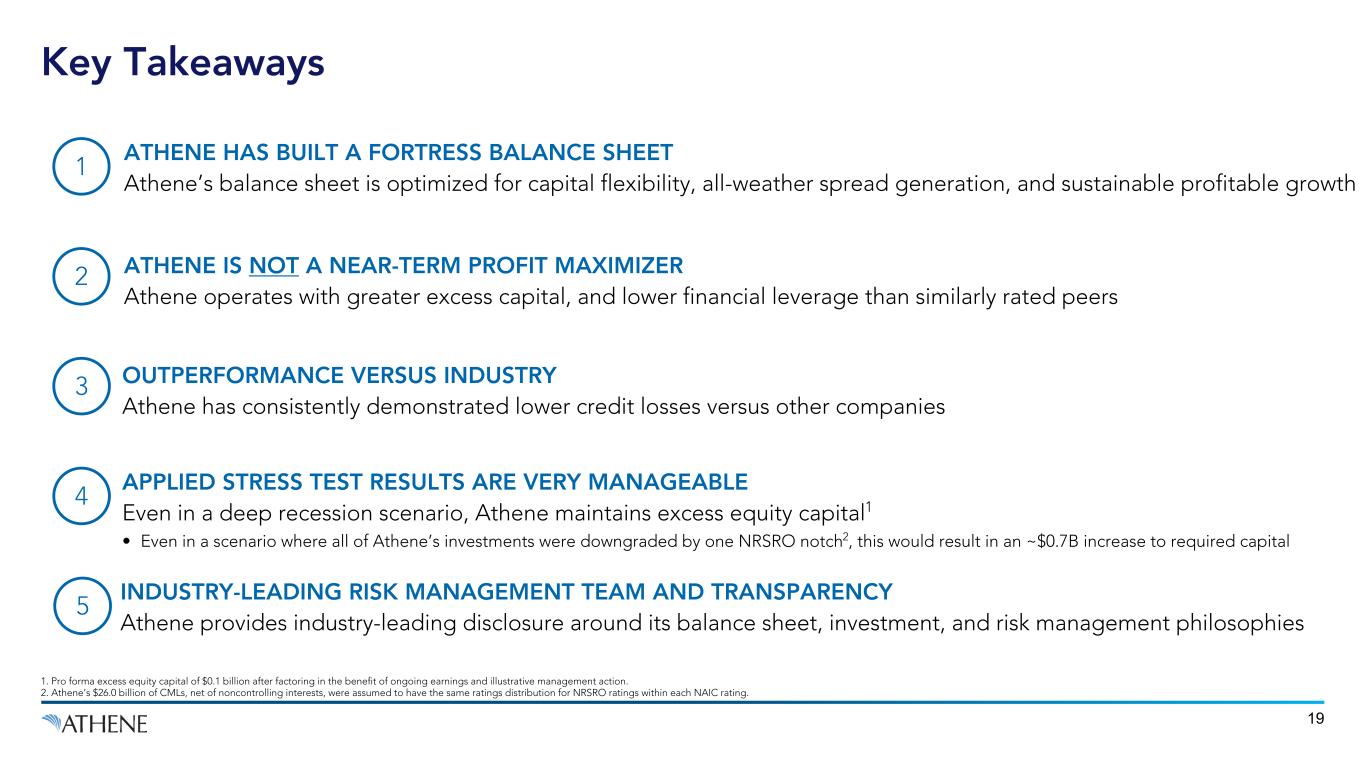

3 ATHENE IS NOT A NEAR-TERM PROFIT MAXIMIZER Athene operates with greater excess capital, and lower financial leverage than similarly rated peers 2 5 INDUSTRY-LEADING RISK MANAGEMENT TEAM AND TRANSPARENCY Athene provides industry-leading disclosure around its balance sheet, investment, and risk management philosophies APPLIED STRESS TEST RESULTS ARE VERY MANAGEABLE Even in a deep recession scenario, Athene maintains excess equity capital1 • Even in a scenario where all of Athene’s investments were downgraded by one NRSRO notch2, this would result in an ~$0.7B increase to required capital 4 ATHENE HAS BUILT A FORTRESS BALANCE SHEET Athene’s balance sheet is optimized for capital flexibility, all-weather spread generation, and sustainable profitable growth 1 Key Takeaways 19 OUTPERFORMANCE VERSUS INDUSTRY Athene has consistently demonstrated lower credit losses versus other companies 1. Pro forma excess equity capital of $0.1 billion after factoring in the benefit of ongoing earnings and illustrative management action. 2. Athene’s $26.0 billion of CMLs, net of noncontrolling interests, were assumed to have the same ratings distribution for NRSRO ratings within each NAIC rating.

Non-GAAP Definitions In addition to our results presented in accordance with accounting principles generally accepted in the United States of America (US GAAP), we present certain financial information that includes non-GAAP measures. Management believes the use of these non-GAAP measures, together with the relevant US GAAP measures, provides information that may enhance an investor’s understanding of our results of operations and the underlying profitability drivers of our business. The majority of these non-GAAP measures are intended to remove from the results of operations the impact of market volatility (other than with respect to alternative investments), which consists of investment gains (losses), net of offsets and non-operating change in insurance liabilities and related derivatives, as well as integration, restructuring, stock compensation and certain other expenses which are not part of our underlying profitability drivers, as such items fluctuate from period to period in a manner inconsistent with these drivers. These measures should be considered supplementary to our results in accordance with US GAAP and should not be viewed as a substitute for the corresponding US GAAP measures. Adjusted Debt-to-Capital Ratio Adjusted debt-to-capital ratio is a non-GAAP measure used to evaluate our capital structure excluding the impacts of AOCI and the cumulative changes in fair value of funds withheld and modco reinsurance assets as well as mortgage loan assets, net of tax. Adjusted debt-to-capital ratio is calculated as total debt at notional value divided by adjusted capitalization. Adjusted capitalization includes our adjusted AHL common stockholder’s equity, preferred stock and the notional value of our debt. Adjusted AHL common stockholder’s equity is calculated as the ending AHL stockholders’ equity excluding AOCI, the cumulative changes in fair value of funds withheld and modco reinsurance assets and mortgage loan assets as well as preferred stock. These adjustments fluctuate period to period in a manner inconsistent with our underlying profitability drivers as the majority of such fluctuation is related to the market volatility of the unrealized gains and losses associated with our AFS securities, reinsurance assets and mortgage loans. Except with respect to reinvestment activity relating to acquired blocks of businesses, we typically buy and hold investments to maturity throughout the duration of market fluctuations, therefore, the period-over-period impacts in unrealized gains and losses are not necessarily indicative of current operating fundamentals or future performance. Adjusted debt-to-capital ratio should not be used as a substitute for the debt-to-capital ratio. However, we believe the adjustments to stockholders’ equity are significant to gaining an understanding of our capitalization, debt utilization and debt capacity. Net Invested Assets In managing our business, we analyze net invested assets, which does not correspond to total investments, including investments in related parties, as disclosed in our consolidated financial statements and notes thereto. Net invested assets represent the investments that directly back our net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which allows us to analyze the profitability of our investment portfolio. Net invested assets include (a) total investments on the consolidated balance sheets, with AFS securities, trading securities and mortgage loans at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets exclude the derivative collateral offsetting the related cash positions. We include the underlying investments supporting our assumed funds withheld and modco agreements and exclude the underlying investments related to ceded reinsurance transactions in our net invested assets calculation in order to match the assets with the income received. We believe the adjustments for reinsurance provide a view of the assets for which we have economic exposure. Net invested assets include our proportionate share of ACRA investments, based on our economic ownership, but do not include the proportionate share of investments associated with the noncontrolling interests. Our net invested assets are averaged over the number of quarters in the relevant period to compute our net investment earned rate for such period. While we believe net invested assets is a meaningful financial metric and enhances our understanding of the underlying drivers of our investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under US GAAP. Non-GAAP Measures & Definitions 20

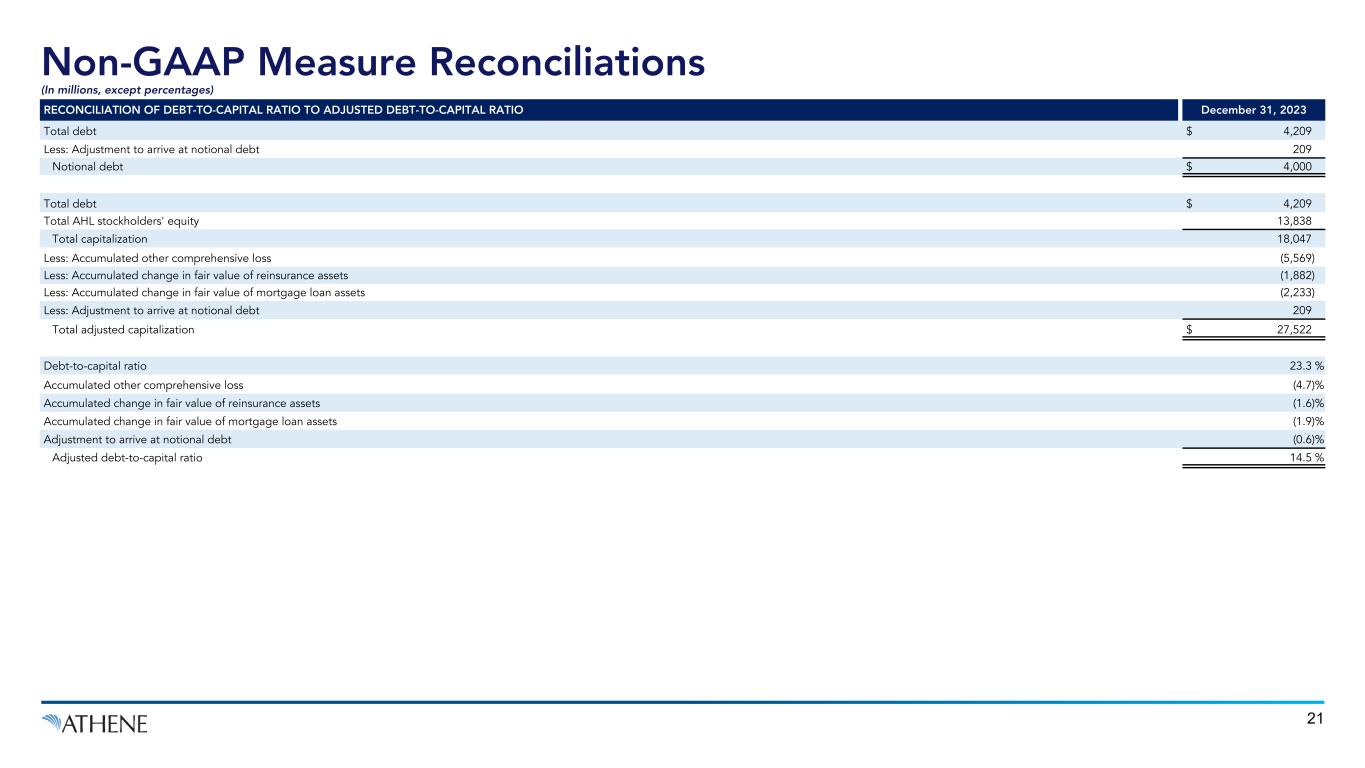

Non-GAAP Measure Reconciliations (In millions, except percentages) 21 RECONCILIATION OF DEBT-TO-CAPITAL RATIO TO ADJUSTED DEBT-TO-CAPITAL RATIO December 31, 2023 Total debt $ 4,209 Less: Adjustment to arrive at notional debt 209 Notional debt $ 4,000 Total debt $ 4,209 Total AHL stockholders' equity 13,838 Total capitalization 18,047 Less: Accumulated other comprehensive loss (5,569) Less: Accumulated change in fair value of reinsurance assets (1,882) Less: Accumulated change in fair value of mortgage loan assets (2,233) Less: Adjustment to arrive at notional debt 209 Total adjusted capitalization $ 27,522 Debt-to-capital ratio 23.3 % Accumulated other comprehensive loss (4.7) % Accumulated change in fair value of reinsurance assets (1.6) % Accumulated change in fair value of mortgage loan assets (1.9) % Adjustment to arrive at notional debt (0.6) % Adjusted debt-to-capital ratio 14.5 %

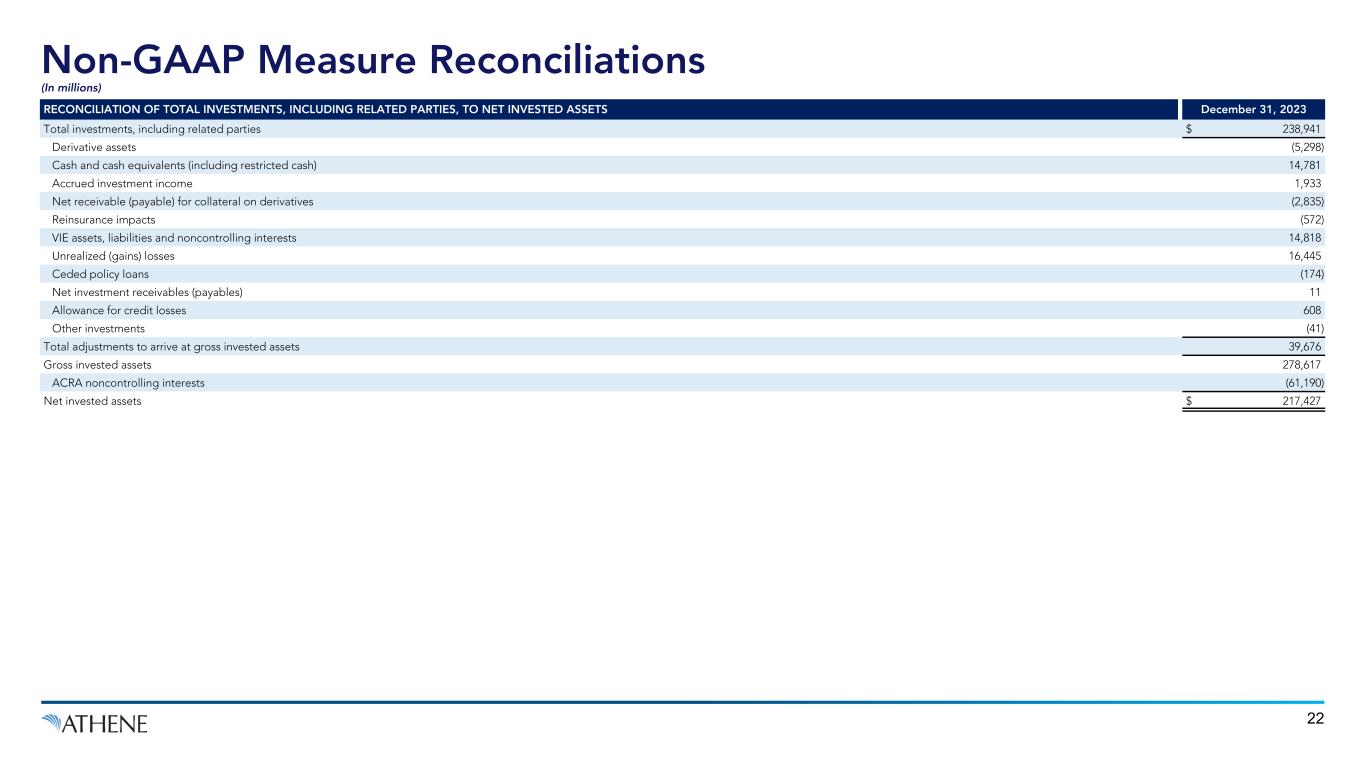

Non-GAAP Measure Reconciliations (In millions) 22 RECONCILIATION OF TOTAL INVESTMENTS, INCLUDING RELATED PARTIES, TO NET INVESTED ASSETS December 31, 2023 Total investments, including related parties $ 238,941 Derivative assets (5,298) Cash and cash equivalents (including restricted cash) 14,781 Accrued investment income 1,933 Net receivable (payable) for collateral on derivatives (2,835) Reinsurance impacts (572) VIE assets, liabilities and noncontrolling interests 14,818 Unrealized (gains) losses 16,445 Ceded policy loans (174) Net investment receivables (payables) 11 Allowance for credit losses 608 Other investments (41) Total adjustments to arrive at gross invested assets 39,676 Gross invested assets 278,617 ACRA noncontrolling interests (61,190) Net invested assets $ 217,427