EX-99.1

Published on March 13, 2023

Investor Presentation March 2023 Apollo Global Management

2 Forward Looking Statements & Other Important Disclosures In this presentation, references to “Apollo,” “we,” “us,” “our” and the “Company” refer collectively to Apollo Global Management, Inc. and its subsidiaries, or as the context may otherwise require. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and other non-historical statements. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this press release, the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “target” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions intended to identify forward- looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to inflation, market conditions and interest rate fluctuations generally, the impact of COVID-19, the impact of energy market dislocation, our ability to manage our growth, our ability to operate in highly competitive environments, the performance of the funds we manage, our ability to raise new funds, the variability of our revenues, earnings and cash flow, the accuracy of management’s assumptions and estimates, our dependence on certain key personnel, our use of leverage to finance our businesses and investments by the funds we manage, Athene’s ability to maintain or improve financial strength ratings, the impact of Athene’s reinsurers failing to meet their assumed obligations, Athene’s ability to manage its business in a highly regulated industry, changes in our regulatory environment and tax status, and litigation risks, among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company’s annual report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2023, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in our other filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law. References in this presentation to “AAM” are to Apollo Asset Management, Inc. and references to “Athene” are to Athene Holding Ltd., each a subsidiary of Apollo Global Management, Inc. This presentation contains information regarding Apollo's financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States ("non-GAAP measures"). Refer to slides at the end of this presentation for the definitions of Adjusted Segment Income (“ASI”), Adjusted Net Income (“ANI”), Fee Related Earnings (“FRE”), Spread Related Earnings (“SRE”) and Principal Investing Income (“PII”), non-GAAP measures presented herein, and reconciliations of GAAP financial measures to the applicable non-GAAP measures. This presentation is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities, products or services, including interests in the funds, vehicles or accounts sponsored or managed by Apollo (each, an “Apollo Fund”), any capital markets services offered by Apollo, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Information contained herein is as of December 31, 2022 unless otherwise noted. This presentation is not complete and the information contained herein may change at any time without notice. Apollo makes no representation or warranty, express or implied, as to the fairness, accuracy, reasonableness or completeness of the information contained herein, including, but not limited to, information obtained from third parties. Unless otherwise specified, information included herein is sourced from and reflects the views and opinions of Apollo Analysts. Certain information contained in these materials has been obtained from sources other than Apollo. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and Apollo does not take any responsibility for such information. This presentation may contain trade names, trademarks and service marks of companies which (i) neither Apollo nor Apollo Funds own or (ii) are investments of Apollo or one or more Apollo Funds. We do not intend our use or display of these companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, such companies. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Past performance is not necessarily indicative of future results and there can be no assurance that Apollo or any Apollo Fund or strategy will achieve comparable results, or that any investments made by Apollo in the future will be profitable. Actual realized value of currently unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the current unrealized valuations are based. Accordingly, the actual realized values of unrealized investments may differ materially from the values indicated herein. Specific references to investments have been provided on a non-performance based criteria for information purposes only. Apollo makes no guarantee that similar investments would be available in the future or, if available, would be profitable. Not all investments shown are currently held by an Apollo Fund. Information contained herein may include information with respect to prior investment performance of one or more Apollo Funds or investments, including gross and/or net internal rates of return (“IRR”) and gross and/or net multiple of investment cost (“MOIC”). Information with respect to prior performance, while a useful tool in evaluating investment activities, is not necessarily indicative of actual results that may be achieved for unrealized investments. The realization of such performance is dependent upon many factors, many of which are beyond the control of Apollo. Aggregated return information is not reflective of an investable product, and as such does not reflect the returns of any Apollo Fund. Please refer to the Definitions pages for definitions of gross and net MOIC, and gross and net IRR. Please refer to the slides at the end of this presentation for additional important information.

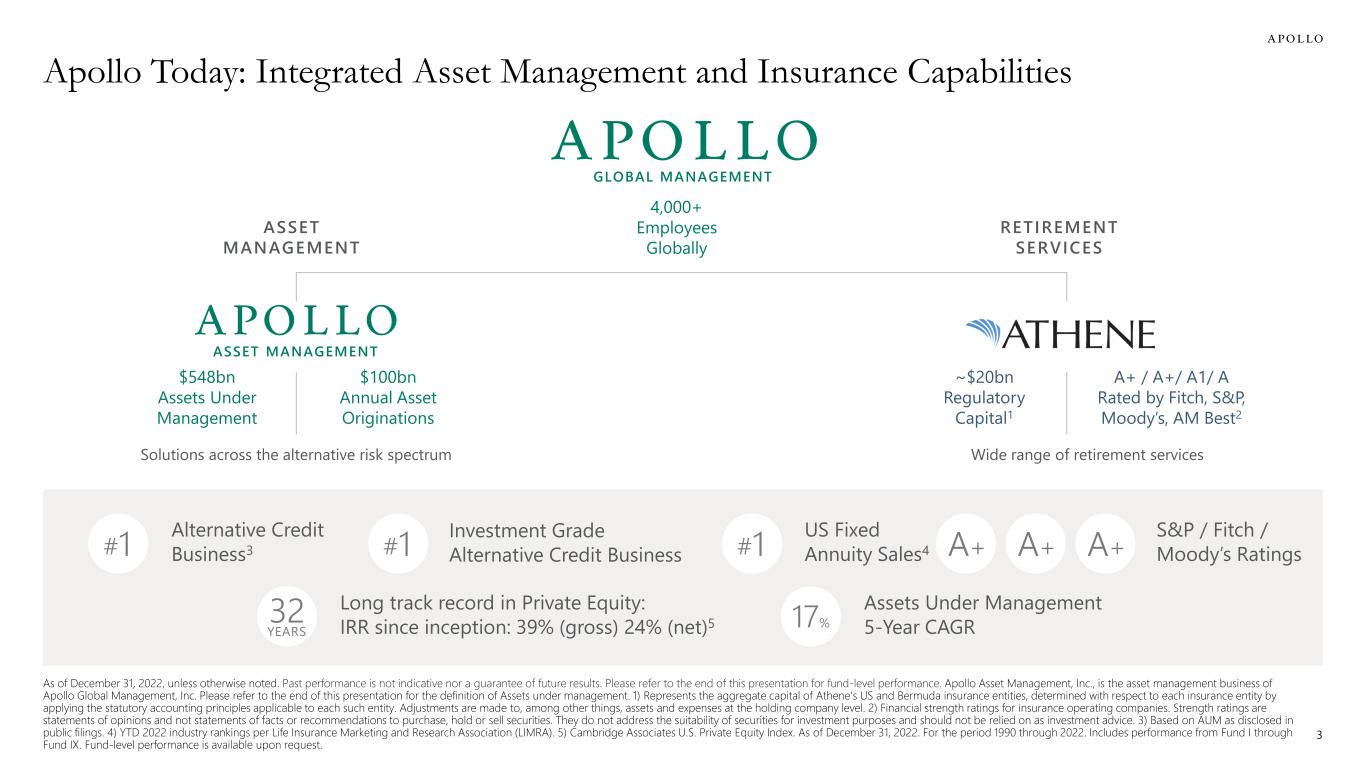

Apollo Today: Integrated Asset Management and Insurance Capabilities $548bn Assets Under Management $100bn Annual Asset Originations ~$20bn Regulatory Capital1 A+ / A+/ A1/ A Rated by Fitch, S&P, Moody’s, AM Best2 ASSET MANAGEMENT RETIREMENT SERVICES 4,000+ Employees Globally 3 ASSET MANAGEMENT Investment Grade Alternative Credit Business #1 GLOBAL MANAGEMENT Solutions across the alternative risk spectrum Wide range of retirement services Alternative Credit Business3#1 Long track record in Private Equity: IRR since inception: 39% (gross) 24% (net)532 YEARS Assets Under Management 5-Year CAGR 17% As of December 31, 2022, unless otherwise noted. Past performance is not indicative nor a guarantee of future results. Please refer to the end of this presentation for fund-level performance. Apollo Asset Management, Inc., is the asset management business of Apollo Global Management, Inc. Please refer to the end of this presentation for the definition of Assets under management. 1) Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. 2) Financial strength ratings for insurance operating companies. Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 3) Based on AUM as disclosed in public filings. 4) YTD 2022 industry rankings per Life Insurance Marketing and Research Association (LIMRA). 5) Cambridge Associates U.S. Private Equity Index. As of December 31, 2022. For the period 1990 through 2022. Includes performance from Fund I through Fund IX. Fund-level performance is available upon request. US Fixed Annuity Sales4#1 S&P / Fitch / Moody’s Ratings A+ A+ A+

Apollo in 2023: Playing on Offense Record AUM Outsized Deployment in 2022 $162B Net New Hires in 2022 +300 FY 2022 Capital Raised ($46B 3rd Party Apollo) $128B Apollo Credit Funds Outperformance vs Benchmarks2 300–900BPS Access Our Latest Financial Results Annual Originations (Run-Rate) $100B Fund IX 2022 Appreciation1 (vs S&P -19%) +23% Note: As of December 31. 2022, or most recently available. Reflects the views and opinions of Apollo Analysts. Subject to change at any time without notice. 1) Represents appreciation of Fund IX in 2022. 2) Credit Strategies Fund is compared to the ICE BofAML US High Yield Index, Apollo Origination Partnership is compared to the S&P LLI and Total Return Fund is compared to 50% S&P LLI + 50% ML HY. Past performance is not indicative nor a guarantee of future results. 4 Earnings Webcast Earnings Release FY 2022 Combined Earnings (Apollo + Athene) $3.7B $548B

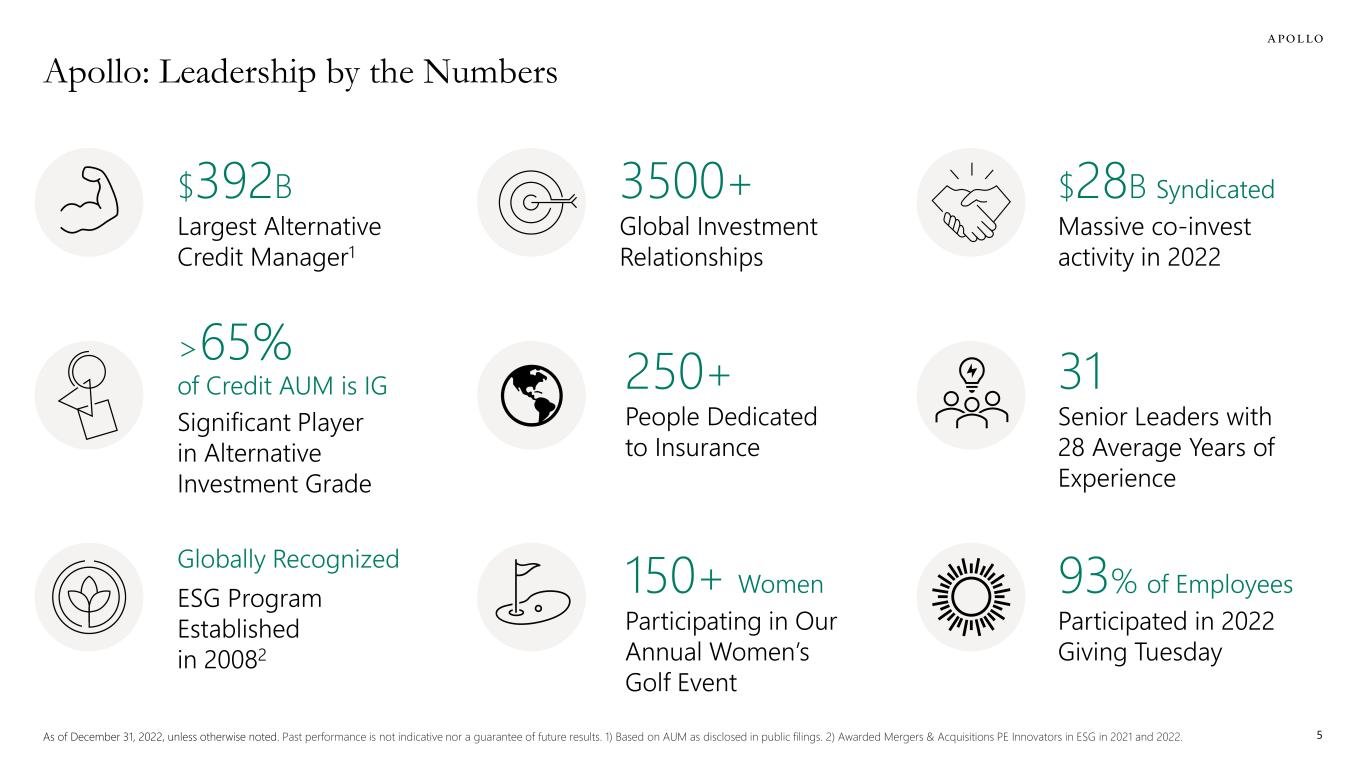

Apollo: Leadership by the Numbers Globally Recognized ESG Program Established in 20082 Significant Player in Alternative Investment Grade >65% of Credit AUM is IG People Dedicated to Insurance 250+ Senior Leaders with 28 Average Years of Experience 31 Largest Alternative Credit Manager1 $392B Global Investment Relationships 3500+ Massive co-invest activity in 2022 $28B Syndicated Participating in Our Annual Women’s Golf Event 150+ Women Participated in 2022 Giving Tuesday 93% of Employees 5As of December 31, 2022, unless otherwise noted. Past performance is not indicative nor a guarantee of future results. 1) Based on AUM as disclosed in public filings. 2) Awarded Mergers & Acquisitions PE Innovators in ESG in 2021 and 2022.

Alternatives An alternative to publicly traded stocks and bonds The PROMISE OF ALTERNATIVES is excess return per unit of risk at every point along the risk-reward spectrum 6 Alternative investments often are speculative, include a high degree of risk and typically have higher fees than traditional investments. There can be no assurance that investment objectives will be achieved. For discussion purposes only. Reflects the views and opinions of Apollo Analysts. Subject to change at any time without notice.

The Apollo Ethos: Purchase Price, Return, and Alignment 1 Purchase Price Matters 2 Excess Return Per Unit of Risk 3 Unparalleled Alignment Allocating capital to the best risk/reward in any market environment Generating excess return per unit of risk across the risk- reward spectrum Committing side by side with investors as one of the largest LPs in our funds1 7 The information provided herein is based on the views and opinions of Apollo Analysts. As such, the analysis is based on certain assumptions which are subject to change without notice. 1) ~43% of Total AUM comes from Apollo and affiliate capital as of December 31, 2022.

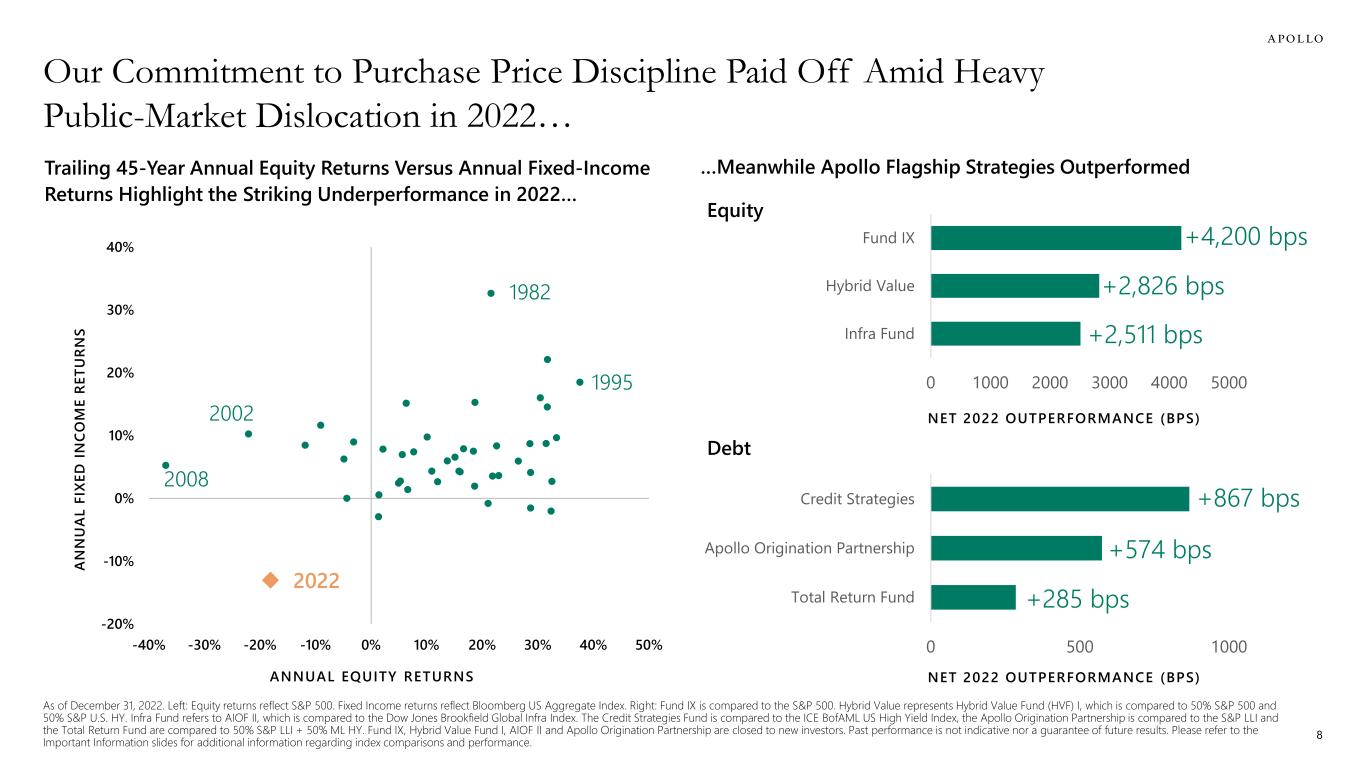

Our Commitment to Purchase Price Discipline Paid Off Amid Heavy Public-Market Dislocation in 2022… …Meanwhile Apollo Flagship Strategies Outperformed -20% -10% 0% 10% 20% 30% 40% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% A N N U A L FI XE D IN CO M E RE TU RN S ANNUAL EQUITY RETURNS 2008 2002 1982 1995 Trailing 45-Year Annual Equity Returns Versus Annual Fixed-Income Returns Highlight the Striking Underperformance in 2022… 8 As of December 31, 2022. Left: Equity returns reflect S&P 500. Fixed Income returns reflect Bloomberg US Aggregate Index. Right: Fund IX is compared to the S&P 500. Hybrid Value represents Hybrid Value Fund (HVF) I, which is compared to 50% S&P 500 and 50% S&P U.S. HY. Infra Fund refers to AIOF II, which is compared to the Dow Jones Brookfield Global Infra Index. The Credit Strategies Fund is compared to the ICE BofAML US High Yield Index, the Apollo Origination Partnership is compared to the S&P LLI and the Total Return Fund are compared to 50% S&P LLI + 50% ML HY. Fund IX, Hybrid Value Fund I, AIOF II and Apollo Origination Partnership are closed to new investors. Past performance is not indicative nor a guarantee of future results. Please refer to the Important Information slides for additional information regarding index comparisons and performance. 2022 0 1000 2000 3000 4000 5000 Infra Fund Hybrid Value Fund IX +2,511 bps +2,826 bps +4,200 bps NET 2022 OUTPERFORMANCE (BPS) Equity 0 500 1000 Total Return Fund Apollo Origination Partnership Credit Strategies +867 bps +574 bps +285 bps Debt NET 2022 OUTPERFORMANCE (BPS)

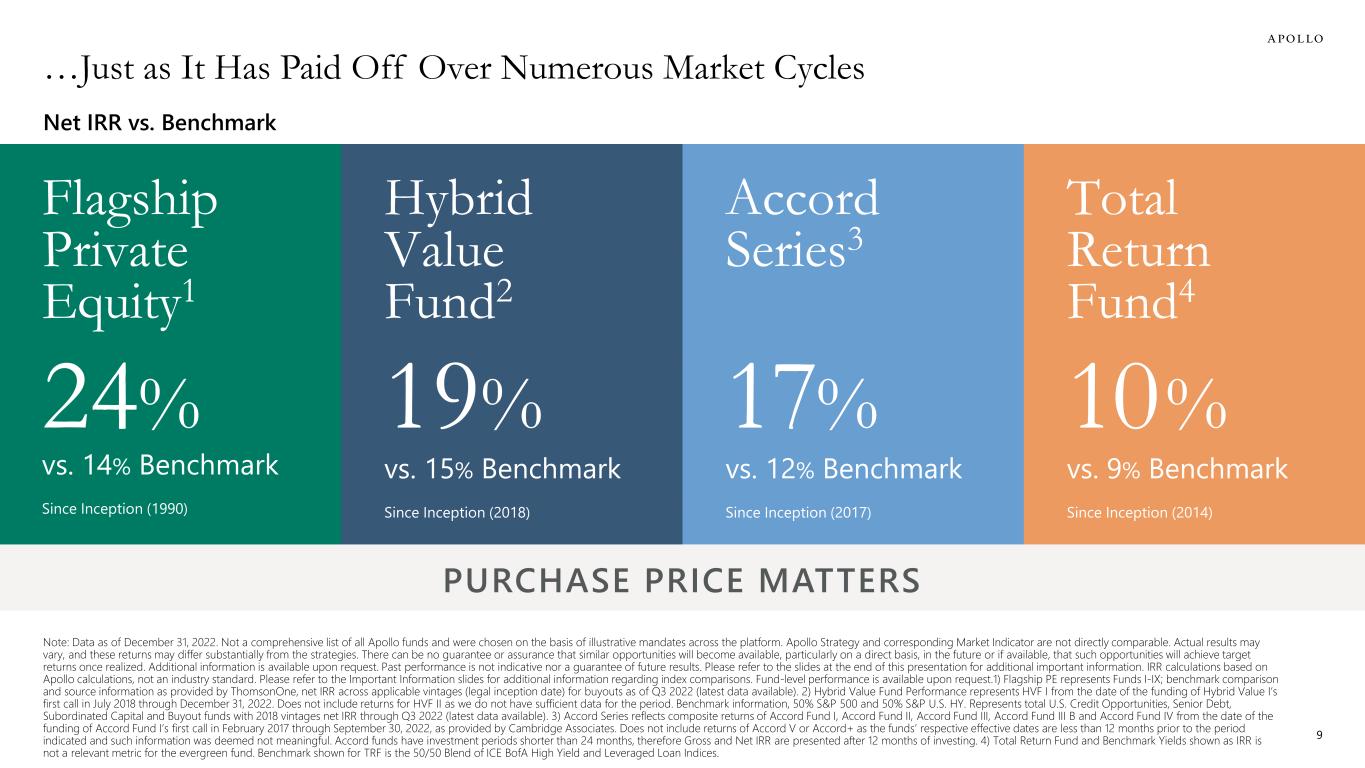

…Just as It Has Paid Off Over Numerous Market Cycles Note: Data as of December 31, 2022. Not a comprehensive list of all Apollo funds and were chosen on the basis of illustrative mandates across the platform. Apollo Strategy and corresponding Market Indicator are not directly comparable. Actual results may vary, and these returns may differ substantially from the strategies. There can be no guarantee or assurance that similar opportunities will become available, particularly on a direct basis, in the future or if available, that such opportunities will achieve target returns once realized. Additional information is available upon request. Past performance is not indicative nor a guarantee of future results. Please refer to the slides at the end of this presentation for additional important information. IRR calculations based on Apollo calculations, not an industry standard. Please refer to the Important Information slides for additional information regarding index comparisons. Fund-level performance is available upon request.1) Flagship PE represents Funds I-IX; benchmark comparison and source information as provided by ThomsonOne, net IRR across applicable vintages (legal inception date) for buyouts as of Q3 2022 (latest data available). 2) Hybrid Value Fund Performance represents HVF I from the date of the funding of Hybrid Value I’s first call in July 2018 through December 31, 2022. Does not include returns for HVF II as we do not have sufficient data for the period. Benchmark information, 50% S&P 500 and 50% S&P U.S. HY. Represents total U.S. Credit Opportunities, Senior Debt, Subordinated Capital and Buyout funds with 2018 vintages net IRR through Q3 2022 (latest data available). 3) Accord Series reflects composite returns of Accord Fund I, Accord Fund II, Accord Fund III, Accord Fund III B and Accord Fund IV from the date of the funding of Accord Fund I’s first call in February 2017 through September 30, 2022, as provided by Cambridge Associates. Does not include returns of Accord V or Accord+ as the funds’ respective effective dates are less than 12 months prior to the period indicated and such information was deemed not meaningful. Accord funds have investment periods shorter than 24 months, therefore Gross and Net IRR are presented after 12 months of investing. 4) Total Return Fund and Benchmark Yields shown as IRR is not a relevant metric for the evergreen fund. Benchmark shown for TRF is the 50/50 Blend of ICE BofA High Yield and Leveraged Loan Indices. 9 Net IRR vs. Benchmark PURCHASE PRICE MATTERS Hybrid Value Fund2 Flagship Private Equity1 Accord Series3 Total Return Fund4 19% vs. 15% Benchmark Since Inception (2018) 17% vs. 12% Benchmark Since Inception (2017) 10% vs. 9% Benchmark Since Inception (2014) 24% vs. 14% Benchmark Since Inception (1990)

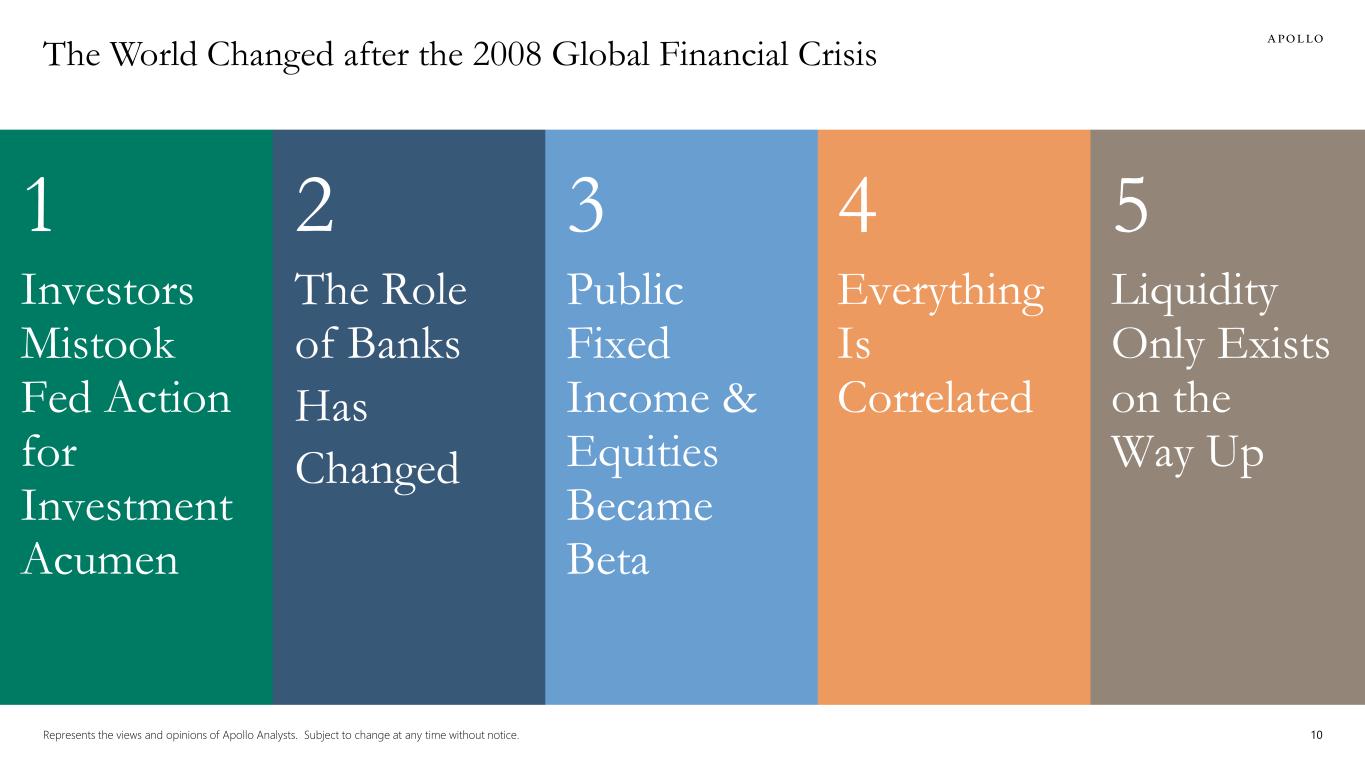

The World Changed after the 2008 Global Financial Crisis 10 1 Investors Mistook Fed Action for Investment Acumen 2 The Role of Banks Has Changed 5 Liquidity Only Exists on the Way Up 4 Everything Is Correlated 3 Public Fixed Income & Equities Became Beta Represents the views and opinions of Apollo Analysts. Subject to change at any time without notice.

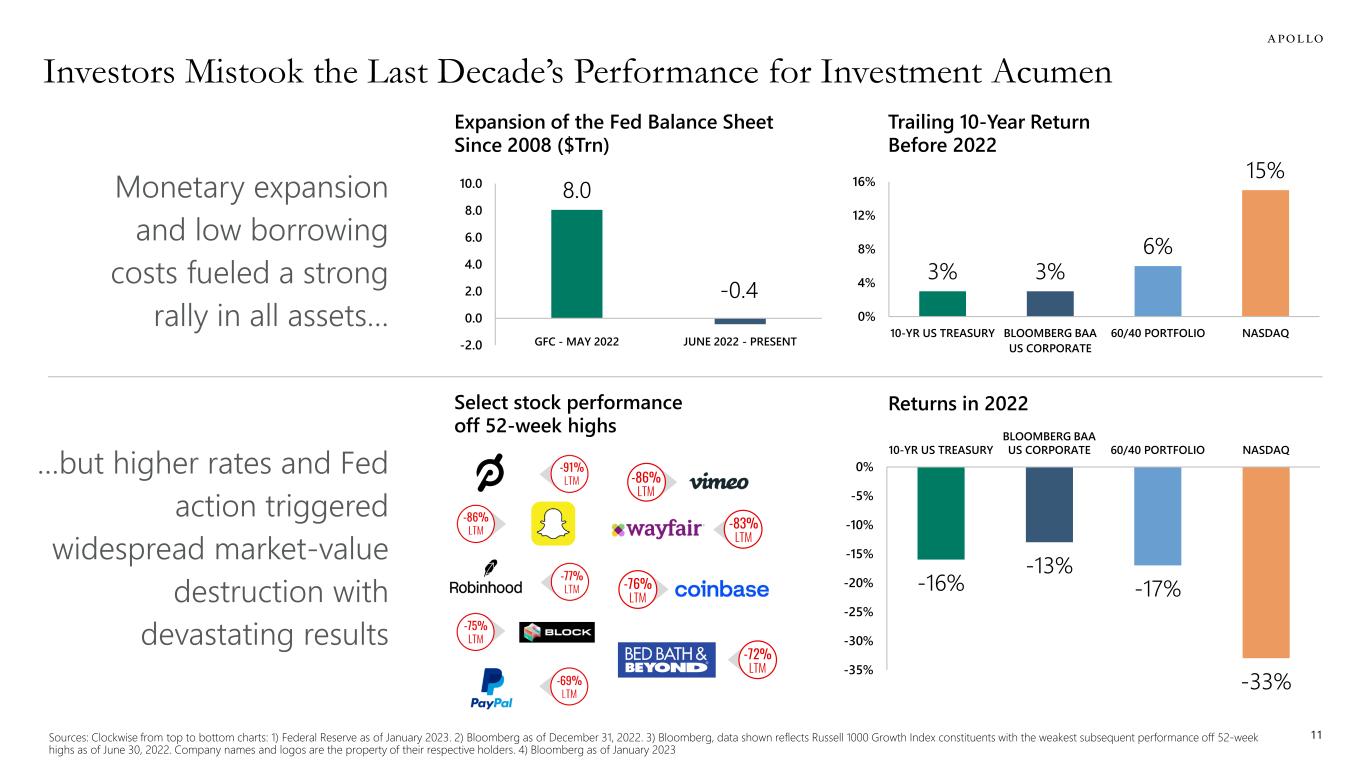

-86% LTM -76% LTM -83% LTM -72% LTM Investors Mistook the Last Decade’s Performance for Investment Acumen Monetary expansion and low borrowing costs fueled a strong rally in all assets… Expansion of the Fed Balance Sheet Since 2008 ($Trn) Trailing 10-Year Return Before 2022 11Sources: Clockwise from top to bottom charts: 1) Federal Reserve as of January 2023. 2) Bloomberg as of December 31, 2022. 3) Bloomberg, data shown reflects Russell 1000 Growth Index constituents with the weakest subsequent performance off 52-week highs as of June 30, 2022. Company names and logos are the property of their respective holders. 4) Bloomberg as of January 2023 Select stock performance off 52-week highs Returns in 2022 -16% -13% -17% -33%-35% -30% -25% -20% -15% -10% -5% 0% 10-YR US TREASURY BLOOMBERG BAA US CORPORATE 60/40 PORTFOLIO NASDAQ 8.0 -0.4 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 GFC - MAY 2022 JUNE 2022 - PRESENT 3% 3% 6% 15% 0% 4% 8% 12% 16% 10-YR US TREASURY BLOOMBERG BAA US CORPORATE 60/40 PORTFOLIO NASDAQ …but higher rates and Fed action triggered widespread market-value destruction with devastating results

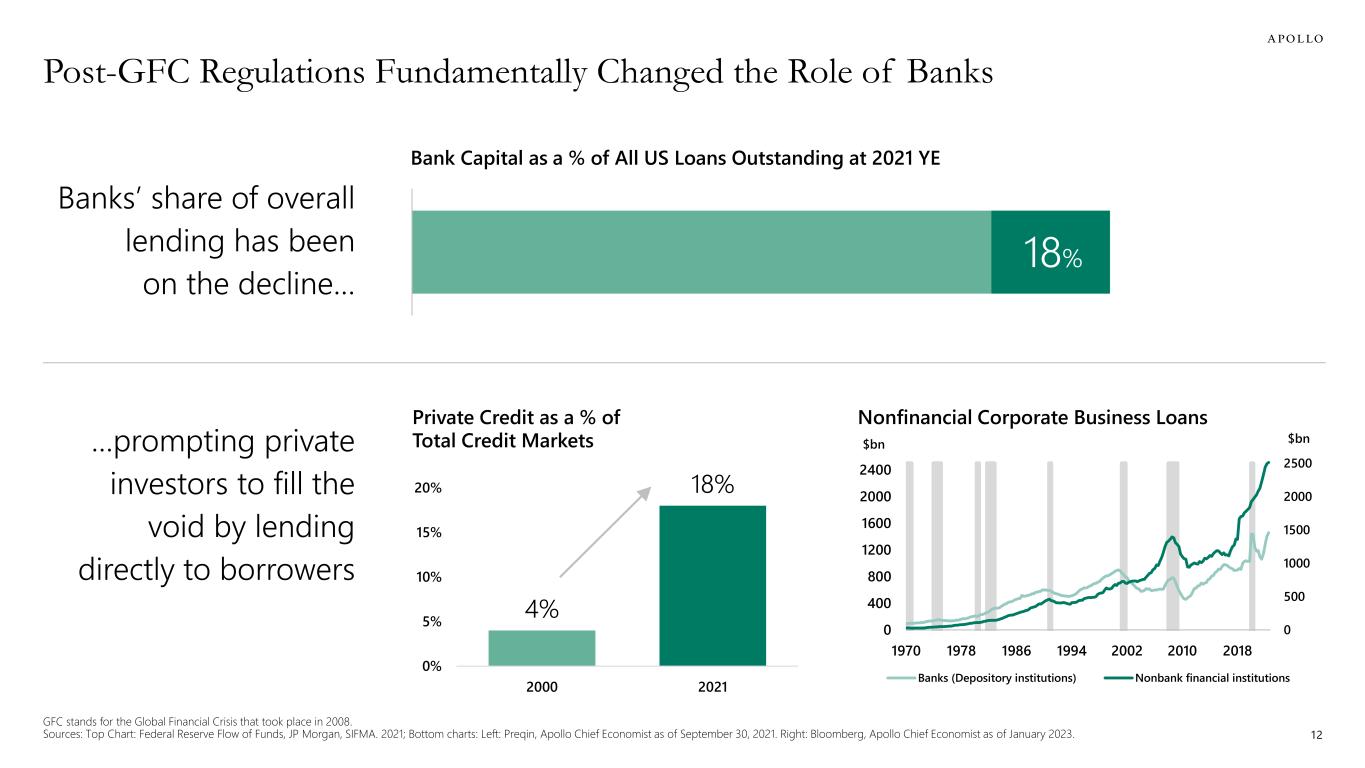

Bank Capital as a % of All US Loans Outstanding at 2021 YE 12 Post-GFC Regulations Fundamentally Changed the Role of Banks Private Credit as a % of Total Credit Markets 4% 18% 0% 5% 10% 15% 20% 2000 2021 GFC stands for the Global Financial Crisis that took place in 2008. Sources: Top Chart: Federal Reserve Flow of Funds, JP Morgan, SIFMA. 2021; Bottom charts: Left: Preqin, Apollo Chief Economist as of September 30, 2021. Right: Bloomberg, Apollo Chief Economist as of January 2023. 0 500 1000 1500 2000 2500 0 400 800 1200 1600 2000 2400 1970 1978 1986 1994 2002 2010 2018 $bn$bn Banks (Depository institutions) Nonbank financial institutions …prompting private investors to fill the void by lending directly to borrowers Nonfinancial Corporate Business Loans Banks’ share of overall lending has been on the decline… 18%

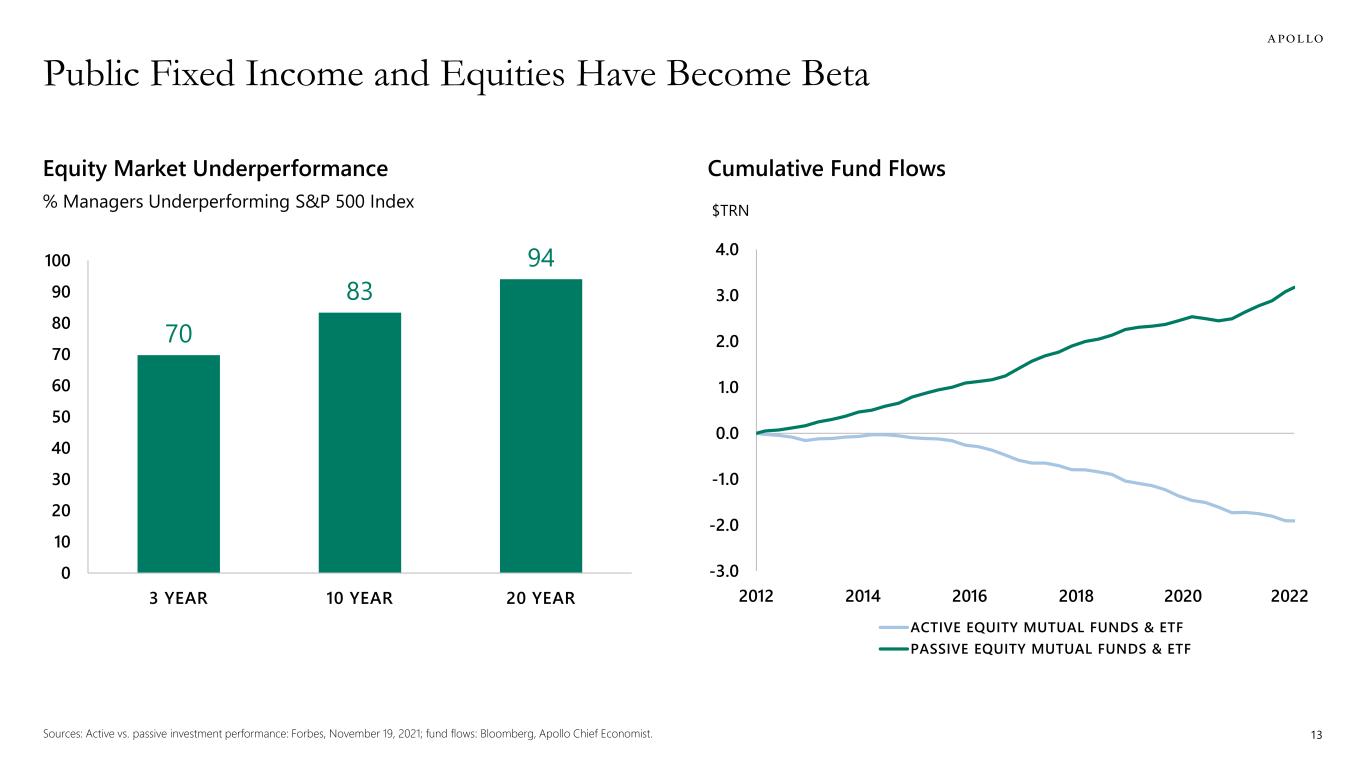

Public Fixed Income and Equities Have Become Beta 70 83 94 0 10 20 30 40 50 60 70 80 90 100 3 YEAR 10 YEAR 20 YEAR -3.0 -2.0 -1.0 0.0 1.0 2.0 3.0 4.0 2012 2014 2016 2018 2020 2022 $TRN ACTIVE EQUITY MUTUAL FUNDS & ETF PASSIVE EQUITY MUTUAL FUNDS & ETF Cumulative Fund FlowsEquity Market Underperformance % Managers Underperforming S&P 500 Index 13Sources: Active vs. passive investment performance: Forbes, November 19, 2021; fund flows: Bloomberg, Apollo Chief Economist.

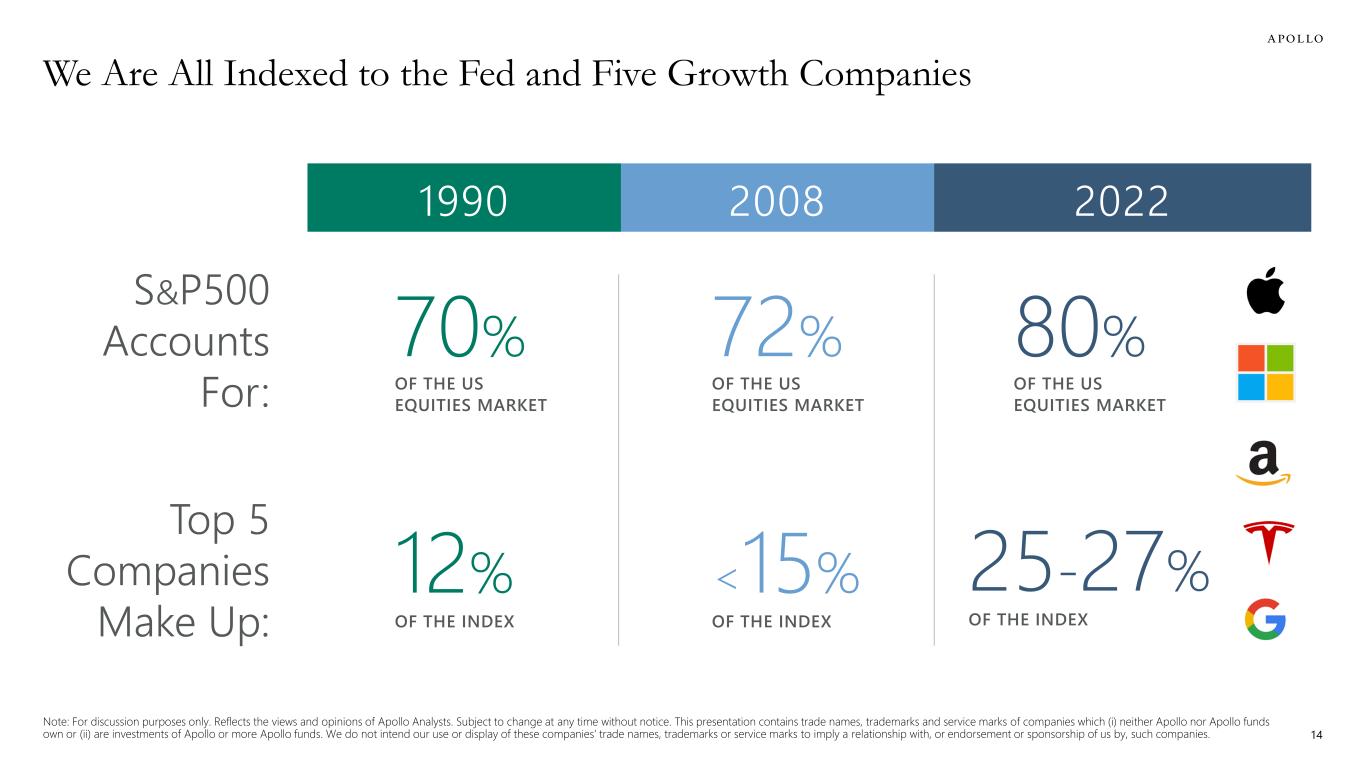

We Are All Indexed to the Fed and Five Growth Companies S&P500 Accounts For: OF THE US EQUITIES MARKET 70% 20081990 2022 Note: For discussion purposes only. Reflects the views and opinions of Apollo Analysts. Subject to change at any time without notice. This presentation contains trade names, trademarks and service marks of companies which (i) neither Apollo nor Apollo funds own or (ii) are investments of Apollo or more Apollo funds. We do not intend our use or display of these companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, such companies. 14 OF THE US EQUITIES MARKET 72% OF THE US EQUITIES MARKET 80% Top 5 Companies Make Up: OF THE INDEX 12% OF THE INDEX <15% OF THE INDEX 25-27%

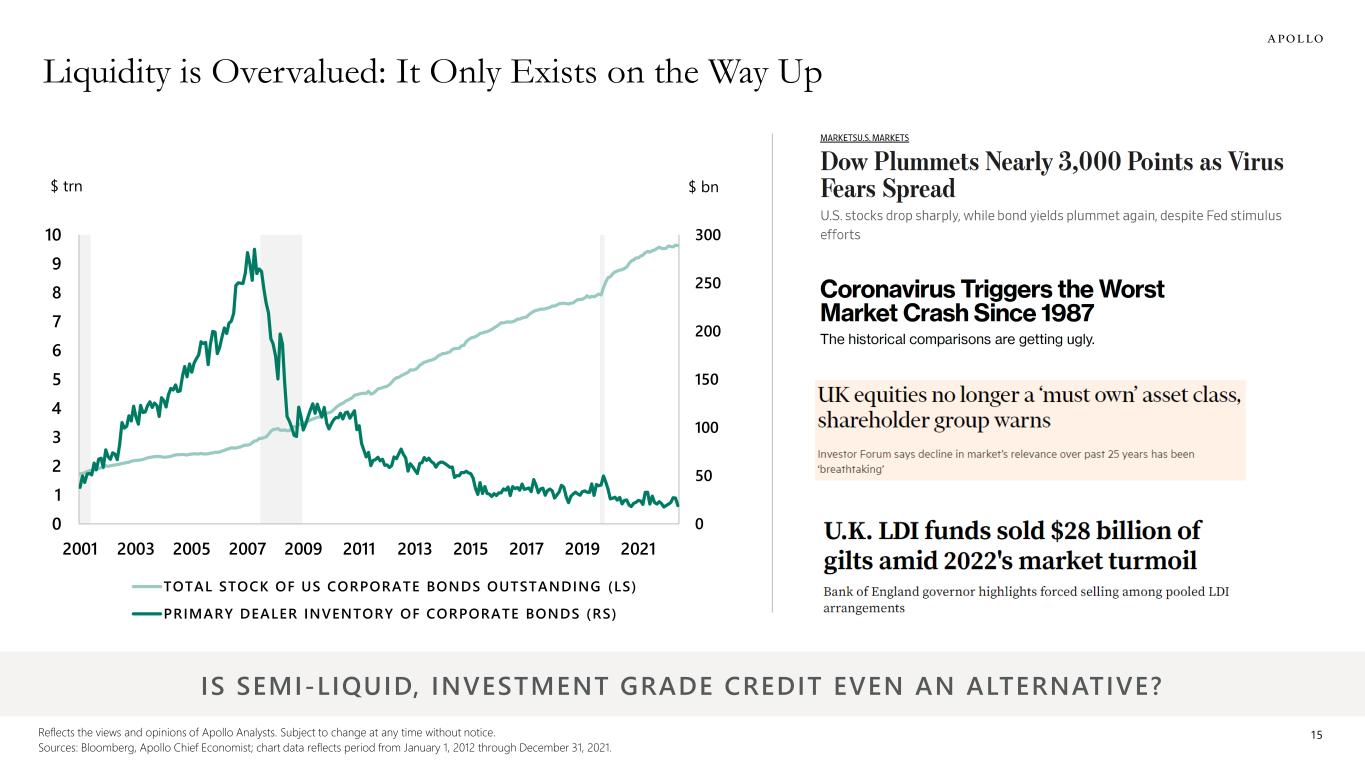

Liquidity is Overvalued: It Only Exists on the Way Up 0 50 100 150 200 250 300 0 1 2 3 4 5 6 7 8 9 10 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 $ bn$ trn TOTAL STOCK OF US CORPORATE BONDS OUTSTANDING (LS) PRIMARY DEALER INVENTORY OF CORPORATE BONDS (RS) IS SEMI-LIQUID, INVESTMENT GRADE CREDIT EVEN AN ALTERNATIVE? 15Reflects the views and opinions of Apollo Analysts. Subject to change at any time without notice. Sources: Bloomberg, Apollo Chief Economist; chart data reflects period from January 1, 2012 through December 31, 2021.

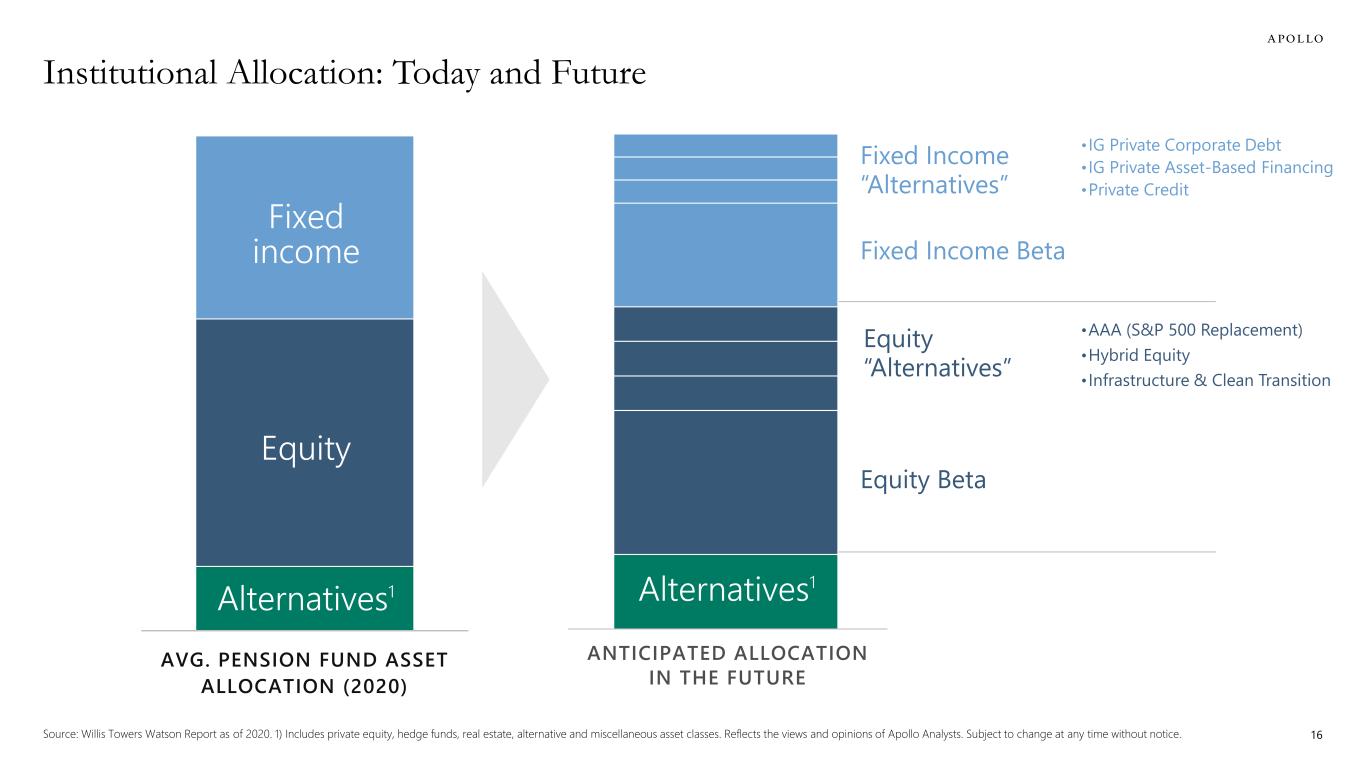

AVG. PENSION FUND ASSET ALLOCATION (2020) Alternatives1 Equity Fixed income Equity Beta ANTICIPATED ALLOCATION IN THE FUTURE 16 Alternatives1 Equity “Alternatives” Fixed Income Beta Fixed Income “Alternatives” •AAA (S&P 500 Replacement) •Hybrid Equity • Infrastructure & Clean Transition • IG Private Corporate Debt • IG Private Asset-Based Financing •Private Credit Institutional Allocation: Today and Future Source: Willis Towers Watson Report as of 2020. 1) Includes private equity, hedge funds, real estate, alternative and miscellaneous asset classes. Reflects the views and opinions of Apollo Analysts. Subject to change at any time without notice.

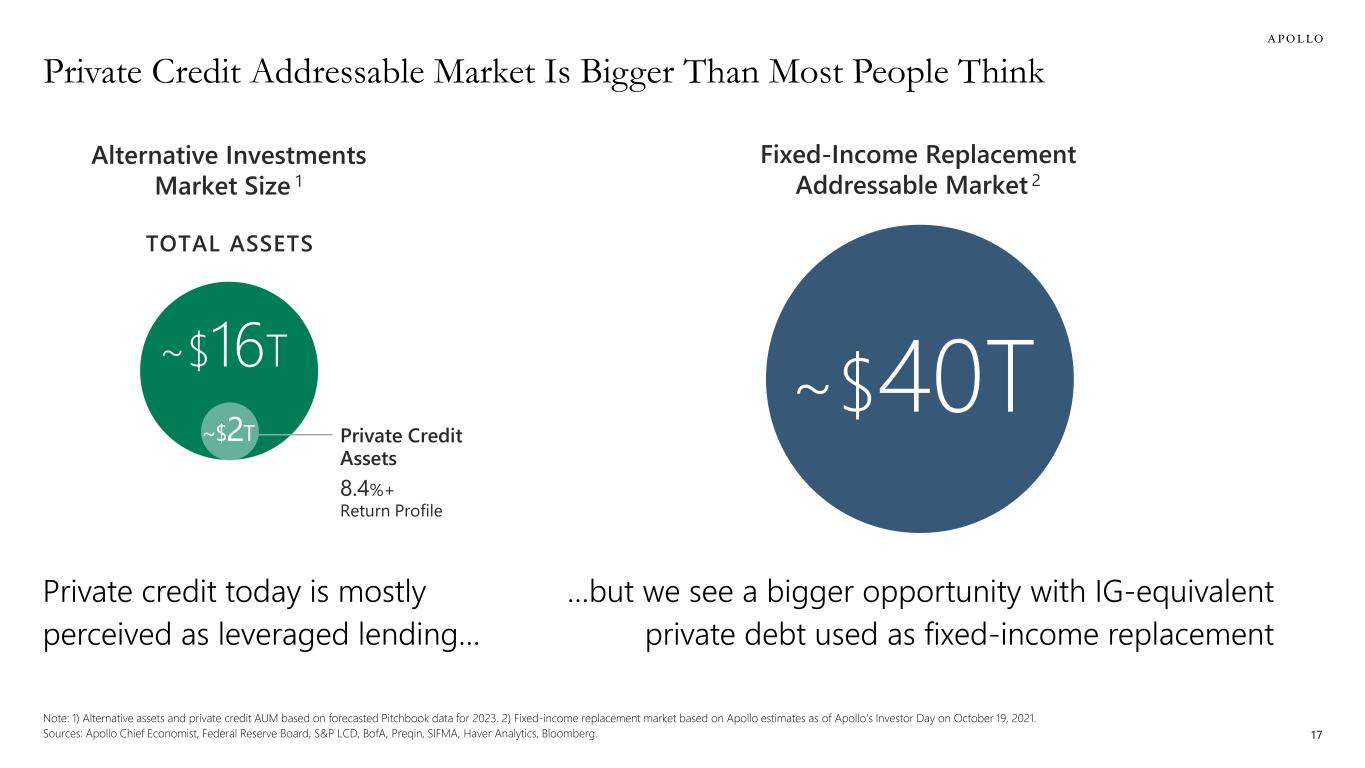

Private Credit Addressable Market Is Bigger Than Most People Think Note: 1) Alternative assets and private credit AUM based on forecasted Pitchbook data for 2023. 2) Fixed-income replacement market based on Apollo estimates as of Apollo’s Investor Day on October 19, 2021. Sources: Apollo Chief Economist, Federal Reserve Board, S&P LCD, BofA, Preqin, SIFMA, Haver Analytics, Bloomberg. 17 ~$40T Fixed-Income Replacement Addressable Market 2 TOTAL ASSETS 8.4%+ Return Profile Private Credit Assets Alternative Investments Market Size 1 ~$16T ~$2T Private credit today is mostly perceived as leveraged lending… …but we see a bigger opportunity with IG-equivalent private debt used as fixed-income replacement

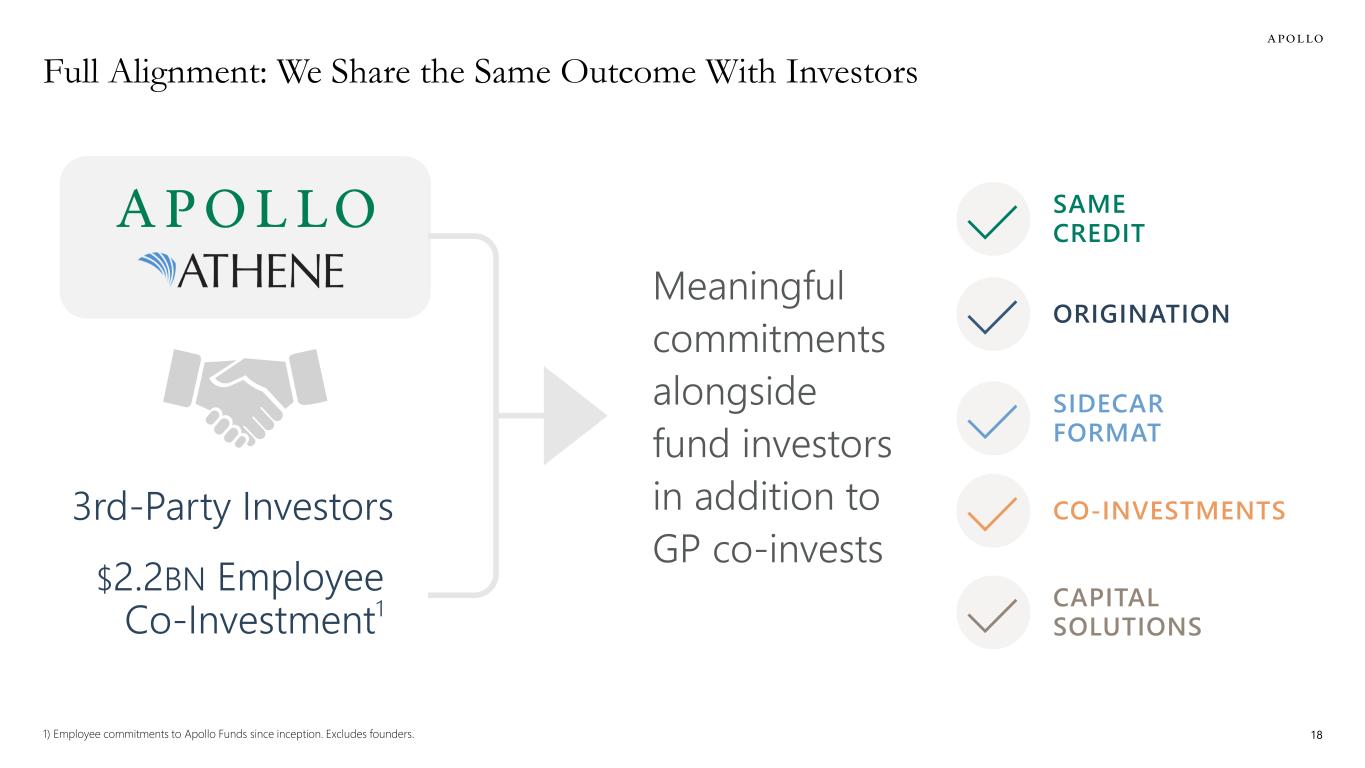

Full Alignment: We Share the Same Outcome With Investors 3rd-Party Investors Meaningful commitments alongside fund investors in addition to GP co-invests 18 SAME CREDIT ORIGINATION SIDECAR FORMAT CO-INVESTMENTS CAPITAL SOLUTIONS $2.2BN Employee Co-Investment1 1) Employee commitments to Apollo Funds since inception. Excludes founders.

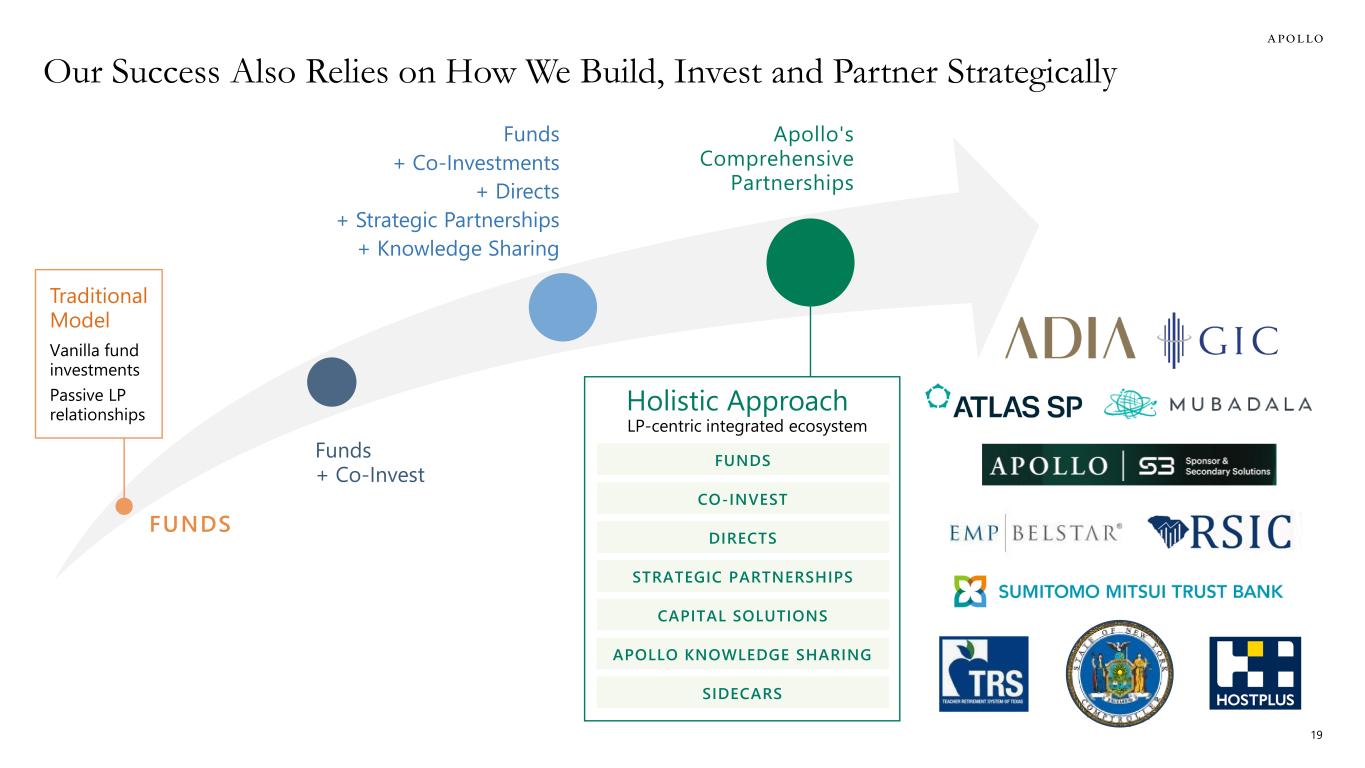

Funds + Co-Invest Funds + Co-Investments + Directs + Strategic Partnerships + Knowledge Sharing Apollo's Comprehensive Partnerships Traditional Model Vanilla fund investments Passive LP relationships FUNDS Holistic Approach LP-centric integrated ecosystem CAPITAL SOLUTIONS DIRECTS CO-INVEST FUNDS STRATEGIC PARTNERSHIPS APOLLO KNOWLEDGE SHARING SIDECARS 19 Our Success Also Relies on How We Build, Invest and Partner Strategically

20 Key Growth Drivers

21 Origination $150B+ Annual target in 3-5 years Capital Solutions $500M Annual fee related revenue target by 2026 Note: Reflects targets previously communicated at Apollo’s Investor Day in October 2021. No guarantee that targets will be achieved. We Are Capitalizing on These Secular Shifts Through Three Strategic Growth Pillars Retail $50B Cumulative organic capital raise target (2022-2026) 21

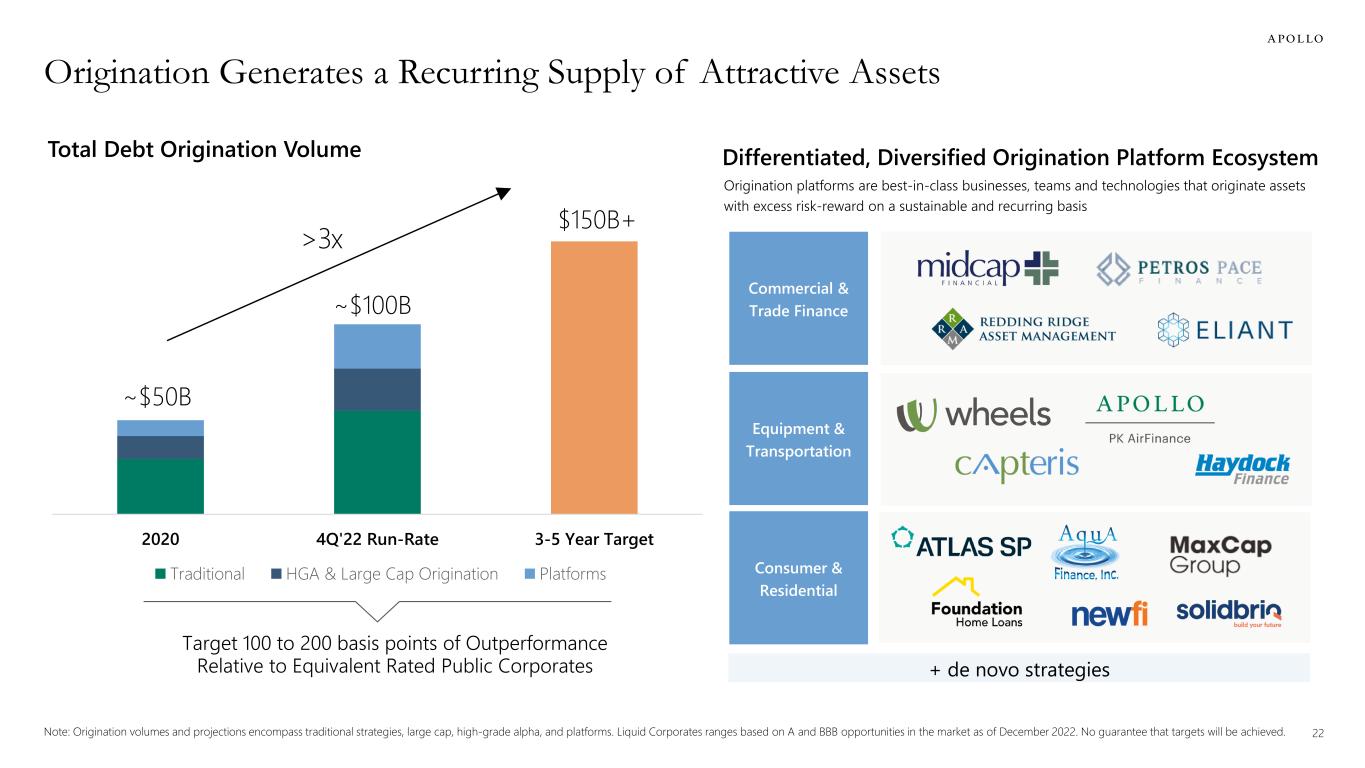

22 Origination Generates a Recurring Supply of Attractive Assets Note: Origination volumes and projections encompass traditional strategies, large cap, high-grade alpha, and platforms. Liquid Corporates ranges based on A and BBB opportunities in the market as of December 2022. No guarantee that targets will be achieved. 2020 4Q'22 Run-Rate 3-5 Year Target Traditional HGA & Large Cap Origination Platforms >3x ~$50B ~$100B $150B+ Target 100 to 200 basis points of Outperformance Relative to Equivalent Rated Public Corporates Total Debt Origination Volume Differentiated, Diversified Origination Platform Ecosystem Origination platforms are best-in-class businesses, teams and technologies that originate assets with excess risk-reward on a sustainable and recurring basis + de novo strategies Commercial & Trade Finance Equipment & Transportation Consumer & Residential

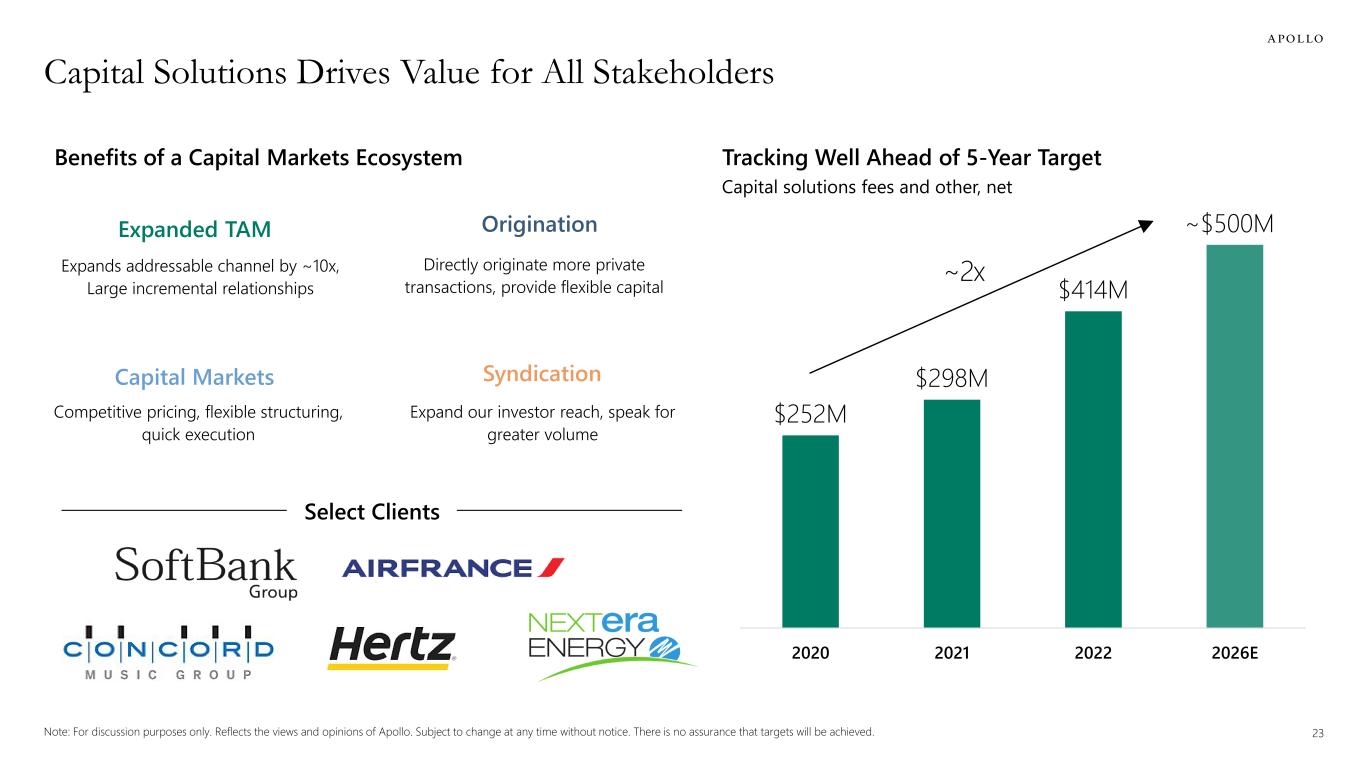

23Note: For discussion purposes only. Reflects the views and opinions of Apollo. Subject to change at any time without notice. There is no assurance that targets will be achieved. Capital Solutions Drives Value for All Stakeholders Directly originate more private transactions, provide flexible capital Competitive pricing, flexible structuring, quick execution Expand our investor reach, speak for greater volume Origination Capital Markets Syndication Expands addressable channel by ~10x, Large incremental relationships Expanded TAM Select Clients Benefits of a Capital Markets Ecosystem $252M $298M $414M ~$500M 2020 2021 2022 2026E Tracking Well Ahead of 5-Year Target ~2x Capital solutions fees and other, net

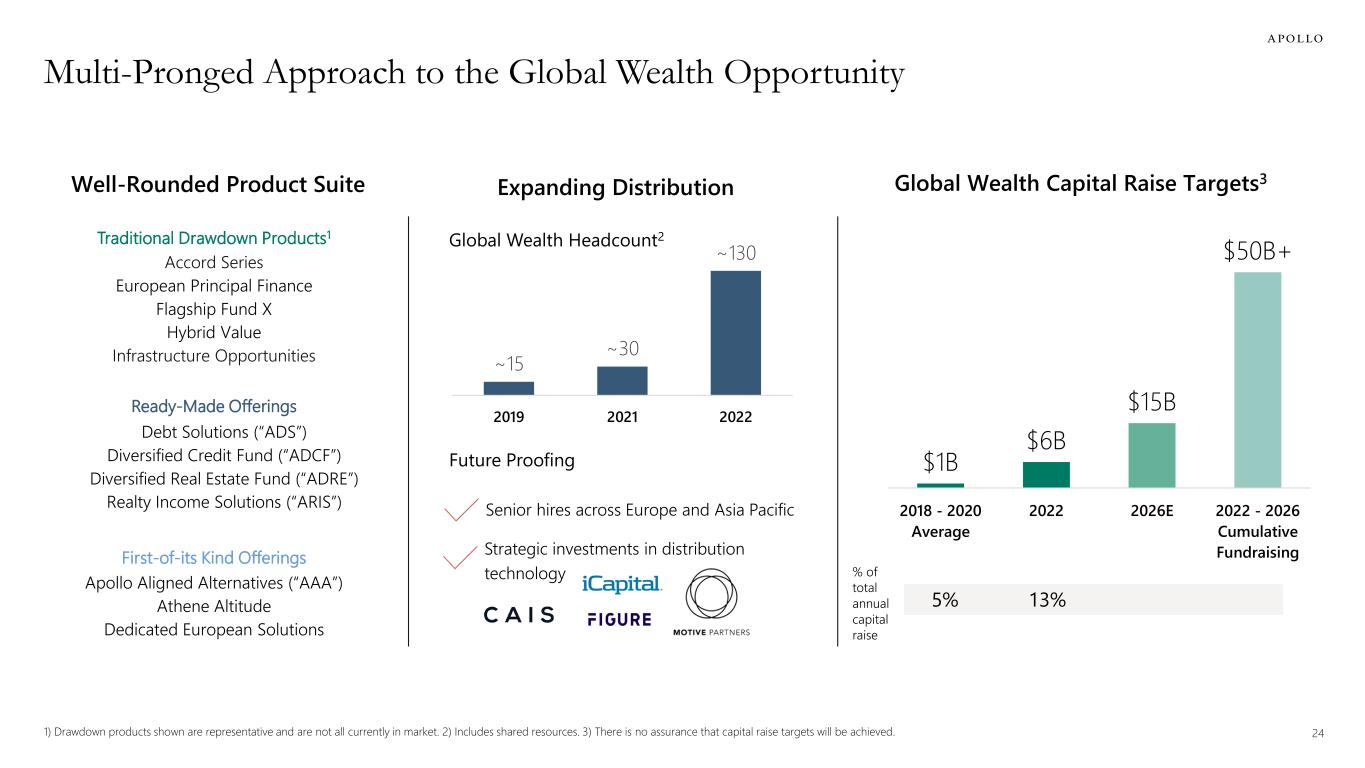

241) Drawdown products shown are representative and are not all currently in market. 2) Includes shared resources. 3) There is no assurance that capital raise targets will be achieved. Multi-Pronged Approach to the Global Wealth Opportunity Accord Series European Principal Finance Flagship Fund X Hybrid Value Infrastructure Opportunities Debt Solutions (“ADS”) Diversified Credit Fund (“ADCF”) Diversified Real Estate Fund (“ADRE”) Realty Income Solutions (“ARIS”) Apollo Aligned Alternatives (“AAA”) Athene Altitude Dedicated European Solutions Traditional Drawdown Products1 Ready-Made Offerings First-of-its Kind Offerings Well-Rounded Product Suite Expanding Distribution ~15 ~30 ~130 2019 2021 2022 Global Wealth Headcount2 Future Proofing Senior hires across Europe and Asia Pacific Strategic investments in distribution technology $1B $6B $15B $50B+ 2018 - 2020 Average 2022 2026E 2022 - 2026 Cumulative Fundraising Global Wealth Capital Raise Targets3 % of total annual capital raise 5% 13%

25 Retirement Services Highlights & Considerations in the Current Environment

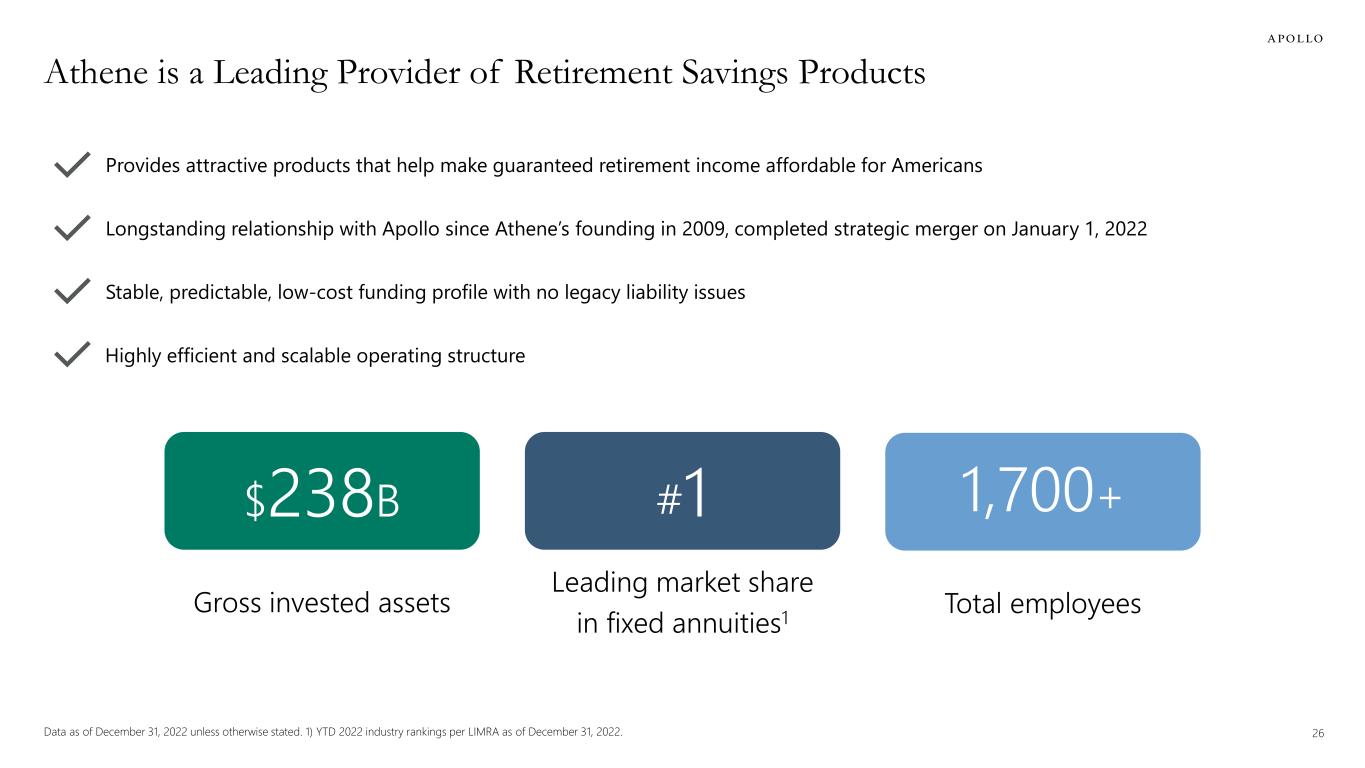

26Data as of December 31, 2022 unless otherwise stated. 1) YTD 2022 industry rankings per LIMRA as of December 31, 2022. Athene is a Leading Provider of Retirement Savings Products Provides attractive products that help make guaranteed retirement income affordable for Americans Stable, predictable, low-cost funding profile with no legacy liability issues Longstanding relationship with Apollo since Athene’s founding in 2009, completed strategic merger on January 1, 2022 Highly efficient and scalable operating structure Total employees 1,700+ Leading market share in fixed annuities1 #1 Gross invested assets $238B

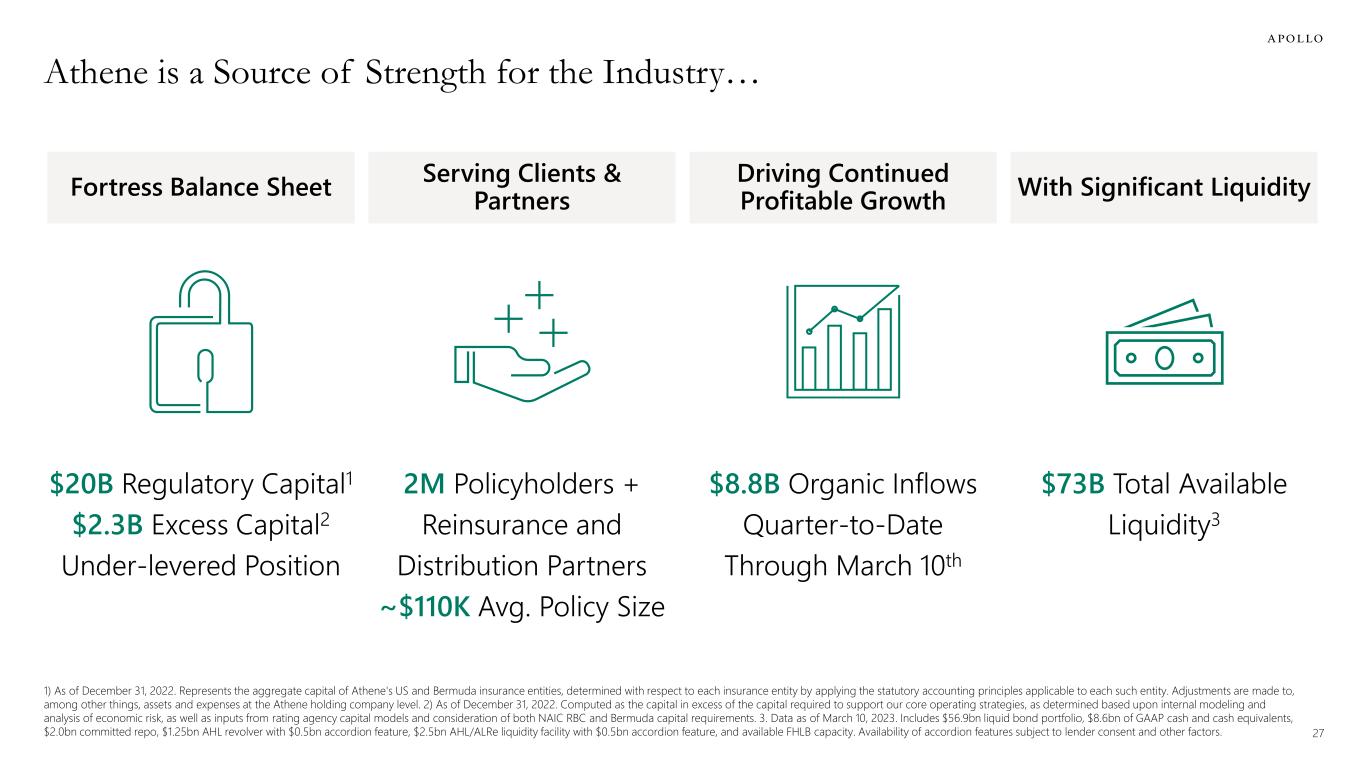

27 1) As of December 31, 2022. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. 2) As of December 31, 2022. Computed as the capital in excess of the capital required to support our core operating strategies, as determined based upon internal modeling and analysis of economic risk, as well as inputs from rating agency capital models and consideration of both NAIC RBC and Bermuda capital requirements. 3. Data as of March 10, 2023. Includes $56.9bn liquid bond portfolio, $8.6bn of GAAP cash and cash equivalents, $2.0bn committed repo, $1.25bn AHL revolver with $0.5bn accordion feature, $2.5bn AHL/ALRe liquidity facility with $0.5bn accordion feature, and available FHLB capacity. Availability of accordion features subject to lender consent and other factors. Athene is a Source of Strength for the Industry… Serving Clients & Partners Driving Continued Profitable GrowthFortress Balance Sheet $20B Regulatory Capital1 $2.3B Excess Capital2 Under-levered Position 2M Policyholders + Reinsurance and Distribution Partners ~$110K Avg. Policy Size $8.8B Organic Inflows Quarter-to-Date Through March 10th With Significant Liquidity $73B Total Available Liquidity3

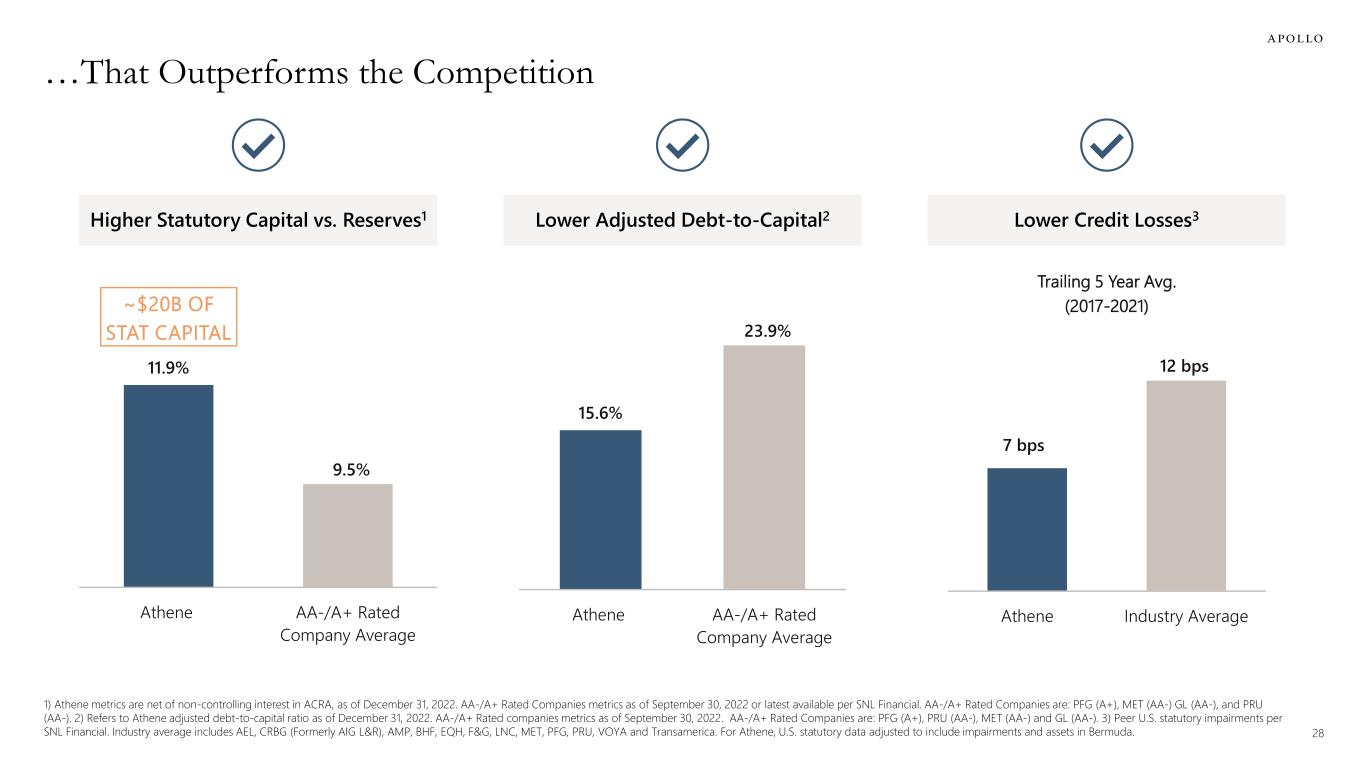

28 11.9% 9.5% Athene AA-/A+ Rated Company Average 1) Athene metrics are net of non-controlling interest in ACRA, as of December 31, 2022. AA-/A+ Rated Companies metrics as of September 30, 2022 or latest available per SNL Financial. AA-/A+ Rated Companies are: PFG (A+), MET (AA-) GL (AA-), and PRU (AA-). 2) Refers to Athene adjusted debt-to-capital ratio as of December 31, 2022. AA-/A+ Rated companies metrics as of September 30, 2022. AA-/A+ Rated Companies are: PFG (A+), PRU (AA-), MET (AA-) and GL (AA-). 3) Peer U.S. statutory impairments per SNL Financial. Industry average includes AEL, CRBG (Formerly AIG L&R), AMP, BHF, EQH, F&G, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. …That Outperforms the Competition ~$20B OF STAT CAPITAL 7 bps 12 bps Athene Industry Average Trailing 5 Year Avg. (2017-2021) Higher Statutory Capital vs. Reserves1 Lower Adjusted Debt-to-Capital2 Lower Credit Losses3 15.6% 23.9% Athene AA-/A+ Rated Company Average

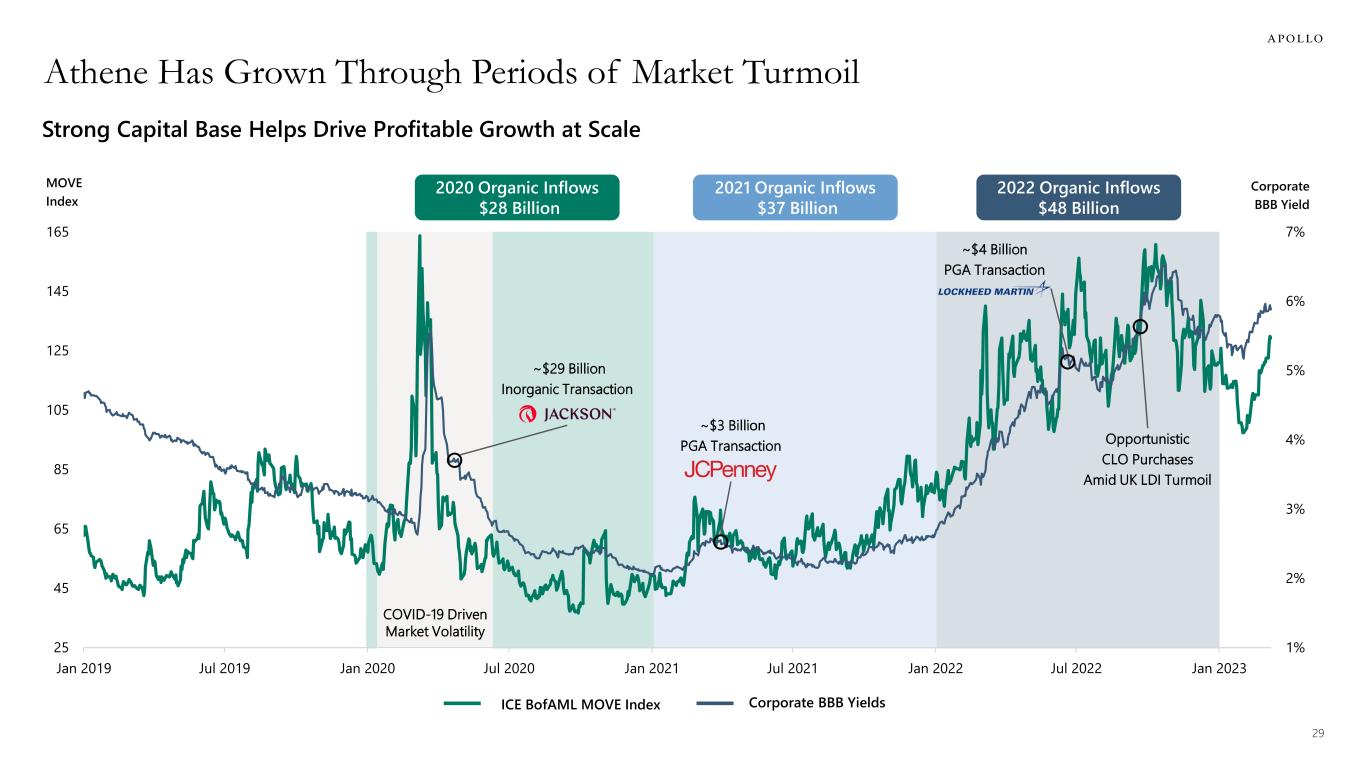

29 Athene Has Grown Through Periods of Market Turmoil 1% 2% 3% 4% 5% 6% 7% 25 45 65 85 105 125 145 165 Jan 2019 Jul 2019 Jan 2020 Jul 2020 Jan 2021 Jul 2021 Jan 2022 Jul 2022 Jan 2023 2022 Organic Inflows $48 Billion Corporate BBB Yield MOVE Index ICE BofAML MOVE Index Corporate BBB Yields COVID-19 Driven Market Volatility ~$29 Billion Inorganic Transaction 2021 Organic Inflows $37 Billion Opportunistic CLO Purchases Amid UK LDI Turmoil ~$4 Billion PGA Transaction ~$3 Billion PGA Transaction Strong Capital Base Helps Drive Profitable Growth at Scale 2020 Organic Inflows $28 Billion

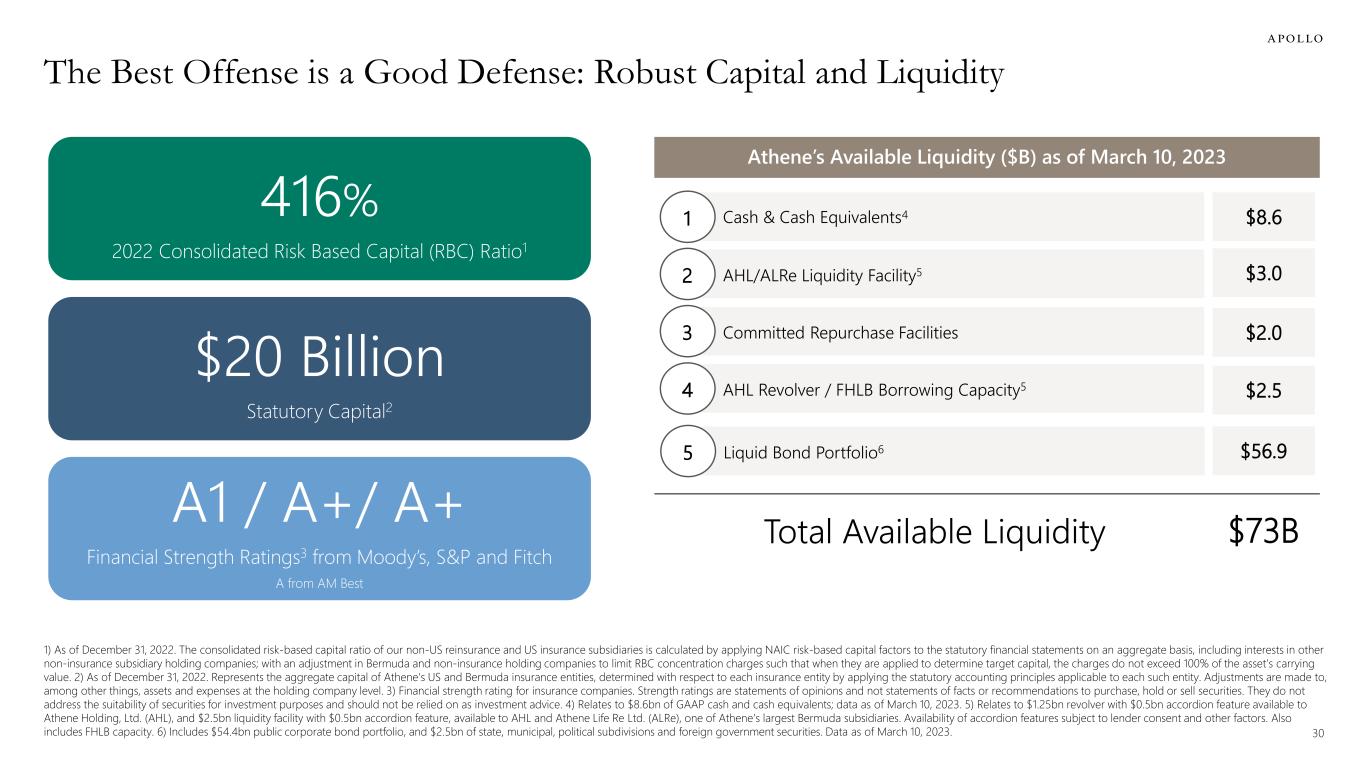

30 1) As of December 31, 2022. The consolidated risk-based capital ratio of our non-US reinsurance and US insurance subsidiaries is calculated by applying NAIC risk-based capital factors to the statutory financial statements on an aggregate basis, including interests in other non-insurance subsidiary holding companies; with an adjustment in Bermuda and non-insurance holding companies to limit RBC concentration charges such that when they are applied to determine target capital, the charges do not exceed 100% of the asset’s carrying value. 2) As of December 31, 2022. Represents the aggregate capital of Athene's US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the holding company level. 3) Financial strength rating for insurance companies. Strength ratings are statements of opinions and not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment purposes and should not be relied on as investment advice. 4) Relates to $8.6bn of GAAP cash and cash equivalents; data as of March 10, 2023. 5) Relates to $1.25bn revolver with $0.5bn accordion feature available to Athene Holding, Ltd. (AHL), and $2.5bn liquidity facility with $0.5bn accordion feature, available to AHL and Athene Life Re Ltd. (ALRe), one of Athene’s largest Bermuda subsidiaries. Availability of accordion features subject to lender consent and other factors. Also includes FHLB capacity. 6) Includes $54.4bn public corporate bond portfolio, and $2.5bn of state, municipal, political subdivisions and foreign government securities. Data as of March 10, 2023. The Best Offense is a Good Defense: Robust Capital and Liquidity 416% 2022 Consolidated Risk Based Capital (RBC) Ratio1 $20 Billion Statutory Capital2 Athene’s Available Liquidity ($B) as of March 10, 2023 • Cash & Cash Equivalents41 • AHL/ALRe Liquidity Facility52 • Committed Repurchase Facilities3 • AHL Revolver / FHLB Borrowing Capacity54 • Liquid Bond Portfolio65 $73B $8.6 $3.0 $2.0 $2.5 $56.9 Total Available LiquidityA1 / A+/ A+ Financial Strength Ratings3 from Moody’s, S&P and Fitch A from AM Best

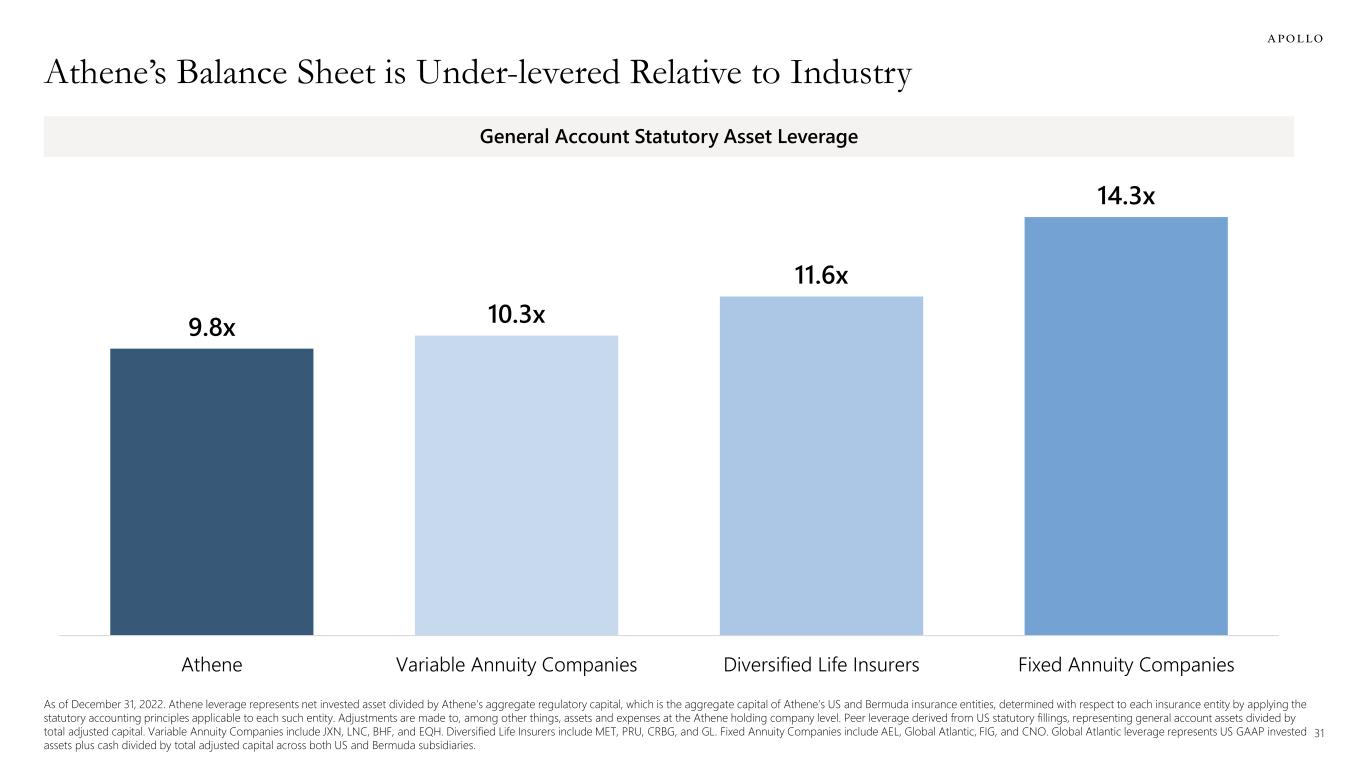

31 As of December 31, 2022. Athene leverage represents net invested asset divided by Athene’s aggregate regulatory capital, which is the aggregate capital of Athene’s US and Bermuda insurance entities, determined with respect to each insurance entity by applying the statutory accounting principles applicable to each such entity. Adjustments are made to, among other things, assets and expenses at the Athene holding company level. Peer leverage derived from US statutory fillings, representing general account assets divided by total adjusted capital. Variable Annuity Companies include JXN, LNC, BHF, and EQH. Diversified Life Insurers include MET, PRU, CRBG, and GL. Fixed Annuity Companies include AEL, Global Atlantic, FIG, and CNO. Global Atlantic leverage represents US GAAP invested assets plus cash divided by total adjusted capital across both US and Bermuda subsidiaries. Athene’s Balance Sheet is Under-levered Relative to Industry 9.8x 10.3x 11.6x 14.3x Athene Variable Annuity Companies Diversified Life Insurers Fixed Annuity Companies General Account Statutory Asset Leverage

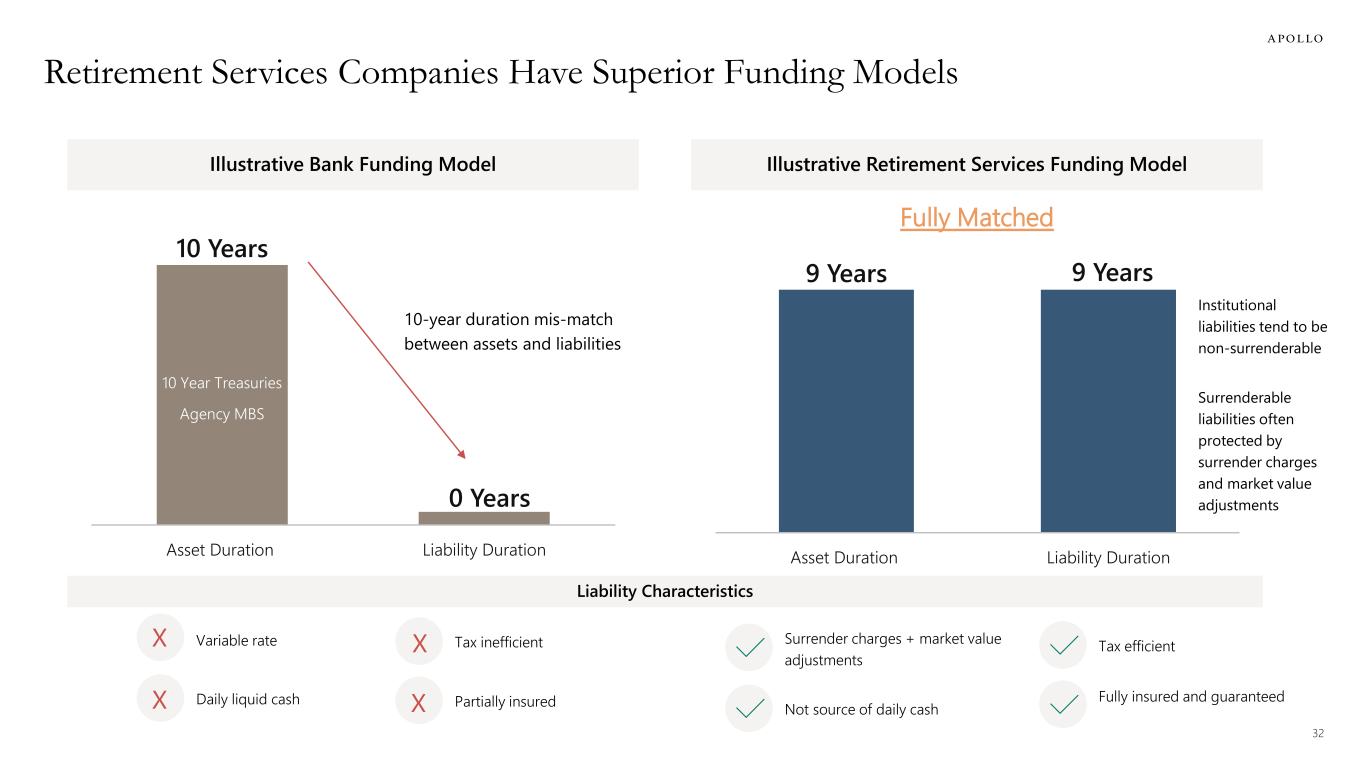

32 Retirement Services Companies Have Superior Funding Models Illustrative Bank Funding Model Illustrative Retirement Services Funding Model 10 Years 0 Years Asset Duration Liability Duration 10-year duration mis-match between assets and liabilities 10 Year Treasuries Agency MBS 9 Years 9 Years Asset Duration Liability Duration Fully Matched Institutional liabilities tend to be non-surrenderable Surrenderable liabilities often protected by surrender charges and market value adjustments Surrender charges + market value adjustments Not source of daily cash Fully insured and guaranteed Tax efficient Variable rate Daily liquid cash Partially insured Tax inefficientX X X X Liability Characteristics

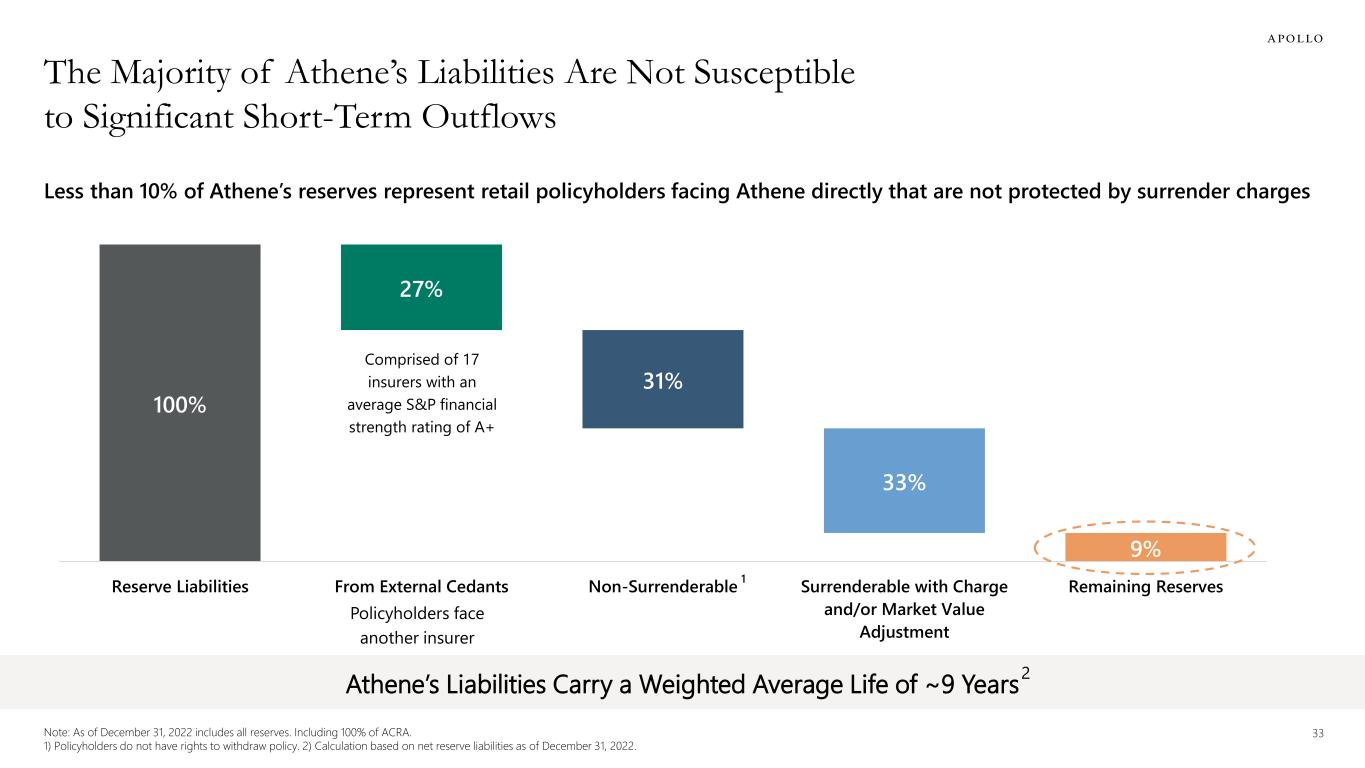

33Note: As of December 31, 2022 includes all reserves. Including 100% of ACRA. 1) Policyholders do not have rights to withdraw policy. 2) Calculation based on net reserve liabilities as of December 31, 2022. The Majority of Athene’s Liabilities Are Not Susceptible to Significant Short-Term Outflows 100% 27% 31% 33% 9% Reserve Liabilities From External Cedants Non-Surrenderable Surrenderable with Charge and/or Market Value Adjustment Remaining Reserves Comprised of 17 insurers with an average S&P financial strength rating of A+ Less than 10% of Athene’s reserves represent retail policyholders facing Athene directly that are not protected by surrender charges 1 Policyholders face another insurer Athene’s Liabilities Carry a Weighted Average Life of ~9 Years2

34 Differentiated Characteristics of Fixed Annuity-Based Funding Model Fixed annuities are a retirement savings product offering principal protection, a particularly desirable attribute amid market volatility Consumers generally do not view annuities as a source of liquidity given their long-dated nature and certain policy-specific terms (i.e. surrender charges, market value adjustments, etc.) Fixed annuities are a relative winner when it comes to “cash sorting” since the guarantees offered and return potential are more attractive than traditional banking products Consumer behavior around policy surrender / withdrawal activity has been extremely predictable over time

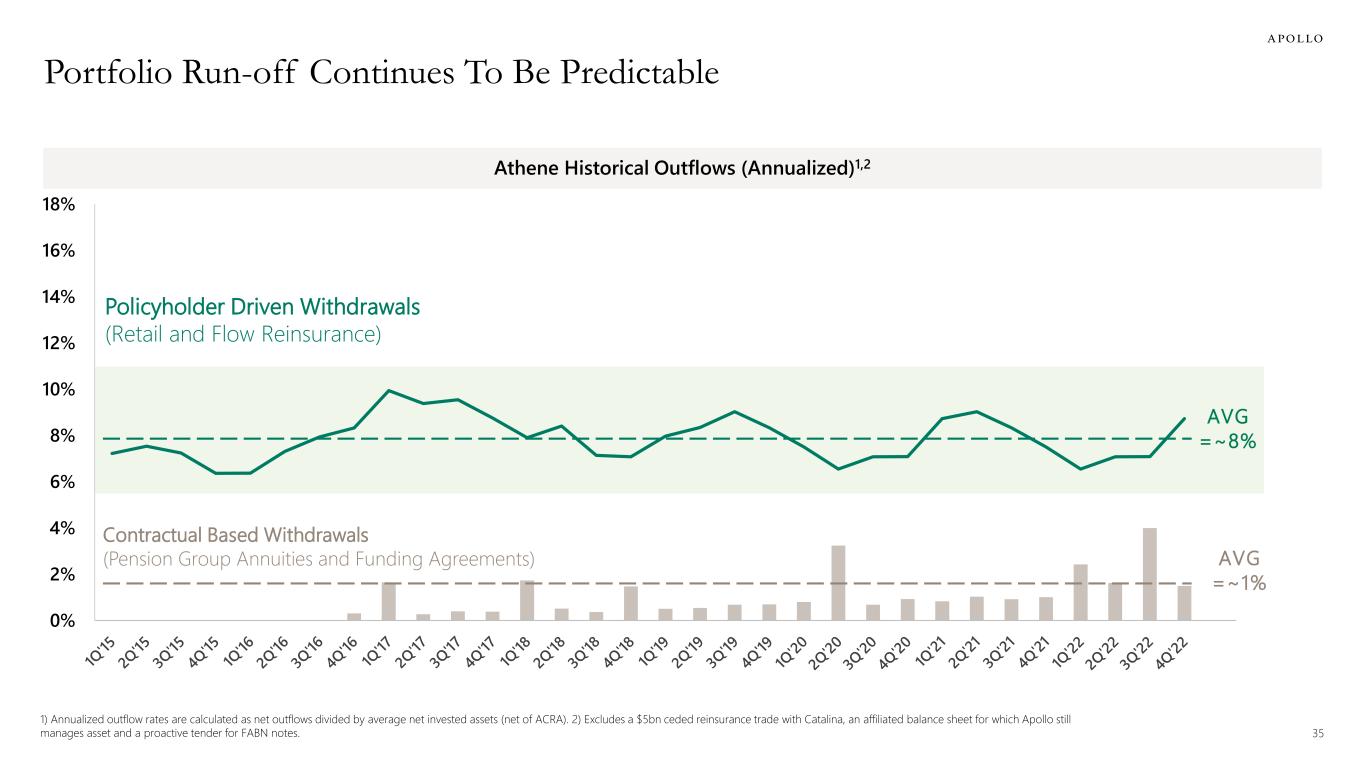

35 1) Annualized outflow rates are calculated as net outflows divided by average net invested assets (net of ACRA). 2) Excludes a $5bn ceded reinsurance trade with Catalina, an affiliated balance sheet for which Apollo still manages asset and a proactive tender for FABN notes. Portfolio Run-off Continues To Be Predictable Athene Historical Outflows (Annualized)1,2 Policyholder Driven Withdrawals (Retail and Flow Reinsurance) 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% AVG =~8% AVG =~1% Contractual Based Withdrawals (Pension Group Annuities and Funding Agreements)

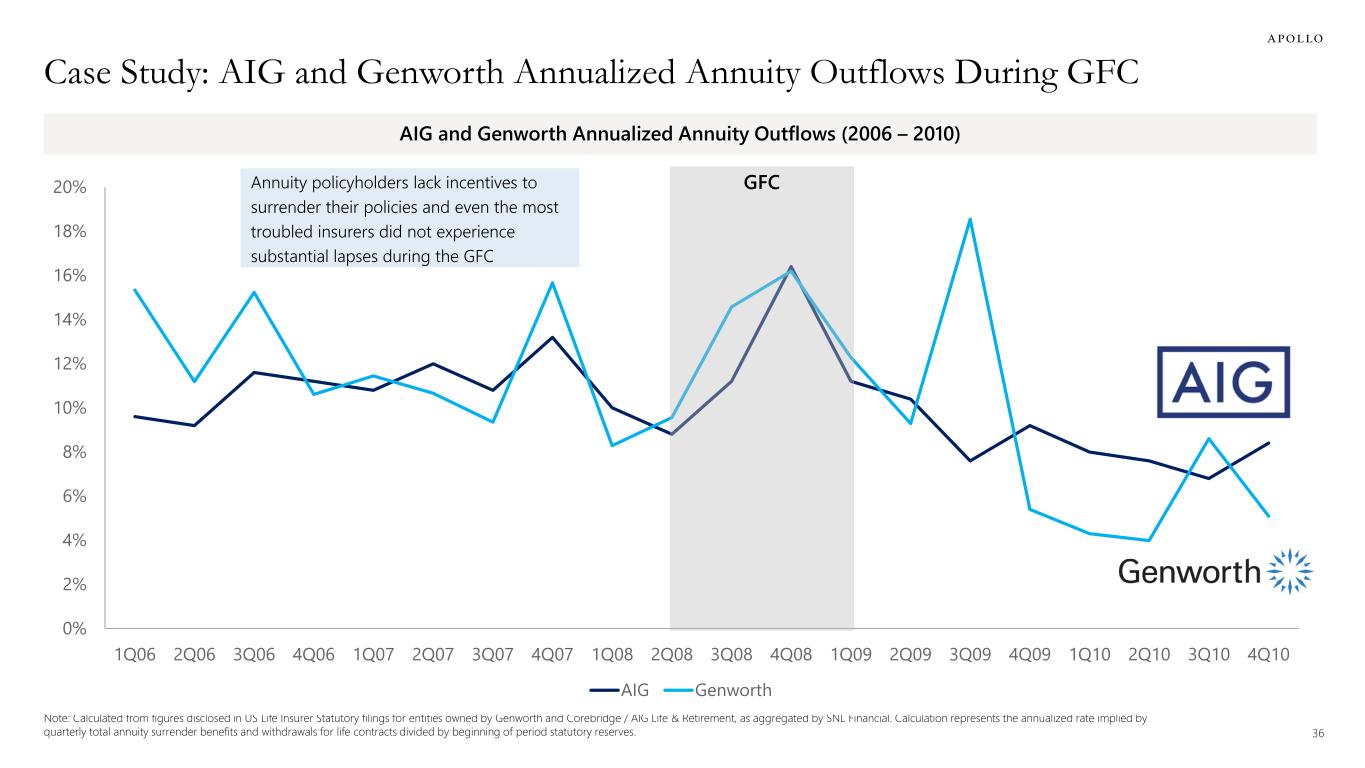

36 Note: Calculated from figures disclosed in US Life Insurer Statutory filings for entities owned by Genworth and Corebridge / AIG Life & Retirement, as aggregated by SNL Financial. Calculation represents the annualized rate implied by quarterly total annuity surrender benefits and withdrawals for life contracts divided by beginning of period statutory reserves. Case Study: AIG and Genworth Annualized Annuity Outflows During GFC 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 AIG Genworth AIG and Genworth Annualized Annuity Outflows (2006 – 2010) Annuity policyholders lack incentives to surrender their policies and even the most troubled insurers did not experience substantial lapses during the GFC GFC

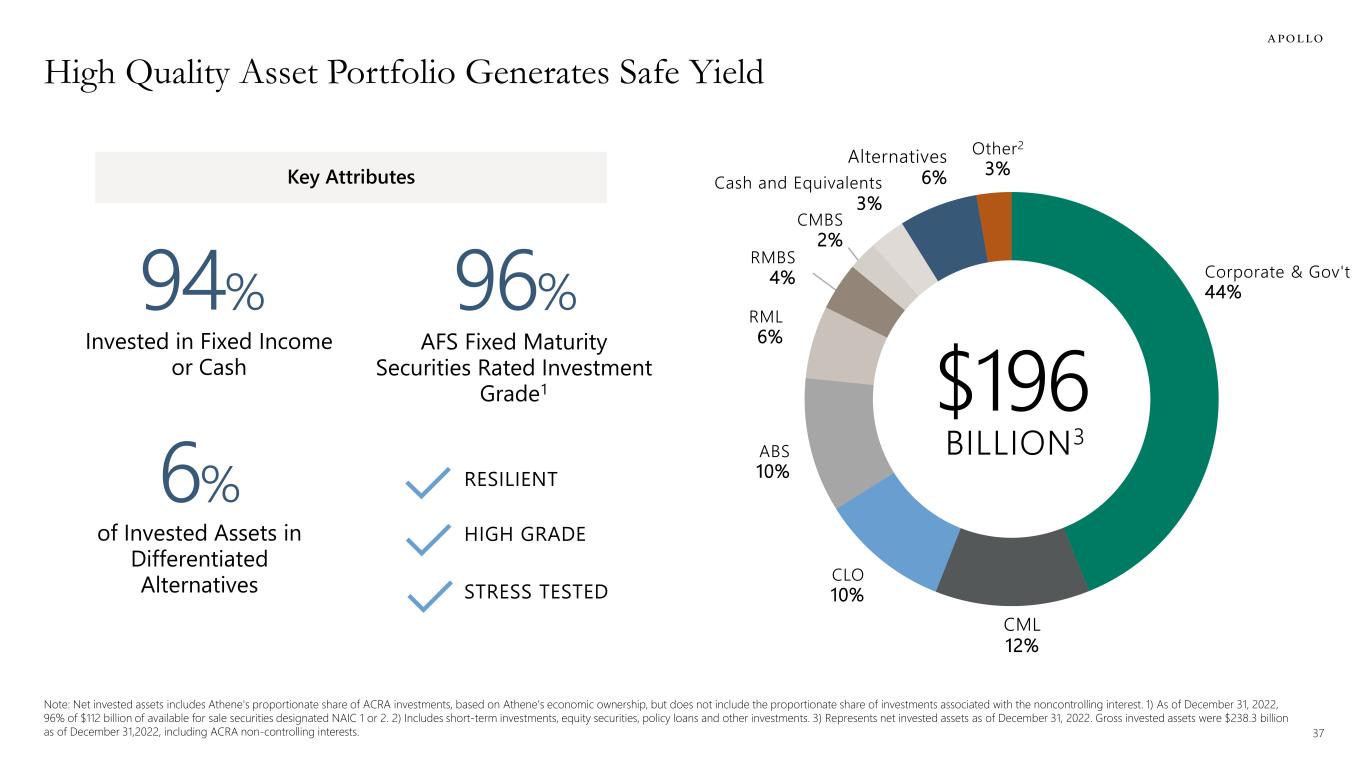

37 Note: Net invested assets includes Athene's proportionate share of ACRA investments, based on Athene's economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. 1) As of December 31, 2022, 96% of $112 billion of available for sale securities designated NAIC 1 or 2. 2) Includes short-term investments, equity securities, policy loans and other investments. 3) Represents net invested assets as of December 31, 2022. Gross invested assets were $238.3 billion as of December 31,2022, including ACRA non-controlling interests. High Quality Asset Portfolio Generates Safe Yield AFS Fixed Maturity Securities Rated Investment Grade1 RESILIENT HIGH GRADE STRESS TESTED 96% Invested in Fixed Income or Cash 94% of Invested Assets in Differentiated Alternatives 6% Key Attributes Corporate & Gov't 44% CML 12% CLO 10% ABS 10% RML 6% RMBS 4% CMBS 2% Cash and Equivalents 3% Alternatives 6% Other2 3% $196 BILLION3

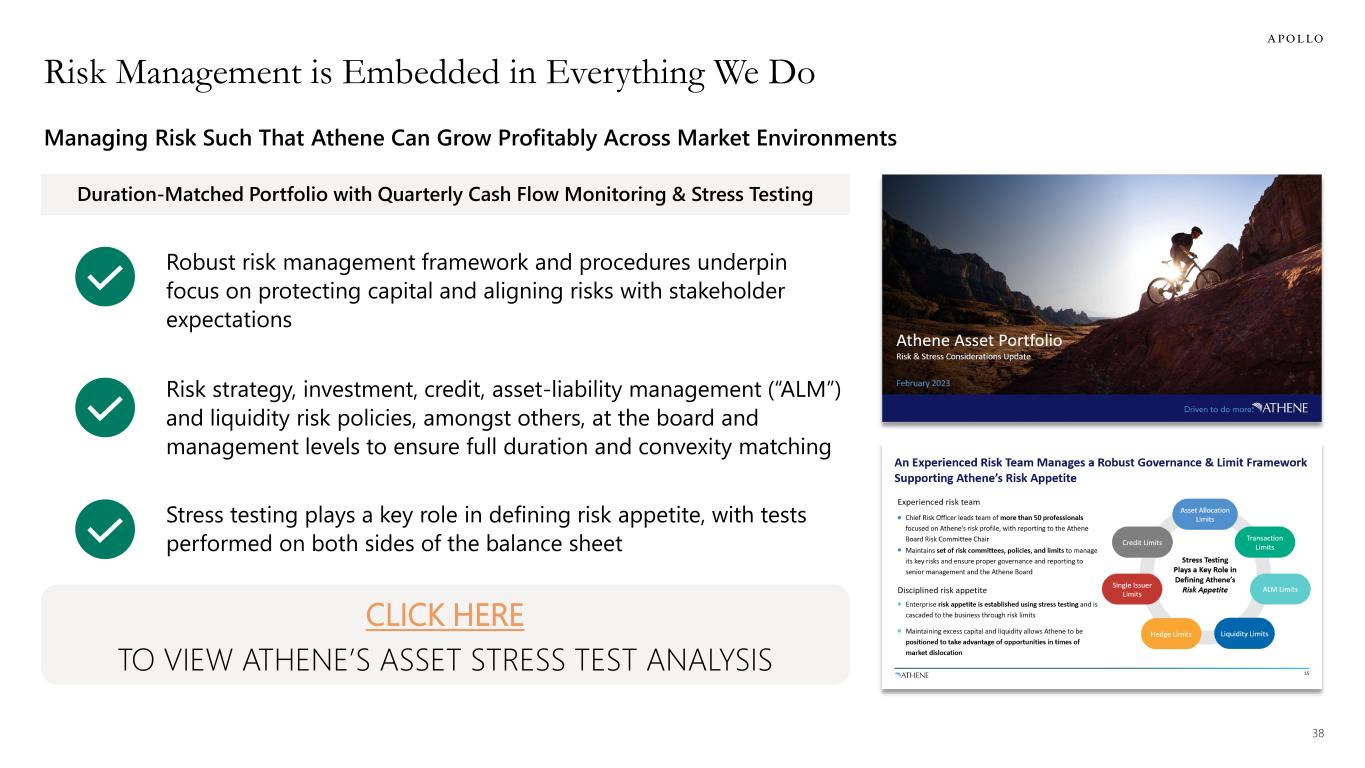

38 Risk Management is Embedded in Everything We Do Managing Risk Such That Athene Can Grow Profitably Across Market Environments Robust risk management framework and procedures underpin focus on protecting capital and aligning risks with stakeholder expectations Risk strategy, investment, credit, asset-liability management (“ALM”) and liquidity risk policies, amongst others, at the board and management levels to ensure full duration and convexity matching Stress testing plays a key role in defining risk appetite, with tests performed on both sides of the balance sheet CLICK HERE TO VIEW ATHENE’S ASSET STRESS TEST ANALYSIS Duration-Matched Portfolio with Quarterly Cash Flow Monitoring & Stress Testing

39 Putting It All Together… Our Financial Targets

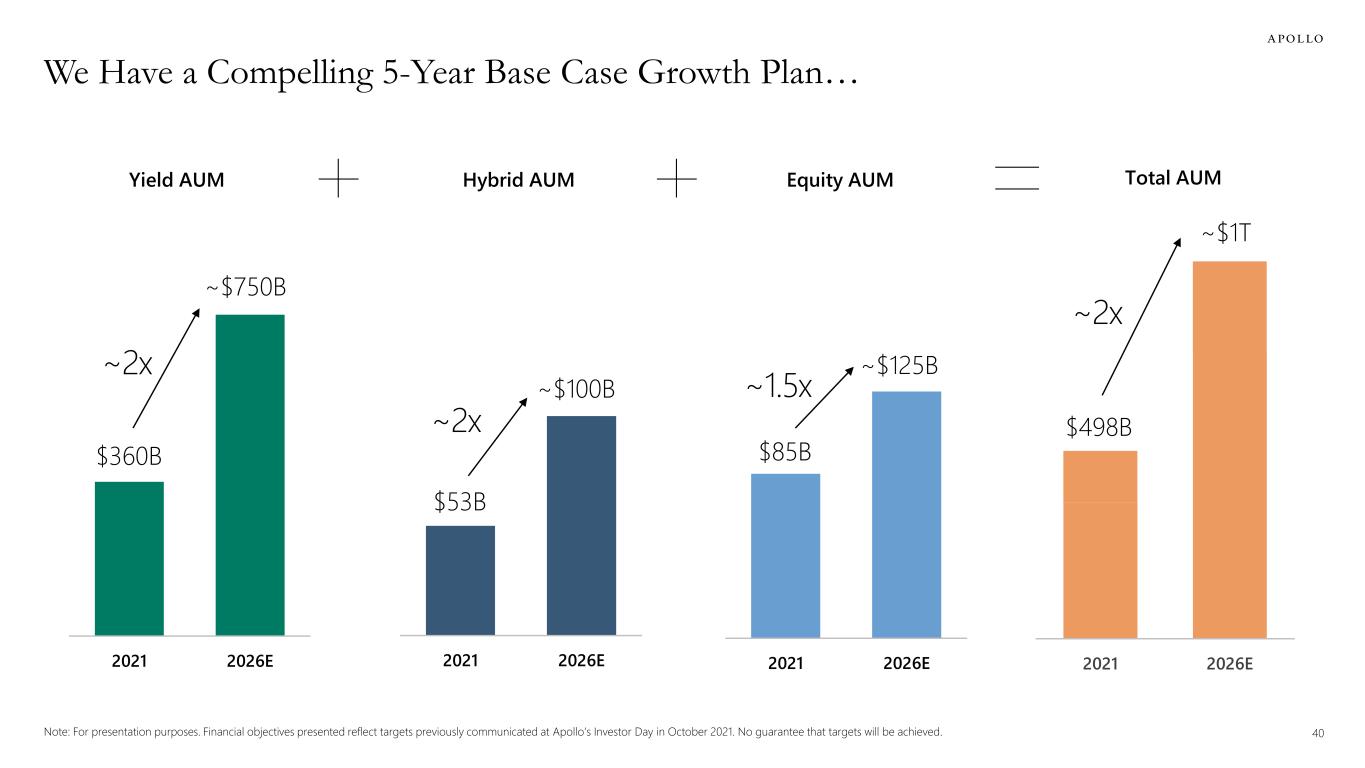

40Note: For presentation purposes. Financial objectives presented reflect targets previously communicated at Apollo’s Investor Day in October 2021. No guarantee that targets will be achieved. We Have a Compelling 5-Year Base Case Growth Plan… 2021 2026E ~$750B $360B ~2x 2021 2026E ~$100B $53B ~2x 2021 2026E ~$125B $85B ~1.5x 2021 2026E ~$1T $498B ~2x Yield AUM Hybrid AUM Equity AUM Total AUM

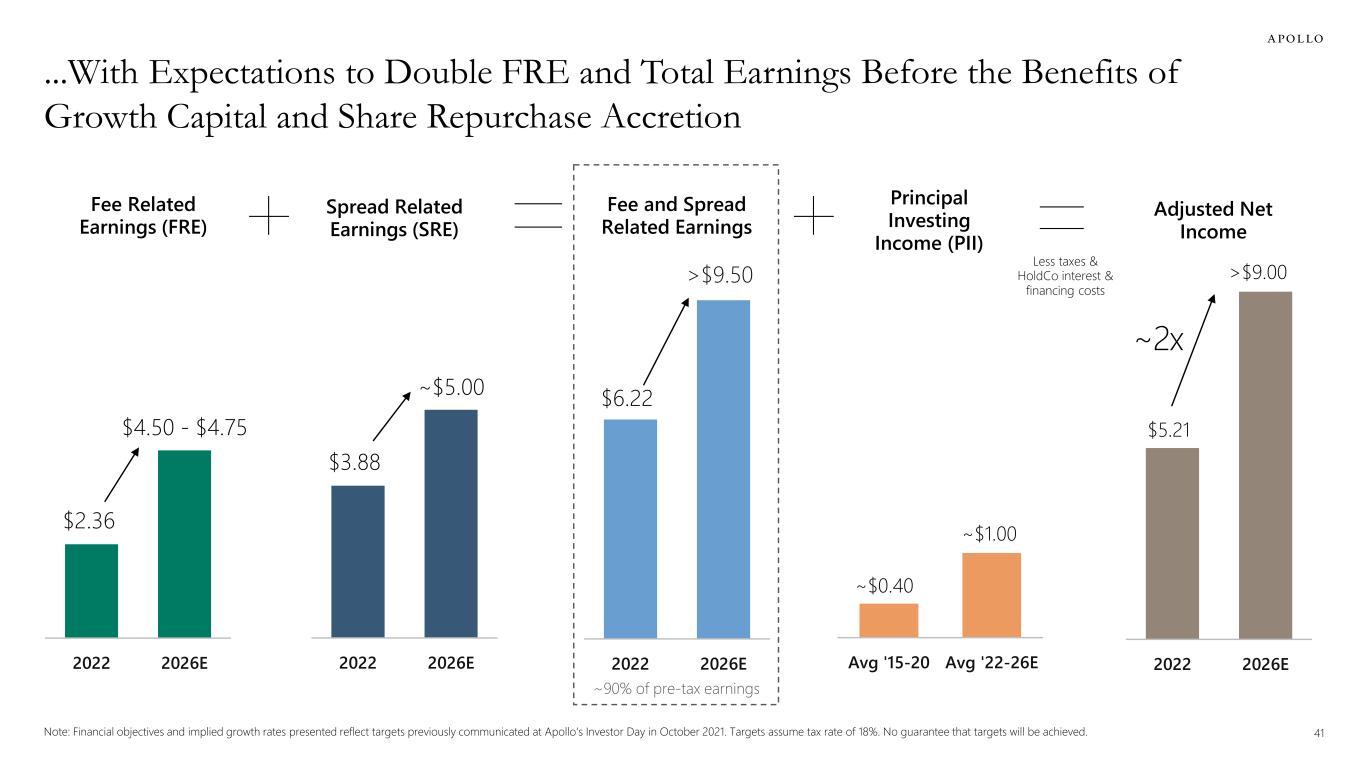

41 ...With Expectations to Double FRE and Total Earnings Before the Benefits of Growth Capital and Share Repurchase Accretion Note: Financial objectives and implied growth rates presented reflect targets previously communicated at Apollo’s Investor Day in October 2021. Targets assume tax rate of 18%. No guarantee that targets will be achieved. Fee Related Earnings (FRE) 2022 2026E $4.50 - $4.75 Spread Related Earnings (SRE) Adjusted Net Income 2022 2026E >$9.00 $2.36 $5.21 Principal Investing Income (PII) Avg '15-20 Avg '22-26E ~$0.40 ~$1.00 +Fee and Spread Related Earnings 2022 2026E $6.22 >$9.50 2022 2026E ~$5.00 $3.88 ~2x Less taxes & HoldCo interest & financing costs ~90% of pre-tax earnings

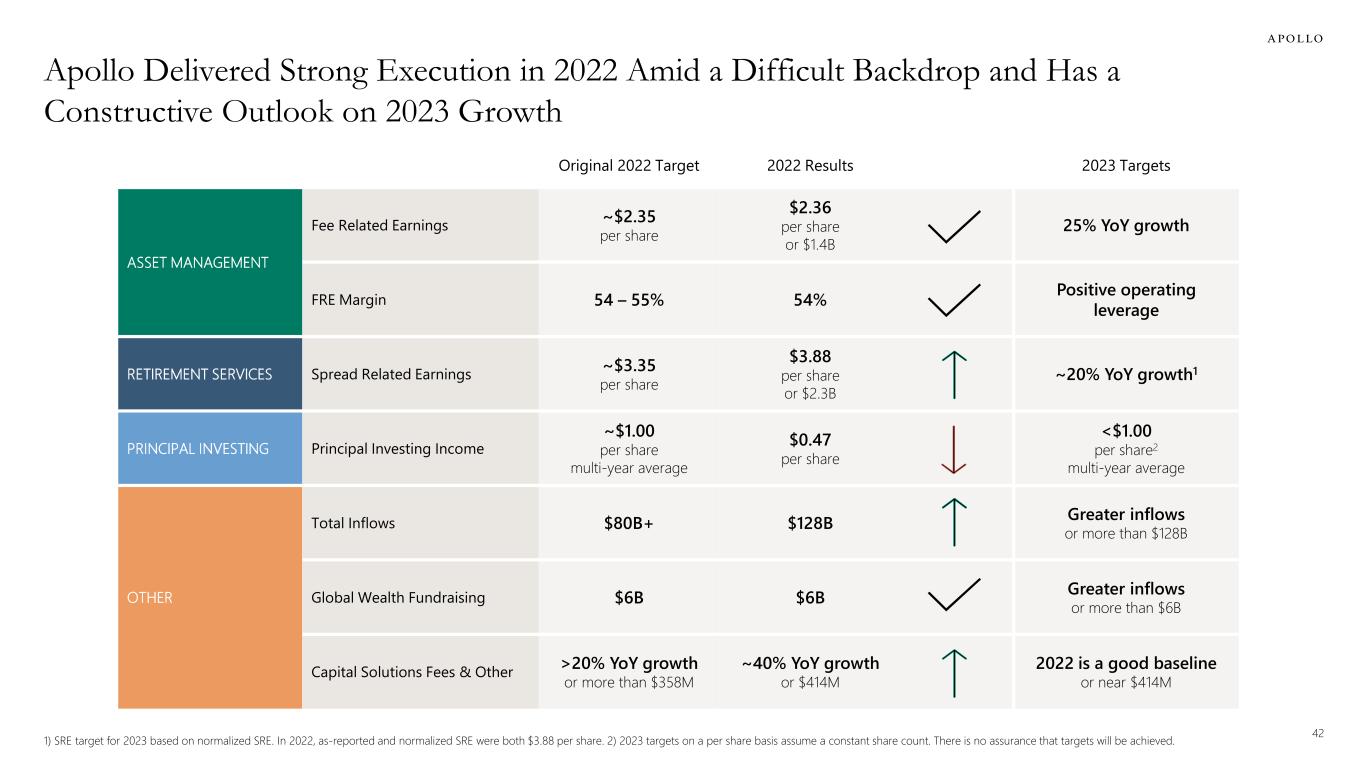

42 Apollo Delivered Strong Execution in 2022 Amid a Difficult Backdrop and Has a Constructive Outlook on 2023 Growth Original 2022 Target 2022 Results 2023 Targets ASSET MANAGEMENT Fee Related Earnings ~$2.35 per share $2.36 per share or $1.4B 25% YoY growth FRE Margin 54 – 55% 54% Positive operating leverage RETIREMENT SERVICES Spread Related Earnings ~$3.35 per share $3.88 per share or $2.3B ~20% YoY growth1 PRINCIPAL INVESTING Principal Investing Income ~$1.00 per share multi-year average $0.47 per share <$1.00 per share2 multi-year average OTHER Total Inflows $80B+ $128B Greater inflows or more than $128B Global Wealth Fundraising $6B $6B Greater inflows or more than $6B Capital Solutions Fees & Other >20% YoY growth or more than $358M ~40% YoY growth or $414M 2022 is a good baseline or near $414M 1) SRE target for 2023 based on normalized SRE. In 2022, as-reported and normalized SRE were both $3.88 per share. 2) 2023 targets on a per share basis assume a constant share count. There is no assurance that targets will be achieved.

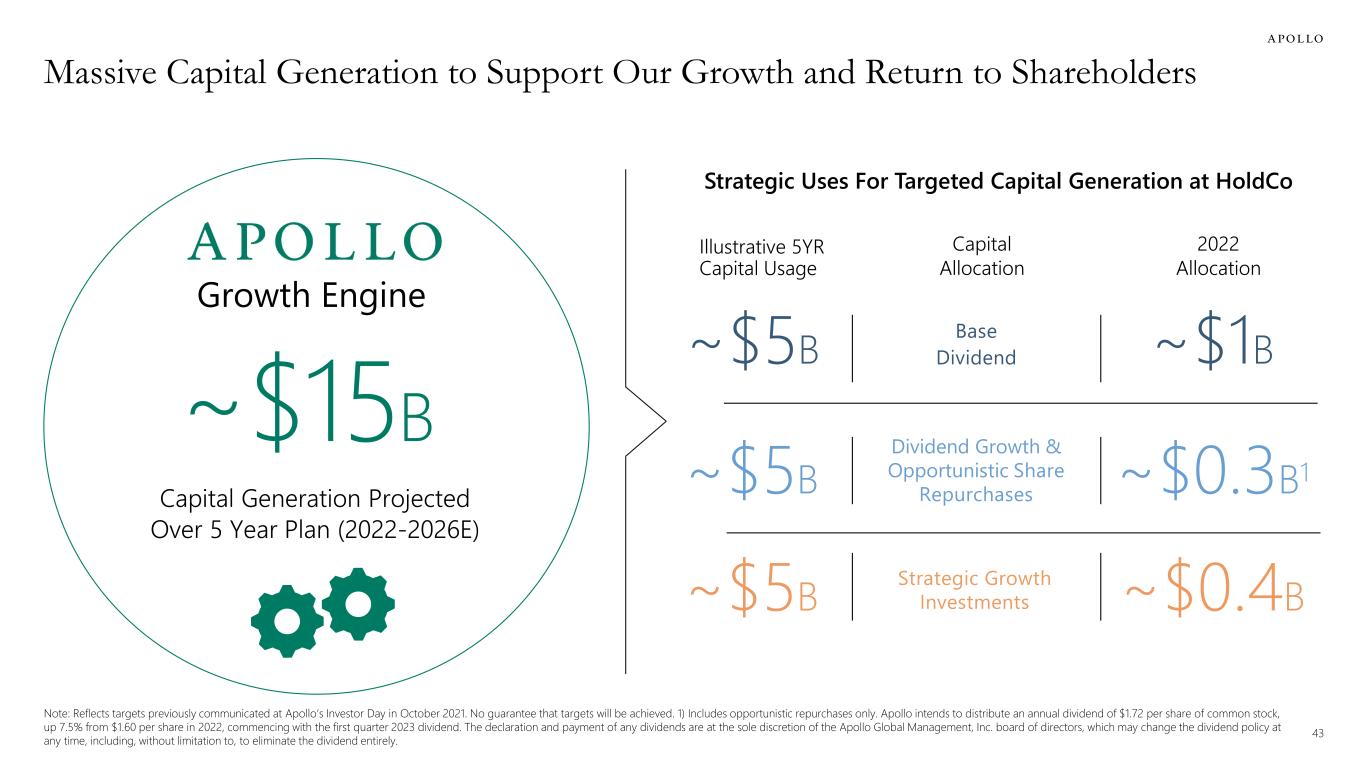

43 Note: Reflects targets previously communicated at Apollo’s Investor Day in October 2021. No guarantee that targets will be achieved. 1) Includes opportunistic repurchases only. Apollo intends to distribute an annual dividend of $1.72 per share of common stock, up 7.5% from $1.60 per share in 2022, commencing with the first quarter 2023 dividend. The declaration and payment of any dividends are at the sole discretion of the Apollo Global Management, Inc. board of directors, which may change the dividend policy at any time, including, without limitation to, to eliminate the dividend entirely. Massive Capital Generation to Support Our Growth and Return to Shareholders Strategic Uses For Targeted Capital Generation at HoldCo Illustrative 5YR Capital Usage Base Dividend~$5B Dividend Growth & Opportunistic Share Repurchases~$5B Strategic Growth Investments~$5B Capital Generation Projected Over 5 Year Plan (2022-2026E) ~$15B Growth Engine 2022 Allocation ~$1B ~$0.3B1 ~$0.4B Capital Allocation

44 Our Purpose

We Seek to Create Positive Impact in Everything We Do Driving a More Sustainable Future Building & Financing Stronger Business Empowering Retirees 45

DRIVING SUSTAINABILITY Workplace CommunityMarketplace 196 Companies participating in the ESG Reporting Program 12.2M MT recycled by reporting companies $19B Deployed by Apollo-managed funds over the past five years in energy transition and sustainability- related investments 2008 Year Apollo’s ESG Program Began EXPANDING OPPORTUNITY 46 We Drive Sustainability and Expand Opportunities in the Communities We Touch Click for Apollo’s Latest ESG Report Data as of January 1, 2008, through December 31, 2022, unless otherwise indicated. For discussion purposes only. Reflects the views and opinions of Apollo Analysts. The information set forth above is subject to change. *MT – Metric Tons. APOLLO CITIZENSHIP

47Note: Employment metrics as of December 31, 2022. Reflects the view and opinions of Apollo. Co-Presidents and Senior Leadership of AAM. Best-in-Class Corporate Governance with Strong Senior Leadership Best-in-Class Governance Independent Chair of the Board Enhanced Corporate Governance with Two Thirds Independent Board Single Share Class with One Share One Vote Firm Leadership Marc Rowan CEO Scott Kleinman Co-President James Zelter Co-President James Belardi CEO, Athene Apollo Senior Leadership Apollo Business Senior Leadership 15 Members 30 Years of industry experience on average 22 Individuals across Yield, Hybrid & Equity 27 Years of industry experience on average

48 Can’t Overstate the Importance of Culture “Culture eats strategy for breakfast.” – PETER DRUCKER We’re Driven by Our People, Our Culture Click below to hear directly from our team on what defines Apollo: Outperform Expectations Lead Responsibly Drive Collaboration Champion Opportunity Challenge Convention

49 Appendix

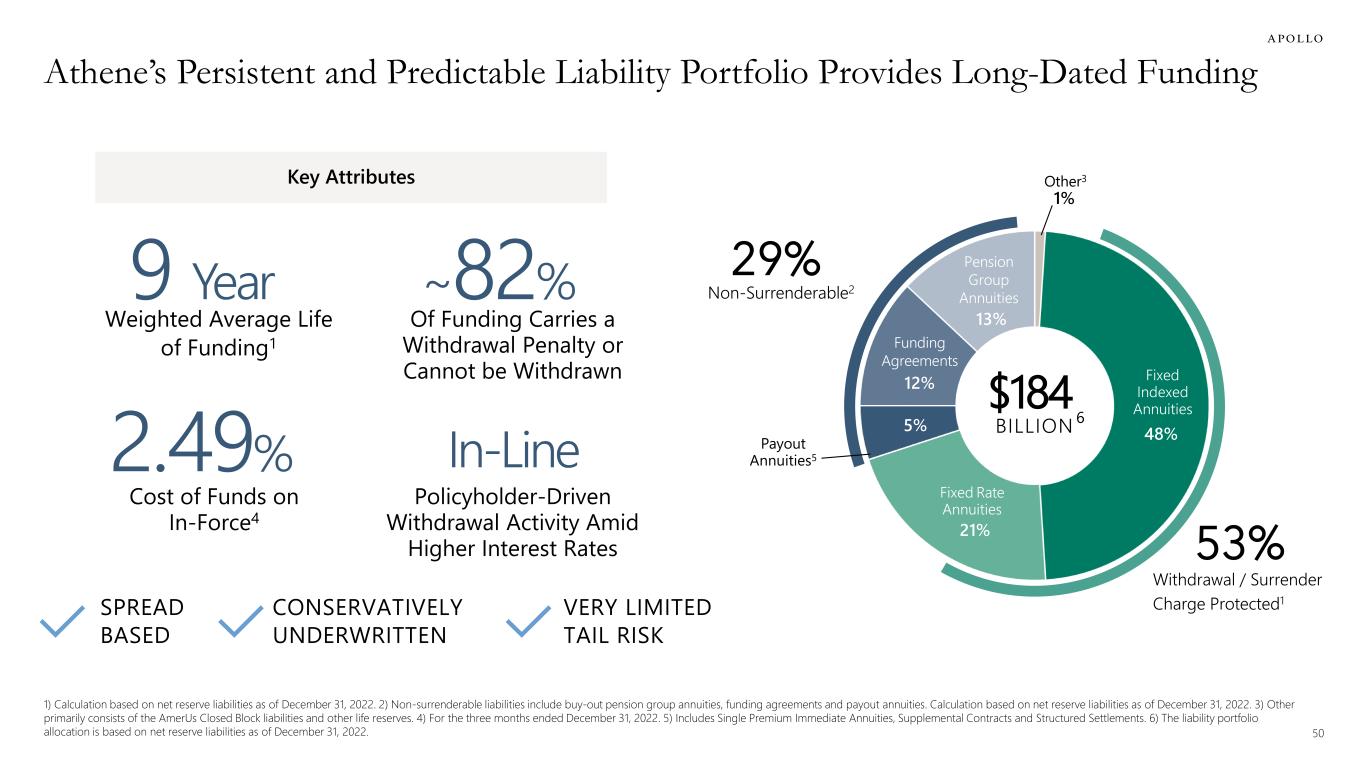

50 1% 48% 21% 5% 12% 13% Fixed Rate Annuities 1) Calculation based on net reserve liabilities as of December 31, 2022. 2) Non-surrenderable liabilities include buy-out pension group annuities, funding agreements and payout annuities. Calculation based on net reserve liabilities as of December 31, 2022. 3) Other primarily consists of the AmerUs Closed Block liabilities and other life reserves. 4) For the three months ended December 31, 2022. 5) Includes Single Premium Immediate Annuities, Supplemental Contracts and Structured Settlements. 6) The liability portfolio allocation is based on net reserve liabilities as of December 31, 2022. Athene’s Persistent and Predictable Liability Portfolio Provides Long-Dated Funding Pension Group Annuities Payout Annuities5 Fixed Indexed Annuities$184 BILLION 6 29% Non-Surrenderable2 Of Funding Carries a Withdrawal Penalty or Cannot be Withdrawn ~82% SPREAD BASED Weighted Average Life of Funding1 9 Year Cost of Funds on In-Force4 2.49% CONSERVATIVELY UNDERWRITTEN VERY LIMITED TAIL RISK Policyholder-Driven Withdrawal Activity Amid Higher Interest Rates 53% Withdrawal / Surrender Charge Protected1 Funding Agreements In-Line Other3Key Attributes

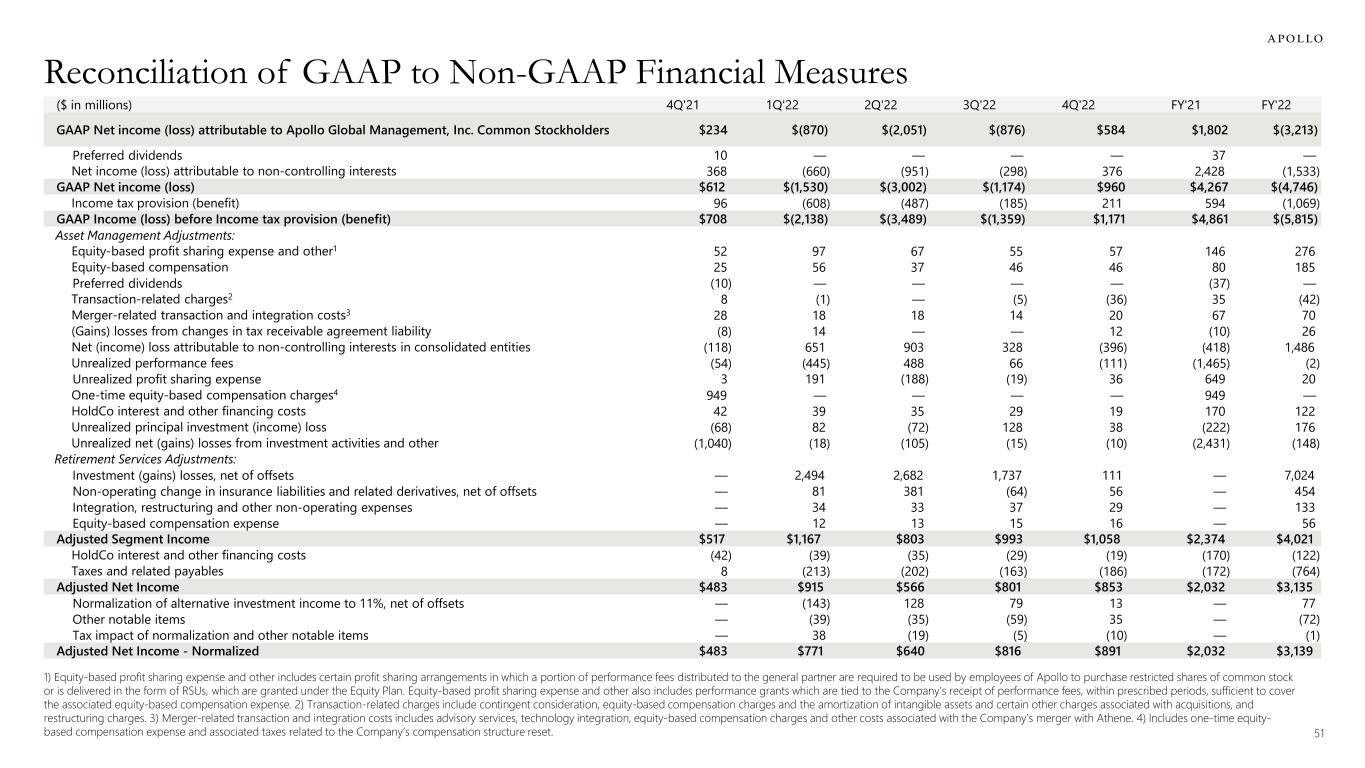

51 1) Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are required to be used by employees of Apollo to purchase restricted shares of common stock or is delivered in the form of RSUs, which are granted under the Equity Plan. Equity-based profit sharing expense and other also includes performance grants which are tied to the Company’s receipt of performance fees, within prescribed periods, sufficient to cover the associated equity-based compensation expense. 2) Transaction-related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and restructuring charges. 3) Merger-related transaction and integration costs includes advisory services, technology integration, equity-based compensation charges and other costs associated with the Company’s merger with Athene. 4) Includes one-time equity- based compensation expense and associated taxes related to the Company’s compensation structure reset. Reconciliation of GAAP to Non-GAAP Financial Measures ($ in millions) 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 FY'21 FY'22 GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $234 $(870) $(2,051) $(876) $584 $1,802 $(3,213) Preferred dividends 10 — — — — 37 — Net income (loss) attributable to non-controlling interests 368 (660) (951) (298) 376 2,428 (1,533) GAAP Net income (loss) $612 $(1,530) $(3,002) $(1,174) $960 $4,267 $(4,746) Income tax provision (benefit) 96 (608) (487) (185) 211 594 (1,069) GAAP Income (loss) before Income tax provision (benefit) $708 $(2,138) $(3,489) $(1,359) $1,171 $4,861 $(5,815) Asset Management Adjustments: Equity-based profit sharing expense and other1 52 97 67 55 57 146 276 Equity-based compensation 25 56 37 46 46 80 185 Preferred dividends (10) — — — — (37) — Transaction-related charges2 8 (1) — (5) (36) 35 (42) Merger-related transaction and integration costs3 28 18 18 14 20 67 70 (Gains) losses from changes in tax receivable agreement liability (8) 14 — — 12 (10) 26 Net (income) loss attributable to non-controlling interests in consolidated entities (118) 651 903 328 (396) (418) 1,486 Unrealized performance fees (54) (445) 488 66 (111) (1,465) (2) Unrealized profit sharing expense 3 191 (188) (19) 36 649 20 One-time equity-based compensation charges4 949 — — — — 949 — HoldCo interest and other financing costs 42 39 35 29 19 170 122 Unrealized principal investment (income) loss (68) 82 (72) 128 38 (222) 176 Unrealized net (gains) losses from investment activities and other (1,040) (18) (105) (15) (10) (2,431) (148) Retirement Services Adjustments: Investment (gains) losses, net of offsets — 2,494 2,682 1,737 111 — 7,024 Non-operating change in insurance liabilities and related derivatives, net of offsets — 81 381 (64) 56 — 454 Integration, restructuring and other non-operating expenses — 34 33 37 29 — 133 Equity-based compensation expense — 12 13 15 16 — 56 Adjusted Segment Income $517 $1,167 $803 $993 $1,058 $2,374 $4,021 HoldCo interest and other financing costs (42) (39) (35) (29) (19) (170) (122) Taxes and related payables 8 (213) (202) (163) (186) (172) (764) Adjusted Net Income $483 $915 $566 $801 $853 $2,032 $3,135 Normalization of alternative investment income to 11%, net of offsets — (143) 128 79 13 — 77 Other notable items — (39) (35) (59) 35 — (72) Tax impact of normalization and other notable items — 38 (19) (5) (10) — (1) Adjusted Net Income - Normalized $483 $771 $640 $816 $891 $2,032 $3,139

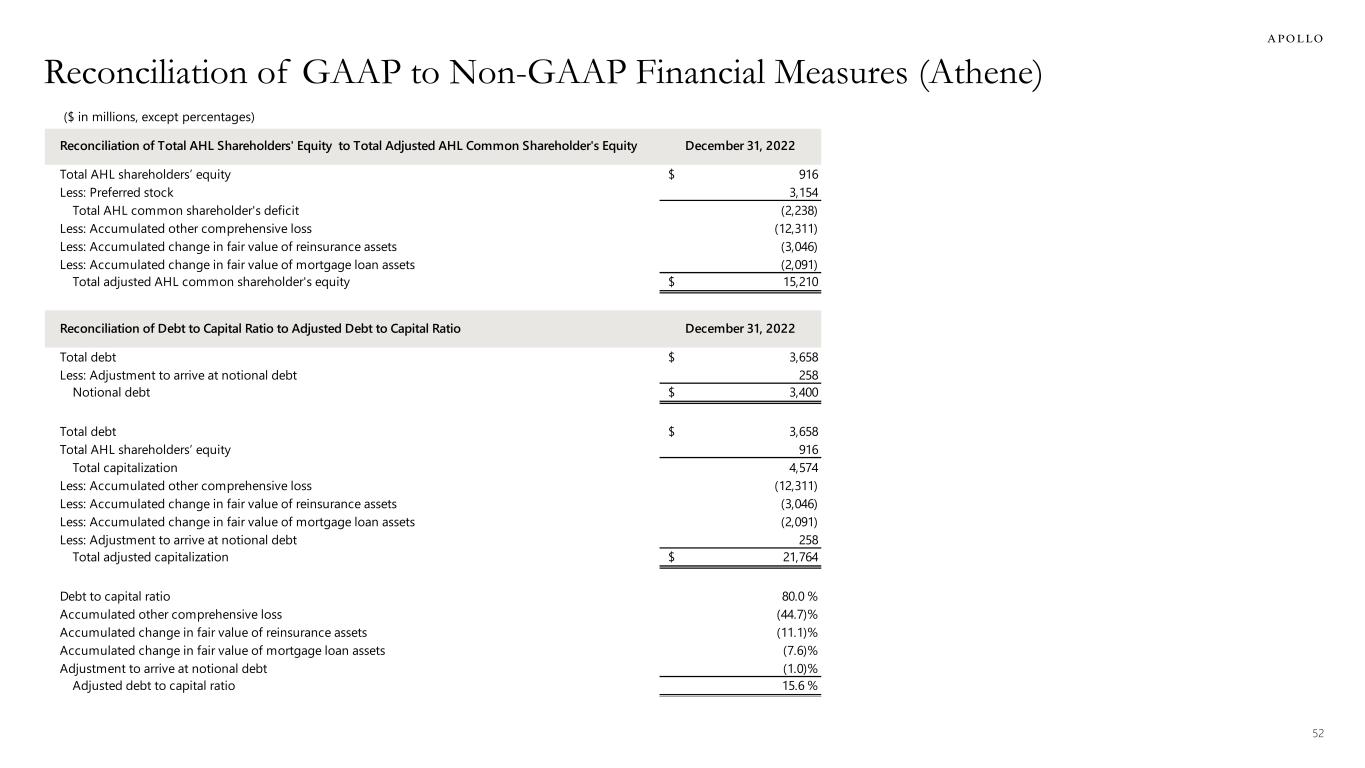

52 Reconciliation of GAAP to Non-GAAP Financial Measures (Athene) ($ in millions, except percentages) Total AHL shareholders’ equity $ 916 Less: Preferred stock 3,154 Total AHL common shareholder's deficit (2,238) Less: Accumulated other comprehensive loss (12,311) Less: Accumulated change in fair value of reinsurance assets (3,046) Less: Accumulated change in fair value of mortgage loan assets (2,091) Total adjusted AHL common shareholder's equity $ 15,210 Total debt $ 3,658 Less: Adjustment to arrive at notional debt 258 Notional debt $ 3,400 Total debt $ 3,658 Total AHL shareholders’ equity 916 Total capitalization 4,574 Less: Accumulated other comprehensive loss (12,311) Less: Accumulated change in fair value of reinsurance assets (3,046) Less: Accumulated change in fair value of mortgage loan assets (2,091) Less: Adjustment to arrive at notional debt 258 Total adjusted capitalization $ 21,764 Debt to capital ratio 80.0 % Accumulated other comprehensive loss (44.7)% Accumulated change in fair value of reinsurance assets (11.1)% Accumulated change in fair value of mortgage loan assets (7.6)% Adjustment to arrive at notional debt (1.0)% Adjusted debt to capital ratio 15.6 % December 31, 2022 Reconciliation of Total AHL Shareholders' Equity to Total Adjusted AHL Common Shareholder's Equity December 31, 2022 Reconciliation of Debt to Capital Ratio to Adjusted Debt to Capital Ratio

53 Reconciliation of GAAP to Non-GAAP Financial Measures (Athene) ($ in millions) Total investments, including related parties Derivative assets Cash and cash equivalents (including restricted cash) Accrued investment income Net receivable (payable) for collateral on derivatives Reinsurance funds withheld and modified coinsurance VIE and VOE assets, liabilities and noncontrolling interest Unrealized (gains) losses Ceded policy loans Net investment receivables (payables) Allowance for credit losses Other investments Total adjustments to arrive at gross invested assets Gross invested assets ACRA noncontrolling interest Net invested assets $ 196,451 (10) 238,310 (41,859) 471 41,862 (179) 186 12,747 22,284 1,423 8,407 1,328 $ 196,448 (3,309) Reconciliation of Total Investments, Including Related Parties, to Net Invested Assets December 31, 2022 (1,486)

54 Reconciliation of GAAP to Non-GAAP Financial Measures (Athene) ($ in millions) Total Liabilities Debt Derivative Laibilities Payables for collateral on derivatives and securities to repurchase Other Liabilities Liabilities of consolidated VIEs Reinsurance impacts Policy loans ceded ACRA noncontroliing interest Other Total adjustments to arrive at net reserve liabilities Net reserve liabilities (179) Reconciliation of Total Liabilities to Net Reserve Liabilities December 31, 2022 $ 243,667 (3,658) (1,646) (3,841) (1,635) (815) (9,186) $ 184,326 (38,382) 1 (59,341)

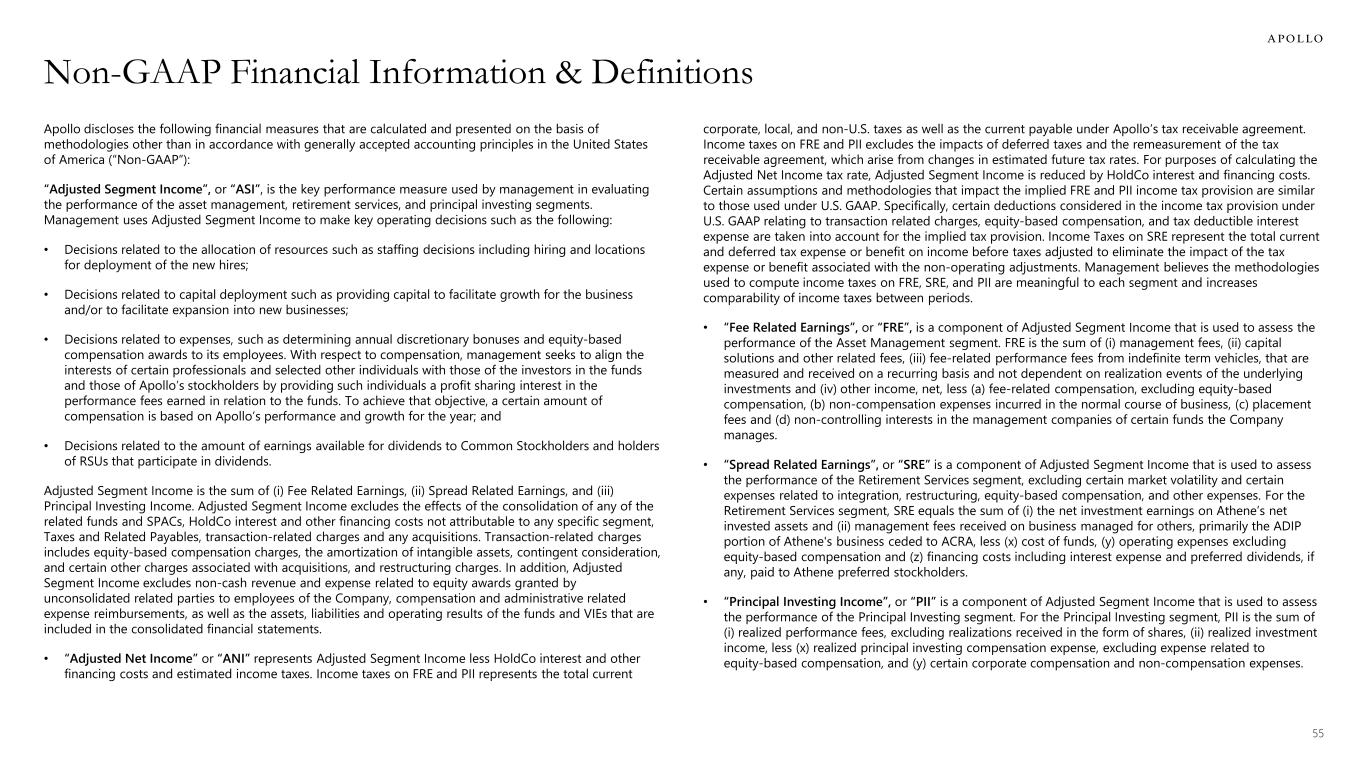

55 Non-GAAP Financial Information & Definitions Apollo discloses the following financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”): “Adjusted Segment Income”, or “ASI”, is the key performance measure used by management in evaluating the performance of the asset management, retirement services, and principal investing segments. Management uses Adjusted Segment Income to make key operating decisions such as the following: • Decisions related to the allocation of resources such as staffing decisions including hiring and locations for deployment of the new hires; • Decisions related to capital deployment such as providing capital to facilitate growth for the business and/or to facilitate expansion into new businesses; • Decisions related to expenses, such as determining annual discretionary bonuses and equity-based compensation awards to its employees. With respect to compensation, management seeks to align the interests of certain professionals and selected other individuals with those of the investors in the funds and those of Apollo’s stockholders by providing such individuals a profit sharing interest in the performance fees earned in relation to the funds. To achieve that objective, a certain amount of compensation is based on Apollo’s performance and growth for the year; and • Decisions related to the amount of earnings available for dividends to Common Stockholders and holders of RSUs that participate in dividends. Adjusted Segment Income is the sum of (i) Fee Related Earnings, (ii) Spread Related Earnings, and (iii) Principal Investing Income. Adjusted Segment Income excludes the effects of the consolidation of any of the related funds and SPACs, HoldCo interest and other financing costs not attributable to any specific segment, Taxes and Related Payables, transaction-related charges and any acquisitions. Transaction-related charges includes equity-based compensation charges, the amortization of intangible assets, contingent consideration, and certain other charges associated with acquisitions, and restructuring charges. In addition, Adjusted Segment Income excludes non-cash revenue and expense related to equity awards granted by unconsolidated related parties to employees of the Company, compensation and administrative related expense reimbursements, as well as the assets, liabilities and operating results of the funds and VIEs that are included in the consolidated financial statements. • “Adjusted Net Income” or “ANI” represents Adjusted Segment Income less HoldCo interest and other financing costs and estimated income taxes. Income taxes on FRE and PII represents the total current corporate, local, and non-U.S. taxes as well as the current payable under Apollo’s tax receivable agreement. Income taxes on FRE and PII excludes the impacts of deferred taxes and the remeasurement of the tax receivable agreement, which arise from changes in estimated future tax rates. For purposes of calculating the Adjusted Net Income tax rate, Adjusted Segment Income is reduced by HoldCo interest and financing costs. Certain assumptions and methodologies that impact the implied FRE and PII income tax provision are similar to those used under U.S. GAAP. Specifically, certain deductions considered in the income tax provision under U.S. GAAP relating to transaction related charges, equity-based compensation, and tax deductible interest expense are taken into account for the implied tax provision. Income Taxes on SRE represent the total current and deferred tax expense or benefit on income before taxes adjusted to eliminate the impact of the tax expense or benefit associated with the non-operating adjustments. Management believes the methodologies used to compute income taxes on FRE, SRE, and PII are meaningful to each segment and increases comparability of income taxes between periods. • “Fee Related Earnings”, or “FRE”, is a component of Adjusted Segment Income that is used to assess the performance of the Asset Management segment. FRE is the sum of (i) management fees, (ii) capital solutions and other related fees, (iii) fee-related performance fees from indefinite term vehicles, that are measured and received on a recurring basis and not dependent on realization events of the underlying investments and (iv) other income, net, less (a) fee-related compensation, excluding equity-based compensation, (b) non-compensation expenses incurred in the normal course of business, (c) placement fees and (d) non-controlling interests in the management companies of certain funds the Company manages. • “Spread Related Earnings”, or “SRE” is a component of Adjusted Segment Income that is used to assess the performance of the Retirement Services segment, excluding certain market volatility and certain expenses related to integration, restructuring, equity-based compensation, and other expenses. For the Retirement Services segment, SRE equals the sum of (i) the net investment earnings on Athene’s net invested assets and (ii) management fees received on business managed for others, primarily the ADIP portion of Athene's business ceded to ACRA, less (x) cost of funds, (y) operating expenses excluding equity-based compensation and (z) financing costs including interest expense and preferred dividends, if any, paid to Athene preferred stockholders. • “Principal Investing Income”, or “PII” is a component of Adjusted Segment Income that is used to assess the performance of the Principal Investing segment. For the Principal Investing segment, PII is the sum of (i) realized performance fees, excluding realizations received in the form of shares, (ii) realized investment income, less (x) realized principal investing compensation expense, excluding expense related to equity-based compensation, and (y) certain corporate compensation and non-compensation expenses.

56 Non-GAAP Financial Information & Definitions (Continued) “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. The net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain perpetual capital vehicles, which have a fee- generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. The fair value of the investments of equity and certain hybrid funds, partnerships and accounts Apollo manages or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. The gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. The fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any management agreements of the funds Apollo manages. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in funds it manages; and (3) the AUM measures that Apollo uses internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. “Capital solutions fees and other, net” primarily includes transaction fees earned by our capital solutions business which we refer to as Apollo Capital Solutions ("ACS") related to underwriting, structuring, arrangement and placement of debt and equity securities, and syndication for funds managed by Apollo, portfolio companies of funds managed by Apollo, and third parties. Capital solutions fees and other, net also includes advisory fees for the ongoing monitoring of portfolio operations and director's fees. These fees also include certain offsetting amounts including reductions in management fees related to a percentage of these fees recognized ("management fee offset") and other additional revenue sharing arrangements. “Debt Origination” represents (i) capital that has been invested in new debt or debt like investments by Apollo's Yield and Hybrid strategies (whether purchased by Apollo funds and accounts, or syndicated to third parties) where Apollo or one of Apollo's platforms has sourced, negotiated, or significantly affected the commercial terms of the investment; (ii) new capital pools formed by debt issuances, including CLOs and (iii) net purchases of certain assets by the funds and accounts we manage that we consider to be private, illiquid, and hard to access assets and which the funds otherwise may not be able to meaningfully access. Debt origination generally excludes any issuance of debt or debt like investments by the portfolio companies of the funds we manage. “FRE Margin” is calculated as Fee Related Earnings divided by fee-related revenues (which includes management fees, capital solutions fees and other, net, and fee-related performance fees). “Gross IRR” of accord series, financial credit investment, structured credit recovery and European principal financial funds represents the annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, performance fees allocated to the general partner and certain other expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. “Gross IRR” of a flagship private equity or hybrid value fund represents the cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on June 30, 2022 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, performance fees and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor.

57 Non-GAAP Financial Information & Definitions (Continued) “Gross IRR” of a real estate equity, hybrid real estate or infrastructure funds The cumulative investment- related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on June 30, 2022 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor. “Gross MOIC” means, with respect to a given portfolio company, the ratio of Total Value to Total Invested Capital. “Realized Value” refers to all cash investment proceeds received by the relevant Apollo Fund, including interest and dividends, but does not give effect to management fees, expenses, incentive compensation or performance fees to be paid by such Apollo Fund. “Total Invested Capital” refers to the aggregate cash invested by the relevant Apollo Fund and includes capitalized costs relating to investment activities, if any, but does not give effect to cash pending investment or available for reserves and excludes amounts, if any, invested on a financed basis with leverage facilities. “Total Value” represents the sum of the total Realized Value and Unrealized Value of investments. “Unrealized Value” refers to the fair value consistent with valuations determined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), for investments not yet realized and may include payments in kind, accrued interest and dividends receivable, if any, and before the effect of certain taxes. In addition, amounts include committed and funded amounts for certain investments “HoldCo” means Apollo Global Management, Inc. (f/k/a Tango Holdings, Inc.) “Inflows” within the Asset Management segment represents (i) at the individual strategy level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers, and (ii) on an aggregate basis, the sum of inflows across the yield, hybrid and equity strategies. “Net MOIC” is, with respect to the applicable fund, the gross MOIC applicable to all investors, including related parties which may not pay fees or carried interest, net of management fees, carried interest, taxes, transaction expenses and other expenses (including interest incurred or earned by the fund itself) to be borne by investors in the indicated fund or funds. Net MOIC does not represent the return to any fund investor. “Net IRR” of accord series, financial credit investment, structured credit recovery and European principal finance funds represents the annualized return of a fund after management fees, performance fees allocated to the general partner and certain other expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. “Net IRR” of a flagship private equity or hybrid value fund represents the gross IRR applicable to the funds, including returns for related parties which may not pay fees or performance fees, net of management fees, certain expenses (including interest incurred or earned by the fund itself) and realized performance fees all offset to the extent of interest income, and measures returns at the fund level on amounts that, if distributed, would be paid to investors of the fund. The timing of cash flows applicable to investments, management fees and certain expenses, may be adjusted for the usage of a fund’s subscription facility. To the extent that a fund exceeds all requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted such that a percentage of up to 20.0% of the unrealized gain is allocated to the general partner of such fund, thereby reducing the balance attributable to fund investors. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. “Net IRR” of real estate equity, hybrid real estate and infrastructure funds represent the fund (and not any one investor in the fund), on the basis of the actual timing of cash inflows received from and outflows paid to investors of the fund (assuming the ending net asset value as of the reporting date or other date specified is paid to investors), excluding certain non-fee and non-performance fee bearing parties, and the return is annualized and compounded after management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns to investors of the fund as a whole. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor. “Principal investing compensation” within the Principal Investing segment represents realized performance compensation, distributions related to investment income and dividends, and includes allocations of certain compensation expenses related to managing the business. “Perpetual Capital” refers to assets under management of indefinite duration, that may only be withdrawn under certain conditions or subject to certain limitations, including but not limited to satisfying required hold periods or percentage limits on the amounts that may be redeemed over a particular period. The investment management, advisory or other service agreements with our Perpetual Capital vehicles may be terminated under certain circumstances.

58 Non-GAAP Financial Information & Definitions (Athene) Adjusted Debt to Capital Ratio Adjusted debt to capital ratio is a non-GAAP measure used to evaluate Athene’s capital structure excluding the impacts of AOCI and the cumulative changes in fair value of funds withheld and modco reinsurance assets as well as mortgage loan assets, net of DAC, DSI, rider reserve and tax offsets. Adjusted debt to capital ratio is calculated as total debt at notional value divided by adjusted capitalization. Adjusted capitalization includes adjusted AHL common shareholder’s equity, preferred stock and the notional value of its debt. Adjusted AHL common shareholder’s equity is calculated as the ending AHL shareholders’ equity excluding AOCI, the cumulative changes in fair value of funds withheld and modco reinsurance assets and mortgage loan assets as well as preferred stock. These adjustments fluctuate period to period in a manner inconsistent with Athene’s underlying profitability drivers as the majority of such fluctuation is related to the market volatility of the unrealized gains and losses associated with its AFS securities. Except with respect to reinvestment activity relating to acquired blocks of businesses, Athene typically buys and holds AFS investments to maturity throughout the duration of market fluctuations, therefore, the period-over-period impacts in unrealized gains and losses are not necessarily indicative of current operating fundamentals or future performance. Adjusted debt to capital ratio should not be used as a substitute for the debt to capital ratio. However, Athene believes the adjustments to shareholders’ equity are significant to gaining an understanding of its capitalization, debt utilization and debt capacity. Net Invested Assets Net invested assets represent the investments that directly back Athene’s net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which is used to analyze the profitability of Athene’s investment portfolio. Net invested assets includes (a) total investments on the consolidated balance sheets with AFS securities at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE and VOE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an adjustment for the allowance for credit losses. Net invested assets also excludes assets associated with funds withheld liabilities related to business exited through reinsurance agreements and derivative collateral (offsetting the related cash positions). Athene includes the underlying investments supporting its assumed funds withheld and modco agreements in its net invested assets calculation in order to match the assets with the income received. Athene believes the adjustments for reinsurance provide a view of the assets for which it has economic exposure. Net invested assets includes Athene’s proportionate share of ACRA investments, based on Athene’s economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. Net invested assets are averaged over the number of quarters in the relevant period to compute a net investment earned rate for such period. While Athene believes net invested assets is a meaningful financial metric and enhances the understanding of the underlying drivers of its investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under GAAP. . Cost of Funds Cost of funds includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the noncontrolling interest. While Athene believes cost of funds is a meaningful metric and enhances the understanding of the underlying profitability drivers of its business, it should not be used as a substitute for total benefits and expenses presented under GAAP. Net Reserve Liabilities Net reserve liabilities represent Athene’s policyholder liability obligations net of reinsurance and is used to analyze the costs of its liabilities. Net reserve liabilities include (a) interest sensitive contract liabilities, (b) future policy benefits, (c) long-term repurchase obligations, (d) dividends payable to policyholders and (e) other policy claims and benefits, offset by reinsurance recoverable, excluding policy loans ceded. Net reserve liabilities include Athene’s proportionate share of ACRA reserve liabilities, based on Athene’s economic ownership, but do not include the proportionate share of reserve liabilities associated with the noncontrolling interest. Net reserve liabilities is net of the ceded liabilities to third-party reinsurers as the costs of the liabilities are passed to such reinsurers and, therefore, Athene has no net economic exposure to such liabilities, assuming its reinsurance counterparties perform under the agreements. The majority of Athene’s ceded reinsurance is a result of reinsuring large blocks of life business following acquisitions. For such transactions, GAAP requires the ceded liabilities and related reinsurance recoverables to continue to be recorded in the consolidated financial statements despite the transfer of economic risk to the counterparty in connection with the reinsurance transaction. While Athene believes net reserve liabilities is a meaningful financial metric and enhances the understanding of the underlying profitability drivers of its business, it should not be used as a substitute for total liabilities presented under GAAP. Sales Sales statistics do not correspond to revenues under GAAP but are used as relevant measures to understand Athene’s business performance as it relates to inflows generated during a specific period of time. Athene’s sales statistics include inflows for fixed rate annuities and FIAs and align with the LIMRA definition of all money paid into an individual annuity, including money paid into new contracts with initial purchase occurring in the specified period and existing contracts with initial purchase occurring prior to the specified period (excluding internal transfers). Athene believe sales is a meaningful metric that enhances the understanding of its business performance and is not the same as premiums presented under GAAP.