EX-99.1

Published on May 5, 2022

Apollo Global Management, Inc. First Quarter 2022 Earnings Exhibit 99.1

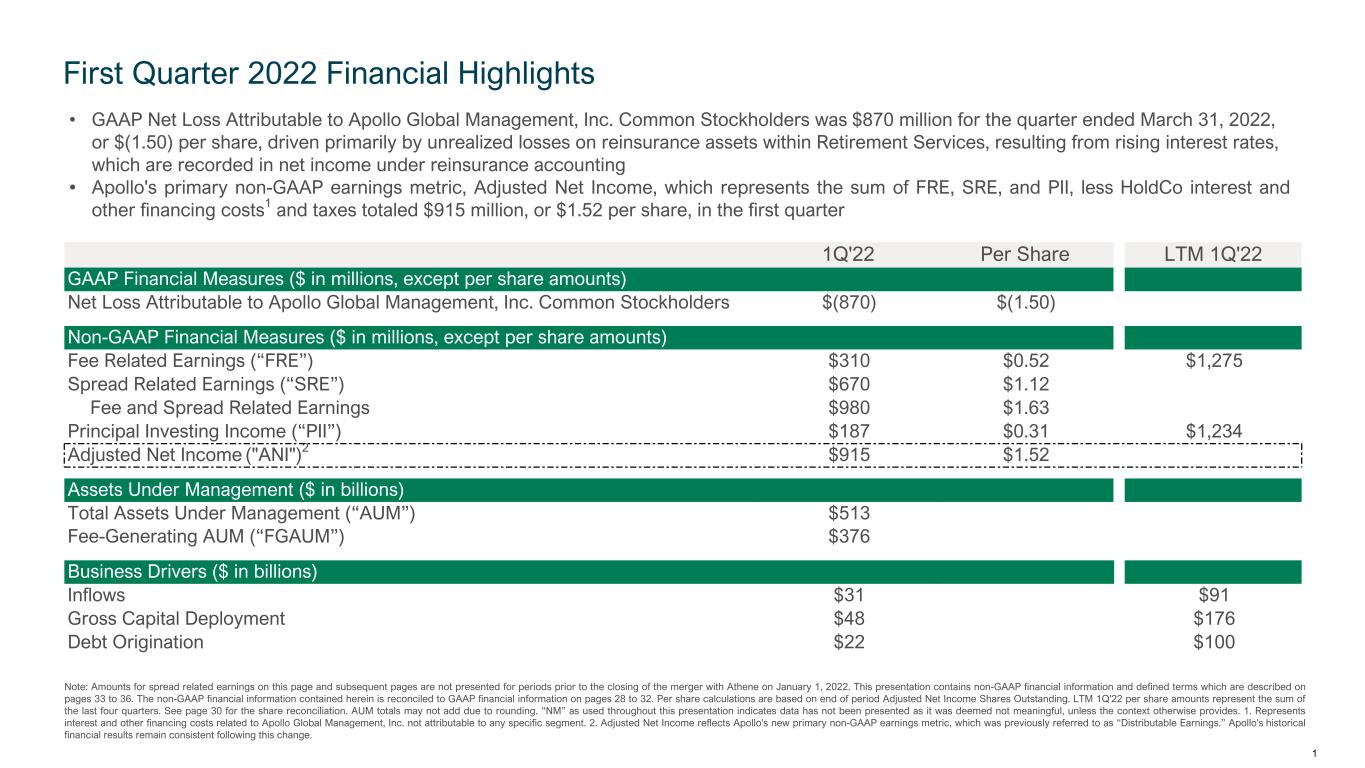

1Q'22 Per Share LTM 1Q'22 GAAP Financial Measures ($ in millions, except per share amounts) Net Loss Attributable to Apollo Global Management, Inc. Common Stockholders $(870) $(1.50) Non-GAAP Financial Measures ($ in millions, except per share amounts) Fee Related Earnings (“FRE”) $310 $0.52 $1,275 Spread Related Earnings (“SRE”) $670 $1.12 Fee and Spread Related Earnings $980 $1.63 Principal Investing Income (“PII”) $187 $0.31 $1,234 Adjusted Net Income ("ANI")2 $915 $1.52 Assets Under Management ($ in billions) Total Assets Under Management (“AUM”) $513 Fee-Generating AUM (“FGAUM”) $376 Business Drivers ($ in billions) Inflows $31 $91 Gross Capital Deployment $48 $176 Debt Origination $22 $100 First Quarter 2022 Financial Highlights • GAAP Net Loss Attributable to Apollo Global Management, Inc. Common Stockholders was $870 million for the quarter ended March 31, 2022, or $(1.50) per share, driven primarily by unrealized losses on reinsurance assets within Retirement Services, resulting from rising interest rates, which are recorded in net income under reinsurance accounting • Apollo's primary non-GAAP earnings metric, Adjusted Net Income, which represents the sum of FRE, SRE, and PII, less HoldCo interest and other financing costs1 and taxes totaled $915 million, or $1.52 per share, in the first quarter Note: Amounts for spread related earnings on this page and subsequent pages are not presented for periods prior to the closing of the merger with Athene on January 1, 2022. This presentation contains non-GAAP financial information and defined terms which are described on pages 33 to 36. The non-GAAP financial information contained herein is reconciled to GAAP financial information on pages 28 to 32. Per share calculations are based on end of period Adjusted Net Income Shares Outstanding. LTM 1Q'22 per share amounts represent the sum of the last four quarters. See page 30 for the share reconciliation. AUM totals may not add due to rounding. “NM” as used throughout this presentation indicates data has not been presented as it was deemed not meaningful, unless the context otherwise provides. 1. Represents interest and other financing costs related to Apollo Global Management, Inc. not attributable to any specific segment. 2. Adjusted Net Income reflects Apollo's new primary non-GAAP earnings metric, which was previously referred to as “Distributable Earnings.” Apollo's historical financial results remain consistent following this change. 1

First Quarter 2022 Business Highlights Apollo delivers strong financial results amid a challenging macro backdrop • FRE of $310 million supported by year-over-year growth in management fees and transaction fees • Robust SRE of $670 million driven by outperformance on Athene’s alternative investment portfolio • Normalized SRE totaled $488 million in the first quarter • Fee and Spread Related Earnings of $980 million represents the combined strength and durability of the Asset Management and Retirement Services businesses • Total AUM of $513 billion grew meaningfully year-over-year, driven by strong inflows of $31 billion across the platform • Gross capital deployment of $48 billion across Apollo's global integrated platform was driven by strong activity across Yield, Hybrid, and Equity strategies Apollo continues to execute on key growth initiatives • Origination: Debt origination volume totaled $22 billion in the first quarter and is run-rating at approximately ~$100 billion annually with activity driven by platforms such as MidCap, traditional sources such as commercial real estate and CLO debt, as well as numerous high grade alpha transactions • Global Wealth: Significant progress with four products fundraising in the channel, and meaningfully expanded distribution capabilities with the acquisition of Griffin Capital's wealth distribution business completed in the first quarter • Capital Solutions: Remained active in sourcing and providing financing solutions amid backdrop of moderating capital markets activity, and ended the quarter with a robust pipeline ✓ ✓ 2

GAAP Income Statement (Unaudited) ($ in millions, expect per share amounts) 1Q'21 4Q'21 1Q'22 Revenues Asset Management Management fees $457 $519 $336 Advisory and transaction fees, net 56 97 66 Investment income 1,778 573 701 Incentive fees 4 6 6 Retirement Services Premiums — — 2,110 Product charges — — 166 Net investment income — — 1,731 Investment related gains (losses) — — (4,217) Revenues of consolidated variable interest entities — — (21) Other revenues — — (3) Total Revenues 2,295 1,195 875 Expenses Asset Management Compensation and benefits (887) (1,509) (734) Interest expense (35) (34) (32) General, administrative and other (100) (153) (148) Retirement Services Interest sensitive contract benefits — — 41 Future policy and other policy benefits — — (2,085) Amortization of deferred acquisition costs, deferred sales inducements and value of business acquired — — (125) Policy and other operating expenses — — (308) Total Expenses (1,022) (1,696) (3,391) Other Income (Loss) – Asset Management Net gains from investment activities 353 1,172 34 Net gains from investment activities of consolidated variable interest entities 113 157 367 Other income (loss), net (17) (120) (23) Total Other Income (Loss) 449 1,209 378 Income (loss) before income tax (provision) benefit 1,722 708 (2,138) Income tax (provision) benefit (203) (96) 608 Net income (loss) 1,519 612 (1,530) Net (income) loss attributable to Non-Controlling interests (840) (369) 660 Net income (loss) attributable to Apollo Global Management, Inc. 679 243 (870) Preferred stock dividends (9) (9) — Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $670 $234 $(870) Earnings (Loss) per share Net income (loss) attributable to Common Stockholders - Basic $2.81 $0.91 $(1.50) Net income (loss) attributable to Common Stockholders - Diluted $2.81 $0.91 $(1.50) Weighted average shares outstanding – Basic 230 246 586 Weighted average shares outstanding – Diluted 230 246 586 3

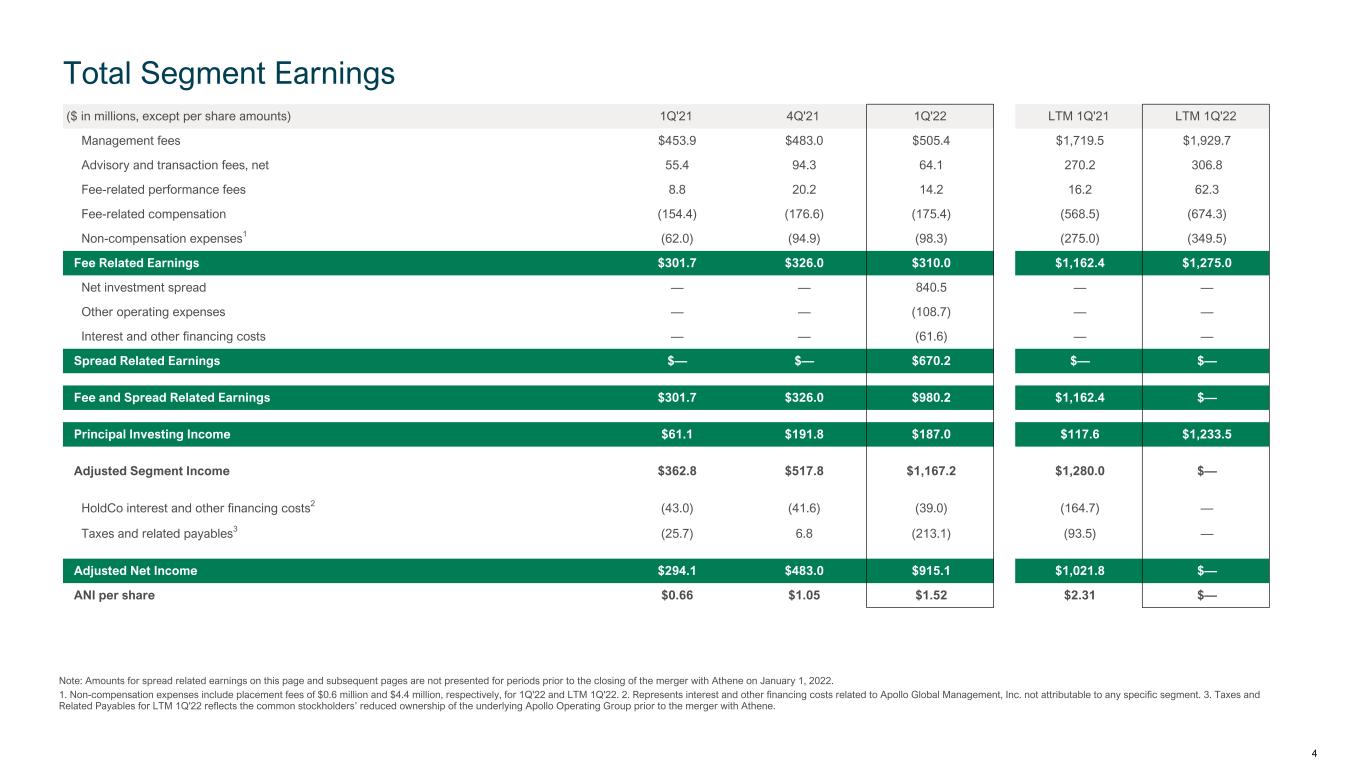

($ in millions, except per share amounts) 1Q'21 4Q'21 1Q'22 LTM 1Q'21 LTM 1Q'22 Management fees $453.9 $483.0 $505.4 $1,719.5 $1,929.7 Advisory and transaction fees, net 55.4 94.3 64.1 270.2 306.8 Fee-related performance fees 8.8 20.2 14.2 16.2 62.3 Fee-related compensation (154.4) (176.6) (175.4) (568.5) (674.3) Non-compensation expenses1 (62.0) (94.9) (98.3) (275.0) (349.5) Fee Related Earnings $301.7 $326.0 $310.0 $1,162.4 $1,275.0 Net investment spread — — 840.5 — — Other operating expenses — — (108.7) — — Interest and other financing costs — — (61.6) — — Spread Related Earnings $— $— $670.2 $— $— Fee and Spread Related Earnings $301.7 $326.0 $980.2 $1,162.4 $— Principal Investing Income $61.1 $191.8 $187.0 $117.6 $1,233.5 Adjusted Segment Income $362.8 $517.8 $1,167.2 $1,280.0 $— HoldCo interest and other financing costs2 (43.0) (41.6) (39.0) (164.7) — Taxes and related payables3 (25.7) 6.8 (213.1) (93.5) — Adjusted Net Income $294.1 $483.0 $915.1 $1,021.8 $— ANI per share $0.66 $1.05 $1.52 $2.31 $— Total Segment Earnings Note: Amounts for spread related earnings on this page and subsequent pages are not presented for periods prior to the closing of the merger with Athene on January 1, 2022. 1. Non-compensation expenses include placement fees of $0.6 million and $4.4 million, respectively, for 1Q'22 and LTM 1Q'22. 2. Represents interest and other financing costs related to Apollo Global Management, Inc. not attributable to any specific segment. 3. Taxes and Related Payables for LTM 1Q'22 reflects the common stockholders’ reduced ownership of the underlying Apollo Operating Group prior to the merger with Athene. 4

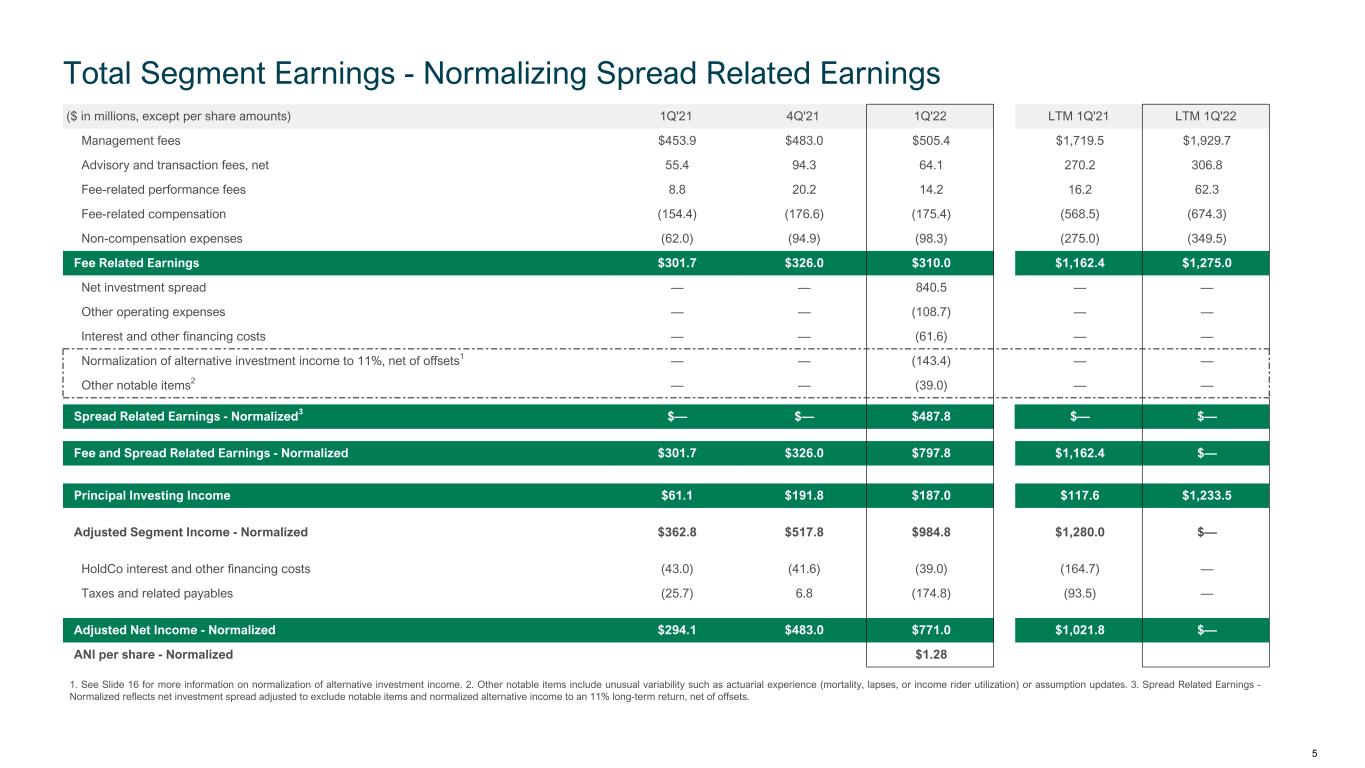

($ in millions, except per share amounts) 1Q'21 4Q'21 1Q'22 LTM 1Q'21 LTM 1Q'22 Management fees $453.9 $483.0 $505.4 $1,719.5 $1,929.7 Advisory and transaction fees, net 55.4 94.3 64.1 270.2 306.8 Fee-related performance fees 8.8 20.2 14.2 16.2 62.3 Fee-related compensation (154.4) (176.6) (175.4) (568.5) (674.3) Non-compensation expenses (62.0) (94.9) (98.3) (275.0) (349.5) Fee Related Earnings $301.7 $326.0 $310.0 $1,162.4 $1,275.0 Net investment spread — — 840.5 — — Other operating expenses — — (108.7) — — Interest and other financing costs — — (61.6) — — Normalization of alternative investment income to 11%, net of offsets1 — — (143.4) — — Other notable items2 — — (39.0) — — Spread Related Earnings - Normalized3 $— $— $487.8 $— $— Fee and Spread Related Earnings - Normalized $301.7 $326.0 $797.8 $1,162.4 $— Principal Investing Income $61.1 $191.8 $187.0 $117.6 $1,233.5 Adjusted Segment Income - Normalized $362.8 $517.8 $984.8 $1,280.0 $— HoldCo interest and other financing costs (43.0) (41.6) (39.0) (164.7) — Taxes and related payables (25.7) 6.8 (174.8) (93.5) — Adjusted Net Income - Normalized $294.1 $483.0 $771.0 $1,021.8 $— ANI per share - Normalized $1.28 Total Segment Earnings - Normalizing Spread Related Earnings 1. See Slide 16 for more information on normalization of alternative investment income. 2. Other notable items include unusual variability such as actuarial experience (mortality, lapses, or income rider utilization) or assumption updates. 3. Spread Related Earnings - Normalized reflects net investment spread adjusted to exclude notable items and normalized alternative income to an 11% long-term return, net of offsets. 5

Segment Details

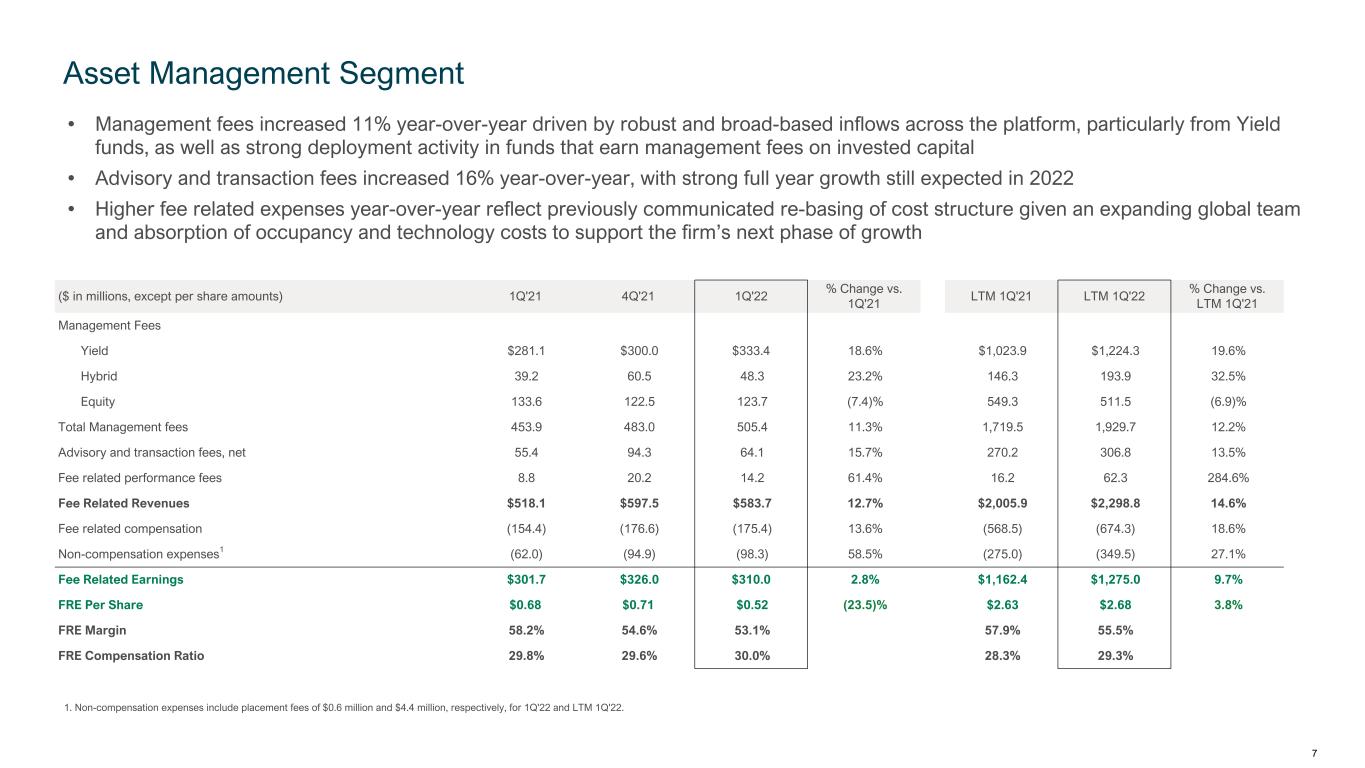

($ in millions, except per share amounts) 1Q'21 4Q'21 1Q'22 % Change vs. 1Q'21 LTM 1Q'21 LTM 1Q'22 % Change vs. LTM 1Q'21 Management Fees Yield $281.1 $300.0 $333.4 18.6% $1,023.9 $1,224.3 19.6% Hybrid 39.2 60.5 48.3 23.2% 146.3 193.9 32.5% Equity 133.6 122.5 123.7 (7.4)% 549.3 511.5 (6.9)% Total Management fees 453.9 483.0 505.4 11.3% 1,719.5 1,929.7 12.2% Advisory and transaction fees, net 55.4 94.3 64.1 15.7% 270.2 306.8 13.5% Fee related performance fees 8.8 20.2 14.2 61.4% 16.2 62.3 284.6% Fee Related Revenues $518.1 $597.5 $583.7 12.7% $2,005.9 $2,298.8 14.6% Fee related compensation (154.4) (176.6) (175.4) 13.6% (568.5) (674.3) 18.6% Non-compensation expenses1 (62.0) (94.9) (98.3) 58.5% (275.0) (349.5) 27.1% Fee Related Earnings $301.7 $326.0 $310.0 2.8% $1,162.4 $1,275.0 9.7% FRE Per Share $0.68 $0.71 $0.52 (23.5)% $2.63 $2.68 3.8% FRE Margin 58.2% 54.6% 53.1% 57.9% 55.5% FRE Compensation Ratio 29.8% 29.6% 30.0% 28.3% 29.3% • Management fees increased 11% year-over-year driven by robust and broad-based inflows across the platform, particularly from Yield funds, as well as strong deployment activity in funds that earn management fees on invested capital • Advisory and transaction fees increased 16% year-over-year, with strong full year growth still expected in 2022 • Higher fee related expenses year-over-year reflect previously communicated re-basing of cost structure given an expanding global team and absorption of occupancy and technology costs to support the firm’s next phase of growth Asset Management Segment 1. Non-compensation expenses include placement fees of $0.6 million and $4.4 million, respectively, for 1Q'22 and LTM 1Q'22. 7

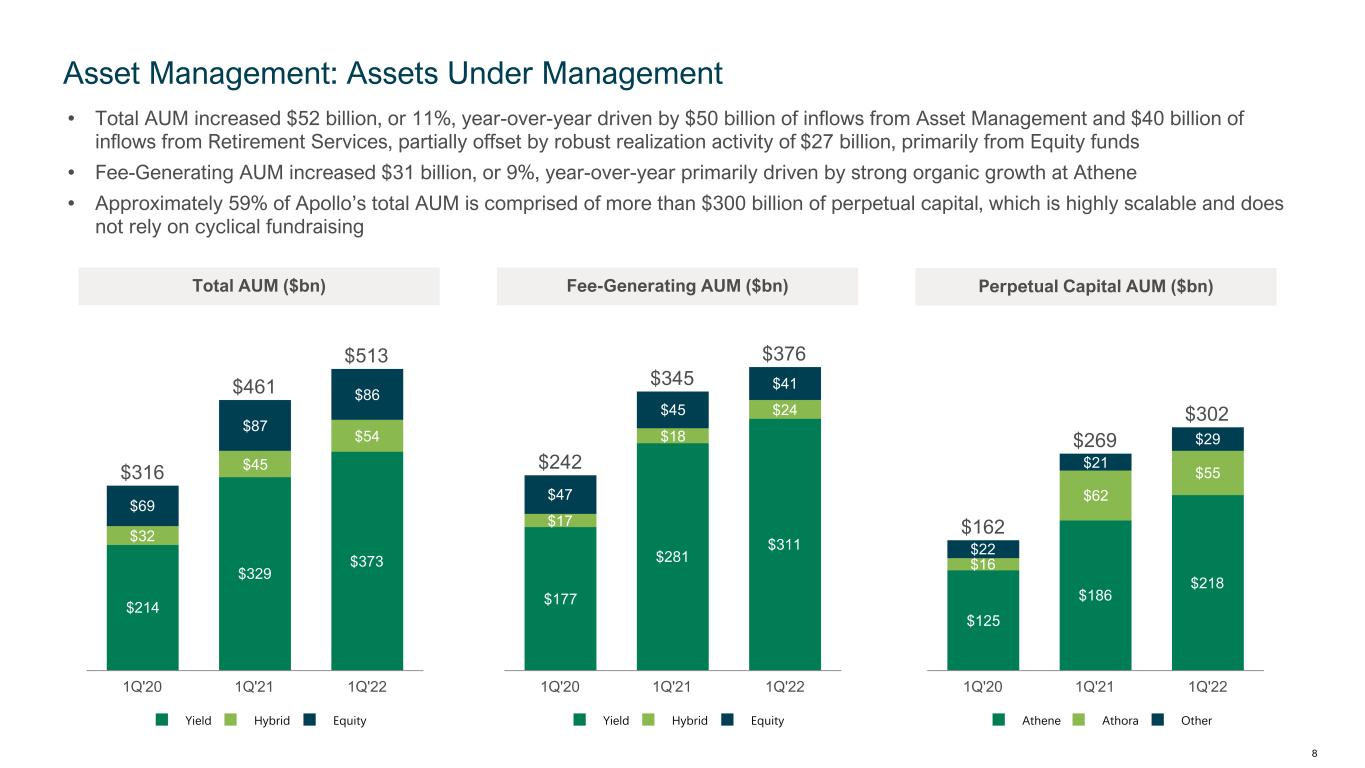

Total AUM ($bn) Fee-Generating AUM ($bn) • Total AUM increased $52 billion, or 11%, year-over-year driven by $50 billion of inflows from Asset Management and $40 billion of inflows from Retirement Services, partially offset by robust realization activity of $27 billion, primarily from Equity funds • Fee-Generating AUM increased $31 billion, or 9%, year-over-year primarily driven by strong organic growth at Athene • Approximately 59% of Apollo’s total AUM is comprised of more than $300 billion of perpetual capital, which is highly scalable and does not rely on cyclical fundraising Asset Management: Assets Under Management $316 $461 $513 $214 $329 $373 $32 $45 $54 $69 $87 $86 Yield Hybrid Equity 1Q'20 1Q'21 1Q'22 $242 $345 $376 $177 $281 $311 $17 $18 $24 $47 $45 $41 Yield Hybrid Equity 1Q'20 1Q'21 1Q'22 Perpetual Capital AUM ($bn) $162 $269 $302 $125 $186 $218 $16 $62 $55 $22 $21 $29 Athene Athora Other 1Q'20 1Q'21 1Q'22 8

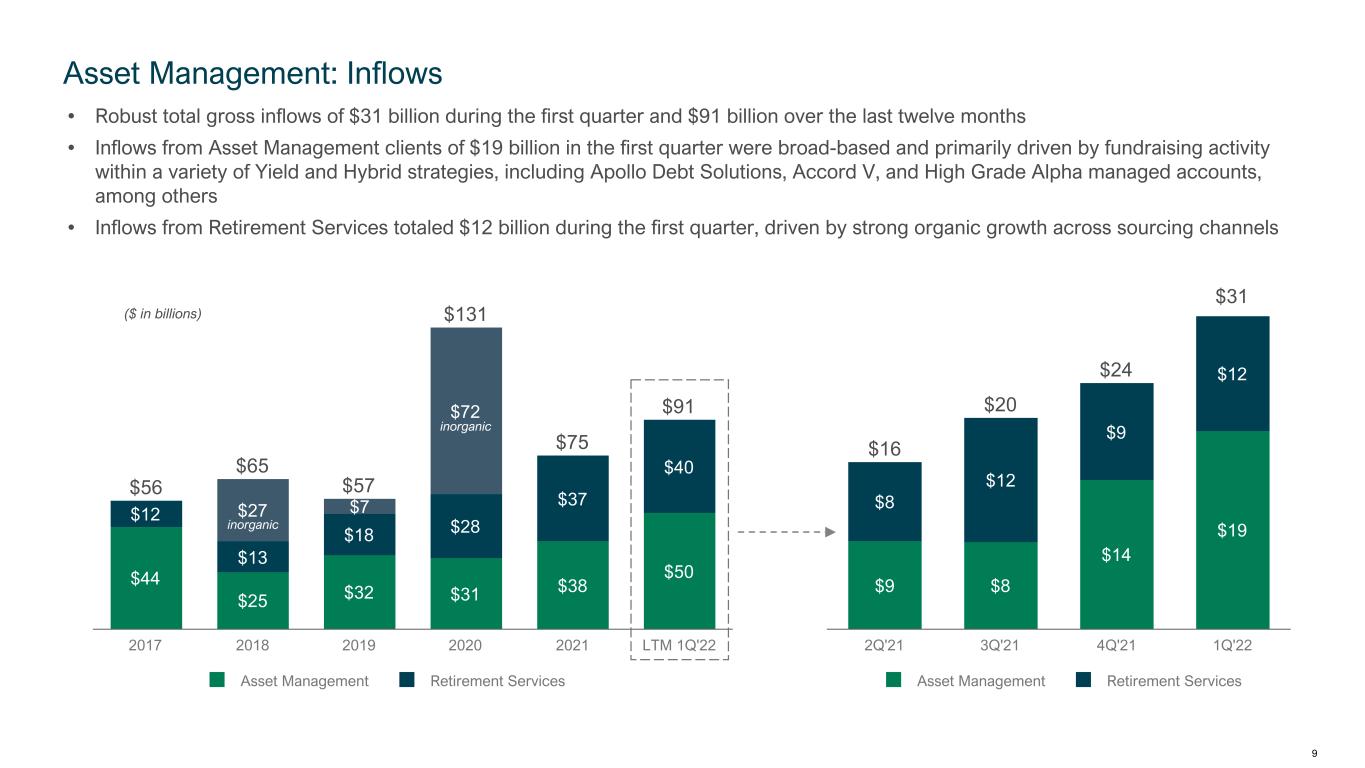

$56 $65 $57 $131 $75 $91 $44 $25 $32 $31 $38 $50 $12 $13 $18 $28 $37 $40 $27 $7 $72 Asset Management Retirement Services 2017 2018 2019 2020 2021 LTM 1Q'22 • Robust total gross inflows of $31 billion during the first quarter and $91 billion over the last twelve months • Inflows from Asset Management clients of $19 billion in the first quarter were broad-based and primarily driven by fundraising activity within a variety of Yield and Hybrid strategies, including Apollo Debt Solutions, Accord V, and High Grade Alpha managed accounts, among others • Inflows from Retirement Services totaled $12 billion during the first quarter, driven by strong organic growth across sourcing channels ($ in billions) Asset Management: Inflows $16 $20 $24 $31 $9 $8 $14 $19 $8 $12 $9 $12 Asset Management Retirement Services 2Q'21 3Q'21 4Q'21 1Q'22 inorganic inorganic 9

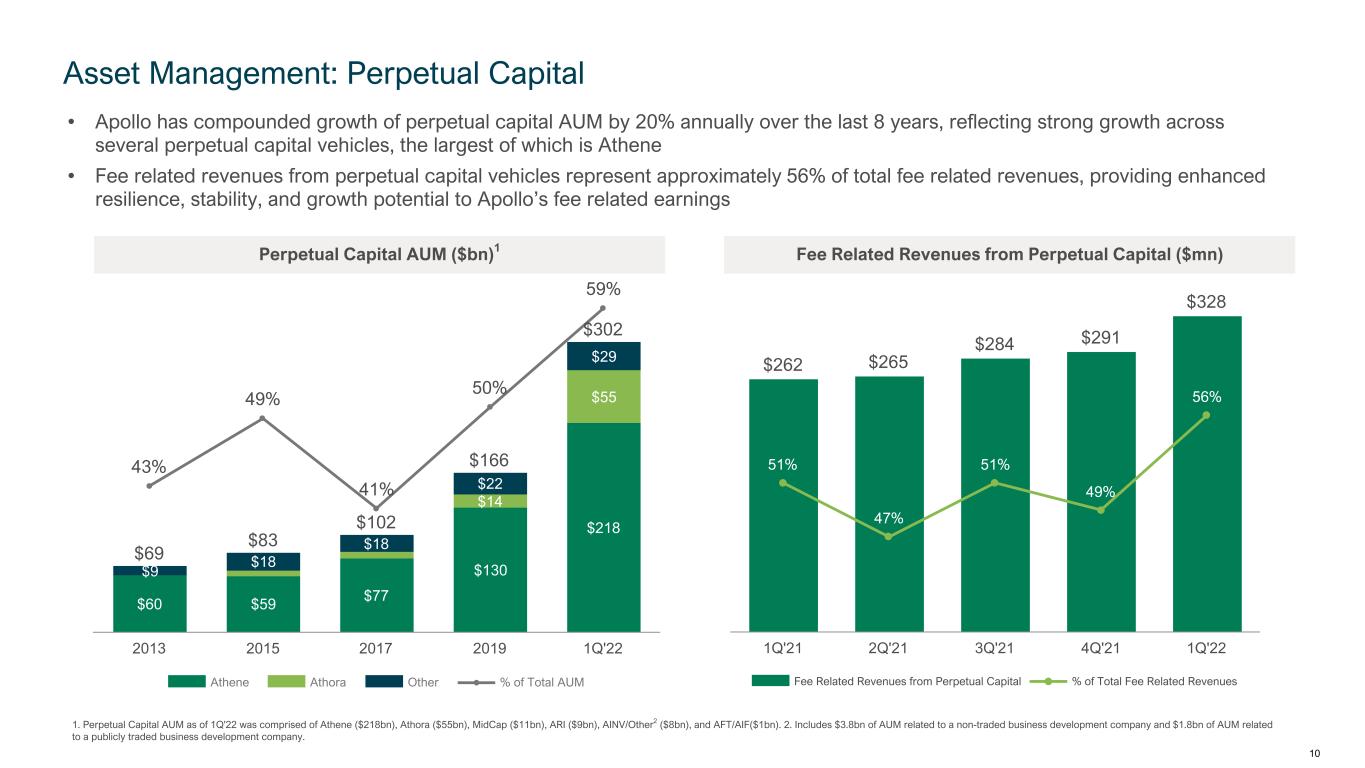

$69 $83 $102 $166 $302 $60 $59 $77 $130 $218 $14 $55 $9 $18 $18 $22 $29 43% 49% 41% 50% 59% Athene Athora Other % of Total AUM 2013 2015 2017 2019 1Q'22 $262 $265 $284 $291 $328 51% 47% 51% 49% 56% Fee Related Revenues from Perpetual Capital % of Total Fee Related Revenues 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 Perpetual Capital AUM ($bn)1 Fee Related Revenues from Perpetual Capital ($mn) • Apollo has compounded growth of perpetual capital AUM by 20% annually over the last 8 years, reflecting strong growth across several perpetual capital vehicles, the largest of which is Athene • Fee related revenues from perpetual capital vehicles represent approximately 56% of total fee related revenues, providing enhanced resilience, stability, and growth potential to Apollo’s fee related earnings Asset Management: Perpetual Capital 1. Perpetual Capital AUM as of 1Q'22 was comprised of Athene ($218bn), Athora ($55bn), MidCap ($11bn), ARI ($9bn), AINV/Other2 ($8bn), and AFT/AIF($1bn). 2. Includes $3.8bn of AUM related to a non-traded business development company and $1.8bn of AUM related to a publicly traded business development company. 10

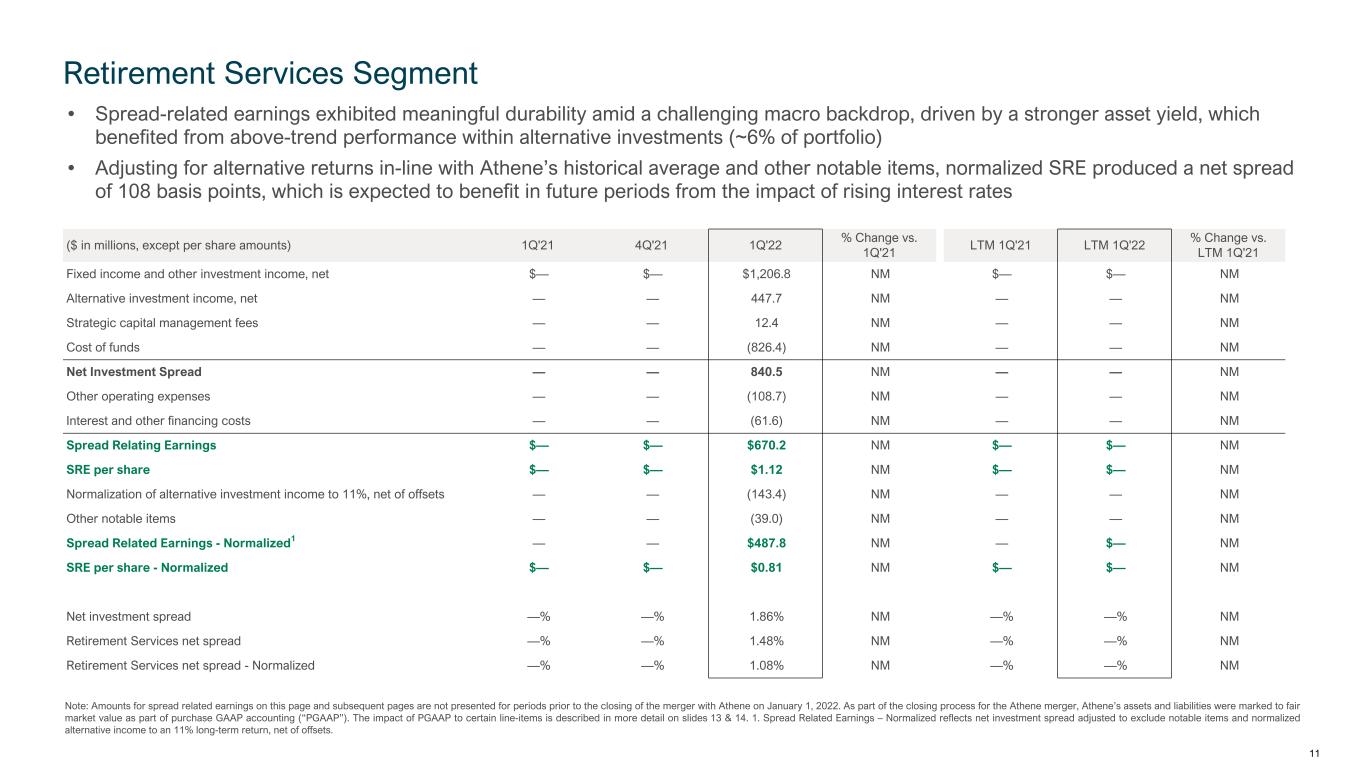

• Spread-related earnings exhibited meaningful durability amid a challenging macro backdrop, driven by a stronger asset yield, which benefited from above-trend performance within alternative investments (~6% of portfolio) • Adjusting for alternative returns in-line with Athene’s historical average and other notable items, normalized SRE produced a net spread of 108 basis points, which is expected to benefit in future periods from the impact of rising interest rates ($ in millions, except per share amounts) 1Q'21 4Q'21 1Q'22 % Change vs. 1Q'21 LTM 1Q'21 LTM 1Q'22 % Change vs. LTM 1Q'21 Fixed income and other investment income, net $— $— $1,206.8 NM $— $— NM Alternative investment income, net — — 447.7 NM — — NM Strategic capital management fees — — 12.4 NM — — NM Cost of funds — — (826.4) NM — — NM Net Investment Spread — — 840.5 NM — — NM Other operating expenses — — (108.7) NM — — NM Interest and other financing costs — — (61.6) NM — — NM Spread Relating Earnings $— $— $670.2 NM $— $— NM SRE per share $— $— $1.12 NM $— $— NM Normalization of alternative investment income to 11%, net of offsets — — (143.4) NM — — NM Other notable items — — (39.0) NM — — NM Spread Related Earnings - Normalized1 — — $487.8 NM — $— NM SRE per share - Normalized $— $— $0.81 NM $— $— NM Net investment spread —% —% 1.86% NM —% —% NM Retirement Services net spread —% —% 1.48% NM —% —% NM Retirement Services net spread - Normalized —% —% 1.08% NM —% —% NM Note: Amounts for spread related earnings on this page and subsequent pages are not presented for periods prior to the closing of the merger with Athene on January 1, 2022. As part of the closing process for the Athene merger, Athene’s assets and liabilities were marked to fair market value as part of purchase GAAP accounting (“PGAAP”). The impact of PGAAP to certain line-items is described in more detail on slides 13 & 14. 1. Spread Related Earnings – Normalized reflects net investment spread adjusted to exclude notable items and normalized alternative income to an 11% long-term return, net of offsets. Retirement Services Segment 11

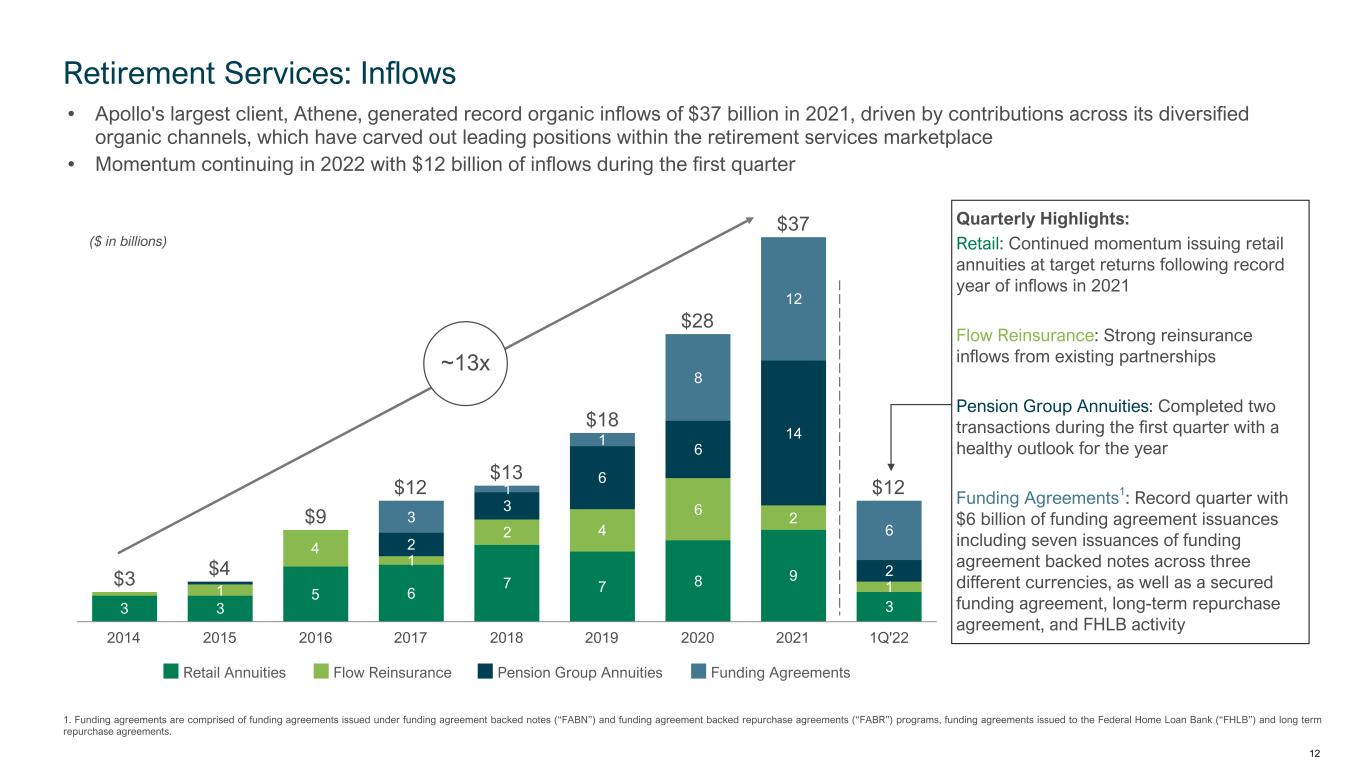

Retirement Services: Inflows $3 $4 $9 $12 $13 $18 $28 $37 $12 3 3 5 6 7 7 8 9 3 1 4 1 2 4 6 2 1 2 3 6 6 14 2 3 1 1 8 12 6 Retail Annuities Flow Reinsurance Pension Group Annuities Funding Agreements 2014 2015 2016 2017 2018 2019 2020 2021 1Q'22 ~13x • Apollo's largest client, Athene, generated record organic inflows of $37 billion in 2021, driven by contributions across its diversified organic channels, which have carved out leading positions within the retirement services marketplace • Momentum continuing in 2022 with $12 billion of inflows during the first quarter Quarterly Highlights: Retail: Continued momentum issuing retail annuities at target returns following record year of inflows in 2021 Flow Reinsurance: Strong reinsurance inflows from existing partnerships Pension Group Annuities: Completed two transactions during the first quarter with a healthy outlook for the year Funding Agreements1: Record quarter with $6 billion of funding agreement issuances including seven issuances of funding agreement backed notes across three different currencies, as well as a secured funding agreement, long-term repurchase agreement, and FHLB activity ($ in billions) 12 1. Funding agreements are comprised of funding agreements issued under funding agreement backed notes (“FABN”) and funding agreement backed repurchase agreements (“FABR”) programs, funding agreements issued to the Federal Home Loan Bank (“FHLB”) and long term repurchase agreements.

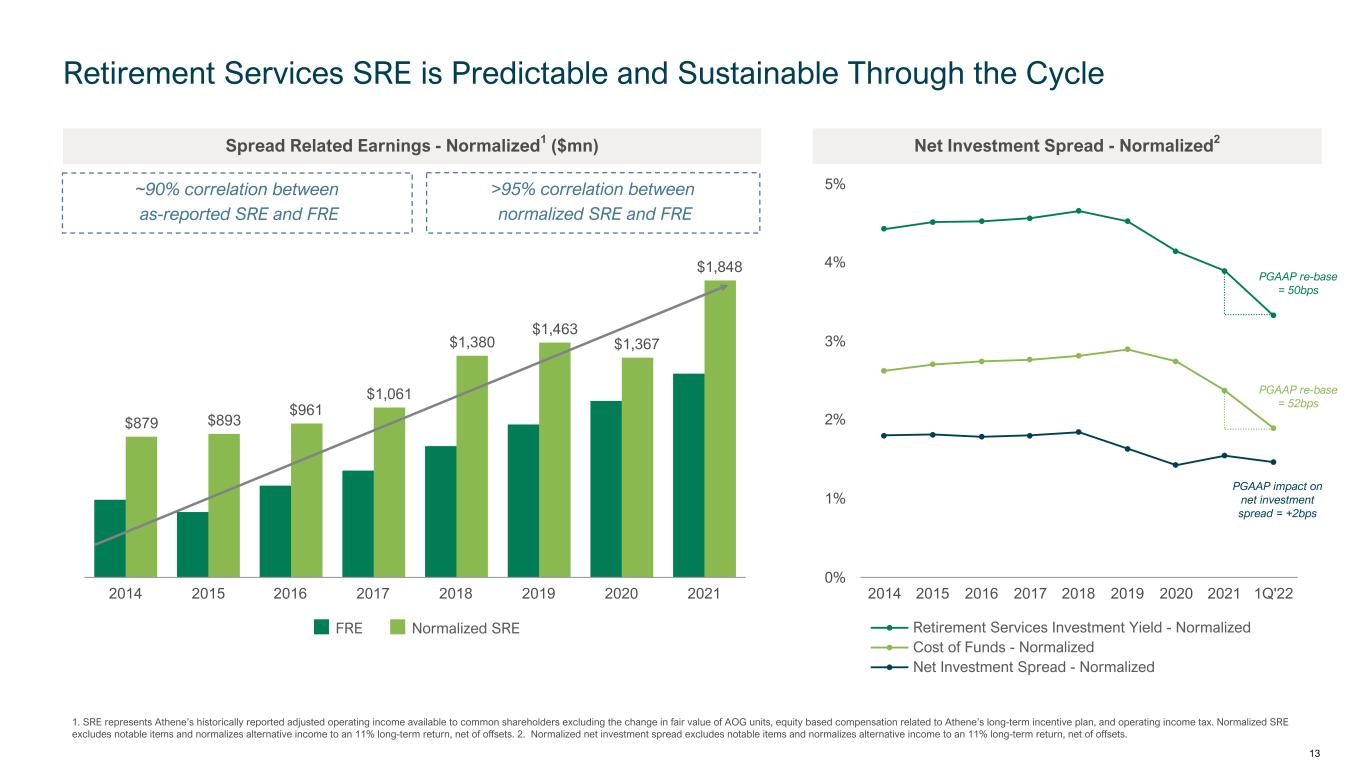

Retirement Services SRE is Predictable and Sustainable Through the Cycle Spread Related Earnings - Normalized1 ($mn) Net Investment Spread - Normalized2 $879 $893 $961 $1,061 $1,380 $1,463 $1,367 $1,848 FRE Normalized SRE 2014 2015 2016 2017 2018 2019 2020 2021 Retirement Services Investment Yield - Normalized Cost of Funds - Normalized Net Investment Spread - Normalized 2014 2015 2016 2017 2018 2019 2020 2021 1Q'22 0% 1% 2% 3% 4% 5% 1. SRE represents Athene’s historically reported adjusted operating income available to common shareholders excluding the change in fair value of AOG units, equity based compensation related to Athene’s long-term incentive plan, and operating income tax. Normalized SRE excludes notable items and normalizes alternative income to an 11% long-term return, net of offsets. 2. Normalized net investment spread excludes notable items and normalizes alternative income to an 11% long-term return, net of offsets. PGAAP impact on net investment spread = +2bps ~90% correlation between as-reported SRE and FRE >95% correlation between normalized SRE and FRE 13 PGAAP re-base = 50bps PGAAP re-base = 52bps

1.08% 0.02% 0.03% 0.17% 0.17% 0.03% (0.02)% 1.48% 4Q'21 1Q'22 3.26% (0.50)% 0.06% 0.02% (0.01)% 2.83% 4Q'21 1Q'22 Investment Portfolio Highlights Fixed Income Investment Yield Bridge (QoQ) Retirement Services: Portfolio Highlights 1. As of March 31, 2022, 95% of $105 billion of available for sale securities designated NAIC 1 or 2. 2. Represents U.S. statutory impairments per SNL Financial as of December 31, 2021. Industry average includes AEL, AIG, AMP, BHF, EQH, FG, LNC, MET, PFG, PRU, VOYA and Transamerica. For Athene, U.S. statutory data adjusted to include impairments and assets in Bermuda. Retirement Services Net Spread Bridge (QoQ) • 95% of Athene’s fixed income portfolio1 is invested in investment grade assets • ~20% or $37 billion of Athene’s portfolio is invested in floating rate assets • Apollo Asset Management aims to generate 30 to 40 basis points of asset outperformance across Athene's portfolio • Target asset classes which generate illiquidity or structuring premium, not incremental credit risk • Focus on directly originated, senior secured loans where control of origination results in better risk-adjusted return • Historical credit losses across total portfolio of only 7 basis points over the past five years compared to 12 basis points for the industry2 14 PGAAP re-base on net inv spread PGAAP re-base with greater step-down in cost of funds Additional floating rate income Other Alts growth and higher fixed income yield Lower cost of funds OpEx, interest, & other financing costs Rebound from prior quarter true- ups PGAAP re-base on corp debt Impact of notable items

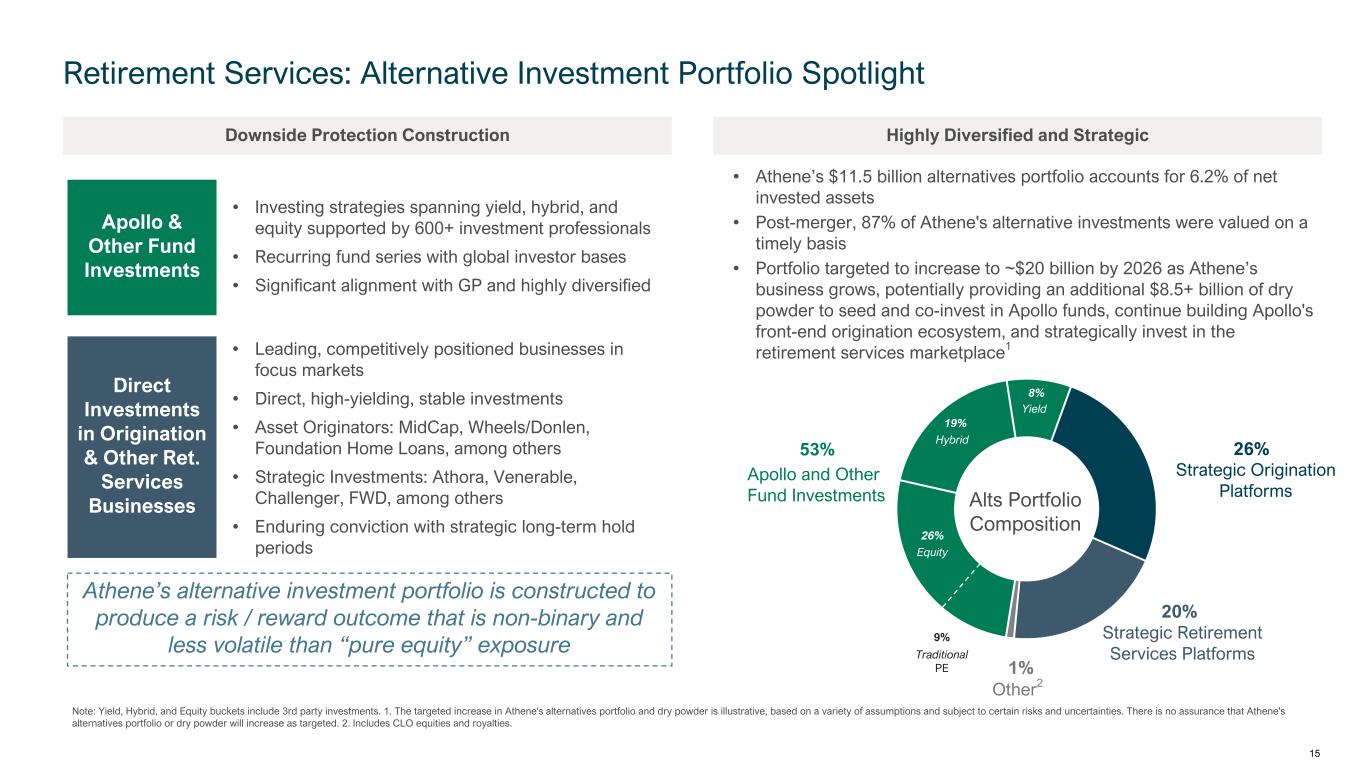

Downside Protection Construction Highly Diversified and Strategic Retirement Services: Alternative Investment Portfolio Spotlight Note: Yield, Hybrid, and Equity buckets include 3rd party investments. 1. The targeted increase in Athene's alternatives portfolio and dry powder is illustrative, based on a variety of assumptions and subject to certain risks and uncertainties. There is no assurance that Athene's alternatives portfolio or dry powder will increase as targeted. 2. Includes CLO equities and royalties. • Investing strategies spanning yield, hybrid, and equity supported by 600+ investment professionals • Recurring fund series with global investor bases • Significant alignment with GP and highly diversified Apollo & Other Fund Investments Direct Investments in Origination & Other Ret. Services Businesses • Leading, competitively positioned businesses in focus markets • Direct, high-yielding, stable investments • Asset Originators: MidCap, Wheels/Donlen, Foundation Home Loans, among others • Strategic Investments: Athora, Venerable, Challenger, FWD, among others • Enduring conviction with strategic long-term hold periods Athene’s alternative investment portfolio is constructed to produce a risk / reward outcome that is non-binary and less volatile than “pure equity” exposure • Athene’s $11.5 billion alternatives portfolio accounts for 6.2% of net invested assets • Post-merger, 87% of Athene's alternative investments were valued on a timely basis • Portfolio targeted to increase to ~$20 billion by 2026 as Athene’s business grows, potentially providing an additional $8.5+ billion of dry powder to seed and co-invest in Apollo funds, continue building Apollo's front-end origination ecosystem, and strategically invest in the retirement services marketplace1 26% 20% 1% Equity Hybrid Yield 53% Apollo and Other Fund Investments Strategic Origination Platforms Strategic Retirement Services Platforms Other2 9% Traditional PE Alts Portfolio Composition 15 26% 19% 8%

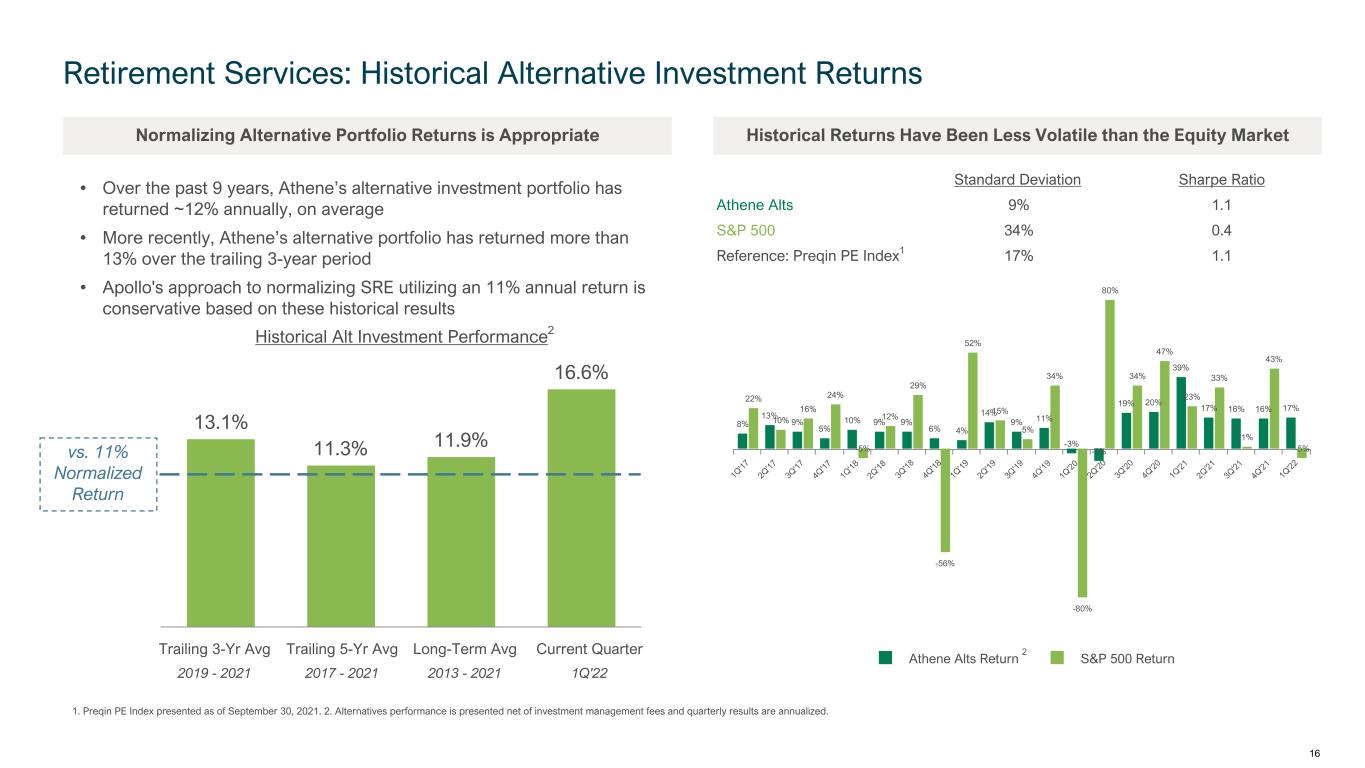

1Q '17 2Q '17 3Q '17 4Q '17 1Q '18 2Q '18 3Q '18 4Q '18 1Q '19 2Q '19 3Q '19 4Q '19 1Q '20 2Q '20 3Q '20 4Q '20 1Q '21 2Q '21 3Q '21 4Q '21 1Q '22 8% 13% 9% 5% 10% 9% 9% 6% 4% 14% 9% 11% -3% -7% 19% 20% 39% 17% 16% 16% 17% 22% 10% 16% 24% -5% 12% 29% -56% 52% 15% 5% 34% -80% 80% 34% 47% 23% 33% 1% 43% -5% Athene Alts Return S&P 500 Return Normalizing Alternative Portfolio Returns is Appropriate Historical Returns Have Been Less Volatile than the Equity Market Retirement Services: Historical Alternative Investment Returns 1. Preqin PE Index presented as of September 30, 2021. 2. Alternatives performance is presented net of investment management fees and quarterly results are annualized. • Over the past 9 years, Athene’s alternative investment portfolio has returned ~12% annually, on average • More recently, Athene’s alternative portfolio has returned more than 13% over the trailing 3-year period • Apollo's approach to normalizing SRE utilizing an 11% annual return is conservative based on these historical results 13.1% 11.3% 11.9% 16.6% Historical Alt Investment Performance2 Trailing 3-Yr Avg Trailing 5-Yr Avg Long-Term Avg Current Quarter 2019 - 2021 2017 - 2021 2013 - 2021 1Q'22 vs. 11% Normalized Return Standard Deviation Sharpe Ratio Athene Alts 9% 1.1 S&P 500 34% 0.4 Reference: Preqin PE Index1 17% 1.1 16 2

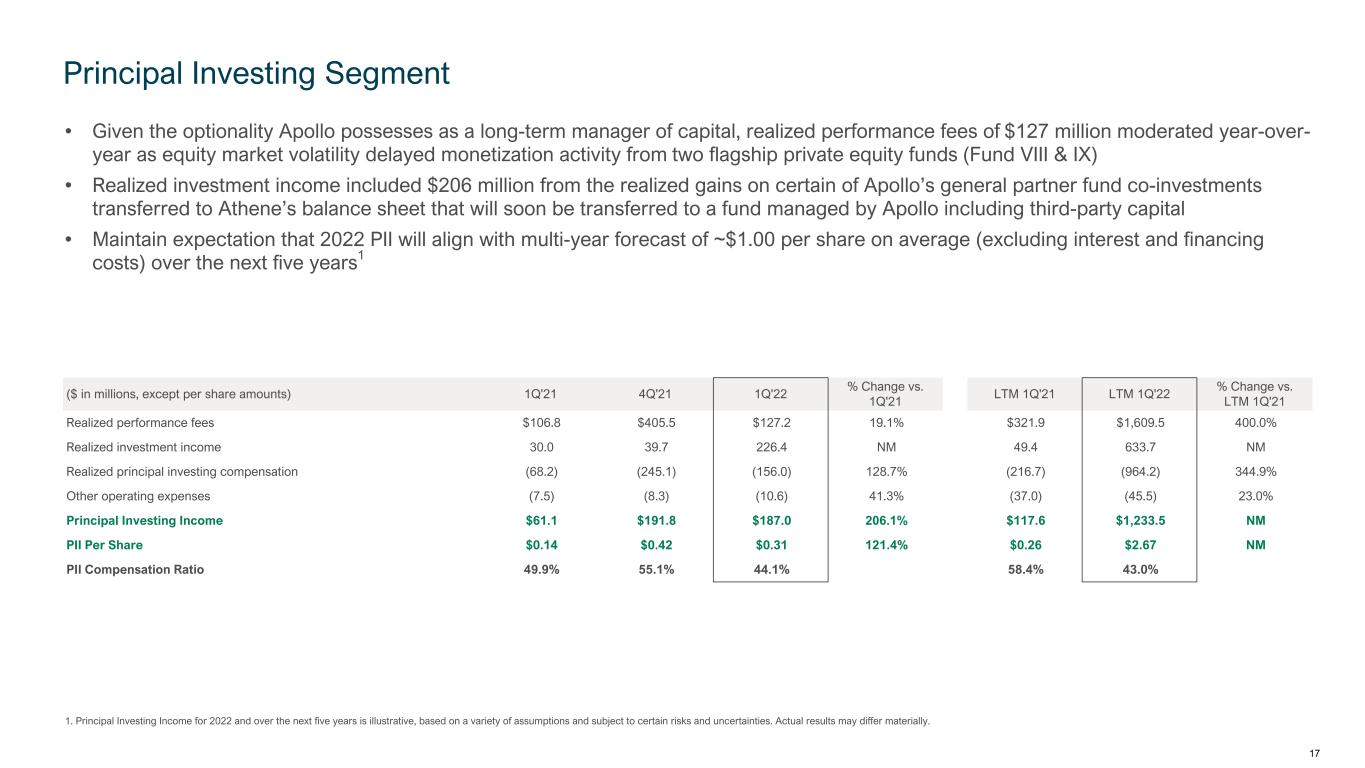

• Given the optionality Apollo possesses as a long-term manager of capital, realized performance fees of $127 million moderated year-over- year as equity market volatility delayed monetization activity from two flagship private equity funds (Fund VIII & IX) • Realized investment income included $206 million from the realized gains on certain of Apollo’s general partner fund co-investments transferred to Athene’s balance sheet that will soon be transferred to a fund managed by Apollo including third-party capital • Maintain expectation that 2022 PII will align with multi-year forecast of ~$1.00 per share on average (excluding interest and financing costs) over the next five years1 ($ in millions, except per share amounts) 1Q'21 4Q'21 1Q'22 % Change vs. 1Q'21 LTM 1Q'21 LTM 1Q'22 % Change vs. LTM 1Q'21 Realized performance fees $106.8 $405.5 $127.2 19.1% $321.9 $1,609.5 400.0% Realized investment income 30.0 39.7 226.4 NM 49.4 633.7 NM Realized principal investing compensation (68.2) (245.1) (156.0) 128.7% (216.7) (964.2) 344.9% Other operating expenses (7.5) (8.3) (10.6) 41.3% (37.0) (45.5) 23.0% Principal Investing Income $61.1 $191.8 $187.0 206.1% $117.6 $1,233.5 NM PII Per Share $0.14 $0.42 $0.31 121.4% $0.26 $2.67 NM PII Compensation Ratio 49.9% 55.1% 44.1% 58.4% 43.0% Principal Investing Segment 17 1. Principal Investing Income for 2022 and over the next five years is illustrative, based on a variety of assumptions and subject to certain risks and uncertainties. Actual results may differ materially.

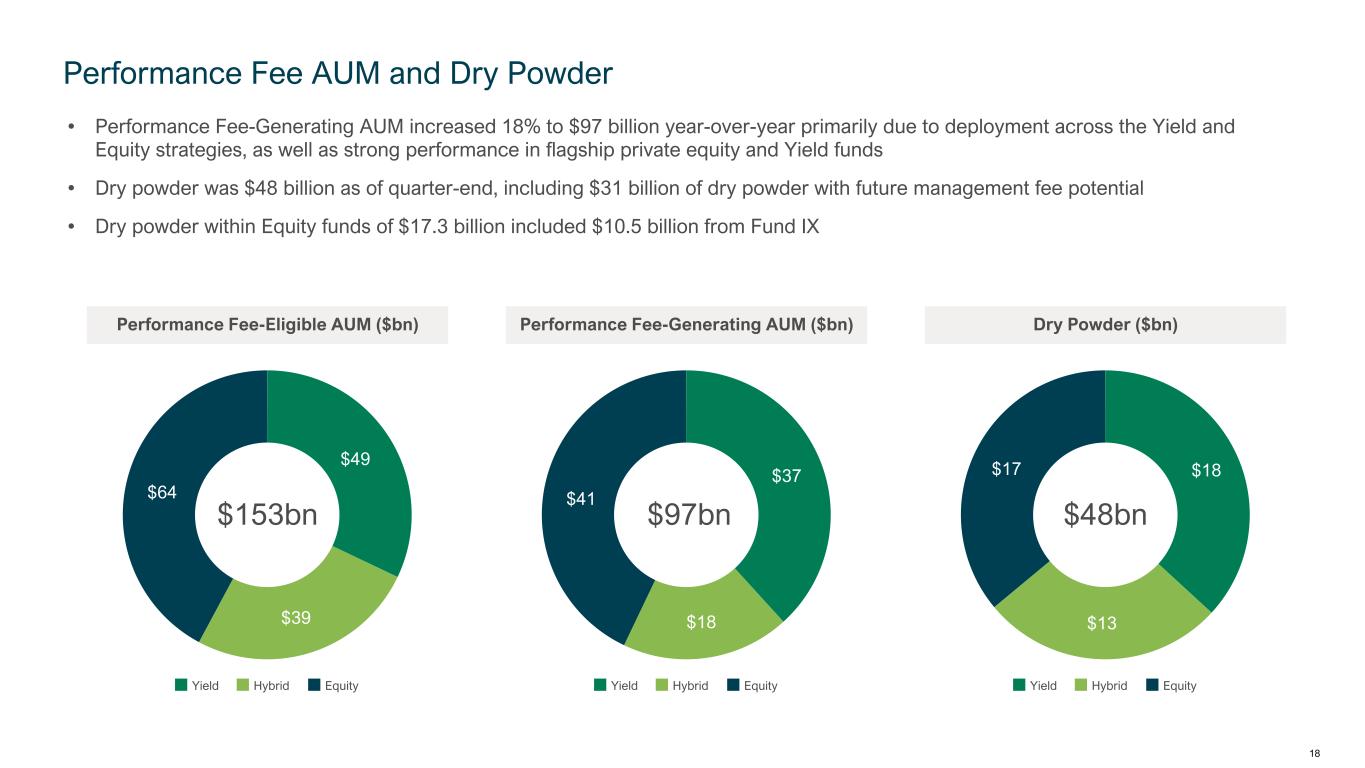

$49 $39 $64 Yield Hybrid Equity • Performance Fee-Generating AUM increased 18% to $97 billion year-over-year primarily due to deployment across the Yield and Equity strategies, as well as strong performance in flagship private equity and Yield funds • Dry powder was $48 billion as of quarter-end, including $31 billion of dry powder with future management fee potential • Dry powder within Equity funds of $17.3 billion included $10.5 billion from Fund IX Performance Fee-Eligible AUM ($bn) Performance Fee-Generating AUM ($bn) Dry Powder ($bn) Performance Fee AUM and Dry Powder $37 $18 $41 Yield Hybrid Equity $18 $13 $17 Yield Hybrid Equity $48bn $97bn$153bn 18

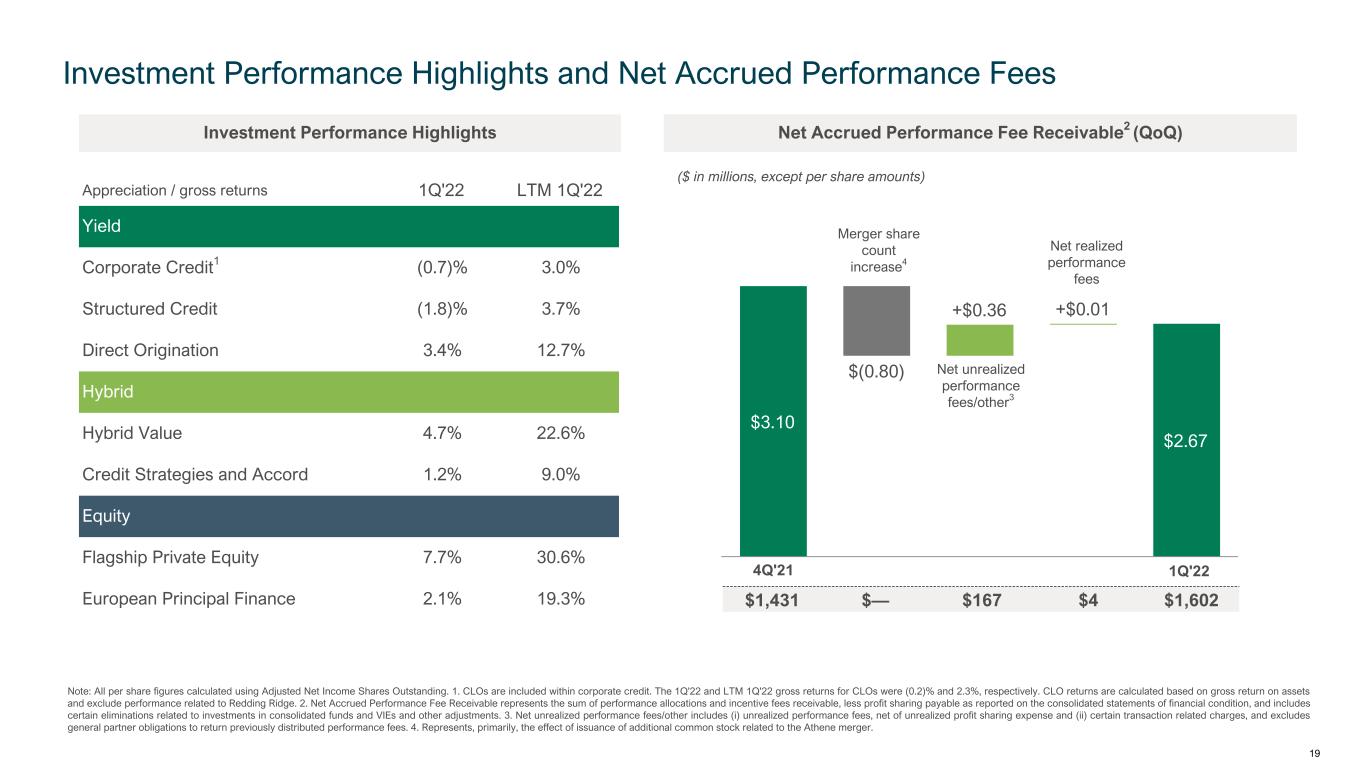

Investment Performance Highlights Net Accrued Performance Fee Receivable2 (QoQ) Appreciation / gross returns 1Q'22 LTM 1Q'22 Yield Corporate Credit1 (0.7)% 3.0% Structured Credit (1.8)% 3.7% Direct Origination 3.4% 12.7% Hybrid Hybrid Value 4.7% 22.6% Credit Strategies and Accord 1.2% 9.0% Equity Flagship Private Equity 7.7% 30.6% European Principal Finance 2.1% 19.3% Investment Performance Highlights and Net Accrued Performance Fees $3.10 $(0.80) +$0.36 +$0.01 $2.67 Net unrealized performance fees/other3 4Q'21 Net realized performance fees Note: All per share figures calculated using Adjusted Net Income Shares Outstanding. 1. CLOs are included within corporate credit. The 1Q'22 and LTM 1Q'22 gross returns for CLOs were (0.2)% and 2.3%, respectively. CLO returns are calculated based on gross return on assets and exclude performance related to Redding Ridge. 2. Net Accrued Performance Fee Receivable represents the sum of performance allocations and incentive fees receivable, less profit sharing payable as reported on the consolidated statements of financial condition, and includes certain eliminations related to investments in consolidated funds and VIEs and other adjustments. 3. Net unrealized performance fees/other includes (i) unrealized performance fees, net of unrealized profit sharing expense and (ii) certain transaction related charges, and excludes general partner obligations to return previously distributed performance fees. 4. Represents, primarily, the effect of issuance of additional common stock related to the Athene merger. Merger share count increase4 1Q'22 19 $1,431 $— $167 $4 $1,602 ($ in millions, except per share amounts)

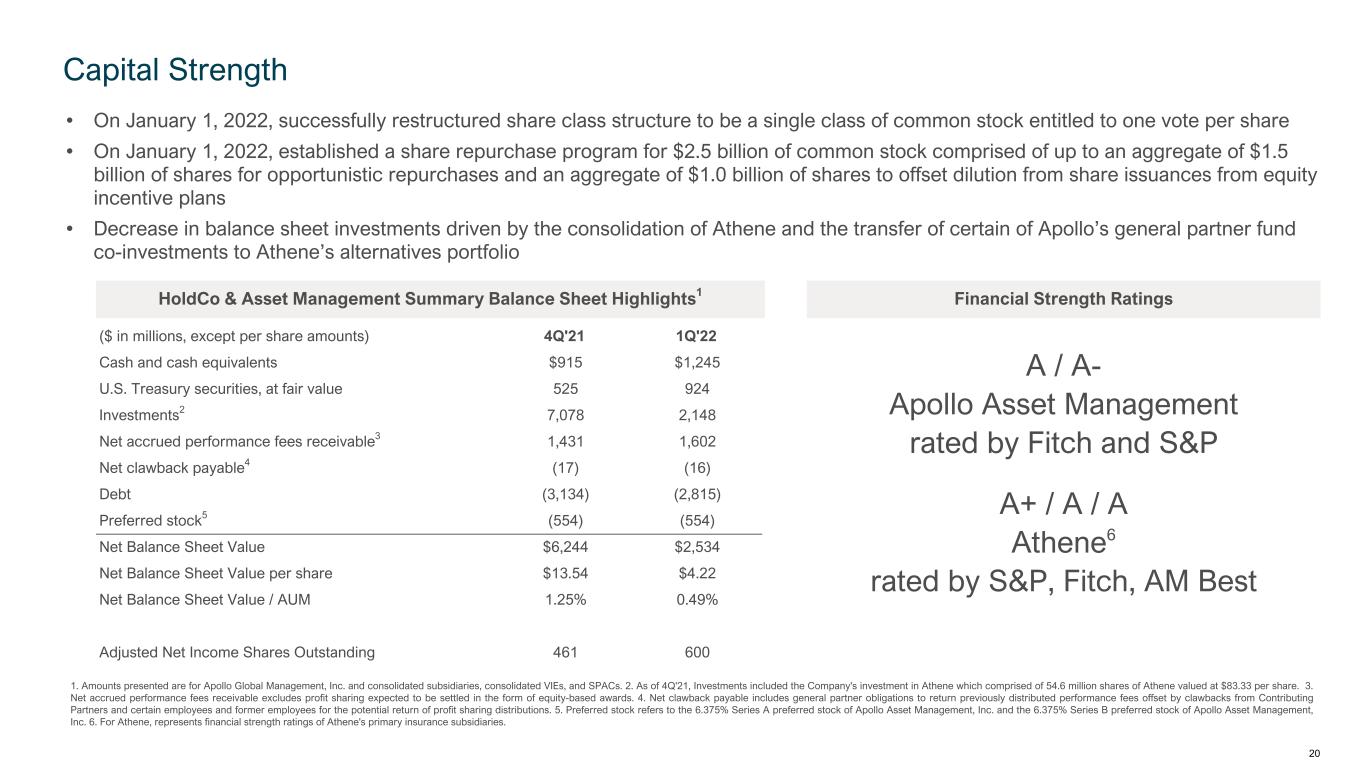

• On January 1, 2022, successfully restructured share class structure to be a single class of common stock entitled to one vote per share • On January 1, 2022, established a share repurchase program for $2.5 billion of common stock comprised of up to an aggregate of $1.5 billion of shares for opportunistic repurchases and an aggregate of $1.0 billion of shares to offset dilution from share issuances from equity incentive plans • Decrease in balance sheet investments driven by the consolidation of Athene and the transfer of certain of Apollo’s general partner fund co-investments to Athene’s alternatives portfolio HoldCo & Asset Management Summary Balance Sheet Highlights1 Financial Strength Ratings ($ in millions, except per share amounts) 4Q'21 1Q'22 Cash and cash equivalents $915 $1,245 U.S. Treasury securities, at fair value 525 924 Investments2 7,078 2,148 Net accrued performance fees receivable3 1,431 1,602 Net clawback payable4 (17) (16) Debt (3,134) (2,815) Preferred stock5 (554) (554) Net Balance Sheet Value $6,244 $2,534 Net Balance Sheet Value per share $13.54 $4.22 Net Balance Sheet Value / AUM 1.25% 0.49% Adjusted Net Income Shares Outstanding 461 600 A / A- Apollo Asset Management rated by Fitch and S&P A+ / A / A Athene6 rated by S&P, Fitch, AM Best Capital Strength 1. Amounts presented are for Apollo Global Management, Inc. and consolidated subsidiaries, consolidated VIEs, and SPACs. 2. As of 4Q'21, Investments included the Company's investment in Athene which comprised of 54.6 million shares of Athene valued at $83.33 per share. 3. Net accrued performance fees receivable excludes profit sharing expected to be settled in the form of equity-based awards. 4. Net clawback payable includes general partner obligations to return previously distributed performance fees offset by clawbacks from Contributing Partners and certain employees and former employees for the potential return of profit sharing distributions. 5. Preferred stock refers to the 6.375% Series A preferred stock of Apollo Asset Management, Inc. and the 6.375% Series B preferred stock of Apollo Asset Management, Inc. 6. For Athene, represents financial strength ratings of Athene's primary insurance subsidiaries. 20

Supplemental Details

($ in millions) Yield3 Hybrid Equity Total Beginning Balance $360,289 $52,772 $84,491 $497,552 Inflows 26,859 2,439 1,359 30,657 Outflows2 (9,547) (453) — (10,000) Net Flows 17,312 1,986 1,359 20,657 Realizations (626) (1,640) (2,246) (4,512) Market Activity (4,279) 622 2,803 (854) Ending Balance $372,696 $53,740 $86,407 $512,843 Three months ended March 31, 2022 ($ in millions) Yield3 Hybrid Equity Total Beginning Balance $328,783 $45,442 $86,913 $461,138 Inflows 70,766 12,231 7,817 90,814 Outflows2 (24,371) (1,015) (1,605) (26,991) Net Flows 46,395 11,216 6,212 63,823 Realizations (3,059) (5,708) (17,761) (26,528) Market Activity 577 2,790 11,043 14,410 Ending Balance $372,696 $53,740 $86,407 $512,843 Twelve Months Ended March 31, 2022 ($ in millions) Yield3 Hybrid Equity Total Beginning Balance $307,306 $21,845 $39,950 $369,101 Inflows 16,453 2,510 1,309 20,272 Outflows2 (8,773) (299) (70) (9,142) Net Flows 7,680 2,211 1,239 11,130 Realizations (309) (582) (263) (1,154) Market Activity (3,359) 27 (26) (3,358) Ending Balance $311,318 $23,501 $40,900 $375,719 Three months ended March 31, 2022 ($ in millions) Yield3 Hybrid Equity Total Beginning Balance $281,465 $18,376 $45,405 $345,246 Inflows 56,884 8,383 3,153 68,420 Outflows2 (26,376) (2,735) (3,290) (32,401) Net Flows 30,508 5,648 (137) 36,019 Realizations (1,958) (1,171) (4,081) (7,210) Market Activity 1,303 648 (287) 1,664 Ending Balance $311,318 $23,501 $40,900 $375,719 Twelve Months Ended March 31, 2022 Fee-Generating AUM Rollforward1 Total AUM Rollforward1 AUM Rollforward 1. Inflows at the individual strategy level represent subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers. Outflows represent redemptions and other decreases in available capital. Realizations represent fund distributions of realized proceeds. Market activity represents gains (losses), the impact of foreign exchange rate fluctuations and other income. 2. Included in the 1Q'22 outflows for Total AUM and FGAUM are $0.6 billion and $0.4 billion of redemptions, respectively. Included in the LTM outflows for Total AUM and FGAUM are $2.6 billion and $2.2 billion of redemptions, respectively. 3. As of 1Q'22, Yield AUM includes $23.8 billion of CLOs, $7.2 billion of which Apollo earns fees based on gross assets and $16.6 billion of which relates to Redding Ridge, from which Apollo earns fees based on net asset value. 22

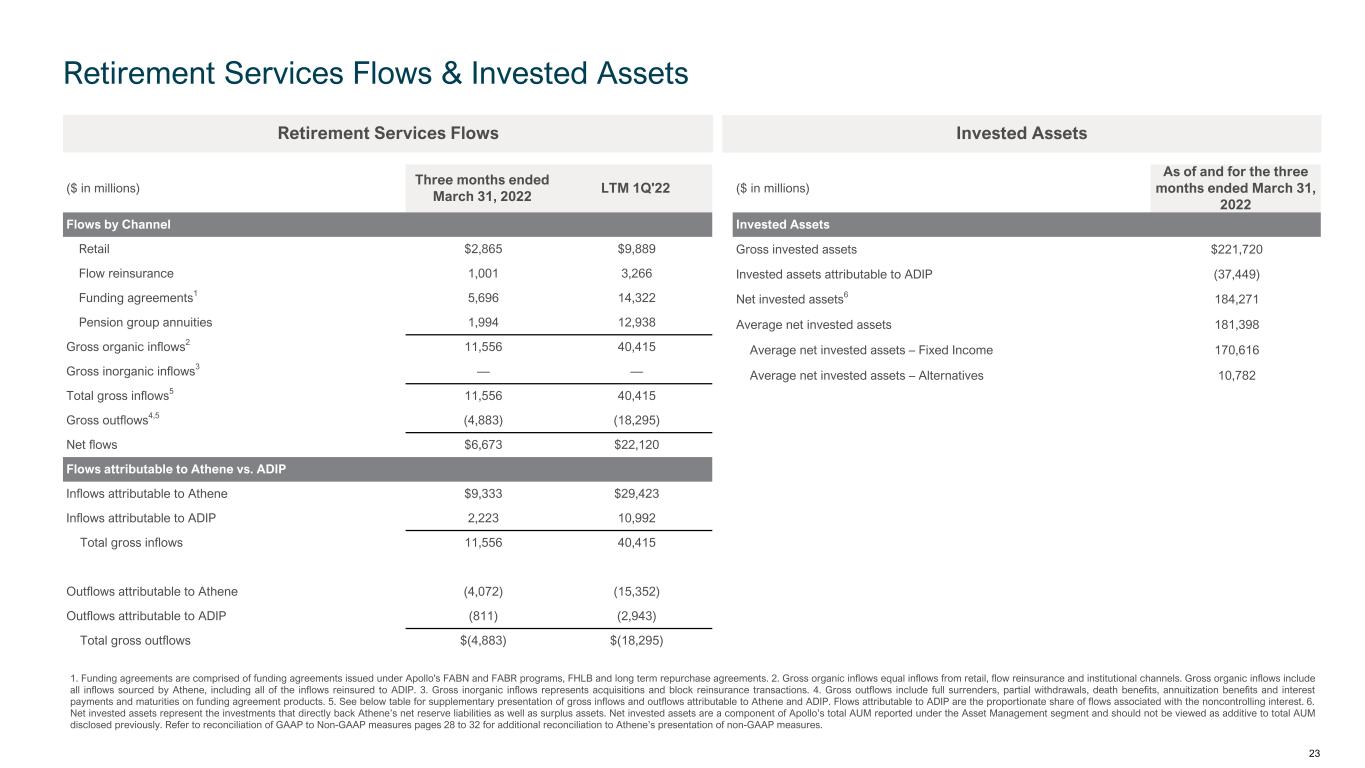

Retirement Services Flows & Invested Assets ($ in millions) Three months ended March 31, 2022 LTM 1Q'22 Flows by Channel Retail $2,865 $9,889 Flow reinsurance 1,001 3,266 Funding agreements1 5,696 14,322 Pension group annuities 1,994 12,938 Gross organic inflows2 11,556 40,415 Gross inorganic inflows3 — — Total gross inflows5 11,556 40,415 Gross outflows4,5 (4,883) (18,295) Net flows $6,673 $22,120 Flows attributable to Athene vs. ADIP Inflows attributable to Athene $9,333 $29,423 Inflows attributable to ADIP 2,223 10,992 Total gross inflows 11,556 40,415 Outflows attributable to Athene (4,072) (15,352) Outflows attributable to ADIP (811) (2,943) Total gross outflows $(4,883) $(18,295) 1. Funding agreements are comprised of funding agreements issued under Apollo's FABN and FABR programs, FHLB and long term repurchase agreements. 2. Gross organic inflows equal inflows from retail, flow reinsurance and institutional channels. Gross organic inflows include all inflows sourced by Athene, including all of the inflows reinsured to ADIP. 3. Gross inorganic inflows represents acquisitions and block reinsurance transactions. 4. Gross outflows include full surrenders, partial withdrawals, death benefits, annuitization benefits and interest payments and maturities on funding agreement products. 5. See below table for supplementary presentation of gross inflows and outflows attributable to Athene and ADIP. Flows attributable to ADIP are the proportionate share of flows associated with the noncontrolling interest. 6. Net invested assets represent the investments that directly back Athene’s net reserve liabilities as well as surplus assets. Net invested assets are a component of Apollo’s total AUM reported under the Asset Management segment and should not be viewed as additive to total AUM disclosed previously. Refer to reconciliation of GAAP to Non-GAAP measures pages 28 to 32 for additional reconciliation to Athene’s presentation of non-GAAP measures. ($ in millions) As of and for the three months ended March 31, 2022 Invested Assets Gross invested assets $221,720 Invested assets attributable to ADIP (37,449) Net invested assets6 184,271 Average net invested assets 181,398 Average net invested assets – Fixed Income 170,616 Average net invested assets – Alternatives 10,782 Retirement Services Flows Invested Assets 23

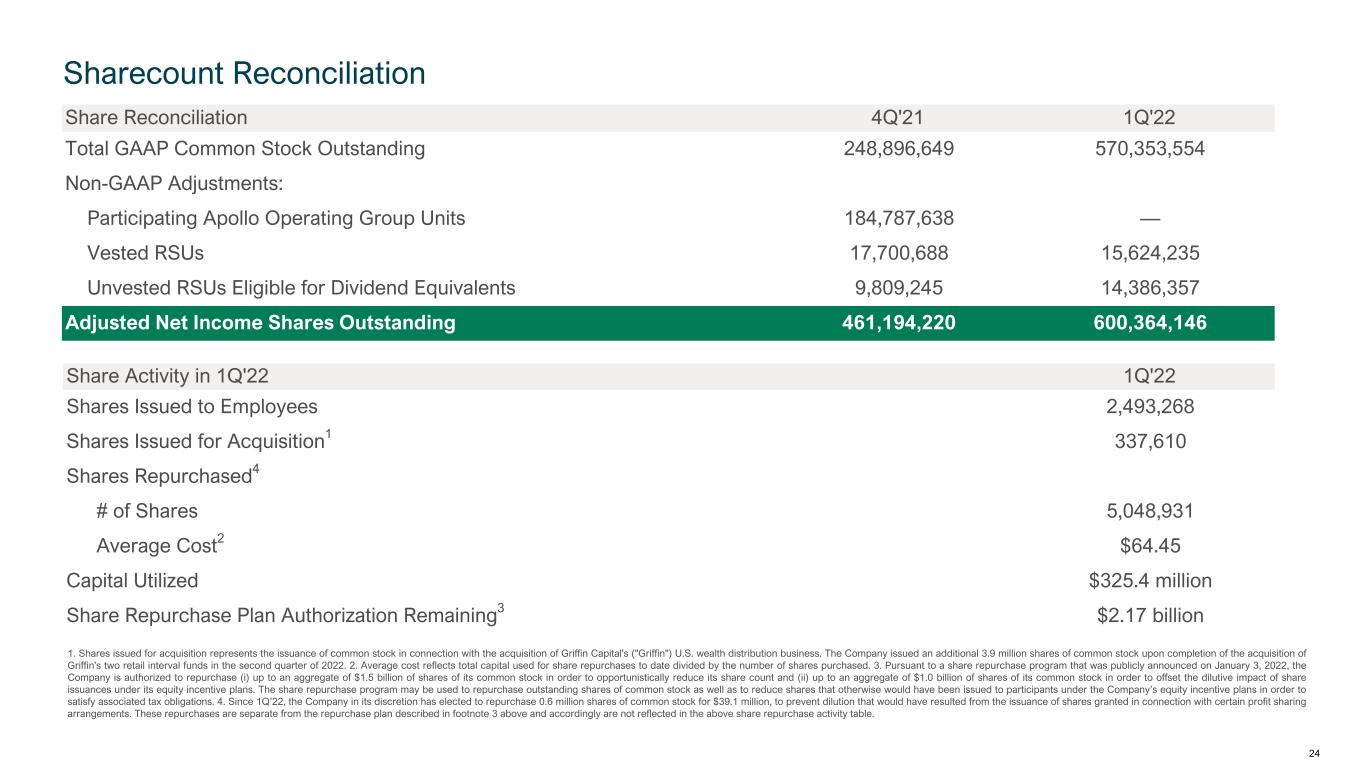

Share Reconciliation 4Q'21 1Q'22 Total GAAP Common Stock Outstanding 248,896,649 570,353,554 Non-GAAP Adjustments: Participating Apollo Operating Group Units 184,787,638 — Vested RSUs 17,700,688 15,624,235 Unvested RSUs Eligible for Dividend Equivalents 9,809,245 14,386,357 Adjusted Net Income Shares Outstanding 461,194,220 600,364,146 Sharecount Reconciliation 1. Shares issued for acquisition represents the issuance of common stock in connection with the acquisition of Griffin Capital's ("Griffin") U.S. wealth distribution business. The Company issued an additional 3.9 million shares of common stock upon completion of the acquisition of Griffin's two retail interval funds in the second quarter of 2022. 2. Average cost reflects total capital used for share repurchases to date divided by the number of shares purchased. 3. Pursuant to a share repurchase program that was publicly announced on January 3, 2022, the Company is authorized to repurchase (i) up to an aggregate of $1.5 billion of shares of its common stock in order to opportunistically reduce its share count and (ii) up to an aggregate of $1.0 billion of shares of its common stock in order to offset the dilutive impact of share issuances under its equity incentive plans. The share repurchase program may be used to repurchase outstanding shares of common stock as well as to reduce shares that otherwise would have been issued to participants under the Company’s equity incentive plans in order to satisfy associated tax obligations. 4. Since 1Q’22, the Company in its discretion has elected to repurchase 0.6 million shares of common stock for $39.1 million, to prevent dilution that would have resulted from the issuance of shares granted in connection with certain profit sharing arrangements. These repurchases are separate from the repurchase plan described in footnote 3 above and accordingly are not reflected in the above share repurchase activity table. Share Activity in 1Q'22 1Q'22 Shares Issued to Employees 2,493,268 Shares Issued for Acquisition1 337,610 Shares Repurchased4 # of Shares 5,048,931 Average Cost2 $64.45 Capital Utilized $325.4 million Share Repurchase Plan Authorization Remaining3 $2.17 billion 24

Reconciliations and Disclosures

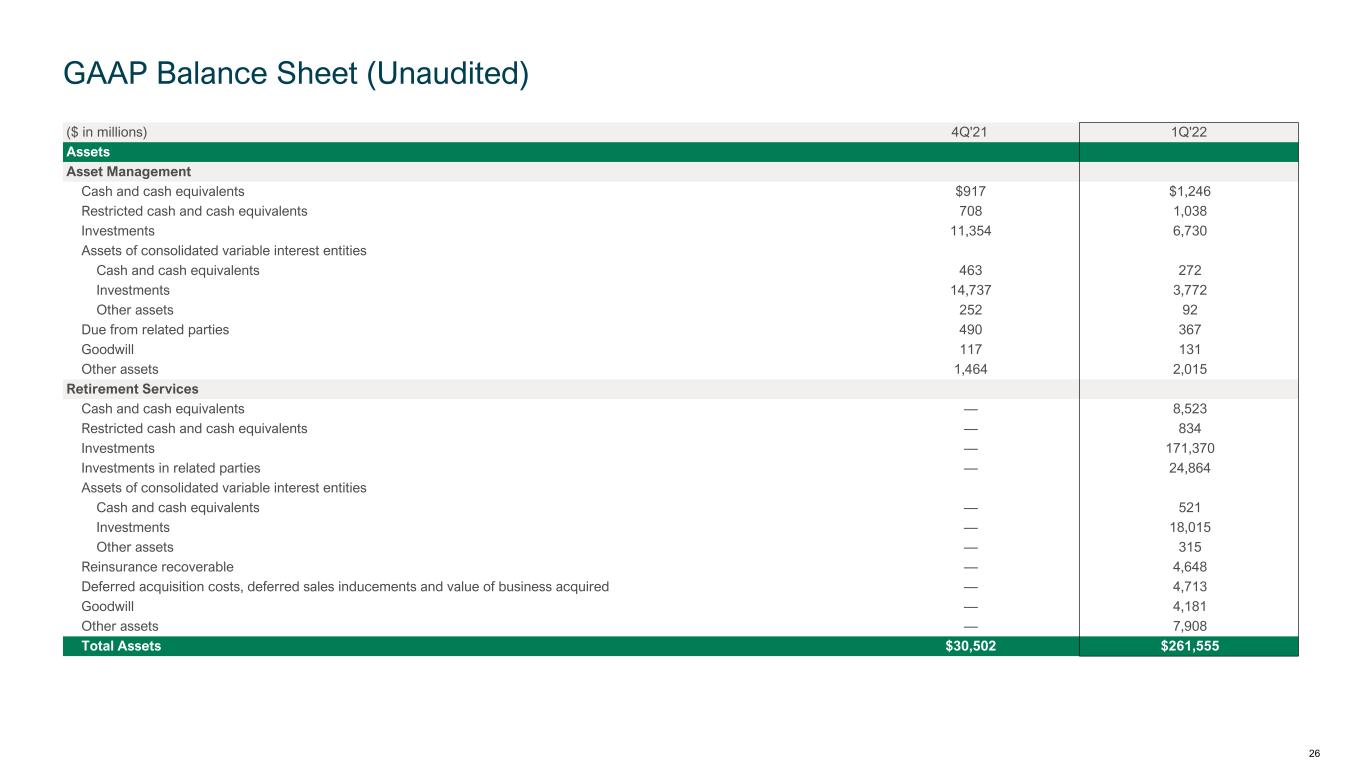

GAAP Balance Sheet (Unaudited) ($ in millions) 4Q'21 1Q'22 Assets Asset Management Cash and cash equivalents $917 $1,246 Restricted cash and cash equivalents 708 1,038 Investments 11,354 6,730 Assets of consolidated variable interest entities Cash and cash equivalents 463 272 Investments 14,737 3,772 Other assets 252 92 Due from related parties 490 367 Goodwill 117 131 Other assets 1,464 2,015 Retirement Services Cash and cash equivalents — 8,523 Restricted cash and cash equivalents — 834 Investments — 171,370 Investments in related parties — 24,864 Assets of consolidated variable interest entities Cash and cash equivalents — 521 Investments — 18,015 Other assets — 315 Reinsurance recoverable — 4,648 Deferred acquisition costs, deferred sales inducements and value of business acquired — 4,713 Goodwill — 4,181 Other assets — 7,908 Total Assets $30,502 $261,555 26

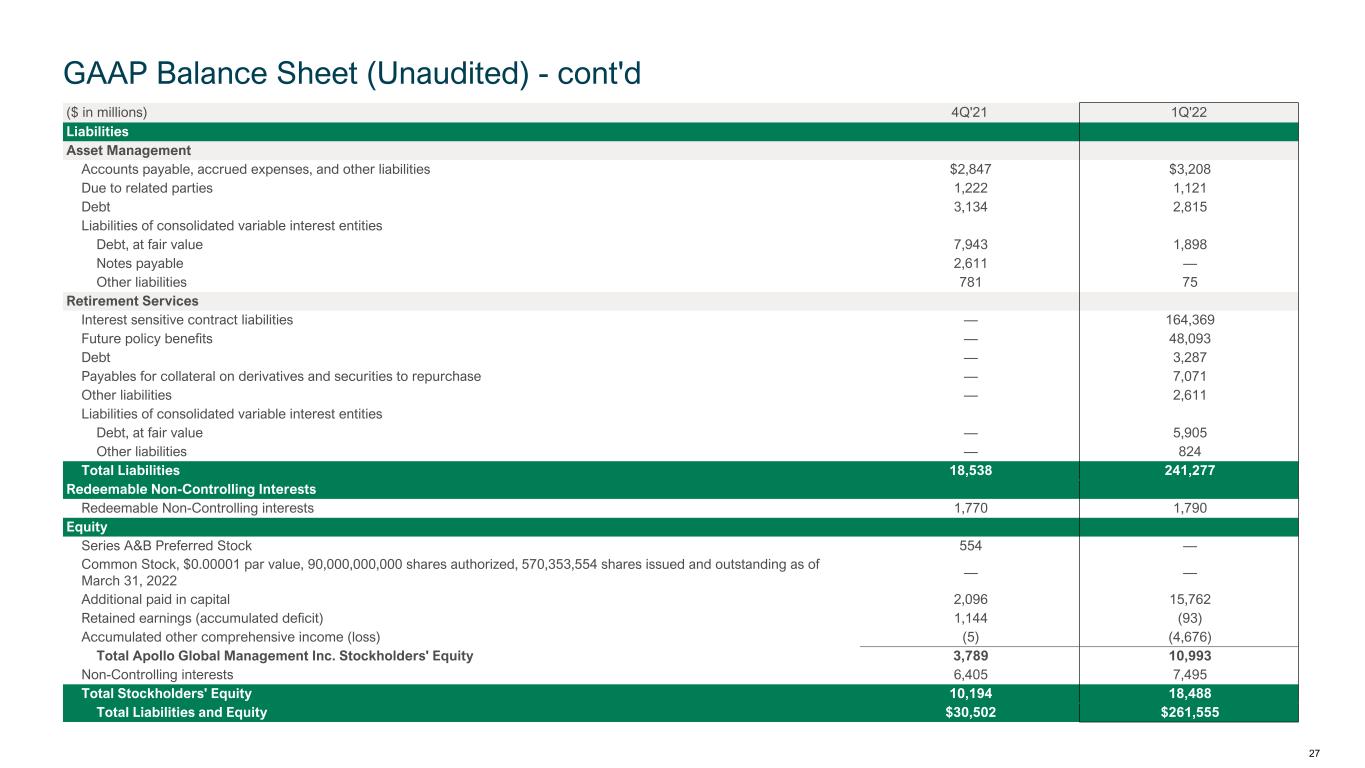

GAAP Balance Sheet (Unaudited) - cont'd ($ in millions) 4Q'21 1Q'22 Liabilities Asset Management Accounts payable, accrued expenses, and other liabilities $2,847 $3,208 Due to related parties 1,222 1,121 Debt 3,134 2,815 Liabilities of consolidated variable interest entities Debt, at fair value 7,943 1,898 Notes payable 2,611 — Other liabilities 781 75 Retirement Services Interest sensitive contract liabilities — 164,369 Future policy benefits — 48,093 Debt — 3,287 Payables for collateral on derivatives and securities to repurchase — 7,071 Other liabilities — 2,611 Liabilities of consolidated variable interest entities Debt, at fair value — 5,905 Other liabilities — 824 Total Liabilities 18,538 241,277 Redeemable Non-Controlling Interests Redeemable Non-Controlling interests 1,770 1,790 Equity Series A&B Preferred Stock 554 — Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 570,353,554 shares issued and outstanding as of March 31, 2022 — — Additional paid in capital 2,096 15,762 Retained earnings (accumulated deficit) 1,144 (93) Accumulated other comprehensive income (loss) (5) (4,676) Total Apollo Global Management Inc. Stockholders' Equity 3,789 10,993 Non-Controlling interests 6,405 7,495 Total Stockholders' Equity 10,194 18,488 Total Liabilities and Equity $30,502 $261,555 27

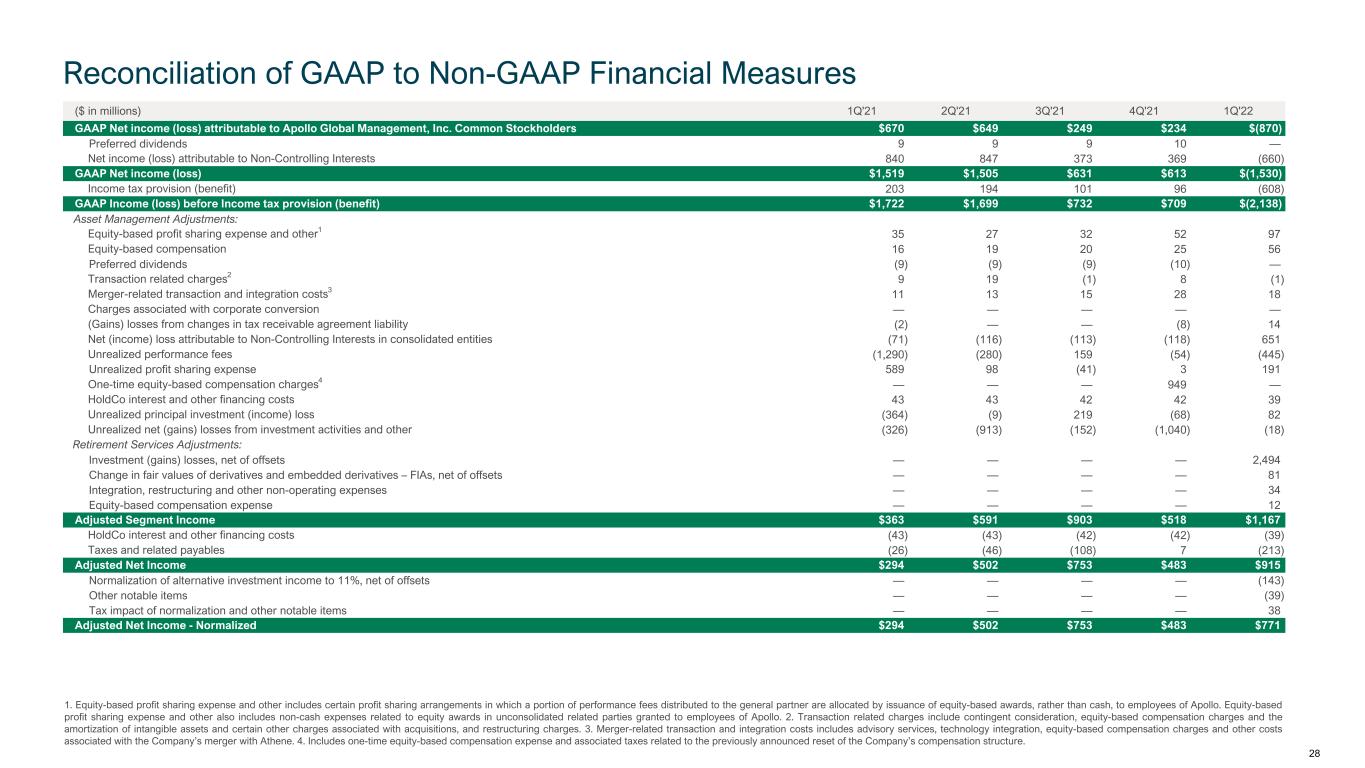

Reconciliation of GAAP to Non-GAAP Financial Measures ($ in millions) 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $670 $649 $249 $234 $(870) Preferred dividends 9 9 9 10 — Net income (loss) attributable to Non-Controlling Interests 840 847 373 369 (660) GAAP Net income (loss) $1,519 $1,505 $631 $613 $(1,530) Income tax provision (benefit) 203 194 101 96 (608) GAAP Income (loss) before Income tax provision (benefit) $1,722 $1,699 $732 $709 $(2,138) Asset Management Adjustments: Equity-based profit sharing expense and other1 35 27 32 52 97 Equity-based compensation 16 19 20 25 56 Preferred dividends (9) (9) (9) (10) — Transaction related charges2 9 19 (1) 8 (1) Merger-related transaction and integration costs3 11 13 15 28 18 Charges associated with corporate conversion — — — — — (Gains) losses from changes in tax receivable agreement liability (2) — — (8) 14 Net (income) loss attributable to Non-Controlling Interests in consolidated entities (71) (116) (113) (118) 651 Unrealized performance fees (1,290) (280) 159 (54) (445) Unrealized profit sharing expense 589 98 (41) 3 191 One-time equity-based compensation charges4 — — — 949 — HoldCo interest and other financing costs 43 43 42 42 39 Unrealized principal investment (income) loss (364) (9) 219 (68) 82 Unrealized net (gains) losses from investment activities and other (326) (913) (152) (1,040) (18) Retirement Services Adjustments: Investment (gains) losses, net of offsets — — — — 2,494 Change in fair values of derivatives and embedded derivatives – FIAs, net of offsets — — — — 81 Integration, restructuring and other non-operating expenses — — — — 34 Equity-based compensation expense — — — — 12 Adjusted Segment Income $363 $591 $903 $518 $1,167 HoldCo interest and other financing costs (43) (43) (42) (42) (39) Taxes and related payables (26) (46) (108) 7 (213) Adjusted Net Income $294 $502 $753 $483 $915 Normalization of alternative investment income to 11%, net of offsets — — — — (143) Other notable items — — — — (39) Tax impact of normalization and other notable items — — — — 38 Adjusted Net Income - Normalized $294 $502 $753 $483 $771 1. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes non-cash expenses related to equity awards in unconsolidated related parties granted to employees of Apollo. 2. Transaction related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and restructuring charges. 3. Merger-related transaction and integration costs includes advisory services, technology integration, equity-based compensation charges and other costs associated with the Company’s merger with Athene. 4. Includes one-time equity-based compensation expense and associated taxes related to the previously announced reset of the Company’s compensation structure. 28

Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd Year ended December 31, ($ in millions) 2014 2015 2016 2017 2018 2019 2020 2021 GAAP Net income (loss) attributable to Apollo Global Management, Inc. Common Stockholders $168 $134 $403 $616 $(42) $807 $120 $1,802 Preferred dividends — — — 14 32 37 37 37 Net income (loss) attributable to Non-Controlling Interests 562 216 567 814 29 693 310 2,429 GAAP Net income (loss) $730 $350 $970 $1,444 $19 $1,537 $467 $4,268 Income tax provision (benefit) 147 27 91 326 86 (129) 87 594 GAAP Income (loss) before Income tax provision (benefit) $877 $377 $1,061 $1,770 $105 $1,408 $554 $4,862 Equity-based profit sharing expense and other1 — 1 3 7 91 96 129 146 Equity-based compensation 105 62 63 65 68 71 68 80 Preferred dividends — — — (14) (32) (37) (37) (37) Transaction related charges 2 34 39 55 17 (6) 49 39 35 Merger-related transaction and integration costs3 — — — — — — — 67 Charges associated with corporate conversion — — — — — 22 4 — (Gains) losses from changes in tax receivable agreement liability (32) — (3) (200) (35) 50 (12) (10) Net (income) loss attributable to Non-Controlling Interests in consolidated entities (157) (21) (6) (9) (32) (31) (118) (418) Unrealized performance fees 1,348 358 (511) (689) 783 (435) (35) (1,465) Unrealized profit sharing expense (517) (137) 180 226 (275) 208 33 649 One-time equity-based compensation charges4 — — — — — — — 949 HoldCo interest and other financing costs 19 27 39 59 69 98 154 170 Unrealized principal investment (income) loss 22 13 (65) (95) 62 (88) (62) (222) Unrealized net (gains) losses from investment activities and other (260) (79) (139) (95) 193 (135) 420 (2,431) Adjusted Segment Income $1,439 $640 $677 $1,042 $991 $1,276 $1,137 $2,375 HoldCo interest and other financing costs (19) (27) (39) (59) (69) (98) (154) (170) Taxes and related payables (74) (10) (10) (26) (44) (62) (90) (173) Adjusted Net Income $1,346 $603 $628 $957 $878 $1,116 $893 $2,032 1. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes non-cash expenses related to equity awards in unconsolidated related parties granted to employees of Apollo. 2. Transaction related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and restructuring charges. 3. Merger-related transaction and integration costs includes advisory services, technology integration, equity-based compensation charges and other costs associated with the Company’s merger with Athene. 4. Includes one-time equity-based compensation expense and associated taxes related to the previously announced reset of the Company’s compensation structure. 29

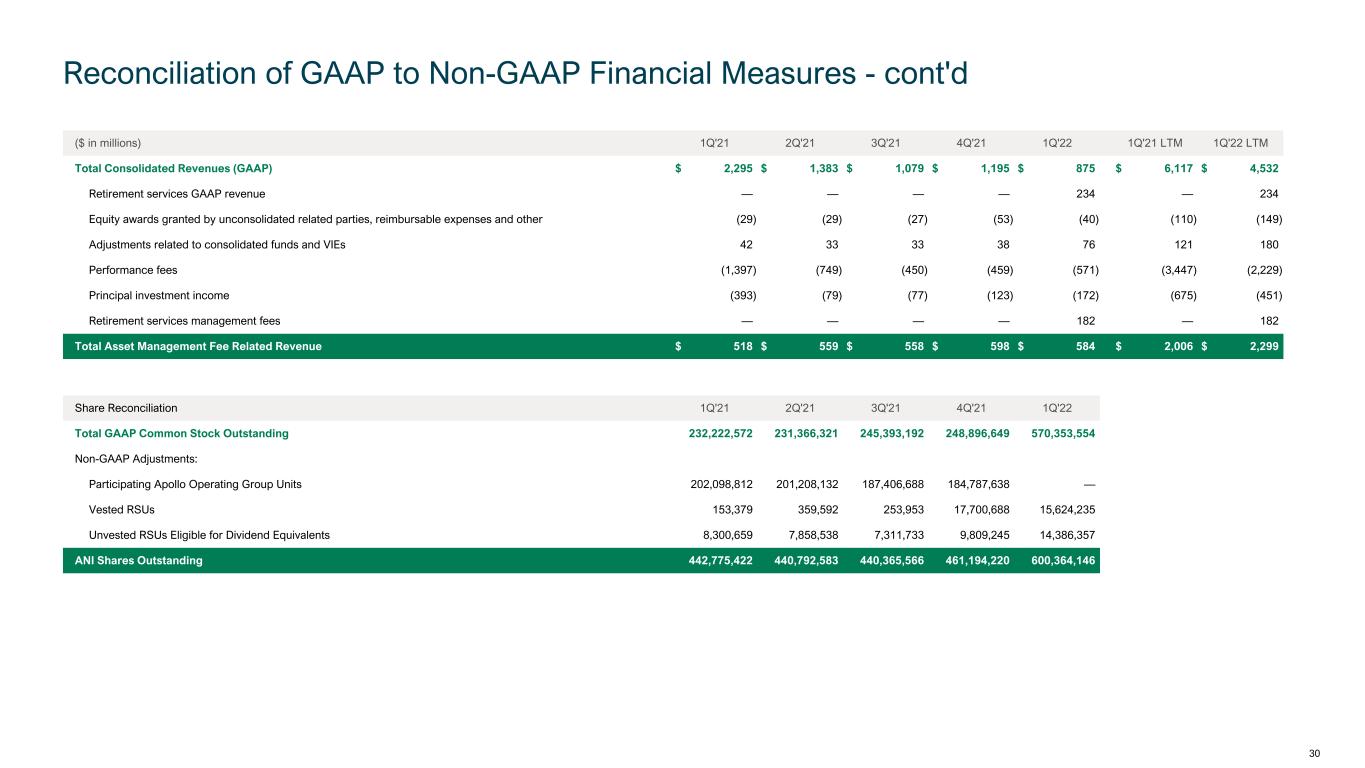

Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd ($ in millions) 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 1Q'21 LTM 1Q'22 LTM Total Consolidated Revenues (GAAP) $ 2,295 $ 1,383 $ 1,079 $ 1,195 $ 875 $ 6,117 $ 4,532 Retirement services GAAP revenue — — — — 234 — 234 Equity awards granted by unconsolidated related parties, reimbursable expenses and other (29) (29) (27) (53) (40) (110) (149) Adjustments related to consolidated funds and VIEs 42 33 33 38 76 121 180 Performance fees (1,397) (749) (450) (459) (571) (3,447) (2,229) Principal investment income (393) (79) (77) (123) (172) (675) (451) Retirement services management fees — — — — 182 — 182 Total Asset Management Fee Related Revenue $ 518 $ 559 $ 558 $ 598 $ 584 $ 2,006 $ 2,299 Share Reconciliation 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 Total GAAP Common Stock Outstanding 232,222,572 231,366,321 245,393,192 248,896,649 570,353,554 Non-GAAP Adjustments: Participating Apollo Operating Group Units 202,098,812 201,208,132 187,406,688 184,787,638 — Vested RSUs 153,379 359,592 253,953 17,700,688 15,624,235 Unvested RSUs Eligible for Dividend Equivalents 8,300,659 7,858,538 7,311,733 9,809,245 14,386,357 ANI Shares Outstanding 442,775,422 440,792,583 440,365,566 461,194,220 600,364,146 30

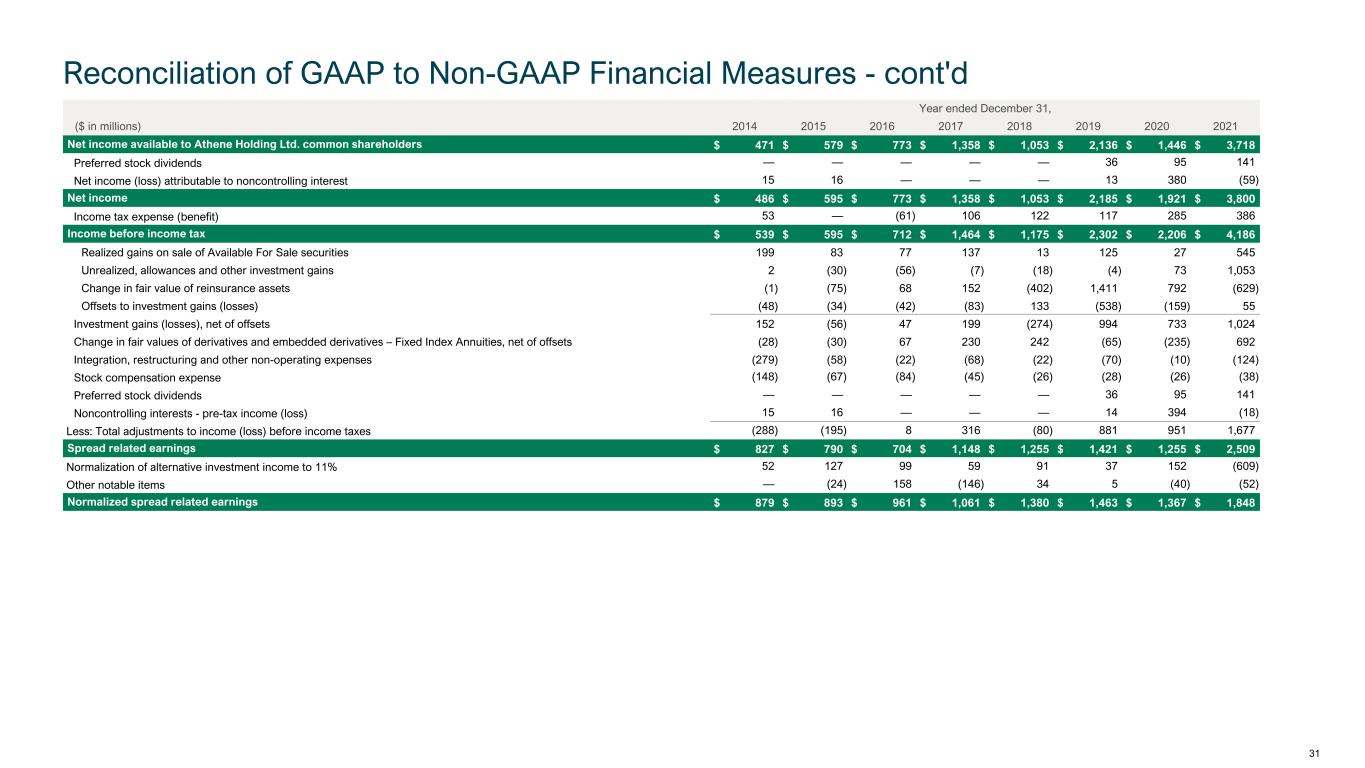

Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd Year ended December 31, ($ in millions) 2014 2015 2016 2017 2018 2019 2020 2021 Net income available to Athene Holding Ltd. common shareholders $ 471 $ 579 $ 773 $ 1,358 $ 1,053 $ 2,136 $ 1,446 $ 3,718 Preferred stock dividends — — — — — 36 95 141 Net income (loss) attributable to noncontrolling interest 15 16 — — — 13 380 (59) Net income $ 486 $ 595 $ 773 $ 1,358 $ 1,053 $ 2,185 $ 1,921 $ 3,800 Income tax expense (benefit) 53 — (61) 106 122 117 285 386 Income before income tax $ 539 $ 595 $ 712 $ 1,464 $ 1,175 $ 2,302 $ 2,206 $ 4,186 Realized gains on sale of Available For Sale securities 199 83 77 137 13 125 27 545 Unrealized, allowances and other investment gains 2 (30) (56) (7) (18) (4) 73 1,053 Change in fair value of reinsurance assets (1) (75) 68 152 (402) 1,411 792 (629) Offsets to investment gains (losses) (48) (34) (42) (83) 133 (538) (159) 55 Investment gains (losses), net of offsets 152 (56) 47 199 (274) 994 733 1,024 Change in fair values of derivatives and embedded derivatives – Fixed Index Annuities, net of offsets (28) (30) 67 230 242 (65) (235) 692 Integration, restructuring and other non-operating expenses (279) (58) (22) (68) (22) (70) (10) (124) Stock compensation expense (148) (67) (84) (45) (26) (28) (26) (38) Preferred stock dividends — — — — — 36 95 141 Noncontrolling interests - pre-tax income (loss) 15 16 — — — 14 394 (18) Less: Total adjustments to income (loss) before income taxes (288) (195) 8 316 (80) 881 951 1,677 Spread related earnings $ 827 $ 790 $ 704 $ 1,148 $ 1,255 $ 1,421 $ 1,255 $ 2,509 Normalization of alternative investment income to 11% 52 127 99 59 91 37 152 (609) Other notable items — (24) 158 (146) 34 5 (40) (52) Normalized spread related earnings $ 879 $ 893 $ 961 $ 1,061 $ 1,380 $ 1,463 $ 1,367 $ 1,848 31

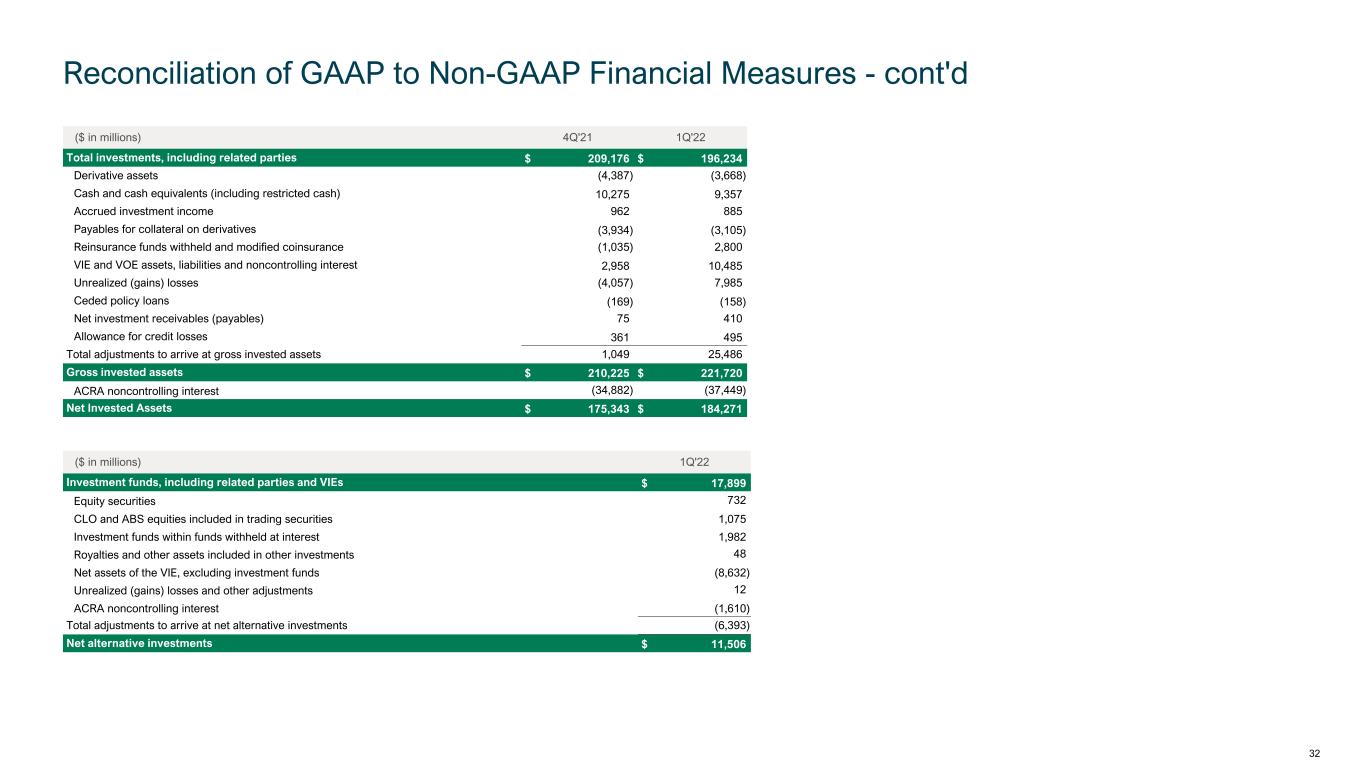

Reconciliation of GAAP to Non-GAAP Financial Measures - cont'd ($ in millions) 1Q'22 Investment funds, including related parties and VIEs $ 17,899 Equity securities 732 CLO and ABS equities included in trading securities 1,075 Investment funds within funds withheld at interest 1,982 Royalties and other assets included in other investments 48 Net assets of the VIE, excluding investment funds (8,632) Unrealized (gains) losses and other adjustments 12 ACRA noncontrolling interest (1,610) Total adjustments to arrive at net alternative investments (6,393) Net alternative investments $ 11,506 32 ($ in millions) 4Q'21 1Q'22 Total investments, including related parties $ 209,176 $ 196,234 Derivative assets (4,387) (3,668) Cash and cash equivalents (including restricted cash) 10,275 9,357 Accrued investment income 962 885 Payables for collateral on derivatives (3,934) (3,105) Reinsurance funds withheld and modified coinsurance (1,035) 2,800 VIE and VOE assets, liabilities and noncontrolling interest 2,958 10,485 Unrealized (gains) losses (4,057) 7,985 Ceded policy loans (169) (158) Net investment receivables (payables) 75 410 Allowance for credit losses 361 495 Total adjustments to arrive at gross invested assets 1,049 25,486 Gross invested assets $ 210,225 $ 221,720 ACRA noncontrolling interest (34,882) (37,449) Net Invested Assets $ 175,343 $ 184,271

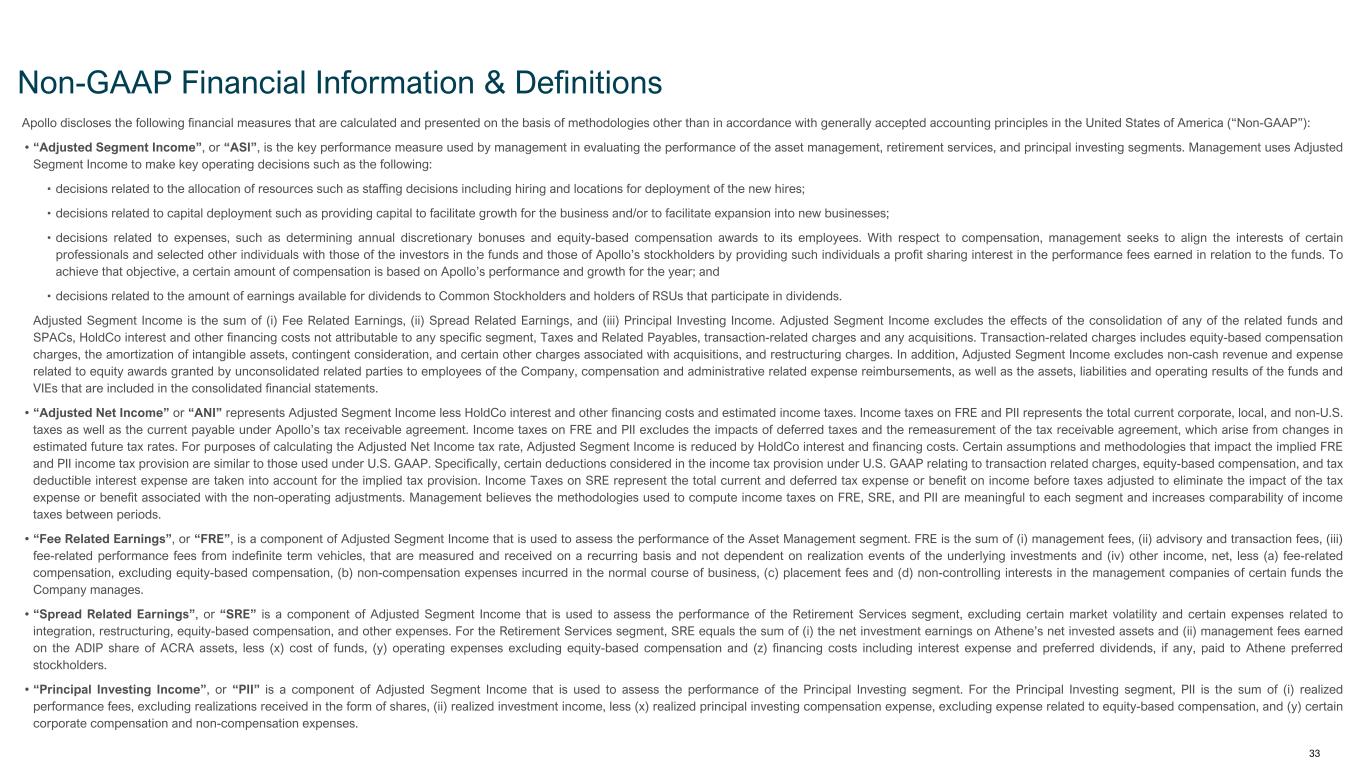

Apollo discloses the following financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”): • “Adjusted Segment Income”, or “ASI”, is the key performance measure used by management in evaluating the performance of the asset management, retirement services, and principal investing segments. Management uses Adjusted Segment Income to make key operating decisions such as the following: ▪ decisions related to the allocation of resources such as staffing decisions including hiring and locations for deployment of the new hires; ▪ decisions related to capital deployment such as providing capital to facilitate growth for the business and/or to facilitate expansion into new businesses; ▪ decisions related to expenses, such as determining annual discretionary bonuses and equity-based compensation awards to its employees. With respect to compensation, management seeks to align the interests of certain professionals and selected other individuals with those of the investors in the funds and those of Apollo’s stockholders by providing such individuals a profit sharing interest in the performance fees earned in relation to the funds. To achieve that objective, a certain amount of compensation is based on Apollo’s performance and growth for the year; and ▪ decisions related to the amount of earnings available for dividends to Common Stockholders and holders of RSUs that participate in dividends. Adjusted Segment Income is the sum of (i) Fee Related Earnings, (ii) Spread Related Earnings, and (iii) Principal Investing Income. Adjusted Segment Income excludes the effects of the consolidation of any of the related funds and SPACs, HoldCo interest and other financing costs not attributable to any specific segment, Taxes and Related Payables, transaction-related charges and any acquisitions. Transaction-related charges includes equity-based compensation charges, the amortization of intangible assets, contingent consideration, and certain other charges associated with acquisitions, and restructuring charges. In addition, Adjusted Segment Income excludes non-cash revenue and expense related to equity awards granted by unconsolidated related parties to employees of the Company, compensation and administrative related expense reimbursements, as well as the assets, liabilities and operating results of the funds and VIEs that are included in the consolidated financial statements. • “Adjusted Net Income” or “ANI” represents Adjusted Segment Income less HoldCo interest and other financing costs and estimated income taxes. Income taxes on FRE and PII represents the total current corporate, local, and non-U.S. taxes as well as the current payable under Apollo’s tax receivable agreement. Income taxes on FRE and PII excludes the impacts of deferred taxes and the remeasurement of the tax receivable agreement, which arise from changes in estimated future tax rates. For purposes of calculating the Adjusted Net Income tax rate, Adjusted Segment Income is reduced by HoldCo interest and financing costs. Certain assumptions and methodologies that impact the implied FRE and PII income tax provision are similar to those used under U.S. GAAP. Specifically, certain deductions considered in the income tax provision under U.S. GAAP relating to transaction related charges, equity-based compensation, and tax deductible interest expense are taken into account for the implied tax provision. Income Taxes on SRE represent the total current and deferred tax expense or benefit on income before taxes adjusted to eliminate the impact of the tax expense or benefit associated with the non-operating adjustments. Management believes the methodologies used to compute income taxes on FRE, SRE, and PII are meaningful to each segment and increases comparability of income taxes between periods. • “Fee Related Earnings”, or “FRE”, is a component of Adjusted Segment Income that is used to assess the performance of the Asset Management segment. FRE is the sum of (i) management fees, (ii) advisory and transaction fees, (iii) fee-related performance fees from indefinite term vehicles, that are measured and received on a recurring basis and not dependent on realization events of the underlying investments and (iv) other income, net, less (a) fee-related compensation, excluding equity-based compensation, (b) non-compensation expenses incurred in the normal course of business, (c) placement fees and (d) non-controlling interests in the management companies of certain funds the Company manages. • “Spread Related Earnings”, or “SRE” is a component of Adjusted Segment Income that is used to assess the performance of the Retirement Services segment, excluding certain market volatility and certain expenses related to integration, restructuring, equity-based compensation, and other expenses. For the Retirement Services segment, SRE equals the sum of (i) the net investment earnings on Athene’s net invested assets and (ii) management fees earned on the ADIP share of ACRA assets, less (x) cost of funds, (y) operating expenses excluding equity-based compensation and (z) financing costs including interest expense and preferred dividends, if any, paid to Athene preferred stockholders. • “Principal Investing Income”, or “PII” is a component of Adjusted Segment Income that is used to assess the performance of the Principal Investing segment. For the Principal Investing segment, PII is the sum of (i) realized performance fees, excluding realizations received in the form of shares, (ii) realized investment income, less (x) realized principal investing compensation expense, excluding expense related to equity-based compensation, and (y) certain corporate compensation and non-compensation expenses. Non-GAAP Financial Information & Definitions 33

• “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. AUM equals the sum of: 1. the net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to- market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of equity and certain hybrid funds, partnerships and accounts Apollo manages or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any of Apollo Fund management agreements. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in its funds; and (3) the AUM measures that Apollo uses internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. Apollo uses AUM, Gross capital deployed and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. • “Fee-Generating AUM” or “FGAUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM. Non-GAAP Financial Information & Definitions - cont'd 34

• “Performance Fee-Eligible AUM” or “PFEAUM” refers to the AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: • “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; • “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is currently below its hurdle rate or preferred return; and • “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. • “ACRA” refers to Athene Co-Invest Reinsurance Affiliate Holding Ltd. • “ADIP” refers to Apollo/Athene Dedicated Investment Program, a fund managed by Apollo including third-party capital that invests alongside Athene in certain investments. • “Appreciation (depreciation)” of flagship private equity and hybrid value funds refers to gain (loss) and income for the periods presented on a total return basis before giving effect to fees and expenses. The performance percentage is determined by dividing (a) the change in the fair value of investments over the period presented, minus the change in invested capital over the period presented, plus the realized value for the period presented, by (b) the beginning unrealized value for the period presented plus the change in invested capital for the period presented. Returns over multiple periods are calculated by geometrically linking each period’s return over time. • “Athene” refers to Athene Holding Ltd. (together with its subsidiaries, “Athene”), a subsidiary of the Company and a leading retirement services company that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs, and to which Apollo, through its consolidated subsidiary Apollo Insurance Solutions Group LP (formerly known as Athene Asset Management LLC) (“ISG”), provides asset management and advisory services. • “Athora” refers to a strategic platform that acquires or reinsures blocks of insurance business in the German and broader European life insurance market (collectively, the “Athora Accounts”). • “Cost of Funds” includes liability costs related to cost of crediting on both deferred annuities and institutional products as well as other liability costs, but does not include the proportionate share of the ACRA cost of funds associated with the noncontrolling interest. While we believe cost of funds is a meaningful financial metric and enhances our understanding of the underlying profitability drivers of our business, it should not be used as a substitute for total benefits and expenses presented under GAAP. • “Debt Origination” represents (i) capital that has been invested in new debt or debt like investments by Apollo's Yield and Hybrid strategies (whether purchased by Apollo funds and accounts, or syndicated to third parties) where Apollo or one of Apollo's platforms has sourced, negotiated, or significantly affected the commercial terms of the investment; (ii) new capital pools formed by debt issuances, including CLOs and (iii) net purchases of certain assets by the funds and accounts we manage that we consider to be private, illiquid, and hard to access assets and which the funds otherwise may not be able to meaningfully access. Debt origination generally excludes any issuance of debt or debt like investments by the portfolio companies of the funds we manage. • “Dry Powder” represents the amount of capital available for investment or reinvestment subject to the provisions of the applicable limited partnership agreements or other governing agreements of the funds, partnerships and accounts we manage. Dry powder excludes uncalled commitments which can only be called for fund fees and expenses and commitments from Perpetual Capital Vehicles. • “FRE Margin” is calculated as Fee Related Earnings divided by fee-related revenues (which includes management fees, transaction and advisory fees and fee-related performance fees). • “Gross Capital Deployment” represents the gross capital that has been invested in investments by the funds and accounts we manage during the relevant period, but excludes certain investment activities primarily related to hedging and cash management functions at the firm. Gross Capital Deployment is not reduced or netted down by sales or refinancings, and takes into account leverage used by the funds and accounts we manage in gaining exposure to the various investments that they have made. 35 Non-GAAP Financial Information & Definitions - cont'd

Non-GAAP Financial Information & Definitions - cont'd • “Gross Return” of a yield fund, European Principal Finance, Credit Strategies and Accord is the monthly or quarterly time-weighted return that is equal to the percentage change in the value of a fund’s portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees allocated to the general partner, or other fees and expenses. Returns for these categories are calculated for all funds and accounts in the respective strategies excluding assets for Athene, Athora and certain other entities where Apollo manages or may manage a significant portion of the total company assets. Returns of CLOs represent the gross returns on assets. Returns over multiple periods are calculated by geometrically linking each period’s return over time. • “Inflows” within the Asset Management segment represents (i) at the individual strategy level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-strategy transfers, and (ii) on an aggregate basis, the sum of inflows across the yield, hybrid and equity strategies. • “Net Invested Assets” represents the investments that directly back Athene's net reserve liabilities as well as surplus assets. Net invested assets is used in the computation of net investment earned rate, which is used to analyze the profitability of Athene’s investment portfolio. Net invested assets includes (a) total investments on the consolidated balance sheets with AFS securities at cost or amortized cost, excluding derivatives, (b) cash and cash equivalents and restricted cash, (c) investments in related parties, (d) accrued investment income, (e) VIE assets, liabilities and noncontrolling interest adjustments, (f) net investment payables and receivables, (g) policy loans ceded (which offset the direct policy loans in total investments) and (h) an allowance for credit losses. Net invested assets also excludes assets associated with funds withheld liabilities related to business exited through reinsurance agreements and derivative collateral (offsetting the related cash positions). Athene includes the underlying investments supporting its assumed funds withheld and modco agreements in its net invested assets calculation in order to match the assets with the income received. Athene believes the adjustments for reinsurance provide a view of the assets for which it has economic exposure. Net invested assets includes Athene’s proportionate share of ACRA investments, based on Athene’s economic ownership, but does not include the proportionate share of investments associated with the noncontrolling interest. Net invested assets are averaged over the number of quarters in the relevant period to compute a net investment earned rate for such period. While Athene believes net invested assets is a meaningful financial metric and enhances the understanding of the underlying drivers of its investment portfolio, it should not be used as a substitute for total investments, including related parties, presented under GAAP. • “Net Investment Earned Rate” is computed as the income from Athene's net invested assets divided by the average net invested assets, for the relevant period. • “Net Investment Spread” measures Athene's investment performance plus our strategic capital management fees from ACRA, less our total cost of funds. Net investment earned rate is a key measure of our investment performance while cost of funds is a key measure of the cost of our policyholder benefits and liabilities. • “Other operating expenses” within the Principal Investing segment represents expenses incurred in the normal course of business and includes allocations of non-compensation expenses related to managing the business. • “Other operating expenses” within the Retirement Services segment represents expenses incurred in the normal course of business inclusive of compensation and non-compensation expenses. • “Principal investing compensation” within the Principal Investing segment represents realized performance compensation, distributions related to investment income and dividends, and includes allocations of certain compensation expenses related to managing the business. • “Perpetual Capital” means capital of Perpetual Capital Vehicles that is of indefinite duration, which may be withdrawn under certain conditions. • “Perpetual Capital Vehicles” refers to (a) assets that are owned by or related to Athene or Athora Holding Ltd. (“Athora Holding” and together with its subsidiaries, “Athora”) but only to the extent that origination or acquisitions of new liabilities exceed the run off driven by maturity or termination of existing liabilities, (b) assets that are owned by or related to MidCap FinCo Designated Activity Company (“MidCap”) and managed by Apollo, (c) assets of publicly traded vehicles managed by Apollo such as Apollo Investment Corporation (“AINV”), Apollo Commercial Real Estate Finance, Inc. (“ARI”), Apollo Tactical Income Fund Inc. (“AIF”), and Apollo Senior Floating Rate Fund Inc. (“AFT”), in each case that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, (d) assets of Apollo Debt Solutions BDC ("ADS"), a non- traded business development company managed by Apollo, and (e) a publicly traded business development company from which Apollo earns certain investment-related service fees. The investment management agreements of AINV, AIF and AFT have one year terms and the investment management agreement of ADS has an initial term of two years and then is subject to annual renewal. These investment management agreements are reviewed annually and remain in effect only if approved by the boards of directors of such companies or by the affirmative vote of the holders of a majority of the outstanding voting shares of such companies, including in either case, approval by a majority of the directors who are not “interested persons” as defined in the Investment Company Act of 1940. In addition, the investment management agreements of AINV, AIF, AFT and ADS may be terminated in certain circumstances upon 60 days’ written notice. The investment management agreement of ARI has a one year term and is reviewed annually by ARI’s board of directors and may be terminated under certain circumstances by an affirmative vote of at least two-thirds of ARI’s independent directors. The investment management or advisory arrangements between each of MidCap and Apollo, Athene and Apollo and Athora and Apollo, may also be terminated under certain circumstances. The agreement pursuant to which Apollo earns certain investment-related service fees from a non-traded business development company may be terminated under certain limited circumstances. 36

Forward-Looking Statements In this presentation, references to “Apollo,” “we,” “us,” “our” and the “Company” refer collectively to Apollo Global Management, Inc. and its subsidiaries, or as the context may otherwise require. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this presentation, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to the impact of COVID-19, the impact of energy market dislocation, market conditions and interest rate fluctuations generally, our ability to manage our growth, our ability to operate in highly competitive environments, the performance of the funds we manage, our ability to raise new funds, the variability of our revenues, earnings and cash flow, our dependence on certain key personnel, the accuracy of management’s assumptions and estimates, our use of leverage to finance our businesses and investments by the funds we manage, Athene’s ability to maintain or improve financial strength ratings, the impact of Athene’s reinsurers failing to meet their assumed obligations, Athene’s ability to manage its business in a highly regulated industry, changes in our regulatory environment and tax status, litigation risks and our ability to recognize the benefits expected to be derived from the merger of Apollo with Athene, among others. Apollo believes these factors include but are not limited to those described under the section entitled “Risk Factors” in Apollo Asset Management, Inc.'s annual report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 25, 2022 and Athene's annual report on Form 10-K filed with the SEC on February 25, 2022, as such factors may be updated from time to time in Apollo’s, AAM’s or Athene’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in other filings with the SEC. Apollo undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law. This presentation does not constitute an offer of any Apollo fund. 37