CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on November 13, 2023

November 13, 2023

Via EDGAR

Mr. Michael Henderson

Ms. Cara Lubit

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-3628

Re: Athene Holding Ltd

Form 10-K for the Fiscal Year Ended December 31, 2022

Form 8-K dated August 7, 2023

Response dated September 29, 2023

File No. 001-37963

Dear Mr. Henderson and Ms. Lubit:

On behalf of Athene Holding Ltd. (the “Company”), set forth below are responses to the additional comments from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) received in the Commission’s letter dated October 30, 2023 (the “Second Comment Letter”), relating to the Company’s filings on Form 10-K and Form 8-K and the response the Company provided on September 29, 2023 to the initial comment letter received from the Staff on September 18, 2023, referenced above. To facilitate the Staff’s review, the headings and numbered paragraphs of this letter correspond to the headings and paragraph numbers contained in the Second Comment Letter, and we have reproduced the text of the Staff’s comments in bold italics below.

Form 8-K dated August 7, 2023

Exhibit 99.1

Selected Income Statement Data, page 4

1.We note response to comment three, in which you state that your alternative investment portfolio has returned approximately 12%, on average, over the past ten years and that you have based your expectation of returns on this and adjusted down to 11% for conservatism. Please address the items below.

•Explain the reasons and factors you considered in determining that ten years is an appropriate lookback period and how your average and estimated rates of return would be affected by a different (longer or shorter) period.

Athene Holding Ltd.

Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda

Tel: 1.441.279.8400 Fax: 1.441.279.8401

Athene.com

Mr. Michael Henderson and Ms. Cara Lubit

U.S. Securities and Exchange Commission

November 13, 2023

Page 2

Response:

The Company acknowledges the Staff’s comment and respectfully submits that the value of alternative investments may result in short-term, market-driven US GAAP income volatility that is not reflective of the performance of such investments when held for a longer time period in support of long-dated insurance liabilities or insurance company surplus. As a result, the Company’s management team focuses on and presents to investors alternative investment income, and supplements that information by providing alternative investment income normalized to an 11% long-term return as an additional data point that provides insight to investors on the period-to-period comparability of the Company’s non-GAAP operating measures, as well as a basis for developing more realistic expectations for future long-term performance.

The Company includes an additional measure with adjustment to an 11% long-term return to present alternative investment returns that are consistent with management’s long-term expectation of returns for this asset class. The Company's long-term expectation of returns is based on its historical experience. The Company began operating in 2009, acquired 100% of the common shares of Aviva USA (which was renamed Athene USA) in 2013, and in 2016 launched an initial public offering. The Company’s alternative investment holdings were significantly influenced both by investment funds acquired in the Aviva USA acquisition, and to a greater extent by the contribution of investment assets from AAA Guarantor – Athene, L.P. and its subsidiary, Apollo Life Re Ltd., in exchange for Class B shares and other consideration, which was completed in 2013 and 2014. The acquisition of Aviva USA significantly increased the size of the Company, and its business and investment portfolio was subsequently repositioned to implement the Company’s current business and investment strategies. As a result, the alternative investment portfolio for historical periods prior to 2013 was less comparable to the Company’s current alternative investment portfolio in size, composition and strategy, and as a result, management considered that the period beginning with 2013 was most relevant in measuring historical experience as a basis for setting long-term expectations.

In shorter time periods, returns are expected to and do deviate from the long-term expectation, and new investments may have lower returns initially than what the Company expects them to achieve over a longer time horizon.

•Tell us how your long-term expectation of returns for this asset class has compared to actual returns and how you determined that the prior ten years would be reflective of forward-looking long-term performance expectations.

The Company opportunistically allocates approximately 5% – 6% of its investment portfolio to alternative investments, where it primarily focuses on fixed income-like, cash flow-based investments. Individual alternative investments are selected based on the investment’s risk-reward profile, incremental effect on diversification and potential for attractive returns due to sector and/or market dislocations. The Company has a strong preference for alternative investments that have some or all of the following characteristics, among others: (1) investments that constitute a direct investment or an investment in a fund with a high degree of co-

Mr. Michael Henderson and Ms. Cara Lubit

U.S. Securities and Exchange Commission

November 13, 2023

Page 3

investment; (2) investments with credit- or debt-like characteristics (for example, a stipulated maturity and par value), or alternatively, investments with reduced volatility when compared to pure equity; or (3) investments that management believes have less downside risk.

In 2022, the Company contributed the majority of its net alternative investments, with a carrying value of $8 billion, to Apollo Aligned Alternatives, L.P. (AAA), a consolidated variable interest entity, in exchange for limited partnership interests in the fund. The Company’s parent, Apollo Global Management, Inc. (“Apollo”) established AAA for the purpose of providing a single vehicle through which the Company and third-party investors can participate in a portfolio of alternative investments. AAA enhances Apollo’s ability to increase its alternative assets under management by raising capital from third parties, while also allowing the Company to achieve greater scale and diversification for alternative investments. AAA is marketed to third party investors with a targeted return profile aligned with the Company’s long-term, historical alternatives investment returns. Third party investors began to invest in AAA on July 1, 2022, and as of September 30, 2023, AAA has assets of approximately $14 billion including third party capital investment of nearly $4 billion.

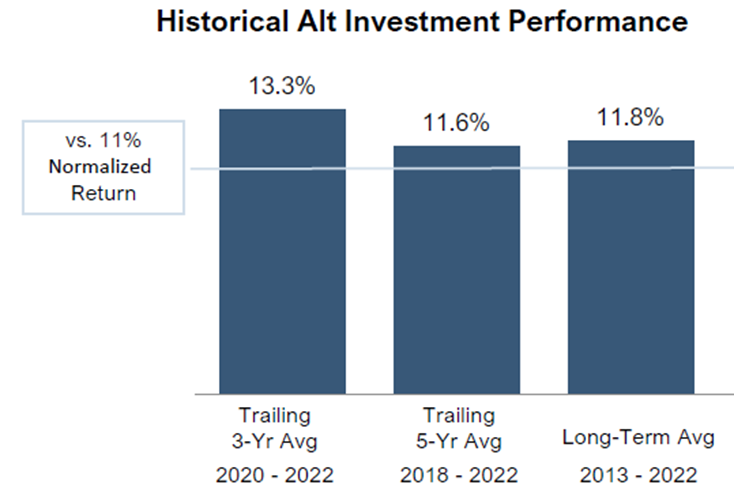

As shown in the graph below, compared to the Company’s long-term expectation of 11% reflected in the normalized return, the Company’s alternative investment portfolio has returned 11.8% annually on average for the period 2013-2022, 11.6% for the period 2018-2022, and 13.3% in the period 2020-2022. Additionally, average returns for the seven-year period 2016-2022 were 10.6% and most recently, alternative investment returns for the third quarter of 2023 were 7.8% on an annualized basis, and 8.2% on average over the twelve months ended September 30, 2023.

The long-term period 2013-2022 included years with annual returns that range from 6.2% to 28.0%, including three years with returns of 6-8%, five years with returns of 9-10% and two years with returns above 20%, which illustrates the wide disparity in the US GAAP basis change

Mr. Michael Henderson and Ms. Cara Lubit

U.S. Securities and Exchange Commission

November 13, 2023

Page 4

in fair value for any individual period. This long-term period includes the impact of significant market volatility, including Brexit, the COVID pandemic, the conflict in Ukraine and significant interest rate increases in 2022, which demonstrates that an 11-12% return has been durable over a long period in a variety of market conditions. Management specifically believes that its long-term experience, starting from 2013 when the current alternative investment strategy was fully implemented, is appropriate because 1) it reflects a sufficiently long duration to represent performance over a range of market conditions and 2) a long-term period is consistent with the Company’s overall investment strategy, which is designed to deliver profitability driven by the spread earned through buying and holding high quality assets that are selected pursuant to an asset-liability management strategy to be similar in duration to the Company’s long-dated insurance liabilities.

•Explain how you determined that 11% is an appropriate adjustment level for conservatism, as well as whether you adjust this level and, if so, under what circumstances.

Response:

The current normalized level of 11% represents management’s long-term annualized return expectation for this asset class, which reflects the Company’s historical long-term results as discussed above, adjusted down to 11% considering that the past ten years included a historically low interest rate environment and overall appreciation in equity markets. In addition, while management’s long-term target for this asset class would generally be 12% or better, management cannot predict the impact of future economic and market conditions, geopolitical disruptions, or the impact of changes in regulatory, fiscal or other governmental policies in the jurisdictions in which we do business and invest, which could cause returns to be lower than those expectations. As discussed above, the 2013-2022 period included some significant disruptions such as Brexit, the COVID pandemic and the conflict in Ukraine, so management believes that assuming a normalizing rate somewhat below the 2013-2022 return of 11.8% is an appropriate point within the range of experience, and consistent with the level the Company uses to manage its business.

As a long-term expectation, management does not expect to change this expectation frequently, unless conditions or factors emerge that warrant adjustment. The Company will continue to assess the actual and expected performance of its alternative investment performance. To date, the long-term normalized rate of return presented has not been adjusted, but the Company may adjust the normalized rate in the future to provide investors with the best estimate of its long-term expectations for this asset class. Examples of factors that could result in an adjustment of the long-term expectation would include experience over a sustained period of time with results that differ from the long-term expectation to an extent sufficient to indicate that the long-term expectations for alternative investment returns should be revised, or a significant change in investment strategy. The results shown in the graph above demonstrate that in shorter time periods, returns are expected to and do deviate from the long-term expectation, such as the trailing three-year average of 13.3%, which is above long-term expectations, and the current period annualized return for the quarter ended September 30, 2023 of 7.8%, which is below the long-term expectation of 11%.

Mr. Michael Henderson and Ms. Cara Lubit

U.S. Securities and Exchange Commission

November 13, 2023

Page 5

2.In addition to the above, please provide us with a more fulsome explanation of your rationale and considerations in determining that this normalization adjustment is not individually tailored accounting. For example, your response states that your adjustment does not change the recognition and measurement principles; however, it is still unclear to us how you reached this conclusion, given that actual recognition and measurement of alternative investment income, as reflected in your financial statements under U.S. GAAP, are not fixed at 11%.

Response:

The Company acknowledges the Staff’s comment and respectfully submits that such adjustment to alternative investment returns is intended as supplemental data only, and does not result in the use of an individually tailored accounting presentation in the Company’s primary non-GAAP operating measures, spread related earnings, investment spread and net investment spread (the “primary non-GAAP operating measures”). The primary non-GAAP operating measures do not change the recognition and measurement principles for revenue or expenses required to be applied in accordance with US GAAP. The adjustment to normalize alternative investment returns for purposes of spread related earnings – normalized, net spread – normalized, and net investment spread – normalized (the “supplemental non-GAAP operating measures”) provides investors with additional data points intended to provide insight on the long-term performance of this asset class, which is based on management’s expectations as well as historical results over a longer time horizon, in contrast to returns that reflect the short-term changes in fair value, which are reflected in both US GAAP net income and in the Company’s primary non-GAAP operating measures.

Additionally, such adjustment does not represent smoothing to the extent it does not eliminate charges or gains related to alternative investments that are non-recurring, infrequent or unusual, nor does it remove specific alternative investment items or transactions. The normalization adjustment to 11% is applied consistently from period to period, without regard to whether the impact of short-term changes in fair value of alternative investments reflected in the reported US GAAP and in the primary non-GAAP operating measures is negative or positive in the current period, which is consistent with how management evaluates the performance of the business.

In reporting periods before the Company began providing the supplemental non-GAAP operating measures, the investment community frequently posed questions seeking to determine to what extent the Company’s primary non-GAAP operating measures included short-term changes in fair value of alternative investments reported under US GAAP and how much that deviated from management’s long-term expectations of investment returns for this asset class.

Mr. Michael Henderson and Ms. Cara Lubit

U.S. Securities and Exchange Commission

November 13, 2023

Page 6

Examples of such questions from earnings call transcripts include:

•On the alternative investment income in the quarter, can you help us think through how much of that was from marking to market?

•Could you give us the marks on the three alternative investments that you highlighted and give us a sense of what the alternative return was, excluding those three investments?

•So this quarter, it was not correlated to the broad markets, though, when we look back at the first two quarters of 2020 when the public markets were negative, we also saw Athene's alternative portfolio negatively marked. So we have this situation where sometimes the returns seem to be correlated or at least related to the public market comps and other times they're not. So how should we think about the underlying returns of the alt portfolio over time?

As a result of such questions, as well as the explanations frequently required to articulate how much short-term volatility was reflected in the primary non-GAAP operating measures and the extent to which that differed from management’s long-term expectations, management determined that regularly providing additional normalized measures to supplement the Company’s primary non-GAAP operating measures would be useful to investors. In addition, the normalized basis is consistent with returns assumed by management in pricing and long-term forecasting of the business.

In the third quarter 2023 and future 8-K filings, the Company has made changes to ensure that the presentation of normalized non-GAAP measures is appropriately accompanied by or referenced to a description of why and how such measures are used and why they are valuable to investors, as noted in the previous response.

Insurance companies registered under the Exchange Act often present alternative investment income normalized to a long-term return. As such, by reporting this measure, the Company also provides investors a measure to assess performance which does not substantially diverge from the practice among its peer companies.

Should any member of the Staff have any questions or comments concerning the responses submitted herein, please do not hesitate to contact me at (515) 342-3860.

Sincerely,

/s/ Martin P. Klein

Martin P. Klein

Executive Vice President and Chief Financial Officer, Athene Holding Ltd.