425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on October 14, 2021

Filed by Apollo Global Management, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 and Rule 14d-2(b)

under the Securities Exchange Act of 1934

Subject Company: Athene Holding Ltd.

Athene / Apollo Merger Summary of Warrant Treatment October 14, 2021

Disclaimer The following pages summarize the treatment of the various warrants issued by Athene Holding Ltd. (“Athene” or the “Company”) in light of the business combination between Athene and Apollo Global Management, Inc. (“Apollo”). The summary information is qualified in its entirety by reference to the actual terms of the warrant agreements and other agreements and instruments referred to in the presentation, including the Agreement and Plan of Merger, by and among Athene, Apollo, Tango Holdings, Inc. (“Tango Holdings”), Blue Merger Sub, Ltd., and Green Merger Sub, Inc. All capitalized terms relating to the warrants have the meanings set forth in the applicable warrant agreement. This information should not be considered complete and may not contain all of the information about the warrants and such other agreements and instruments that are important to you. We urge you to read carefully the warrant agreements applicable to you as the terms of the warrants are governed by the warrant agreements and not by this summary. We also urge you to discuss your warrants with your accounting, legal and tax advisors. Neither Athene nor Apollo assumes any liability for any of the information provided in this presentation.

Treatment of Warrants in the Merger In February 2020, Athene issued warrants to current and former employees upon the closing of a strategic transaction with Apollo, in which Apollo and Athene exchanged shares such that Apollo increased its ownership in Athene to 35% and Athene took a 7% stake in Apollo The warrants were granted to current and former employees in partial consideration for Class M common shares that were held by the warrant holders prior to the February 2020 transaction The warrants are exercisable for Class A common shares of Athene The warrants were fully vested upon their issuance In March 2021, Athene and Apollo announced their pending business combination. Converting Athene warrants into equivalent warrants of Tango Holdings may be a taxable event that would accelerate significant capital gains for holders Instead, upon the closing of the mergers, warrant holders will receive Tango Holdings common stock in an amount representing the full fair value of their warrants in a non-taxable exchange Fair value will be calculated at the closing of the mergers using the Black-Scholes option pricing model and will include the ‘option value’ in excess of the intrinsic value the warrants would receive if they were exercised today The Black-Scholes calculation will utilize the same assumptions that Athene has used historically, including for the issuance of the warrants in February 2020 and in regular financial reporting Term: 10 years (for warrants issued in exchange for former M-4 shares) Risk-free rate: U.S. treasury yield curve corresponding to term Volatility: Based on Athene’s historical stock price performance, with adjustment for outsized volatility during COVID A third party will review the final calculations and assumptions

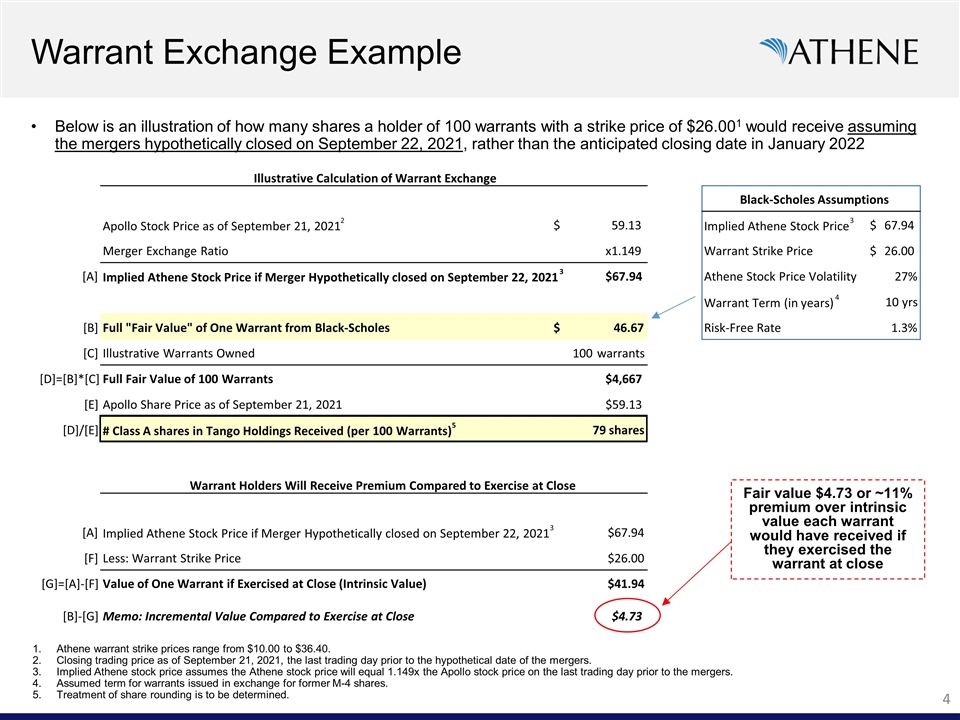

Below is an illustration of how many shares a holder of 100 warrants with a strike price of $26.001 would receive assuming the mergers hypothetically closed on September 22, 2021, rather than the anticipated closing date in January 2022 Warrant Exchange Example Athene warrant strike prices range from $10.00 to $36.40. Closing trading price as of September 21, 2021, the last trading day prior to the hypothetical date of the mergers. Implied Athene stock price assumes the Athene stock price will equal 1.149x the Apollo stock price on the last trading day prior to the mergers. Assumed term for warrants issued in exchange for former M-4 shares. Treatment of share rounding is to be determined. Fair value $4.73 or ~11% premium over intrinsic value each warrant would have received if they exercised the warrant at close Illustrative Calculation of Warrant Exchange Black-Scholes Assumptions Apollo Stock Price as of September 21, 2021 2 59.13 $ Implied Athene Stock Price 3 67.94 $ Merger Exchange Ratio x1.149 Warrant Strike Price 26.00 $ [A] Implied Athene Stock Price if Merger Hypothetically closed on September 22, 2021 3 $67.94 Athene Stock Price Volatility 27% Warrant Term (in years) 4 10 yrs [B] Full "Fair Value" of One Warrant from Black-Scholes 46.67 $ Risk-Free Rate 1.3% [C] Illustrative Warrants Owned 100 warrants [D]=[B]*[C] Full Fair Value of 100 Warrants $4,667 [E] Apollo Share Price as of September 21, 2021 $59.13 [D]/[E] # Class A shares in Tango Holdings Received (per 100 Warrants) 5 79 shares [A] Implied Athene Stock Price if Merger Hypothetically closed on September 22, 2021 3 $67.94 [F] Less: Warrant Strike Price $26.00 [G]=[A]-[F] Value of One Warrant if Exercised at Close (Intrinsic Value) $41.94 [B]-[G] Memo: Incremental Value Compared to Exercise at Close $4.73 Warrant Holders Will Receive Premium Compared to Exercise at Close

Legal Disclosure Additional Information Regarding the Transaction and Where to Find It This document is being made in respect of the proposed transaction involving Tango Holdings, Apollo, and the Company. The proposed transaction will be submitted to the stockholders of Apollo and the shareholders of the Company for their respective consideration. In connection therewith, the parties intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive proxy statement, which will be mailed to the stockholders of Apollo and the shareholders of the Company. However, such documents are not currently available. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, AS APPLICABLE, INVESTORS AND SECURITY HOLDERS OF APOLLO AND THE COMPANY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive joint proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about Apollo and the Company, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Apollo will be available free of charge under the “Stockholders” section of Apollo’s website located at http://www.apollo.com or by contacting Apollo’s Investor Relations Department at (212) 822-0528 or APOInvestorRelations@apollo.com. Copies of the documents filed with the SEC by the Company will be available free of charge under the “Investors” section of the Company’s website located at http://www.athene.com or by contacting the Company’s Investor Relations Department at (441) 279-8531 or ir@athene.com. Participants in the Solicitation Apollo, the Company, and Tango Holdings and their respective directors, executive officers, members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Apollo and Tango Holdings is set forth in Apollo’s proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on August 16, 2021, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Information about the directors and executive officers of the Company and Tango Holdings is set forth in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, its amendment to its annual report on Form 10-K/A for the fiscal year ended December 31, 2020, which was filed with the SEC on April 20, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitations of the stockholders of Apollo and the shareholders of the Company, and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements and other relevant materials to be filed with the SEC when they become available.