425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on March 8, 2021

Filed by Apollo Global Management, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 and Rule 14d-2(b)

under the Securities Exchange Act of 1934

Subject Company: Athene Holding Ltd.

(Commission File No. 001-37963)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2021

Apollo Global Management, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35107 | 20-8880053 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

9 West 57th Street, 43rd Floor, New York, New York 10019

(Address of principal executive offices) (Zip Code)

Registrants telephone number, including area code: (212) 515-3200

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Class A Common Stock | APO | New York Stock Exchange | ||

| 6.375% Series A Preferred Stock | APO.PR A | New York Stock Exchange | ||

| 6.375% Series B Preferred Stock | APO.PR B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement |

Agreement and Plan of Merger

On March 8, 2021, Apollo Global Management, Inc., a Delaware corporation (AGM), entered into an Agreement and Plan of Merger (the Merger Agreement) with Athene Holding Ltd., a Bermuda exempted company (AHL), Tango Holdings, Inc., a Delaware corporation and a direct wholly owned subsidiary of AGM (HoldCo), Blue Merger Sub, Ltd., a Bermuda exempted company and a direct wholly owned subsidiary of HoldCo (AHL Merger Sub), and Green Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of HoldCo (AGM Merger Sub and, together with AHL Merger Sub, the Merger Subs).

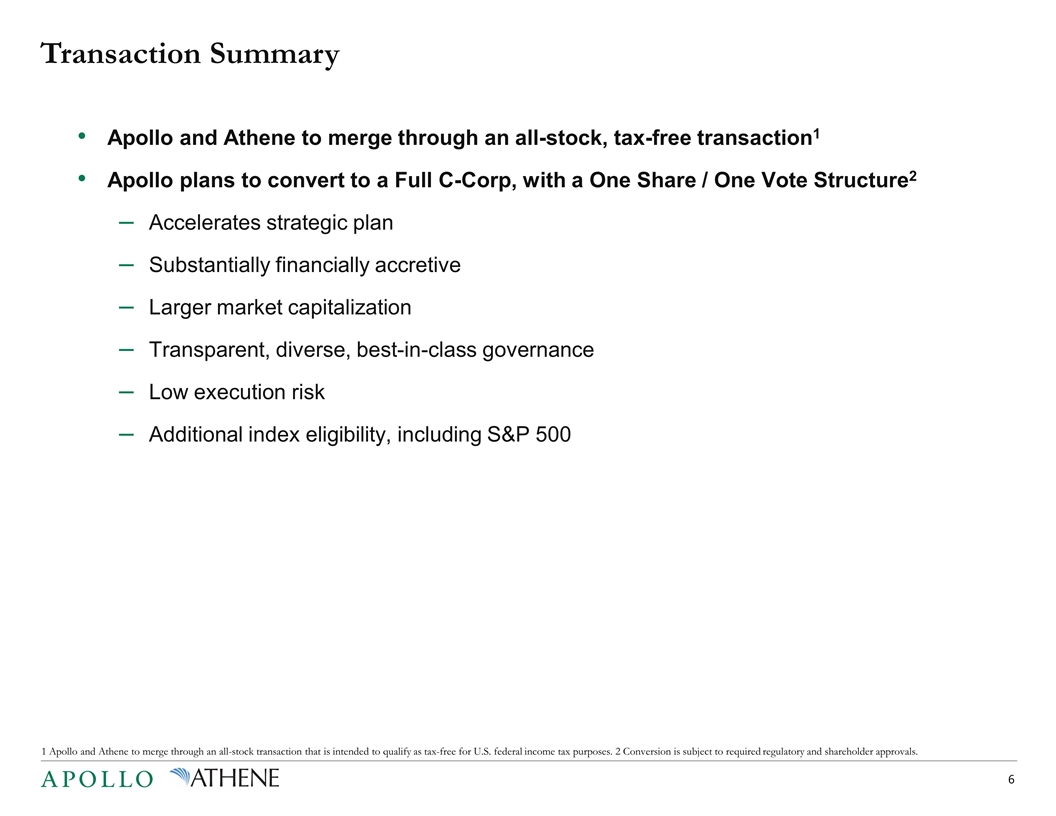

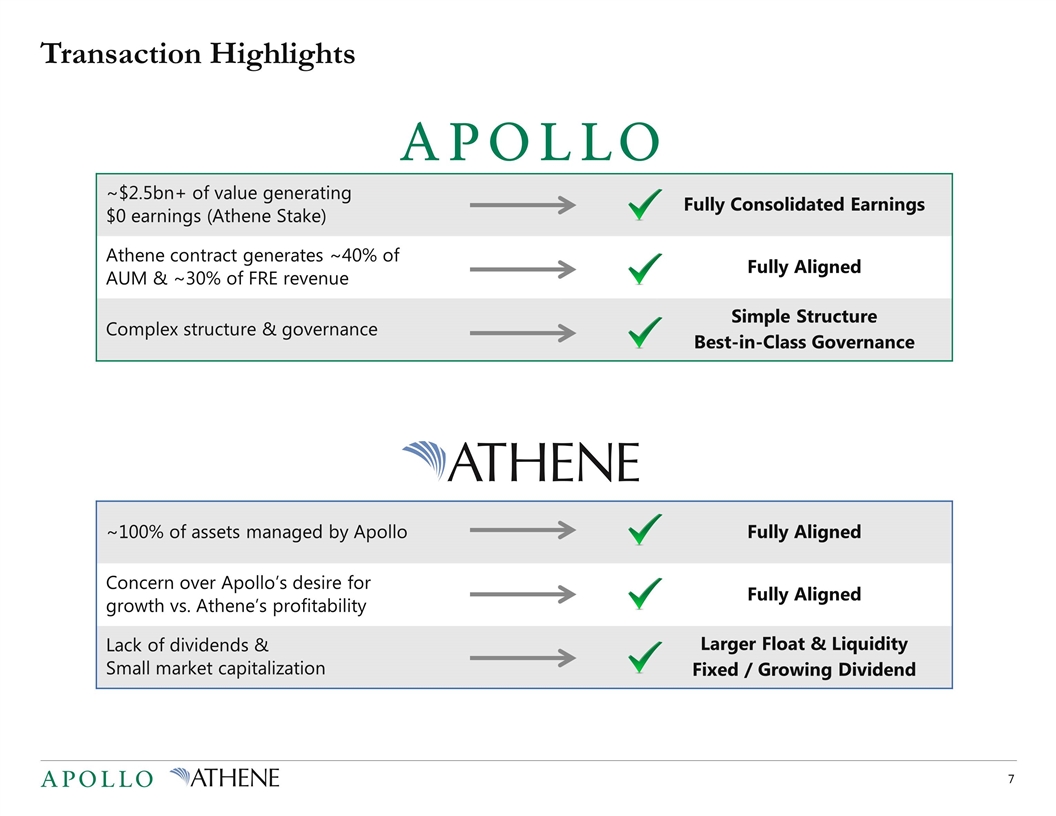

The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, AGM and AHL will effect an all-stock merger transaction to combine their respective businesses through: (a) the merger of AHL Merger Sub with and into AHL (the AHL Merger), with AHL as the surviving entity in the AHL Merger and a direct wholly owned subsidiary of HoldCo (the AHL Surviving Entity), and (b) the merger of AGM Merger Sub with and into AGM (the AGM Merger and, together with the AHL Merger, the Mergers) with AGM as the surviving entity in the AGM Merger and a direct wholly owned subsidiary of HoldCo (the AGM Surviving Entity). The Mergers are intended to become effective concurrently and, upon the consummation of the Mergers, AGM and AHL will be direct wholly owned subsidiaries of HoldCo, which will be renamed Apollo Global Management, Inc. following the closing of the transactions contemplated by the Merger Agreement.

Upon the terms and subject to the conditions of the Merger Agreement, which has been approved by the boards of directors of both companies, as well as the conflicts committee of AGMs board and a special committee of certain disinterested members of the board of directors of AHL, at the effective time of the AHL Merger, each issued and outstanding share of AHL Class A common stock, par value $0.001 per share (AHL Shares) (other than AHL Shares held by AHL as treasury shares (including HoldCo, the Merger Subs and the respective controlled funds of AGM or any direct or indirect wholly owned subsidiary of AGM)), will be converted automatically into the right to receive 1.149 (the Exchange Ratio) duly authorized, validly issued, fully paid and nonassessable shares of Class A common stock, par value $0.00001 per share, of HoldCo (such shares, HoldCo Shares) and any cash paid in lieu of fractional HoldCo Shares. No fractional HoldCo Shares will be issued in connection with the AHL Merger, and AHLs shareholders will receive cash in lieu of any fractional HoldCo Shares.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the AGM Merger, each issued and outstanding share of AGM Class A common stock, par value $0.00001 per share (AGM Shares) (other than AGM Shares (a) held by AGM as treasury shares or (b) by AGM Merger Sub or any direct or indirect wholly owned subsidiary of AGM) will be converted automatically into one (1) HoldCo Share. Upon closing of the transactions contemplated by the Merger Agreement, current AGM stockholders will own approximately 76% of HoldCo on a fully diluted basis, and AHL shareholders will own approximately 24%.

At the effective time of the AGM Merger, each of the issued and outstanding series of preferred shares of AGM will remain issued and outstanding as preferred shares of the AGM Surviving Entity, and at the effective time of the AHL Merger, each of the issued and outstanding preferred shares of AHL will remain issued and outstanding as preferred shares of the AHL Surviving Entity, in each case as described further in the Merger Agreement.

At the effective time of the AHL Merger, each of the issued and outstanding warrants of AHL that is outstanding immediately prior to the effective time of the AHL Merger will, automatically and without any action on the part of the holder of an AHL warrant, remain outstanding in accordance with its terms, or, alternatively, be exchanged for such consideration from HoldCo in connection with the transactions contemplated by the Merger Agreement as may be agreed in writing by AGM and AHL prior to the effective time of the AHL Merger.

At the effective time of the AHL Merger, each outstanding option to purchase AHL Shares, award of restricted AHL Shares and award of AHL restricted share units will be converted into a similar award (with the same terms and conditions) with respect to HoldCo Shares based on the Exchange Ratio, in each case, as described further in the Merger Agreement; except that outstanding awards of restricted AHL Shares and AHL restricted share units, in each case, that are subject to performance-based vesting conditions, will convert into time-based awards with respect to HoldCo Shares based on the applicable target-level of performance and will vest at the end of the applicable performance period.

1

At the effective time of the AGM Merger, each outstanding option to purchase AGM Shares, award of restricted AGM Shares and award of AGM restricted share units will be converted into a similar award (with the same terms and conditions, including any performance conditions) with respect to HoldCo Shares, in each case, as described further in the Merger Agreement.

Facility Option

The Merger Agreement permits AGM to exercise its option to increase its common share holding in AHL pursuant to the Shareholders Agreement, dated as of February 28, 2020, by and among AHL and the parties thereto, as may be amended.

Board of Directors of HoldCo

The Merger Agreement provides that the board of directors of HoldCo immediately following the effective time of the AHL Merger will consist of (i) four (4) directors selected by the disinterested members of the board of directors of AHL and reasonably acceptable to AGM, of which three (3) must qualify as an independent director under the listing standards of the New York Stock Exchange and the applicable rules of the SEC, (ii) the directors of AGM in office immediately prior to the effective time of the AHL Merger, and (c) no more than eighteen (18) directors in the aggregate.

Conditions and Regulatory Efforts

Consummation of the Mergers is subject to certain conditions, including approval of the AHL Merger by AHL shareholders and approval of the AGM Merger by AGM stockholders. Further conditions include the receipt of required regulatory approvals, the absence of any injunction or order restraining the Mergers, the declaration of effectiveness of the registration statement on Form S-4 pursuant to which HoldCo Shares issued in the AGM Merger and the AHL Merger will be registered under the Securities Act, and the completion in all respects of the contemplated restructuring of AGM in respect of potential governance changes and related transactions concurrently with the consummation of the Mergers. AGM and AHL make customary covenants to use their respective reasonable best efforts (subject to certain qualifications) to take all actions necessary to cause the conditions to closing to be satisfied as promptly as reasonably practicable, including using their respective reasonable best efforts to obtain all necessary governmental and regulatory approvals.

Representations, Warranties and Covenants

The Merger Agreement contains customary representations and warranties from both AGM and AHL, and also contains customary covenants, including covenants, subject to certain exceptions, to conduct their respective operations in the ordinary course during the period between the execution of the Merger Agreement and the closing of the Mergers and not to engage in certain types of transactions during this period.

No Solicitation; Change of Recommendation

The Merger Agreement contains a no shop provision that restricts AHLs ability to solicit third-party acquisition proposals or provide information to or engage in discussions or negotiations with third parties that have made or might make an acquisition proposal for AHL. The no shop provision is subject to a provision that allows AHL, under certain circumstances and in compliance with certain obligations, to provide information and participate in discussions and negotiations with respect to an unsolicited written third-party acquisition proposal where the board of directors of AHL determines that such proposal is reasonably expected to result in a Superior Proposal (as defined in the Merger Agreement) and that failure to do so would be inconsistent with the directors fiduciary duties under Bermuda law.

Under certain limited circumstances and in compliance with certain obligations, AHL may change its recommendation with respect to the AHL Merger and the Merger Agreement where the board of directors of AHL determines that failure to do so would be inconsistent with the directors fiduciary duties under Bermuda law.

Under certain limited circumstances and in compliance with certain obligations, AGM may change its recommendation with respect to the AGM Merger and the Merger Agreement where the board of directors of AGM determines that failure to do so would be inconsistent with the directors fiduciary duties under Delaware law.

2

Termination

The Merger Agreement contains certain termination rights and provides that, upon termination of the Merger Agreement in the event (i) the board of directors of AGM withdraws, suspends, withholds or, in any manner adverse to AHL, amends its recommendation of approval of the AGM Merger and the Merger Agreement by AGM stockholders and (ii) AGM stockholder approval of the AGM Merger and the Merger Agreement is not obtained at the AGM stockholder meeting at which the AGM Merger and the Merger Agreement is submitted for approval, then AGM will be obligated to pay AHL a cash termination fee of $81,900,000.

Voting Matters

The Merger Agreement provides that AGM will vote (or cause to be voted) any AHL Shares beneficially owned by it or any of its subsidiaries in favor of the approval of the Merger Agreement, the Statutory Merger Agreement (as defined in the Merger Agreement) and the AHL Merger at any meeting of AHL shareholders at which the Merger Agreement, the Statutory Merger Agreement and the AHL Merger will be submitted for approval.

The Merger Agreement provides that AHL will vote (or cause to be voted) any AGM Shares it or any of its subsidiaries owns or has the power to vote or cause to be voted in favor of the AGM Merger at any meeting of AGM stockholders at which the AGM Merger will be submitted for approval. However, AHLs obligation (i) will be subject to and only given effect to the extent such obligations would be consistent with the fiduciary duties of the board of directors of AHL under Bermuda law and (ii) will terminate in full in the event the board of directors of AHL withdraws, suspends, withholds or, in any manner adverse to AGM, amends its recommendation of approval of the Merger Agreement, the Statutory Merger Agreement and the AHL Merger by AHL shareholders.

The foregoing description of the Merger Agreement and the transactions contemplated thereby does not purport to be complete and is subject to and qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Merger Agreement has been included solely to provide investors and security holders with information regarding its terms. It is not intended to be a source of financial, business or operational information about AGM, AHL or their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Merger Agreement are made only for purposes of the agreement and are made as of specific dates; are solely for the benefit of the parties; may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Merger Agreement, including being qualified by confidential disclosures made for the purpose of allocating contractual risk between the parties instead of establishing matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of AGM, AHL or their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in public disclosures.

| Item 8.01 | Other Events |

Voting Agreement

On March 8, 2021, AHL entered into a voting agreement with Leon Black, Joshua Harris and Marc Rowan (collectively, the AGM Founders, and such agreement, the Voting Agreement), who hold (i) approximately 6% of the issued and outstanding AGM Shares and (ii) through BRH Holdings GP, Ltd., the one (1) issued and outstanding share of Class B common stock of AGM, par value $0.00001 per share (the AGM Class B Common Stock, together with the AGM Shares held by the AGM Founders, the Subject Shares). The Voting Agreement, among other things, requires that the AGM Founders vote (or cause to be voted) substantially all of the Subject Shares and any Tiger AGM Shares (as defined below) in favor of adopting the Merger Agreement and the AGM Merger and against certain other transactions. As of March 8, 2021, Subject Shares and Tiger AGM Shares that are, in each case, subject to the Voting Agreement constitute approximately 58% of the aggregate voting power of AGMs Class A common stock and Class B common stock. If the AGM Board makes an adverse recommendation to the AGM shareholders in connection with the transactions contemplated by the Merger Agreement, the Voting Agreement provides that the number of Subject Shares and Tiger AGM Shares that the AGM Founders are required to vote (or cause to be voted) shall not exceed 35% of the aggregate voting power of AGMs Class A common stock and Class B common stock. The Voting Agreement will terminate upon the earlier of the termination of the Merger Agreement and certain other specified events.

3

As used above, Tiger AGM Shares refers to the AGM Shares owned by advisory clients of Tiger Global Management, LLC and/or its related persons proprietary accounts (Tiger) that are subject to an irrevocable proxy pursuant to which AGM Management, LLC, AGMs Class C Stockholder (the Class C Stockholder), has the right to vote all of such AGM Shares at any meeting of AGM stockholders and in connection with any written consent by AGM stockholders as determined in the sole discretion of the Class C Stockholder.

Communications

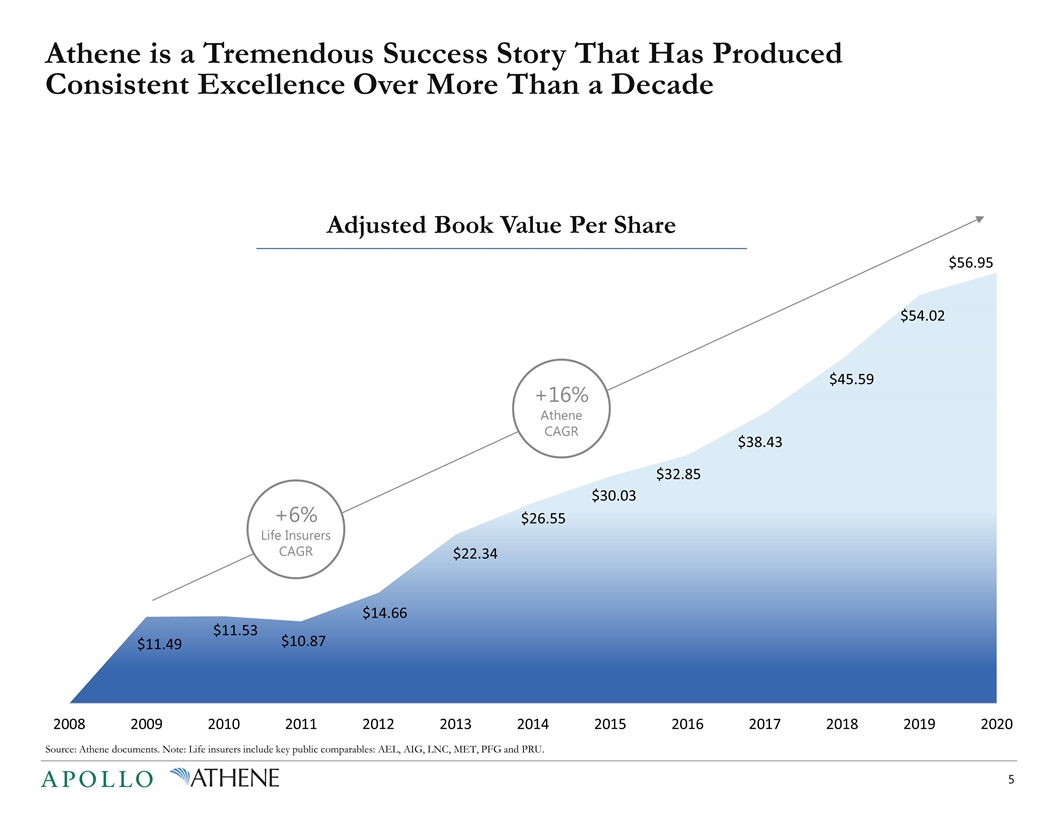

On March 8, 2021, AGM and AHL issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

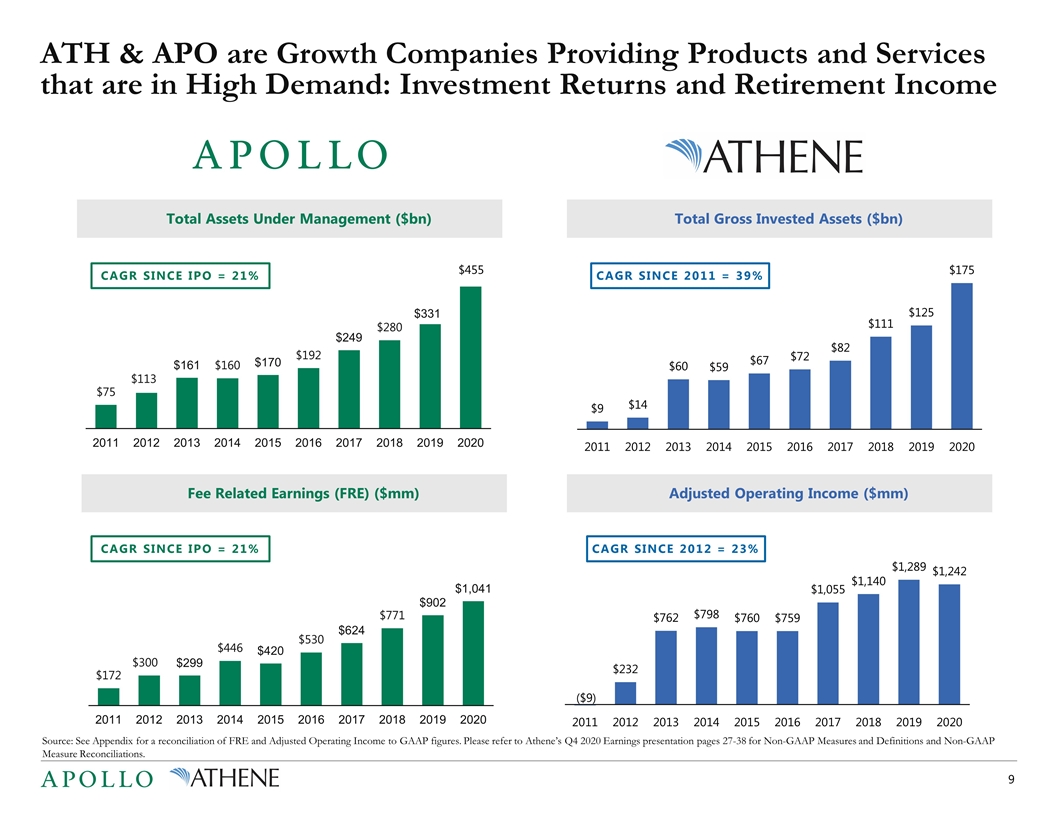

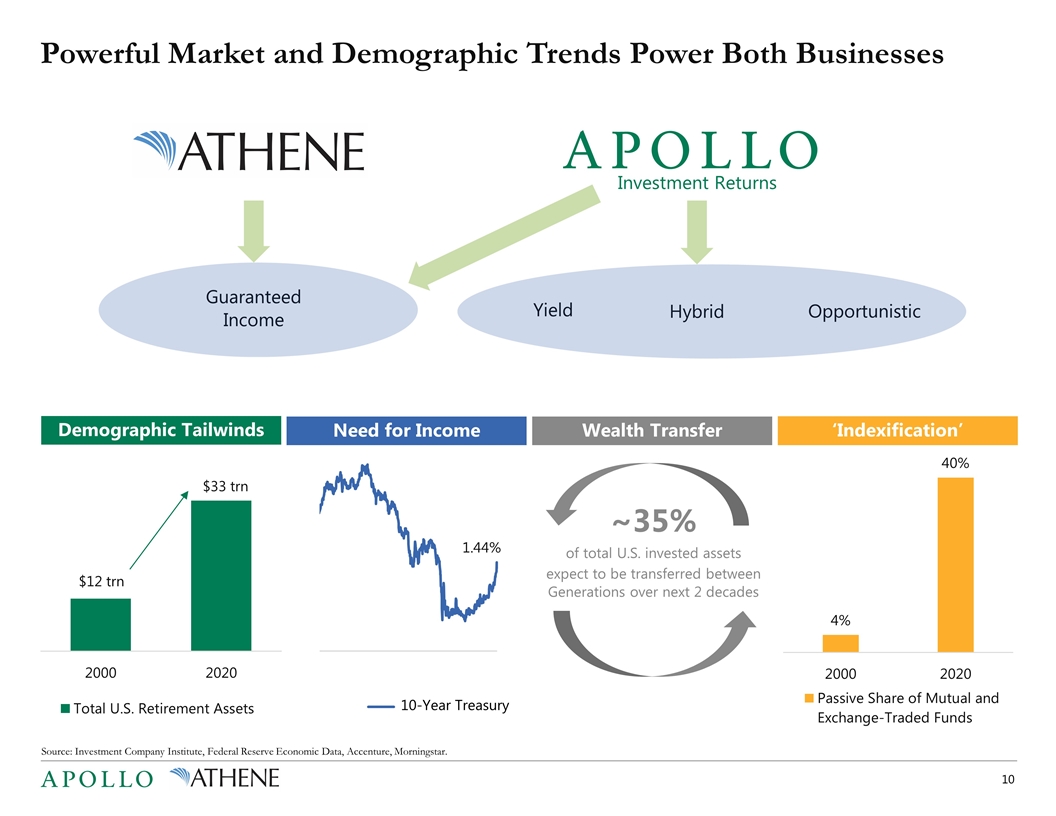

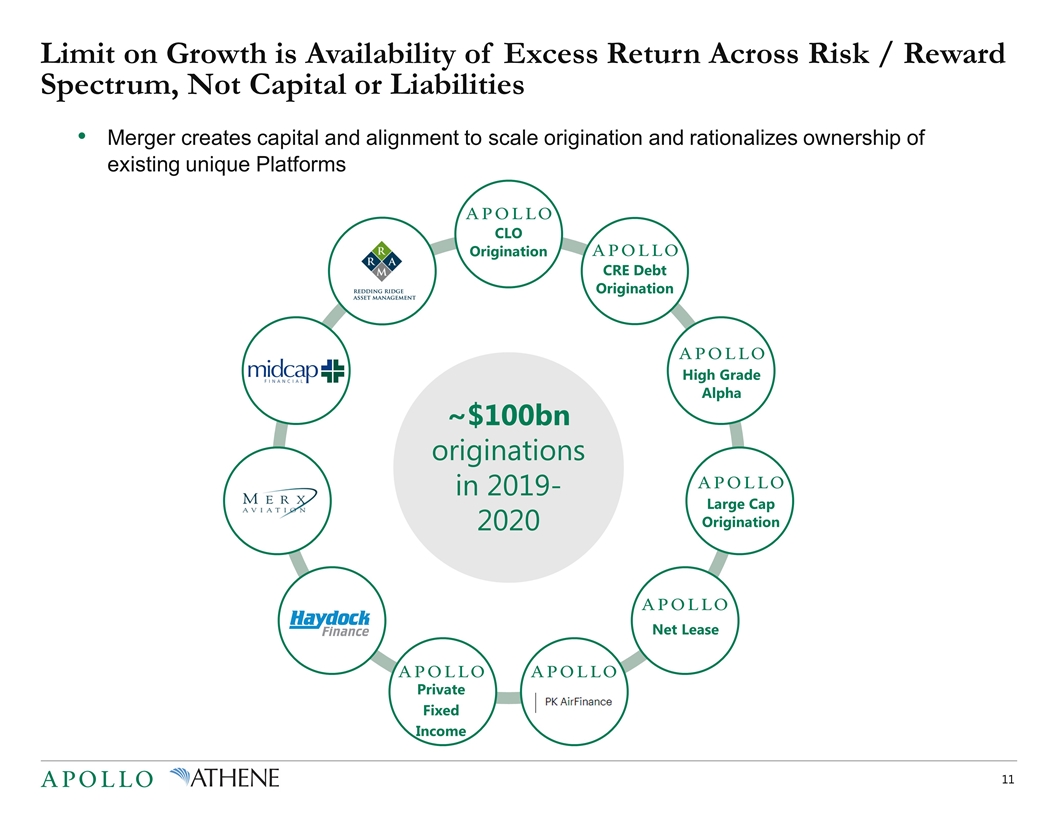

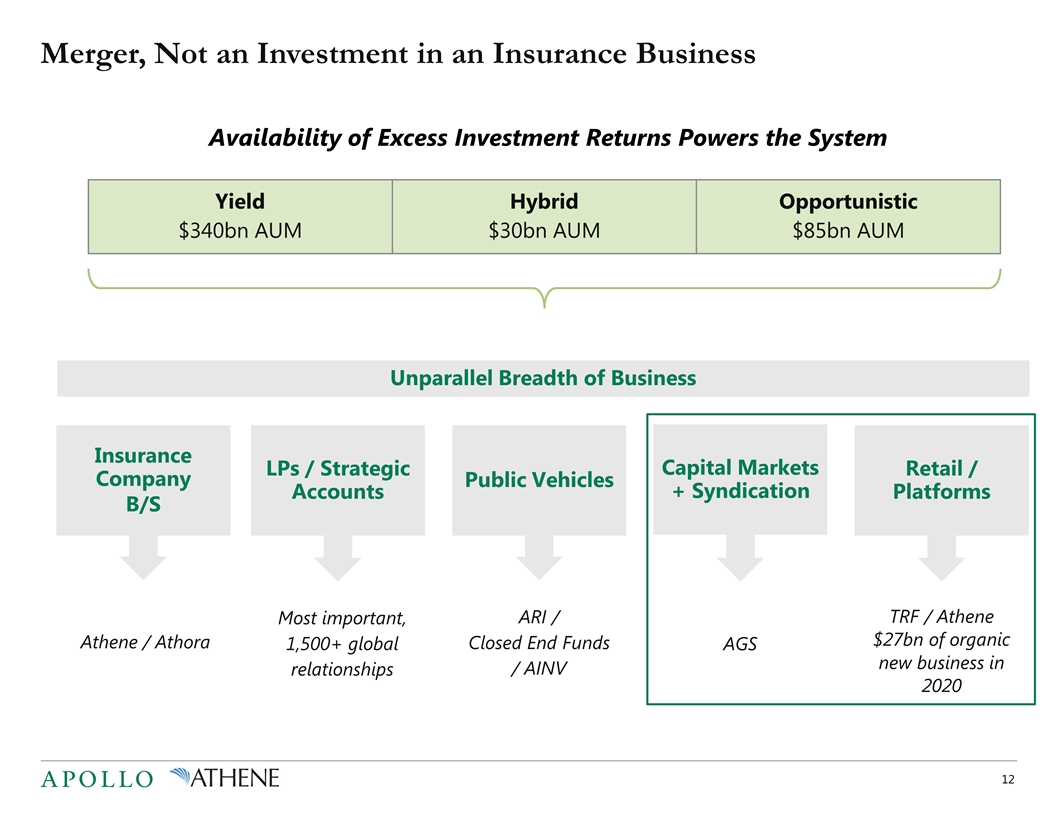

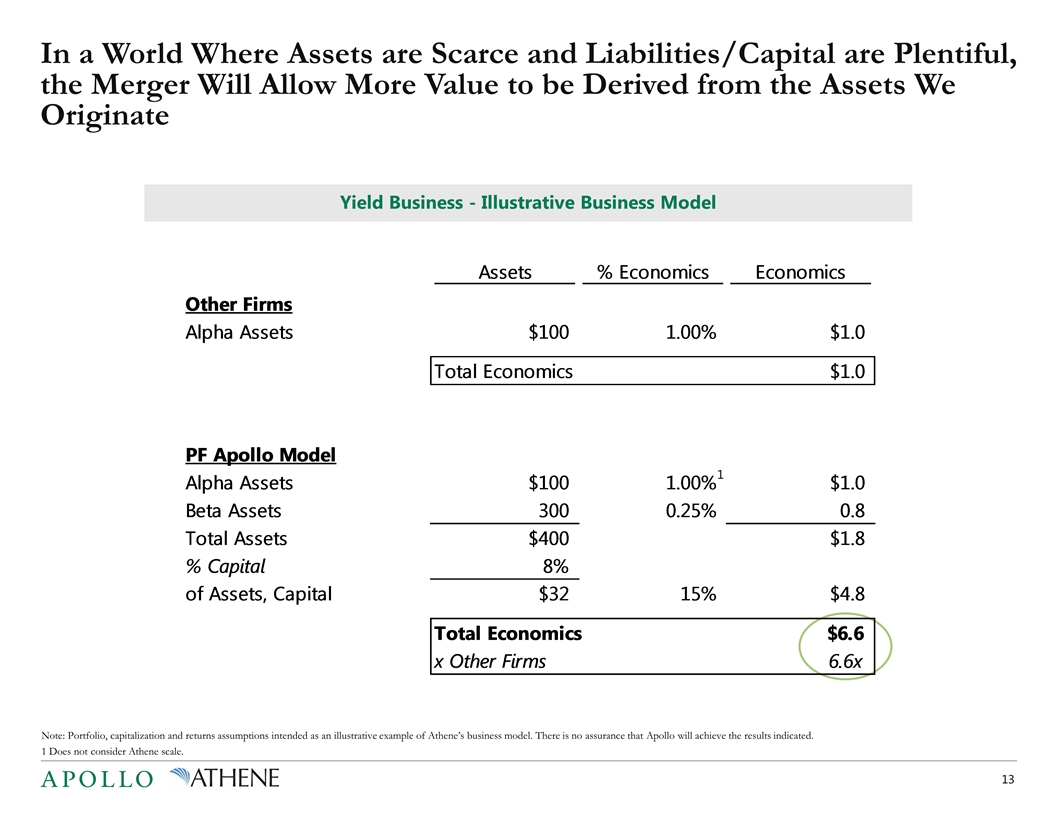

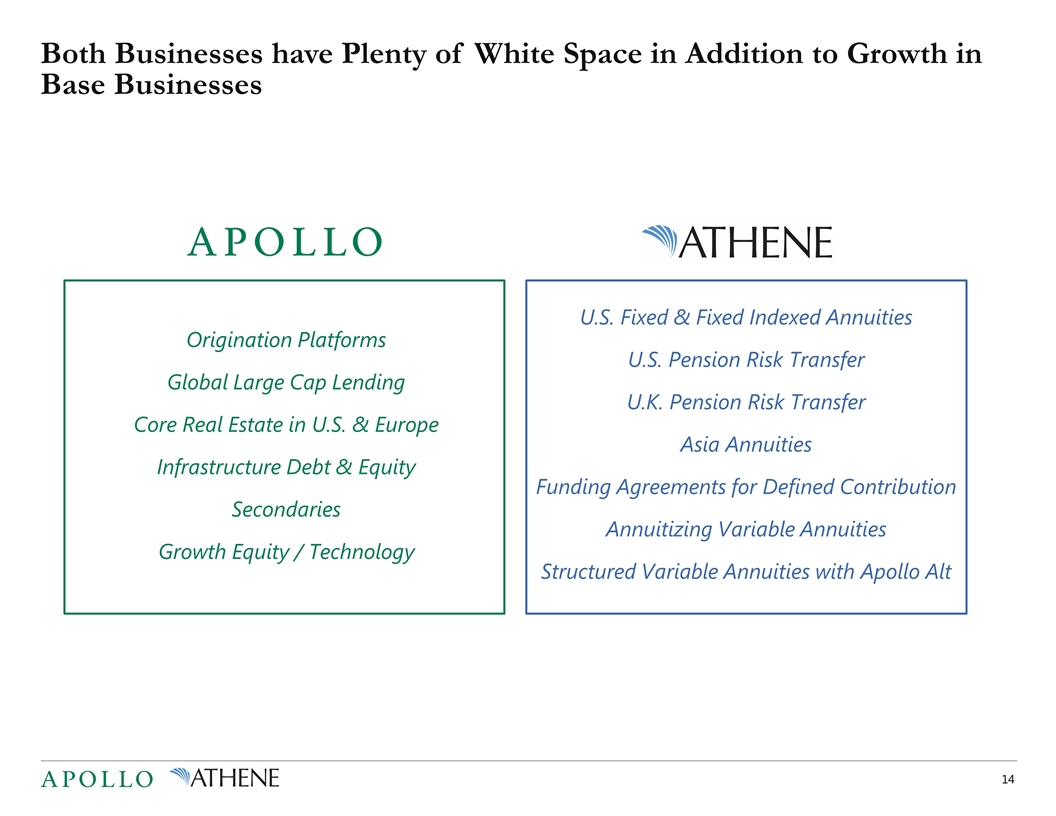

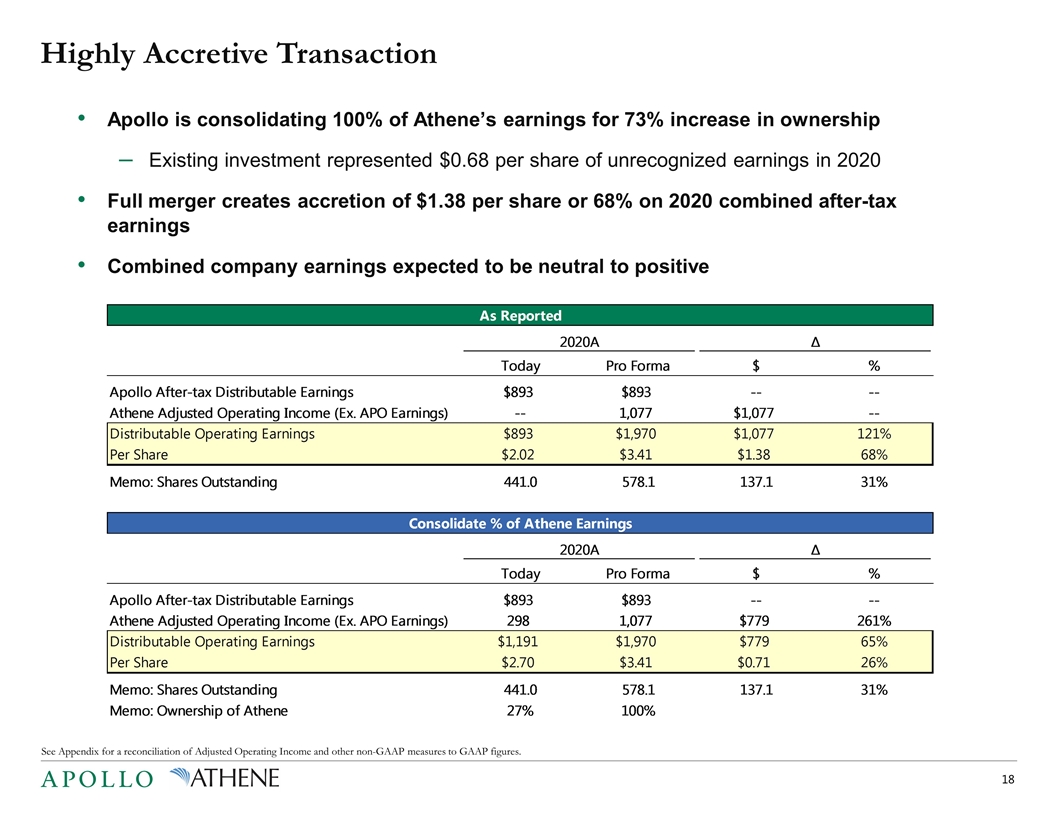

On March 8, 2021, AGM and AHL held a joint conference call with analysts and investors regarding the transactions contemplated by the Merger Agreement. A copy of the materials that was presented during such conference call is posted on the Stockholders section of AGMs website at https://www.apollo.com/stockholders and is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. A transcript of the call is furnished as Exhibit 99.8 to this Current Report on Form 8-K.

On March 8, 2021, AGM issued a letter to its limited partners announcing the execution of the Merger Agreement. A copy of the letter is furnished as Exhibit 99.3 to this Current Report on Form 8-K and is incorporated herein by reference.

On March 8, 2021, AGM distributed an e-mail to its employees announcing the execution of the Merger Agreement. A copy of the e-mail is furnished as Exhibit 99.4 to this Current Report on Form 8-K and is incorporated herein by reference.

On March 8, 2021, AGM disseminated a Tweet announcing the execution of the Merger Agreement. A copy of the Tweet is furnished as Exhibit 99.5 to this Current Report on Form 8-K and is incorporated herein by reference.

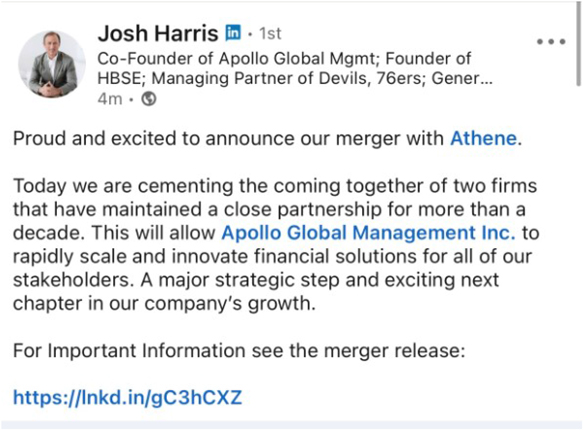

On March 8, 2021, AGM posted a message on LinkedIn announcing the execution of the Merger Agreement. A copy of the message is furnished as Exhibit 99.6 to this Current Report on Form 8-K and is incorporated herein by reference.

On March 8, 2021, Joshua Harris posted a message on LinkedIn announcing the execution of the Merger Agreement. A copy of the message is furnished as Exhibit 99.7 to this Current Report on Form 8-K and is incorporated herein by reference.

* * *

The information in this Current Report on Form 8-K, including Exhibits 99.1 through 99.8, contains forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, discussions related to AGMs expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on managements beliefs, as well as assumptions made by, and information currently available to, management. When used in this Current Report on Form 8-K, the words believe, anticipate, estimate, expect, intend and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. It is possible that actual results will differ, possibly materially, from the anticipated results indicated in these statements. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to AGMs dependence on certain key personnel, AGMs ability to raise new private equity, credit or real assets funds, the impact of COVID-19, the impact of energy market dislocation, market conditions, generally, AGMs ability to manage its growth, fund performance, changes in AGMs regulatory environment and tax status, the variability of AGMs revenues, net income and cash flow, AGMs use of leverage to finance its businesses and investments by

4

AGM funds, litigation risks and potential governance changes and related transactions which are subject to regulatory, corporate and shareholder approvals, among others. Due to the COVID-19 pandemic, there has been uncertainty and disruption in the global economy and financial markets. While AGM is unable to accurately predict the full impact that COVID-19 will have on AGMs results from operations, financial condition, liquidity and cash flows due to numerous uncertainties, including the duration and severity of the pandemic and containment measures, AGMs compliance with these measures has impacted AGMs day-to-day operations and could disrupt AGMs business and operations, as well as that of the AGM funds and their portfolio companies, for an indefinite period of time. AGM believes these factors include but are not limited to those described under the section entitled Risk Factors in AGMs annual report on Form 10-K filed with the SEC on February 19, 2021, as such factors may be updated from time to time in AGMs periodic filings with the SEC, which are accessible on the SECs website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Current Report on Form 8-K and in other filings.

The proposed transaction contemplated by the Merger Agreement is subject to risks, uncertainties and assumptions, which include, but are not limited to: (i) that AGM may be unable to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant or place material restrictions on its approval for the consummation of the proposed transaction; (ii) uncertainty as to the timing of completion of the proposed transaction; (iii) the inability to complete the proposed transaction due to the failure to obtain AGM stockholder approval and AHL shareholder approval for the proposed transaction; (iv) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (v) risks related to disruption of managements attention from AGMs ongoing business operations due to the proposed transaction; (vi) the effect of the announcement of the proposed transaction on AGMs relationships with its clients, operating results and business generally; (vii) the outcome of any legal proceedings to the extent initiated against AGM or others following the announcement of the proposed transaction, as well as AGMs managements response to any of the aforementioned factors; and (viii) industry conditions.

AGM undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law. This Current Report on Form 8-K does not constitute an offer of any AGM fund.

* * *

5

| Item 9.01. | Financial Statements and Exhibits. |

| Exhibit No. |

Description | |

| 2.1 | Agreement and Plan of Merger, dated as of March 8, 2021, by and among Apollo Global Management, Inc., Athene Holding Ltd., Tango Holdings, Inc., Blue Merger Sub, Ltd., and Green Merger Sub, Inc.* | |

| 99.1 | Joint Press Release, dated March 8, 2021 | |

| 99.2 | Investor Presentation, dated March 8, 2021 | |

| 99.3 | Letter to AGM Limited Partners, dated March 8, 2021 | |

| 99.4 | E-mail to Apollo Employees, dated March 8, 2021 | |

| 99.5 | Tweet, dated March 8, 2021 | |

| 99.6 | LinkedIn message, dated March 8, 2021 | |

| 99.7 | LinkedIn message, dated March 8, 2021 | |

| 99.8 | Call transcript, dated March 8, 2021 | |

| * | Exhibits and Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the omitted schedules upon request by the U.S. Securities and Exchange Commission. |

Additional Information Regarding the Transaction and Where to Find It

This Current Report on Form 8-K is being made in respect of the proposed transaction involving HoldCo, AGM and AHL. The proposed transaction will be submitted to the stockholders of AGM and the shareholders of AHL for their respective consideration. In connection therewith, the parties intend to file relevant materials with the Securities and Exchange Commission (the SEC), including a definitive joint proxy statement/prospectus, which will be mailed to the stockholders of AGM and the shareholders of AHL. However, such documents are not currently available. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, AS APPLICABLE, INVESTORS AND SECURITY HOLDERS OF AGM AND AHL ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive joint proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about AGM and AHL, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC by AGM will be available free of charge under the Stockholders section of AGMs website located at http://www.apollo.com or by contacting AGMs Investor Relations Department at (212) 822-0528 or APOInvestorRelations@apollo.com.

Copies of the documents filed with the SEC by AHL will be available free of charge under the Investors section of AHLs website located at http://www.athene.com or by contacting AHLs Investor Relations Department at (441) 279-8531 or ir@athene.com.

Participants in the Solicitation

AGM, AHL, HoldCo and their respective directors, executive officers, members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction.

Information about the directors and executive officers of AGM and HoldCo is set forth in AGMs proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on August 20, 2020, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above.

6

Information about the directors and executive officers of AHL is set forth in AHLs proxy statement for its 2020 annual meeting of shareholders, which was filed with the SEC on April 21, 2020, its annual report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on February 19, 2021, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above.

Other information regarding the participants in the proxy solicitations of the stockholders of AGM and the shareholders of AHL, and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| APOLLO GLOBAL MANAGEMENT, INC. | ||||

| Date: March 8, 2021 | By: | /s/ John J. Suydam |

||||

| Name: | John J. Suydam | |||||

| Title: | Chief Legal Officer | |||||

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

By and Among

ATHENE HOLDING LTD;

APOLLO GLOBAL MANAGEMENT, INC.;

TANGO HOLDINGS, INC.;

BLUE MERGER SUB, LTD.; and

GREEN MERGER SUB, INC.

Dated as of March 8, 2021

TABLE OF CONTENTS

Page

| ARTICLE I | ||||||

| THE MERGERS | ||||||

| Section 1.01 |

AGM Merger | 2 | ||||

| Section 1.02 |

AHL Merger | 3 | ||||

| Section 1.03 |

Effective Time; Closing | 3 | ||||

| Section 1.04 |

Effects of Mergers | 4 | ||||

| Section 1.05 |

Memorandum of Association and Bye-Laws of the AHL Surviving Entity | 4 | ||||

| Section 1.06 |

Certificate of Incorporation and Bylaws of AGM Surviving Entity | 4 | ||||

| Section 1.07 |

Certificate of Incorporation and Bylaws of Tango Holdings | 4 | ||||

| Section 1.08 |

Board of Directors and Officers of AHL Surviving Entity | 4 | ||||

| Section 1.09 |

Board of Directors and Officers of AGM Surviving Entity | 5 | ||||

| Section 1.10 |

Board of Directors of Tango Holdings | 5 | ||||

| ARTICLE II | ||||||

| EFFECT ON SECURITIES OF THE CONSTITUENT ENTITIES; | ||||||

| PAYMENT OF CONSIDERATION | ||||||

| Section 2.01 |

Effect of AHL Merger on the Share Capital of AHL Merger Sub and AHL | 5 | ||||

| Section 2.02 |

Effect of AGM Merger on the Capital Stock of AGM Merger Sub and AGM | 7 | ||||

| Section 2.03 |

Surrender of Tango Holdings Shares Held by AGM | 8 | ||||

| Section 2.04 |

Exchange Fund | 8 | ||||

| Section 2.05 |

AHL Equity Awards | 12 | ||||

| Section 2.06 |

Shares of Dissenting Holders of AHL. | 13 | ||||

| Section 2.07 |

AGM Equity Awards | 14 | ||||

| Section 2.08 |

AHL Warrants | 15 | ||||

| Section 2.09 |

Adjustments | 16 | ||||

| ARTICLE III | ||||||

| REPRESENTATIONS AND WARRANTIES OF AHL | ||||||

| Section 3.01 |

Organization; Standing | 16 | ||||

| Section 3.02 |

Capitalization | 17 | ||||

| Section 3.03 |

Authority; Noncontravention; Voting Requirements | 18 | ||||

| Section 3.04 |

Governmental Approvals | 20 | ||||

| Section 3.05 |

AHL SEC Documents; Undisclosed Liabilities; Internal Controls | 20 | ||||

| Section 3.06 |

Absence of Certain Changes | 22 | ||||

| Section 3.07 |

Legal Proceedings | 22 | ||||

| Section 3.08 |

Compliance with Laws; Permits | 22 | ||||

i

| Section 3.09 |

Tax Matters | 23 | ||||

| Section 3.10 |

Insurance Product Related Tax Matters | 24 | ||||

| Section 3.11 |

Employee Benefits | 25 | ||||

| Section 3.12 |

Labor Matters | 26 | ||||

| Section 3.13 |

Investments; Derivatives | 27 | ||||

| Section 3.14 |

Intellectual Property | 27 | ||||

| Section 3.15 |

Anti-Takeover Provisions | 28 | ||||

| Section 3.16 |

Real Property | 28 | ||||

| Section 3.17 |

Contracts | 28 | ||||

| Section 3.18 |

Insurance Subsidiaries | 30 | ||||

| Section 3.19 |

Statutory Statements; Examinations | 30 | ||||

| Section 3.20 |

Agreements with Insurance Regulators | 31 | ||||

| Section 3.21 |

Insurance | 31 | ||||

| Section 3.22 |

Insurance Producers | 32 | ||||

| Section 3.23 |

Reserves | 32 | ||||

| Section 3.24 |

Separate Accounts | 32 | ||||

| Section 3.25 |

Insurance Policies | 33 | ||||

| Section 3.26 |

Brokers and Other Advisors | 33 | ||||

| Section 3.27 |

Related Party Transactions | 33 | ||||

| Section 3.28 |

No Other Representations or Warranties | 33 | ||||

| ARTICLE IV | ||||||

| REPRESENTATIONS AND WARRANTIES OF AGM | ||||||

| Section 4.01 |

Organization; Standing | 34 | ||||

| Section 4.02 |

Capitalization | 35 | ||||

| Section 4.03 |

Authority; Noncontravention; Voting Requirements | 37 | ||||

| Section 4.04 |

Governmental Approvals | 38 | ||||

| Section 4.05 |

Ownership and Operations of Tango Holdings, AGM Merger Sub and AHL Merger Sub | 39 | ||||

| Section 4.06 |

AGM SEC Documents; Undisclosed Liabilities; Internal Controls | 39 | ||||

| Section 4.07 |

Absence of Certain Changes | 41 | ||||

| Section 4.08 |

Legal Proceedings | 41 | ||||

| Section 4.09 |

Compliance with Laws; Permits | 41 | ||||

| Section 4.10 |

Tax Matters | 41 | ||||

| Section 4.11 |

Employee Benefits | 43 | ||||

| Section 4.12 |

Labor Matters | 44 | ||||

| Section 4.13 |

Intellectual Property | 44 | ||||

| Section 4.14 |

Real Property | 45 | ||||

| Section 4.15 |

Contracts | 45 | ||||

| Section 4.16 |

Anti-Takeover Provisions | 47 | ||||

| Section 4.17 |

Certain Arrangements | 47 | ||||

| Section 4.18 |

Brokers and Other Advisors | 47 | ||||

| Section 4.19 |

Ownership of AHL Shares and AHL Preferred Shares | 47 | ||||

| Section 4.20 |

No Other Representations or Warranties | 47 | ||||

ii

| ARTICLE V | ||||||

| ADDITIONAL COVENANTS AND AGREEMENTS | ||||||

| Section 5.01 |

Conduct of Business | 48 | ||||

| Section 5.02 |

No Solicitation by AHL; Change in Recommendation | 55 | ||||

| Section 5.03 |

Preparation of Joint Proxy/Prospectus; Shareholders Meetings | 59 | ||||

| Section 5.04 |

Reasonable Best Efforts | 62 | ||||

| Section 5.05 |

Public Announcements; Other Communications | 64 | ||||

| Section 5.06 |

Access to Information; Confidentiality | 64 | ||||

| Section 5.07 |

AHL Indemnification and Insurance | 65 | ||||

| Section 5.08 |

AGM Indemnification and Insurance | 67 | ||||

| Section 5.09 |

Rule 16b-3 | 70 | ||||

| Section 5.10 |

Employee Matters | 70 | ||||

| Section 5.11 |

Notification of Certain Matters; Shareholder Litigation | 71 | ||||

| Section 5.12 |

Voting Matters | 72 | ||||

| Section 5.13 |

Stock Exchange Listing | 72 | ||||

| Section 5.14 |

Stock Exchange De-listing | 72 | ||||

| Section 5.15 |

Tax Matters | 72 | ||||

| Section 5.16 |

Debt Matters | 73 | ||||

| Section 5.17 |

Pre-Closing Restructuring | 74 | ||||

| Section 5.18 |

Termination of Related Party Transactions | 74 | ||||

| Section 5.19 |

Further Assurances | 74 | ||||

| ARTICLE VI | ||||||

| CONDITIONS PRECEDENT | ||||||

| Section 6.01 |

Conditions to Each Partys Obligation To Effect the Mergers | 74 | ||||

| Section 6.02 |

Conditions to Obligations of AGM, Tango Holdings, AGM Merger Sub and AHL Merger Sub | 75 | ||||

| Section 6.03 |

Conditions to Obligations of AHL | 76 | ||||

| Section 6.04 |

Frustration of Closing Conditions | 77 | ||||

| ARTICLE VII | ||||||

| TERMINATION | ||||||

| Section 7.01 |

Termination | 77 | ||||

| Section 7.02 |

Effect of Termination | 79 | ||||

| Section 7.03 |

Termination Fee | 79 | ||||

| ARTICLE VIII | ||||||

| MISCELLANEOUS | ||||||

| Section 8.01 |

No Survival of Representations and Warranties | 80 | ||||

iii

| Section 8.02 |

Amendment or Supplement | 80 | ||||

| Section 8.03 |

Extension of Time, Waiver, Etc. | 80 | ||||

| Section 8.04 |

Assignment | 80 | ||||

| Section 8.05 |

Counterparts | 80 | ||||

| Section 8.06 |

Entire Agreement; No Third-Party Beneficiaries | 81 | ||||

| Section 8.07 |

Governing Law; Jurisdiction | 81 | ||||

| Section 8.08 |

Specific Enforcement | 82 | ||||

| Section 8.09 |

WAIVER OF JURY TRIAL | 82 | ||||

| Section 8.10 |

Remedies | 83 | ||||

| Section 8.11 |

Notices | 83 | ||||

| Section 8.12 |

Severability | 84 | ||||

| Section 8.13 |

Definitions | 85 | ||||

| Section 8.14 |

Fees and Expenses | 98 | ||||

| Section 8.15 |

Limitation on Recourse | 98 | ||||

| Section 8.16 |

Interpretation | 99 | ||||

| EXHIBIT |

|

|||||

| Exhibit A |

Form of Statutory Merger Agreement | |||||

| Exhibit B |

Form of AGM Representation Letter | |||||

| Exhibit C |

Form of AHL Representation Letter | |||||

| SCHEDULE |

|

|||||

| Schedule I |

Required Regulatory Approvals | |||||

iv

This AGREEMENT AND PLAN OF MERGER (this Agreement) dated as of March 8, 2021, among Athene Holding Ltd, a Bermuda exempted company (AHL), Apollo Global Management, Inc., a Delaware corporation (AGM), Tango Holdings, Inc., a Delaware corporation and a direct wholly owned subsidiary of AGM (Tango Holdings), Blue Merger Sub, Ltd., a Bermuda exempted company and a direct wholly owned subsidiary of Tango Holdings (AHL Merger Sub), and Green Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of Tango Holdings (AGM Merger Sub).

WHEREAS, the Board of Directors of AHL (the AHL Board) (upon the recommendation of a special committee consisting of independent members of the AHL Board not affiliated with AGM (the Special Committee)) has (i) approved the AHL Merger, this Agreement and the Statutory Merger Agreement, (ii) determined that the terms of this Agreement and the Statutory Merger Agreement are in the best interests of and fair to AHL and its shareholders, (iii) declared the advisability of this Agreement, the Statutory Merger Agreement and the AHL Merger, (iv) determined that the Merger Consideration constitutes fair value for each AHL Share in accordance with the Bermuda Companies Act, (v) determined that the preferred shares of the AHL Surviving Entity as described in Section 2.01(d) constitute fair value for each AHL Preferred Series A Share, AHL Preferred Series B Share, AHL Preferred Series C Share and AHL Preferred Series D Share, as applicable, in accordance with the Bermuda Companies Act and (vi) resolved, subject to Section 5.02, to recommend approval of the AHL Merger, this Agreement and the Statutory Merger Agreement to its shareholders;

WHEREAS, the Board of Directors of AGM has (i) approved the AGM Merger and this Agreement, (ii) determined that the terms of this Agreement are in the best interests of and fair to AGM and its stockholders, (iii) declared the advisability of this Agreement and the AGM Merger and (iv) resolved, subject to Section 5.03(c), to recommend approval and adoption of the AGM Merger and this Agreement to its stockholders;

WHEREAS, the Board of Directors of the AHL Merger Sub has (i) unanimously approved the AHL Merger, this Agreement and the Statutory Merger Agreement, (ii) determined that the terms of this Agreement and the Statutory Merger Agreement are in the best interests of and fair to the AHL Merger Sub and its sole shareholder, (iii) declared the advisability of this Agreement, the Statutory Merger Agreement and the AHL Merger and (iv) resolved to recommend approval of the AHL Merger, this Agreement and the Statutory Merger Agreement to its sole shareholder;

WHEREAS, the Board of Directors of AGM Merger Sub has (i) unanimously approved the AGM Merger and this Agreement, (ii) determined that the terms of this Agreement are in the best interests of and fair to AGM Merger Sub and its sole stockholder, (iii) declared the advisability of this Agreement and the AGM Merger and (iv) resolved to recommend approval and adoption of the AGM Merger and this Agreement to its sole stockholder;

WHEREAS, concurrently with the execution and delivery of this Agreement, and as a condition and inducement to the willingness of AHL to enter into this Agreement, certain stockholders of AGM (the Principal AGM Stockholders) are entering into a voting agreement (the Voting Agreement) with AHL pursuant to which the Principal AGM Stockholders have agreed, upon the terms and subject to the conditions set forth in the Voting Agreement, to, among other things, vote all of their AGM Shares and AGM Class B Common Stock in favor of the approval and adoption of the AGM Merger and this Agreement;

WHEREAS, AGM Management, LLC, as the holder of all of the outstanding shares of AGM Class C Common Stock, has delivered an irrevocable approval, which shall become automatically effective immediately following the execution and delivery of this Agreement, approving the entry by AGM into this Agreement and consummation of the AGM Merger (the Class C Stockholder Approval);

WHEREAS, the Board of Directors of Tango Holdings has (i) unanimously approved this Agreement, (ii) determined that the terms of this Agreement are in the best interests of and fair to Tango Holdings and its sole stockholder and (iii) declared the advisability of this Agreement;

WHEREAS, it is intended that, substantially concurrent with the Closing, (i) certain issued and outstanding Operating Group Units held of record or beneficially by Persons other than AGM and its Subsidiaries and other than AHL and its Subsidiaries will be exchanged for Tango Holdings Shares and (ii) the issued and outstanding Operating Group Units held of record or beneficially by AHL and its Subsidiaries will be directly or indirectly exchanged for Tango Holdings Shares (collectively, the Operating Group Unit Exchange);

WHEREAS, it is the intent of the parties that, for U.S. federal income tax purposes, the Mergers, taken together along with any Operating Group Unit Exchange, qualify as a transaction described in Section 351 of the Code;

WHEREAS, AGM and the other parties to the AGM Restructuring intend to complete the AGM Restructuring prior to or effective as of the Closing; and

WHEREAS, it is the current intent of the parties that the Transactions are consummated after January 1, 2022.

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants and agreements set forth herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereby agree as follows:

ARTICLE I

THE MERGERS

Section 1.01 AGM Merger. Upon the terms and subject to the conditions set forth in this Agreement, and pursuant to the DGCL, at the AGM Effective Time, AGM Merger Sub shall be merged with and into AGM (the AGM Merger), the separate corporate existence of AGM Merger Sub shall thereupon cease and AGM shall survive the AGM Merger (such surviving company, the AGM Surviving Entity) as a wholly owned Subsidiary of Tango Holdings. References in this Agreement to AGM for periods after the AGM Effective Time shall include AGM Surviving Entity.

2

Section 1.02 AHL Merger. Upon the terms and subject to the conditions set forth in this Agreement and the Statutory Merger Agreement, and pursuant to Section 104H of the Companies Act 1981 of Bermuda, as amended (the Bermuda Companies Act), at the AHL Effective Time, AHL Merger Sub shall be merged with and into AHL (the AHL Merger and, together with the AGM Merger, the Mergers), the separate corporate existence of AHL Merger Sub shall thereupon cease and AHL shall survive the AHL Merger (such surviving company, the AHL Surviving Entity) as a wholly owned Subsidiary of Tango Holdings. References in this Agreement to the AHL for periods after the AHL Effective Time shall include AHL Surviving Entity.

Section 1.03 Effective Time; Closing.

(a) Upon the terms and subject to the conditions set forth in this Agreement, AGM and AGM Merger Sub will on the Closing Date, file or cause to be filed a certificate of merger (the AGM Certificate of Merger), in accordance with Section 251 of the DGCL, with the Secretary of State of the State of Delaware and make all other filings or recordings required by the DGCL in connection with the AGM Merger. The AGM Merger shall become effective at such time as the AGM Certificate of Merger is duly filed with the Secretary of State of the State of Delaware or such other date and time as specified in the AGM Certificate of Merger (the AGM Effective Time).

(b) Upon the terms and subject to the conditions set forth in this Agreement and the Statutory Merger Agreement, AHL and AHL Merger Sub will (i) on the Closing Date, execute and deliver the Statutory Merger Agreement, (ii) on or prior to the Closing Date, cause an application for registration of the AHL Surviving Entity (the Merger Application) to be executed and delivered to the Registrar of Companies in Bermuda (the Registrar) as provided under Section 108 of the Bermuda Companies Act and to be accompanied by the documents required by Section 108(2) of the Bermuda Companies Act and (iii) cause to be included in the Merger Application a request that the Registrar issue the certificate of merger with respect to the AHL Merger (the AHL Certificate of Merger) on the Closing Date at the time of day mutually agreed upon by AHL and AGM and set forth in the Merger Application. The AHL Merger shall become effective upon the issuance of the AHL Certificate of Merger by the Registrar at the time and date shown on the AHL Certificate of Merger (the AHL Effective Time).

(c) AHL and AGM agree that they shall (i) specify in the AGM Certificate of Merger that the effective time of the AGM Merger shall be 9:00 a.m., New York time (or such other time mutually agreed upon by AHL and AGM), on the Closing Date and (ii) request that the Registrar provide in the AHL Certificate of Merger that the effective time of the AHL Merger shall be 9:00 a.m., New York time (or such other time mutually agreed upon by AHL and AGM), on the Closing Date.

(d) The closing (the Closing) of the Mergers shall take place at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, One Manhattan West, New York, New York at 9:00 a.m., New York time, on a date that is the third (3rd) business day following the satisfaction or (to the extent permitted by applicable Law) waiver by the party or parties entitled to the benefits thereof of the conditions set forth in Article VI (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or (to the extent permitted by applicable

3

Law) waiver of those conditions at such time), or at such other place, time and date as shall be agreed to in writing by AHL and AGM; provided, that it is the current intent of the parties that the Closing shall occur after January 1, 2022. The date on which the Closing occurs is referred to in this Agreement as the Closing Date.

Section 1.04 Effects of Mergers.

(a) From and after the AGM Effective Time, the AGM Merger shall have the effects set forth in this Agreement and Section 251 of the DGCL.

(b) From and after the AHL Effective Time, the AHL Merger shall have the effects set forth in this Agreement and Section 109(2) of the Bermuda Companies Act.

Section 1.05 Memorandum of Association and Bye-Laws of the AHL Surviving Entity. At the AHL Effective Time, (a) the memorandum of association of AHL immediately prior to the AHL Effective Time shall be amended to be substantially in the form of the memorandum of association of the AHL Merger Sub and (b) the bye-laws of AHL Surviving Entity shall be amended to be substantially in the form of the bye-laws of AHL Merger Sub immediately prior to the AHL Effective Time, in each case until thereafter changed or amended as provided therein or pursuant to applicable Law (and in each case, subject to Section 5.07 hereof), except that the name of AHL Merger Sub reflected therein shall be reasonably determined by Tango Holdings prior to Closing.

Section 1.06 Certificate of Incorporation and Bylaws of AGM Surviving Entity. At the AGM Effective Time, (a) the certificate of incorporation of AGM Merger Sub immediately prior to the AGM Effective Time shall become the certificate of incorporation of AGM Surviving Entity and (b) the bylaws of AGM Surviving Entity shall be amended to be substantially in the form of the bylaws of AGM Merger Sub immediately prior to the AGM Effective Time, in each case until thereafter changed or amended as provided therein or pursuant to applicable Law (and in each case, subject to Section 5.07 hereof), except that the name of AHL Merger Sub reflected therein shall be reasonably determined by Tango Holdings prior to Closing.

Section 1.07 Certificate of Incorporation and Bylaws of Tango Holdings. The parties hereto shall cause (a) the certificate of incorporation of Tango Holdings in effect immediately prior to the AGM Effective Time to be amended and restated at the AHL Effective Time in the form described on Section 1.07 of the AGM Disclosure Schedule and (b) the bylaws of Tango Holdings in effect immediately prior to the AGM Effective Time to be amended and restated at the AHL Effective Time in the form described on Section 1.07 of the AGM Disclosure Schedule. The name of Tango Holdings immediately after the AGM Effective Time shall be Apollo Global Management, Inc.

Section 1.08 Board of Directors and Officers of AHL Surviving Entity. The parties hereto shall cause the directors of AHL Merger Sub in office immediately prior to the AHL Effective Time to be the directors of AHL Surviving Entity until the earlier of their death, resignation or removal or until their respective successors are duly elected or appointed and qualified, as the case may be, in accordance with the Bermuda Companies Act and bye-laws of AHL Surviving Entity. The officers of AHL in office immediately prior to the AHL Effective Time shall be the officers of AHL Surviving Entity until the earlier of their death, resignation or removal or until their respective successors are duly elected or appointed and qualified, as the case may be.

4

Section 1.09 Board of Directors and Officers of AGM Surviving Entity. The parties hereto shall cause the directors of AGM Merger Sub in office immediately prior to the AGM Effective Time to be the directors of AGM Surviving Entity until the earlier of their death, resignation or removal or until their respective successors are duly elected or appointed and qualified, as the case may be, in accordance with the DGCL and bylaws of the AGM Surviving Entity. The officers of AGM in office immediately prior to the AGM Effective Time shall be the officers of the AGM Surviving Entity until the earlier of their death, resignation or removal or until their respective successors are duly elected or appointed and qualified, as the case may be.

Section 1.10 Board of Directors of Tango Holdings. The parties hereto shall cause the Board of Directors of Tango Holdings immediately following the AHL Effective Time to consist of (a) four (4) directors of AHL in office immediately prior to the AHL Effective Time, including (i) the individual set forth on Section 1.10 of the AHL Disclosure Schedule and (ii) three (3) selected by the disinterested members of the Board of Directors of AHL and reasonably acceptable to AGM, and which must qualify as an independent director under the listing standards of the NYSE and the applicable rules of the SEC, (b) the directors of AGM in office immediately prior to the AHL Effective Time and (c) no more than eighteen (18) directors in the aggregate.

ARTICLE II

EFFECT ON SECURITIES OF THE CONSTITUENT ENTITIES;

PAYMENT OF CONSIDERATION

Section 2.01 Effect of AHL Merger on the Share Capital of AHL Merger Sub and AHL. At the AHL Effective Time, by virtue of the occurrence of the AHL Merger, and without any action on the part of AHL, AHL Merger Sub, Tango Holdings or AGM or any holder of any AHL Shares or any shares, par value $1.00 per share, of AHL Merger Sub (AHL Merger Sub Shares):

(a) Share Capital of AHL Merger Sub. Each AHL Merger Sub Share that is issued immediately prior to the AHL Effective Time shall automatically be canceled and converted into and become the right to receive an issuance from the AHL Surviving Entity of a number of duly authorized, validly issued, fully paid and nonassessable common shares, par value $1.00 per share, of the AHL Surviving Entity (the Surviving AHL Shares) that is equal to the number of AHL Shares canceled and converted under the mechanics of Section 2.01(c). For the purposes of this Section 2.01(a), nonassessable means in relation to fully paid shares of the AHL Surviving Entity that no shareholder shall be obliged to contribute further amounts to the capital of AHL Surviving Entity, either in order to complete payment for their shares, to satisfy claims of creditors of the AHL Surviving Entity, or otherwise.

5

(b) Cancelation of Treasury Shares; Treatment of AGM-Owned Shares and Shares Held by AHL Subsidiaries. Each AHL Share that is owned by AHL as treasury shares and any AHL Share owned by AHL Merger Sub immediately prior to the AHL Effective Time shall automatically be canceled and shall cease to exist and no consideration shall be delivered in exchange therefor nor any repayment of capital made in respect thereof. Each AHL Share that is owned by any direct or indirect wholly owned Subsidiary of AHL and each AHL Share that is owned by the Apollo Operating Group or any direct or indirect Subsidiary of the Apollo Operating Group shall not represent the right to receive the Merger Consideration and shall instead convert into one (1) Surviving AHL Share. For the avoidance of doubt, Operating Group Units shall, in no event, be deemed to be treasury shares of AHL.

(c) Conversion of AHL Shares. Subject to Section 2.01(b), Section 2.04(d) and Section 2.06, each AHL Share that is issued immediately prior to the AHL Effective Time shall automatically be canceled and converted into and shall thereafter represent the right to receive an issuance from Tango Holdings of 1.149 (the Exchange Ratio) duly authorized, validly issued, fully paid and nonassessable shares of common stock, par value $0.00001 per share, of Tango Holdings (such shares, Tango Holdings Shares, and such share consideration, the Merger Share Consideration) and any cash paid in lieu of fractional Tango Holdings Shares in accordance with Section 2.04(d) (the Merger Consideration). Subject to Section 2.06, as of the AHL Effective Time, all such AHL Shares shall no longer be issued and shall automatically be canceled and shall cease to exist, and each holder of a certificate that immediately prior to the AHL Effective Time evidenced any AHL Shares (each, a Certificate) or uncertificated AHL Shares represented by book-entry immediately prior to the AHL Effective Time (each, a Book-Entry Share) shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration pertaining to the AHL Shares represented by such Certificate or Book-Entry Share, as applicable, to be paid in consideration therefor, in accordance with Section 2.04(b) without interest.

(d) AHL Preferred Shares.

(i) Subject to Section 2.06, each AHL Preferred Series A Share issued immediately prior to the AHL Effective Time shall automatically be converted into an issued preferred share of the AHL Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AHL Preferred Series A Shares, which certificate of designations shall remain at and following the AHL Effective Time in full force and effect as an obligation of the AHL Surviving Entity in accordance with Section 109(2) of the Bermuda Companies Act.

(ii) Subject to Section 2.06, each AHL Preferred Series B Share issued immediately prior to the AHL Effective Time shall automatically be converted into an issued preferred share of the AHL Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AHL Preferred Series B Shares, which certificate of designations shall remain at and following the AHL Effective Time in full force and effect as an obligation of the AHL Surviving Entity in accordance with Section 109(2) of the Bermuda Companies Act.

6

(iii) Subject to Section 2.06, each AHL Preferred Series C Share issued immediately prior to the AHL Effective Time shall automatically be converted into an issued preferred share of the AHL Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AHL Preferred Series C Shares, which certificate of designations shall remain at and following the AHL Effective Time in full force and effect as an obligation of the AHL Surviving Entity in accordance with Section 109(2) of the Bermuda Companies Act.

(iv) Subject to Section 2.06, each AHL Preferred Series D Share issued immediately prior to the AHL Effective Time shall automatically be converted into an issued preferred share of the AHL Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AHL Preferred Series D Shares, which certificate of designations shall remain at and following the AHL Effective Time in full force and effect as an obligation of the AHL Surviving Entity in accordance with Section 109(2) of the Bermuda Companies Act.

Section 2.02 Effect of AGM Merger on the Capital Stock of AGM Merger Sub and AGM. At the AGM Effective Time, by virtue of the occurrence of the AGM Merger, and without any action on the part of AGM, AGM Merger Sub, Tango Holdings or any holder of any AGM Shares or any stock, par value $1.00 per share, of AGM Merger Sub (AGM Merger Sub Share):

(a) Capital Stock of AGM Merger Sub. Each AGM Merger Sub Share that is issued and outstanding immediately prior to the AGM Effective Time shall be automatically canceled and converted into and become a number of shares of duly authorized, validly issued, fully paid and nonassessable common stock, par value $1.00 per share, of AGM Surviving Entity (the Surviving AGM Stock) that is equal to the number of AGM Shares canceled and converted under the mechanics of Section 2.02(c).

(b) Cancelation of Treasury Shares; Treatment of Shares Held by AGM Subsidiaries. Each AGM Share that is owned by AGM as treasury shares and any AGM Share owned by AGM Merger Sub immediately prior to the AGM Effective Time shall automatically be canceled and shall cease to exist and no consideration shall be delivered in exchange therefor nor any repayment of capital made in respect thereof. Each AGM Share that is owned by any direct or indirect wholly-owned Subsidiary of AGM shall convert into one (1) share of Surviving AGM Stock, and no other consideration shall be delivered in exchange therefor nor any repayment of capital made in respect thereof.

(c) Conversion of AGM Shares. Subject to Section 2.02(b) and Section 2.07(b), each AGM Share that is issued and outstanding immediately prior to the AGM Effective Time shall automatically be canceled and converted into and shall thereafter represent the right to receive from Tango Holdings one (1) Tango Holdings Share (the AGM Merger Consideration). As of the AGM Effective Time, all such AGM Shares shall no longer be issued and outstanding and shall automatically be canceled and shall cease to exist, and each holder of a certificate that immediately prior to the AGM Effective Time evidenced any AGM Shares (each, a AGM Certificate) or uncertificated AGM Shares represented by book-entry immediately prior to the AGM Effective Time (each, a Book-Entry AGM Share) shall cease to have any rights with respect thereto, except the right to receive the AGM Merger Consideration, in accordance with Section 2.02(b), without interest.

7

(d) AGM Preferred Shares.

(i) Each share of AGM Series A Preferred Stock issued and outstanding immediately prior to the AGM Effective Time shall remain issued and outstanding as a preferred share of the AGM Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AGM Series A Preferred Stock, which certificate of designations shall remain at and following the AGM Effective Time in full force and effect as an obligation of the AGM Surviving Entity.

(ii) Each share of AGM Series B Preferred Stock issued and outstanding immediately prior to the AGM Effective Time shall remain issued and outstanding as a preferred share of the AGM Surviving Entity and shall be entitled to the same dividend and all other preferences and privileges, voting rights, relative, participating, optional and other special rights, and qualifications, limitations and restrictions set forth in the certificate of designations applicable to the AGM Series B Preferred Stock, which certificate of designations shall remain at and following the AGM Effective Time in full force and effect as an obligation of the AGM Surviving Entity.

Section 2.03 Surrender of Tango Holdings Shares Held by AGM. Immediately following the AGM Effective Time, each Tango Holdings Share owned by the AGM Surviving Entity shall be surrendered to Tango Holdings without payment therefor.

Section 2.04 Exchange Fund. (a) Paying Agent. At or prior to the Closing Date, Tango Holdings shall, and AGM shall cause Tango Holdings to, designate a bank or trust company reasonably acceptable to AHL and to AGM to act as agent (the Paying Agent) for the payment and delivery of the aggregate Merger Consideration and the aggregate AGM Merger Consideration in accordance with this Article II and, in connection therewith, shall at or prior to the Closing Date enter into an agreement with the Paying Agent in a form reasonably acceptable to AHL and to AGM. At or prior to the AHL Effective Time and AGM Effective Time, Tango Holdings shall deposit or cause to be deposited with the Paying Agent (i) a number of certificated Tango Holdings Shares or Tango Holdings Shares in book-entry form sufficient to pay the aggregate Merger Share Consideration and the AGM Merger Consideration and (ii) an amount in cash sufficient to pay, to the extent then determinable, cash payable in lieu of fractional shares pursuant to Section 2.04(d) (such shares and cash, and cash referred to in the immediately following sentence, being hereinafter referred to as the Exchange Fund). From time to time as necessary and determinable, Tango Holdings shall promptly deposit or cause to be deposited with the Paying Agent additional cash sufficient to pay the cash payable in lieu of fractional shares pursuant to Section 2.04(d). Pending its disbursement in accordance with this Section 2.04, the Exchange Fund shall be invested by the Paying Agent as directed by Tango Holdings in (i) short-term direct obligations of the United States of America, (ii) short-term obligations for which the full faith and credit of the United States of America is pledged to provide for the payment of principal and interest, (iii) short-

8

term commercial paper rated the highest quality by either Moodys Investors Service, Inc. or Standard and Poors Ratings Services or (iv) certificates of deposit, bank repurchase agreements or bankers acceptances of commercial banks with capital exceeding $5 billion. Any and all interest earned on the funds in the Exchange Fund shall be paid by the Paying Agent to Tango Holdings. No investment losses resulting from investment of the funds deposited with the Paying Agent shall diminish the rights of any former holder of AHL Shares to receive cash payable in lieu of fractional shares pursuant to Section 2.04(d).

(b) Letter of Transmittal; Exchange of Certificates. As soon as practicable after the AHL Effective Time and the AGM Effective Time (but in no event later than three (3) business days after the AHL Effective Time and the AGM Effective Time), Tango Holdings shall cause the Paying Agent to (i) mail to each holder of a Certificate a form of letter of transmittal (which shall be in such form and have such other customary provisions as Tango Holdings may specify, subject to AHLs reasonable approval (to be sought prior to the AHL Effective Time)), together with instructions thereto, setting forth, inter alia, the procedures by which holders of Certificates may receive the Merger Consideration and (ii) mail to each holder of an AGM Certificate a form of letter of transmittal (which shall be in such form and have such other customary provisions as Tango Holdings may specify, subject to AGMs reasonable approval (to be sought prior to the AHL Effective Time)), together with instructions thereto, setting forth, inter alia, the procedures by which holders of AGM Certificates may receive the AGM Merger Consideration. Notwithstanding anything in this Agreement to the contrary, holders of Book-Entry Shares and Book-Entry AGM Shares shall not be required to deliver a Certificate or an executed letter of transmittal to the Paying Agent to receive the Merger Consideration or AGM Merger Consideration, as applicable, that such holder is entitled to receive pursuant to this Article II. The Paying Agent shall deliver to such holder, (x) with respect to holders of Certificates or AGM Certificates, upon the completion of such applicable procedures by a holder and the surrender of such holders Certificates or AGM Certificates or (y) with respect to holders of Book-Entry Shares or Book-Entry AGM Shares, as promptly as practicable after the AHL Effective Time or the AGM Effective Time, as applicable, (A) a certificate or book-entry representing that number of whole Tango Holdings Shares (rounded down to the nearest whole Tango Holdings Share (taking into account all Certificates, Book-Entry Shares, AGM Certificates and Book-Entry AGM Shares held by such holder)) that such holder has the right to receive pursuant to the provisions of this Article II and (B) if applicable, cash in an amount (subject to Section 2.04(h)) equal to the cash in lieu of fractional shares that such holder has the right to receive pursuant to Section 2.04(d). If payment of the Merger Consideration or AGM Merger Consideration is to be made to a Person other than the Person in whose name a Certificate or AGM Certificate, as applicable, surrendered is registered, it shall be a condition of payment that (x) the Certificate or AGM Certificate so surrendered shall be properly endorsed (where applicable) or shall otherwise be in, or accompanied by, the proper form for transfer duly executed on behalf of the transferor where required for transfer and (y) the Person requesting such payment (1) shall have paid any transfer and other Taxes required by reason of the payment of the Merger Consideration or AGM Merger Consideration to a Person other than the registered holder or (2) shall have established to the reasonable satisfaction of AHL Surviving Entity, AGM Surviving Entity, or Tango Holdings that such Tax either has been paid or is not applicable. Until satisfaction of the applicable procedures contemplated by this Section 2.04 and subject to Section 2.06, each Certificate or Book-Entry Share shall be deemed at any time after the AHL Effective Time to represent only the right to receive the Merger Consideration. Until satisfaction of the applicable procedures contemplated by this Section 2.04 and subject to Section 2.06, each AGM Certificate or Book-Entry AGM Share shall be deemed at any time after the AGM Effective Time to represent only the right to receive the AGM Merger Consideration. No interest shall be paid or shall accrue on the Merger Consideration or AGM Merger Consideration payable pursuant to this Article II.

9

(c) No Further Ownership Rights in AHL Shares and AGM Shares.

(i) Share Register. The Merger Consideration paid in respect of each AHL Share upon surrender of Certificates, in the case of certificated AHL Shares, or automatically, in the case of Book-Entry Shares, in accordance with the terms of this Article II shall be deemed to have been paid in full satisfaction of all rights pertaining to such AHL Shares previously represented by such Certificates or Book-Entry Shares, subject, however, to Section 2.06. At the AHL Effective Time, the share register of AHL shall be closed and thereafter there shall be no further registration of transfers on the share register of AHL Surviving Entity of AHL Shares that were outstanding immediately prior to the AHL Effective Time. From and after the AHL Effective Time, the holders of AHL Shares formerly represented by Certificates or Book-Entry Shares immediately prior to the AHL Effective Time shall cease to have any rights with respect to such underlying AHL Shares, except as otherwise provided for herein or by applicable Law. Subject to the last sentence of Section 2.04(f), if, at any time after the AHL Effective Time, Certificates or Book-Entry Shares are presented to AHL Surviving Entity for any reason, they shall be canceled and exchanged as provided in this Article II.

(ii) Transfer Books. The AGM Merger Consideration paid in respect of each AGM Share upon surrender of AGM Certificates, in the case of certificated AGM Shares, or automatically, in the case of Book-Entry AGM Shares, in accordance with the terms of this Article II shall be deemed to have been paid in full satisfaction of all rights pertaining to such AGM Shares previously represented by such AGM Certificates or Book-Entry AGM Shares, subject, however, to Section 2.06. At the AGM Effective Time, the transfer books of AGM shall be closed and thereafter there shall be no further registration of transfers on the transfer books of the AGM Surviving Entity of AGM Shares that were outstanding immediately prior to the AGM Effective Time. From and after the AGM Effective Time, the holders of AGM Shares formerly represented by AGM Certificates or Book-Entry AGM Shares immediately prior to the AGM Effective Time shall cease to have any rights with respect to such underlying AGM Shares, except as otherwise provided for herein or by applicable Law. Subject to the last sentence of Section 2.04(f), if, at any time after the AGM Effective Time, AGM Certificates or Book-Entry AGM Shares are presented to AGM Surviving Entity for any reason, they shall be canceled and exchanged as provided in this Article II.

(d) No Fractional Shares. Notwithstanding anything in this Agreement to the contrary, no fraction of a Tango Holdings Share may be issued in connection with the AHL Merger, and no dividends or other distributions with respect to Tango Holdings Shares shall be payable on or with respect to any fractional share and no such fractional share will entitle the owner thereof to vote or to any rights of a shareholder of Tango Holdings. In lieu of the issuance of any such fractional share, any holder of AHL Shares or AHL Equity Awards who would otherwise have been entitled to a fraction of a Tango Holdings Share shall be paid cash, without interest, in an amount equal to (i) the fractional share interest to which such holder would otherwise be entitled under this Article II multiplied by (ii) the Average AGM Share Price.

10

(e) Lost, Stolen or Destroyed Certificates or AGM Certificates. If any Certificate (other than Certificates representing Dissenting Shares) shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such Certificate to be lost, stolen or destroyed and, if required by AHL Surviving Entity, the posting by such Person of a bond, in such reasonable amount as Tango Holdings may direct, as indemnity against any claim that may be made against it with respect to such Certificate, the Paying Agent will pay, in exchange for such lost, stolen or destroyed Certificate, the applicable Merger Consideration. If any AGM Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such AGM Certificate to be lost, stolen or destroyed and, if required by AGM Surviving Entity, the posting by such Person of a bond, in such reasonable amount as Tango Holdings may direct, as indemnity against any claim that may be made against it with respect to such AGM Certificate, the Paying Agent will pay, in exchange for such lost, stolen or destroyed AGM Certificate, the applicable AGM Merger Consideration.

(f) Termination of Exchange Fund. At any time following the first anniversary of the Closing Date, Tango Holdings shall be entitled to require the Paying Agent to deliver to it any portion of the Exchange Fund (including any interest received with respect thereto) that had been made available to the Paying Agent and which has not been disbursed to former holders of AHL Shares or AGM Shares, and thereafter such former holders shall be entitled to look only to Tango Holdings for, and Tango Holdings shall remain liable to the extent required by applicable Law for, payment of their claims of the Merger Consideration or AGM Merger Consideration. Any amounts remaining unclaimed by such holders at such time at which such amounts would otherwise escheat to or become property of any Governmental Authority shall become, immediately prior to such time, to the extent permitted by applicable Law, the property of Tango Holdings or its designee, free and clear of all claims or interest of any Person previously entitled thereto.

(g) No Liability. Notwithstanding any provision of this Agreement to the contrary, none of the parties hereto, the AHL Surviving Entity, the AGM Surviving Entity or the Paying Agent shall be liable to any Person for Merger Consideration or AGM Merger Consideration delivered to a public official pursuant to any applicable state, federal or other abandoned property, escheat or similar Law.

(h) Withholding Taxes. Tango Holdings, AGM, the AGM Surviving Entity, and the Paying Agent shall be entitled to deduct and withhold from the consideration otherwise payable pursuant to this Agreement such amounts as are required to be deducted and withheld with respect to the making of such payment under the Code, or under any provision of other applicable Tax Laws. To the extent amounts are so withheld and paid over to the appropriate Governmental Authority, the withheld amounts shall be treated for all purposes of this Agreement as having been paid to or on behalf of the Person in respect of which such deduction and withholding was made.

11

Section 2.05 AHL Equity Awards.

(a) Prior to the AHL Effective Time, the AHL Board (or, if appropriate, any duly-authorized committee thereof administering the AHL Share Plans) shall adopt such resolutions and take such other actions to adjust the terms of all AHL Equity Awards to provide that, immediately following the AHL Effective Time:

(i) each AHL Option, whether vested or unvested, that is outstanding immediately prior to the AHL Effective Time shall be converted into an option to purchase a number of Tango Holdings Shares (rounded down to the nearest whole Tango Holdings Share) equal to the product of (i) the Exchange Ratio multiplied by (ii) the number of AHL Shares subject to such AHL Option immediately prior to the AHL Effective Time (rounded down to the nearest whole share) (the Adjusted AHL Options), with an exercise price equal to the quotient of (x) the exercise price of such AHL Option divided by (y) the Exchange Ratio (rounded up to the nearest whole cent). The parties intend that the adjustments in this Section 2.05(a)(i) are in accordance with Treasury Regulation Section 1.409A-1(B)(5)(v)(D) and will not subject any Adjusted AHL Option to Section 409A of the Code. Except as provided in this Section 2.05(a), each Adjusted AHL Option shall otherwise be subject to the same terms and conditions as were applicable under the related AHL Option immediately prior to the AHL Effective Time (including, for the avoidance of doubt, the ability to satisfy any required withholding obligations upon vesting and settlement of such Adjusted AHL Options through net settlement, and any accelerated vesting in connection with a termination of service);