PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 10, 2017

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant: ☒ Filed by a Party other than the Registrant: ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ATHENE HOLDING LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Table of Contents

ATHENE HOLDING LTD.

Chesney House, 96 Pitts Bay Road,

Pembroke, HM08, Bermuda

NOTICE OF 2017 ANNUAL GENERAL MEETING OF SHAREHOLDERS

OF ATHENE HOLDING LTD.

Hamilton, Bermuda

April 24, 2017

Dear Shareholder:

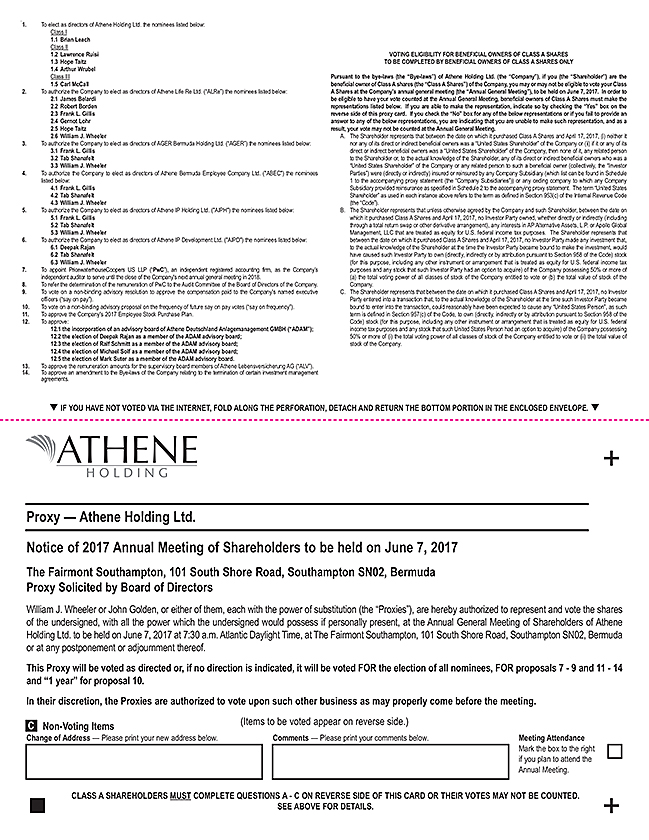

Notice is hereby given that the annual general meeting of the holders of Class A and Class B common shares (the Shareholders) of Athene Holding Ltd. (the Company, AHL, our, us, or we) is to be held at the Fairmont Southampton, 101 South Shore Road, Southampton SN02, Bermuda on June 7, 2017 at 7:30 a.m. local time for the following purposes:

| 1. | to elect the directors of Athene Holding Ltd. named in the accompanying Proxy Statement; |

| 2. | to authorize the election of the directors of Athene Life Re Ltd. named in the accompanying Proxy Statement; |

| 3. | to authorize the election of the directors of AGER Bermuda Holding Ltd. named in the accompanying Proxy Statement; |

| 4. | to authorize the election of the directors of Athene Bermuda Employee Company Ltd. named in the accompanying Proxy Statement |

| 5. | to authorize the election of the directors of Athene IP Holding Ltd. named in the accompanying Proxy Statement; |

| 6. | to authorize the election of the directors of Athene IP Development Ltd. named in the accompanying Proxy Statement; |

| 7. | to appoint PricewaterhouseCoopers US LLP (PwC), an independent registered accounting firm, as the Companys independent auditor to serve until the close of the Companys next annual general meeting in 2018; |

| 8. | to refer the determination of the remuneration of PwC to the audit committee of the board of directors of the Company; |

| 9. | to vote on a non-binding advisory resolution to approve the compensation paid to the Companys named executive officers (Say on Pay); |

| 10. | to vote on a non-binding advisory proposal on the frequency of future Say on Pay votes (Say on Frequency); |

| 11. | to approve the Companys 2017 Employee Stock Purchase Plan; |

| 12. | to approve the incorporation of an advisory board of Athene Deutschland Anlagemanagement GMBH and the election of the members thereof named in the accompanying Proxy Statement; |

| 13. | to approve the remuneration amounts for the supervisory board members of Athene Lebensversicherung AG; and |

| 14. | to approve an amendment to the Bye-laws of the Company relating to the termination of certain investment management agreements. |

Table of Contents

The board of directors recommends a vote FOR each of Items 1 through 9 and Items 11 through 14. The board of directors recommends a vote for one year for Item 10. The Company will also present the Companys audited consolidated financial statements for the year ended December 31, 2016 at the annual general meeting pursuant to the Bermuda Companies Act 1981 and Bye-law 78 of the Companys Ninth Amended and Restated Bye-laws (the Bye-laws).

Only Shareholders of record, as shown by the Register of Shareholders and the records of Computershare and the Company at the close of business on April 17, 2017 (the Record Date) are entitled to receive notice and only those Shareholders able to affirmatively make the representations contained in the accompanying proxy card are entitled to vote at the annual general meeting. CERTAIN HOLDERS OF THE COMPANYS CLASS A COMMON SHARES MAY NOT BE ENTITLED TO VOTE OR MAY BE LIMITED OR OTHERWISE ADJUSTED IN ACCORDANCE WITH THE BYE-LAWS AND AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IN ACCORDANCE WITH THE BYE-LAWS, THE BOARD OF DIRECTORS RETAINS THE AUTHORITY, IN ITS SOLE AND ABSOLUTE DISCRETION, TO DETERMINE WHETHER A HOLDERS SHARES CARRY NO VOTING RIGHTS, REDUCED VOTING RIGHTS OR ADJUSTED VOTING RIGHTS. PLEASE SEE IMPORTANT VOTING INFORMATION IN THE ACCOMPANYING PROXY STATEMENT FOR A DESCRIPTION OF THE VOTING RIGHTS APPLICABLE TO HOLDERS OF CLASS A AND CLASS B COMMON SHARES.

The proxy statement and accompanying materials are first being made available to Shareholders on or about April 24, 2017.

Under Bermuda law, if an item set out in this Notice is no longer applicable at the time of the meeting, the Chairman of the meeting may decide not to put such resolution to a vote at the meeting.

YOU MAY COMPLETE YOUR PROXY BY INTERNET OR MAIL AS SET FORTH ON THE ENCLOSED PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. PROXIES SUBMITTED BY THE INTERNET MUST BE RECEIVED BY 12:00 P.M., ATLANTIC DAYLIGHT TIME, ON JUNE 5, 2017. YOU MAY ALSO ATTEND THE MEETING AND VOTE IN PERSON. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. YOUR SHARES WILL BE VOTED PURSUANT TO THE INSTRUCTIONS CONTAINED IN YOUR COMPLETED PROXY. IF YOU RETURN A SIGNED PROXY CARD AND NO INSTRUCTIONS ARE GIVEN, YOUR SHARES WILL BE VOTED FOR ITEMS 7 THROUGH 9 AND ITEMS 11 AND 14 AND ONE YEAR FOR ITEM 10.

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be Held on June 7, 2017: the proxy statement for Shareholders is also available at www.investorvote.com/ATH.

| By order of the board of directors, |

|

|

| Tab Shanafelt |

| Corporate Secretary |

Table of Contents

Table of Contents

| PAGE | ||||

| 75 | ||||

| APPROVAL OF REMUNERATION AMOUNTS FOR THE SUPERVISORY BOARD MEMBERS OF ATHENE LEBENSVERSICHERUNG AG |

76 | |||

| 77 | ||||

| 79 | ||||

Table of Contents

ATHENE HOLDING LTD.

PROXY STATEMENT

FOR

THE ANNUAL GENERAL MEETING OF HOLDERS OF CLASS A AND CLASS B COMMON SHARES

TO BE HELD ON JUNE 7, 2017

IMPORTANT INFORMATION ABOUT THE ANNUAL GENERAL MEETING

AND PROXY PROCEDURES

The accompanying proxy is solicited by the board of directors of Athene Holding Ltd. (the Company) to be voted at the annual general meeting (Annual General Meeting) of holders of the Companys Class A and Class B common shares (the Shareholders and the Shares, respectively) to be held at the Fairmont Southampton, 101 South Shore Road, Southampton SN02, Bermuda on June 7, 2017 at 7:30 a.m. Atlantic Daylight Time, and any adjournments thereof. This proxy statement and the accompanying materials are first being made available to Shareholders on or about April 24, 2017.

The Purpose of the Annual General Meeting

At the Annual General Meeting, the Shareholders will vote in person or by proxy on the following matters as set forth in the notice of the meeting:

| 1. | to elect the directors of Athene Holding Ltd. named in this Proxy Statement; |

| 2. | to authorize the election of the directors of Athene Life Re Ltd. named in this Proxy Statement; |

| 3. | to authorize the election of the directors of AGER Bermuda Holding Ltd. named in this Proxy Statement; |

| 4. | to authorize the election of the directors of Athene Bermuda Employee Company Ltd. named in this Proxy Statement |

| 5. | to authorize the election of the directors of Athene IP Holding Ltd. named in this Proxy Statement; |

| 6. | to authorize the election of the directors of Athene IP Development Ltd. named in this Proxy Statement; |

| 7. | to appoint PricewaterhouseCoopers US LLP (PwC), an independent registered accounting firm, as the Companys independent auditor to serve until the close of the Companys next annual general meeting in 2018; |

| 8. | to refer the determination of the remuneration of PwC to the audit committee of the board of directors of the Company; |

| 9. | to vote on a non-binding advisory resolution to approve the compensation paid to the Companys named executive officers (Say on Pay); |

| 10. | to vote on a non-binding advisory proposal on the frequency of future Say on Pay votes (Say on Frequency); |

| 11. | to approve the Companys 2017 Employee Stock Purchase Plan; |

| 12. | to approve the incorporation of an advisory board of Athene Deutschland Anlagemanagement GMBH and the election of the members thereof named in this Proxy Statement; |

| 13. | to approve the remuneration amounts for the supervisory board members of Athene Lebensversicherung AG; and |

1

Table of Contents

| 14. | to approve an amendment to the Bye-laws of the Company relating to the termination of certain investment management agreements. |

Presentation of Financial Statements

In accordance with the Bermuda Companies Act 1981 and Bye-law 78 of the Companys Ninth Amended and Restated Bye-laws (the Bye-laws), the Companys audited GAAP consolidated financial statements for the year ended December 31, 2016 will be presented at the Annual General Meeting and will be made available not later than five (5) business days prior to the Annual General Meeting. The board of directors of the Company will have approved these financial statements. There is no requirement under Bermuda law that these financial statements be approved by Shareholders, and no such approval will be sought at the Annual General Meeting.

Shareholders Entitled to Vote at the Annual General Meeting

Shareholders of record as of the close of business on April 17, 2017 (the Record Date) that are eligible to vote will be entitled to vote at the Annual General Meeting. As of April 17, 2017, there were [ ] outstanding Class A common shares and [ ] outstanding Class B common shares. Each holder of a Class A common share or Class B common share entitles the holder of record thereof to vote at the Annual General Meeting, subject to certain adjustments and limitations, including those set forth in the Companys Bye-laws and as described herein under IMPORTANT VOTING INFORMATIONAdjustments to Voting Rights of Class A Common Shares and Voting Rights of Class B Common Shares. CERTAIN HOLDERS OF THE COMPANYS CLASS A COMMON SHARES MAY NOT BE ENTITLED TO VOTE IN ACCORDANCE WITH THE BYE-LAWS AND AS DESCRIBED HEREIN. IN ACCORDANCE WITH THE BYE-LAWS, THE BOARD OF DIRECTORS RETAINS THE AUTHORITY, IN ITS SOLE AND ABSOLUTE DISCRETION, TO DETERMINE WHETHER A HOLDERS SHARES CARRY NO VOTING RIGHTS, REDUCED VOTING RIGHTS OR ADJUSTED VOTING RIGHTS. See IMPORTANT VOTING INFORMATIONAdjustments to Voting Rights of Class A Common Shares.

2

Table of Contents

Voting Procedures; Quorum

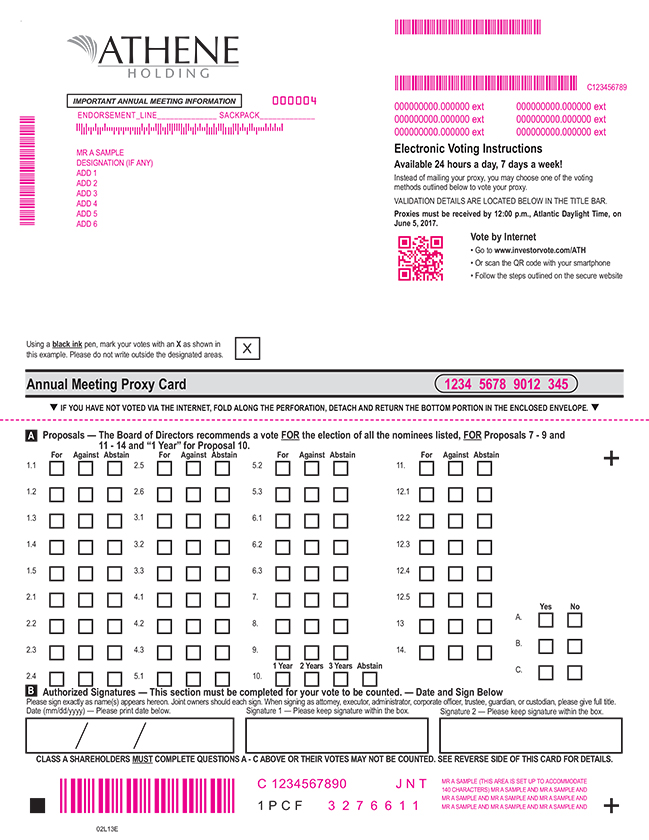

You can ensure that your Shares are properly voted at the meeting by completing, signing, dating and returning the enclosed proxy card to Proxy Services, c/o Computershare Investor Services, P.O. Box 30202, College Station, Texas 77842-9909. Shareholders may also complete their proxy via the internet in accordance with the instructions on your proxy card. Proxies submitted by the internet must be received by 12:00 p.m., Atlantic Daylight Time, on June 5, 2017.

A Shareholder has the right to appoint another person (who need not be a Shareholder) to represent the Shareholder at the Annual General Meeting by completing an alternative form of proxy which can be obtained from the Corporate Secretary or by notifying the Inspectors of Election. See Inspectors of Election below. Every Shareholder entitled to vote has the right to do so either in person or by one or more persons authorized by a written proxy executed by such Shareholder and filed with the Corporate Secretary. Any proxy duly executed will continue in full force and effect unless revoked by the person executing it in writing or by the filing of a subsequent proxy. See Revocation of Proxies below.

A Shareholder of record can vote their Shares at the Annual General Meeting by attending the meeting and completing a ballot or by proxy in one of two ways: (1) by dating, signing and completing the proxy card and returning it in accordance with the instructions provided on the proxy card; or (2) electronically via the internet as described in the proxy card. Proxy cards must be either returned by mail or electronically by 12:00 p.m. Atlantic Daylight Time on June 5, 2017.

Each of Items 1 through 8 and 11 through 14 to be voted upon at the Annual General Meeting requires the affirmative vote of a majority of the total voting power attributable to all shares of the Company represented at the Annual General Meeting, in each case provided there is a quorum (consisting of Shareholders present in person or by proxy entitled to cast a majority of the total votes attributable to all shares of the Company issued and outstanding). Shares owned by Shareholders electing to abstain from voting with respect to any proposal and broker non-votes will be counted towards the presence of a quorum but will not be considered votes cast with respect to matters to be voted upon at the Annual General Meeting. Therefore, abstentions and broker non-votes will have no effect on the outcome of the matters to be voted upon at the Annual General Meeting. A broker non-vote occurs when a nominee, such as a broker, holding Shares in street name for a beneficial owner, does not vote on a particular proposal because that nominee does not have discretionary voting power with respect to a proposal and has not received instructions from the beneficial owner. A Shareholder of Shares held in street name that would like to instruct their broker how to vote their Shares should follow the directions provided by their broker.

Each of Items 9 and 10 to be voted upon at the Annual General Meeting is an advisory vote, and the result will not be binding. However, our compensation committee will consider the outcome of the vote in Item 9 when evaluating the effectiveness of our compensation principles and in connection with its compensation decisions, and we will consider shareholders to have expressed a preference in Item 10 for the frequency option that receives the largest number of favorable votes. Shares owned by Shareholders electing to abstain from voting with respect to Items 9 and 10 and broker non-votes will be counted towards the presence of a quorum but will not be considered votes cast. Therefore, abstentions and broker non-votes will have no effect on the outcome of Items 9 and 10.

If you hold your Shares through a broker, bank or other financial institution, in order for your vote to be counted on any matter, you must provide specific voting instructions to your broker, bank or financial institution by following your broker, bank or financial institutions instructions for completing and returning the proxy card to your broker, bank or financial institution or following your broker, bank or financial institutions instructions to vote your Shares via the Internet. Voting deadlines vary by institution. Please check with your broker, bank or other financial institution for the voting cut-off date for the Annual General Meeting.

3

Table of Contents

Revocation of Proxies

Any Shareholder giving a proxy has the power to revoke it prior to its exercise by: (1) giving notice of such revocation in writing to the Secretary of the Company at Athene Holding Ltd., Chesney House, 96 Pitts Bay Road, Pembroke, HM08, Bermuda; (2) by attending and voting in person at the Annual General Meeting; or (3) by executing a subsequent proxy, provided that any such action is taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the votes are taken. Sending in a signed proxy will not affect your right to attend the meeting and vote. If a Shareholder attends the meeting and votes in person, any previously submitted proxy will be considered revoked. If a Shareholder holds their Shares in street name by a broker and has directed its broker to vote its Shares, such Shareholder should instruct its broker to change its vote or obtain a proxy to vote its Shares if such Shareholder wishes to cast its vote in person at the Annual General Meeting.

Adjustments to Voting Rights of Class A Common Shares

The Bye-laws generally provide that Shareholders are entitled to vote, on a non-cumulative basis, at all annual general and special meetings of Shareholders with respect to matters on which Class A common shares are eligible to vote. The Class A common shares collectively represent 55% of the total voting power of all of the Shares, subject to certain voting restrictions and adjustments described below. This allocation of 55% of the total voting power to the Class A common shares applies regardless of the number of Class A common shares that may be issued and outstanding.

In general, the Bye-laws provide that the board of directors may determine that certain shares shall carry no voting rights or shall have reduced voting rights to the extent that it reasonably determines that it is necessary to do so to avoid any adverse tax consequences to the Company or, upon the request of certain Shareholders, to avoid adverse regulatory consequences to such Shareholder. In addition, the board of directors has the authority under the Bye-laws to request information from any Shareholder for the purpose of determining whether a Shareholders voting rights are to be adjusted pursuant to the Bye-laws. IF A SHAREHOLDER FAILS TO RESPOND TO ANY REQUEST FOR INFORMATION OR SUBMITS INCOMPLETE OR INACCURATE INFORMATION IN RESPONSE TO A REQUEST BY THE COMPANY, THE BOARD OF DIRECTORS, IN ITS SOLE AND ABSOLUTE DISCRETION, MAY REDUCE OR ELIMINATE THE SHAREHOLDERS VOTING RIGHTS.

The Bye-laws also include several specific restrictions and adjustments to the voting power of the Class A common shares. If a holder is subject to the restrictions described below, their Class A common shares may be deemed to be non-voting or the voting power attributable to such Class A common shares may be reduced. Such restrictions depend on the identity and characteristics of the holder of the shares as of the Record Date; for example, Class A common shares that are deemed non-voting for the 2017 Annual General Meeting may, as a result of a subsequent transfer to a different holder, be entitled to vote at a later meeting of Shareholders. The Class A common share voting restrictions are as follows:

| | Class A common shares shall be deemed non-voting if the Shareholder (or any person related to the Shareholder within the meaning of Section 953(c) of the Internal Revenue Code (the Code) or to whom the ownership of such Shareholders shares is attributed under Section 958 of the Code, each, a Tax-Attributed Affiliate) (1) owns, directly indirectly or constructively, Class B common shares, (2) owns, directly, indirectly or constructively, an equity interest in Apollo Global Management, LLC (AGM) or AP Alternative Investments, L.P. (AAA) or (3) is a member of the Apollo Group at which time any member of the Apollo Group holds Class B common shares. |

| | The voting power of those Class A common shares that are entitled to vote shall be adjusted so that no Shareholder or Tax-Attributed Affiliate (other than a member of the Apollo Group, defined below) holds more than 9.9% of the total voting power of common shares. This limitation is intended to reduce the likelihood that the Company, Athene Life Re Ltd. (ALRe) or any of the Companys subsidiaries |

4

Table of Contents

| domiciled outside of the United States will be treated as a controlled foreign corporation in any taxable year (other than for purposes of taking into account related person insurance income). Apollo Group means, (A) AGM and its affiliates (collectively, Apollo), (B) AAA GuarantorAthene, L.P., (C) any investment fund or other collective investment vehicle whose general partner or managing member is owned, directly or indirectly, by AGM or by one or more of AGMs subsidiaries, (D) BRH Holdings GP, Ltd. and its shareholders, and (E) any affiliate of a person described in clauses (A), (B), (C) or (D) above; provided, none of the Company or its subsidiaries, nor any person employed by the Company, its subsidiaries or Athene Asset Management, L.P. (AAM), shall be deemed to be a member of the Apollo Group. For avoidance of doubt, any Person managed by AGM or by one or more of AGMs subsidiaries pursuant to a managed account agreement (or similar arrangement) without AGM or by one or more of AGMs subsidiaries controlling such Person as a general partner or managing member shall not be part of the Apollo Group. |

| | The aggregate votes conferred by the shares held by employees of the Company and its subsidiaries, AAM and the Apollo Group may constitute collectively no more than 3% of the total voting power of the Company. |

The amount of any reduction in voting power that occurs by operation of the adjustments described above will generally be allocated proportionately among all other Class A common shares entitled to vote. If such reallocation in turn triggers one of the adjustments described above, the adjustments will be reapplied serially until additional adjustments are not necessary. Any of the foregoing adjustments are likely to result in a Class A common share having voting rights in excess of one vote per share.

THE ACCOMPANYING PROXY CARD CONTAINS REQUIRED REPRESENTATIONS IN ORDER TO DETERMINE WHETHER YOUR CLASS A COMMON SHARES ARE SUBJECT TO THE ADJUSTMENTS DESCRIBED ABOVE. A FAILURE TO COMPLETE THESE REQUIRED REPRESENTATIONS MAY RENDER YOUR SHARES INELIGIBLE FOR VOTING.

Restrictions on Holding Class A Common Shares

The Bye-laws also contain certain restrictions on holders of Class A Common Shares. Bye-law 5.1 provides that no Shareholder (including certain affiliates and related persons) may:

| | acquire any interests in AAA or AGM; |

| | knowingly permit itself to be (directly or indirectly) insured or reinsured by any subsidiary of the Company or any ceding company specified in Schedules 1 and 2 to this proxy statement, if such Shareholder is a United States shareholder of the Company within the meaning of Section 953(c) of the Code; |

| | knowingly permit itself (or to its actual knowledge, any direct or indirect beneficial owner of itself) to own (directly, indirectly or constructively under Section 958 of the Code) stock of the Company possessing more than 50% of the total voting power or total value of the Company; or |

| | make any investment or enter into a transaction that, to the actual knowledge of such Shareholder at the time such person becomes bound to make the investment or enter into the transaction, would cause such person to own (directly, indirectly or constructively within the meaning of Section 958 of the Code) stock of the Company possessing more than 50% of the total voting power or total value of the Company. |

If any holder of Class A common shares is not in compliance with the foregoing restrictions, Class A common shares held by such Shareholder shall be deemed non-voting shares.

THE ACCOMPANYING PROXY CARD CONTAINS REQUIRED REPRESENTATIONS IN ORDER TO DETERMINE WHETHER WHETHER YOU ARE IN COMPLIANCE WITH THE RESTRICTIONS ABOVE. A FAILURE TO COMPLETE THESE REQUIRED REPRESENTATIONS MAY RENDER YOUR SHARES NON-VOTING SHARES.

5

Table of Contents

Voting Rights of Class B Common Shares

The Class B common shares represent, in aggregate, 45% of the total voting power of the Shares, subject to certain adjustments that are described below and in our Bye-laws. Only members of the Apollo Group may own Class B common shares. If AAA GuarantorAthene, L.P. holds a majority of the Class B common shares, the cumulative vote of the Class B common shares shall be cast based on the vote of the majority of the Class B common shares. In this instance, because the Class B common shares vote as a single block and can only be held by members of the Apollo Group, Apollo controls the voting power of the Class B common shares. As of the record date of the 2017 Annual General Meeting, it is expected that AAA GuarantorAthene, L.P. will hold a majority of the Class B common shares.

Should it be the case that AAA GuarantorAthene, L.P. does not hold a majority of the Class B common shares, the voting power of the Class B common shares will be allocated on a pro rata basis among all holders of Class B common shares, provided that if certain conditions are met (described in detail in Bye-Law 4.2(b)(iii) and defined therein as a Class B Adjustment Condition, then the voting power of Class B common shares shall be reduced as follows:

| (1) | First, the voting power of the Class B common shares directly held by the Shareholder(s) (i) with the highest Relative Class B Ownership Percentage (as defined in the Bye-laws) as of such time and (ii) whose Class B common shares have voting power as of such time (the Adjustment Shareholder(s)) that are attributable to the Smallest Class B 9.9% U.S. Person (as defined in the Bye-laws) shall be reduced (but not below zero (0)) until the Class B Adjustment Condition is no longer met or such Smallest Class B 9.9% U.S. Person is no longer a Class B 9.9% U.S. Person (taking into account any reallocation of voting power pursuant to clause (2) below), whichever requires the smallest reduction in voting power. |

| (2) | Second, the aggregate voting power reduced in clause (1) above shall be reallocated pro rata among the Class B common shares directly held by all other Shareholders. |

| (3) | Third, the adjustments described in clause (1) above and the reallocation described in clause (2) above shall be reapplied serially to the next Smallest Class B 9.9% U.S. Person until the Class B Adjustment Condition is no longer met. |

| (4) | Any excess voting power that cannot be reallocated pursuant to clauses (1), (2) and (3) above shall be transferred pursuant to the Bye-laws, and thereafter clause (3) above shall not apply. |

Pursuant to the Bye-laws, the pro rata reallocation of voting power of the Class B common shares provided for above shall not be permitted to the extent such reallocation would cause (i) a U.S. Person to become a Class B 9.9% U.S. Person (determined after such reallocation) or (ii) the Voting Ratio (as defined below) with respect to any Class B Common Share to be greater than fifteen (15). Any voting power that cannot be reallocated on a pro rata basis among all of the Class B common shares directly held by all other Shareholders due to the reallocation discussed above shall nonetheless be reallocated to such shares to the maximum extent possible without violating the limitations described herein. Voting Ratio means, with respect to any share in the Company, a fraction (i) the numerator of which is the percentage of the Total Voting Power represented by such share and (ii) the denominator of which is a fraction (expressed as a percentage) (a) the numerator of which is the value of that share and (b) the denominator of which is the total value of all outstanding shares in the Company.

If after providing for the reduction of voting power as set forth herein, clause (A) of the Class B Adjustment Condition continues to be met, the Total Voting Power of the Class B common shares shall be reduced (and the Total Voting Power of the Class A Common Shares correspondingly increased) until such Class B Adjustment Condition is no longer met, unless all Affected Class B Shareholders (as defined in the Bye-laws) agree otherwise.

6

Table of Contents

Inspectors of Election

Computershare Trust Company, N.A., P.O. Box 30170, College Station, TX 77842-3170, United States of America, has been appointed as Inspectors of Election for the Annual General Meeting. Representatives of Computershare will be available during the Annual General Meeting to facilitate the voting of ballots and determine the results of the vote.

Availability of Proxy Materials

Proxy materials for the Annual General Meeting, including the Notice of 2017 Annual General Meeting and Proxy Statement are available online for viewing and downloading at: www.investorvote.com/ATH.

7

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Principal Shareholders

The following table sets forth information as of March 1, 2017 regarding the beneficial ownership of our Class A common shares and our Class B common shares by (1) each person or group who is known by us to own beneficially more than 5% of our outstanding Class A common shares or our Class B common shares (including any securities convertible or exchangeable within 60 days into Class A common shares or Class B common shares, as applicable), (2) each of our named executive officers (NEOs), (3) each of our directors and (4) all of our current executive officers and directors as a group.

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. Our Class B common shares are convertible into Class A common shares at any time at the option of the holder, with prior notice to the Company, on a one-for-one basis. Accordingly, for the purposes of this table each holder of Class B common shares is deemed to be the beneficial owner of an equal number of Class A common shares (in addition to any other Class A common shares beneficially owned by such holder), which is reflected in the table entitled Amount and Nature of Beneficial Ownership under the columns Number of Shares and Percent for the Class A common shares. In addition, the voting power of our shareholders may be restricted or adjusted as described in IMPORTANT VOTING INFORMATION above. Additionally, in some cases, certain Class A common shares may be deemed non-voting. See IMPORTANT VOTING INFORMATIONRestrictions on Holding Class A Common Shares. See Voting Power for an illustration of the voting power of certain shareholders who beneficially own more than 5% of our Class A common shares and Class B common shares. Such illustration includes shareholders who may own non-voting Class A common shares who, to our knowledge, beneficially own more than 5% of our outstanding Class A common shares and Class B common shares.

To our knowledge, each person named in the table below has sole voting and investment power with respect to all of the Class A common shares, Class B common shares and Class M common shares convertible into Class A common shares within 60 days shown as beneficially owned by such person, except as otherwise set forth in the notes to the table and pursuant to applicable community property laws. Additionally, to our knowledge, certain of these shareholders also own equity interests in AAA, which holds a significant number of our Class B common shares. As of March 1, 2017, such equity interests of AAA do not entitle the holders thereof to exchange such interests for common shares of Athene, but AAA may at any time elect to distribute the common shares of Athene that it holds to such holders, whether by its liquidation or otherwise, in accordance with its limited partnership agreement. The Class B common shares distributed by AAA will automatically become Class A common shares upon any such distribution to unitholders unless a unitholder is a member of the Apollo Group. The notes to the table below reflect the pro forma ownership of certain shareholders who, to our knowledge, also own interests in AAA assuming their respective interests in AAA were exchanged for Class B common shares of Athene and that such Class B common shares were exchanged on a one-for-one basis into Class A common shares of Athene as of March 1, 2017. Unless otherwise indicated in the table or footnotes below, the address for each officer and director listed in the table is c/o Athene Holding Ltd., Chesney House, First Floor, 96 Pitts Bay Road, Pembroke, HM08, Bermuda.

8

Table of Contents

| Amount and Nature of Beneficial Ownership | ||||||||||||||||

| Class A Common Shares Beneficially Owned(1) |

Class B Common Shares Beneficially Owned |

|||||||||||||||

| Number of Shares |

Percent(2) | Number of Shares |

Percent | |||||||||||||

| Apollo Holders(3)(4) |

109,293,521 | 57.7 | % | 109,293,521 | 97.7 | % | ||||||||||

| Cambridge Global Asset Management(5) |

5,288,159 | 6.8 | % | | | |||||||||||

| Executive Officers and Directors |

||||||||||||||||

| James R. Belardi(6) |

5,035,965 | 6.2 | % | | | |||||||||||

| William J. Wheeler(7) |

552,231 | * | | | ||||||||||||

| Grant Kvalheim(8) |

2,147,962 | 2.8 | % | | | |||||||||||

| Martin P. Klein(9) |

88,440 | * | | | ||||||||||||

| Frank Gillis(10) |

1,354,752 | 1.7 | % | | | |||||||||||

| Marc Rowan(11) |

227,953 | * | 227,953 | * | ||||||||||||

| Marc Beilinson(12) |

49,611 | * | | | ||||||||||||

| Gernot Lohr(13) |

1,179,575 | 1.5 | % | | | |||||||||||

| Matthew R. Michelini(14) |

125,433 | * | | | ||||||||||||

| Robert Borden(15) |

41,638 | * | | | ||||||||||||

| Hope Taitz(16) |

54,119 | * | | | ||||||||||||

| Lawrence J. Ruisi(17) |

42,060 | * | | | ||||||||||||

| Dr. Manfred Puffer(18) |

41,780 | * | | | ||||||||||||

| H. Carl McCall(19) |

| | | | ||||||||||||

| Brian Leach(20) |

| | | | ||||||||||||

| Arthur Wrubel(21) |

| | | | ||||||||||||

| All directors and executive officers as a group (17 persons)(22) |

10,945,639 | 13.2 | % | 227,953 | * | |||||||||||

| * | Represents less than 1%. |

| (1) | Class M common shares are subject to time- or performance-based vesting and once vested are convertible into Class A common shares. The number of Class M common shares included in the table represents the number of Class M common shares that vest as of April 30, 2017, the date that is 60 days after March 1, 2017. We assume for purposes of the table that Class M common shares convert into Class A common shares on a one-for-one basis. |

| (2) | The percentage of beneficial ownership of our Class A common shares is based on 77,410,448 Class A common shares outstanding as of March 1, 2017. |

| (3) | Consists of shares held of record by the following members of the Apollo Group (the Apollo Holders): 74,586,353 Class B common shares held of record by AAA GuarantorAthene, L.P., 5,552,068 Class B common shares held of record by Stanhope Life, L.P., 2,487,485 Class B common shares held of record by Stanhope Life II, L.P., 5,546,327 Class B common shares held of record by Palmetto Athene Holdings (Cayman), L.P., 80,096 Class B common shares held of record by Apollo Palmetto Advisors, L.P., 4,542,924 Class B common shares held of record by AHL 2014 Investor, L.P., 1,437,944 Class B common shares held of record by AHL 2014 Investor II, L.P., 14,683,515 Class B common shares held of record by Apollo Principal Holdings III, L.P., 6,073 Class B common shares held of record by AAA Associates, L.P., 212,840 Class B common shares held of record by AAA Holdings, L.P., one Class B common share held of record by Athene Asset Management, L.P. and 157,894 Class B common shares that have been granted to employees and are held of record by Apollo Management Holdings, L.P. as custodian. The percentage of beneficial ownership of the Class A common shares above assumes the conversion of all 111,852,897 Class B common shares outstanding as of March 1, 2017 into Class A common shares. |

AAA Investments, L.P. is the general partner of AAA GuarantorAthene, L.P. AAA Associates, L.P. is the general partner of AAA Investments, L.P. AAA MIP Limited is the general partner of AAA Associates, L.P. Apollo Alternative Assets, L.P. provides investment services to AAA GuarantorAthene, L.P., AAA Investments, L.P., AAA Associates, L.P. and AAA MIP Limited. Apollo International Management, L.P. is

9

Table of Contents

the managing general partner of Apollo Alternative Assets, L.P. Apollo International Management GP, LLC is the general partner of Apollo International Management, L.P. AAA Holdings GP, Ltd. is the general partner of AAA Holdings, L.P.

Apollo Palmetto Athene Partnership, L.P. is the limited partner of Palmetto Athene Holdings (Cayman), L.P. Apollo Palmetto Management, LLC is the general partner of Palmetto Athene Holdings (Cayman), L.P. and Apollo Palmetto Athene Partnership, L.P. and as such has the right to control the disposition of the Athene common shares held by Palmetto Athene Holdings (Cayman), L.P. Apollo Principal Holdings IV, L.P. is the sole member of Apollo Palmetto Management, LLC. Apollo Principal Holdings IV GP, Ltd. is the general partner of Apollo Principal Holdings IV, L.P. Apollo Palmetto Athene Management, LLC is the general partner for Apollo Palmetto Athene Partnership, L.P. The general partner of Athene Asset Management, L.P. is AAM GP Ltd. The sole shareholder of AAM GP Ltd. is Apollo Life Asset Ltd. Apollo Capital Management, L.P. is the sole member-manager of Apollo Palmetto Athene Management, LLC and the sole shareholder of Apollo Life Asset Ltd. The general partner of Apollo Capital Management, L.P is Apollo Capital Management GP, LLC. Apollo Management Holdings, L.P. is the sole member and manager of Apollo International Management GP, LLC and Apollo Capital Management GP, LLC, and the sole shareholder of AAA Holdings GP, Ltd. Apollo Management Holdings GP, LLC is the general partner of Apollo Management Holdings, L.P.

Stanhope Life Advisors, L.P. is the general partner of each of Stanhope Life, L.P. and Stanhope Life II, L.P. Apollo Administration GP Ltd. is the general partner of Stanhope Life Advisors, L.P. AHL 2014 Investor GP, Ltd. is the general partner of each of AHL 2014 Investor, L.P. and AHL 2014 Investor II, L.P. Apollo Principal Holdings III, L.P. is the sole shareholder of each of Apollo Administration GP Ltd. and AHL 2014 Investor GP, Ltd. Apollo Principal Holdings III GP, Ltd. is the general partner of Apollo Principal Holdings III L.P.

Leon Black, Joshua Harris and Marc Rowan are executive officers and the managers or directors of Apollo Management Holdings GP, LLC, Apollo Principal Holdings III GP, Ltd. and Apollo Principal Holdings IV GP, Ltd. and as such may be deemed to have voting and dispositive control of the shares of Athene common shares that are held by the Apollo Holders.

Certain affiliates of the Apollo Group (the Plan Participants) have entered into a trading plan pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the Rule 10b5-1 Plan) to enable them to sell our Class A common shares (the Plan Shares) during periods to be determined in the future (the Plan Period). The Plan Shares that may be sold will consist of our common shares earned as incentive allocations owing or payable to the Plan Participants during the Plan Period in connection with, among other things, certain distributions in kind or certain direct or indirect sales of our common shares by affiliated entities of the Plan Participants.

| (4) | The address of each of Stanhope Life, L.P., Stanhope Life II, L.P., Stanhope Life Advisors, L.P., Apollo Administration GP Ltd., AHL 2014 Investor, L.P., AHL 2014 Investor II, L.P., AHL 2014 Investor GP, Ltd., Apollo Principal Holdings III, L.P., Apollo Principal Holdings III GP, Ltd., Apollo Principal Holdings IV, L.P., Apollo Principal Holdings IV GP, Ltd., AAM GP Ltd., Apollo Life Asset Ltd. and Palmetto Athene Holdings (Cayman), L.P. is c/o Intertrust Corporate Services (Cayman) Limited, 190 Elgin Street, George Town, KY1-9005 Grand Cayman, Cayman Islands. The address of AAA Investments, L.P., Apollo Alternative Assets, L.P., Apollo Palmetto Athene Partnership, L.P., and Apollo Palmetto Management, LLC is One Manhattanville Road, Suite 201, Purchase, New York 10577. The address of AAA Associates, L.P., AAA MIP Limited, AAA Holdings, L.P. and AAA Holdings GP Limited is Trafalgar Court, Les Banques, GY1 3QL, St. Peter Port, Guernsey, Channel Islands. The address of each of Athene Asset Management, L.P., Apollo Palmetto Advisors, L.P., Apollo Palmetto Athene Management, LLC, AAA GuarantorAthene, L.P., Apollo International Management, L.P., Apollo International Management GP, LLC, Apollo Capital Management, L.P., Apollo Capital Management GP, LLC, Apollo Management Holdings, L.P. and Apollo Management Holdings, GP, LLC the Apollo Holders, Apollo and Apollos investment manager and advisors, and Messrs. Black, Harris and Rowan is 9 West 57th Street, 43rd Floor, New York, New York 10019. |

10

Table of Contents

| (5) | The number of shares listed for Cambridge Global Asset Management is based on Amendment No. 1 to Schedule 13G filed by Cambridge Global Asset Management on January 31, 2017. |

| (6) | Consists of (1) 904,168 Class A common shares held of record by the James and Leslie Belardi Family Trust, (2) 1,750 Class A common shares held of record by the Belardi Family Irrevocable Trust, (3) options to acquire 42,881 Class A common shares vested as of April 30, 2017 and (4) 4,087,166 Class M common shares vested as of April 30, 2017 which are convertible into Class A common shares. Excludes 15,487 restricted Class A common shares, 58,911 Class A restricted stock units, options to acquire 85,764 Class A common shares and 100,000 Class M common shares which are unvested as of April 30, 2017. Mr. Belardi disclaims beneficial ownership of all common shares of Athene held by the Belardi Family Irrevocable Trust and the members of the Apollo Group. |

| (7) | Consists of (1) 364,123 Class A common shares, (2) options to acquire 21,441 Class A common shares vested as of April 30, 2017 and (3) 166,667 Class M common shares vested as of April 30, 2017 which are convertible into Class A common shares. Excludes 1,598 restricted Class A common shares, 29,456 Class A restricted stock units, options to acquire 42,882 Class A common shares and 2,333,333 Class M common shares which are unvested as of April 30, 2017. |

| (8) | Consists of (1) 577,162 Class A common shares held of record by Grant Kvalheim April 2014 GRAT, (2) 37,150 Class A common shares held of record by Grant Kvalheim 2009 Childrens GST Exempt Trust-DK, (3) 37,150 Class A common shares held of record by Grant Kvalheim 2009 Childrens GST Exempt Trust-LK, (4) 37,150 Class A common shares held of record by Grant Kvalheim 2009 Childrens GST Exempt Trust-MK, (5) 1,431,932 Class A common shares held of record by Grant Kvalheim individually, (6) options to acquire 12,150 Class A common shares vested as of April 30, 2017 and (7) 15,268 Class M common shares vested as of April 30, 2017 which are convertible into Class A common shares. Excludes 23,501 restricted Class A common shares, 16,693 Class A restricted stock units, options to acquire 24,300 Class A common shares and 454,667 Class M common shares which are unvested as of April 30, 2017. |

| (9) | Consists of (1) 66,123 Class A common shares, (2) options to acquire 10,721 Class A common shares vested as of April 30, 2017 and (3) 11,596 Class M common shares vested as of April 30, 2017 which are convertible into Class A common shares. Excludes 14,728 Class A restricted stock units, options to acquire 21,441 Class A common shares and 242,667 Class M common shares which are unvested as of April 30, 2017. |

| (10) | Consists of (1) 280,056 Class A common shares held of record by Mr. Gillis individually, (2) 20,000 Class A common shares held of record by an individual retirement account in the name of Mr. Gillis, (3) options to acquire 8,577 Class A common shares vested as of April 30, 2017 and (4) 1,046,119 Class M common shares vested as of April 30, 2017 which are convertible into Class A common shares. Excludes 2,681 restricted Class A common shares, 11,783 Class A restricted stock units, options to acquire 17,152 Class A common shares and 192,565 Class M common shares which are unvested as of April 30, 2017. |

| (11) | Consists of Class B common shares held by entities directly or indirectly controlled by Mr. Rowan. Mr. Rowan disclaims beneficial ownership of all interests in AAA, which is a limited partner of AAA Investments, L.P., Class A common shares and Class B common shares owned by the Apollo Holders or any entities that he directly or indirectly controls, or that may be beneficially owned by any entities directly or indirectly controlled by Mr. Rowan, the Apollo Holders or any other members of the Apollo Group, AAA or any entities directly or indirectly controlled by Mr. Rowan. Mr. Rowan does not have the power to vote or dispose of any Athene common shares that may from time to time be held by AAA and therefore is not deemed to beneficially own such shares. Assuming all of such interests were exchanged on an equivalent basis for Class B common shares of Athene as of March 1, 2017, Mr. Rowan would own 1,579,208 Class B common shares. |

| (12) | Excludes 19,369 restricted Class A common shares which are unvested as of April 30, 2017. |

| (13) | Mr. Lohr disclaims beneficial ownership of all common shares of Athene held of record or beneficially owned by the Apollo Holders or any other member of the Apollo Group. In addition to his ownership of our Class A common shares, Mr. Lohr also owns interests in AAA, which is a limited partner of AAA Investments, L.P. Mr. Lohr does not have the power to vote or dispose of any Athene common shares that may be held from time to time by AAA and therefore is not deemed to beneficially own such shares. Assuming all of such interests were exchanged on an equivalent basis for Class B common shares of |

11

Table of Contents

| Athene, and such shares were in turn exchanged for Class A common shares on a one-for-one basis, in each case, as of March 1, 2017, Mr. Lohr would own an additional 526,415 Class A common shares and, together with the Class A common shares that he is deemed to beneficially own shown in the table above, he would own a total of 1,705,990 of our Class A common shares. 1,103,589 Class A common shares owned by Mr. Lohr have been pledged as security to a financial institution. |

| (14) | Mr. Michelini disclaims beneficial ownership of all common shares of Athene held of record or beneficially owned by the Apollo Holders or any other member of the Apollo Group. Mr. Michelini owns interests in AAA, which is a limited partner of AAA Investments, L.P. Mr. Michelini does not have the power to vote or dispose of any Athene common shares that may be held from time to time by AAA and therefore is not deemed to beneficially own such shares. Assuming all of such interests were exchanged on an equivalent basis for Class B common shares of Athene and such shares were in turn exchanged for Class A common shares on a one-for-one basis, in each case, as of March 1, 2017, Mr. Michelini would own an additional 3,071 Class A common shares and, together with the Class A common shares that he is deemed to beneficially own shown in the table above, he would own a total of 128,504 of our Class A common shares. |

| (15) | Consists of (1) 37,147 Class A common shares held of record by PENSCO Trust Co. Custodian FBO Robert L. Borden IRA and (2) 4,491 Class A common shares held of record by Mr. Borden individually. Excludes 19,162 restricted Class A common shares which are unvested as of April 30, 2017. |

| (16) | Excludes 20,021 restricted Class A common shares which are unvested as of April 30, 2017. |

| (17) | Excludes 19,551 restricted Class A common shares which are unvested as of April 30, 2017. |

| (18) | Excludes 19,290 restricted Class A common shares which are unvested as of April 30, 2017. |

| (19) | Excludes 16,087 restricted Class A common shares which are unvested as of April 30, 2017. |

| (20) | Excludes 16,057 restricted Class A common shares which are unvested as of April 30, 2017. |

| (21) | Excludes 16,087 restricted Class A common shares which are unvested as of April 30, 2017. |

| (22) | Totals include restricted common shares and options which have vested or will vest as of April 30, 2017. |

Voting Power

The following table sets forth the voting power as of March 1, 2017 of each person or group who is known by us to own beneficially more than 5% in voting power of our outstanding Class A common shares or Class B common shares (including any securities convertible or exchangeable within 60 days into Class A common shares or Class B common shares, as applicable). Apollo beneficially owns or exercises voting control over the Class B common shares.

The aggregate and respective voting power of our Class A common shares and Class B common shares is determined in accordance with our Bye-laws. The Class A common shares collectively represent 55% of the total voting power of our common shares and the Class B common shares represent, in aggregate, 45% of the total voting power of our common shares, each subject to certain adjustments, as described in IMPORTANT VOTING INFORMATION above.

The voting rights exercisable by Class A shareholders other than Apollo are limited so that holders (other than the Apollo Group) (Control Groups) are deemed not to hold more than 9.9% of the total voting power conferred by our shares. The percentage reduction of votes that occurs by operation of the foregoing limitation will generally be reallocated proportionately among other Class A common shareholders who are not members of these groups so long as such reallocation does not cause a Control Group to hold more than 9.9% of the total voting power of our shares. In addition, certain Class A common shares may be deemed non-voting when owned by a shareholder if such shareholder (or certain of its affiliates) (1) owns, directly or indirectly, Class B common shares, (2) holds an equity interest in Apollo or AAA or (3) is a member of the Apollo Group at which time any member of the Apollo Group holds Class B common shares, subject to certain exceptions. As such, certain of our Class A common shareholders hold voting shares, but such shares are non-voting when being held by such holder due to these restrictions. If such holder sold any such shares to another holder that would not be subject to these restrictions, such Class A common shares would be voting shares.

12

Table of Contents

Pursuant to our bye-laws, the total voting power of Class A common shares held by members of our management and employees of the Apollo Group that are shareholders is limited to 3% of the total voting power of our common shares.

The table below shows the voting power of certain shareholders who, to our knowledge, beneficially own more than 5% in voting power of our outstanding Class A common shares and Class B common shares as of March 1, 2017.

| Number of Class A Common Shares Owned |

Number of Class B Common Shares Owned |

Number of Shares Owned |

Percent of Total Outstanding Class A Common Shares and Class B Common Shares Owned |

Total Voting Power of Class A Common Shares and Class B Common Shares Taken Together(1) |

||||||||||||||||

| Apollo Holders |

| 109,293,521 | 109,293,521 | 57.8 | % | 45.0 | % | |||||||||||||

| (1) | The Class B common shares represent, in aggregate, 45% of the total voting power of our common shares, subject to certain adjustments, as described in IMPORTANT VOTING INFORMATIONVoting Rights of Class B Common Shares above. |

13

Table of Contents

Corporate Governance

Our business and affairs are managed under the direction of our board of directors. Our board of directors currently consists of 12 members. Five of our directors are employees of or consultants to Apollo or its affiliates (including Mr. Belardi, our Chairman, Chief Executive Officer and Chief Investment Officer, who is also Chairman, Chief Executive Officer and Chief Investment Officer of AAM). We believe that it is appropriate, given the nature of our business, that the offices of Chief Executive Officer and Chairman have been vested in the same person.

Under our Bye-laws, our board of directors will consist of not less than two and not more than 17 directors. Our board size is currently set at 13 members, with one vacancy. If there is a vacancy on our board of directors due to death, disability, disqualification, removal or resignation, or there is an increase in the number of our directors or a failure to elect a director at a shareholder meeting, the board of directors may appoint any person as a member of the board of directors on an interim basis until the next annual general meeting provided that such person has been approved by a majority of the nominating and corporate governance committee. At the next annual general meeting, the vacancy will be put to a shareholder vote. Persons appointed by the board of directors to fill vacancies must be approved by a majority of the board of directors.

Director Independence

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Messrs. Beilinson, Borden, Leach, McCall, Ruisi and Wrubel and Ms. Taitz do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors meet the independence requirements of the NYSE listing rules. Consequently, a majority of our directors are independent directors. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director and non-Apollo director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our common shares by such director and any transactions involving them described under Certain Relationships and Related Transactions, and Director Independence herein.

During 2016, (1) Mr. Siddiqui, an Apollo employee, was a member of our audit and compensation committees; (2) Mr. Rowan was a member of our compensation committee; and (3) Mr. Michelini was a member of our nominating and corporate governance committee. Mr. Siddiqui resigned from the board of directors and all committees on which he served effective as of March 20, 2017. None of Mr. Siddiqui, Mr. Rowan, or Mr. Michelini met or meets the independence requirements of the NYSE rules. The NYSE rules require that our audit, compensation, and nominating and corporate governance committees be comprised exclusively of independent directors within one year of the effectiveness of the registration statement for our initial public offering. Not later than the first anniversary of the effectiveness of the registration statement for our initial public offering, all members of the respective committees will be independent.

Board Meetings and Committees; Attendance at Annual General Meeting

The board of directors held three meetings in 2016. During 2016, the audit committee met four times, the compensation committee met four times, the nominating and corporate governance committee met two times, the risk committee met two times, the executive committee met one time and the conflicts committee met eight times. Each director attended at least 75% of his or her board and committee meetings other than Messrs. Beilinson and Lohr.

14

Table of Contents

No directors of the Company attended the 2016 annual general meeting. As a public company, the Company will now encourage directors to use best efforts to attend all future annual general meetings, including the 2017 Annual General Meeting.

Classified Board of Directors

Our Bye-laws provide for our board of directors to be divided into three classes with members of each class serving staggered three-year terms. Only one class of directors will be elected at each annual general meeting of Shareholders, with directors in other classes continuing for the remainder of their respective three-year terms. Our current directors are divided among the three classes as follows:

| | our Class I directors are Messrs. Belardi, Michelini, Leach, Lohr and Rowan and, except as provided below with respect to Mr. Leach, their terms will expire at our annual general meeting to be held in 2019; |

| | our Class II directors are Messrs. Wrubel, Ruisi and Ms. Taitz and, except as provided below with respect to Mr. Wrubel, their terms will expire at our Annual General Meeting to be held in 2017; and |

| | our Class III directors are Messrs. Borden, McCall and Beilinson and Dr. Puffer and, except as provided below with respect to Mr. McCall, their terms will expire at our annual general meeting to be held in 2018. |

Messrs. Wrubel, Leach and McCall have been appointed to the board of directors subject to being nominated and elected by Shareholders at the Annual General Meeting. If elected at the Annual General Meeting, Mr. Wrubel will be a Class II director whose term will expire at our annual general meeting to be held in 2020, Mr. Leach will be a Class I director whose term will expire at our annual general meeting to be held in 2019 and Mr. McCall will be a Class III director whose term will expire at our annual general meeting to be held in 2018.

Our directors hold office until their successors have been elected and qualified or until the earlier of their death, resignation or removal. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

The classification of our board of directors may have the effect of delaying or preventing changes of control of our Company.

Lead Independent Director

On October 26, 2016, the board of directors elected Ms. Taitz to the newly-created position of Lead Independent Director, effective immediately. In this new role, Ms. Taitz will, among other things, preside at executive sessions of the independent directors, serve as liaison between the chairman and the independent directors, review board meeting schedules and agendas, review information sent to the board and be authorized to call meetings of the independent directors.

15

Table of Contents

Committees of the Board of Directors

Our board of directors has the authority to appoint committees to perform certain management and administration functions. Our board of directors has six standing committees: audit, compensation, nominating and corporate governance, conflicts, executive and risk. The table below shows the membership for each of the board of directors standing committees.

| Audit Committee |

Compensation Committee |

Conflicts Committee |

||

| Lawrence J. Ruisi (Chair)* |

Marc Beilinson (Chair)* | Marc Beilinson* | ||

| Hope Taitz* |

Marc Rowan | Robert Borden* | ||

| Brian Leach* |

H. Carl McCall* | Hope Taitz* | ||

| Arthur Wrubel* | ||||

| Executive Committee |

Nominating and Corporate Governance Committee |

Risk Committee |

||

| James R. Belardi |

Hope Taitz (Chair)* | Manfred Puffer (Chair) | ||

| Marc Rowan |

Matthew Michelini | Robert Borden* | ||

| Matthew Michelini |

Arthur Wrubel* | Matthew Michelini | ||

| H. Carl McCall* | Lawrence J. Ruisi* | |||

| Brian Leach* | ||||

| * | Independent director for purposes of the NYSE corporate governance listing requirements. |

Audit Committee

The audit committees duties include, but are not limited to, assisting the board of directors with its oversight and monitoring responsibilities regarding:

| | the integrity of the Companys consolidated financial statements and financial and accounting processes; |

| | compliance with the audit, internal accounting and internal controls requirements by AHL and its subsidiaries; |

| | the independent auditors qualifications, independence and performance; |

| | related party transactions other than transactions between AHL and its subsidiaries and Apollo and its affiliates (other than AHL and its subsidiaries) and other related party transactions ancillary thereto that are required to be reviewed by the conflicts committee or by the disinterested directors on our board of directors as described under Conflicts Committee below, or are expressly exempt from such review under our internal policies; |

| | the performance of the internal accounting and financial controls of the Company and its subsidiaries (including monitoring and reporting by subsidiaries) and the function of the internal audit departments of the Company and its subsidiaries; |

| | the Companys legal and regulatory compliance and ethical standards; and |

| | procedures to receive, retain and treat complaints regarding accounts, internal accounting controls or auditing matters and to receive confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

| | Members of our audit committee also review the Companys financial disclosure and public filings. |

Our audit committee is currently comprised of Messrs. Leach and Ruisi and Ms. Taitz. Mr. Ruisi is the chair of the audit committee. Messrs. Ruisi, Leach and Ms. Taitz each meet the independence requirements of the NYSE rules. We will rely on the phase-in rules of the SEC with respect to the independence of our audit

16

Table of Contents

committee under Rule 10A-3(b)(1) under the Exchange Act and the rules of the NYSE. These rules require that at least a majority of the members of our audit committee be independent within 90 days of the effectiveness of the registration statement for our initial public offering and all members be independent within one year of the effectiveness of the registration statement in connection with our initial public offering. Each member of our audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. The chair of our audit committee, Mr. Ruisi, is an independent director and an audit committee financial expert as that term is defined in the rules and regulations of the SEC. Our board of directors has approved a written charter under which the audit committee will operate. A copy of the charter of our audit committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following Report of the Audit Committee of the Board of Directors of the Company does not constitute soliciting material and should not be deemed filed or incorporated by reference into any future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act, except to the extent the Company specifically incorporates this Report by reference.

The audit committee has reviewed and discussed the audited consolidated financial statements of the Company with management and the independent auditors for the year ended December 31, 2016. The audit committee has discussed with the independent auditors the matters required to be discussed by Auditing Standard No. 1301, as adopted by the Public Company Accounting Oversight Board.

The audit committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board in Rule 3526 regarding the independent auditors communications with the audit committee concerning independence. The audit committee has discussed with the independent auditors the independent auditors independence. The independent auditors and the Companys internal auditors had full access to the audit committee, including meetings without management present as needed.

Based on the audit committees review and discussions referred to above, the audit committee recommended to the board of directors that the Companys audited consolidated financial statements be included in the Companys Annual Report on Form 10-K for the year ended December 31, 2016.

AUDIT COMMITTEE

Lawrence J. Ruisi, Chairman

Brian Leach

Hope Taitz

Compensation Committee

The purposes of the compensation committee are generally to:

| | review and approve annually corporate goals and objectives, including financial and other performance targets, relevant to Chief Executive Officer and executive officer compensation; |

| | review and approve annually corporate goals and objectives, including financial and other performance targets, relevant to compensation paid to the other executive officers and key employees of the Company and its subsidiaries; |

| | review, approve and, when necessary, make recommendations to the board of directors regarding the Companys compensation plans, including with respect to incentive compensation plans and share-based plans, policies and programs; |

17

Table of Contents

| | review and administer the Companys share incentive plans and any other share-based plan and any incentive-based plan of the Company and its subsidiaries, including approving grants and/or awards of restricted stock, stock options and other forms of equity-based compensation under any such plans to executive officers; |

| | review and approve, for the Chief Executive Officer and other executive officers of the Company, when and if appropriate, employment agreements, severance agreements, consulting agreements and change in control or termination agreements; |

| | prepare the compensation committee report to be included in an annual report or proxy statement, as required by applicable SEC and NYSE rules; |

| | review periodically the Companys compensation plans, policies and programs to assess whether such policies encourage excessive or inappropriate risk-taking or earnings manipulation; |

| | review the results of any advisory stockholder votes on executive compensation and consider whether to recommend adjustments to the Companys executive compensation policies and practices as a result of such vote; and |

| | monitor compliance with stock ownership guidelines for the Chief Executive Officer and other executive officers of the Company. |

Our compensation committee is comprised of Messrs. Beilinson, McCall, Rowan, and Wrubel. Mr. Siddiqui was the chair of the compensation committee through 2016, and Mr. Beilinson is the current chair of the compensation committee. Currently, Messrs. Beilinson, McCall and Wrubel meet the independence requirements of the NYSE rules. Not later than the first anniversary of the effectiveness of the registration statement for our initial public offering, all members of the compensation committee will be independent. Our board of directors has approved a written charter under which the compensation committee will operate. A copy of the charter of our compensation committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The compensation committee has reviewed and discussed COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS with executive management. Based on its review, the compensation committee recommended to the board of directors that COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS be included in this Proxy Statement.

COMPENSATION COMMITTEE

Marc A. Beilinson, Chairman

Arthur Wrubel

H. Carl McCall

Marc J. Rowan

Nominating and Corporate Governance Committee

The purposes of the nominating and corporate governance committee are to:

| | identify, evaluate and recommend individuals qualified to become members of our board of directors or the boards of directors of material operating subsidiaries of the Company (each, a Subsidiary Board), consistent with criteria approved by our board of directors or Subsidiary Boards, as applicable; |

18

Table of Contents

| | select, or recommend that our board of directors or any Subsidiary Board select, the director nominees to stand for election at each annual general meeting of shareholders of the Company or any subsidiary or to fill vacancies on our board of directors or any Subsidiary Board, as applicable; |

| | develop and recommend to our board of directors a set of corporate governance guidelines applicable to the Company and its subsidiaries; and |

| | oversee the annual performance evaluation of our board of directors and the Subsidiary Boards and each of their respective committees and management. |

The nominating and corporate governance committee recommends directors eligible to serve on all committees of our board of directors and committees of the Subsidiary Boards, as applicable. The nominating and corporate governance committee also reviews and evaluates, in accordance with our Bye-laws, all shareholder director nominees. All shareholder director nominations must be made in accordance with the requirements of our Bye-laws, which specify the appropriate period of notice (as described below in MORE INFORMATIONShareholders Proposals and Director Nominees for the 2018 Annual General Meeting) and enumerate certain required disclosures the shareholder must include with his or her notice of intent to the Company when making a director nomination.

In recommending directors and evaluating shareholder director nominees, the nominating and corporate governance committee as a general matter seeks to compose the Companys boards to be of effective size and composition with a diversity of backgrounds, skills and experiences. The nominating and corporate governance committee, considers several additional factors, including the potential directors

| | fitness and propriety for the position, including a high level of professional ethics, integrity, leadership values and the ability to exercise sound judgment; |

| | useful qualifications, industry experience, technical expertise; education and other skills and expertise, as well as the interplay of those factors with the qualifications and experience of incumbent directors; |

| | a willingness and ability to devote the time necessary to carry out the duties and responsibilities of board membership; |

| | a desire to oversee that the operations and financial reporting are effected in an accurate and transparent manner and in compliance with applicable laws, rules and regulations; and |

| | a dedication to the representation of the best interests of the Company and its shareholders. |

The nominating and corporate governance committee engaged Korn Ferry International (Korn Ferry) to provide assistance with the three director searches we undertook in 2016. In connection with the searches, Korn Ferry assisted the nominating and corporate governance committee in identifying individuals with appropriate qualifications, evaluating those individuals suitableness for the open positions and recommending one or more of the individuals to the nominating and corporate governance committee. Following these three searches in 2016, we engaged as directors H. Carl McCall, Arthur Wrubel and Brian Leach.

Our nominating and corporate governance committee is comprised of Messrs. McCall, Michelini and Wrubel and Ms. Taitz. Ms. Taitz is the chair of the nominating and governance committee. Currently, Messrs. McCall and Wrubel and Ms. Taitz meet the independence requirements of the NYSE rules. Not later than the first anniversary of the effectiveness of the registration statement for our initial public offering, all members of our nominating and corporate governance committee will be independent directors. A copy of the charter of our nominating and corporate governance committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

19

Table of Contents

Conflicts Committee

Because the Apollo Group has a significant voting interest in AHL, and because AHL and its subsidiaries have entered into, and will continue in the future to enter into, transactions with Apollo and its affiliates, our Bye-laws require us to maintain a conflicts committee, currently consisting of three directors of the Company that are not officers or employees of any member of the Apollo Group and are designated by our board of directors. The conflicts committee meets quarterly and consists of Messrs. Beilinson and Borden and Ms. Taitz. The conflicts committee reviews and must approve of material transactions by and between AHL and its subsidiaries, on the one hand, and members of the Apollo Group, on the other hand, including any modification or waiver of the IMAs (as defined herein) with AAM, subject to certain exceptions. The conflicts committee is also responsible for the review and approval of related party transactions that are incidental or ancillary to the foregoing transactions. For a description of the functions of the conflicts committee and such exceptions, see CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCERelated Party Transaction Policy.

Executive Committee

The executive committee is responsible for facilitating the approval of certain actions that do not require consideration by the full board of directors or that are specifically delegated by the board of directors to the executive committee. The executive committee possesses and may exercise all powers of the board of directors in the management and direction of the Companys business consistent with our Bye-laws, applicable law (including any applicable rule of any stock exchange or quotation system on which our common shares are then listed) and our operating guidelines, except that the executive committee shall not perform such functions that are expressly delegated to other committees of the board of directors. The executive committee does not have the power to:

| | declare dividends on or distributions of or in respect of shares of the Company; |

| | issue shares or authorize or approve the issuance or sale, or contract for sale, of shares or determine the designation and relative rights, preferences and limitations of a series or class of shares unless specifically delegated by action of the board of directors to the executive committee or a subcommittee of the executive committee; |

| | recommend to Shareholders any action that requires Shareholder approval; |

| | recommend to Shareholders a dissolution or winding up of the Company or a revocation of a dissolution or winding up of the Company; |

| | amend or repeal any provision of the memorandum of association or Bye-laws; |

| | agree to the settlement of any litigation, dispute, investigation or other similar matter with respect to the Company that is not within the scope of authority previously delegated to the executive committee by the board of directors; |

| | approve the sale or lease of real or personal property assets with a fair value greater than a threshold amount specifically delegated to the executive committee by the board of directors; |

| | authorize mergers (other than a merger of any wholly-owned subsidiary with the Company), acquisitions, joint ventures, consolidations or dispositions of assets or any business of the Company or any investment in any business or Company by the Company with a fair value in excess of a threshold amount specifically delegated to the committee by the board of directors; or approve the sale, lease, exchange or encumbrance of any material asset of the Company that, in each case, is not within the scope of authority previously delegated to the executive committee by action of the board of directors; or |

| | amend, alter or repeal, or take any action inconsistent with any resolution or action of the board of directors. |

Our executive committee is comprised of Messrs. Belardi, Michelini and Rowan.

20

Table of Contents

Risk Committee